Global Biomanufacturing Viral Detection And Quantification Market

Market Size in USD Million

CAGR :

%

USD

518.41 Million

USD

1,061.35 Million

2024

2032

USD

518.41 Million

USD

1,061.35 Million

2024

2032

| 2025 –2032 | |

| USD 518.41 Million | |

| USD 1,061.35 Million | |

|

|

|

|

Biomanufacturing Viral Detection and Quantification Market Size

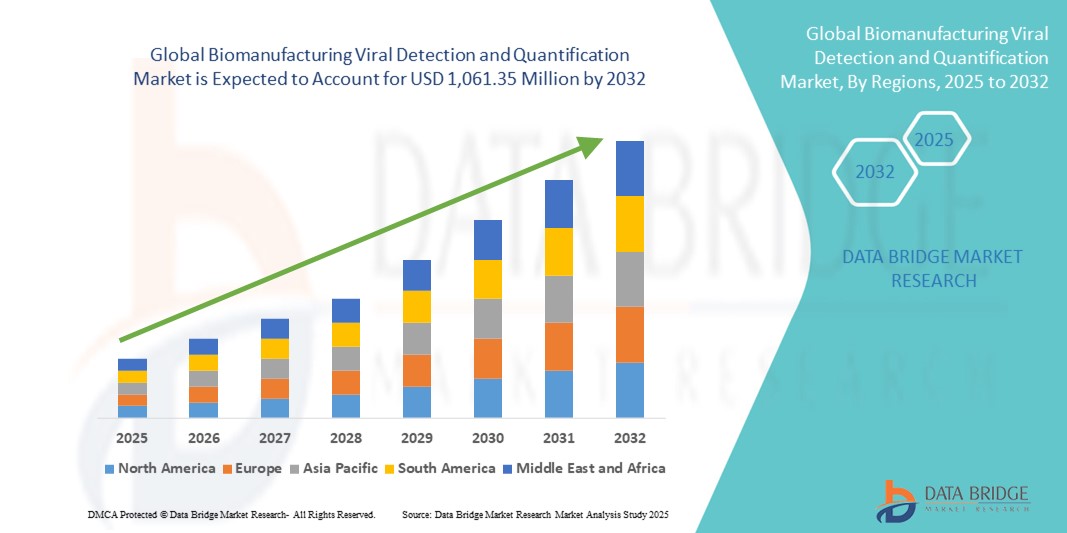

- The global biomanufacturing viral detection and quantification market size was valued at USD 518.41 million in 2024 and is expected to reach USD 1,061.35 million by 2032, at a CAGR of 9.37% during the forecast period

- The market growth is largely driven by the increasing focus on biosafety and regulatory compliance in biologics production, necessitating robust viral monitoring during biomanufacturing processes

- Furthermore, the expanding pipeline of biologics and gene therapies, along with the growing need for sensitive, rapid, and high-throughput detection methods, is reinforcing the demand for advanced viral detection and quantification solutions. These intersecting trends are significantly accelerating market expansion and enhancing quality assurance standards across the global biopharmaceutical landscape

Biomanufacturing Viral Detection and Quantification Market Analysis

- Viral detection and quantification systems, essential for identifying and measuring viral contaminants in biomanufacturing, are increasingly critical to ensuring product safety, regulatory compliance, and quality control across biologics, vaccines, and gene therapies production

- The rising demand for biologics and advanced therapies is the primary driver behind the market's growth, as manufacturers seek rapid, sensitive, and reliable viral monitoring technologies to meet stringent regulatory standards

- North America dominated the biomanufacturing viral detection and quantification market with the largest revenue share of 41.8% in 2024, attributed to a strong biopharmaceutical infrastructure, high R&D investments, and the presence of major biotech firms and contract development and manufacturing organizations (CDMOs) focused on biologics and cell and gene therapies

- Asia-Pacific is expected to be the fastest growing region in the biomanufacturing viral detection and quantification market during the forecast period, driven by expanding biomanufacturing capacity, supportive government initiatives, and increasing outsourcing of biologics production to countries such as China, India, and South Korea

- The PCR segment dominated the biomanufacturing viral detection and quantification market with a share of 46.7% in 2024, due to its widespread use, high sensitivity, and ability to provide quantitative viral load data essential for regulatory validation and process optimization

Report Scope and Biomanufacturing Viral Detection and Quantification Market Segmentation

|

Attributes |

Biomanufacturing Viral Detection and Quantification Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Biomanufacturing Viral Detection and Quantification Market Trends

Advancement in Rapid, High-Throughput Viral Detection Technologies

- A major and accelerating trend in the global biomanufacturing viral detection and quantification market is the growing adoption of advanced, high-throughput, and rapid viral detection methods especially PCR, next-generation sequencing (NGS), and digital PCR platforms. These technologies are enabling real-time, sensitive, and scalable analysis of viral contaminants during biopharmaceutical production

