Global Biodegradable Poly L Lactic Acid Scaffold Systems Market

Market Size in USD Million

CAGR :

%

USD

185.00 Million

USD

526.24 Million

2024

2032

USD

185.00 Million

USD

526.24 Million

2024

2032

| 2025 –2032 | |

| USD 185.00 Million | |

| USD 526.24 Million | |

|

|

|

|

Biodegradable Poly-L-Lactic Acid Scaffold Systems Market Size

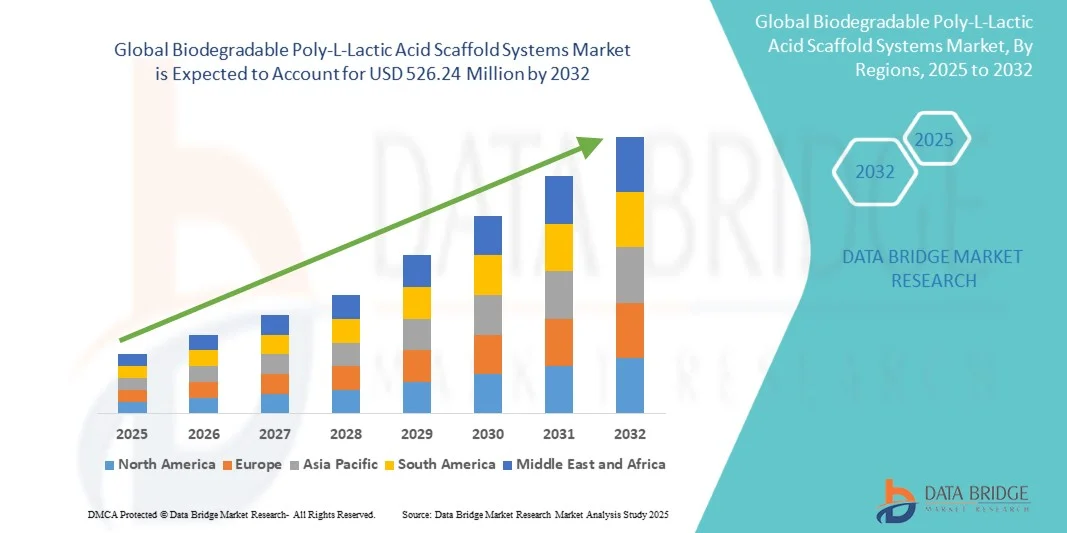

- The global biodegradable poly-L-lactic acid scaffold systems market size was valued at USD 185.00 million in 2024 and is expected to reach USD 526.24 million by 2032, at a CAGR of 13.96% during the forecast period

- The market growth is primarily driven by the rising demand for biocompatible and bioresorbable materials in tissue engineering and regenerative medicine, as researchers and manufacturers increasingly adopt PLLA scaffolds for bone, dental, and soft tissue repair applications

- In addition, advancements in 3D printing and nanofiber fabrication technologies, coupled with the growing emphasis on sustainable and patient-specific medical solutions, are accelerating the adoption of PLLA-based scaffolds across healthcare and research sectors—thereby propelling the overall market expansion

Biodegradable Poly-L-Lactic Acid Scaffold Systems Market Analysis

- Biodegradable Poly-L-Lactic Acid (PLLA) scaffold systems, designed to support tissue regeneration and gradual resorption within the body, are becoming essential components in regenerative medicine, orthopedics, and dental applications due to their biocompatibility, mechanical strength, and controlled degradation properties

- The growing demand for PLLA scaffolds is primarily fueled by the rising prevalence of musculoskeletal disorders, bone injuries, and soft tissue damage, alongside increasing research investments in tissue engineering and bioresorbable implant technologies

- North America dominated the PLLA scaffold systems market with the largest revenue share of 39.4% in 2024, supported by advanced healthcare infrastructure, strong biotechnology research networks, and the early adoption of 3D printing and biofabrication technologies for medical applications

