Global Black Beer Market

Market Size in USD Billion

CAGR :

%

USD

29.29 Billion

USD

55.84 Billion

2024

2032

USD

29.29 Billion

USD

55.84 Billion

2024

2032

| 2025 –2032 | |

| USD 29.29 Billion | |

| USD 55.84 Billion | |

|

|

|

|

Black Beer Market Size

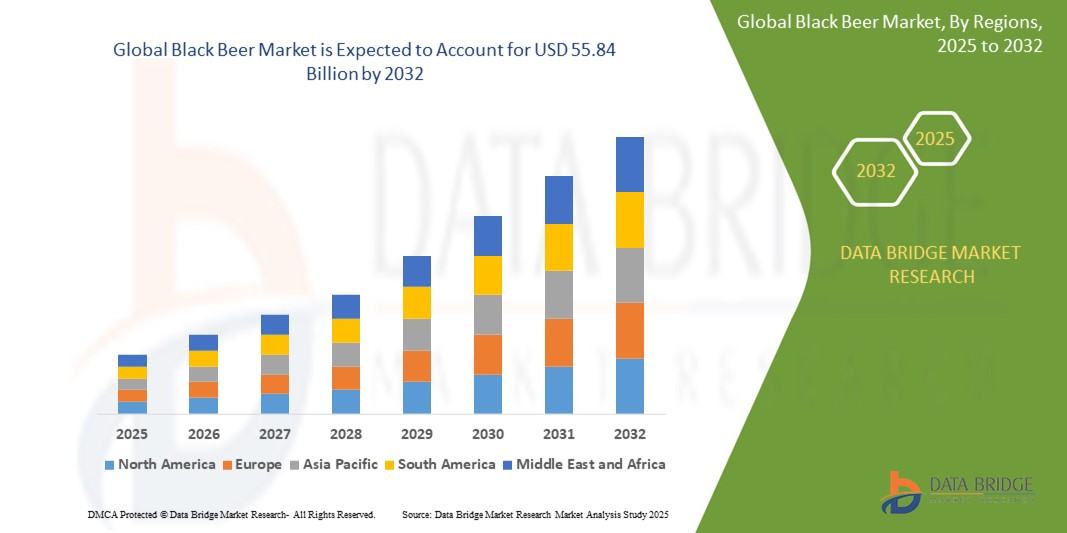

- The global black beer market size was valued at USD 29.29 billion in 2024 and is expected to reach USD 55.84 billion by 2032, at a CAGR of 8.40% during the forecast period

- The market growth is largely fuelled by the increasing consumer preference for craft beers and dark beer varieties, coupled with rising disposable incomes and a growing interest in diverse and premium alcoholic beverages

- The expanding popularity of black beer in emerging economies, driven by urbanization and changing lifestyles, is also significantly contributing to market growth

Black Beer Market Analysis

- The black beer market demonstrates a trend of increasing consumer interest in darker beer styles, often associated with richer and more complex flavour profiles, influencing product innovation and variety within the beverage industry

- Current market analysis indicates a growing segment of consumers willing to explore and pay a premium for unique and artisanal black beer offerings, suggesting opportunities for craft breweries and specialized brands to cater to this evolving taste

- Asia-Pacific dominates the black beer market with the largest revenue share of 35.5% in 2025, riven by a growing consumer base, increasing disposable income, and rising interest in premium and craft beer varieties.

- North America is expected to be the fastest growing region in the black beer market during the forecast period due to the rapid expansion of the craft brewing industry, evolving consumer preferences for bold and diverse flavours, and strong presence of innovative breweries.

- The cans segment likely holds a significant market share of 65.5% due to the lightweight, convenient, and cost-effective packaging advantages. Cans are preferred for their portability, faster chilling, and longer shelf life, making them ideal for both retail and on-the-go consumption. They are also more environmentally friendly and recyclable, aligning with the growing sustainability trend. Breweries benefit from lower shipping costs and reduced breakage risks compared to glass packaging. In addition, the rise of canned craft beers and limited-edition releases has boosted consumer preference for this format. As a result, cans continue to dominate the black beer packaging landscape.

