Global Biological Therapy Market

Market Size in USD Billion

CAGR :

%

USD

457.53 Billion

USD

933.30 Billion

2024

2032

USD

457.53 Billion

USD

933.30 Billion

2024

2032

| 2025 –2032 | |

| USD 457.53 Billion | |

| USD 933.30 Billion | |

|

|

|

|

Biological Therapy Market Size

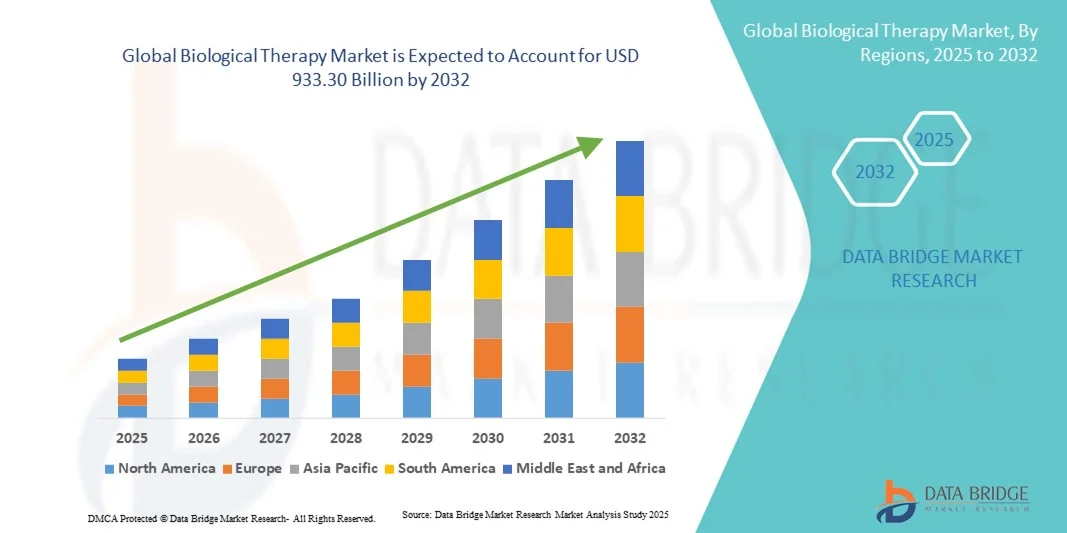

- The global biological therapy market size was valued at USD 457.53 billion in 2024 and is expected to reach USD 933.30 billion by 2032, at a CAGR of 9.32% during the forecast period

- The market growth is primarily driven by increasing prevalence of chronic and autoimmune diseases, rising adoption of targeted therapies, and continuous advancements in biopharmaceutical research and development

- In addition, growing investments in biotechnology, expansion of biologics manufacturing infrastructure, and increasing awareness among patients and healthcare providers regarding personalized treatment options are supporting the widespread adoption of biological therapies, thereby fueling the overall market growth

Biological Therapy Market Analysis

- Biological therapies, encompassing products such as monoclonal antibodies, vaccines, and recombinant proteins, are becoming essential in treating chronic, autoimmune, and genetic disorders due to their targeted action, efficacy, and potential for personalized treatment approaches in both hospital and outpatient settings

- The growing demand for biological therapies is primarily driven by increasing prevalence of chronic diseases, rising adoption of targeted and precision therapies, and continuous advancements in biotechnology and drug development

- North America dominated the biological therapy market with the largest revenue share of 38.9% in 2024, fueled by advanced healthcare infrastructure, high R&D investments, early adoption of biologics, and a strong presence of key pharmaceutical and biotech companies, particularly in the U.S., where innovations in monoclonal antibodies, CAR-T therapies, and biosimilars are accelerating market growth

- Asia-Pacific is expected to be the fastest growing region in the biological therapy market during the forecast period due to increasing healthcare expenditure, expanding biopharmaceutical manufacturing capabilities, and growing awareness of advanced therapies among patients and healthcare providers