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, driven by expanding healthcare expenditure, the growing presence of biomedical manufacturing in countries such as China, Japan, and South Korea, and supportive government initiatives promoting regenerative medicine

- The bone regeneration segment dominated the market with largest market share of 41.8% in 2024, attributed to its broad clinical use in orthopedic, craniofacial, and dental reconstruction procedures, where PLLA scaffolds offer an optimal balance between mechanical performance and biodegradability

Report Scope and Biodegradable Poly-L-Lactic Acid Scaffold Systems Market Segmentation

|

Attributes |

Biodegradable Poly-L-Lactic Acid Scaffold Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Biodegradable Poly-L-Lactic Acid Scaffold Systems Market Trends

“Advancements in 3D Bioprinting and Personalized Regenerative Implants”

- A significant and accelerating trend in the global biodegradable PLLA scaffold systems market is the integration of 3D bioprinting and nanofabrication technologies, enabling the development of patient-specific, structurally precise, and functionally optimized tissue regeneration scaffolds

- For instance, researchers have successfully utilized 3D-printed PLLA scaffolds to create complex bone and cartilage structures with tailored porosity and degradation rates, enhancing clinical outcomes in orthopedic and craniofacial surgeries

- The convergence of 3D bioprinting with PLLA-based biomaterials enables the fabrication of multi-layered, gradient, and hybrid scaffolds, improving mechanical strength, vascularization potential, and biocompatibility for advanced tissue engineering applications

- Furthermore, innovations in additive manufacturing are allowing clinicians to customize scaffold architecture based on patient anatomy, ensuring improved integration and faster recovery in bone and soft tissue repair procedures

- The seamless combination of biodegradable polymers and biofabrication technologies is transforming regenerative medicine by reducing surgical complications associated with permanent implants

- This trend toward personalized, sustainable, and bioresorbable scaffold solutions is reshaping the biomaterials landscape, driving companies and research institutes to invest in next-generation 3D-printed PLLA scaffold systems for clinical and commercial applications

Biodegradable Poly-L-Lactic Acid Scaffold Systems Market Dynamics

Driver

“Rising Demand for Biocompatible and Bioresorbable Materials in Regenerative Medicine”

- The increasing prevalence of bone fractures, degenerative disorders, and dental defects is fueling the demand for biodegradable and bioactive scaffolds that eliminate the need for secondary surgeries for implant removal

- For instance, in February 2024, Evonik Industries AG announced advancements in its RESOMER® polymer line, designed to enhance the strength and controlled degradation of PLLA-based scaffolds for orthopedic and dental applications

- As healthcare providers seek safer and more sustainable solutions, PLLA scaffolds offer the advantage of gradual resorption, supporting tissue regeneration while minimizing immune response or long-term complications

- Furthermore, the surge in R&D investments across tissue engineering and regenerative medicine, particularly in North America and Asia-Pacific, is propelling the adoption of PLLA scaffolds across clinical and research domains

- The ability to combine PLLA with bioactive coatings, growth factors, and nanocomposites further enhances therapeutic outcomes, making it a preferred material for next-generation implantable scaffold systems

- The rising focus on biocompatibility, mechanical stability, and sustainability continues to drive innovations, strengthening the market’s position within the global biomedical materials industry

Restraint/Challenge

“High Production Costs and Stringent Regulatory Compliance Requirements”

- The complex fabrication processes involved in producing high-quality PLLA scaffolds, including precision 3D printing and nanofiber electrospinning, significantly elevate manufacturing costs and limit scalability

- For instance, several small and mid-sized biomedical companies face challenges in achieving consistent scaffold architecture and degradation profiles due to stringent quality and safety regulations governing implantable biomaterials

- Compliance with international standards such as FDA, CE, and ISO 13485 requires extensive testing on biocompatibility, sterility, and mechanical integrity, which extends product development timelines and increases costs

