Global Bioabsorbable Orthopedic Implants Market

Market Size in USD Billion

CAGR :

%

USD

1.86 Billion

USD

4.02 Billion

2025

2033

USD

1.86 Billion

USD

4.02 Billion

2025

2033

| 2026 –2033 | |

| USD 1.86 Billion | |

| USD 4.02 Billion | |

|

|

|

|

Bioabsorbable Orthopedic Implants Market Size

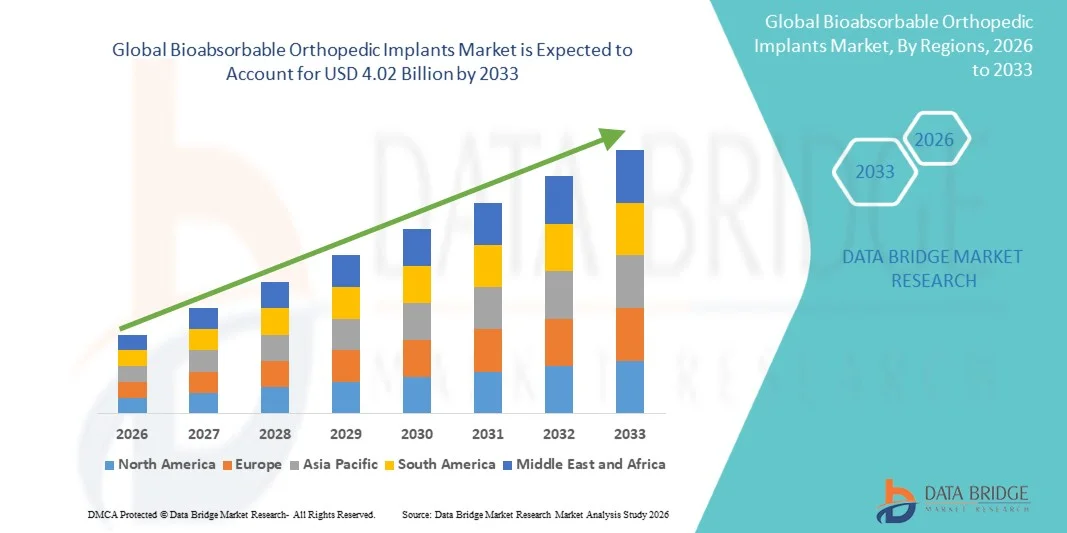

- The global bioabsorbable orthopedic implants market size was valued at USD 1.86 billion in 2025 and is expected to reach USD 4.02 billion by 2033, at a CAGR of 10.10% during the forecast period

- The market growth is largely driven by the increasing preference for bioabsorbable implants over traditional metal implants, owing to their ability to gradually dissolve in the body and eliminate the need for secondary removal surgeries, thereby improving patient outcomes and reducing healthcare costs

- Furthermore, rising incidences of orthopedic trauma, sports injuries, and degenerative bone conditions, along with continuous advancements in biomaterials and minimally invasive surgical techniques, are positioning bioabsorbable orthopedic implants as a preferred solution, significantly accelerating overall market growth

Bioabsorbable Orthopedic Implants Market Analysis

- Bioabsorbable orthopedic implants, designed to provide temporary mechanical support and gradually degrade within the body, are becoming essential in modern orthopedic and trauma surgeries due to their ability to eliminate implant removal procedures and support natural bone healing processes in both pediatric and adult patients

- The increasing demand for bioabsorbable orthopedic implants is primarily driven by the rising prevalence of orthopedic trauma, sports-related injuries, and degenerative bone disorders, along with growing clinical preference for minimally invasive and patient-centric treatment approaches

- North America dominated the bioabsorbable orthopedic implants market with the largest revenue share of 40.2% in 2025, supported by advanced healthcare infrastructure, high adoption of innovative surgical technologies, and a strong presence of leading orthopedic device manufacturers, with the U.S. witnessing significant utilization in sports medicine and trauma fixation procedures

- Asia-Pacific is expected to be the fastest-growing region in the bioabsorbable orthopedic implants market during the forecast period, with an anticipated share increase driven by rising healthcare expenditure, expanding access to advanced orthopedic treatments, and a growing patient pool resulting from urbanization and higher incidence of bone injuries

