Global Biomedical Materials Market

Market Size in USD Billion

CAGR :

%

USD

15.27 Billion

USD

35.45 Billion

2024

2032

USD

15.27 Billion

USD

35.45 Billion

2024

2032

| 2025 –2032 | |

| USD 15.27 Billion | |

| USD 35.45 Billion | |

|

|

|

|

Biomedical Materials Market Size

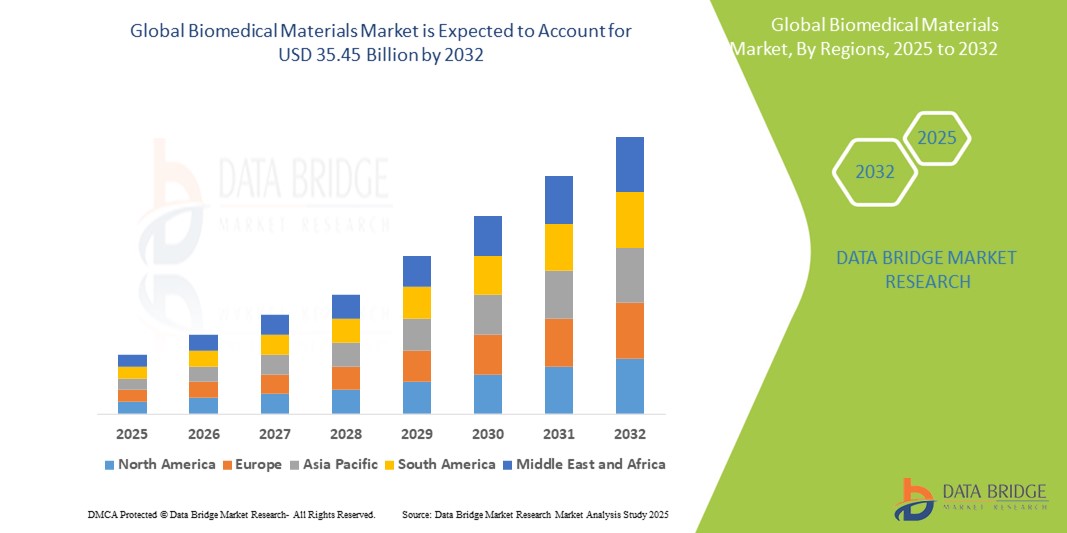

- The global biomedical materials market size was valued at USD 15.27 billion in 2024 and is expected to reach USD 35.45 billion by 2032, at a CAGR of 11.10% during the forecast period

- The market growth is largely fueled by rising healthcare expenditures, increased demand for advanced medical implants and prosthetics, and continuous innovation in biocompatible and bioresorbable materials, driving their widespread application across various medical disciplines

- Furthermore, the expanding geriatric population and rising prevalence of chronic conditions such as cardiovascular, orthopedic, and neurological disorders are accelerating the need for effective, safe, and long-lasting biomaterials. These converging factors are propelling the adoption of biomedical materials, thereby significantly boosting the industry's growth

Biomedical Materials Market Analysis

- Biomedical materials, encompassing a wide range of natural and synthetic substances used in medical applications, are increasingly vital components in the development of implants, prosthetics, tissue engineering scaffolds, and drug delivery systems due to their high biocompatibility, mechanical strength, and functional adaptability

- The escalating demand for biomedical materials is primarily fueled by an aging global population, a surge in chronic diseases, and increasing demand for advanced medical treatments, particularly in orthopedics, cardiology, and dentistry

- North America dominated the biomedical materials market with the largest revenue share of 39.2% in 2024, characterized by robust healthcare infrastructure, rising R&D investments, and the strong presence of leading biomedical and medtech companies, with the U.S. experiencing notable advancements in regenerative medicine and bioresorbable implant technologies

- Asia-Pacific is expected to be the fastest growing region in the biomedical materials market during the forecast period due to expanding healthcare access, increasing medical tourism, and growing investments in biomedical innovation

- Polymeric biomaterials segment dominated the biomedical materials market with a market share of 42.1% in 2024, driven by their versatility, biodegradability, and increasing use in a wide range of applications such as wound healing, orthopedic devices, and tissue engineering

Report Scope and Biomedical Materials Market Segmentation

|

Attributes |

Biomedical Materials Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Biomedical Materials Market Trends

“Advancements in Regenerative Medicine and Biodegradable Implants”

