Global Biotinidase Deficiency Market

Market Size in USD Million

CAGR :

%

USD

500.50 Million

USD

674.50 Million

2024

2032

USD

500.50 Million

USD

674.50 Million

2024

2032

| 2025 –2032 | |

| USD 500.50 Million | |

| USD 674.50 Million | |

|

|

|

|

Biotinidase Deficiency Market Size

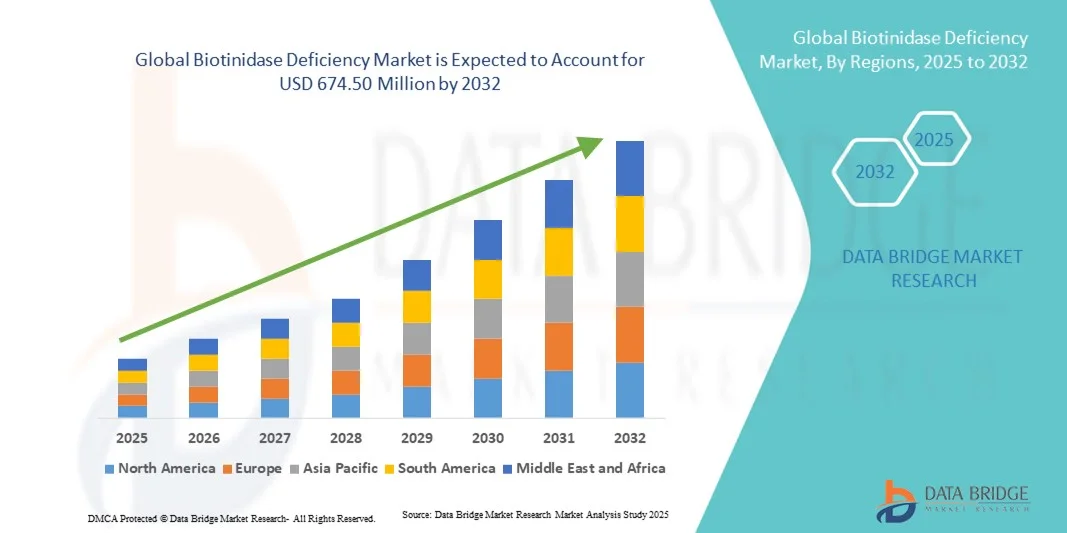

- The global biotinidase deficiency market size was valued at USD 500.5 Million in 2024 and is expected to reach USD 674.50 Million by 2032, at a CAGR of 3.80% during the forecast period

- The market growth is largely fueled by increasing awareness about genetic metabolic disorders and the rising adoption of early diagnostic and treatment interventions across both pediatric and adult populations

- Furthermore, growing demand for advanced screening programs, newborn testing initiatives, and innovative therapeutic approaches is accelerating the uptake of Biotinidase Deficiency solutions, thereby significantly boosting the industry's growth

Biotinidase Deficiency Market Analysis

- Biotinidase Deficiency, a rare metabolic disorder caused by insufficient activity of the biotinidase enzyme, is increasingly gaining attention due to rising awareness about newborn screening and early intervention programs

- The escalating demand for early diagnosis, effective treatment, and newborn screening programs is primarily fueled by growing healthcare infrastructure, increasing awareness among clinicians and parents, and the adoption of advanced diagnostic tools

- North America dominated the biotinidase deficiency market with the largest revenue share of 44.5% in 2024, characterized by advanced healthcare infrastructure, high awareness of rare metabolic disorders, and a strong presence of key diagnostic and therapeutic solution providers, with the U.S. experiencing substantial growth in biotinidase deficiency diagnostics and treatments due to robust newborn screening initiatives and the adoption of enzyme replacement therapies

- Asia-Pacific is expected to be the fastest-growing region in the biotinidase deficiency market during the forecast period, driven by improving healthcare access, increasing awareness of metabolic disorders, and expansion of diagnostic and treatment facilities in countries such as China, India, and Japan