- For instance, Thermo Fisher Scientific offers a range of qPCR-based viral detection kits that deliver rapid turnaround times while meeting stringent regulatory standards. Similarly, Roche’s digital PCR solutions provide absolute quantification of viral DNA/RNA with high accuracy, even at low concentrations

- These advanced platforms allow manufacturers to streamline quality control workflows, shorten release timelines, and improve biosafety by identifying even trace amounts of viral contamination. In addition, automated sample preparation systems are being integrated with these tools to increase efficiency and reduce operator error

- The demand for multiplex detection kits capable of identifying multiple viruses in a single test is also rising, enhancing operational throughput. Technologies such as NGS are increasingly being adopted to perform broad-spectrum viral screening, providing deep insights into known and emerging viral threats within production environments

- This trend toward more accurate, efficient, and scalable viral testing is reshaping expectations for regulatory compliance and quality assurance in biologics manufacturing. As a result, companies such as Merck KGaA and Bio-Rad Laboratories are investing in platform development that supports real-time monitoring, data analytics integration, and automation

- The growing emphasis on rapid viral detection and digital quantification is expanding across biologics, vaccines, and cell and gene therapy production, reinforcing the importance of agile and validated testing frameworks across the industry

Biomanufacturing Viral Detection and Quantification Market Dynamics

Driver

Increased Demand for Biosafety in Biologics and Cell Therapy Manufacturing

- The rising demand for biologics, monoclonal antibodies, and advanced therapies such as cell and gene therapies is a key driver for the market, as these products require stringent viral safety controls during development and production

- For instance, in March 2024, WuXi Biologics expanded its viral clearance capabilities in response to heightened global demand for faster and more reliable biosafety testing in clinical and commercial production. This reflects the industry’s shift toward investing in advanced viral detection platforms to meet evolving regulatory expectations

- Regulatory authorities such as the FDA and EMA mandate thorough viral safety testing throughout biomanufacturing workflows, encouraging adoption of sensitive detection and quantification systems. These tools enable manufacturers to identify contamination risks early, avoid costly batch failures, and ensure product quality and patient safety

- Furthermore, as the complexity and volume of biologics increase, manufacturers are seeking scalable and automated solutions that reduce testing times, enhance throughput, and provide reproducible results. The integration of real-time monitoring tools into continuous bioprocessing setups is further reinforcing the demand for viral detection systems

- The push for faster time-to-market, paired with the growing use of CDMOs and increasing outsourcing of viral testing, continues to support the development and deployment of viral detection and quantification technologies across global facilities

Restraint/Challenge

Technical Complexity and Regulatory Stringency in Validation Processes

- The technical challenges associated with validating viral detection and quantification methods across diverse biological products remain a key restraint in the market. Each biologic or gene therapy product may require customized viral testing protocols, increasing time, cost, and complexity

- For instance, implementing novel detection platforms such as NGS requires rigorous validation to meet regulatory standards, along with skilled personnel and infrastructure—posing hurdles for small and mid-sized manufacturers

- In addition, inconsistent global regulatory guidelines and variations in acceptance of newer viral detection technologies create challenges for companies operating in multiple markets. This limits the adoption of innovative solutions, particularly in emerging markets where regulatory harmonization is lacking

- High initial investment in advanced detection platforms, as well as operational costs for skilled staff, reagents, and quality control systems, further hinder adoption by cost-sensitive manufacturers

- Overcoming these challenges will require industry collaboration, standardization of validation protocols, and regulatory guidance to support the deployment of emerging technologies

- Educational initiatives to upskill workforce capabilities and technological innovation aimed at simplifying assay workflows are also critical to expanding market reach and enabling wider adoption across biomanufacturing settings

Biomanufacturing Viral Detection and Quantification Market Scope

The market is segmented on the basis of offering type, technology, application, and end user.

- By Offering Type

On the basis of offering type, the biomanufacturing viral detection and quantification market is segmented into consumables, instruments, and services. The consumables segment dominated the market with the largest revenue share in 2024, owing to the recurrent need for reagents, assay kits, primers, probes, and viral standards used across viral detection workflows. The growing frequency of testing throughout the biomanufacturing lifecycle, especially in the production of biologics and gene therapies, continues to fuel demand for high-quality and compliant consumables. The segment also benefits from the expansion of continuous manufacturing models, which require consistent testing and reagent supply.

The services segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing outsourcing of viral safety testing to contract laboratories and CDMOs. This trend is particularly prevalent among small and mid-sized biopharma companies seeking regulatory-compliant, cost-effective testing solutions without the need for internal infrastructure. In addition, specialized service providers offer expertise in assay development, method validation, and regulatory documentation.

