Global Biobased Adhesives Market

Market Size in USD Billion

CAGR :

%

USD

1.05 Billion

USD

3.60 Billion

2024

2032

USD

1.05 Billion

USD

3.60 Billion

2024

2032

| 2025 –2032 | |

| USD 1.05 Billion | |

| USD 3.60 Billion | |

|

|

|

|

Biobased Adhesives Market Size

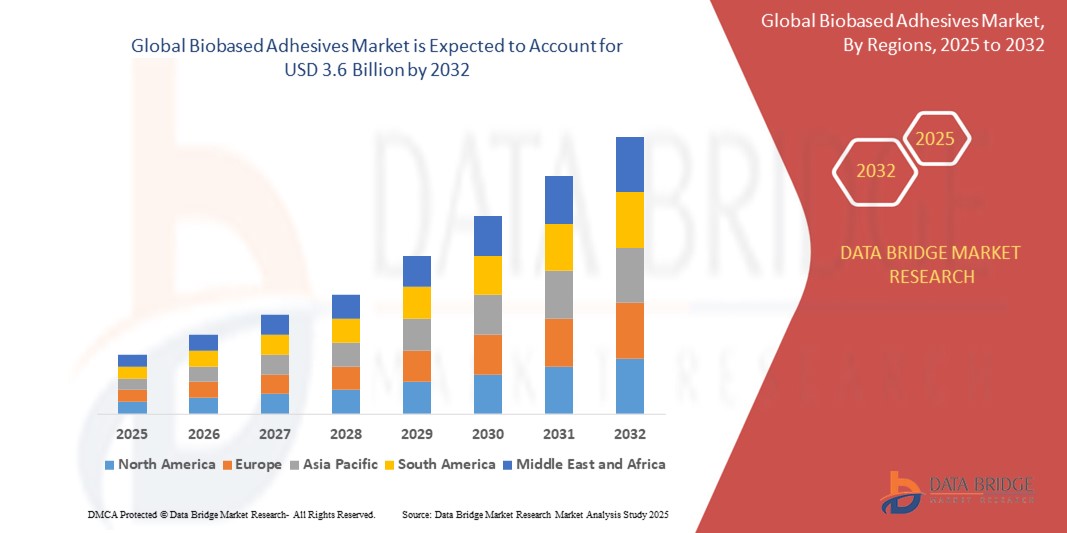

- The global biobased adhesives market size was valued at USD 1.05 billion in 2024 and is expected to reach USD 3.6 billion by 2032, at a CAGR of 16.60% during the forecast period

- The market growth is largely fueled by the increasing shift toward sustainable materials and the rising implementation of environmental regulations across industries, encouraging the replacement of synthetic adhesives with biobased alternatives derived from renewable sources

- Furthermore, rising consumer and industrial demand for non-toxic, biodegradable, and low-VOC adhesives in sectors such as packaging, construction, and woodworking is establishing biobased adhesives as the preferred choice for eco-conscious applications. These converging factors are accelerating the adoption of bioformulations, thereby significantly boosting the industry's growth

Biobased Adhesives Market Analysis

- Biobased adhesives are bonding agents derived from renewable materials such as starch, soy, lignin, and rosin, offering a sustainable alternative to petroleum-based adhesives. They are used in various applications including packaging, construction, wood processing, personal care, and medical

- The escalating demand for biobased adhesives is primarily fueled by regulatory pressure to reduce environmental impact, growing awareness of green building practices, and increasing adoption of compostable and recyclable packaging materials across global markets

- Europe dominated the biobased adhesives market with a share of 34.5% in 2024, due to stringent environmental regulations, strong sustainability goals, and the widespread presence of industries actively transitioning toward bio-based materials

- Asia-Pacific is expected to be the fastest growing region in the biobased adhesives market during the forecast period due to rising environmental consciousness, industrial growth, and growing investments in sustainable materials

