Europe Skin Tightening Market

Market Size in USD Billion

CAGR :

%

USD

2.70 Billion

USD

6.97 Billion

2025

2033

USD

2.70 Billion

USD

6.97 Billion

2025

2033

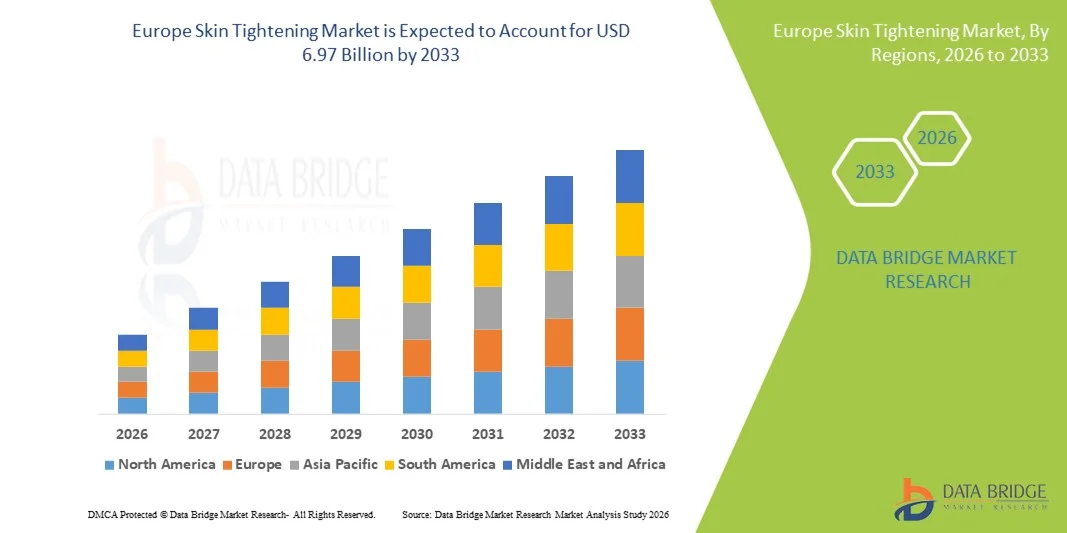

| 2026 –2033 | |

| USD 2.70 Billion | |

| USD 6.97 Billion | |

|

|

|

|

Europe Skin Tightening Market Size

- The Europe skin tightening market size was valued at USD 2.70 billion in 2025 and is expected to reach USD 6.97 billion by 2033, at a CAGR of 12.6% during the forecast period

- The market growth is largely fueled by the rising demand for non-invasive and minimally invasive aesthetic procedures, driven by an aging population seeking youthful appearance and advancements in energy-based technologies such as radiofrequency, ultrasound, and laser systems

- Furthermore, increasing consumer preference for personalized aesthetic treatments, growing awareness about skin rejuvenation solutions, and expanding medical spa infrastructure across Europe are establishing skin tightening procedures as a mainstream cosmetic solution. These factors are significantly accelerating the market’s expansion across the region

Europe Skin Tightening Market Analysis

- Skin tightening procedures, leveraging advanced technologies such as radiofrequency, ultrasound, and laser systems, are increasingly becoming central to Europe’s aesthetic medicine landscape due to their ability to deliver non-invasive skin rejuvenation, lifting, and firming with minimal recovery time

- The growing demand for youthful appearance among aging populations, rising disposable incomes, and increasing acceptance of minimally invasive treatments are driving the expansion of the Europe skin tightening market across both medical and cosmetic segments

- Germany dominated the Europe skin tightening market with the largest revenue share of 41.3% in 2025, supported by its robust aesthetic industry, high consumer awareness, and the presence of leading device manufacturers and dermatology clinics offering advanced skin tightening solutions

- Italy is expected to be the fastest-growing country in the Europe skin tightening market during the forecast period, driven by increasing adoption of non-surgical cosmetic treatments, rising medical tourism, and growing investment in high-end aesthetic centers

- The Radio Frequency Skin Tightening segment dominated the Europe skin tightening market with a market share of 44.7% in 2025, owing to its proven efficacy, safety across various skin types, and its growing integration into both clinical and home-use aesthetic devices

