Global Brominated Vegetable Oil Bvo Market

Market Size in USD Billion

CAGR :

%

USD

3.45 Billion

USD

5.54 Billion

2024

2032

USD

3.45 Billion

USD

5.54 Billion

2024

2032

| 2025 –2032 | |

| USD 3.45 Billion | |

| USD 5.54 Billion | |

|

|

|

|

Brominated Vegetable Oil (BVO) Market Size

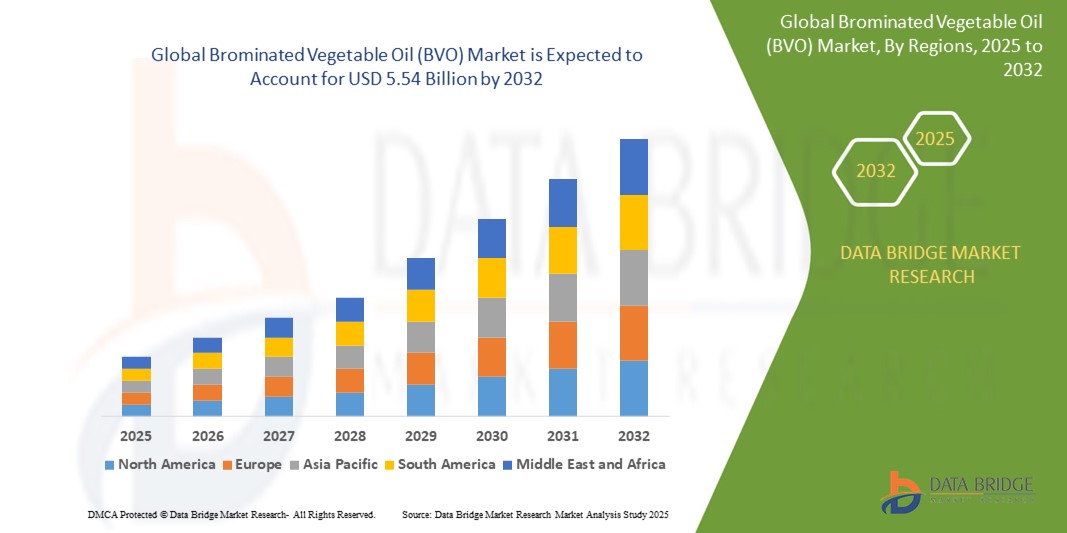

- The global brominated vegetable oil (BVO) market size was valued at USD 3.45 billion in 2024 and is expected to reach USD 5.54 billion by 2032, at a CAGR of 6.10% during the forecast period

- The market growth is primarily driven by the increasing demand for BVO in the beverage industry, particularly for stabilizing citrus-flavored soft drinks, coupled with its application in bakery products and other industrial uses such as flame retardants

- In addition, growing consumer preference for processed food and beverages, along with advancements in food stabilization technologies, is boosting the adoption of BVO, thereby significantly contributing to market expansion

Brominated Vegetable Oil (BVO) Market Analysis

- Brominated vegetable oil (BVO) is a food additive used primarily as an emulsifier and stabilizer in beverages, ensuring uniform dispersion of flavor oils in citrus-based drinks. Its applications also extend to bakery products, pesticides, and flame retardants, making it a versatile compound in various industries

- The rising demand for BVO is fueled by the growth of the global beverage industry, increasing consumption of processed foods, and the need for effective stabilization solutions in food and industrial applications

- North America dominated the BVO market with the largest revenue share of 42.3% in 2024, driven by a well-established beverage industry, high consumption of processed foods, and the presence of major market players

- Asia-Pacific is expected to be the fastest-growing region in the BVO market during the forecast period, propelled by rapid urbanization, rising disposable incomes, and increasing demand for packaged beverages and processed foods

- The soy segment dominated the largest market revenue share of 62.3% in 2024, driven by its widespread availability, cost-effectiveness, and suitability for bromination processes in food applications, particularly in beverages

Report Scope and Brominated Vegetable Oil (BVO) Market Segmentation

|

Attributes |

Brominated Vegetable Oil (BVO) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Brominated Vegetable Oil (BVO) Market Trends

“Increasing Adoption of Alternative Emulsifiers and Stabilizers”

- The global Brominated Vegetable Oil (BVO) market is experiencing a notable shift toward the exploration and adoption of alternative emulsifiers and stabilizers, driven by health and regulatory concerns

- Advances in food technology are enabling the development of natural and synthetic substitutes, such as sucrose esters, polysorbates, ester gum, and guar gum, which offer similar functionalities to BVO without associated health risks

- These alternatives are being integrated into beverage formulations to maintain stability and prevent flavor separation, particularly in citrus-flavored soft drinks and sports beverages

- For instance, several beverage manufacturers are reformulating products to replace BVO with safer options, aligning with consumer preferences for cleaner labels and natural ingredients

- This trend is enhancing the appeal of BVO alternatives, making them more attractive to health-conscious consumers and manufacturers navigating stringent regulatory environments

- Research and development efforts are focused on improving the efficacy and cost-effectiveness of these alternatives, further driving their adoption across the food and beverage industry

