Global Bone Anchored Hearing Systems Bahs Market

Market Size in USD Billion

CAGR :

%

USD

2.42 Billion

USD

6.53 Billion

2025

2033

USD

2.42 Billion

USD

6.53 Billion

2025

2033

| 2026 –2033 | |

| USD 2.42 Billion | |

| USD 6.53 Billion | |

|

|

|

|

Bone Anchored Hearing Systems Market Size

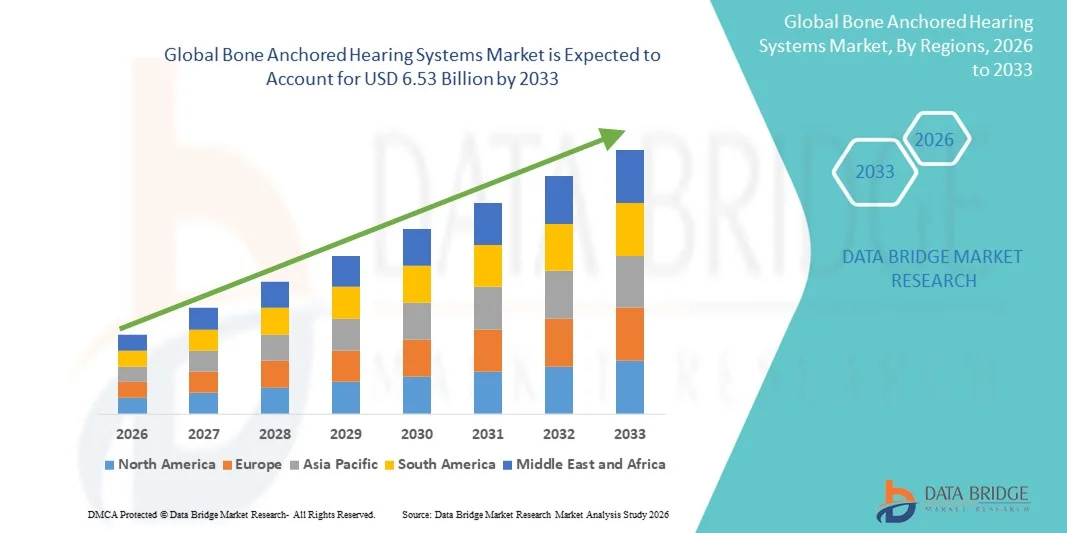

- The global bone anchored hearing systems market size was valued at USD 2.42 billion in 2025 and is expected to reach USD 6.53 billion by 2033, at a CAGR of 13.2% during the forecast period

- The market growth is largely driven by increasing prevalence of hearing loss, advancements in implantable hearing devices, and growing awareness about bone conduction technology among patients and healthcare providers

- Furthermore, rising demand for minimally invasive and effective hearing solutions, coupled with technological innovations in sound processor design and connectivity features, is positioning bone anchored hearing systems as a preferred option for both clinical and personal use. These converging factors are accelerating the adoption of bone anchored hearing solutions, thereby significantly boosting the industry's growth

Bone Anchored Hearing Systems Market Analysis

- Bone anchored hearing systems, offering implantable solutions for conductive, mixed, and single-sided sensorineural hearing loss, are increasingly vital in modern audiology and ENT practices due to their effectiveness, minimally invasive implantation, and superior sound quality compared to conventional hearing aids

- The rising demand for bone anchored hearing systems is primarily fueled by growing awareness of advanced hearing solutions, increasing prevalence of hearing impairment, and the need for reliable alternatives to traditional hearing aids, particularly among patients with chronic ear conditions or anatomical malformations

- North America dominated the bone anchored hearing systems market with the largest revenue share of 39.7% in 2025, driven by early adoption of implantable hearing technologies, high healthcare expenditure, and the presence of leading medical device manufacturers. The U.S. witnessed substantial growth in bone anchored hearing systems procedures, particularly in specialized ENT clinics and hospitals, supported by innovations in implant design and digital sound processor technology

- Asia-Pacific is expected to be the fastest growing region in the bone anchored hearing systems market during the forecast period, owing to expanding healthcare infrastructure, rising awareness about hearing rehabilitation, and increasing accessibility to advanced hearing solutions in emerging economies

- Sensorineural hearing loss segment dominated the bone anchored hearing systems market with a market share of 43.7% in 2025, driven by the high prevalence of sensorineural conditions, clinical effectiveness of bone anchored hearing systems for such patients, and increasing adoption by ENT specialists for long-term auditory rehabilitation