Report Scope and Black Beer Market Segmentation

|

Attributes |

Black Beer Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Black Beer Market Trends

“Rising Popularity of Craft and Specialty Black Beers”

- Rising demand for craft and specialty black beers is reshaping the market as consumers move beyond conventional styles such as stouts and porters in search of more unique, flavorful options

- Craft breweries are innovating with ingredients and techniques, producing black beers aged in barrels or infused with elements such as vanilla, coffee, chocolate, and spices

- The trend is not limited to Western regions, in Asia-Pacific, local craft brewers are gaining attention by using native ingredients to create regionally inspired black beer variants

- For instance, in the U.S., craft brands such as Founders and Goose Island have launched barrel-aged imperial stouts that have gained a cult following

- In Japan, microbreweries such as Hitachino Nest have introduced dark beers incorporating ingredients such as yuzu and roasted barley, reflecting local tastes and traditions

Black Beer Market Dynamics

Driver

“Rising Consumer Preference for Craft and Premium Beers”

- Growing consumer interest in craft and premium beers is a key driver of the black beer market, especially among millennials and Gen Z who prioritize unique, bold flavor profiles over traditional lagers

- Black beers such as stouts and porters appeal to evolving palates due to their rich notes of coffee, chocolate, caramel, and roasted malt, aligning with the demand for artisanal drinking experiences

- The premiumization trend in alcoholic beverages positions black beer as a sophisticated choice, with consumers willing to pay more for quality, limited-edition, and complex brews

- For instance, U.S. craft breweries have found success with barrel-aged imperial stouts that offer layered flavors and higher alcohol content, attracting connoisseurs and collectors

- Exposure through beer festivals, tasting events, and beer tourism is helping black beers reach global audiences, expanding their visibility beyond traditional markets

- In Europe, chocolate-infused porters showcased at specialty beer events have driven interest among casual drinkers and helped smaller breweries scale their niche offerings

Restraint/Challenge

“Limited Consumer Awareness and Seasonal Demand”

- One major challenge in the black beer market is the limited mainstream appeal, as many consumers still perceive dark beers as overly bitter or heavy, which discourages experimentation

- For instance, in tropical regions, black beers struggle to gain traction as they are often seen as more suitable for winter, reducing their year-round marketability

- Misconceptions about high alcohol and calorie content make black beers less attractive to health-conscious consumers who lean toward light or low-carb options

- This perception is compounded by inconsistent labelling and lack of tasting notes, making it difficult for new consumers to understand flavour profiles before purchase

- In emerging markets, the dominance of large macro-breweries limits the visibility and availability of black beer, hindering category awareness and consumer access

- The production of black beers requires specialized ingredients and brewing techniques, which can raise costs and deter smaller breweries from entering or expanding in the segment

- To address these issues, the industry must invest in consumer education, accessible pricing strategies, and promoting black beers as versatile choices beyond seasonal consumption

Black Beer Market Scope

The global black beer market is segmented based on packaging, product, and distribution channel.

- By Packaging

On the basis of packaging, the black beer market is segmented into cans and bottles.

The cans segment likely holds a significant market share of 65.5% due to the lightweight, convenient, and cost-effective packaging advantages. Cans are preferred for their portability, faster chilling, and longer shelf life, making them ideal for both retail and on-the-go consumption. They are also more environmentally friendly and recyclable, aligning with the growing sustainability trend. Breweries benefit from lower shipping costs and reduced breakage risks compared to glass packaging. In addition, the rise of canned craft beers and limited-edition releases has boosted consumer preference for this format. As a result, cans continue to dominate the black beer packaging landscape.

The bottle segment is anticipated to witness a rapid growth rate, driven by its premium image and strong appeal in traditional and upscale retail channels. Bottled black beers are often associated with artisanal quality, heritage, and better preservation of flavor, which appeals to discerning consumers. Glass bottles also offer aesthetic advantages that suit branding and gift-oriented purchases. Their popularity in bars, restaurants, and curated retail experiences adds to their growth momentum. As consumers seek more refined and flavorful beer options, the demand for bottled black beers is expected to rise significantly.