- By Technology

On the basis of technology, the biomanufacturing viral detection and quantification market is segmented into PCR, ELISA, flow cytometry, plaque assay, and others. The PCR segment held the largest market share of 46.7% in 2024 due to its high sensitivity, specificity, and rapid turnaround in detecting and quantifying viral nucleic acids. Widely adopted as a regulatory gold standard, PCR is the cornerstone of viral safety testing in biomanufacturing. Both traditional qPCR and emerging digital PCR (dPCR) platforms are seeing increased deployment for their ability to detect low-level contamination and support real-time monitoring.

The flow cytometry segment is projected to witness the fastest growth from 2025 to 2032, driven by its capability to provide multiparametric analysis, rapid detection of viral antigens, and viability assessments in complex biological samples. Its application in real-time monitoring of viral vectors in cell and gene therapy production is significantly expanding its adoption.

- By Application

On the basis of application, the biomanufacturing viral detection and quantification market is categorized into blood and blood products manufacturing, vaccines and therapeutics manufacturing, cellular and gene therapy products manufacturing, stem cell products manufacturing, and tissue and tissue products manufacturing. The vaccines and therapeutics manufacturing segment held the largest market revenue share in 2024, supported by the rising demand for viral safety in large-scale vaccine production and monoclonal antibody manufacturing. Regulatory expectations for viral clearance studies and in-process testing in these segments remain stringent, boosting adoption of rapid and sensitive detection methods.

The cellular and gene therapy products manufacturing segment is expected to witness the highest growth rate through 2032. The growing number of approved cell and gene therapies, along with their complex and sensitive nature, necessitates rigorous viral detection protocols to ensure product safety. Increasing global investments in CGT infrastructure further support segment expansion.

- By End User

On the basis of end user, the biomanufacturing viral detection and quantification market is segmented into life science companies, testing laboratories, contract research organizations (CROs), and contract development and manufacturing organizations (CDMOs). The life science companies segment held the largest market share in 2024, attributed to the growing number of biologic drugs in development and commercialization. These organizations maintain extensive in-house testing capabilities to comply with regulatory requirements and safeguard production pipelines.

The CDMOs segment is projected to experience the fastest growth from 2025 to 2032, as pharmaceutical companies increasingly outsource viral safety testing and manufacturing to specialized CDMOs. The flexibility, scalability, and cost-efficiency offered by CDMOs, combined with their expanding global presence, are driving adoption across the biopharmaceutical industry.

Biomanufacturing Viral Detection and Quantification Market Regional Analysis

- North America dominated the biomanufacturing viral detection and quantification market with the largest revenue share of 41.8% in 2024, attributed to a strong biopharmaceutical infrastructure, high R&D investments, and the presence of major biotech firms and contract development and manufacturing organizations (CDMOs) focused on biologics and cell and gene therapies

- The region's strong demand is supported by high investments in biologics and gene therapy development, coupled with the widespread presence of major pharmaceutical companies, CROs, and CDMOs with advanced biosafety capabilities

- In addition, increased R&D funding, a mature regulatory landscape, and early adoption of advanced viral detection technologies such as PCR and digital PCR have positioned North America as a leader in ensuring viral safety across biomanufacturing workflows, making it a critical region for market expansion and innovation

U.S. Biomanufacturing Viral Detection and Quantification Market Insight

The U.S. biomanufacturing viral detection and quantification market captured the largest revenue share of 78% in 2024 within North America, fueled by the country’s leading position in biologics, vaccines, and gene therapy production. The presence of top-tier pharmaceutical companies, advanced research infrastructure, and stringent regulatory frameworks from agencies such as the FDA support widespread adoption of viral safety testing. In addition, high investment in innovation, combined with an increasing reliance on PCR and next-generation sequencing technologies, is driving the demand for accurate, real-time viral detection solutions.

Europe Biomanufacturing Viral Detection and Quantification Market Insight

The Europe biomanufacturing viral detection and quantification market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by strict biosafety standards set by the EMA and the growing pipeline of biologics and advanced therapies. Increasing public and private investments in biomanufacturing, particularly in Germany, France, and Switzerland, are fostering regional growth. The need for regulatory-compliant testing and quality assurance processes across clinical and commercial stages is accelerating the adoption of high-precision detection technologies.

U.K. Biomanufacturing Viral Detection and Quantification Market Insight

The U.K. biomanufacturing viral detection and quantification market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by its strong academic and biopharma research ecosystem. Rising interest in gene therapy and personalized medicine, coupled with the MHRA’s emphasis on rigorous viral safety evaluation, is encouraging the use of validated detection tools. Moreover, government support for biotech innovation and growing collaboration with CDMOs are boosting market penetration in the country.