- Screws segment dominated the bioabsorbable orthopedic implants market with a share of 38.9% in 2025, driven by their extensive use in fracture fixation and ligament reconstruction procedures, ease of application, and proven clinical effectiveness across a wide range of orthopedic indications

Report Scope and Bioabsorbable Orthopedic Implants Market Segmentation

|

Attributes |

Bioabsorbable Orthopedic Implants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Bioabsorbable Orthopedic Implants Market Trends

“Advancements in Biomaterials and Composite Implant Technologies”

- A significant and accelerating trend in the global bioabsorbable orthopedic implants market is the continuous advancement in biomaterials and composite implant technologies aimed at improving mechanical strength, controlled degradation, and biocompatibility across orthopedic applications

- For instance, manufacturers are increasingly developing polymer-ceramic composite implants that combine bioabsorbable polymers with bioactive ceramics to enhance load-bearing capacity while supporting bone regeneration during the healing process

- Innovations in material science are enabling implants with more predictable resorption timelines, reducing inflammation risks and ensuring structural support aligns closely with the natural bone healing cycle

- In addition, advancements in manufacturing techniques, including precision molding and additive manufacturing, are improving implant customization for patient-specific anatomical requirements

- This trend toward technologically advanced and biologically optimized implants is reshaping clinical preferences, encouraging surgeons to adopt bioabsorbable solutions across trauma, sports medicine, and pediatric orthopedics

- As a result, demand for next-generation bioabsorbable orthopedic implants with enhanced performance characteristics is steadily increasing across both developed and emerging healthcare markets

- The growing collaboration between medical device manufacturers and research institutions is accelerating innovation cycles, leading to faster commercialization of advanced bioabsorbable implant solutions

Bioabsorbable Orthopedic Implants Market Dynamics

Driver

“Rising Incidence of Orthopedic Injuries and Preference for Minimally Invasive Treatments”

- The growing incidence of orthopedic trauma, sports injuries, and age-related musculoskeletal disorders, coupled with a rising preference for minimally invasive surgical procedures, is a key driver of demand for bioabsorbable orthopedic implants

- For instance, increasing participation in sports activities globally has led to a higher number of ligament and tendon injuries, boosting the adoption of bioabsorbable screws and fixation devices in sports medicine surgeries

- Bioabsorbable implants reduce the need for secondary removal surgeries, lowering overall treatment costs and minimizing patient discomfort, which makes them increasingly attractive to both surgeons and healthcare providers

- Furthermore, advancements in surgical techniques and growing awareness of patient-centric treatment outcomes are reinforcing the shift away from permanent metal implants

- Hospitals and orthopedic centers are increasingly incorporating bioabsorbable solutions into standard treatment protocols to improve recovery outcomes and reduce long-term complications

- These factors collectively continue to propel the adoption of bioabsorbable orthopedic implants across trauma care, reconstructive surgery, and pediatric orthopedics

- Increasing awareness among surgeons regarding the long-term benefits of bioabsorbable implants is driving broader acceptance and inclusion in clinical treatment guidelines

- The rising demand for faster patient recovery and reduced hospital readmission rates is further encouraging healthcare providers to adopt bioabsorbable orthopedic implant solutions

Restraint/Challenge

“Mechanical Strength Limitations and Regulatory Approval Complexity”

- Limitations related to the mechanical strength and load-bearing capacity of bioabsorbable orthopedic implants compared to traditional metal implants remain a significant challenge for broader market adoption

- For instance, in high-stress fracture fixation procedures, surgeons may remain cautious about using fully bioabsorbable implants due to concerns over premature degradation or insufficient structural support

- In addition, variability in degradation rates can lead to inflammatory responses or delayed healing if implants do not resorb as intended within the clinical timeline

- Stringent regulatory approval processes for implantable medical devices further pose hurdles, as manufacturers must demonstrate long-term safety, efficacy, and predictable degradation behavior

- These regulatory and technical challenges can increase development timelines and costs, particularly for smaller companies and innovative product entrants

- Addressing these restraints through improved material engineering, robust clinical evidence, and streamlined regulatory strategies will be essential for sustained growth in the bioabsorbable orthopedic implants market

- High development and manufacturing costs associated with advanced bioabsorbable materials can limit affordability and slow adoption in cost-sensitive healthcare markets

- Limited long-term clinical data for newer bioabsorbable materials may create hesitation among surgeons, affecting adoption rates in complex orthopedic procedures

Bioabsorbable Orthopedic Implants Market Scope

The market is segmented on the basis of product type, material type, application, and end use.