- By Product

On the basis of product, the black beer market is segmented into dark lager, dark ale, brown porter, and stout. The dark lager segment likely holds a substantial market share of 50.5%, driven by the balance it offers between rich flavor and smooth drinkability. Dark lagers appeal to a broad consumer base by combining roasted malt profiles with a lighter body compared to heavier black beer types. Their versatility makes them suitable for casual and frequent consumption, particularly among those transitioning from lighter beers. The global popularity of dark lagers in both mass-market and craft categories reinforce their dominant position. In addition, their availability across a wide price range and strong distribution in retail channels support sustained demand.

The stout segment is expected to witness a notable growth rate, fueled by the bold flavor profile and growing popularity among craft beer enthusiasts. Stouts, especially those with infused flavors such as coffee, chocolate, or vanilla, are gaining traction in specialty beer markets and among consumers seeking unique taste experiences. Limited-edition and barrel-aged stouts are creating excitement and driving demand in regions with a developed craft beer culture. Their association with premium quality and artisanal craftsmanship also contributes to expanding their consumer base. As beer tourism and tasting events rise, stouts continue to capture attention and loyalty.

- By Distribution Channel

On the basis of distribution channel, the black beer market is segmented into online and offline. The online segment currently holds the largest market share 75.5%, attributed to the growing preference for convenience, broader product availability, and home delivery services. E-commerce platforms enable consumers to explore a wide range of black beer brands and styles, often with detailed product descriptions and customer reviews. Online sales are also supported by digital promotions, subscription services, and social media marketing targeting niche beer communities. The pandemic-driven shift in consumer behavior further accelerated online purchases, with many consumers continuing the habit post-recovery. Easy access to specialty and craft black beers online has helped the segment retain dominance.

The offline segment is anticipated to witness the fastest CAGR, driven by the experiential nature of in-person purchases and increasing availability of black beers in retail outlets and bars. Consumers often prefer tasting before buying, especially with premium and craft black beer options, making offline channels such as brewpubs, liquor stores, and tasting rooms essential. The rise in beer festivals, local brewery tours, and promotional events is also reviving foot traffic in offline spaces. As awareness of black beer styles grows, more physical retailers are expanding shelf space and promotions for them. This hands-on engagement enhances consumer trust and supports future growth.

Black Beer Market Regional Analysis

- Asia-Pacific held the largest market share of 35.5% in the global black beer market, driven by strong demand for diverse, flavorful beer styles across countries such as China, Japan, and South Korea

- China accounted for the highest share within the region, supported by a growing middle class, increasing disposable income, and rising interest in international and craft beer varieties

- Japan’s black beer market is expanding steadily, as consumers shift from traditional lagers to richer styles such as stouts and porters, reflecting a sophisticated palate and appreciation for premium brews

- With a maturing beer market and rising craft beer culture, Asia-Pacific continues to lead global demand, attracting both domestic and international breweries to invest in black beer offerings

Japan Black Beer Market Insight

The Japan black beer market is gaining momentum, reflecting a gradual shift in consumer preferences towards more diverse and flavorful beer options beyond the dominant pale lagers. As the craft beer movement takes hold in Japan, consumers are becoming increasingly curious about styles such as stout and porter, appreciating their rich malt flavors and varied profiles. Domestic craft breweries are beginning to produce their own interpretations of these styles, often incorporating local ingredients or catering to Japanese palates. The growing number of specialty beer bars and the increasing availability of imported craft beers are also contributing to the rising popularity and consumption of black beers in Japan.

China Black Beer Market Insight

The China black beer market accounted for a significant revenue share in the Asia Pacific region in 2025, driven by a rapidly expanding middle class with increasing disposable income and a growing appetite for diverse and premium alcoholic beverages, including craft beer. While pale lagers still dominate the overall beer market, there is a rising interest in more flavorful options such as stouts and porters, particularly among younger consumers in urban areas. Both domestic and international breweries are introducing a wider range of black beer styles to cater to this evolving demand. The growth of e-commerce platforms and specialty beer retailers is also making these previously fewer common styles more accessible to consumers across China.

North America Black Beer Market Insight

The North American black beer market experienced significant growth in 2024, and this trend is expected to continue. The U.S. black beer market captured the largest revenue share within North America in 2025. This is primarily driven by the dynamic craft beer scene across the U.S., where brewers are constantly experimenting with and popularizing various black beer styles, from robust stouts to hoppy black IPAs. American consumers' increasing preference for craft and specialty beers, coupled with a well-established retail and distribution network, fuels the strong performance of the black beer segment in the U.S.