Brominated Vegetable Oil (BVO) Market Dynamics

Driver

“Rising Demand for Processed Foods and Beverages”

- The growing consumer preference for processed and packaged foods, particularly citrus-flavored beverages, is a key driver for the global Brominated Vegetable Oil (BVO) market

- BVO is widely used as an emulsifier and stabilizer in beverages such as sodas and sports drinks, ensuring uniform dispersion of citrus oils and enhancing product consistency

- Increasing urbanization, rising disposable incomes, and changing dietary habits, especially in emerging markets, are boosting the demand for convenient food and beverage products

- The expansion of the global food and beverage industry, coupled with innovations in flavor profiles, is further fueling the use of BVO in specific applications

- North America dominates the market due to high consumption of packaged food and beverages, supported by higher purchasing power and consumer health awareness

- The Asia-Pacific region is the fastest-growing market, driven by population growth, increasing production of bakery products, and rising demand for processed foods

Restraint/Challenge

“Regulatory Restrictions and Health Concerns”

- The global Brominated Vegetable Oil (BVO) market faces significant challenges due to stringent regulatory restrictions and health concerns associated with bromine exposure

- Several countries, including those in Europe, India, Japan, and others, have banned or heavily restricted BVO use in food and beverages due to potential health risks, such as neurological issues, memory loss, and thyroid complications from long-term exposure

- The U.S. Food and Drug Administration (FDA) revoked its authorization for BVO use in food in July 2024, citing safety concerns based on studies showing adverse health effects in humans

- The high cost of compliance with varying international regulations and the need for reformulation to meet safety standards pose barriers for manufacturers

- Consumer awareness of health risks and demand for natural, organic ingredients are pushing companies to seek safer alternatives, limiting BVO market growth in regions with strict regulations or high health consciousness

- The fragmented regulatory landscape across countries complicates global operations for manufacturers, further hindering market expansion in sensitive markets

Brominated Vegetable Oil (BVO) market Scope

The market is segmented on the basis of source and application.

- By Source

On the basis of source, the global brominated vegetable oil (BVO) market is segmented into soy and corn. The soy segment dominated the largest market revenue share of 62.3% in 2024, driven by its widespread availability, cost-effectiveness, and suitability for bromination processes in food applications, particularly in beverages. Soy-based BVO is preferred due to its compatibility with emulsification requirements in citrus-flavored soft drinks.

The corn segment is expected to witness the fastest growth rate of 6.8% from 2025 to 2032, driven by increasing demand for alternative vegetable oil sources and advancements in processing technologies. Corn-based BVO is gaining traction in regions with strong corn production, such as North America, due to its scalability and potential for improved safety profiles through innovative formulations.

- y Application

On the basis of application, the global brominated vegetable oil (BVO) market is segmented into beverages, bakery products, pesticides, and flame retardants. The beverages segment dominated the market with a revenue share of 68.7% in 2024, primarily due to BVO’s role as an emulsifier in citrus-flavored soft drinks and sports drinks, ensuring uniform flavor dispersion and product stability. The high consumption of flavored beverages, particularly in North America, supports this segment’s dominance.

The bakery products segment is anticipated to experience the fastest growth rate of 7.2% from 2025 to 2032. Increasing demand for processed and packaged baked goods, coupled with BVO’s ability to enhance texture and shelf-life, drives adoption in this segment. Innovations in safer BVO formulations and growing consumer preference for convenience foods in emerging markets, particularly in Asia-Pacific, further accelerate this growth.

Brominated Vegetable Oil (BVO) Market Regional Analysis

- North America dominated the BVO market with the largest revenue share of 42.3% in 2024, driven by a well-established beverage industry, high consumption of processed foods, and the presence of major market players

- Consumers prioritize BVO for its ability to stabilize flavors and enhance beverage consistency, particularly in regions with robust food and beverage industries

- Growth is supported by advancements in BVO formulations and its diverse applications, despite regulatory challenges in some regions

U.S. Brominated Vegetable Oil (BVO) Market Insight

The U.S. brominated vegetable oil (BVO) market captured the largest revenue share of 84.8% in 2024 within North America, fueled by strong demand for BVO as an emulsifier in citrus-flavored beverages and sports drinks. Consumer awareness of BVO’s role in maintaining flavor stability and preventing ingredient separation drives market growth. The trend towards processed food consumption and innovations in beverage formulations further boosts adoption. However, evolving regulations, including the FDA’s decision to revoke BVO’s food additive status due to health concerns, are prompting manufacturers to explore alternatives, influencing future market trends.

Europe Brominated Vegetable Oil (BVO) Market Insight

The U.K. Brominated Vegetable Oil (BVO) market is highly restricted due to bans on BVO in food and beverage applications, driven by health and safety regulations. Limited demand exists in non-food applications, such as flame retardants, where BVO’s fire-resistant properties are valued. Consumer awareness of health risks and a strong preference for natural emulsifiers hinder market expansion. Regulatory compliance and the shift towards safer alternatives continue to shape the market, with minimal growth expected.

