Global Biochips Market

Market Size in USD Billion

CAGR :

%

USD

39.41 Billion

USD

114.18 Billion

2024

2032

USD

39.41 Billion

USD

114.18 Billion

2024

2032

| 2025 –2032 | |

| USD 39.41 Billion | |

| USD 114.18 Billion | |

|

|

|

|

Biochips Market Size

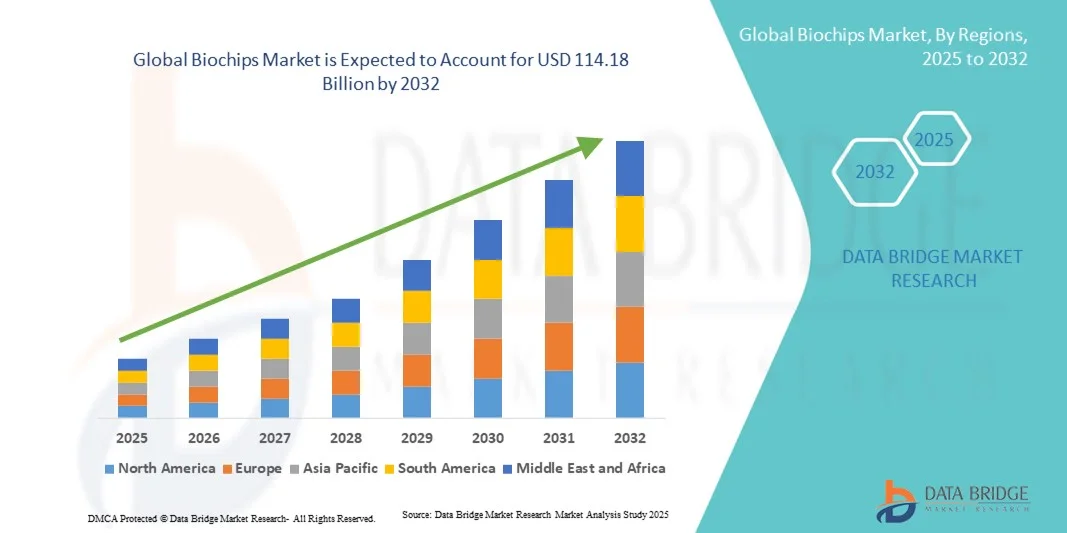

- The global biochips market size was valued at USD 39.41 billion in 2024 and is expected to reach USD 114.18 billion by 2032, at a CAGR of 14.22% during the forecast period

- The market growth is largely fueled by the increasing integration of biochips in diagnostics, genomics, proteomics, and personalized medicine, enabling rapid, high-throughput, and accurate biological analyses

- Furthermore, rising demand for cost-effective, miniaturized, and automated solutions in healthcare, pharmaceuticals, and research laboratories is establishing biochips as a critical tool for modern life sciences and clinical applications. These converging factors are accelerating the adoption of biochip technologies, thereby significantly driving the industry's growth

Biochips Market Analysis

- Biochips, comprising miniaturized platforms that integrate multiple biological assays on a single chip, are increasingly essential in modern diagnostics, genomics, proteomics, and drug discovery due to their high-throughput capabilities, precision, and automation potential

- The escalating demand for biochips is primarily driven by the rising adoption of personalized medicine, growing need for rapid and cost-effective diagnostic solutions, and advancements in microfluidics and nanotechnology enabling compact, efficient platforms

- North America dominated the biochips market with the largest revenue share of 39% in 2024, characterized by advanced healthcare infrastructure, early adoption of cutting-edge technologies, and a strong presence of key market players, with the U.S. leading in biochip R&D, particularly in genomics and clinical diagnostics, driven by innovations from both established biotech firms and startups focusing on high-throughput and multiplexed assays

- Asia-Pacific is expected to be the fastest growing region in the biochips market during the forecast period due to increasing healthcare expenditure, expanding biotechnology research, and rising adoption of advanced diagnostic tools in emerging economies

- DNA chip segment dominated the biochips market with a market share of 43.2% in 2024, driven by its proven applications in gene expression profiling, disease diagnostics, and personalized medicine research

Report Scope and Biochips Market Segmentation

|

Attributes |

Biochips Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Biochips Market Trends

Integration with AI and High-Throughput Automation

- A significant and accelerating trend in the global biochips market is the increasing integration of artificial intelligence (AI) and automated high-throughput platforms, enhancing data accuracy, assay speed, and operational efficiency

- For instance, AI-enabled biochip systems can optimize sample processing, identify patterns in genomic or proteomic data, and reduce human error in laboratory workflows

- Integration of AI allows predictive analysis in diagnostics, real-time anomaly detection, and adaptive assay optimization, improving the overall reliability of test results