- The kids segment dominated the largest market revenue share of 60% in 2024, owing to early-life screening programs, pediatric supplementation, and higher awareness of congenital deficiency

Report Scope and Biotinidase Deficiency Market Segmentation

|

Attributes |

Biotinidase Deficiency Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Biotinidase Deficiency Market Trends

Enhanced Convenience Through Improved Diagnosis and Therapeutic Management

- A significant and accelerating trend in the global biotinidase deficiency market is the growing adoption of advanced diagnostic tools and integrated patient management solutions. These developments are significantly enhancing patient care, enabling timely diagnosis, and improving long-term management of the disorder

- For instance, recent innovations in newborn screening programs and genetic testing allow early identification of Biotinidase Deficiency, facilitating immediate therapeutic intervention with biotin supplementation. Early diagnosis has been shown to prevent severe clinical manifestations, including neurological and dermatological complications. Similarly, specialized patient monitoring platforms enable healthcare providers to track adherence to biotin therapy and assess symptom progression, offering a comprehensive management solution

- Advances in diagnostic approaches, including high-throughput genetic screening and enzyme activity assays, enable more precise and reliable detection of Biotinidase Deficiency. For example, many clinical laboratories now utilize tandem mass spectrometry and next-generation sequencing to identify affected infants and adults, improving overall diagnostic accuracy and facilitating early intervention. These tools allow clinicians to optimize treatment plans and ensure timely administration of biotin, preventing irreversible complications

- The integration of diagnostic and therapeutic solutions into broader healthcare platforms facilitates coordinated management of patients across multiple care settings. Through centralized reporting and patient records, clinicians can monitor biochemical parameters, track treatment adherence, and adjust therapy based on individual patient needs, creating a more efficient and personalized care experience

- This trend towards more precise, patient-centered, and coordinated management is fundamentally reshaping expectations for treatment outcomes in Biotinidase Deficiency. Consequently, companies such as BioMarin and Amicus Therapeutics are developing comprehensive programs focused on early diagnosis, effective treatment, and long-term patient support

- The demand for improved diagnostic and therapeutic solutions is growing rapidly across both pediatric and adult populations, as healthcare providers increasingly prioritize early detection, disease prevention, and comprehensive care management

Biotinidase Deficiency Market Dynamics

Driver

Growing Need Due to Rising Awareness and Improved Screening Programs

- The increasing prevalence of genetic disorders awareness and the expansion of newborn screening initiatives is a significant driver for the heightened demand for Biotinidase Deficiency diagnostic and therapeutic solutions

- For instance, in April 2024, multiple hospitals in the U.S. and Europe expanded their newborn screening panels to include Biotinidase Deficiency, allowing early detection and immediate intervention. Such initiatives by healthcare institutions are expected to drive market growth during the forecast period

- As caregivers and clinicians become more aware of the consequences of untreated Biotinidase Deficiency, the adoption of advanced enzyme assays, genetic tests, and biotin supplementation programs offers a compelling improvement over traditional, reactive approaches

- Furthermore, the growing focus on integrated patient care and preventive health is making comprehensive management solutions an integral component of pediatric and adult care programs, ensuring timely therapy and reducing long-term complications

- The convenience of early detection, individualized treatment plans, and consistent monitoring are key factors propelling the adoption of Biotinidase Deficiency solutions in clinical settings. The trend toward improved healthcare infrastructure and increasing availability of specialized testing options further contributes to market growth

Restraint/Challenge

Concerns Regarding Accessibility and High Initial Costs

- Challenges surrounding the accessibility and cost of diagnostic tests and therapeutic interventions pose a significant barrier to broader market adoption. Enzyme activity assays, genetic testing, and long-term biotin therapy require specialized laboratory infrastructure and trained personnel, which may not be available in all regions

- For instance, limited availability of advanced screening facilities in developing countries has delayed early diagnosis, leading to more severe clinical outcomes and slower market penetration

- Addressing these challenges through expanded laboratory networks, healthcare provider training, and patient education is crucial for increasing adoption. Companies such as BioMarin emphasize support programs and collaborations with healthcare systems to improve access and affordability

