Global Blood Glucose Sensor Patch Market

Market Size in USD Billion

CAGR :

%

14.44 USD

27.02 USD

2024

2032

14.44 USD

27.02 USD

2024

2032

| 2025 –2032 | |

| 14.44 USD | |

| 27.02 USD | |

|

|

|

|

Blood Glucose Sensor Patch Market Size

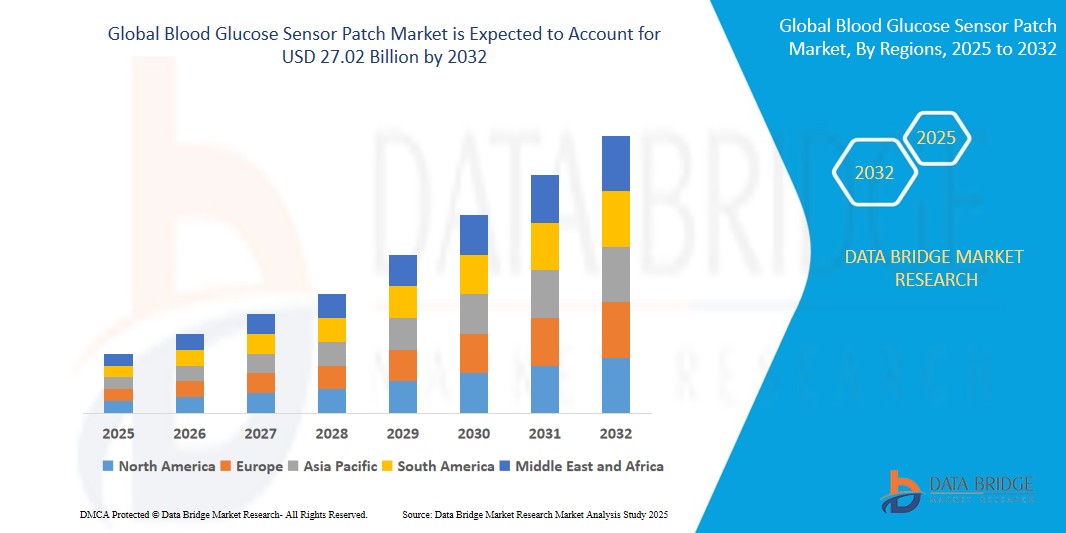

- The global Blood Glucose Sensor Patch market size was valued at USD 14.44 billion in 2024 and is expected to reach USD 27.02 billion by 2032, at a CAGR of 8.15% during the forecast period

- The market growth is primarily driven by the increasing prevalence of diabetes worldwide, combined with a shift towards non-invasive, continuous glucose monitoring (CGM) technologies. These patches offer real-time glucose tracking, reducing the need for finger-prick tests and improving disease management outcomes

- Additionally, technological advancements such as integration with smartphones, wearable devices, and AI-based health analytics are enhancing the usability and accuracy of sensor patches. Companies are introducing features like Bluetooth connectivity, waterproof designs, and long-duration sensors, further propelling market adoption

Blood Glucose Sensor Patch Market Analysis

- Blood Glucose Sensor Patches, designed for continuous glucose monitoring (CGM), are becoming essential tools in diabetes management across both clinical and personal healthcare settings due to their non-invasive nature, real-time glucose tracking, and integration with digital health platforms. These patches provide users with critical insights for timely intervention, supporting better glycemic control and reducing complications.

- The rising demand for Blood Glucose Sensor Patches is primarily fueled by the growing global prevalence of diabetes, increasing emphasis on self-monitoring of blood glucose (SMBG), and a shift toward wearable healthcare technologies. Patients and healthcare providers are favoring CGM patches for their ability to provide continuous, real-time data, reducing reliance on traditional blood glucose meters and finger-prick tests.

- North America dominates the Blood Glucose Sensor Patch market with the largest revenue share of 40.01% in 2025, owing to high healthcare awareness, favorable reimbursement frameworks, and widespread adoption of digital health innovations. The U.S., in particular, leads with strong uptake driven by a tech-savvy population, supportive FDA approvals (e.g., Dexcom G7, Abbott’s FreeStyle Libre), and growing use of sensor patches in telehealth and remote monitoring programs.

- Asia-Pacific is expected to be the fastest-growing region in the Blood Glucose Sensor Patch market during the forecast period, propelled by increasing urbanization, rising healthcare expenditure, government initiatives for diabetes awareness, and growing adoption of wearable health devices in countries like China, India, and Japan. The rising middle-class population and access to affordable smart health solutions are contributing to accelerated market penetration.

