Global Bone Wax Market

Market Size in USD Billion

CAGR :

%

USD

77.52 Billion

USD

94.82 Billion

2024

2032

USD

77.52 Billion

USD

94.82 Billion

2024

2032

| 2025 –2032 | |

| USD 77.52 Billion | |

| USD 94.82 Billion | |

|

|

|

|

Bone Wax Market Size

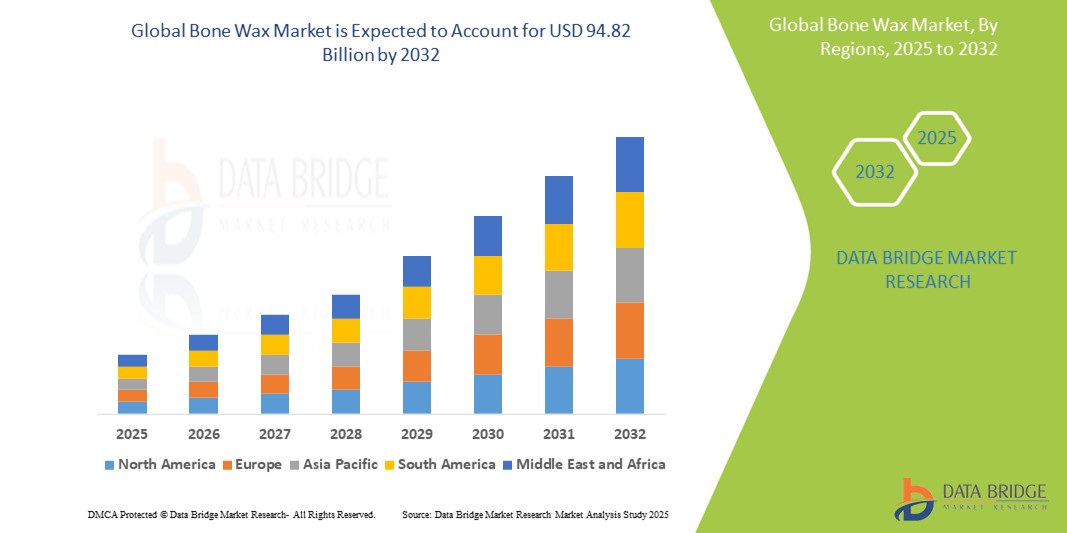

- The global bone wax market size was valued at USD 77.52 billion in 2024 and is expected to reach USD 94.82 billion by 2032, at a CAGR of 2.55% during the forecast period

- The market growth is largely fueled by the rising prevalence of surgical procedures, particularly orthopedic, neurosurgical, and cardiothoracic surgeries, where bone wax is commonly used to control bone bleeding. The increasing global burden of trauma injuries and elective surgeries is further driving demand for effective hemostatic agents such as bone wax

- Furthermore, technological advancements in Bone Wax formulations, including the development of absorbable and antibiotic-impregnated variants, are enhancing product safety and efficacy, thereby encouraging wider clinical adoption. These converging factors are accelerating the uptake of Bone Wax solutions, thereby significantly boosting the industry's growth

Bone Wax Market Analysis

- Bone wax, a sterile mixture used to control bleeding from bone surfaces during surgical procedures, remains a critical hemostatic agent in orthopedic, neurosurgery, and cardiothoracic applications due to its ease of use and immediate effectiveness

- The escalating demand for Bone Wax is primarily fueled by the rising number of surgical procedures globally, increasing incidence of trauma injuries, and growing preference for minimally invasive and complex surgical techniques requiring efficient hemostatic solutions

- North America dominated the bone wax market with the largest revenue share of 38.7% in 2024, driven by the high volume of orthopedic and neurosurgical procedures, advanced healthcare infrastructure, and the presence of leading market players offering both conventional and bioabsorbable bone wax products. The U.S. continues to lead the regional market due to high surgical rates and robust hospital procurement networks

- Asia-Pacific is expected to be the fastest growing region in the bone wax market, projected to expand at a CAGR of 6.9% during the forecast period, due to growing healthcare expenditure, increasing adoption of advanced surgical tools, and a surge in orthopedic cases in countries such as China, India, and Japan