- A significant and accelerating trend in the global biomedical materials market is the rapid innovation in regenerative medicine and biodegradable implants, which is transforming how injuries and chronic diseases are treated. These advancements are enabling the development of next-generation materials that support tissue repair, promote cellular regeneration, and safely degrade within the body over time

- For instance, companies such as Evonik Industries and DSM Biomedical are investing in bioresorbable polymers and scaffolds that can naturally integrate with human tissues, minimizing the need for secondary surgeries. Similarly, 3D printing technologies are being employed to produce patient-specific implants and drug-delivery matrices using advanced biomaterials

- Innovations in nanotechnology and bioengineering are enabling the creation of materials that mimic natural tissue structures and exhibit enhanced properties such as controlled drug release, antimicrobial activity, or responsive behavior to biological stimuli

- These materials are increasingly used in applications such as wound healing, orthopedic implants, cardiovascular grafts, and dental restoration, contributing to faster patient recovery and better clinical outcomes. Furthermore, the demand for minimally invasive and personalized medical solutions is boosting the need for smart biomedical materials capable of adapting to physiological conditions

- The integration of biologically active molecules and stem-cell compatible matrices into biomaterials is also driving research and commercialization efforts. Companies such as Medtronic and Stryker are expanding their portfolios with materials optimized for regenerative capabilities, paving the way for next-gen therapies in musculoskeletal and neural applications

- This trend towards intelligent, bioactive, and biodegradable solutions is redefining expectations for medical devices and therapeutic interventions. As healthcare systems seek more effective, less invasive, and patient-tailored treatments, the demand for advanced biomedical materials is projected to grow significantly across global markets

Biomedical Materials Market Dynamics

Driver

“Growing Demand Driven by Aging Population and Advanced Medical Interventions”

- The increasing global aging population, combined with the growing burden of chronic and degenerative diseases, is a primary driver for the expanding biomedical materials market

- For instance, in 2024, Evonik introduced a next-generation bioresorbable polymer aimed at enhancing the performance of cardiovascular stents and orthopedic screws, reflecting the industry's focus on aging-related medical needs

- As older populations require more implants, prosthetics, and surgical interventions, biomedical materials offer durable, biocompatible, and safe solutions for long-term use. Their use is particularly crucial in orthopedic, dental, and cardiovascular treatments, where patient safety and implant longevity are paramount

- Moreover, the push for less invasive procedures and personalized medicine has led to greater reliance on smart biomaterials that support tissue repair, enable targeted drug delivery, and reduce the risk of immune response or infection

- Advancements in materials science are also allowing the development of multifunctional biomaterials that combine therapeutic and structural properties, providing a comprehensive solution in modern medical care

- The increasing adoption of biomedical materials in emerging fields such as 3D bioprinting, organ regeneration, and nanomedicine is further propelling market expansion, supported by substantial government and private sector investments in biomedical R&D

Restraint/Challenge

“Regulatory Complexities and High Development Costs”

- The stringent regulatory frameworks governing biomedical materials pose a significant challenge to market growth. As these materials directly interact with human tissues, they are subject to rigorous safety and efficacy assessments by agencies such as the FDA (U.S.) and EMA (Europe)

- For instance, delays in product approvals or rejections due to lack of long-term biocompatibility data can hinder timely market entry and increase development costs for manufacturers

- In addition, the complex and often lengthy clinical trial requirements can strain resources, particularly for smaller biotech firms or startups attempting to introduce novel biomaterials

- The high cost of research, manufacturing, and quality assurance—especially for cutting-edge materials involving stem cells, nanocomposites, or genetic engineering—can limit adoption in cost-sensitive healthcare systems

- Moreover, inconsistencies in international regulatory standards can make global market entry challenging, requiring firms to tailor materials and documentation to diverse regional requirements

- Addressing these barriers through collaborative industry efforts, clearer regulatory pathways, and innovation in cost-effective production methods will be essential to sustaining the biomedical materials market’s momentum

Biomedical Materials Market Scope

The market is segmented on the basis of type, application, and end user.

- By Type

On the basis of type, the biomedical materials market is segmented into metallic biomaterials, ceramic biomaterials, polymeric biomaterials, and natural biomaterials. The polymeric biomaterials segment dominated the market with the largest revenue share of 42.1% in 2024, owing to their versatility, biocompatibility, and adaptability across a range of medical applications such as wound healing, orthopedics, and controlled drug delivery. Their ease of fabrication and customizable mechanical properties allow widespread usage in implants, scaffolds, and prosthetics. In addition, innovations in biodegradable polymers and nanocomposites are expanding their role in regenerative medicine.

