Global Body Contouring Devices Market

Market Size in USD Billion

CAGR :

%

USD

2.67 Billion

USD

6.81 Billion

2025

2033

USD

2.67 Billion

USD

6.81 Billion

2025

2033

| 2026 –2033 | |

| USD 2.67 Billion | |

| USD 6.81 Billion | |

|

|

|

|

Body Contouring Devices Market Size

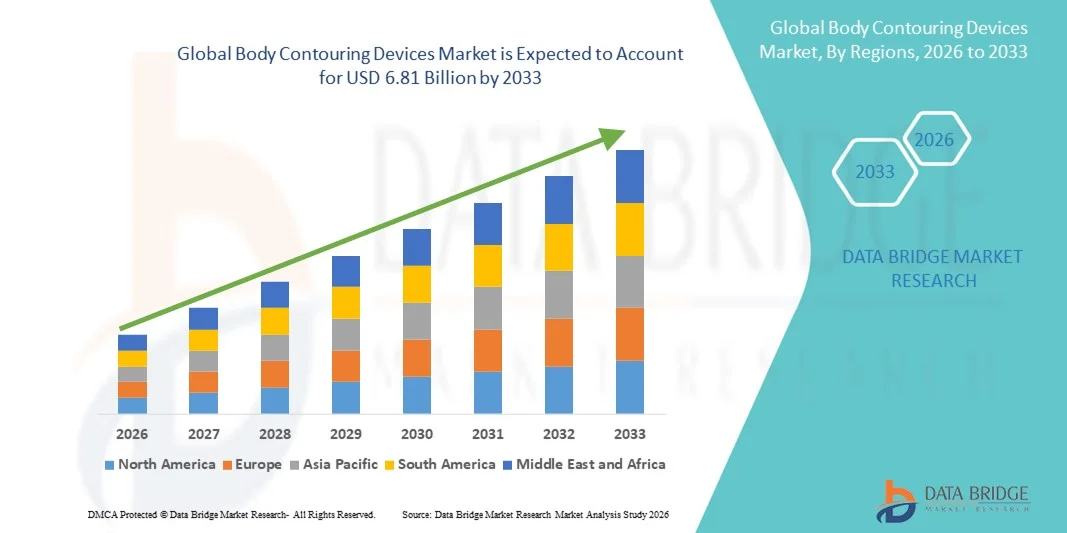

- The global body contouring devices market size was valued at USD 2.67 billion in 2025 and is expected to reach USD 6.81 billion by 2033, at a CAGR of 12.43% during the forecast period

- The market growth is largely driven by the rising prevalence of obesity and aesthetic consciousness, along with continuous technological advancements in non-invasive and minimally invasive body contouring solutions across clinical and med-spa settings

- Furthermore, increasing consumer preference for safe, effective, and downtime-free cosmetic procedures is positioning body contouring devices as a preferred choice for body shaping and fat reduction. These converging factors are accelerating the adoption of body contouring technologies, thereby significantly boosting the industry’s growth

Body Contouring Devices Market Analysis

- Body contouring devices, offering non-invasive and minimally invasive solutions for fat reduction, skin tightening, and body shaping, are becoming integral components of modern aesthetic and cosmetic treatment offerings across hospitals, dermatology clinics, and medical spas due to their safety profile, reduced downtime, and growing clinical efficacy

- The escalating demand for body contouring devices is primarily driven by the rising prevalence of obesity, increasing aesthetic awareness, growing acceptance of cosmetic procedures, and strong consumer preference for non-surgical body shaping solutions

- North America dominated the body contouring devices market with the largest revenue share of 41.6% in 2025, supported by high procedure volumes, a strong presence of leading aesthetic device manufacturers, advanced healthcare infrastructure, and high consumer spending on cosmetic treatments, with the U.S. witnessing robust demand for non-invasive fat reduction and skin tightening technologies