- Non-absorbable bone wax segment dominated the bone wax market with a market share of 64.3% in 2024, attributed to its widespread use in traditional surgeries, low cost, and ease of availability, especially in developing and mid-income economies where conventional surgical products remain the standard

Report Scope and Bone Wax Market Segmentation

|

Attributes |

Bone Wax Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bone Wax Market Trends

“Advanced Formulations Driving User-Centric Innovations”

- A significant and accelerating trend in the global bone wax market is the growing development of advanced formulations designed to address clinical limitations associated with traditional bone wax products, such as poor biodegradability, inflammation, and delayed bone healing

- For instance, several manufacturers are introducing bioabsorbable bone wax alternatives that naturally dissolve in the body post-surgery, reducing the risk of foreign body reactions and improving patient outcomes. Companies such as Abyrx and Medtronic are leading innovations in this space with FDA-cleared products that go beyond hemostasis by supporting bone regeneration

- Furthermore, the emergence of antimicrobial-infused bone wax formulations is gaining traction, particularly in orthopaedic and neurosurgical procedures where post-operative infections are a concern. These variants help reduce microbial colonization and support faster recovery

- Enhanced material science and R&D investment have also enabled the creation of pliable, easy-to-mold bone wax that performs consistently across a range of surgical conditions, improving ease of use for surgeons and reducing intraoperative complications

- This evolution in formulation and functionality is reshaping surgeon expectations, with a clear demand shift toward bone wax solutions that are not only effective at bleeding control but also promote healing, minimize infection risk, and meet stringent regulatory standards

- The trend is particularly strong in high-volume surgical markets such as the U.S., Germany, and Japan, where hospitals increasingly prefer premium, evidence-backed materials that deliver both clinical and economic value

Bone Wax Market Dynamics

Driver

“Growing Need Due to Rising Surgical Volumes and Orthopedic Procedures”

- The global bone wax market is witnessing significant growth driven by the increasing number of surgical procedures, particularly in orthopedics, neurosurgery, and cardiothoracic surgeries, where effective hemostasis is critical

- For instance, with rising incidences of trauma, bone fractures, and age-related degenerative bone conditions, the need for reliable intraoperative bleeding control has surged, propelling the demand for bone wax products across hospitals and surgical centers

- Moreover, the growing aging population worldwide, especially in regions such as North America, Europe, and Japan, is contributing to an uptick in elective surgeries such as hip and knee replacements—further boosting the usage of bone wax as a standard adjunct in such procedures

- In addition, the ongoing expansion of healthcare infrastructure in emerging markets and the rise in medical tourism in countries such as India, Thailand, and Brazil have led to an increase in surgical volumes, thereby creating lucrative opportunities for bone wax manufacturers

- Favorable reimbursement frameworks, improved surgeon awareness, and the inclusion of advanced formulations with antimicrobial and bioabsorbable properties are accelerating product adoption in both public and private healthcare settings

Restraint/Challenge

“Adverse Tissue Reactions and Shift Toward Bioabsorbable Alternatives”

- Despite its clinical benefits, traditional bone wax formulations pose challenges such as poor resorption, foreign body reactions, and interference with bone healing, which can deter usage in some advanced surgical settings

- For instance, several studies have indicated that conventional non-absorbable bone wax may provoke inflammatory responses and granuloma formation, especially when used in high quantities or sensitive surgical sites, leading surgeons to seek safer alternatives

- This concern has spurred a gradual market shift toward bioabsorbable and biocompatible substitutes that offer effective hemostasis without compromising healing outcomes.

- Products from companies such as Abyrx and Medtronic that focus on next-generation, absorbable bone wax materials are gaining traction

- However, bioabsorbable bone wax is typically priced higher than traditional paraffin-based options, presenting a challenge for price-sensitive healthcare facilities, particularly in low-income regions

- Furthermore, lack of adequate clinical training and resistance to adopting newer materials among some surgeons in developing regions also hinder market penetration for innovative products

- Addressing these challenges through extensive clinical validation, competitive pricing strategies, and surgeon education will be vital for accelerating the transition toward safer and more effective bone wax alternatives, ensuring long-term market sustainability

Bone Wax Market Scope

The market is segmented on the basis of product, material, application and end user.