- In addition, the relatively high cost of comprehensive testing and lifelong biotin therapy compared to basic medical care can be a barrier, particularly for low-income populations or regions with limited healthcare funding

- While costs are gradually decreasing with technological advancements and wider screening programs, affordability remains a concern that can hinder widespread adoption, especially where awareness and healthcare resources are limited

- Overcoming these challenges through expanded screening initiatives, subsidized testing programs, and patient support services will be vital for sustained growth of the Biotinidase Deficiency market in the forecast period

Biotinidase Deficiency Market Scope

The market is segmented on the basis of category, consumers, application, dosage form, purpose, source, end-users, and distribution channel.

- By Category

On the basis of category, the Biotinidase Deficiency market is segmented into profound and partial. The profound category dominated the largest market revenue share of 55% in 2024, driven by the severity of enzyme deficiency requiring early diagnosis and therapeutic intervention. Profound cases demand consistent supplementation and monitoring, increasing market adoption. Hospitals and specialty clinics are key contributors to this segment due to the higher frequency of clinical follow-ups. The segment benefits from strong awareness among caregivers and pediatricians regarding early detection. Governments and healthcare organizations prioritize treatment programs for profound deficiency, supporting widespread adoption. Pharmaceutical companies focus on developing standardized dosing and delivery forms for this category. The segment is further reinforced by integration with newborn screening programs in multiple countries. Clinical guidelines recommend early treatment for profound cases, increasing patient pool size. Research initiatives focusing on genetic studies also enhance market dominance. Higher reimbursement rates for profound deficiency therapies support segment revenue. Healthcare provider training on symptom management drives awareness. The segment remains robust due to consistent demand and established treatment protocols.

The partial category is anticipated to witness the fastest CAGR of 20.4% from 2025 to 2032, fueled by increasing awareness, improved diagnostic capabilities, and the growing recognition of mild and moderate biotinidase deficiency. Early screening and less severe symptomology allow partial deficiency patients to adopt dietary supplements and lifestyle management. Market growth is supported by increasing parental awareness, school healthcare programs, and pediatric counseling. Online sales and pharmacy networks improve accessibility for partial deficiency patients. Rising interest in preventive healthcare and personalized supplementation drives uptake. Pharmaceutical companies are innovating dosage forms suitable for long-term management. Nutritionists and dieticians recommend biotin-enriched products for partial cases. Technological advancements in rapid testing promote early detection, expanding patient coverage. Regional healthcare initiatives in APAC and Europe support growth. Market penetration in emerging countries is rising due to better access to supplements. Telemedicine and online health platforms contribute to faster adoption. The segment benefits from research highlighting benefits of early intervention in partial deficiency.

- By Consumers

On the basis of consumers, the market is segmented into men, women, and kids. The kids segment dominated the largest market revenue share of 60% in 2024, owing to early-life screening programs, pediatric supplementation, and higher awareness of congenital deficiency. Newborn screening initiatives, pediatric hospitals, and routine checkups drive adoption. Parents prioritize corrective measures to prevent long-term complications. Pediatricians recommend standardized biotin supplementation regimens. Government health programs reinforce early intervention, further boosting segment revenue. Educational initiatives highlight the importance of enzyme monitoring in children. Pediatric formulations like chewable tablets and liquids are widely available. Research on congenital biotinidase deficiency continues to support early treatment. Pediatric nutrition and preventive healthcare trends favor segment growth. Integration of genetic counseling in clinics promotes awareness. Distribution through hospitals and specialty pharmacies enhances accessibility. High compliance in children due to parental monitoring sustains revenue dominance.