- Asia-Pacific is expected to be the fastest growing region in the body contouring devices market during the forecast period due to rapid urbanization, an expanding middle-class population, rising disposable incomes, and increasing penetration of aesthetic clinics across China, South Korea, Japan, and India

- The non-invasive body contouring segment dominated the market with a market share of 68.4% in 2025, driven by strong patient preference for procedures offering minimal risk, no anesthesia, shorter recovery times, and cost-effective alternatives to traditional surgical body contouring procedures

Report Scope and Body Contouring Devices Market Segmentation

|

Attributes |

Body Contouring Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Body Contouring Devices Market Trends

Rising Shift Toward Non-Invasive and Technology-Driven Aesthetic Solutions

- A significant and accelerating trend in the global body contouring devices market is the growing preference for non-invasive and minimally invasive technologies such as cryolipolysis, radiofrequency, laser-based, and ultrasound-based systems, driven by reduced downtime and improved safety profiles

- For instance, CoolSculpting Elite by Allergan Aesthetics utilizes advanced cryolipolysis technology to target fat cells with higher precision, while Cutera’s truSculpt iD employs radiofrequency energy for customizable body sculpting treatments across multiple body areas

- Technological advancements in body contouring devices are enabling enhanced treatment accuracy, faster session times, and improved patient comfort. For instance, newer systems incorporate real-time temperature monitoring, adaptive energy delivery, and AI-enabled treatment customization to optimize clinical outcomes

- The integration of advanced technologies is also supporting multi-functional platforms that combine fat reduction, skin tightening, and muscle toning within a single device, allowing clinics to expand service offerings while improving return on investment

- This trend toward safer, more efficient, and technology-driven body contouring solutions is reshaping patient expectations and treatment standards. Consequently, companies such as Cynosure and BTL Aesthetics are continuously investing in next-generation non-invasive platforms with enhanced precision and versatility

- The demand for technologically advanced non-invasive body contouring devices is growing rapidly across dermatology clinics and medical spas, as patients increasingly prioritize effective results with minimal discomfort and recovery time

Body Contouring Devices Market Dynamics

Driver

Growing Aesthetic Awareness and Demand for Non-Surgical Procedures

- The increasing focus on physical appearance, rising obesity rates, and growing acceptance of aesthetic treatments are major drivers accelerating the demand for body contouring devices globally

- For instance, in March 2025, BTL Aesthetics expanded its EMSCULPT NEO installations across North America and Europe to address rising demand for non-surgical fat reduction and muscle toning procedures, supporting overall market growth

- As consumers seek effective body shaping solutions without the risks associated with surgical procedures, body contouring devices offer compelling benefits such as minimal invasiveness, reduced complications, and faster recovery times

- Furthermore, the proliferation of medical spas and aesthetic clinics, coupled with increased marketing through social media and influencer culture, is significantly boosting awareness and accessibility of body contouring treatments

- The rising influence of social media, digital marketing, and celebrity endorsements is significantly shaping consumer perceptions and driving demand for body contouring treatments worldwide

- For instance, aesthetic clinics increasingly leverage before-and-after treatment visuals and influencer-led campaigns on platforms such as Instagram and TikTok to boost awareness and patient engagement

- The availability of customizable treatment options, affordability compared to surgery, and suitability for a wide range of body types are key factors propelling adoption across both female and male patient populations

- The growing preference for outpatient aesthetic procedures and the expansion of cosmetic services in emerging markets are further contributing to sustained growth of the body contouring devices market

Restraint/Challenge

High Treatment Costs and Regulatory Compliance Barriers

- Concerns related to the high upfront cost of advanced body contouring devices and treatment affordability pose a significant challenge to widespread market adoption, particularly in price-sensitive regions

- For instance, premium non-invasive body contouring systems incorporating multiple technologies often require substantial capital investment, limiting adoption among smaller clinics and standalone aesthetic centers

- Regulatory compliance and varying approval requirements across regions can also delay product launches and increase development costs for manufacturers, impacting overall market expansion