- Monoclonal antibodies segment dominated the biological therapy market with a market share of 43.1% in 2024, driven by their proven efficacy in treating cancers, autoimmune disorders, and inflammatory conditions, as well as ongoing research leading to next-generation antibody therapies

Report Scope and Biological Therapy Market Segmentation

|

Attributes |

Biological Therapy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Biological Therapy Market Trends

Rising Adoption of Personalized and Targeted Therapies

- A significant and accelerating trend in the global biological therapy market is the increasing shift toward personalized and precision medicine, enabling treatments tailored to individual patient profiles based on genetic, biomarker, or disease-specific characteristics

- For instance, CAR-T cell therapies are being designed to target specific cancer antigens, offering highly individualized treatment options for patients with refractory or relapsed hematologic malignancies

- Advancements in diagnostic tools and companion diagnostics allow healthcare providers to select the most effective biological therapy, improving patient outcomes and reducing trial-and-error in treatment regimens

- The integration of big data analytics and AI in therapy selection enhances treatment accuracy by predicting patient response and optimizing dosing schedules, creating more efficient therapeutic pathways

- This trend toward highly targeted, patient-centric therapies is reshaping expectations in clinical practice, driving demand for biologics that offer superior efficacy with minimized adverse effects

- The demand for personalized biological therapies is rapidly increasing across oncology, autoimmune, and rare disease segments, as healthcare providers and patients prioritize precision treatment and better clinical outcomes

Biological Therapy Market Dynamics

Driver

Increasing Prevalence of Chronic and Autoimmune Diseases

- The rising global burden of chronic, autoimmune, and inflammatory diseases is a primary driver for the growing adoption of biological therapies, creating sustained demand across multiple therapeutic areas

- For instance, the increasing incidence of rheumatoid arthritis and inflammatory bowel disease is leading to greater uptake of monoclonal antibodies and other targeted biologics

- Biological therapies provide enhanced efficacy and reduced side effects compared to conventional small-molecule drugs, driving preference among healthcare providers and patients

- Expanding healthcare infrastructure, government initiatives, and reimbursement policies supporting access to advanced therapies are further enabling market growth across developed and emerging regions

- Biologics are estimated to grow promptly in the next years due to the high productivity of small molecule therapeutics. Major market players in the pharmaceutical industry are continuously focusing on developing innovative drugs to keep up with the competition

- Ongoing R&D and the development of next-generation biologics, including biosimilars and cell therapies, continue to widen the scope of treatable conditions, strengthening overall market expansion

Restraint/Challenge

High Treatment Costs and Regulatory Complexities

- The high cost of biological therapies and complex regulatory approval processes pose significant challenges to market adoption, limiting accessibility for price-sensitive patients and healthcare systems

- For instance, CAR-T therapies and advanced monoclonal antibodies often carry treatment costs in the range of hundreds of thousands of dollars per patient, restricting uptake in developing regions

- Strict regulatory requirements for clinical trials, manufacturing, and post-marketing surveillance increase the time and investment needed to bring new biologics to market, posing barriers for smaller biotech companies

- Safety concerns, including immunogenicity and adverse effects, require rigorous monitoring, adding complexity to therapy administration and patient management

- While biosimilars are helping reduce treatment costs, limited awareness and skepticism among healthcare providers and patients can slow adoption

- Overcoming these challenges through cost reduction strategies, streamlined regulatory pathways, and enhanced education on safety and efficacy will be critical for sustaining market growth

Biological Therapy Market Scope

The market is segmented on the basis of type, route of administration, end-users, and distribution channel.

- By Type

On the basis of type, the global biological therapy market is segmented into monoclonal antibodies, vaccines, cancer growth blockers, cytokines, and others. The monoclonal antibodies segment dominated the market in 2024, holding the largest revenue share of 43.1%, driven by their proven efficacy in treating cancers, autoimmune disorders, and inflammatory diseases. Monoclonal antibodies are widely adopted due to their targeted mechanism of action, ability to minimize systemic side effects, and compatibility with other therapeutic regimens. Hospitals and specialty centers prefer monoclonal antibody therapies for chronic and complex conditions, ensuring steady demand. In addition, ongoing innovations, such as next-generation and bispecific antibodies, are expanding their therapeutic potential. Strong R&D pipelines and significant investment by pharmaceutical companies further reinforce their market dominance. The widespread awareness among clinicians and patients about the effectiveness of monoclonal antibodies also supports their continued leadership in the market.

