Global Bone Void Filler Market

Market Size in USD Billion

CAGR :

%

USD

4.02 Billion

USD

6.01 Billion

2024

2032

USD

4.02 Billion

USD

6.01 Billion

2024

2032

| 2025 –2032 | |

| USD 4.02 Billion | |

| USD 6.01 Billion | |

|

|

|

|

Bone Void Filler Market Size

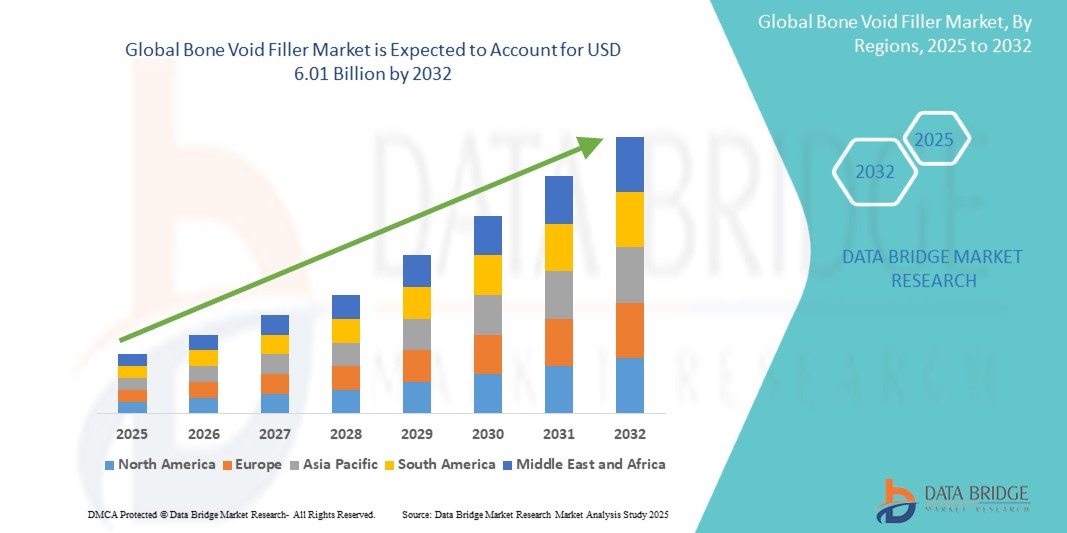

- The global bone void filler market was valued at USD 4.02 billion in 2024 and is expected to reach USD 6.01 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 5.14%, primarily driven by the increasing orthopedic surgeries and aging population

- This growth is driven by factors such as the increasing number of orthopedic surgeries and bone-related disorders and advancements in biomaterial technologies

Bone Void Filler Market Analysis

- The bone void filler market refers to the segment of the medical device industry that focuses on materials used to fill bone defects, gaps, or voids caused by injury, disease, or surgical procedures. These fillers are used to support bone healing, improve stability, and enhance recovery in patients with bone fractures, osteoporosis, and other musculoskeletal disorders

- The global market is projected to grow at a CAGR of 5.14%, driven by factors such as the rising incidence of orthopedic surgeries, an aging population, and increased awareness of advanced treatment options

- For instance, In February 2023, a leading healthcare company launched a new bioactive bone void filler. This product was designed to promote faster healing and integrate more effectively with natural bone, catering to the growing demand for more efficient and biocompatible bone repair solutions

- The market is also influenced by technological advancements, such as the development of synthetic and composite bone void fillers that offer better clinical outcomes. With the rise in age-related bone diseases and an increased preference for minimally invasive procedures, the bone void filler market is set for continued expansion. The trend toward personalized healthcare is also contributing to the sector's growth, as customized solutions gain popularity

Report Scope and Bone Void Filler Market Segmentation

|

Attributes |

Bone Void Filler Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Bone Void Filler Market Trends

“Increasing Use of Bioactive and Resorbable Materials”

- One prominent trend in the global bone void filler market is the increasing use of bioactive and resorbable materials

- These advanced fillers promote better bone regeneration by actively interacting with the surrounding bone tissue, enhancing healing and integration