The women segment is expected to witness the fastest CAGR of 19.7% from 2025 to 2032, driven by increasing health consciousness, focus on beauty and wellness, and rising use of biotin supplements for hair, skin, and nail health. Female-targeted nutraceuticals and wellness products promote adoption. Online e-commerce platforms expand availability. Awareness campaigns on haircare, pregnancy-related nutrition, and beauty supplements accelerate growth. Women are adopting preventive supplementation to address deficiency risks. Cosmetic and nutraceutical companies target women through marketing campaigns. Retail pharmacy promotions and subscription models enhance accessibility. Dieticians and wellness professionals recommend biotin-enriched formulations. Growth is further supported by social media and influencer-led campaigns. Female-specific formulations, including capsules and soft gels, attract consistent consumption. Research on biotin benefits in women strengthens market confidence. Workplace health programs in urban regions drive adoption.

- By Application

On the basis of application, the Biotinidase Deficiency market is segmented into skincare, haircare, nail care, and others. The haircare segment held the largest market revenue share of 50% in 2024, fueled by high consumer awareness of biotin’s role in promoting hair growth and reducing hair loss. Cosmetic and nutraceutical companies heavily target this segment. Haircare formulations include tablets, soft gels, and liquid supplements. Dermatologists and trichologists recommend biotin-based supplements as part of treatment plans. Marketing campaigns highlight visible hair improvement outcomes. Retail pharmacy and online availability boost adoption. Social media influence and wellness trends drive consistent demand. Haircare-focused products are widely promoted in urban centers. Integration with beauty clinics enhances credibility. Formulations often combine biotin with other vitamins, increasing efficacy. Subscription-based sales models encourage repeat purchases. Collaborations between beauty brands and healthcare providers further promote market share. The segment benefits from continuous product innovation and packaging improvements.

The skincare segment is expected to witness the fastest CAGR of 18.9% from 2025 to 2032, driven by growing consumer interest in anti-aging, skin repair, and overall wellness. Biotin supplements are increasingly incorporated into formulations targeting skin hydration, elasticity, and radiance. Rising awareness of nutritional dermatology fuels adoption. Cosmetic companies launch female-focused campaigns emphasizing skin health benefits. Retail expansion and e-commerce penetration enhance accessibility. Influencer-led promotions and clinical endorsements drive credibility. Demand for combination products with collagen and vitamins supports growth. Skincare professionals recommend biotin for preventive skin care. Online subscriptions and personalized wellness kits increase convenience. Marketing emphasizes visible improvements and preventive care benefits. Biotin-enriched skincare supplements are increasingly recommended during pregnancy and post-partum. Consumer preference for natural and plant-based products contributes to segment expansion. Continuous innovation in dosage forms, including powders and capsules, enhances market growth.

- By Dosage Form

On the basis of dosage form, the Biotinidase Deficiency market is segmented into capsules, tablets, powder, soft gels, liquid, and others. The capsules segment dominated the largest market revenue share of 48% in 2024, driven by ease of administration, precise dosing, and widespread availability. Capsules are preferred in pediatric and adult supplementation programs. Pharmaceutical companies focus on standardized capsule formulations to ensure bioavailability. Hospitals and retail pharmacies commonly stock capsules, reinforcing their market presence. Capsules offer convenient storage and portability. Patient compliance is high due to familiar administration. Clinical guidelines favor capsule-based dosing for routine supplementation. Manufacturing processes for capsules are well-established and cost-efficient. Capsules integrate well with combination nutrient products. Availability across e-commerce platforms supports adoption. Packaging innovations, including blister packs, enhance stability. Global distribution networks ensure accessibility across regions.

The liquid segment is expected to witness the fastest CAGR of 21.2% from 2025 to 2032, driven by increasing demand among children, elderly, and patients with swallowing difficulties. Liquids provide flexibility in dosing adjustments. Pediatric formulations with flavor enhancements encourage adherence. Homecare and telemedicine programs promote liquid supplementation. Growth is supported by convenience for caregivers and patients. Online pharmacies facilitate easy access. Liquid products often combine biotin with other vitamins, enhancing appeal. Hospital and clinic recommendation for infants and young children increases adoption. Nutritional programs incorporate liquid forms for targeted interventions. Packaging innovations, including measured droppers, improve accuracy. Liquid formulations are integrated into wellness kits for multi-vitamin supplementation. Regional expansion and growing awareness of deficiency drive market uptake.