- Automated biochip platforms enable simultaneous analysis of thousands of samples, supporting faster clinical and research outputs while reducing labor-intensive manual procedures

- This trend towards intelligent and automated biochip systems is reshaping expectations for laboratory efficiency and precision, with companies such as Illumina developing AI-assisted platforms capable of adaptive sequencing and high-throughput genotyping

- Increasing collaboration between biochip developers and software companies is enabling the creation of integrated platforms that combine hardware, analytics, and cloud-based data storage for seamless lab workflows

- Rising investment in next-generation sequencing (NGS) and multi-omics research is pushing biochip innovation, encouraging development of versatile chips capable of handling diverse biomolecular analyses

- The adoption of AI-integrated biochips is growing rapidly in both clinical diagnostics and research laboratories, as institutions increasingly prioritize faster, more accurate, and scalable solutions

Biochips Market Dynamics

Driver

Rising Demand Due to Personalized Medicine and Rapid Diagnostics

- The increasing demand for personalized medicine and rapid diagnostic solutions is a key driver of the heightened adoption of biochips across healthcare and research sectors

- For instance, biochips are used to rapidly analyze patient-specific genomic or proteomic data, enabling tailored therapeutic strategies and early disease detection

- Growing awareness of the benefits of early diagnostics and individualized treatment plans is encouraging hospitals, laboratories, and biotech firms to adopt biochip-based solutions

- Furthermore, the expanding biotechnology and pharmaceutical sectors are leveraging biochips for drug discovery, biomarker identification, and clinical trials, reinforcing their market demand

- Increasing prevalence of chronic diseases and infectious disease outbreaks is driving the need for rapid, multiplexed testing platforms, boosting biochip adoption in diagnostics

- Strong government and private funding for genomics, proteomics, and molecular diagnostics research is further incentivizing the use of biochips in both clinical and research settings

- The high-throughput, miniaturized, and automated nature of biochips allows institutions to reduce costs, save time, and improve accuracy, further propelling market growth

Restraint/Challenge

Technical Complexity and Regulatory Compliance Hurdles

- The complexity of biochip design, integration, and operation poses a significant challenge for widespread market adoption, requiring specialized skills and infrastructure

- For instance, laboratories must invest in advanced instrumentation and train personnel to operate sophisticated biochip platforms, which can limit adoption in smaller or resource-constrained settings

- In addition, strict regulatory standards for clinical diagnostics, data accuracy, and patient safety can delay product approvals and market entry for biochip manufacturers

- High development costs, including materials, reagents, and validation processes, contribute to the overall expense of biochip systems, potentially restricting adoption among cost-sensitive research institutions

- Limited interoperability between biochip platforms and existing laboratory information management systems (LIMS) can hinder seamless adoption and workflow integration

- Concerns over data security, storage, and handling, particularly for patient genomic information, add another layer of regulatory and technical complexity for biochip deployment

- Overcoming these challenges through simplified designs, standardized protocols, and compliance with regulatory frameworks will be essential for sustained biochip market expansion

Biochips Market Scope

The market is segmented on the basis of product type, fabrication technology, application, and end user.

- By Product Type

On the basis of product type, the biochips market is segmented into DNA chips, lab-on-a-chip, protein chips, and other arrays. The DNA chip segment dominated the market with the largest revenue share of 43.2% in 2024, driven by its extensive use in gene expression analysis, disease diagnostics, and personalized medicine. DNA chips allow rapid screening of thousands of genes simultaneously, enabling early detection of genetic disorders and facilitating targeted therapeutic interventions. Research institutions and clinical laboratories favor DNA chips for their high accuracy, reproducibility, and integration with next-generation sequencing platforms. Furthermore, their established track record in genomics research and compatibility with AI-driven analysis platforms enhances their adoption. Continuous innovations, such as multiplexed DNA chip arrays and improved sensitivity, also contribute to their dominance.

The lab-on-a-chip segment is expected to witness the fastest growth during 2025–2032 due to its ability to miniaturize laboratory processes and perform multiple assays on a single chip. These chips are increasingly adopted for point-of-care diagnostics, environmental monitoring, and drug screening. Lab-on-a-chip devices reduce reagent consumption, assay time, and operational complexity while delivering rapid and accurate results. Rising demand for portable, automated, and high-throughput testing platforms in hospitals and research laboratories fuels their market growth. The segment also benefits from growing interest in microfluidics and wearable diagnostic applications.