Germany Brominated Vegetable Oil (BVO) Market Insight

Germany’s Brominated Vegetable Oil (BVO) market is constrained by strict regulatory frameworks banning BVO in food and beverages due to potential health risks. The country’s advanced manufacturing sector utilizes BVO in limited non-food applications, such as flame retardants and pesticides, where its functional properties are valued. German consumers’ focus on health-conscious and sustainable products drives demand for natural alternatives, limiting BVO’s market penetration. Innovations in safer emulsifiers and regulatory pressures further restrict growth.

Asia-Pacific Brominated Vegetable Oil (BVO) Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate in the global Brominated Vegetable Oil (BVO) market, driven by expanding food and beverage production and rising disposable incomes in countries such as China, India, and Japan. Increasing consumer awareness of BVO’s role in enhancing beverage consistency and its applications in bakery products and pesticides fuels demand. Despite bans in some countries such as India and Japan, less stringent regulations in other markets and growing industrialization support market expansion.

Japan Brominated Vegetable Oil (BVO) Market Insight

Japan’s Brominated Vegetable Oil (BVO) market faces significant restrictions due to a ban on BVO in food and beverage applications, driven by health concerns. Limited growth is observed in non-food sectors, such as flame retardants and pesticides, where BVO’s functional properties are utilized. The presence of major manufacturers and a focus on technological advancements encourage exploration of safer alternatives. Consumer preference for high-quality, natural ingredients and strict regulatory standards limit BVO’s market penetration.

China Brominated Vegetable Oil (BVO) Market Insight

China holds the largest share of the Asia-Pacific Brominated Vegetable Oil (BVO) market, driven by rapid urbanization, rising beverage consumption, and increasing demand for emulsifiers in citrus-flavored drinks. The country’s growing middle class and focus on cost-effective food additives support BVO adoption in beverages and bakery products. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility. However, increasing consumer awareness of health risks and regulatory shifts towards natural alternatives may influence future growth.

Brominated Vegetable Oil (BVO) Market Share

The brominated vegetable oil (BVO) industry is primarily led by well-established companies, including:

- Synutra International (China)

- Kraft Foods Group, Inc. (U.S.)

- Kerry Ingredients & Flavours (Ireland)

- Abitec Corporation (U.S.)

- Watson Inc. (U.S.)

- Advanced Food Systems Inc. (U.S.)

- Aarhuskarlshamn AB (Sweden)

- Firmenich SA (Switzerland)

- BASF Company (Germany)

- Eurobio Lab (France)

- The Good Scents Company (U.S.)

- DeWolf Chemical (U.S.)

- COSME ITALY (Italy)

- Penta Manufacturing Company (U.S.)

- Parchem Fine & Specialty Chemicals (U.S.)

- Spectrum (U.S.)

What are the Recent Developments in Global Brominated Vegetable Oil (BVO) Market?

- In August 2024, the U.S. Food and Drug Administration (FDA) officially revoked the regulation permitting the use of Brominated Vegetable Oil (BVO) in food products. This action followed recent studies conducted in collaboration with the National Institutes of Health (NIH), which revealed that BVO may pose adverse health risks, including potential effects on the thyroid and other organs. The FDA concluded that BVO is no longer considered safe for consumption, prompting a one-year compliance period for manufacturers to reformulate and relabel affected products

- In July 2024, the U.S. Food and Drug Administration (FDA) issued its final rule revoking the authorization for Brominated Vegetable Oil (BVO) as a food additive. This decision followed collaborative studies with the National Institutes of Health (NIH) that identified potential health risks, including thyroid toxicity and bioaccumulation of brominated compounds. The rule officially takes effect on August 2, 2024, and companies have until August 2, 2025 to reformulate, relabel, and phase out BVO-containing products from the market

- In September 2024, Health Canada officially removed Brominated Vegetable Oil (BVO) from its list of permitted food additives, citing concerns from a recent safety assessment. Although no immediate health risks were identified, the findings did not support continued use of BVO in food products. The ban aligns with similar actions taken by the U.S. FDA and other global regulators. To ease the transition, Health Canada granted a one-year compliance period, ending August 30, 2025, allowing manufacturers time to reformulate and relabel affected products

- In May 2024, Health Canada issued a formal proposal to eliminate Brominated Vegetable Oil (BVO) from its list of permitted food additives. This decision followed an updated safety assessment, which reviewed new toxicological data and concluded that BVO’s continued use could not be supported. Although no immediate health risks were identified, the agency could not establish an acceptable daily intake due to observed adverse effects at lower doses. To facilitate industry compliance, Health Canada proposed a one-year transition period, allowing manufacturers time to reformulate and relabel affected products

- In October 2023, California became the first U.S. state to ban Brominated Vegetable Oil (BVO) along with potassium bromate, propylparaben, and red dye No. 3, under the California Food Safety Act (AB 418). Signed into law by Governor Gavin Newsom, the regulation prohibits the manufacture, sale, and distribution of food products containing these additives starting January. The move reflects growing concerns over the safety of certain food chemicals and aligns California with international standards, as these substances are already banned in the European Union and other countries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Brominated Vegetable Oil Bvo Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Brominated Vegetable Oil Bvo Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Brominated Vegetable Oil Bvo Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.