- The amperometric technology segment is expected to dominate the Blood Glucose Sensor Patch market with a market share of 43.2% in 2025, driven by its proven accuracy, cost-effectiveness, and adaptability in continuous glucose monitoring devices. This electrochemical sensing method is widely adopted by leading CGM brands for its high sensitivity and fast response time, supporting its leadership in the global sensor patch market.

Report Scope and Blood Glucose Sensor Patch Market Segmentation

|

Attributes |

Blood Glucose Sensor Patch Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Blood Glucose Sensor Patch Market Trends

“Next-Generation CGM with AI-Enabled Analytics and Smartphone Integration”

- A significant trend reshaping the global Blood Glucose Sensor Patch market is the integration of advanced AI and mobile analytics, enabling users and healthcare providers to gain deeper, more actionable insights into blood glucose patterns. Companies are leveraging AI to predict hypoglycemic and hyperglycemic events before they occur, enhancing preventive care.

- For example, in April 2023, Dexcom launched the Dexcom G7 Continuous Glucose Monitoring System in Europe and the U.S., with a compact wearable patch, real-time alerts, and seamless smartphone integration. It allows users to track glucose trends and receive predictive warnings via AI-enabled algorithms. The device is also integrated with Apple Health and Android platforms, offering broad accessibility and ease of use.

- Similarly, Abbott’s FreeStyle Libre 3, approved by the FDA in May 2022, provides minute-by-minute glucose readings and supports Bluetooth-enabled smartphone apps, enabling remote monitoring and alerts. This innovation reflects growing demand for voice-controlled, AI-assisted diabetes management, especially for pediatric and elderly patients who require caregiver involvement.

- Startups such as Nutromics (Australia) are working on smartpatches that combine AI with microneedle sensors to provide continuous data and drug dosing feedback, representing a shift toward theranostic patches that go beyond monitoring.

- The increasing demand for data-driven, AI-powered Blood Glucose Sensor Patches is also evident in the rise of cloud-based platforms offered by companies like Senseonics, whose Eversense E3 system offers up to 180-day wear time and is enhanced with remote data sharing and personalized analytics. These trends point to a growing appetite for comprehensive, automated diabetes management ecosystems.

Blood Glucose Sensor Patch Market Dynamics

Driver

“Rising Global Diabetes Prevalence and Real-Time Health Monitoring Demand”

- The rising global incidence of diabetes is one of the strongest market drivers. According to the International Diabetes Federation (IDF), more than 537 million adults worldwide were living with diabetes in 2021, a number expected to rise to 643 million by 2030. This surge underscores the critical need for non-invasive, continuous monitoring solutions like sensor patches.

- In response, companies are scaling up investments in sensor-based wearable technologies. In August 2023, Medtronic plc announced the global expansion of its Guardian 4 Sensor Patch, which offers real-time continuous glucose monitoring without fingersticks and is integrated with the MiniMed insulin pump ecosystem.

- Moreover, January 2023 saw Roche expanding its mySugr app platform globally to better integrate with CGM devices, enabling patients to manage insulin dosing with real-time patch data.

- The demand for remote monitoring, especially in post-COVID telehealth ecosystems, further propels growth. Healthcare systems in the U.S., Germany, and Japan are adopting CGM-based home monitoring kits, supported by insurance reimbursements, making these patches more accessible

Restraint/Challenge

“Data Privacy Concerns and Cost Barriers in Emerging Markets”

- A major restraint is consumer concern over data security, particularly for devices that transmit sensitive health data via wireless networks. With growing scrutiny around healthcare data privacy, especially in regions like Europe (GDPR) and the U.S. (HIPAA), manufacturers must invest in cybersecurity frameworks.

- For instance, in March 2023, security researchers identified vulnerabilities in Bluetooth-enabled CGM devices, prompting firms like Abbott and Dexcom to release firmware updates aimed at tightening data transmission protocols and enhancing device encryption.

- Another challenge is the high upfront cost of sensor patch systems. Premium solutions like Eversense E3 or Dexcom G7 can cost hundreds of dollars per month without insurance, posing adoption hurdles in low- and middle-income regions.

- To mitigate this, LifeScan (OneTouch) partnered with Noom in November 2023 to provide affordable diabetes management plans bundled with sensor patches and virtual coaching, targeting price-sensitive populations in Latin America and Southeast Asia.