- Furthermore, the lack of standardized evaluation frameworks for biodegradable scaffold performance and degradation kinetics creates additional regulatory hurdles for new market entrants

- The high cost of advanced medical-grade PLLA polymers and the specialized expertise required for biofabrication pose economic challenges, particularly for startups and academic spin-offs

- Overcoming these barriers through process optimization, regulatory harmonization, and scalable biomanufacturing will be critical to ensure broader commercialization and affordability of PLLA scaffold systems worldwide

Biodegradable Poly-L-Lactic Acid Scaffold Systems Market Scope

The market is segmented on the basis of product type, material composition, fabrication technology, application, and end user.

- By Product Type

On the basis of product type, the biodegradable PLLA scaffold systems market is segmented into 3D printed scaffolds, electrospun nanofibrous scaffolds, porous sponges, films & membranes, and composite scaffolds. The 3D Printed Scaffolds segment dominated the market with the largest revenue share in 2024, owing to its precision in replicating complex tissue structures and enabling patient-specific designs. The integration of advanced additive manufacturing technologies allows for controlled pore geometry and mechanical strength, making it ideal for orthopedic and craniofacial reconstruction. High clinical adoption in bone and cartilage regeneration, coupled with growing investments in 3D bioprinting research, has reinforced the leadership of this segment. Continuous improvements in computer-aided design and material extrusion systems are further enhancing scaffold customization and reproducibility, which contributes to its dominance. The scalability of 3D-printed PLLA scaffolds is also enabling their transition from laboratory research to clinical applications.

The Electrospun Nanofibrous Scaffolds segment is expected to witness the fastest growth rate from 2025 to 2032, driven by their superior surface area-to-volume ratio and excellent cell adhesion properties. These scaffolds mimic the extracellular matrix, promoting faster tissue integration and regeneration, particularly in soft tissue engineering and wound healing. Rising research in electrospinning for drug delivery and nanostructured regenerative platforms is fueling segment growth. Furthermore, continuous advancements in multi-nozzle electrospinning systems and polymer blend formulations are improving fiber uniformity and functionality. The increasing interest from biotechnology startups and research institutes in developing nanofiber-based implants is expected to accelerate market expansion.

- By Material Composition

On the basis of material composition, the market is segmented into pure PLLA, PLLA blends, and PLLA composites. The Pure PLLA segment dominated the market with the largest share in 2024, supported by its proven biocompatibility, mechanical stability, and regulatory acceptance across medical applications. Pure PLLA scaffolds are widely utilized in bone and dental tissue regeneration due to their predictable degradation rate and strong load-bearing properties. Their established use in FDA-approved bioresorbable implants has positioned this material as the standard choice for many medical device manufacturers. In addition, the consistent supply chain for medical-grade PLLA polymers enhances production scalability for both research and clinical deployment. Ongoing clinical validation studies continue to reinforce confidence in pure PLLA-based solutions, maintaining its dominance.

The PLLA Composites segment is anticipated to register the fastest CAGR during the forecast period, driven by the growing adoption of composite formulations combining PLLA with ceramics such as hydroxyapatite (HA) or tricalcium phosphate (TCP). These composites offer improved osteoconductivity and mechanical strength, making them suitable for large bone defect repair. Increasing research in nanocomposite scaffolds using bioactive fillers and nanoparticles enhances cell proliferation and accelerates bone remodeling. For instance, PLLA–HA composites are being developed for customized craniofacial and orthopedic scaffolds with improved mechanical integrity. The combination of bioactivity, adaptability, and tunable degradation is propelling composite PLLA materials as next-generation biomaterials for advanced clinical use.