- Concerns regarding variable reimbursement policies and the largely out-of-pocket nature of body contouring procedures limit accessibility for a broader patient base

- For instance, non-invasive body contouring treatments are typically classified as elective cosmetic procedures, resulting in minimal insurance coverage and restricting adoption among cost-sensitive consumers

- In addition, inconsistent treatment outcomes and patient dissatisfaction in cases of improper device usage can negatively affect consumer trust and repeat procedure rates

- While ongoing technological improvements are addressing safety and efficacy concerns, the lack of standardized training and skilled practitioners remains a barrier to optimal device utilization

- Overcoming these challenges through cost-effective device innovation, expanded practitioner training programs, and streamlined regulatory pathways will be critical for ensuring long-term growth and adoption of body contouring technologies

Body Contouring Devices Market Scope

The market is segmented on the basis of device type, procedure, application, and end users.

- By Device Type

On the basis of device type, the global body contouring devices market is segmented into non-invasive devices, minimally invasive devices, and invasive devices. The non-invasive devices segment dominated the market with the largest revenue share of 68.4% in 2025, driven by strong patient preference for procedures that do not require surgery, anesthesia, or extended recovery periods. Technologies such as cryolipolysis, radiofrequency, ultrasound, and laser-based systems are widely adopted across dermatology clinics and medical spas due to their favorable safety profile and minimal downtime. These devices are particularly popular among working professionals seeking aesthetic improvements without disrupting daily routines. In addition, continuous technological advancements improving treatment efficacy and comfort have reinforced the dominance of this segment. The expanding number of med-spa centers globally further supports high utilization of noninvasive body contouring devices.

The minimally invasive devices segment is expected to witness the fastest growth during the forecast period, fueled by rising demand for procedures that offer more visible and longer-lasting results than noninvasive treatments while remaining less invasive than surgery. Techniques involving small incisions, localized fat removal, or energy-assisted lipolysis are gaining traction among patients seeking enhanced body sculpting outcomes. Growing acceptance of combination procedures and advancements in cannula design and safety features are supporting adoption. Increasing availability of trained practitioners and rising awareness of minimally invasive aesthetic options are further accelerating growth. This segment benefits from a balance between effectiveness, recovery time, and cost efficiency.

- By Procedure

On the basis of procedure, the market is segmented into nonsurgical skin resurfacing, nonsurgical skin tightening, cellulite treatment, liposuction, and others. The nonsurgical skin tightening segment dominated the market in 2025, driven by increasing demand for treatments that address skin laxity associated with aging, weight loss, and postpartum changes. Procedures using radiofrequency and ultrasound technologies are widely performed due to their ability to stimulate collagen production and improve skin firmness without surgery. These treatments are commonly offered across clinics and med-spas, contributing to high procedure volumes. The growing aging population and rising aesthetic awareness among both men and women further support segment dominance. High patient satisfaction and repeat treatment rates also reinforce its leading position.

The cellulite treatment segment is projected to grow at the fastest rate over the forecast period, owing to increasing consumer focus on body aesthetics and texture improvement. Advanced technologies combining vacuum-assisted subcision, radiofrequency, and laser energy are delivering improved and longer-lasting cellulite reduction outcomes. Rising awareness through social media and aesthetic marketing campaigns is expanding the target patient base. The growing number of women seeking targeted cellulite solutions and the introduction of FDA-approved devices are accelerating adoption. This segment benefits from unmet demand and continuous innovation.

- By Application

On the basis of application, the global body contouring devices market is segmented into fat reduction and skin tightening. The fat reduction segment accounted for the largest market revenue share in 2025, driven by the increasing prevalence of obesity and strong consumer demand for localized fat removal solutions. Noninvasive fat reduction procedures are widely preferred due to their effectiveness in targeting stubborn fat deposits resistant to diet and exercise. Technologies such as cryolipolysis and laser lipolysis have gained widespread acceptance across aesthetic clinics. The growing desire for body shaping and contour enhancement among younger demographics further supports segment dominance. High procedure volumes and repeat sessions contribute significantly to revenue generation.