Report Scope and Europe Skin Tightening Market Segmentation

|

Attributes |

Europe Skin Tightening Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Europe Skin Tightening Market Trends

Rising Popularity of Non-Invasive and Combination Aesthetic Procedures

- A significant and accelerating trend in the Europe skin tightening market is the growing preference for non-invasive and combination aesthetic treatments that deliver visible anti-aging results without surgery or extensive recovery time. This evolution reflects a wider societal shift toward natural-looking enhancements and preventive skincare solutions

- For instance, the combination of radiofrequency (RF) with microneedling, such as the Morpheus8 device used by leading clinics in Germany and the U.K., has gained popularity for delivering deeper collagen remodeling with minimal downtime. Similarly, ultrasound-based systems such as Ultherapy are being increasingly adopted in France and Italy for facial lifting and contouring

- The integration of advanced technologies in aesthetic devices enables precise energy delivery, improved patient comfort, and more consistent outcomes. For instance, Lutronic’s Genius RF platform utilizes real-time impedance feedback to optimize energy distribution, enhancing treatment safety and effectiveness across diverse skin types. Furthermore, the rising adoption of hybrid systems that combine multiple modalities, such as laser and RF, allows clinicians to customize treatments for individual patient needs

- The seamless incorporation of skin tightening solutions within dermatology clinics and medispas across Europe is enhancing patient accessibility to safe, science-backed, and minimally invasive aesthetic care. Through these centers, consumers can access advanced treatments integrated with personalized skincare and maintenance regimens for long-term benefits

- This trend toward non-surgical, technology-driven skin tightening is reshaping consumer expectations in aesthetic medicine. Consequently, companies such as Alma Lasers and BTL Industries are developing next-generation platforms that combine energy-based technologies for optimal tightening results with minimal side effects

- The demand for non-invasive and combination skin tightening procedures is growing rapidly across both men and women, as consumers increasingly seek effective, low-downtime solutions that complement their busy, modern lifestyles.

Europe Skin Tightening Market Dynamics

Driver

Growing Demand Due to Aging Population and Technological Advancements

- The rising aging population across Europe, coupled with increasing emphasis on aesthetic well-being and youthful appearance, is a key driver of the growing demand for skin tightening procedures

- For instance, in March 2025, BTL Industries introduced the upgraded Exilis Ultra 360 in the U.K., enhancing simultaneous RF and ultrasound delivery for improved skin firming and contouring. Such product advancements are expected to fuel regional market growth during the forecast period

- As consumers become more aware of safe and effective non-surgical options, skin tightening treatments are increasingly preferred over invasive cosmetic surgeries. These procedures offer shorter recovery periods, natural results, and a lower risk of complications

- Furthermore, continuous innovations in aesthetic devices such as precision energy control, real-time monitoring, and improved ergonomics are broadening the adoption of skin tightening solutions among dermatologists and aesthetic practitioners

- The convenience of outpatient treatments, expanding availability of certified aesthetic centers, and growing demand for preventive anti-aging care are key factors driving the adoption of skin tightening procedures across Europe. The popularity of social media-driven beauty trends and increased marketing visibility also play a significant role in market expansion

Restraint/Challenge

Potential Side Effects and Stringent Regulatory Compliance

- Concerns surrounding post-treatment side effects, such as mild redness, swelling, or skin irritation, pose a challenge to the broader acceptance of skin tightening procedures among cautious consumers. These effects, though temporary, can influence patient confidence in new technologies

- For instance, reports of inconsistent results from low-quality devices have led some European consumers to seek treatments only from highly reputed clinics, thereby limiting growth among smaller or unregulated service providers

- Addressing these safety concerns through improved device quality, clinician training, and standardized procedural protocols is crucial for maintaining trust in energy-based treatments. Companies such as Fotona and Venus Concept emphasize their CE-certified technologies and robust safety mechanisms in promotional efforts. In addition, Europe’s stringent medical device regulations under the MDR framework require extensive clinical validation, extending approval timelines and increasing compliance costs for manufacturers

- While regulatory oversight ensures patient safety, it also raises entry barriers for emerging players and slows innovation cycles, particularly for startups introducing novel skin tightening systems

- Overcoming these challenges through continuous clinical research, adherence to European quality standards, and enhanced practitioner education will be essential to sustaining market growth and patient satisfaction in the long term

Europe Skin Tightening Market Scope

The market is segmented on the basis of product type, portability, treatment type, application, end user, and distribution channel.