- By Fabrication Technology

On the basis of fabrication technology, the market is segmented into melt extrusion, electrospinning, solvent casting, gas foaming, and phase separation. The Melt Extrusion segment dominated the market in 2024, attributed to its ability to produce uniform and mechanically robust PLLA scaffolds suitable for large-scale production. This method is widely used in creating 3D-printed scaffolds and medical filaments due to its precision and compatibility with additive manufacturing systems. The process ensures minimal solvent residue, making it compliant with medical-grade regulatory standards. Its cost-effectiveness and process reproducibility have made it a preferred fabrication method for orthopedic and dental scaffold manufacturers. Furthermore, advancements in temperature control and extrusion head design are improving the customization and microarchitecture of scaffolds produced using this technology.

The Electrospinning segment is expected to experience the fastest growth rate during 2025–2032, due to its ability to create nanofiber scaffolds that closely mimic natural extracellular matrices. Electrospun scaffolds facilitate superior cell adhesion, proliferation, and differentiation—key aspects in tissue regeneration. The technique’s flexibility in controlling fiber diameter and morphology makes it ideal for drug delivery and soft tissue applications. For instance, researchers are utilizing coaxial electrospinning to incorporate bioactive molecules into PLLA nanofibers for sustained release therapies. Growing demand for high-performance, nanostructured biomaterials is expected to fuel adoption across academic and industrial research settings.

- By Application

On the basis of application, the market is segmented into bone regeneration, dental applications, cardiovascular repair, soft tissue engineering, and drug delivery. The Bone Regeneration segment accounted for the largest revenue share of 41.8% in 2024, driven by the extensive use of PLLA scaffolds in fracture fixation, spinal fusion, and bone graft substitutes. The material’s high strength-to-weight ratio, slow degradation rate, and osteoconductive properties make it ideal for supporting bone tissue regrowth. Increasing incidences of bone injuries and osteoporosis are further propelling clinical demand. In addition, collaboration between orthopedic device manufacturers and biomaterial companies is enhancing innovation in bioresorbable fixation systems. The segment benefits from growing clinical preference for biodegradable implants over metallic alternatives, reducing long-term complications.

The Soft Tissue Engineering segment is projected to grow at the fastest rate during the forecast period, supported by advancements in tissue-engineered ligaments, tendons, and skin substitutes using PLLA nanofibrous scaffolds. These scaffolds provide elasticity and biocompatibility essential for regenerating soft tissues. For instance, research in biofunctionalized PLLA membranes coated with collagen or growth factors has shown promising results in wound healing and tendon repair. The increasing number of research collaborations focusing on soft tissue regeneration and personalized medicine is accelerating segment expansion. The rising emphasis on minimally invasive regenerative therapies continues to enhance market opportunities in this area.

- By End User

On the basis of end user, the market is segmented into hospitals & surgical centers, research institutes & laboratories, contract manufacturing organizations (CMOs), and dental clinics. The Hospitals & Surgical Centers segment dominated the market in 2024, as these facilities are primary adopters of PLLA-based scaffold implants for orthopedic, dental, and reconstructive surgeries. The growing acceptance of bioresorbable implants for faster patient recovery and reduced post-surgical complications has driven adoption. Hospitals prefer PLLA scaffolds for their proven safety, clinical efficacy, and compatibility with imaging systems. In addition, ongoing integration of 3D printing units in major healthcare institutions supports the on-site customization of implants. The strong reimbursement support for regenerative and reconstructive procedures in developed regions further reinforces this segment’s dominance.

The Research Institutes & Laboratories segment is anticipated to register the fastest CAGR during 2025–2032, owing to increasing academic and industrial research focused on developing advanced biomaterials. For instance, university research centers are using PLLA scaffolds for stem cell differentiation, drug testing, and prototype development for regenerative therapies. Government funding and public-private collaborations are encouraging exploratory work in biofabrication and scaffold optimization. The surge in biotechnology startups focusing on customized, research-grade scaffold systems is also contributing to the rapid growth of this segment.