- By Purpose

On the basis of purpose, the Biotinidase Deficiency market is segmented into beauty and energy. The beauty segment held the largest revenue share of 57% in 2024, fueled by consumer awareness of biotin’s role in promoting hair, skin, and nail health. Beauty supplements are widely promoted through pharmacies, retail stores, and online channels. Marketing campaigns highlight visible aesthetic benefits. Dermatologists, trichologists, and wellness professionals recommend biotin-based products. Urban populations show high adoption due to lifestyle-focused health trends. Combination formulations with other vitamins and minerals strengthen efficacy. Celebrity endorsements and influencer campaigns drive consistent demand. E-commerce penetration enhances accessibility. Product innovation, including flavored capsules and gummies, increases engagement. Subscription models ensure repeat consumption. Partnerships between beauty and pharmaceutical brands enhance credibility.

The energy segment is expected to witness the fastest CAGR of 19.5% from 2025 to 2032, driven by increasing awareness of biotin’s role in metabolism and energy production. Energy-focused supplements are gaining traction among working adults, athletes, and health-conscious populations. Nutraceutical companies introduce combination formulas targeting metabolic support. Online retail and subscription programs expand reach. Clinical studies highlighting metabolic benefits support marketing campaigns. Workplace wellness programs encourage adoption. Convenient dosage forms, including tablets and soft gels, facilitate compliance. E-commerce and pharmacy partnerships enhance availability. Influencer and social media promotions educate consumers on benefits. Product innovation in flavoring and packaging increases uptake. Integration with multi-nutrient programs boosts effectiveness. Regional expansion in emerging markets further fuels growth.

- By Source

On the basis of source, the Biotinidase Deficiency market is segmented into vegetable and meat. The vegetable segment dominated the largest revenue share of 52% in 2024, driven by rising preference for plant-based nutrition, vegan lifestyles, and easy digestibility. Vegetable-derived biotin is widely used in supplements for children and adults. Regulatory compliance and clean-label trends support adoption. Educational initiatives promote vegetable-based supplementation. Formulation flexibility allows combination with other nutrients. Retail and online availability enhances accessibility. Hospitals and clinics recommend vegetable sources due to lower allergenicity. Production scalability supports consistent supply. Consumer perception of safety and sustainability reinforces preference. Urban adoption of plant-based diets contributes to revenue dominance.

The meat segment is expected to witness the fastest CAGR of 18.7% from 2025 to 2032, fueled by demand for high-potency biotin supplements, traditional dietary preferences, and nutritional awareness in certain regions. Meat-derived biotin is incorporated into capsules, tablets, and liquids. Supplement manufacturers innovate with flavoring and fortified options. Hospitals and clinics recommend meat-based biotin for targeted supplementation. Distribution through pharmacies and online channels ensures wider reach. Educational campaigns highlight bioavailability and efficacy. Growth is supported by cultural preferences for animal-sourced nutrients. Expansion in emerging markets increases accessibility. Combination formulations with other vitamins enhance adoption. Sports nutrition and wellness programs promote meat-based biotin uptake.

- By End-Users

On the basis of end-users, the Biotinidase Deficiency market is segmented into clinics, hospitals, drug stores, retail pharmacy, and online pharmacy. The hospitals segment dominated the largest revenue share of 50% in 2024, owing to advanced diagnostic facilities, routine checkups, and therapeutic monitoring. Hospitals serve as primary distribution hubs for biotin supplementation. Integration with nutritionists and dieticians enhances patient compliance. Clinical programs and newborn screening initiatives increase adoption. Hospitals offer standardized dosage forms, improving patient experience. Insurance coverage and reimbursement policies further support growth. Government-backed supplementation programs drive institutional demand. Hospitals also conduct clinical studies supporting biotin usage. Multidisciplinary teams manage treatment and counseling. Strong logistics and procurement networks reinforce revenue share.