- By Product Type

On the basis of product type, the Europe skin tightening market is segmented into radio frequency (RF) skin tightening, laser skin tightening, and ultrasound skin tightening. The radio frequency skin tightening segment dominated the market with the largest revenue share of 44.7% in 2025, owing to its proven efficacy, safety profile, and versatility in addressing various skin laxity concerns. RF devices work by stimulating collagen production through controlled heating of the dermal layers, making them suitable for both facial and body applications. For instance, BTL Exilis and Thermage systems are widely adopted across Germany, France, and the U.K., where aesthetic clinics favor their predictable results and non-invasive nature. The ease of use, minimal downtime, and compatibility with multiple skin types have further strengthened RF’s dominance in clinical and home-use applications across Europe.

The ultrasound skin tightening segment is anticipated to witness the fastest growth rate from 2026 to 2033, driven by increasing demand for precision-based and non-invasive lifting treatments. Ultrasound devices, such as Ultherapy and Sofwave, target deeper tissue layers to stimulate collagen remodeling without surface damage, appealing to patients seeking natural-looking rejuvenation. The growing adoption of ultrasound-based procedures in Italy and Spain reflects the rising preference for long-lasting results with minimal discomfort. Increasing investments in advanced focused ultrasound technologies and expanding clinical evidence of safety and efficacy are expected to further accelerate segment growth.

- By Portability

On the basis of portability, the Europe skin tightening market is segmented into portable and standalone devices. The standalone segment dominated the market in 2025 due to its widespread use in professional dermatology clinics, hospitals, and cosmetic centers. Standalone systems offer higher power output, precision, and treatment depth, which are essential for achieving clinical-grade results in non-surgical skin tightening. For instance, leading platforms such as Alma Accent Prime and Fotona TightSculpting are preferred in European aesthetic clinics for full-body and facial tightening procedures. Their superior cooling systems, customizable energy parameters, and consistent efficacy have made standalone devices the standard for professional use.

The portable segment is projected to register the fastest CAGR during the forecast period, fueled by growing demand for home-based aesthetic devices and the increasing accessibility of affordable, compact skin tightening tools. European consumers, particularly in the U.K. and France, are showing growing interest in at-home beauty technologies that offer convenience and cost savings. Portable RF and LED-based devices, such as those from brands such as NuFACE and FOREO, are gaining traction due to their ease of use and visible results over consistent use. The trend toward self-care and personal aesthetic maintenance is expected to further boost the adoption of portable devices across the region.

- By Treatment Type

On the basis of treatment type, the market is segmented into non-invasive and minimally invasive treatments. The non-invasive segment dominated the Europe skin tightening market in 2025, attributed to the growing popularity of procedures that deliver effective results without incisions or anesthesia. Technologies such as RF, ultrasound, and laser-based systems enable collagen stimulation and skin lifting with minimal downtime, appealing to a broad demographic of consumers. For instance, non-invasive procedures such as Thermage FLX and Ultherapy have become mainstream in major cities such as London, Paris, and Munich due to their safety and natural results. The high patient comfort, short recovery period, and growing demand for preventive anti-aging treatments further reinforce this segment’s dominance.

The minimally invasive segment is expected to experience the fastest growth during the forecast period, driven by advancements in microneedling RF and injectable-based tightening therapies. Treatments such as Morpheus8 and Secret RF offer enhanced collagen remodeling by delivering controlled energy through micro-pins, achieving deeper tightening effects. The increasing number of dermatology clinics offering combination treatments pairing minimally invasive skin tightening with fillers or PRP is further accelerating adoption. Rising acceptance among patients seeking long-term outcomes with slightly higher downtime is fueling the growth of this segment across Europe.

- By Application

On the basis of application, the market is segmented into reduce wrinkles, face lifting, body lifting, anti-aging, and others. The anti-aging segment dominated the Europe skin tightening market in 2025, supported by the rapidly growing aging population and increasing awareness of early skin rejuvenation treatments. Anti-aging applications encompass both facial and body tightening to improve elasticity, smooth fine lines, and restore youthful contours. For instance, demand for RF and ultrasound-based procedures targeting collagen regeneration is particularly high among consumers aged 35–60 in Western Europe. The popularity of aesthetic clinics offering age-preventive care programs and personalized anti-aging protocols is further boosting this segment’s market share.