- Bridging these gaps will require public-private collaborations, affordable product lines, and enhanced cybersecurity education to drive widespread adoption globally.

Blood Glucose Sensor Patch Market Scope

The market is segmented on the basis technology, wearable type, application, and end-user industry.

• By Technology

On the basis of technology, the Blood Glucose Sensor Patch market is segmented into Amperometric, Conductometric, and Potentiometric.

The Amperometric technology segment dominates the market with the largest revenue share of 43.2% in 2025, owing to its high sensitivity, accuracy, and real-time detection of glucose levels through enzymatic reactions.

For instance, Abbott’s FreeStyle Libre 3, which utilizes amperometric biosensing, was launched across Europe and the U.S. in 2023, and remains the most widely used CGM system globally.

The Potentiometric segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its minimal interference, low power requirements, and potential for continuous wearable diagnostics.

Companies like BioIntelliSense are investing in potentiometric wearable biosensors that enable longer-term non-invasive monitoring with enhanced signal stability.

• By Wearable Type

Based on wearable type, the market is categorized into Wristwear, Footwear, Neckwear, and Bodywear.

The Bodywear segment holds the largest revenue share in 2025, as most CGM patches are worn on the upper arm, abdomen, or back. Their discreet design and direct skin contact enhance accuracy and compliance.

For example, Dexcom G7 and Eversense E3 are both body-worn patches, enabling continuous glucose readings with integrated sensors and transmitters.

The Wristwear segment is projected to grow at the fastest rate, fueled by innovations in multi-sensing smartwatches with non-invasive glucose estimation.

• By Application

On the basis of application, the market is segmented into Monitoring, Diagnostics, and Medical Therapeutics.

The Monitoring segment dominates the market in 2025, driven by the increasing adoption of real-time glucose monitoring (RTGM) devices to enable better glycemic control.

Devices like Senseonics’ Eversense E3, which offers 180-day continuous monitoring, exemplify this trend, improving adherence and clinical outcomes for both Type 1 and insulin-dependent Type 2 diabetics.

The Medical Therapeutics segment is expected to register the fastest CAGR, as blood glucose sensor patches become integrated with automated insulin delivery systems and digital therapeutics platforms.

• By End-User Industry

On the basis of end-user industry, the market is segmented into Healthcare, Fitness and Sports, and Homecare.

The Healthcare segment holds the largest revenue share in 2025, driven by growing clinical adoption in hospitals, diabetes clinics, and remote patient monitoring programs.

The Fitness and Sports segment is anticipated to witness the fastest CAGR from 2025 to 2032, as athletes and wellness-conscious individuals adopt non-invasive glucose biosensors for performance optimization and metabolic monitoring.

Blood Glucose Sensor Patch Market Regional Analysis

- North America dominates the Blood Glucose Sensor Patch market with the largest revenue share of 40.01% in 2024, driven by strong clinical demand for continuous glucose monitoring (CGM) systems and increasing prevalence of diabetes.

- The region benefits from robust healthcare infrastructure, favorable reimbursement policies, and growing awareness of proactive diabetes management.

- According to the Centers for Disease Control and Prevention (CDC), over 38 million Americans had diabetes as of 2023, prompting higher demand for real-time monitoring devices like glucose sensor patches.

- The launch of Dexcom G7 in the U.S. in 2023 further solidified North America's leadership, offering improved accuracy and smaller size compared to previous models.

U.S. Blood Glucose Sensor Patch Market Insight

The U.S. market captured over 83% of North America's revenue share in 2025, fueled by technological innovation, high diabetes prevalence, and increasing user preference for wearable, discreet CGMs. The approval of the Eversense E3 CGM System by the FDA in February 2022, which offers a 180-day sensor life, expanded options for U.S. patients preferring long-duration implants. Additionally, Medicare’s expanded CGM coverage for Type 2 diabetes patients using insulin as of April 2023 has significantly increased device uptake among elderly populations.

Europe Blood Glucose Sensor Patch Market Insight

Europe is projected to register a strong CAGR through 2032, driven by increasing adoption of digital health technologies and rising healthcare digitization across countries.

In 2023, the European Commission approved the use of Abbott's FreeStyle Libre 3 under expanded reimbursement schemes in Germany, France, and Italy, boosting accessibility and adoption.

The region's focus on preventive care and remote monitoring is driving the demand for wearable glucose monitoring solutions, particularly among aging populations and those with chronic conditions.