- Plant-Based segment dominated the market with a market share of 66% in 2024, due to growing environmental awareness, regulatory support for sustainable materials, and a strong preference for non-toxic, renewable sources across industries. Plant-based adhesives, derived from starch, soy, and lignin, are widely adopted in packaging, wood processing, and paper industries due to their biodegradability and low VOC emissions. Their compatibility with green certifications and eco-labeling further strengthens their market appeal, especially among manufacturers seeking to meet sustainability goals

Report Scope and Biobased Adhesives Market Segmentation

|

Attributes |

Biobased Adhesives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Biobased Adhesives Market Trends

“Rising Development of New Applications of Biobased Adhesives”

- A significant and accelerating trend in the biobased adhesives market is the expansion into new and innovative applications, driven by advancements in biotechnology and increasing demand for sustainable materials

- For instance, companies such as Henkel AG & Co. KGaA, 3M, and Arkema S.A. are investing in research and development to create bioadhesives suitable for diverse uses, including sustainable packaging, wood composites, medical devices, and automotive components

- The packaging industry, in particular, is witnessing rapid adoption of biobased adhesives for food-safe, compostable, and recyclable packaging solutions, as seen with major players such as Henkel and H.B. Fuller partnering with consumer brands to meet eco-friendly packaging goals

- Ongoing innovations—such as the use of genetically engineered proteins, bioengineered polymers, and nano-bioadhesives—are enhancing the performance, durability, and versatility of biobased adhesives, making them increasingly competitive with traditional petrochemical-based products

- The construction and healthcare sectors are also embracing biobased adhesives for green building materials and medical-grade applications, reflecting a broader shift toward non-toxic, low-VOC, and renewable bonding solutions

- In conclusion, the ongoing development of new applications and continuous technological advancements are positioning biobased adhesives as essential components in the transition toward a more sustainable and circular industrial economy, with strong growth prospects across multiple sectors

Biobased Adhesives Market Dynamics

Driver

“Rising Corporate Sustainability Goals”

- The growing emphasis on corporate sustainability is a major driver for the biobased adhesives market, as companies seek to reduce their environmental footprint and align with global climate targets

- For instance, leading manufacturers such as Henkel, 3M, and Arkema are integrating biobased adhesives into their product lines to help clients in packaging, construction, and consumer goods sectors achieve their sustainability commitments and respond to regulatory pressures for greener supply chains

- The adoption of biobased adhesives is also being propelled by consumer demand for eco-friendly products, as well as the need for compliance with stricter environmental regulations and certifications such as LEED and BREEAM

- Investment in renewable feedstocks, process innovation, and product certification is enabling companies to differentiate themselves and capture market share in a rapidly evolving landscape

- As sustainability becomes a core business priority, the demand for biobased adhesives is expected to continue rising across global markets

Restraint/Challenge

“Limited Raw Material Supply”

- Limited and sometimes inconsistent supply of renewable raw materials poses a significant challenge for the biobased adhesives market, affecting scalability and price stability

- For instance, companies such as H.B. Fuller and Arkema face hurdles in securing sufficient quantities of high-quality plant-based resins, starches, and proteins, especially as demand accelerates across multiple industries

- Seasonal fluctuations, climate change impacts, and competition with food supply chains can further constrain availability and drive up costs, making it difficult for manufacturers to ensure consistent production and pricing

- Addressing this challenge will require ongoing investment in agricultural innovation, supply chain diversification, and the development of new bio-based feedstocks that do not compete with food resources

- Collaborative efforts between manufacturers, raw material suppliers, and policymakers will be crucial to support the long-term growth and resilience of the biobased adhesives market

Biobased Adhesives Market Scope

The market is segmented on the basis of type, raw materials, and application.

- By Type

On the basis of type, the biobased adhesives market is segmented into animal-based and plant-based. The plant-based segment dominated the largest market revenue share of 66% in 2024 due to growing environmental awareness, regulatory support for sustainable materials, and a strong preference for non-toxic, renewable sources across industries. Plant-based adhesives, derived from starch, soy, and lignin, are widely adopted in packaging, wood processing, and paper industries due to their biodegradability and low VOC emissions. Their compatibility with green certifications and eco-labeling further strengthens their market appeal, especially among manufacturers seeking to meet sustainability goals.