The ceramic biomaterials segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by their superior bioactivity, corrosion resistance, and integration with bone tissues, making them highly suitable for orthopedic and dental applications. Increasing demand for advanced bone graft substitutes and coatings for implants is supporting the growth of this segment.

- By Application

On the basis of application, the biomedical materials market is segmented into cardiovascular, orthopedic, ophthalmology, dental, plastic surgery, wound healing, neurology, and other applications. The orthopedic application segment led the market in 2024, supported by the rising incidence of bone disorders, fractures, and joint degeneration in aging populations. High-volume usage of metallic and polymeric biomaterials in joint replacements, bone plates, and screws drives this dominance. Demand is further reinforced by advancements in 3D-printed orthopedic implants and biodegradable bone scaffolds.

The wound healing segment is expected to witness the fastest CAGR during the forecast period, fueled by increasing cases of chronic wounds, diabetic ulcers, and surgical site infections. Innovations in bioactive dressings and skin substitutes using natural and synthetic biomaterials are contributing to rapid growth in this area.

- By End User

On the basis of end user, the biomedical materials market is segmented into healthcare facilities, diagnostic centres, and tissue engineering. The healthcare facilities segment accounted for the largest market share in 2024, owing to the widespread use of biomedical materials in hospitals, surgical centers, and rehabilitation clinics. These settings demand a broad spectrum of implants, prosthetics, and wound care products, which are critical to modern medical procedures.

The tissue engineering segment is projected to witness the highest growth rate from 2025 to 2032, driven by the increasing focus on regenerative medicine and organ replacement research. Rising R&D investment, breakthroughs in stem cell-based scaffolding, and demand for biocompatible materials in lab-grown tissue construction are key growth drivers in this emerging segment.

Biomedical Materials Market Regional Analysis

- North America dominated the biomedical materials market with the largest revenue share of 39.2% in 2024, characterized by robust healthcare infrastructure, rising R&D investments, and the strong presence of leading biomedical and medtech companies, with the U.S. experiencing notable advancements in regenerative medicine and bioresorbable implant technologies

- The U.S., in particular, leads in the development and adoption of next-generation biomaterials for use in orthopedics, cardiovascular treatments, dental reconstruction, and wound healing

- This strong market position is further supported by a high incidence of chronic diseases, an aging population, and a well-established regulatory framework that encourages the commercialization of novel biomaterial solutions. The presence of major industry players and partnerships between academic institutions and biotech companies also enhance regional growth, positioning North America as a global leader in biomedical material applications across healthcare sectors

U.S. Biomedical Materials Market Insight

The U.S. biomedical materials market captured the largest revenue share of 82.3% in 2024 within North America, driven by advanced healthcare infrastructure, rising prevalence of chronic diseases, and strong investment in R&D. The demand for innovative materials in orthopedic implants, cardiovascular devices, and tissue engineering is accelerating. Regulatory support from the FDA and a high adoption rate of biocompatible technologies also contribute significantly. Moreover, collaborations between research institutions and biotech companies are fostering innovation in personalized medicine and next-generation biomaterials

Europe Biomedical Materials Market Insight

The Europe biomedical materials market is projected to grow at a robust CAGR throughout the forecast period, supported by strong public health systems, aging populations, and government-funded research initiatives. The European Union’s strict medical safety regulations are driving the adoption of certified, high-quality biomaterials across orthopedic, dental, and cardiovascular applications. Demand is rising in both public and private healthcare sectors, with ongoing investment in biodegradable and regenerative materials contributing to the market's dynamic growth

U.K. Biomedical Materials Market Insight

The U.K. biomedical materials market is expected to expand at a notable CAGR during the forecast period, fueled by advancements in medical technologies and increasing demand for customized, minimally invasive implants. Supportive government funding for life sciences and the NHS's emphasis on patient outcomes are promoting the use of high-performance biomaterials. In addition, the country’s thriving biotech ecosystem and academic partnerships are accelerating innovations, especially in polymeric and regenerative materials for orthopedic and neurology applications.

Germany Biomedical Materials Market Insight

The Germany biomedical materials market is poised for significant growth during the forecast period, backed by the nation’s engineering excellence, stringent healthcare standards, and proactive investment in medical R&D. German hospitals and clinics are early adopters of innovative materials, particularly in orthopedics and dental care. The country also leads in precision manufacturing of metallic and ceramic biomaterials, making it a key supplier across Europe. Growing demand for patient-specific implants and biocompatible solutions continues to drive market expansion.