Biodegradable Poly-L-Lactic Acid Scaffold Systems Market Regional Analysis

- North America dominated the PLLA scaffold systems market with the largest revenue share of 39.4% in 2024, supported by advanced healthcare infrastructure, strong biotechnology research networks, and the early adoption of 3D printing and biofabrication technologies for medical applications

- The region’s dominance is supported by the presence of leading biotechnology and medical device companies, well-established healthcare infrastructure, and a high rate of clinical adoption of bioresorbable implants

- Consumers and healthcare providers in North America highly value the biocompatibility, controlled degradation, and customization potential offered by PLLA scaffolds for bone and soft tissue regeneration procedures

U.S. Biodegradable Poly-L-Lactic Acid Scaffold Systems Market Insight

The U.S. biodegradable PLLA scaffold systems market captured the largest revenue share of 79% in 2024 within North America, driven by advanced biomedical research, high healthcare expenditure, and rapid adoption of regenerative medicine. The nation’s robust R&D ecosystem, supported by the FDA’s progressive stance on bioresorbable materials, fuels continuous innovation in orthopedic and cardiovascular scaffolds. Growing clinical applications in bone tissue regeneration and customized 3D-printed implants further stimulate demand. In addition, strong collaborations between universities, biotechnology startups, and major medtech firms enhance the country’s leadership in next-generation bioengineered scaffolds.

Europe Biodegradable Poly-L-Lactic Acid (PLLA) Scaffold Systems Market Insight

The Europe biodegradable PLLA scaffold systems market is projected to expand at a substantial CAGR throughout the forecast period, driven by rising healthcare investments, aging populations, and the growing adoption of sustainable biomaterials. European nations are increasingly supporting clinical trials and public-private collaborations focused on bioresorbable and patient-specific scaffolds. Demand is particularly high in orthopedics, dental applications, and cardiovascular tissue repair. Moreover, EU-backed initiatives promoting environmentally responsible materials and strict regulatory standards encourage the use of biodegradable polymers such as PLLA in medical devices.

U.K. Biodegradable Poly-L-Lactic Acid (PLLA) Scaffold Systems Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR during the forecast period, propelled by increased academic research and funding in tissue engineering and regenerative medicine. The presence of strong research clusters and NHS-backed pilot programs utilizing biodegradable scaffolds for bone and soft tissue repair contribute to market momentum. Rising awareness of bioresorbable implants as an alternative to permanent metallic materials supports adoption. In addition, the U.K.’s growing ecosystem of biotechnology startups and contract research organizations (CROs) continues to accelerate clinical development and commercialization of PLLA-based systems.

Germany Biodegradable Poly-L-Lactic Acid (PLLA) Scaffold Systems Market Insight

The Germany biodegradable PLLA scaffold systems market is expected to expand at a considerable CAGR during the forecast period, supported by the country’s leadership in medical engineering, material sciences, and biopolymer research. Germany’s strong healthcare infrastructure and emphasis on precision manufacturing promote adoption across orthopedic and dental reconstruction procedures. The focus on eco-friendly, patient-safe biomaterials aligns with national sustainability goals, encouraging hospitals and R&D institutions to integrate PLLA scaffolds. Furthermore, collaborations between German universities, Fraunhofer institutes, and medtech firms are enhancing innovation in advanced scaffold fabrication techniques.

Asia-Pacific Biodegradable Poly-L-Lactic Acid (PLLA) Scaffold Systems Market Insight

The Asia-Pacific biodegradable PLLA scaffold systems market is poised to grow at the fastest CAGR of 25% from 2025 to 2032, fueled by rapid medical innovation, expanding healthcare access, and increased focus on bioresorbable implants in China, Japan, and India. The region’s cost-effective manufacturing capabilities and rising investments in 3D printing technologies are fostering large-scale scaffold production. Government initiatives promoting biotechnology development and regenerative medicine further drive market adoption. As awareness of sustainable, biocompatible materials grows, hospitals and research centers across APAC are increasingly integrating PLLA scaffolds for orthopedic, dental, and tissue regeneration applications.