The retail pharmacy segment is expected to witness the fastest CAGR of 19.3% from 2025 to 2032, driven by increasing consumer self-awareness, convenience, and preference for over-the-counter supplementation. Retail pharmacies ensure easy access to capsules, soft gels, and liquid formulations. Marketing campaigns educate consumers on health benefits. E-commerce partnerships with retail chains further expand reach. Urban populations favor retail purchases for daily supplementation. Convenience and accessibility drive consistent consumption. Subscription and loyalty programs encourage repeat purchases. Online and in-store promotions boost product

- By Distribution Channel

On the basis of distribution channel, the Biotinidase Deficiency market is segmented into hospital pharmacy, retail pharmacy, online pharmacy, and others. The hospital pharmacy segment held the largest market revenue share of 48% in 2024, driven by institutional supply, integration with treatment protocols, and availability of professional guidance. Hospitals ensure timely replenishment and patient compliance. Bulk procurement by hospitals reinforces volume-based dominance. Hospitals coordinate with suppliers for uninterrupted supply. Clinical support and monitoring encourage adherence. Government-backed health programs and insurance reimbursements support hospital pharmacy utilization. Pharmaceutical companies maintain dedicated distribution channels to hospitals. Specialized training for pharmacists enhances credibility. Hospitals serve as primary centers for pediatric and adult supplementation programs. Collaborative initiatives with research institutions strengthen adoption. Hospitals benefit from centralized inventory management and quality assurance.

The online pharmacy segment is expected to witness the fastest CAGR of 21.1% from 2025 to 2032, fueled by the growing adoption of e-commerce platforms, home delivery, and digital health awareness. Online pharmacies offer convenience, doorstep delivery, and subscription models. Increased consumer preference for digital shopping channels drives segment growth. Telemedicine consultations integrate with online dispensing, boosting adoption. Availability of diverse dosage forms, including capsules and liquids, promotes flexibility. Marketing campaigns and educational content enhance consumer engagement. Online pharmacies expand reach to remote and semi-urban regions. User-friendly interfaces facilitate repeat purchases. Digital payment options and promotional offers attract customers. Social media and influencer campaigns increase awareness. Integration with wellness platforms encourages holistic supplementation. Online subscriptions ensure consistent consumption and adherence.

Biotinidase Deficiency Market Regional Analysis

- North America dominated the biotinidase deficiency market with the largest revenue share of 44.5% in 2024, characterized by advanced healthcare infrastructure, high awareness of rare metabolic disorders, and a strong presence of key diagnostic and therapeutic solution providers

- The market, in particular, has experienced substantial growth in Biotinidase Deficiency diagnostics and treatments due to robust newborn screening initiatives, widespread use of enzyme activity assays, and the adoption of enzyme replacement therapies

- The region’s well-established healthcare ecosystem, coupled with extensive research activities and government-led rare disease programs, has contributed to early detection and improved patient outcomes

U.S. Biotinidase Deficiency Market Insight

The U.S. biotinidase deficiency market captured the largest revenue share within North America in 2024. This growth is fueled by the expansion of nationwide newborn screening programs, the integration of genetic testing into standard clinical practice, and increasing access to specialized treatment facilities. Healthcare providers are emphasizing early diagnosis and timely intervention to prevent severe neurological, dermatological, and developmental complications associated with untreated Biotinidase Deficiency. Additionally, ongoing research initiatives and collaborations between hospitals, diagnostic laboratories, and pharmaceutical companies are enhancing the availability and efficacy of treatment options.

Europe Biotinidase Deficiency Market Insight

The Europe biotinidase deficiency market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising awareness of metabolic disorders and increasing emphasis on early detection and comprehensive care. Countries such as Germany, France, and Italy are investing in advanced diagnostic technologies, including enzyme activity assays and genetic sequencing, to enable timely identification and treatment of affected patients. The region is witnessing significant growth across both pediatric and adult populations, with hospitals and specialty clinics adopting standardized protocols for monitoring and therapy management.