- By Product Type

On the basis of product type, the global bioabsorbable orthopedic implants market is segmented into screws, plates, nails, and wires. The screws segment dominated the market with the largest revenue share of 38.9% in 2025, primarily due to its extensive use in fracture fixation, ligament reconstruction, and sports medicine procedures. Bioabsorbable screws are widely preferred as they provide strong initial fixation while gradually degrading, eliminating the need for implant removal surgeries. Their high adoption in minimally invasive procedures and proven clinical reliability across trauma and orthopedic surgeries further reinforce their dominant position. In addition, continuous advancements in screw design and material strength have expanded their applicability across complex orthopedic indications. The growing volume of sports injuries and reconstructive surgeries has also supported sustained demand for bioabsorbable screws globally.

The plates segment is expected to be the fastest-growing product type during the forecast period, driven by increasing adoption in complex fracture management and pediatric orthopedics. Bioabsorbable plates offer advantages such as reduced stress shielding and avoidance of long-term foreign material presence in the body. Their use is expanding in craniofacial and maxillofacial surgeries, where implant removal can be particularly challenging. Technological advancements improving the load-bearing capacity of bioabsorbable plates are further accelerating adoption. Rising awareness among surgeons regarding long-term patient benefits is also contributing to rapid growth in this segment.

- By Material Type

On the basis of material type, the market is segmented into polylactic acid (PLA), polyglycolic acid (PGA), polycaprolactone (PCL), and composite materials. The polylactic acid (PLA) segment dominated the market in 2025, owing to its favorable biocompatibility, predictable degradation profile, and widespread clinical acceptance. PLA-based implants provide adequate mechanical strength for many orthopedic applications while degrading into non-toxic byproducts. Their extensive use in screws, pins, and fixation devices has made PLA the material of choice for manufacturers. In addition, the relatively lower production cost and strong clinical track record of PLA implants have supported their widespread adoption. Ongoing improvements in PLA formulations continue to enhance performance and expand application areas.

The composite materials segment is anticipated to witness the fastest growth rate during the forecast period, driven by the need for improved mechanical strength and controlled resorption behavior. Composite implants combine bioabsorbable polymers with bioactive ceramics to enhance osteointegration and load-bearing capacity. These materials are increasingly used in demanding orthopedic applications where traditional polymers may fall short. Rising R&D investments and collaborations between material science firms and medical device manufacturers are accelerating innovation in this segment. The growing focus on next-generation implants that closely mimic natural bone properties is expected to further fuel rapid growth.

- By Application

On the basis of application, the market is segmented into trauma surgery, orthopedic surgery, and tissue repair. The trauma surgery segment accounted for the largest market share in 2025, driven by the high global incidence of fractures and accident-related injuries. Bioabsorbable implants are widely used in trauma fixation as they reduce the need for follow-up surgeries and lower the risk of long-term complications. Their use is particularly prominent in pediatric trauma cases, where implant removal can interfere with bone growth. Increasing emergency trauma cases and expanding access to advanced orthopedic care continue to support the dominance of this segment. The preference for faster recovery and reduced hospital stays further strengthens adoption.

The tissue repair segment is expected to grow at the fastest CAGR during the forecast period, fueled by increasing demand for regenerative and minimally invasive treatments. Bioabsorbable implants are gaining traction in cartilage repair, ligament reconstruction, and soft tissue fixation procedures. Advancements in biomaterials that promote tissue regeneration are expanding the scope of applications in this segment. Growing adoption of sports medicine procedures and rising awareness of regenerative therapies are key growth drivers. This segment also benefits from increasing investments in orthopedic biologics and regenerative medicine solutions.