Japan Biodegradable Poly-L-Lactic Acid (PLLA) Scaffold Systems Market Insight

The Japan market is gaining strong traction due to its mature medical technology landscape, aging population, and emphasis on minimally invasive therapies. Japan’s early adoption of tissue-engineered solutions and its strong focus on innovation in bioabsorbable polymers support steady market growth. The integration of PLLA scaffolds in orthopedic and cardiovascular treatments is rising alongside advancements in nanofibrous and 3D-printed scaffold technologies. Moreover, strategic government funding in regenerative medicine and partnerships between academic institutions and medical device manufacturers are enhancing clinical adoption across hospitals and research facilities.

India Biodegradable Poly-L-Lactic Acid (PLLA) Scaffold Systems Market Insight

The India biodegradable PLLA scaffold systems market accounted for the largest revenue share in Asia-Pacific in 2024, supported by a rapidly expanding medical device manufacturing base and increasing adoption of regenerative therapies. Government-backed initiatives such as “Make in India” and investments in biomedical innovation are encouraging local production of cost-effective PLLA scaffolds. Growing patient awareness of bioresorbable implants and rising orthopedic and dental procedure volumes also fuel demand. Furthermore, collaborations between Indian research institutions and global medtech players are strengthening R&D capabilities, making India a key emerging hub for biodegradable scaffold technologies.

Biodegradable Poly-L-Lactic Acid Scaffold Systems Market Share

The Biodegradable Poly-L-Lactic Acid Scaffold Systems industry is primarily led by well-established companies, including:

- Ilex Life Sciences (U.S.)

- Gelatex Technologies (Estonia)

- CD Bioparticles (U.S.)

- Poly-Med Incorporated (U.S.)

- NatureWorks LLC (U.S.)

- TotalEnergies Corbion (Netherlands)

- Evonik Industries AG (Germany)

- Futerro S.A. (Belgium)

- Abbott (U.S.)

- Boston Scientific Corporation (U.S.)

- Medtronic (Ireland)

- Terumo Corporation (Japan)

- W. L. Gore & Associates (U.S.)

- B. Braun SE (Germany)

- Cook (U.S.)

- MicroPort Scientific Corporation (China)

- Stryker (U.S.)

- Zimmer Biomet. (U.S.)

- Xeltis (Switzerland)

- Biomedical Structures, LLC (U.S.)

What are the Recent Developments in Global Biodegradable Poly-L-Lactic Acid Scaffold Systems Market?

- In March 2025, a collaborative preclinical study published on a novel fully-amorphous PLLA/PLGA bioresorbable scaffold demonstrated improved healing, reduced inflammation and positive remodeling in a porcine coronary model signalling a translation step toward commercial bioresorbable PLLA scaffold products

- In August 2024, LifeNet Health, in collaboration with Johnson & Johnson MedTech, launched the “PliaFX Pak” bone allograft product in the U.S., which features a scaffold-such as network of mineralised bone chips and demineralised cortical fibers. This joint launch underlines how scaffold/void-filler technologies are being commercialised via partnerships between regenerative-medicine companies and major device firms

- In May 2024, eSUNMed Biotechnology (Shenzhen) Co., Ltd. announced that its medical-grade PLLA material had passed registration under the Chinese National Medical Products Administration. This milestone means the PLLA raw material can now serve as a standard implant-grade polymer for downstream scaffold and implant products, helping simplify product regulatory approval and shorten market cycles

- In July 2024, 4D Medicine Ltd (UK) announced a £3.4 m Series A investment to commercialize its “4Degra®” resorbable biomaterial platform potentially applicable to PLLA-type scaffolds for orthopaedic and soft tissue applications

- In March 2021, Meril Life Sciences officially launched its bio-resorbable scaffold product “MeRes100 BRS” (100-micron PLLA-based scaffold) for coronary applications, marking one of the first indigenous PLLA-based scaffold devices in the Indian market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.