U.K. Blood Glucose Sensor Patch Market Insight

The U.K. market is expected to grow at a noteworthy CAGR due to supportive NHS policies and rising incidence of lifestyle diseases.

In 2024, the National Health Service (NHS) included FreeStyle Libre on its prescription list for Type 1 and insulin-treated Type 2 diabetics, significantly expanding the addressable market.

With a strong public healthcare infrastructure and a proactive push toward remote care, the U.K. is witnessing growing integration of blood glucose sensor patches into chronic disease management programs.

Germany Blood Glucose Sensor Patch Market Insight

Germany is poised for considerable growth in this market, driven by advanced medical infrastructure, increased diabetes screening, and rising digital health investments.

Germany’s Digital Health Act, encouraging telemedicine and connected health devices, supports the integration of CGMs into electronic patient records and physician monitoring dashboards. The country is also a key R&D hub, with companies like Roche and B. Braun actively investing in wearable biosensor development for clinical use.

Asia-Pacific Blood Glucose Sensor Patch Market Insight

Asia-Pacific is projected to grow at the fastest CAGR of over 25% in 2025, fueled by rapid urbanization, rising disposable incomes, and government support for digital health solutions. According to the International Diabetes Federation (IDF), China and India are home to over 220 million diabetics combined, creating massive market potential for CGM adoption. Regional production capabilities are also improving affordability, with local players like Sinocare and Meiqi expanding access to cost-effective glucose sensor patches.

Japan Blood Glucose Sensor Patch Market Insight

Japan’s market is growing steadily due to an aging population and a strong preference for minimally invasive and high-tech health solutions.

In 2023, Abbott’s FreeStyle Libre system received expanded coverage from Japan’s National Health Insurance, significantly increasing adoption among elderly diabetics.

Japan’s tech-savvy population and early adoption of wearable medical technologies are boosting demand for integrated CGM systems paired with smartphones and telemedicine platforms.

China Blood Glucose Sensor Patch Market Insight

China led the Asia-Pacific market in revenue share in 2025, thanks to large-scale diabetes prevalence, local manufacturing strength, and health tech adoption. China’s Healthy China 2030 plan promotes early diagnosis and digital health innovations, directly supporting CGM penetration in public and private healthcare systems.

In 2024, MicroTech Medical launched its SiBio CGM for commercial use, which integrates Bluetooth connectivity and app-based monitoring, enhancing affordability and accessibility for middle-class consumers

Blood Glucose Sensor Patch Market Share

The Blood Glucose Sensor Patch industry is primarily led by well-established companies, including:

- Abbott Laboratories (U.S.)

- Dexcom, Inc. (U.S.)

- Medtronic plc (Ireland)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Senseonics Holdings, Inc. (U.S.)

- A. Menarini Diagnostics (Italy)

- Johnson & Johnson (U.S.)

- GlySens Incorporated (U.S.)

- Echo Therapeutics, Inc. (U.S.)

- Ypsomed (Switzerland)

Latest Developments in Global Blood Glucose Sensor Patch Market

- In April 2024, Dexcom, Inc. received CE Mark approval for its G7 Continuous Glucose Monitoring (CGM) System across Europe. The G7 system is a next-generation wearable blood glucose sensor patch that offers smaller size, faster warm-up time, and improved accuracy compared to its predecessor. The launch enables real-time glucose monitoring with smartphone integration, driving adoption among patients with diabetes seeking convenient, non-invasive solutions.

- In February 2024, Abbott Laboratories announced that its FreeStyle Libre 3 received expanded reimbursement coverage under Germany’s statutory health insurance (SHI) system. This development significantly increases access to sensor-based glucose monitoring for both Type 1 and insulin-treated Type 2 diabetes patients, further positioning Abbott as a market leader in wearable glucose monitoring patches in Europe.

- In October 2023, Medtronic plc launched the Simplera™ CGM sensor in select global markets. The Simplera is a fully disposable, all-in-one continuous glucose sensor patch designed for easy self-application, targeting users in both clinical and at-home settings. This reflects the industry’s push toward more user-friendly, accessible sensor technologies for long-term diabetes management.

- In September 2023, Senseonics Holdings, Inc. received FDA approval for its Eversense E3 CGM system, offering a 180-day wear duration, the longest currently available. The sensor patch is implantable and includes a removable transmitter, representing a novel approach in the CGM segment and appealing to patients looking for extended-use, low-maintenance options

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Blood Glucose Sensor Patch Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Blood Glucose Sensor Patch Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Blood Glucose Sensor Patch Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.