- By End Use

On the basis of end use, the market is segmented into hospitals, ambulatory surgical centers, and specialty clinics. The hospitals segment dominated the bioabsorbable orthopedic implants market in 2025, as hospitals handle a high volume of complex orthopedic and trauma surgeries. Availability of advanced surgical infrastructure, skilled orthopedic surgeons, and comprehensive post-operative care makes hospitals the primary end users. The adoption of innovative implant technologies is typically higher in hospital settings due to better access to capital and reimbursement mechanisms. Hospitals also serve as key centers for clinical trials and early adoption of next-generation bioabsorbable implants. These factors collectively contribute to the segment’s dominant market position.

The ambulatory surgical centers segment is projected to be the fastest-growing end-use segment during the forecast period, driven by the shift toward outpatient and minimally invasive orthopedic procedures. ASCs offer cost-effective treatment options with shorter recovery times, making them increasingly attractive for both patients and healthcare providers. The growing preference for same-day surgeries and reduced hospital stays is accelerating implant adoption in these settings. Advancements in surgical techniques and implant designs suitable for outpatient procedures further support growth. Rising investments in ASC infrastructure, particularly in emerging markets, are expected to sustain this rapid expansion.

Bioabsorbable Orthopedic Implants Market Regional Analysis

- North America dominated the bioabsorbable orthopedic implants market with the largest revenue share of 40.2% in 2025, supported by advanced healthcare infrastructure, high adoption of innovative surgical technologies, and a strong presence of leading orthopedic device manufacturers, with the U.S. witnessing significant utilization in sports medicine and trauma fixation procedures

- Healthcare providers in the region place strong emphasis on patient-centric treatment outcomes, favoring bioabsorbable implants due to their ability to eliminate secondary removal surgeries and reduce long-term complication risks

- This widespread adoption is further supported by strong reimbursement frameworks, high healthcare expenditure, a well-established network of orthopedic specialists, and the presence of leading medical device manufacturers, positioning bioabsorbable orthopedic implants as a preferred solution across both acute trauma care and elective orthopedic surgeries

U.S. Bioabsorbable Orthopedic Implants Market Insight

The U.S. bioabsorbable orthopedic implants market captured the largest revenue share of 80% in 2025 within North America, driven by the high volume of orthopedic trauma and sports-related surgeries, along with rapid adoption of advanced implant technologies. Healthcare providers in the U.S. increasingly prioritize bioabsorbable implants to reduce secondary removal procedures and improve patient recovery outcomes. The strong presence of leading orthopedic device manufacturers, favorable reimbursement policies, and widespread acceptance of minimally invasive surgical techniques continue to propel market growth. Moreover, rising participation in sports and an aging population prone to musculoskeletal disorders are further contributing to sustained market expansion.

Europe Bioabsorbable Orthopedic Implants Market Insight

The Europe bioabsorbable orthopedic implants market is projected to expand at a notable CAGR during the forecast period, primarily driven by stringent clinical standards and increasing demand for patient-centric orthopedic solutions. Growing awareness of the long-term benefits of bioabsorbable implants, such as reduced complication risks and elimination of follow-up surgeries, is supporting adoption across the region. Increasing orthopedic procedure volumes, coupled with advancements in biomaterials, are fostering market growth. The region is witnessing steady uptake across trauma, reconstructive, and pediatric orthopedic applications, particularly in technologically advanced healthcare systems.

U.K. Bioabsorbable Orthopedic Implants Market Insight

The U.K. bioabsorbable orthopedic implants market is anticipated to grow at a steady CAGR during the forecast period, supported by rising adoption of minimally invasive orthopedic procedures and increasing focus on reducing healthcare costs. The growing incidence of sports injuries and age-related bone disorders is encouraging healthcare providers to adopt bioabsorbable solutions. In addition, the National Health Service’s emphasis on improving surgical outcomes and reducing repeat procedures is favoring the use of absorbable implants. Continued investments in orthopedic care infrastructure are expected to further support market growth in the U.K.

Germany Bioabsorbable Orthopedic Implants Market Insight

The Germany bioabsorbable orthopedic implants market is expected to expand at a healthy CAGR during the forecast period, driven by strong emphasis on advanced medical technologies and high clinical standards. Germany’s well-established healthcare infrastructure and focus on innovation support the adoption of next-generation bioabsorbable implants. Increasing demand for solutions that enhance bone healing while minimizing long-term implant risks is boosting market uptake. The country’s aging population and rising number of orthopedic surgeries further contribute to sustained growth across trauma and reconstructive procedures.