U.S. Black Beer Market Insight

The U.S. black beer market captured the largest revenue share within North America in 2025, fueled by the robust and innovative American craft brewing industry. Consumers are increasingly drawn to the diverse range of black beer styles available, including rich stouts with various flavor infusions (coffee, chocolate, vanilla), hoppy and bitter black IPAs, and smooth, easy-drinking porters. The strong preference for locally brewed and artisanal beers, coupled with the extensive distribution networks of craft breweries and the vibrant beer culture across the country, continues to propel the growth of the black beer segment. Furthermore, the popularity of beer festivals and events that showcase a wide array of beer styles contributes to increased consumer awareness and trial of black beers

Europe Black Beer Market Insight

The European black beer market is projected to maintain a substantial market presence throughout the forecast period, characterized by a blend of tradition and innovation. The U.K. black beer market is anticipated to grow at a noteworthy pace, driven by a rising interest in craft beers and a consumer base that appreciates both classic and contemporary interpretations of styles such as stout and porter. Similarly, the German black beer market is expected to expand at a considerable rate, building upon its rich brewing heritage with styles such as Schwarzbier remaining popular while new craft versions gain traction. The increasing demand for diverse and flavorful beer options across Europe supports the continued growth of the black beer market.

U.K. Black Beer Market Insight

The U.K. black beer market is anticipated to grow at a noteworthy pace during the forecast period, driven by a rising enthusiasm for craft beer and a consumer base that appreciates the depth and complexity of styles such as stout and porter. Traditional British breweries continue to produce classic versions, while a new wave of craft breweries is experimenting with modern interpretations, often incorporating unique ingredients and brewing techniques. The increasing number of pubs and bars offering a wider selection of craft beers, along with the growing popularity of home brewing and online beer retailers, is contributing to the expanding interest and consumption of black beers in the U.K.

Germany Black Beer Market Insight

The German black beer market is expected to expand at a considerable rate, building upon the country's long and distinguished brewing heritage. While Germany is renowned for its lagers, traditional dark lagers such as Schwarzbier remain popular for their smooth, roasted malt character. In addition, the burgeoning craft beer scene in Germany is seeing brewers explore other black beer styles such as stouts and porters, often with a focus on high-quality ingredients and innovative brewing methods. The well-established beer culture and the presence of numerous breweries, both large and small, contribute to a diverse and evolving black beer market that caters to both traditional tastes and new preferences.

Black Beer Market Share

The Black Beer industry is primarily led by well-established companies, including:

- Anheuser Busch InBev SA/NV (Belgium)

- Asahi Group Holdings Ltd. (Japan)

- Beavertown Brewery (U.K.)

- Buxton Brewery Co. Ltd. (U.K.)

- Carlsberg Breweries AS (Denmark)

- Diageo Plc (U.K.)

- Heineken NV (Netherlands)

- Mikkeller ApS (Denmark)

- Stone Brewing Co. (U.S.)

- The Boston Beer Co. Inc. (U.S.)

Latest Developments in Global Black Beer Market

- In August 2024, Tilray Brands, Inc. completed the acquisition of four craft breweries—Hop Valley Brewing Company, Terrapin Beer Co., Revolver Brewing, and Atwater Brewery—from Molson Coors Beverage Company. This move strengthens Tilray’s footprint in the U.S. craft beer market and expands its portfolio of premium brews. The acquisition boosts the company’s distribution capabilities and positions it as a top player in the American craft beer segment

- In July 2024, World of Brands (WoB), an AlcoBev startup, launched its ready-to-drink craft beer brand in Karnataka, India. Manufactured in a facility in Mudhol, this launch introduces artisan brews tailored to regional preferences. The development aims to capitalize on India’s growing craft beer segment and diversify offerings for urban consumers seeking innovative beverage experiences

- In May 2024, Modus Brewing collaborated with YouTube group Trash Taste to launch the “Trash Taste Pale Ale,” a 5.2% ABV craft beer. This product blends pop culture influence with craft brewing, creating a crisp and citrusy ale that appeals to a younger, digital-savvy audience. The collaboration not only enhances brand visibility but also fosters cross-industry innovation in product development

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Black Beer Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Black Beer Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Black Beer Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.