The face lifting segment is projected to witness the fastest growth from 2026 to 2033, driven by increasing consumer preference for non-surgical alternatives to facelifts. Treatments such as HIFU and laser-based tightening are becoming widely adopted for enhancing jawline definition and cheek contouring. For instance, the rising demand for Ultherapy and Fotona 4D laser in countries such as Spain and Italy reflects the growing cultural emphasis on youthful facial aesthetics. The quick recovery, visible lifting effect, and suitability for multiple skin types are accelerating the popularity of non-surgical face-lifting treatments.

- By End User

On the basis of end user, the Europe skin tightening market is segmented into dermatology clinics, hospitals, beauty salons and cosmetic centers, and homecare. The dermatology clinics segment dominated the market in 2025, owing to the concentration of advanced technologies and skilled practitioners within these settings. Clinics across Germany, France, and the U.K. are leading in offering professional-grade RF, laser, and ultrasound tightening procedures with customizable treatment plans. Patients prefer these clinics for their clinical expertise, safety standards, and access to FDA- and CE-approved devices. In addition, the rising number of boutique aesthetic clinics and medispas across urban centers is further contributing to the dominance of this segment.

The homecare segment is expected to grow at the fastest CAGR during the forecast period, driven by increased consumer interest in self-administered skincare devices. The convenience of performing treatments at home, combined with lower costs and continuous technological improvements in compact devices, is fueling demand. For instance, portable RF and LED devices from brands such as CurrentBody and Tripollar are gaining traction across the U.K., France, and the Netherlands. The growing online retail distribution and social media-driven awareness of home aesthetic technologies are accelerating this segment’s expansion.

- By Distribution Channel

On the basis of distribution channel, the Europe skin tightening market is segmented into direct, tenders, and retail. The direct segment dominated the market in 2025, primarily due to the strong preference of professional institutions and large aesthetic chains to purchase equipment directly from manufacturers or authorized distributors. This approach ensures authenticity, after-sales service, and access to the latest device upgrades. For instance, companies such as Alma Lasers, Cutera, and Fotona have established direct distribution networks across Europe to strengthen customer engagement and provide on-site training. The reliability and long-term maintenance support associated with direct purchases make this channel dominant in clinical settings.

The retail segment is projected to experience the fastest growth during the forecast period, driven by the rise of e-commerce and the increasing availability of portable skin tightening devices through online platforms. European consumers are increasingly purchasing compact RF and LED-based devices from online retailers such as Amazon and brand-owned web stores. For instance, FOREO and NuFACE have expanded their retail presence across multiple European markets through partnerships with beauty and electronics retailers. The growing trust in online product reviews and easy access to product information are boosting retail channel expansion in the region.

Europe Skin Tightening Market Regional Analysis

- Germany dominated the Europe skin tightening market with the largest revenue share of 41.3% in 2025, supported by its robust aesthetic industry, high consumer awareness, and the presence of leading device manufacturers and dermatology clinics offering advanced skin tightening solutions

- Consumers across major countries such as Germany, France, Italy, and the U.K. highly value the effectiveness, safety, and minimal downtime offered by advanced energy-based devices such as radiofrequency, ultrasound, and laser systems for skin rejuvenation and tightening

- This growing adoption is further supported by strong healthcare infrastructure, the presence of leading aesthetic technology manufacturers, and high awareness of cosmetic innovation, positioning Europe as a leading hub for advanced skin tightening treatments across clinical, cosmetic, and home-use settings

The Germany Skin Tightening Market Insight

The Germany skin tightening market captured the largest revenue share in 2025 within Europe, driven by high consumer spending on advanced aesthetic procedures and the strong presence of key technology providers. German dermatology and aesthetic clinics widely utilize laser, RF, and combined energy-based systems for face and body tightening. The country’s emphasis on clinical safety, technological innovation, and precision medicine supports its leadership position in the market. In addition, a growing aging population, coupled with increasing interest in non-surgical anti-aging solutions, continues to reinforce Germany’s dominance in the regional market.