The animal-based segment is expected to witness moderate yet steady growth from 2025 to 2032, driven by its traditional use in woodworking, bookbinding, and artisanal applications. Although facing competition from synthetic and plant-based alternatives, animal-based adhesives still hold value in niche markets requiring strong adhesion properties, natural origin, and minimal synthetic processing.

- By Raw Materials

On the basis of raw materials, the market is segmented into rosin, starch, lignin, soy, and others. The starch segment held the largest market revenue share in 2024 due to its abundant availability, low cost, and excellent adhesive properties, particularly for packaging and labeling applications. Starch-based adhesives are widely used in paper products and corrugated boxes, offering strong bonding capabilities while being environmentally friendly and compostable.

The lignin segment is anticipated to witness the fastest CAGR from 2025 to 2032, owing to advancements in lignin valorization technologies and its growing role as a sustainable substitute for petroleum-based phenols in adhesive formulations. As a byproduct of the paper and bioethanol industries, lignin offers cost-effective and performance-enhancing potential for adhesives in construction and wood applications. Its aromatic structure enhances durability and bonding strength, making it an increasingly attractive option in industrial use cases.

- By Application

On the basis of application, the biobased adhesives market is segmented into packaging and paper, construction, wood, personal care, and medical. The packaging and paper segment accounted for the largest market revenue share in 2024, driven by the surge in demand for eco-friendly packaging solutions and regulatory pressures to phase out synthetic adhesives in food-safe applications. The shift toward biodegradable and recyclable packaging materials has significantly increased the adoption of biobased adhesives in labeling, box sealing, and envelope manufacturing.

The construction segment is projected to experience the fastest growth from 2025 to 2032, supported by the growing integration of green building materials and sustainable construction practices. Biobased adhesives are gaining traction in flooring, paneling, and insulation applications due to their reduced environmental footprint and compliance with LEED and other green building standards. Their low-emission profiles and safety advantages further support adoption across commercial and residential projects aiming for sustainability certification.

Biobased Adhesives Market Regional Analysis

- Europe dominated the biobased adhesives market with the largest revenue share of 34.5% in 2024, driven by stringent environmental regulations, strong sustainability goals, and the widespread presence of industries actively transitioning toward bio-based materials

- The region’s industrial sectors, particularly packaging, construction, and automotive, are increasingly adopting biobased adhesives to reduce carbon footprints and comply with EU environmental directives

- This uptake is further fueled by active government support, circular economy initiatives, and high consumer demand for eco-friendly products, positioning Europe as a frontrunner in sustainable adhesive technologies

Germany Biobased Adhesives Market Insight

The Germany biobased adhesives market captured the largest share within Europe in 2024, propelled by its advanced manufacturing sector and proactive environmental policies. German industries are investing heavily in green technologies, and biobased adhesives are gaining ground in wood processing, automotive, and construction sectors. High R&D spending and the push for circular materials under the country’s Climate Action Plan 2050 further reinforce market growth.

France Biobased Adhesives Market Insight

The France biobased adhesives market is projected to grow at a robust CAGR during the forecast period, supported by increasing public and private sector investment in sustainable packaging and building materials. French companies are leveraging government incentives to innovate in biopolymer-based adhesive formulations, particularly for use in food-safe and recyclable packaging applications.

North America Biobased Adhesives Market Insight

The North America biobased adhesives market is witnessing steady growth, driven by rising consumer awareness, corporate sustainability initiatives, and expanding applications in packaging and construction. The U.S., in particular, is seeing strong demand for plant-based adhesives in corrugated packaging, supported by large-scale retailers prioritizing compostable and recyclable materials. Moreover, government backing for bioeconomy initiatives is fostering innovation and commercialization of new adhesive technologies.