- By Fabrication Technology

On the basis of fabrication technology, the biochips market is segmented into microarrays and microfluidics. The microarray segment dominated in 2024 due to its widespread application in genomics, proteomics, and biomarker discovery. Microarrays allow simultaneous analysis of thousands of biomolecules on a single platform, supporting large-scale gene expression profiling and clinical diagnostics. Their high sensitivity, reproducibility, and compatibility with automated analysis tools make them a preferred choice in research and diagnostic laboratories. Established protocols and a mature supply chain further reinforce their market dominance.

The microfluidics segment is expected to witness the fastest growth during 2025–2032, driven by miniaturization and integration of lab processes for point-of-care and personalized diagnostics. Microfluidic biochips enable rapid sample processing, reduced reagent consumption, and high-throughput screening in compact formats. Rising investment in portable diagnostic devices, automated drug discovery platforms, and on-site testing solutions fuels the adoption of microfluidics. In addition, innovations in fluid handling, sensor integration, and multiplexed assays enhance their performance and scalability.

- By Application

On the basis of application, the biochips market is segmented into drug discovery and development, disease diagnostics, genomics, proteomics, agriculture, and other applications. The disease diagnostics segment dominated in 2024, driven by increasing demand for rapid, accurate, and cost-effective diagnostic solutions in hospitals and clinical labs. Biochips enable early detection of genetic disorders, infectious diseases, and chronic conditions, supporting personalized treatment strategies. The integration of biochips with AI and high-throughput platforms enhances diagnostic efficiency, reduces turnaround time, and improves patient outcomes. Growing healthcare expenditure and government initiatives for advanced diagnostics further reinforce this segment’s market dominance.

The drug discovery and development segment is expected to witness the fastest growth during 2025–2032 due to the rising need for efficient, high-throughput screening platforms. Biochips accelerate the identification of potential drug candidates, biomarkers, and therapeutic targets while reducing time and cost in preclinical research. Pharmaceutical companies increasingly adopt biochips to optimize compound screening, toxicity testing, and pharmacogenomics studies. The segment benefits from advancements in automation, multiplexed assays, and integration with bioinformatics tools.

- By End User

On the basis of end user, the biochips market is segmented into hospitals, diagnostic centers, biotechnology & pharmaceutical companies, and academic & research institutes. The biotechnology & pharmaceutical companies segment dominated the market in 2024, driven by extensive R&D activities in genomics, proteomics, and drug discovery. These companies leverage biochips for high-throughput screening, target validation, and clinical trial research, improving efficiency and reducing costs. Partnerships with biochip developers and integration with AI-based analysis platforms strengthen their adoption. The established presence of key players and continuous technological advancements further reinforce market dominance.

The academic & research institutes segment is expected to witness the fastest growth during 2025–2032 due to increasing funding for molecular biology, genomics, and personalized medicine research. Institutes utilize biochips for experimental studies, large-scale gene profiling, and biomarker discovery. The growing availability of affordable and user-friendly biochip platforms, combined with a focus on collaborative research and innovation, is driving adoption. Moreover, the integration of biochips with teaching laboratories and training programs encourages early exposure to advanced technologies.

Biochips Market Regional Analysis

- North America dominated the biochips market with the largest revenue share of 39% in 2024, characterized by advanced healthcare infrastructure, early adoption of cutting-edge technologies, and a strong presence of key market players

- Institutions and laboratories in the region highly value the accuracy, high-throughput capabilities, and automation offered by biochips, which enable rapid diagnostics, gene expression profiling, and drug discovery applications

- This widespread adoption is further supported by substantial R&D investments, strong presence of key biochip manufacturers, and government initiatives promoting precision medicine and molecular diagnostics, establishing biochips as a critical tool for both clinical and research applications

U.S. Biochips Market Insight

The U.S. biochips market captured the largest revenue share of 42% in 2024 within North America, fueled by the country’s advanced healthcare infrastructure and extensive R&D investments in genomics, proteomics, and molecular diagnostics. Institutions and laboratories are increasingly prioritizing rapid, high-throughput, and automated testing solutions offered by biochips. The rising focus on personalized medicine, early disease detection, and biomarker discovery further drives market adoption. Moreover, collaborations between biochip manufacturers and pharmaceutical companies enhance innovation and accessibility. Integration of AI-driven analytics and automated platforms is significantly contributing to the market's expansion.

Europe Biochips Market Insight

The Europe biochips market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing demand for precision diagnostics, stringent regulatory standards, and growing investment in life sciences research. Urbanization and the proliferation of biotechnology hubs are fostering the adoption of biochips in hospitals, diagnostic centers, and research institutes. European institutions are also drawn to the efficiency, accuracy, and miniaturization offered by biochip platforms. The region is witnessing significant growth across genomics, proteomics, and drug discovery applications, with biochips being incorporated into both new laboratory setups and upgrades of existing facilities.