The vaccines segment is anticipated to witness the fastest growth during the forecast period due to rising immunization programs and increasing focus on preventive healthcare. Vaccines targeting infectious and lifestyle-related diseases are gaining traction across emerging markets. Advances in recombinant and mRNA vaccine technologies are accelerating product launches. Public health initiatives and government funding are expanding vaccine coverage, driving adoption. Homecare and outpatient settings are increasingly administering vaccines, adding to market expansion. Awareness campaigns and growing healthcare infrastructure further contribute to rapid growth in the vaccines segment.

- By Route of Administration

On the basis of route of administration, the market is segmented into intravenous, subcutaneous, intramuscular, and others. The intravenous segment dominated in 2024, accounting for the largest revenue share, due to its suitability for hospital-based administration of high-dose biologics and complex therapies. Intravenous administration allows controlled infusion of therapies such as monoclonal antibodies and cytokines, ensuring safety and efficacy. Hospitals and specialty centers are the primary end-users for IV-administered biologics. Intravenous delivery also facilitates combination treatments and monitoring of patient response in real-time. Advanced infusion devices and hospital infrastructure further support the dominance of IV administration. Clinicians often prefer intravenous routes for critical care and oncology patients due to reliable bioavailability and therapeutic outcomes.

The subcutaneous segment is expected to witness the fastest growth from 2025 to 2032, fueled by patient preference for self-administration and homecare compatibility. Subcutaneous injections enable convenient, minimally invasive delivery of therapies such as monoclonal antibodies and vaccines. This route reduces hospital visits and associated healthcare costs, appealing to patients and providers. Advances in pre-filled auto-injectors and wearable delivery devices are improving adoption. Subcutaneous administration also supports chronic disease management and outpatient treatment. Patient education and awareness programs are accelerating acceptance of subcutaneous therapies.

- By End-Users

On the basis of end-users, the market is segmented into hospitals, homecare, specialty centers, and others. The hospitals segment dominated the market in 2024, due to the availability of specialized infrastructure, trained staff, and equipment required for administering complex biological therapies. Hospitals manage high patient volumes requiring monoclonal antibodies, cytokines, and cancer growth blockers. Hospitals are also key for clinical trials and early adoption of novel therapies. Their ability to monitor adverse events ensures patient safety, supporting demand for hospital-administered biologics. Collaborations with biotech companies and integrated care models reinforce hospital dominance. Hospitals are also central to awareness programs and treatment adoption for emerging biologics.

The homecare segment is projected to witness the fastest growth during the forecast period, driven by rising preference for self-administration, convenience, and remote healthcare solutions. Increasing availability of pre-filled syringes, auto-injectors, and digital monitoring devices enables safe home administration. Chronic disease management and vaccination programs are major drivers of homecare adoption. Telemedicine integration supports patient compliance and monitoring. Reduced hospital visits and associated costs make homecare an attractive option for patients. Growing awareness and education on self-administration are further accelerating the segment’s growth.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacy, online pharmacy, and retail pharmacy. The hospital pharmacy segment dominated in 2024, as hospitals serve as primary procurement centers for high-value and complex biologics, ensuring safe handling and storage. Hospital pharmacies maintain cold chain logistics for temperature-sensitive biologics. They cater to inpatient and outpatient requirements, including infusion therapies and immunotherapies. Collaborations with pharmaceutical companies facilitate timely supply of biologics. Hospital pharmacies also provide professional guidance and monitoring, ensuring compliance with treatment protocols. Their strategic position within healthcare infrastructure secures dominance in the distribution channel segment.