- For instance, In March 2025, Elute, Inc. received U.S. Food and Drug Administration (FDA) approval for BonVie+, a novel synthetic resorbable bone void filler implant. BonVie+ is designed to fill bone defects and is gradually replaced by new bone over time, promoting natural healing

- Resorbable materials, on the other hand, gradually degrade over time, eliminating the need for secondary surgeries to remove the filler, making them more appealing for both patients and surgeons

- This trend is improving patient outcomes by providing more effective, longer-lasting treatments, reducing recovery times, and lowering the risk of adverse reactions, which is fueling the growth of the bone void filler market

Bone Void Filler Market Dynamics

Driver

“Increasing Number of Orthopedic Surgeries and Bone-Related Disorders”

- The increasing number of orthopedic surgeries and bone-related disorders is significantly driving the demand for bone void fillers

- As the global population ages, the prevalence of conditions such as osteoporosis, bone fractures, and trauma increases, leading to a higher number of surgical interventions

- Orthopedic surgeries, especially those involving joint replacements, spinal surgeries, and trauma-related procedures, often require bone void fillers to support bone healing and improve recovery outcomes

- The advancement in bone void filler materials, particularly resorbable and bioactive options, offers enhanced healing, better integration with natural bone, and reduces the risk of complications

For instance,

- In April 2023, Zimmer Biomet launched the Tether Bone Void Filler, a resorbable, bioactive material designed to promote bone regeneration in spinal surgeries. This launch highlights the growing demand for advanced bone healing solutions in orthopedic procedures

- In September 2022, Stryker Corporation introduced the AccuFill Bone Graft Substitute, a resorbable bone filler for trauma and spinal surgeries, addressing the increasing need for effective bone healing solutions in surgical treatments

- As more individuals undergo orthopedic surgeries and require bone defect treatments, the demand for innovative bone void fillers market continues to rise

Opportunity

“Growing Trend of Minimally Invasive Surgeries”

- The growing trend of minimally invasive surgeries presents a significant opportunity for the bone void filler market

- As surgical techniques evolve, the demand for less invasive procedures has increased, making it essential for bone void fillers to be adaptable for use in minimally invasive surgeries

- These procedures, which typically require smaller incisions and faster recovery times, benefit from the use of advanced bone void fillers that offer quick healing, reduce the risk of infection, and improve overall surgical outcomes

- Minimally invasive surgeries, such as arthroscopy and endoscopic spinal procedures, require bone void fillers that can provide effective support while minimizing complications

For instance,

- In March 2024, according to an article published by Orthopedic Today, advancements in minimally invasive spinal surgery have driven the demand for innovative bone void fillers that can be injected or used via small incisions, reducing patient recovery time and enhancing surgical precision

- In December 2022, Medtronic launched a new bioactive bone void filler designed for use in minimally invasive orthopedic surgeries, capitalizing on the growing trend toward less invasive surgical options

- The growing demand for minimally invasive surgeries presents a significant opportunity for the bone void filler market, driving innovations in bioactive materials that enhance surgical outcomes and accelerate market growth

Restraint/Challenge

“High Cost of Bone Void Fillers”

- The high cost of bone void fillers, particularly advanced bioactive and resorbable materials, poses a significant restraint for the market

- These specialized bone fillers can be expensive, making them less accessible, especially in developing regions or for smaller healthcare facilities with limited budgets

- The financial burden of these materials may discourage hospitals and clinics from adopting the latest technologies, opting instead for cheaper, less effective alternatives

For instance,

- In December 2022, Stryker Corporation announced in a press release that the high cost of their advanced bone void filler products, such as their Tritanium series, remains a challenge for broader adoption, especially in cost-sensitive markets. This is due to the high manufacturing costs and the premium nature of the materials used

- As a result, the high cost of these products can delay the overall growth and accessibility of bone void fillers, hindering their widespread use

Bone Void Filler Market Scope

The market is segmented on the basis of type, form, application, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Form |

|

|

By Application |

|

|

By End User |

|

Bone Void Filler Market Regional Analysis

“North America is the Dominant Region in the Bone Void Filler Market”