The skin tightening segment is expected to register the fastest growth during the forecast period, supported by rising demand for anti-aging and post-weight-loss skin firming treatments. Increasing adoption among aging populations and individuals undergoing significant weight reduction is driving growth. Technological advancements enabling deeper tissue penetration and improved collagen remodeling are enhancing clinical outcomes. The ability to combine skin tightening with fat reduction treatments is also increasing utilization. Expanding applications across facial and body areas are further accelerating segment expansion.

- By End Users

On the basis of end users, the market is segmented into hospitals, clinics and spa centers, and clinical research laboratories. The clinics and spa centers segment dominated the market in 2025, driven by the rapid expansion of medical spas and standalone aesthetic clinics globally. These facilities offer a wide range of noninvasive and minimally invasive body contouring procedures in cost-effective and consumer-friendly settings. High patient footfall, shorter appointment wait times, and personalized treatment plans contribute to segment leadership. The growing preference for outpatient aesthetic procedures over hospital-based treatments further supports dominance. Aggressive marketing strategies and package-based offerings also enhance patient acquisition.

The hospitals segment is anticipated to witness the fastest growth during the forecast period, driven by increasing integration of advanced aesthetic services within hospital settings. Hospitals are increasingly investing in high-end body contouring technologies to attract premium patients and expand cosmetic service lines. Rising trust in hospital-based procedures and availability of multidisciplinary care support growth. In addition, hospitals are preferred for invasive and complex body contouring procedures requiring higher clinical oversight. Growing medical tourism in emerging economies is also contributing to segment expansion.

Body Contouring Devices Market Regional Analysis

- North America dominated the body contouring devices market with the largest revenue share of 41.6% in 2025, supported by high procedure volumes, a strong presence of leading aesthetic device manufacturers, advanced healthcare infrastructure, and high consumer spending on cosmetic treatments

- Consumers in the region place high value on effective, minimally invasive solutions that offer visible results with minimal downtime, along with access to technologically advanced devices across dermatology clinics and medical spas

- This widespread adoption is further supported by high disposable incomes, a well-established aesthetic healthcare infrastructure, and the growing preference for outpatient cosmetic procedures, positioning body contouring devices as a preferred choice across both clinical and med-spa settings

U.S. Body Contouring Devices Market Insight

The U.S. body contouring devices market captured the largest revenue share within North America in 2025, driven by high procedure volumes, strong aesthetic awareness, and early adoption of advanced non-invasive technologies. Consumers increasingly prioritize minimally invasive fat reduction and skin tightening solutions that deliver visible results with limited downtime. The widespread presence of medical spas, dermatology clinics, and board-certified aesthetic practitioners further supports market growth. Moreover, continuous product innovation and strong marketing through digital platforms are significantly contributing to the expansion of the U.S. body contouring devices market.

Europe Body Contouring Devices Market Insight

The Europe body contouring devices market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising aesthetic consciousness and increasing demand for non-surgical cosmetic procedures. Growing urbanization, an aging population, and higher acceptance of aesthetic treatments are fostering adoption across the region. European consumers are drawn to safe, clinically validated technologies that offer gradual and natural-looking results. The market is witnessing notable growth across hospitals, dermatology clinics, and medical spas, supported by expanding cosmetic service offerings in both Western and Eastern Europe.

U.K. Body Contouring Devices Market Insight

The U.K. body contouring devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising demand for non-invasive aesthetic treatments and increasing focus on physical appearance. Concerns related to weight management, skin laxity, and post-pregnancy body changes are encouraging consumers to opt for body contouring procedures. The strong presence of private aesthetic clinics and increasing influence of social media and celebrity culture are supporting market expansion. In addition, growing awareness of advanced technologies such as radiofrequency and cryolipolysis is fueling adoption.