The online pharmacy segment is expected to witness the fastest growth during the forecast period, driven by increasing adoption of e-commerce in healthcare and growing demand for convenience in obtaining biologics. Online pharmacies enable direct-to-patient delivery, including refrigerated shipping for sensitive therapies. Integration with telehealth platforms supports patient adherence and monitoring. Expanding digital payment and logistics networks further enhance adoption. Patient preference for doorstep delivery and reduced hospital visits drives growth. Rising awareness and regulatory support for online pharmaceutical sales contribute to the rapid expansion of this segment.

Biological Therapy Market Regional Analysis

- North America dominated the biological therapy market with the largest revenue share of 38.9% in 2024, fueled by advanced healthcare infrastructure, high R&D investments, early adoption of biologics, and a strong presence of key pharmaceutical and biotech companies

- The U.S., in particular, leads the region due to a strong presence of key pharmaceutical and biotechnology companies, extensive clinical trial activities, and a well-established reimbursement ecosystem supporting biologic treatments

- Widespread awareness among healthcare providers and patients regarding the efficacy of monoclonal antibodies, vaccines, and other targeted therapies is further boosting adoption across hospitals and specialty centers

U.S. Biological Therapy Market Insight

The U.S. biological therapy market captured the largest revenue share of 39% in 2024 within North America, driven by advanced healthcare infrastructure, high adoption of innovative biologics, and a strong R&D ecosystem. Patients and healthcare providers increasingly prioritize targeted therapies such as monoclonal antibodies, CAR-T cell treatments, and vaccines for chronic, autoimmune, and oncological conditions. The presence of leading biotechnology and pharmaceutical companies, combined with favorable reimbursement policies, supports rapid market expansion. Moreover, extensive clinical trials and early adoption of next-generation biologics are accelerating growth. The growing prevalence of chronic diseases, coupled with patient demand for personalized treatment options, further propels the U.S. market.

Europe Biological Therapy Market Insight

The Europe biological therapy market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing prevalence of chronic and autoimmune diseases and strong healthcare infrastructure. Government initiatives promoting access to advanced biologics and stringent regulatory frameworks for biologics are fostering market growth. The region’s aging population and rising awareness of targeted therapies are increasing demand across hospitals and specialty centers. Europe is also witnessing significant adoption of biosimilars, reducing treatment costs and broadening patient access. Research collaborations and technological advancements in biologics further support market expansion.

U.K. Biological Therapy Market Insight

The U.K. biological therapy market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by rising demand for personalized medicine and innovative treatment options. Increasing prevalence of autoimmune and rare diseases encourages adoption of monoclonal antibodies, vaccines, and other biologics. Strong government support for healthcare innovation, alongside robust healthcare infrastructure, facilitates market penetration. Patients and clinicians are increasingly opting for biologics due to superior efficacy and safety profiles compared to conventional therapies. The growing trend of outpatient treatment and home administration also contributes to market growth.

Germany Biological Therapy Market Insight

The Germany biological therapy market is expected to expand at a considerable CAGR during the forecast period, driven by high awareness of advanced therapies and well-established healthcare infrastructure. The country emphasizes R&D and innovation in biotechnology, fostering adoption of monoclonal antibodies, vaccines, and cell therapies. Increasing prevalence of chronic and rare diseases promotes the uptake of targeted biologics in hospitals and specialty centers. Germany’s focus on precision medicine and regulatory support for advanced biologics enhances market growth. Integration of biologics into treatment protocols for oncology and autoimmune disorders further strengthens market demand.

Asia-Pacific Biological Therapy Market Insight

The Asia-Pacific biological therapy market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by increasing healthcare expenditure, expanding infrastructure, and rising patient awareness in countries such as China, Japan, and India. Growing prevalence of chronic and infectious diseases is accelerating demand for vaccines and monoclonal antibodies. Government initiatives supporting biotechnology and personalized medicine are boosting adoption. The region is emerging as a manufacturing hub for biologics, improving affordability and accessibility. Increased urbanization and a growing middle-class population further fuel market growth.