Germany Biomanufacturing Viral Detection and Quantification Market Insight

The Germany biomanufacturing viral detection and quantification market is expected to expand at a considerable CAGR during the forecast period, supported by the country’s advanced biotech manufacturing capabilities and commitment to pharmaceutical quality. Germany’s leadership in cell therapy and vaccine development is increasing the need for scalable, high-throughput viral detection platforms. In addition, its regulatory alignment with EU biosafety requirements and emphasis on automation and digitalization are reinforcing adoption among local manufacturers and CDMOs.

Asia-Pacific Biomanufacturing Viral Detection and Quantification Market Insight

The Asia-Pacific biomanufacturing viral detection and quantification market is poised to grow at the fastest CAGR of 25% during the forecast period of 2025 to 2032, driven by expanding biopharma manufacturing capabilities, especially in China, India, South Korea, and Japan. Government-backed investments in biologics, biosimilars, and pandemic preparedness initiatives are strengthening the demand for viral safety testing solutions. Moreover, increasing outsourcing to regional CDMOs and availability of cost-effective diagnostic technologies are expanding the market’s reach.

Japan Biomanufacturing Viral Detection and Quantification Market Insight

The Japan biomanufacturing viral detection and quantification market is gaining momentum due to its highly regulated biopharmaceutical industry and strong focus on innovation and biosafety. The country’s rising investment in regenerative medicine and gene therapy is driving the demand for sensitive, validated viral detection methods. Advanced infrastructure and a preference for high-precision technologies such as digital PCR and NGS are fostering rapid market adoption across biomanufacturing facilities and research institutions.

India Biomanufacturing Viral Detection and Quantification Market Insight

The India biomanufacturing viral detection and quantification market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to the country’s expanding biosimilars market, growing pharmaceutical exports, and government support for biopharma infrastructure. The emergence of domestic CDMOs and increased participation in global vaccine and biologic production have heightened the need for reliable viral safety protocols. Rising awareness of global regulatory requirements and greater access to modern testing technologies are key drivers supporting market growth in India.

Biomanufacturing Viral Detection and Quantification Market Share

The biomanufacturing viral detection and quantification industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Merck KGaA (Germany)

- Sartorius AG (Germany)

- Charles River Laboratories (U.S.)

- Danaher Corporation (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- QIAGEN (Netherlands)

- Lonza Group Ltd. (Switzerland)

- Pall Corporation (U.S.)

- PerkinElmer (U.S.)

- GE Healthcare (U.S.)

- F. Hoffmann-La Roche AG (Switzerland)

- BD (U.S.)

- Promega Corporation (U.S.)

- FUJIFILM Diosynth Biotechnologies (U.S.)

- Avantor, Inc. (U.S.)

- SGS Societe Generale de Surveillance SA. (Switzerland)

- Eurofins Scientific (Luxembourg)

- Virapur LLC (U.S.)

- BioReliance Corporation (U.S.)

What are the Recent Developments in Global Biomanufacturing Viral Detection and Quantification Market?

- In April 2024, Thermo Fisher Scientific Inc. expanded its viral vector services with a new facility in Plainville, Massachusetts, aimed at supporting gene therapy production. The facility is equipped with advanced viral detection and quantification capabilities, including digital PCR and qPCR systems, ensuring regulatory compliance and product safety. This expansion strengthens Thermo Fisher’s position in the viral safety segment, catering to rising global demand for cell and gene therapies

- In March 2024, Sartorius AG launched an integrated viral clearance validation platform designed to streamline biosafety testing in biologics manufacturing. The platform combines advanced detection technologies with automation features to reduce turnaround times and improve accuracy. This development reflects Sartorius’ strategic focus on enhancing quality control processes in biopharma manufacturing through cutting-edge, scalable solutions

- In February 2024, Charles River Laboratories International, Inc. announced the expansion of its biologics testing services in Europe, with new capabilities in viral detection and quantification for advanced therapy medicinal products (ATMPs). The move aims to meet growing demand from European cell and gene therapy developers seeking timely and compliant viral safety testing. This strategic investment underscores Charles River’s commitment to supporting global biomanufacturing pipelines

- In January 2024, Bio-Rad Laboratories, Inc. introduced a next-generation droplet digital PCR (ddPCR) system tailored for the detection and absolute quantification of viral contaminants in biopharmaceutical products. The new platform enhances sensitivity and reproducibility, especially in complex biologic matrices, and is designed to meet stringent regulatory expectations for viral safety validation

- In January 2023, Merck KGaA (MilliporeSigma in the U.S. and Canada) launched the "Viresolve Pro Shield H" solution—a virus-retentive prefilter optimized for the removal of parvoviruses and larger viruses during biomanufacturing. Designed to enhance process robustness, this new product reflects Merck’s ongoing innovation in viral filtration and detection technologies. It aligns with the industry’s shift toward more efficient, integrated viral safety solutions to support high-throughput biologics manufacturing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.