Report Scope and Bone Anchored Hearing Systems Market Segmentation

|

Attributes |

Bone Anchored Hearing Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Bone Anchored Hearing Systems Market Trends

Advancements Through Wireless Connectivity and Digital Sound Processors

- A significant and accelerating trend in the global bone anchored hearing systems market is the integration of wireless connectivity and advanced digital sound processors, enhancing patient convenience and hearing quality

- For instance, Cochlear’s Baha 6 Max offers direct streaming from smartphones and other audio devices, providing users with seamless connectivity for improved listening experiences in various environments

- Digital processor integration in bone anchored hearing systems allows features such as adaptive noise reduction, automatic environmental adjustment, and personalized hearing profiles. For instance, Oticon Medical Ponto 5 uses adaptive algorithms to optimize sound processing based on surrounding noise conditions

- The integration of wireless and smart connectivity with bone anchored hearing systems enables centralized control through companion mobile applications, allowing users to adjust volume, switch programs, or monitor battery life from a single interface

- This trend toward more intelligent, connected, and user-friendly hearing solutions is fundamentally reshaping patient expectations for auditory rehabilitation. Consequently, companies such as MED-EL are developing devices with wireless streaming, AI-based sound optimization, and app-based remote control

- The demand for bone anchored hearing systems that offer seamless connectivity and advanced sound processing is growing rapidly across both clinical and home-based applications, as patients increasingly prioritize convenience and high-quality hearing performance

Bone Anchored Hearing Systems Market Dynamics

Driver

Increasing Prevalence of Hearing Loss and Awareness of Advanced Solutions

- The rising prevalence of hearing impairment, coupled with growing awareness of implantable solutions, is a significant driver for the heightened demand for bone anchored hearing systems

- For instance, in March 2025, Cochlear Limited reported a surge in global adoption of its bone anchored hearing solutions due to increased patient awareness campaigns in ENT clinics

- As patients seek more effective alternatives to traditional hearing aids, bone anchored hearing systems offer superior sound quality, improved speech recognition, and long-term auditory benefits, providing a compelling solution for various types of hearing loss

- Furthermore, increasing ENT specialist recommendations and audiology-focused educational initiatives are making bone anchored hearing systems a preferred choice for patients requiring durable and high-performance hearing solutions

- The convenience of minimally invasive implantation, compatibility with wireless streaming devices, and ability to treat sensorineural, conductive, or mixed hearing loss are key factors propelling adoption across diverse patient populations

- The growing healthcare infrastructure, rising awareness about hearing rehabilitation, and technological advancements in processor design further contribute to the expansion of the bone anchored hearing systems market

Restraint/Challenge

Surgical Complexity and High Device Costs

- Concerns surrounding the surgical procedure required for implanting bone anchored hearing systems pose a significant challenge to broader market penetration. As the procedure involves minor surgery and post-operative care, some patients are hesitant to adopt the technology

- For instance, reports of post-surgical complications or prolonged healing times have made certain patient segments cautious about choosing implantable hearing solutions

- Addressing these surgical concerns through improved minimally invasive techniques, enhanced training for ENT specialists, and clear patient education is crucial for building confidence and adoption. In addition, the relatively high cost of bone anchored hearing systems compared to conventional hearing aids can be a barrier for price-sensitive patients, particularly in developing regions

- While insurance coverage and reimbursement policies are gradually improving, the upfront expense for advanced digital processors and implantable devices remains a challenge for widespread adoption

- Overcoming these challenges through innovations in surgical procedures, patient awareness programs, and development of cost-effective devices will be vital for sustained market growth

- Companies such as Oticon Medical and MED-EL emphasize minimally invasive implantation, clinical effectiveness, and support programs in their marketing to reassure potential patients and healthcare providers

Bone Anchored Hearing Systems Market Scope

The market is segmented on the basis of raw material and application.

- By Raw Material

On the basis of raw material, the bone anchored hearing systems market is segmented into titanium alloy, ceramics composites, and others. The titanium alloy segment dominated the market with the largest market revenue share of 51.4% in 2025, driven by its high biocompatibility, corrosion resistance, and proven success in long-term implant stability. Titanium alloy implants are widely preferred by ENT surgeons due to their strong osseointegration, reducing the risk of implant failure and post-surgical complications. The segment also benefits from extensive clinical validation, established regulatory approvals, and patient trust, which collectively reinforce its dominance in the market. In addition, the availability of diverse implant designs and sizes for various patient anatomies enhances the adoption of titanium alloy-based bone anchored hearing systems.