U.K. Biochips Market Insight

The U.K. biochips market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing focus on molecular diagnostics, personalized healthcare, and biomedical research. Rising concerns over chronic diseases and early detection are encouraging healthcare providers and research institutes to adopt biochip technologies. In addition, the U.K.’s strong biotechnology sector, supportive government policies, and robust research funding are expected to stimulate market growth. The integration of biochips with advanced data analytics and high-throughput platforms further enhances their application across clinical and research laboratories.

Germany Biochips Market Insight

The Germany biochips market is expected to expand at a considerable CAGR during the forecast period, fueled by growing awareness of precision medicine, strong life sciences research infrastructure, and increasing adoption of technologically advanced diagnostic tools. Germany’s focus on innovation, sustainability, and high-quality laboratory standards promotes biochip adoption, particularly in clinical diagnostics and pharmaceutical R&D. Integration with automated platforms and AI-based analytics is becoming increasingly prevalent. German healthcare providers and research institutions show a strong preference for reliable, high-performance, and scalable biochip solutions.

Asia-Pacific Biochips Market Insight

The Asia-Pacific biochips market is poised to grow at the fastest CAGR during 2025–2032, driven by rising healthcare expenditure, rapid urbanization, and technological advancements in countries such as China, Japan, and India. Increasing adoption of advanced diagnostic tools, growing genomics and proteomics research, and government initiatives promoting digital health and biotechnology are driving market growth. Furthermore, APAC is emerging as a manufacturing hub for biochip components and systems, making biochips more accessible and affordable. The rising prevalence of chronic and infectious diseases is also boosting demand for rapid, multiplexed testing solutions.

Japan Biochips Market Insight

The Japan biochips market is gaining momentum due to the country’s high investment in biotechnology, strong research ecosystem, and focus on personalized medicine. Japanese institutions prioritize accuracy, automation, and miniaturization in laboratory workflows, promoting biochip adoption. The integration of biochips with IoT-enabled diagnostics and AI analytics is fueling growth. Moreover, Japan’s aging population and increasing healthcare needs are such asly to spur demand for high-throughput, easy-to-use diagnostic solutions in both clinical and research applications.

India Biochips Market Insight

The India biochips market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s expanding biotechnology sector, rapid urbanization, and high rates of technological adoption. India is emerging as a hub for biochip-based diagnostics, research, and drug discovery applications. Rising government support for genomics and life sciences research, increasing availability of affordable biochip platforms, and growing collaborations between domestic and international companies are key factors propelling market growth. The rising prevalence of chronic and infectious diseases further drives the adoption of biochip technologies in hospitals, diagnostic centers, and research institutes.

Biochips Market Share

The Biochips industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Illumina, Inc. (U.S.)

- PerkinElmer (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- QIAGEN (Germany)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Abbott (U.S.)

- GE HealthCare (U.S.)

- Standard BioTools (U.S.)

- Ayoxxa Biosystems GmbH (Germany)

- Danaher (U.S.)

- Fluidigm Corporation (U.S.)

- Micronit B.V. (Netherlands)

- Hualian Biotech. (Taiwan)

- BIOMÉRIEUX (France)

- Sysmex Corporation (Japan)

- BioChip Labs (U.S.)

- Dexcel (Israel)

What are the Recent Developments in Global Biochips Market?

- In October 2024, researchers developed a portable, low-cost biochip device capable of detecting colorectal and prostate cancer quickly and accurately. This advancement has the potential to improve cancer diagnosis in resource-limited settings

- In May 2024, Visionary Holdings Inc. announced the introduction of its world-class biochip technology products. These innovations are expected to enhance capabilities in genomics, proteomics, and diagnostics

- In April 2024, Boston Micro Fabrication launched BMF Biotechnology Inc. to advance the use of 3D biochips in pharmaceutical and cosmetic research. These microfluidic chips enable the recapitulation of physiologically relevant tissues at a large scale, enhancing drug and cosmetic response prediction and accelerating research pathways

- In January 2024, Agilent Technologies introduced the ProteoAnalyzer system, an advanced automated platform designed for protein analysis using parallel capillary electrophoresis. This system simplifies and enhances the efficiency of analyzing complex protein mixtures, a process central to analytical workflows across the pharmaceutical, biotechnology, food analysis, and academic research sectors. The launch underscores Agilent's commitment to providing cutting-edge solutions for protein analysis

- In November 2023, Toray Industries Inc. introduced an allergy-testing biochip capable of measuring multiple allergen-specific immunoglobulin E (IgE) levels simultaneously. This innovative biochip enables rapid and comprehensive allergy testing, improving diagnostic accuracy and patient care. The product launch reflects Toray's dedication to advancing healthcare solutions through cutting-edge biochip technology

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.