Germany Body Contouring Devices Market Insight

The Germany body contouring devices market is expected to expand at a considerable CAGR during the forecast period, fueled by high standards of medical care and growing demand for technologically advanced aesthetic solutions. Germany’s emphasis on safety, precision, and regulatory compliance supports the adoption of clinically proven body contouring devices. Rising interest in non-invasive fat reduction and skin tightening treatments among middle-aged consumers is driving demand. The integration of body contouring services within dermatology clinics and private hospitals is further contributing to market growth.

Asia-Pacific Body Contouring Devices Market Insight

The Asia-Pacific body contouring devices market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and increasing acceptance of aesthetic procedures. Countries such as China, South Korea, Japan, and India are witnessing strong demand for non-invasive body shaping solutions. The growing number of aesthetic clinics, coupled with medical tourism and increasing awareness through digital platforms, is accelerating market growth. Furthermore, improving access to advanced technologies is expanding the regional consumer base.

Japan Body Contouring Devices Market Insight

The Japan body contouring devices market is gaining momentum due to the country’s strong aesthetic culture, aging population, and high demand for minimally invasive treatments. Japanese consumers place significant emphasis on safety, precision, and natural-looking outcomes, driving adoption of advanced non-invasive technologies. The increasing number of medical spas and dermatology clinics offering body contouring services is supporting growth. Moreover, demand for skin tightening and fat reduction treatments among aging and post-weight-loss populations is contributing to market expansion.

India Body Contouring Devices Market Insight

The India body contouring devices market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, a growing middle-class population, and increasing aesthetic awareness. India is emerging as a key market for non-invasive body contouring procedures due to rising obesity rates and strong demand for affordable cosmetic treatments. The expansion of medical spas, cosmetic clinics, and domestic device manufacturers is improving accessibility. In addition, growing medical tourism and social media-driven awareness are key factors propelling market growth in India.

Body Contouring Devices Market Share

The Body Contouring Devices industry is primarily led by well-established companies, including:

- Cutera (U.S.)

- InMode (U.S.)

- Fotona (Slovenia)

- Alma Lasers (Israel)

- Lumenis (Israel)

- Cynosure (U.S.)

- BTL Aesthetics (U.S.)

- Venus Concept (Canada)

- Sciton (U.S.)

- Syneron-Candela (U.S.)

- Merz Pharma GmbH & Co. KGaA (Germany)

- Lutronic (South Korea)

- EndyMed Medical (Israel)

- ThermiGen (U.S.)

- Zimmer MedizinSysteme (Germany)

- Lynton Lasers (U.K.)

- MicroAire (U.S.)

- Erchonia Corporation (U.S.)

- Asclepion (Germany)

- Solta Medical (U.S.)

What are the Recent Developments in Global Body Contouring Devices Market?

- In October 2025, Apyx Medical submitted a new FDA 510(k) premarket notification to expand the AYON system’s labeled capabilities to include power liposuction, aiming to make it the first fully integrated body contouring solution covering every aspect of contouring within one platform

- In August 2025, Cynosure Lutronic received U.S. FDA clearance for its XERF™ device, an innovative radiofrequency (RF) platform designed to deliver advanced non-invasive skin-tightening treatments that enhance body contouring results by tightening soft tissues without needles or downtime; this clearance enables broader availability of XERF in the U.S. aesthetics market and expands treatment options for providers and patients seeking non-surgical contouring solutions

- In May 2025, Apyx Medical Corporation received FDA 510(k) clearance for its AYON Body Contouring System™, a first-of-its-kind all-in-one platform combining precision body contouring technologies, and is preparing for commercial launch to key surgeons later in the year

- In March 2024, BioPhotas, Inc. launched the Celluma CONTOUR, an FDA-cleared LED light therapy device for body contouring, aging skin, and pain management, marking expansion of LED technology into multi-purpose aesthetic applications

- In March 2023, Dominion Aesthetic Technologies’ EON Smarter Body Contouring device gained additional FDA clearance for treating the back and thighs, broadening the first robotic, touchless laser system’s non-invasive lipolysis indications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.