The ceramics composites segment is anticipated to witness the fastest growth rate of 20.8% from 2026 to 2033, fueled by ongoing material innovation and the development of lighter, more aesthetic, and hypoallergenic alternatives to metal implants. Ceramics composites offer advantages such as reduced allergic reactions and improved comfort for sensitive patients, making them increasingly attractive for specific patient groups. Growing R&D efforts to improve strength and integration properties are further accelerating the adoption of ceramic-based implants, particularly in regions with rising awareness of advanced hearing rehabilitation solutions.

- By Application

On the basis of application, the bone anchored hearing systems market is segmented into sensorineural hearing loss, mixed hearing loss, conductive hearing loss, and single-sided deafness. The sensorineural hearing loss segment dominated the market with the largest market revenue share of 43.7% in 2025, driven by the high prevalence of sensorineural conditions and the clinical effectiveness of bone anchored hearing systems in restoring auditory function for such patients. ENT specialists frequently recommend bone anchored hearing systems for patients with chronic or irreversible sensorineural hearing loss, owing to the improved speech recognition and sound clarity compared to conventional hearing aids. The segment also benefits from growing awareness campaigns and the increasing availability of advanced sound processors that enhance patient outcomes.

The single-sided deafness segment is expected to witness the fastest CAGR of 19.6% from 2026 to 2033, driven by rising diagnosis rates and the growing preference for implantable solutions over traditional contralateral routing of signals (CROS) hearing aids. Bone anchored hearing systems provide effective sound conduction to the normal-hearing ear, improving spatial awareness and speech comprehension in noisy environments. Increasing ENT recommendations, patient awareness, and technological advancements in discreet and lightweight devices are further supporting the rapid adoption of this application segment globally.

Bone Anchored Hearing Systems Market Regional Analysis

- North America dominated the bone anchored hearing systems market with the largest revenue share of 39.7% in 2025, driven by early adoption of implantable hearing technologies, high healthcare expenditure, and the presence of leading medical device manufacturers

- Patients and healthcare providers in the region highly value the clinical effectiveness, improved sound quality, and minimally invasive nature of bone anchored hearing systems, along with seamless compatibility with wireless streaming and digital sound processors

- This widespread adoption is further supported by well-established healthcare infrastructure, high healthcare expenditure, and the presence of leading medical device manufacturers, establishing bone anchored hearing systems as the preferred solution for hearing restoration in both clinical and home-based settings

U.S. Bone Anchored Hearing Systems Market Insight

The U.S. bone anchored hearing systems market captured the largest revenue share of 79% in 2025 within North America, driven by high awareness of advanced hearing rehabilitation solutions and widespread adoption of implantable devices. Patients increasingly prefer bone anchored hearing systems due to their clinical effectiveness, minimally invasive procedure, and compatibility with wireless streaming and digital sound processors. The presence of leading medical device manufacturers, extensive ENT and audiology networks, and favorable healthcare reimbursement policies further bolster market growth. In addition, patient education campaigns and rising prevalence of hearing loss are contributing to the strong adoption of these systems across clinical and home-based applications.

Europe Bone Anchored Hearing Systems Market Insight

The Europe bone anchored hearing systems market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by growing awareness of implantable hearing solutions and increasing prevalence of hearing impairment. The demand for advanced auditory rehabilitation is fostering adoption across residential and clinical settings. European patients and healthcare providers are increasingly opting for bone anchored hearing systems due to their superior sound quality, minimally invasive implantation, and long-term benefits. The market also benefits from robust healthcare infrastructure, regulatory support for implantable devices, and rising ENT specialist recommendations.

U.K. Bone Anchored Hearing Systems Market Insight

The U.K. bone anchored hearing systems market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising prevalence of hearing loss and a growing preference for advanced implantable solutions over conventional hearing aids. In addition, awareness campaigns, patient education programs, and ENT specialist endorsements are encouraging adoption. The U.K.’s strong healthcare system, coupled with supportive reimbursement policies, facilitates wider accessibility of bone anchored hearing systems for both clinical and personal use. Integration with wireless devices and smartphone applications further enhances patient convenience and satisfaction.

Germany Bone Anchored Hearing Systems Market Insight

The Germany bone anchored hearing systems market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of implantable hearing solutions and high adoption of advanced auditory rehabilitation technologies. Germany’s well-established healthcare infrastructure, emphasis on clinical innovation, and strong regulatory framework promote the adoption of bone anchored hearing systems. Integration with wireless streaming, digital sound processors, and patient-friendly features are increasingly preferred by users seeking enhanced hearing performance. Rising ENT specialist recommendations and growing public awareness about hearing loss treatment options further contribute to market growth.