Asia-Pacific Biomedical Materials Market Insight

The Asia-Pacific biomedical materials market is projected to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by expanding healthcare access, increasing surgical procedures, and rising demand for cost-effective medical implants. Countries such as China, India, and Japan are seeing major investments in healthcare infrastructure and biomedical innovation. Government initiatives promoting biotechnology, alongside a growing medical tourism industry, are accelerating the adoption of advanced biomaterials in the region.

Japan Biomedical Materials Market Insight

The Japan biomedical materials market is advancing rapidly due to the country’s aging population, high medical standards, and strong focus on technological innovation. With a healthcare system that emphasizes precision and quality, demand is growing for advanced polymeric and ceramic biomaterials in orthopedic, dental, and ophthalmology applications. In addition, Japan’s leadership in regenerative medicine and 3D printing is promoting new use cases for tissue-engineered biomaterials and implantable devices.

India Biomedical Materials Market Insight

The India biomedical materials market accounted for the largest market revenue share in Asia Pacific in 2024, fueled by a rapidly expanding healthcare sector, rising surgical volumes, and government initiatives such as Make in India. The country’s growing middle class is driving demand for affordable yet high-quality implants and wound healing products. Domestic production of biomaterials is increasing, and public-private partnerships are accelerating innovation in tissue engineering and bioresorbable materials tailored to regional needs.

Biomedical Materials Market Share

The biomedical materials industry is primarily led by well-established companies, including:

- Evonik Industries AG (Germany)

- dsm-firmenich (Netherlands)

- Corbion NV (Netherlands)

- BASF SE (Germany)

- Celanese Corporation (U.S.)

- Covestro AG (Germany)

- DuPont (U.S.)

- Victrex plc (U.K.)

- CRS Holdings, LLC. (U.S.)

- SABIC (Saudi Arabia)

- Zimmer Biomet (U.S.)

- Invibio Ltd. (U.K.)

- Medtronic (Ireland)

- Stryker (U.S.)

- Nobel Biocare Services AG (Switzerland)

- Collagen Solutions (US) LLC (U.K.)

- Bioretec (Finland)

- Kuraray Co., Ltd. (Japan)

- Orthocell Ltd. (Australia)

- Poly-Med Incorporated (U.S.)

What are the Recent Developments in Global Biomedical Materials Market?

- In April 2023, Evonik Industries AG, a global specialty chemicals leader, expanded its production capacity for RESOMER, a biodegradable polymer used in medical devices and drug delivery systems. This strategic move supports growing global demand for bioresorbable materials in orthopedic, cardiovascular, and oncology applications. The expansion enhances Evonik's capability to supply high-quality biomedical materials that meet stringent regulatory standards, reinforcing its leadership in the advanced biomaterials segment

- In March 2023, DSM Biomedical, a subsidiary of DSM-Firmenich, partnered with the University of Maastricht to advance collagen-based regenerative technologies for soft tissue repair. The collaboration focuses on developing next-generation materials that promote natural healing and improve patient outcomes in orthopedic and dental surgeries. This move highlights DSM's ongoing commitment to innovation and collaboration in regenerative medicine

- In March 2023, BASF SE launched Steronyl, a new line of sterilizable engineering plastics tailored for medical device applications, including surgical instruments and implantable components. The material offers excellent biocompatibility, high strength, and thermal stability, making it ideal for healthcare manufacturers seeking reliable biomedical solutions. This product launch reinforces BASF’s role in supplying specialized polymers for advanced medical use

- In February 2023, Corbion N.V., a leader in lactic acid-based biomaterials, announced the development of a new PLA-PGA composite for absorbable sutures and implants. Designed to meet growing clinical demands for precision and performance, the material offers tailored degradation rates and mechanical properties. This innovation aligns with Corbion’s mission to create sustainable, patient-focused solutions in biomedical applications

- In January 2023, Collagen Matrix, Inc. received FDA 510(k) clearance for its OsteoMatrix+ Bone Graft Matrix, designed to support bone regeneration in orthopedic and dental procedures. The product combines mineralized collagen with a proprietary polymer matrix, offering improved handling and biological performance. This regulatory milestone emphasizes Collagen Matrix’s dedication to developing advanced, clinically validated materials for regenerative medicine

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.