- By Product

On the basis of product, the bone wax market is segmented into absorbable bone wax and non-absorbable bone wax. The non-absorbable bone wax segment dominated the market with a revenue share of 64.3% in 2024, due to its extensive use in orthopedic and trauma surgeries and its cost-effectiveness.

Absorbable bone wax is projected to witness the fastest CAGR of 6.9% from 2025 to 2032, driven by its superior biocompatibility, lower post-operative complications, and increasing preference among surgeons for advanced hemostatic solutions.

- By Material

On the basis of material, the bone wax market is segmented into natural bone wax and synthetic bone wax. Natural bone wax accounted for the largest market share of 59.7% in 2024, supported by its traditional use, affordability, and accessibility in various healthcare settings.

Synthetic bone wax is expected to grow at the fastest CAGR of 7.2% during the forecast period, due to advantages such as resorbability, reduced infection risk, and improved surgical outcomes.

- By Application

On the basis of application, the bone wax market is segmented into neurosurgery, orthopedic surgery, thoracic surgery, dental/oral surgery, and others. Orthopedic surgery held the highest share at 48.5% in 2024, attributed to the large number of bone-related procedures, including fracture repairs and joint replacements.

Neurosurgery is anticipated to register the fastest CAGR of 7.5% from 2025 to 2032, due to increasing demand for precise bleeding control during complex cranial and spinal procedures.

- By End User

On the basis of end user, the bone wax market is segmented into hospitals, specialty clinics, ambulatory surgical centers (ASCS), and others. Hospitals dominated the segment with a market share of 61.8% in 2024, owing to their advanced infrastructure, higher surgical volumes, and greater access to specialized bone wax products.

Ambulatory surgical centers (ASCs) are expected to experience the fastest CAGR of 6.8% between 2025 and 2032, driven by cost-effective outpatient care models and the rise of minimally invasive surgeries requiring compact hemostatic tools such as bone wax.

Bone Wax Market Regional Analysis

- North America dominated the bone wax market with the largest revenue share of 38.7% in 2024, driven by a high volume of orthopedic and trauma surgeries and increasing adoption of surgical hemostatic agents across advanced healthcare systems

- The growing geriatric population, increasing prevalence of bone-related disorders, and widespread awareness of surgical bleeding management solutions are fueling market demand

- In addition, the strong presence of major market players, ongoing product innovations, and access to advanced healthcare infrastructure further support the dominance of this region

U.S. Bone Wax Market Insight

The U.S. bone wax market captured 70% of North America’s revenue share in 2024, propelled by high surgical volumes, increased orthopedic and neurosurgical procedures, and rapid uptake of next-generation absorbable bone wax products. Rising healthcare expenditures, favorable reimbursement structures, and strong clinical research infrastructure are accelerating the adoption of bone wax in hospitals and specialty clinics. Moreover, leading manufacturers such as Medtronic, Johnson & Johnson, and Baxter are investing in R&D and clinical trials to enhance product performance, which is contributing to market expansion.

Europe Bone Wax Market Insight

The Europe bone wax market is projected to expand at a substantial CAGR over the forecast period, driven by stringent surgical safety regulations, growing incidence of bone-related conditions, and technological advancements in surgical procedures. Increased orthopedic, thoracic, and dental surgeries across countries such as Germany, France, and the U.K. are contributing to product demand. Rising preference for absorbable bone waxes due to their improved biocompatibility and reduced infection risk is another significant factor propelling the regional market.

U.K. Bone Wax Market Insight

The U.K. bone wax market is expected to grow at a noteworthy CAGR during the forecast period, owing to the increasing number of elective orthopedic procedures and an expanding geriatric population. The National Health Service (NHS) initiatives to improve surgical outcomes and reduce post-operative complications are favoring the adoption of hemostatic agents such as bone wax. In addition, the growing preference for biodegradable and resorbable surgical products is fostering market growth.

Germany Bone Wax Market Insight

The Germany bone wax market is poised for steady growth from 2025 to 2032, supported by advanced healthcare infrastructure, strong orthopedic device manufacturing capabilities, and a high focus on patient safety. Surgeons and hospitals in Germany are increasingly adopting synthetic and absorbable bone waxes to minimize foreign body reactions and post-surgical complications. Government investments in hospital modernization and surgical innovation are expected to further boost market expansion.