U.S. Biobased Adhesives Market Insight

The U.S. biobased adhesives market accounted for over 75% of the North American revenue share in 2024. The market is supported by growing interest from CPG companies and manufacturers seeking alternatives to synthetic adhesives. Strong regulatory frameworks, such as USDA BioPreferred labeling, are encouraging wider use across industries. Packaging and wood processing remain key application areas, further boosted by domestic sourcing of raw materials such as soy and starch.

Asia-Pacific Biobased Adhesives Market Insight

The Asia-Pacific biobased adhesives market is expected to register the fastest CAGR from 2025 to 2032, fueled by rising environmental consciousness, industrial growth, and growing investments in sustainable materials. Countries such as China, India, and Japan are experiencing growing demand in construction, packaging, and personal care segments as they align with global green manufacturing trends. Regional governments are also offering incentives for bio-based chemical production and import substitution of petrochemical adhesives.

China Biobased Adhesives Market Insight

The China biobased adhesives market led the region in revenue share in 2024, driven by a large manufacturing base, rapid adoption of green packaging, and the growing domestic production of plant-based feedstocks. China's national targets to reduce plastic waste and boost the bioeconomy are pushing industries toward cleaner adhesive options, especially in e-commerce packaging and woodworking applications.

India Biobased Adhesives Market Insight

The India biobased adhesives market is anticipated to expand rapidly due to rising demand in the construction and packaging sectors, backed by growing environmental awareness and government-led sustainable development programs. Local manufacturers are increasing production of starch- and soy-based adhesives as affordable, eco-friendly alternatives for use in furniture, paper products, and consumer goods.

Biobased Adhesives Market Share

The biobased adhesives industry is primarily led by well-established companies, including:

- 3M (U.S.)

- Henkel Adhesives Technologies India Private Limited (India)

- Merck KGaA (Germany)

- Arkema (France)

- H.B. Fuller (U.S.)

- Paramelt B.V. (Netherlands)

- Danimer Scientific (U.S.)

- Ashland (U.S.)

- Adhesives Research, Inc. (U.S.)

- Yparex (Netherlands)

- CryoLife (U.S.)

- Tate & Lyle (U.K.)

Latest Developments in Global Biobased Adhesives Market

- In July 2025, Bostik strengthened its position in the biobased adhesives market with the launch of Born2Bond Ultra K85, a high-performance instant engineering adhesive derived from 60% bio-based raw materials. Designed to withstand up to 1,000 hours under the demanding double 85 test (85 °C temperature and 85% humidity), this product demonstrates that bio-based formulations can deliver premium durability and reliability without compromising on health, safety, or environmental standards. The launch underscores a growing industry shift toward high-performance green adhesives, further accelerating market innovation and adoption across industrial applications

- In October 2024, Bostik introduced Fast Glue Ultra+, a significant advancement that blends high adhesive performance with a firm focus on sustainability. This product aligns with the industry's increasing demand for eco-friendly alternatives, reinforcing Bostik’s commitment to environmental responsibility while influencing broader market trends toward greener product development

- In September 2024, Biophilica, a London-based material innovator, launched Brightbond, a 100% biobased adhesive made entirely from renewable resources. After 18 months of R&D, Brightbond emerged with bonding capabilities comparable to conventional PVA adhesives, marking a major step toward mainstream replacement of synthetic adhesives. This innovation contributes to market expansion by proving that fully renewable formulations can match the performance expectations of traditional products, particularly in applications focused on biodegradability and circular material usage.

- In April 2024, labelstock specialist VPF expanded its adhesive portfolio with HM302, a new high-bonding hotmelt adhesive based on organic rubber. This mineral oil-free, bio-based adhesive boasts a certified organic content of at least 45 percent, a low carbon footprint, and higher initial tack compared to all previous VPF adhesives

- In March 2022, biotech company Conagen announced the development of highly sought-after debondable hot melt adhesives, created using high-performance materials derived from sustainable and natural bio-molecules

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Biobased Adhesives Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Biobased Adhesives Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Biobased Adhesives Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.