- North America is the dominant region in the Bone Void Filler Market, driven by advanced healthcare infrastructure, high adoption of innovative bone grafting solutions, and increasing orthopedic and trauma cases

- The U.S. leads due to a rising aging population, favorable reimbursement policies, and growing demand for minimally invasive procedures

- In addition, strong research and development activities, along with the presence of key market players, further solidify North America’s dominance in the global bone void filler industry

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific is projected to register the highest growth rate in the Bone Void Filler Market, driven by increasing healthcare investments, a rapidly aging population, and a rising prevalence of orthopedic disorders such as osteoporosis and fractures

- Countries such as China, India, and Japan are experiencing a surge in demand for advanced bone grafting solutions due to expanding healthcare infrastructure, growing medical tourism, and improving accessibility to surgical treatments

- China is projected to register the highest growth rate in the Bone Void Filler Market, driven by rapid advancements in healthcare infrastructure, an increasing elderly population, and a rising prevalence of orthopedic disorders such as osteoporosis and fractures

- In addition, increasing awareness about minimally invasive procedures, advancements in biomaterials, and government initiatives to enhance healthcare facilities further propel market expansion. The rising number of road accidents, sports injuries, and trauma cases also contribute to the demand for bone void fillers

Bone Void Filler Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- ABYRX, Inc. (U.S.)

- Arthrex, Inc. (U.S.)

- Anika Therapeutics, Inc. (U.S.)

- Amend Surgical (U.S.)

- Biocomposites (U.K.)

- BONESUPPORT AB (Sweden)

- Bone Solutions, Inc. (U.S.)

- dsm-firmenich (Netherlands)

- Elute, Inc. (U.S.)

- Graftys (France)

- Halma plc (U.K.)

- Healio (U.S.)

- Integra LifeSciences (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Orthofix Medical Inc. (U.S.)

- ORTHOREBIRTH CO. LTD (Japan)

- Regenity (U.S.)

- Stryker (U.S.)

- Synergy Biomedical, LLC (U.S.)

- ZimVie Inc. (U.S.)

- Zimmer Biomet (U.S.)

Latest Developments in Global Bone Void Filler Market

- In November 2024, the U.S. Food and Drug Administration (FDA) granted 510(k) marketing clearance to Acuitive Technologies Inc. for CITREPORE, a synthetic bioactive bone void filler incorporating the company’s patented CITREGEN biomaterial technology. Once placed in a bone void, CITREPORE undergoes a predictable resorption process, gradually being replaced by the patient's natural bone. In addition, it releases Citrate, which plays a key role in metabolically guiding the bone healing process

- In April 2023, ZimVie Inc. announced the launch of two new additions to its biomaterials portfolio: the RegenerOss CC Allograft Particulate, a natural blend of cortical and cancellous bone particles designed for filling bony voids in various dental applications, and the RegenerOss Bone Graft Plug, a user-friendly grafting solution for filling extraction sockets and periodontal defects. Both grafting solutions are now available across North America

- In April 2023, Abyrx, Inc. announced that it had received additional FDA clearances for its MONTAGE Settable, Resorbable Bone Putty, approved for use as both a bone void filler and cranial bone cement. MONTAGE is a hand-moldable, hardening putty designed for intraoperative use, achieving bone-like properties within minutes of mixing and application

- In July 2022, Bone Solutions Inc. announced that it had received FDA 510(k) clearance for expanded indications of its Mg OSTEOINJECT. As the first drillable, adhesive, and injectable bone void filler in the U.S. to incorporate magnesium, a vital element for bone health and development, the product's expanded indication allows its use as an adjunct to hardware fixation, providing support to bone fragments during surgical procedures

- In March 2022, Synergy Biomedical, LLC, a developer of advanced biomaterial products, announced the launch of BIOSPHERE FLEX SP EXTREMITIES, a synthetic bioactive bone graft. Leveraging Synergy’s proprietary BIOSPHERE Technology, this sheet putty consists of spherical bioactive glass granules integrated with a porous collagen/sodium hyaluronate carrier, offering enhanced bone regeneration properties

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.