Asia-Pacific Bone Wax Market Insight

The Asia-Pacific bone wax market is expected to register the fastest CAGR of 6.9% from 2025 to 2032, driven by increasing healthcare investments, rising surgical volumes, and a growing middle-class population in countries such as China, India, and Japan. The expansion of medical tourism and availability of cost-effective surgical solutions is also propelling the use of bone wax in the region. In addition, local manufacturers are entering the market with affordable products, increasing accessibility and adoption in emerging economies.

Japan Bone Wax Market Insight

The Japan bone wax market is experiencing growth due to the country’s advanced medical technologies, rising elderly population, and demand for minimally invasive surgeries. With one of the highest aging populations globally, Japan is witnessing a surge in orthopedic, neurosurgical, and dental procedures that require effective bleeding control tools such as bone wax. Hospitals are increasingly adopting absorbable waxes that reduce the risk of post-surgical complications and support faster recovery.

China Bone Wax Market Insight

The China bone wax market held the largest revenue share in Asia Pacific in 2024, driven by the expanding healthcare infrastructure, increasing number of trauma and orthopedic surgeries, and support from government healthcare reforms. Domestic manufacturers are producing competitively priced bone wax products, increasing affordability and local availability. Furthermore, China's focus on healthcare modernization and growing demand for high-quality surgical consumables are contributing significantly to the market’s rapid growth.

Bone Wax Market Share

The bone wax industry is primarily led by well-established companies, including:

- Aesculap, Inc. (U.S.)

- Bentley Healthcare Pvt. Ltd. (India)

- Baxter (U.S.)

- B. Braun SE (Germany)

- Johnson & Johnson Services, Inc. (U.S.)

- Medtronic (Ireland)

- ABYRX, Inc. (U.S.)

- GPC Medical (U.S.)

- Medline Industries, Inc. (U.S.)

- Futura Surgicare (India)

- Corza Medical (U.S.)

- Dolphin Sutures (India)

- AIP Medical SA (Belgium)

Latest Developments in Global Bone Wax Market

- In April 2024, B. Braun SE, a prominent German healthcare solutions provider, launched its next-generation absorbable bone wax product designed to reduce postoperative complications and improve hemostasis during orthopedic and neurosurgical procedures. This new formulation focuses on enhanced biocompatibility and ease of application, reinforcing the company’s commitment to surgical innovation and safety. The product launch positions B. Braun to strengthen its footprint in both developed and emerging markets

- In March 2024, Medtronic plc announced the expansion of its bone hemostatic product line with the introduction of a synthetic, fully bioresorbable bone wax, targeting trauma and spinal surgeries. This development aims to address the clinical demand for advanced materials that minimize infection risks and do not interfere with bone healing. The strategic move is part of Medtronic’s broader push toward developing next-gen surgical consumables in response to growing surgeon and patient preferences

- In February 2024, Johnson & Johnson Private Limited introduced its novel non-absorbable bone wax stick in select Asia-Pacific markets, emphasizing controlled application and long shelf-life. The launch was accompanied by clinical training initiatives across major hospitals in India and Southeast Asia. This step highlights the company’s strategy to expand its product accessibility and improve surgical outcomes in high-volume healthcare settings

- In January 2024, Bentley Healthcare Pvt. Ltd. (India) unveiled an economical bone wax solution tailored for emerging markets. The product, available in both natural and synthetic variants, was developed in response to increased demand for cost-effective surgical consumables in rural and semi-urban hospitals. Bentley’s initiative aligns with the government’s "Make in India" campaign and targets large-volume orthopedic and trauma centers

- In December 2023, WNDM Medical Inc. (U.S.) received FDA clearance for its biodegradable bone wax formulation, marking a milestone in sustainable surgical innovation. The new wax aims to offer superior hemostatic performance while eliminating the risk of long-term foreign body reactions. The company announced plans to roll out the product in U.S. hospitals and expand into EU markets by mid-2025

- In November 2023, Abyrx Inc. announced strategic collaborations with leading neurosurgical centers in the U.S. to conduct real-world evaluations of its next-gen absorbable bone hemostats. These studies focus on comparing efficacy, wound healing time, and surgeon preference. The initiative reflects Abyrx’s dedication to evidence-based product refinement and establishing clinical benchmarks in bone hemostasis

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.