Japan Biological Therapy Market Insight

The Japan biological therapy market is gaining momentum due to advanced healthcare infrastructure, high adoption of innovative biologics, and a strong focus on elderly patient care. The country’s aging population and rising prevalence of chronic and autoimmune diseases are increasing demand for monoclonal antibodies, vaccines, and cell therapies. Integration of biologics into hospital-based and homecare treatment settings supports rapid adoption. Strong investment in biotechnology R&D and government initiatives promoting advanced therapies further drive growth. Japanese patients and clinicians are increasingly seeking targeted, personalized treatments, contributing to market expansion.

India Biological Therapy Market Insight

The India biological therapy market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to increasing healthcare expenditure, expanding infrastructure, and growing patient awareness. Rising prevalence of chronic, infectious, and autoimmune diseases is driving demand for biologics across hospitals, specialty centers, and homecare. Government initiatives supporting biotechnology, personalized medicine, and immunization programs are further boosting market adoption. The presence of domestic manufacturers and affordable biologic options enhances accessibility. Rapid urbanization and an expanding middle-class population are key factors propelling growth in India.

Biological Therapy Market Share

The Biological Therapy industry is primarily led by well-established companies, including:

- Amgen Inc. (U.S.)

- Novartis AG (Switzerland)

- Sanofi (France)

- Johnson & Johnson and its affiliates (U.S.)

- Bristol-Myers Squibb Company (U.S.)

- Lilly USA, LLC (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Biogen Inc. (U.S.)

- Regeneron Pharmaceuticals, Inc. (U.S.)

- Moderna, Inc. (U.S.)

- Takeda Pharmaceutical Company Limited (Japan)

- Gilead Sciences, Inc. (U.S.)

- Vertex Pharmaceuticals Incorporated (U.S.)

- BioMarin Pharmaceutical Inc. (U.S.)

- Alnylam Pharmaceuticals, Inc. (U.S.)

- Argenx (Belgium)

- BeiGene, Ltd. (China)

- CELLTRION INC. (South Korea)

- Samsung Biologics (South Korea)

What are the Recent Developments in Global Biological Therapy Market?

- In September 2025, Enlaza Therapeutics announced a strategic collaboration with Vertex Pharmaceuticals to develop novel tumor-activated immunotherapies, including masked T-cell engagers, utilizing Enlaza's proprietary War-Lock technology platform. This partnership aims to enhance the specificity and efficacy of treatments for certain autoimmune diseases and improve conditioning in sickle cell disease and beta thalassemia

- In April 2025, Boehringer Ingelheim and Cue Biopharma entered into a collaboration to develop next-generation treatments for autoimmune and inflammatory diseases. This partnership combines Boehringer Ingelheim's expertise in immunology with Cue Biopharma's proprietary ImmTAC platform, aiming to create more targeted and effective therapies for patients with autoimmune conditions

- In April 2025, The FDA approved ZEVASKYN (prademagene zamikeracel), an autologous cell-based gene therapy, for the treatment of chronic wounds in adult and pediatric patients with recessive dystrophic epidermolysis bullosa (RDEB). This therapy involves genetically modifying a patient's own skin cells to express functional type VII collagen, addressing a significant unmet need in RDEB treatment

- In March 2025, The U.S. Food and Drug Administration (FDA) approved Qfitlia (fitusiran), an innovative small interfering RNA (siRNA) therapy, for the routine prophylaxis of bleeding episodes in adults and pediatric patients aged 12 years and older with hemophilia A or B, with or without factor VIII or IX inhibitors. This approval marks a significant advancement in hemophilia treatment, offering a novel approach to managing the condition

- In March 2025, AstraZeneca announced an agreement to acquire biotechnology company EsoBiotec for up to USD 1 billion. This acquisition aims to bolster AstraZeneca's cell therapy capabilities, particularly in cancer and autoimmune diseases. EsoBiotec's technology enables genetic modification of immune cells inside the body within minutes, a major advancement over the current weeks-long process

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.