France Skin Tightening Market Insight

The France skin tightening market is projected to grow steadily during the forecast period, fueled by the country’s strong culture of beauty and aesthetics and its advanced dermatology sector. French consumers are increasingly adopting skin tightening treatments as part of comprehensive anti-aging regimens, particularly those targeting facial rejuvenation and wrinkle reduction. The presence of well-established aesthetic centers in Paris, Lyon, and Marseille offering high-quality treatments using CE-certified technologies contributes to the country’s growth. Furthermore, growing demand among middle-aged populations for subtle, natural-looking results is accelerating the adoption of energy-based skin tightening solutions.

Italy Skin Tightening Market Insight

The Italy skin tightening market is expected to witness the fastest growth rate in Europe during the forecast period, supported by the country’s booming medical tourism industry and rising awareness of aesthetic wellness. Italian consumers are showing a growing preference for non-invasive and combination treatments, such as radiofrequency with microneedling, for comprehensive rejuvenation. For instance, aesthetic centers in Milan and Rome have reported rising demand for devices such as BTL Exilis and Alma Accent Prime due to their proven results. The influence of fashion and media, along with increasing demand for youthful appearance among both genders, is further propelling the market’s expansion.

Spain Skin Tightening Market Insight

The Spain skin tightening market is gaining momentum due to the rising popularity of cosmetic treatments and the expansion of private aesthetic clinics across major cities. Spanish consumers are embracing skin tightening procedures as part of broader facial and body contouring treatments, driven by lifestyle-focused wellness trends. The country’s warm climate and high awareness of skincare maintenance have contributed to early adoption of laser and ultrasound-based solutions. Moreover, increasing affordability and the availability of flexible payment options for aesthetic procedures are fostering continued growth of the Spanish market.

Europe Skin Tightening Market Share

The Europe Skin Tightening industry is primarily led by well-established companies, including:

- Alma Lasers (Israel)

- BTL Group of Companies (Czech Republic)

- Fotona (Slovenia)

- Lutronic Holding (South Korea)

- Merz Pharma (Germany)

- Venus (Canada)

- InMode Ltd. (Israel)

- Cutera, Inc. (U.S.)

- Sciton (U.S.)

- Quanta System (Italy)

- ASCLEPION (Germany)

- ENDYMED (Israel)

- Lynton Lasers Ltd (U.K.)

- Zimmer MedizinSysteme GmbH (Germany)

- GSD Aesthetic (China)

- Eufoton s.r.l. (Italy)

- Lumenis Be Ltd. (U.S.)

- Solta Medical (U.S.)

- DEKA M.E.L.A. S.r.l. (Italy)

- Alma Medical (U.A.E.)

What are the Recent Developments in Europe Skin Tightening Market?

- In January 2025, a new device combining radio-frequency microneedling technology the Potenza RF Microneedling system was referenced in published insights as having been launched in 2021 and gaining traction in Europe. This reinforces the rising adoption of minimally-invasive skin tightening modalities throughout region

- In May 2024, TOOsonix A/S’s image-guided high-intensity focused ultrasound (HIFU) device System ONE‑M received CE certification under the EU Medical Device Regulation (MDR), enabling its sale across the European Economic Area. This marks a significant regulatory milestone for a high-precision dermatology device that supports skin tightening applications among others

- In February 2024, Venus Versa Pro (by Venus Concept) received CE-Mark approval for the European Union market. The system is a multi‐modal aesthetic device combining IPL, Nano-Fractional RF and (MP)² technologies, enabling clinicians to address skin tightness, texture, and rejuvenation in one platform. The CE marking allows the device’s commercial rollout in Europe, signalling growing technological convergence in skin tightening treatments

- In February 2024, Nu Skin Enterprises launched its consumer-targeted device RenuSpa iO, featuring adaptive micro-current technology for at-home skin stimulation and tightening. Although this launch is global, it reflects the growing home-use skin tightening trend in Europe as well

- In April 2023, HydraFacial Syndeo (by BeautyHealth) was launched in select European & Asia-Pacific markets beginning April 2023, debuting at the AMWC conference in Monaco. While primarily a facial treatment platform, its launch reinforces the expansion of advanced device systems into Europe’s aesthetic clinics, enhancing non-invasive skin tightening and rejuvenation capabilities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.