Asia-Pacific Bone Anchored Hearing Systems Market Insight

The Asia-Pacific bone anchored hearing systems market is poised to grow at the fastest CAGR of 23% during the forecast period of 2026 to 2033, driven by increasing urbanization, rising disposable incomes, and technological advancements in countries such as China, Japan, and India. Growing awareness about hearing loss and implantable solutions, coupled with expanding healthcare infrastructure, is driving adoption. The region is also witnessing an increase in trained ENT specialists and audiologists, facilitating wider access to advanced hearing rehabilitation. Moreover, government initiatives promoting healthcare access and digital health solutions are supporting market growth.

Japan Bone Anchored Hearing Systems Market Insight

The Japan bone anchored hearing systems market is gaining momentum due to the country’s advanced healthcare ecosystem, high awareness of hearing rehabilitation, and increasing prevalence of hearing loss. Patients value minimally invasive implantation and high-quality sound restoration provided by these systems. Integration with wireless devices and mobile apps enhances usability and convenience. Japan’s aging population is expected to further drive demand for bone anchored hearing systems in both residential and clinical settings. The country’s focus on innovation in medical devices supports continuous advancements in implant and processor technologies.

India Bone Anchored Hearing Systems Market Insight

The India bone anchored hearing systems market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s growing awareness of hearing loss solutions, expanding healthcare infrastructure, and increasing disposable incomes. India is witnessing rising adoption of implantable hearing solutions in hospitals, ENT clinics, and private audiology centers. The availability of cost-effective bone anchored hearing systems and government initiatives to promote hearing rehabilitation are key factors propelling market growth. Increasing patient education, coupled with the presence of local and international medical device manufacturers, further supports market expansion.

Bone Anchored Hearing Systems Market Share

The Bone Anchored Hearing Systems industry is primarily led by well-established companies, including:

- Cochlear Ltd. (Australia)

- MED EL Medical Electronics (Austria)

- GN Hearing A/S (Denmark)

- WS Audiology A/S (Denmark)

- Oticon Medical (Denmark)

- Sonova Holding AG (Switzerland)

- Starkey Hearing Technologies (U.S.)

- Widex (Denmark)

- William Demant A/S (Denmark)

- Sophono Inc. (U.S.)

- Amplifon S.p.A. (Italy)

- Audina Hearing Instruments, Inc. (U.S.)

- Benson Medical Instruments (U.S.)

- Zhejiang Nurotron Biotechnology Co., Ltd. (China)

- Interacoustics A/S (Denmark)

- RION Co., Ltd. (Japan)

- Bernafon AG (Switzerland)

- Eargo, Inc. (U.S.)

- Envoy Medical Corporation (U.S.)

- BHM Tech Produktionsgesellschaft mbH (Germany)

What are the Recent Developments in Global Bone Anchored Hearing Systems Market?

- In June 2025, Oticon Medical officially launched the Sentio™ active transcutaneous bone anchored hearing system in Canada, marking the first commercial release of this new implant option designed to keep the skin intact while delivering advanced bone conduction hearing for patients with conductive, mixed hearing loss, or single‑sided deafness, and expanding clinical choice beyond traditional percutaneous systems

- In October 2024, the Sentio bone conduction implant developed in collaboration with Chalmers University of Technology and Sahlgrenska University Hospital was highlighted for receiving clinical approvals in both Europe and the US, representing a decade of research and signaling a major breakthrough by eliminating external abutments and associated complications

- In July 2024, Oticon Medical’s Sentio™ System received U.S. FDA clearance and CE mark approval in Europe as the company’s first active transcutaneous bone conduction hearing solution, offering a lighter sound processor and under‑skin implant to reduce infection risk and broaden global clinical adoption of advanced BAHS technology

- In April 2024, Cochlear Limited received U.S. FDA clearance to lower the age indication for its Osia® Bone Anchored Hearing System to children as young as 5 years old, enabling younger pediatric patients with conductive or mixed hearing loss or single‑sided deafness to access advanced implantable hearing support that improves high‑frequency hearing and daily communication

- In June 2023, the UK’s Competition and Markets Authority blocked the full acquisition of Oticon Medical’s bone‑anchored implant unit by Cochlear Ltd. while approving the sale of the cochlear implant division, ensuring that the BAHS business remains independent and able to compete a regulatory action with significant implications for market competition and innovation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.