Asia-Pacific Bioabsorbable Orthopedic Implants Market Insight

The Asia-Pacific bioabsorbable orthopedic implants market is poised to grow at the fastest CAGR during the forecast period, driven by rapidly expanding healthcare infrastructure, increasing urbanization, and a growing patient pool. Rising awareness of advanced orthopedic treatments and improving access to surgical care are accelerating adoption across the region. Countries such as China, Japan, and India are witnessing increased volumes of trauma and orthopedic procedures, supporting market growth. In addition, expanding local manufacturing capabilities and cost-effective implant solutions are improving accessibility across emerging economies.

Japan Bioabsorbable Orthopedic Implants Market Insight

The Japan bioabsorbable orthopedic implants market is gaining momentum due to the country’s advanced healthcare system, aging population, and strong focus on technological innovation. The high prevalence of age-related musculoskeletal conditions is driving demand for implants that support natural healing and reduce long-term complications. Japanese healthcare providers emphasize precision and quality, supporting adoption of bioabsorbable implants in orthopedic and trauma surgeries. Integration of advanced biomaterials and growing acceptance of minimally invasive procedures continue to fuel market growth.

India Bioabsorbable Orthopedic Implants Market Insight

The India bioabsorbable orthopedic implants market accounted for the largest revenue share in Asia Pacific in 2025, driven by rapid urbanization, a growing middle-class population, and increasing access to advanced orthopedic care. Rising incidences of road accidents, sports injuries, and degenerative bone disorders are significantly boosting demand. Government initiatives to improve healthcare infrastructure and expand surgical capabilities are further supporting market growth. In addition, the availability of cost-effective bioabsorbable implant solutions and increasing adoption by private hospitals are accelerating market penetration across India.

Bioabsorbable Orthopedic Implants Market Share

The Bioabsorbable Orthopedic Implants industry is primarily led by well-established companies, including:

- Bioretec Ltd (Finland)

- Arthrex, Inc. (U.S.)

- Stryker (U.S.)

- Zimmer Biomet. (U.S.)

- Smith & Nephew (U.K.)

- Johnson & Johnson Services, Inc. (U.S.)

- Medtronic (Ireland)

- B. Braun SE (Germany)

- CONMED Corporation (U.S.)

- OrthoPediatrics Corp. (U.S.)

- Evonik Industries AG (Germany)

- KLS Martin Group (Germany)

- Xtant Medical Holdings, Inc. (U.S.)

- Acumed LLC (U.S.)

- Citieffe S.r.l. (Italy)

- Teijin Limited (Japan)

- Meril Life Sciences Pvt. Ltd. (India)

- Biometrix Ltd. (U.S.)

- Paragon 28, Inc. (U.S.)

- Orthomed S.A.S. (France)

What are the Recent Developments in Global Bioabsorbable Orthopedic Implants Market?

- In December 2025, Bioretec revealed that the U.S. FDA granted its RemeOs™ DrillPin Breakthrough Device Designation, recognizing this magnesium alloy-based bioabsorbable fixation device as a potentially transformative technology for pediatric and adult fracture treatment

- In October 2025, Bioretec Ltd announced that its RemeOs™ Screw LAG Solid received Transitional Pass-Through Payment (TPT) status from the U.S. Centers for Medicare & Medicaid Services (CMS), providing new reimbursement support that can accelerate clinical adoption of this bioabsorbable implant in hospitals and surgical centers

- In April 2023, following the March FDA authorization, Bioretec publicly updated its commercialization strategy and product pipeline to accelerate the U.S. rollout of its RemeOs™ bioabsorbable orthopedic implant family and align financial targets with market demand

- In March 2023, Bioretec’s RemeOs™ trauma screw became the first bioresorbable metal orthopedic implant authorized by the U.S. Food and Drug Administration (FDA), marking a major regulatory and technological milestone for metal bioabsorbable implants in trauma fixation

- In March 2021, Inion’s CompressOn™ bioabsorbable headless compression screw received FDA 510(k) clearance, broadening surgeon options for fracture fixation with a fully bioabsorbable polymer-based implant that dissolves in the body over time

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.