U.K. Biotinidase Deficiency Market Insight

The U.K. biotinidase deficiency market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by enhanced healthcare initiatives, government-supported newborn screening programs, and the rising need for early intervention and treatment management. The country’s healthcare infrastructure, combined with increasing awareness among clinicians and caregivers, supports improved diagnosis and treatment rates, helping to mitigate long-term complications associated with the disorder.

Germany Biotinidase Deficiency Market Insight

The Germany biotinidase deficiency market is expected to expand at a considerable CAGR during the forecast period, fueled by growing awareness of rare metabolic disorders and increasing adoption of standardized enzyme replacement therapies. Germany’s well-developed healthcare infrastructure, strong research capabilities, and focus on preventive care are contributing to improved patient outcomes and expanding the demand for diagnostic and therapeutic solutions across both pediatric and adult populations.

Asia-Pacific Biotinidase Deficiency Market Insight

The Asia-Pacific Biotinidase Deficiency market is poised to grow at the fastest CAGR during the forecast period, driven by improving healthcare access, increasing awareness of metabolic disorders, and the expansion of diagnostic and treatment facilities in countries such as China, India, and Japan. Government initiatives supporting rare disease screening, coupled with investments in healthcare infrastructure, are enabling early diagnosis and better management of Biotinidase Deficiency. Rising disposable incomes and growing healthcare awareness are further contributing to the region’s market growth.

Japan Biotinidase Deficiency Market Insight

The Japan biotinidase deficiency market is gaining momentum due to the country’s advanced healthcare system, strong emphasis on early diagnosis, and expansion of specialized treatment facilities. The focus on preventive healthcare and rare disease management is supporting growth across both pediatric and adult populations. Increasing awareness among clinicians and caregivers regarding effective treatment protocols, including timely biotin supplementation, is enhancing patient outcomes and market adoption.

China Biotinidase Deficiency Market Insight

The China Biotinidase Deficiency market accounted for the largest market revenue share in Asia-Pacific in 2024. This growth is driven by expanding healthcare infrastructure, increasing awareness of rare metabolic disorders, and improved access to diagnostic and therapeutic services. Government initiatives aimed at enhancing newborn screening programs and the establishment of specialized metabolic disorder clinics are key factors supporting market expansion. Furthermore, the rising middle-class population and increasing investments in healthcare are enabling greater penetration of diagnostic and treatment solutions across both urban and semi-urban regions.

Biotinidase Deficiency Market Share

The Biotinidase Deficiency industry is primarily led by well-established companies, including:

- Hikma Pharmaceuticals (Jordan)

- Cipla (India)

- Sanofi (France)

- Novartis AG (Switzerland)

- Amgen (U.S.)

- BioMarin Pharmaceutical (U.S.)

- Shire (Ireland)

- Sandoz (Germany)

- Pfizer Inc .(U.S.)

- Roche (Switzerland)

Latest Developments in Global Biotinidase Deficiency Market

- In January 2025, the Biotinidase Deficiency market was valued at approximately USD 245 million in 2024 and is anticipated to reach USD 398 million by 2033, exhibiting a compound annual growth rate (CAGR) of 5.5% from 2025 to 2033. This growth is attributed to increasing awareness and advancements in diagnostic and treatment options

- In March 2025, a comprehensive study was conducted to assess and validate the methodologies employed in biotinidase deficiency assays, focusing on both fluorometric and colorimetric techniques. The research aimed to ensure that diagnostic procedures are highly accurate, reliable, and reproducible across clinical laboratories. By comparing these methods, the study provided insights into optimizing testing protocols, reducing errors, and enhancing early detection of biotinidase deficiency, ultimately supporting timely intervention and better patient management

- In January 2025, a retrospective observational study analyzed the role of biotinidase deficiency testing in reproductive carrier screening programs. The study highlighted the significance of such testing in identifying carriers and informing prospective parents about potential genetic risks. Findings emphasized the importance of integrating biotinidase deficiency screening into genetic counseling and family planning initiatives, aiding healthcare providers in offering tailored advice and preventative strategies to reduce the risk of passing the disorder to offspring

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.