Global Bromine Market

Market Size in USD Billion

CAGR :

%

USD

3.10 Billion

USD

4.60 Billion

2024

2032

USD

3.10 Billion

USD

4.60 Billion

2024

2032

| 2025 –2032 | |

| USD 3.10 Billion | |

| USD 4.60 Billion | |

|

|

|

|

Global Bromine Market Size

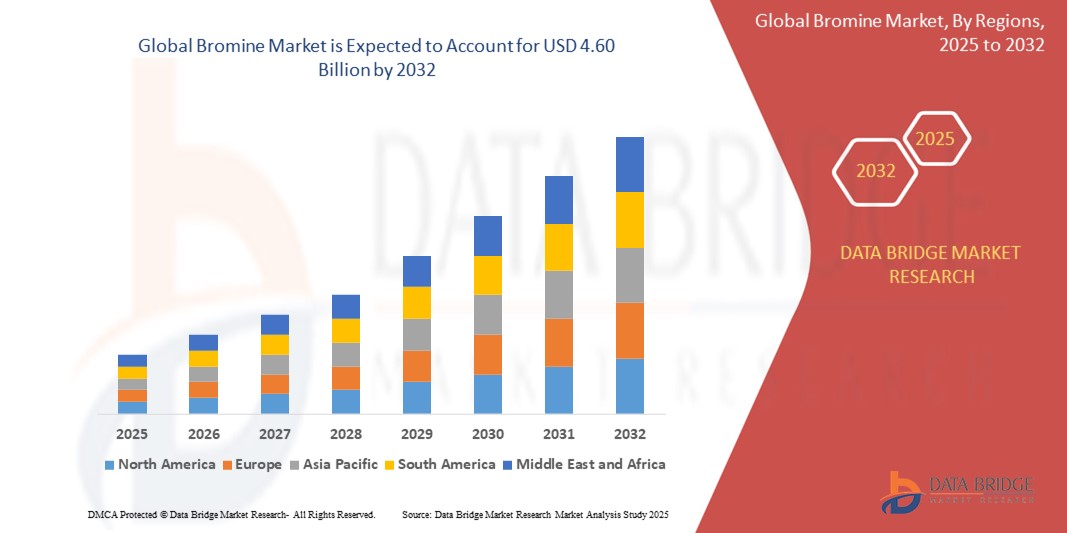

- The global bromine market was valued at USD 3.10 billion in 2024 and is expected to reach USD 4.60 billion by 2032

- During the forecast period of 2025 to 2032 the market is such as to grow at a CAGR of 5.05%, primarily driven by the surge in oil & gas application

- This growth is driven by factors such as increased demands of flame retardants, growth in agriculture, and environment regulation and substitution

Global Bromine Market Analysis

- The global bromine market is a crucial sector within the chemicals industry, primarily used in applications such as flame retardants, oil and gas production, water treatment, and agriculture

- The demand for bromine is significantly driven by its use in flame retardants, which are increasingly used in various industries, such as electronics, textiles, automotive, and construction, to improve fire safety. In addition, the growing need for oilfield applications and agriculture-related chemicals contributes to the market's expansion

- Emerging economies in regions such as Asia-Pacific and Latin America are major growth drivers, as industrialization and urbanization increase demand for bromine-based products in various sectors

- For instance, the Asia-Pacific region holds a significant market share due to the growing automotive, electronics, and construction sectors in countries such as China and India. These regions are seeing rapid industrial development, fueling the need for flame retardants and other bromine-based products

- North America is the dominant region, primarily due to its advanced technological infrastructure and established oil and gas industry, where bromine is used in drilling fluids and other operations. The market in North America is expected to remain strong, with steady growth driven by innovations in bromine applications and an increasing demand from various industrial sectors

- Globally, bromine ranks among the key raw materials in several industries, including electronics and agriculture, making it indispensable for maintaining safety standards, advancing technological applications, and ensuring agricultural productivity. It is expected to continue playing a pivotal role in meeting global industrial needs

Report Scope and Global Bromine Market Segmentation

|

Attributes |

Global Bromine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Bromine Market Trends

“Rising Demand for Flame Retardants and Environmental Regulations”

- One prominent trend in the global bromine market is the increasing demand for flame retardants and the growing influence of environmental regulations

- Bromine-based flame retardants are widely used in various industries, such as electronics, automotive, and construction, to enhance fire safety and meet regulatory standards

- For instance, bromine compounds are incorporated into materials such as textiles, plastics, and insulation to prevent or slow the spread of fire, especially in high-risk sectors such as electronics and automotive

- Environmental regulations are encouraging the development of safer and more sustainable bromine-based products. This is leading to innovations in the production of flame retardants that are both effective and environmentally friendly

- This trend is driving the demand for advanced bromine compounds and contributing to the growth of the bromine market globally, especially in regions with stringent safety and environmental standards

Global Bromine Market Dynamics

Driver

“Rising Demand for Bromine in Flame Retardants and Industrial Applications”

- The growing demand for flame retardants is one of the primary drivers in the global bromine market. Bromine compounds, particularly brominated flame retardants, are widely used in industries such as electronics, automotive, construction, and textiles to enhance fire safety

- As global safety standards become more stringent, the use of bromine-based flame retardants is increasing to meet these regulations. The demand for these chemicals is particularly strong in regions with high industrial activity and increasing awareness of fire safety

- The construction industry, driven by urbanization and infrastructure development, is one of the largest consumers of flame retardants, further increasing the demand for bromine. In addition, the electronics industry relies heavily on bromine-based compounds to ensure fire safety in consumer electronics, electric vehicles, and industrial machinery

- With the rise in global industrial activities and safety regulations focusing on fire prevention, the demand for bromine in flame retardants and other industrial applications is expected to grow significantly

- Furthermore, the oil and gas industry also contribute to bromine demand, as it is used in drilling fluids and well stimulation processes, playing a crucial role in the extraction of fossil fuels

For instance,

- The use of bromine in oilfield applications is expected to continue growing as the oil extraction industry expands in developing regions

Opportunity

“Rising Demand for Sustainable and Eco-Friendly Bromine Solutions”

- The increasing focus on environmental sustainability presents a significant opportunity for the global bromine market. With growing concerns over the environmental impact of traditional bromine-based products, there is a rising demand for more eco-friendly alternatives and sustainable production practices

- Bromine-based flame retardants, while crucial for safety in industries such as electronics and construction, face pressure due to environmental regulations and the push for greener alternatives. This has led to significant investments in developing sustainable bromine products that are both effective and environmentally friendly

- The shift towards biodegradable and non-toxic flame retardants opens up new market opportunities, as manufacturers strive to meet increasing regulatory demands and consumer preferences for safer, greener materials

- In addition, bromine recycling and the development of circular economy practices present another opportunity. Companies that can develop efficient recycling methods for bromine and its compounds may benefit from growing demand in markets where sustainability is prioritized

- The oil and gas sector also provides opportunities for bromine, especially in oilfield applications, as innovations in well-stimulation techniques are driving the need for more efficient and environmentally conscious solutions

For instance

- In June 2024, a study published by the International Journal of Green Chemistry highlighted the potential for developing sustainable bromine-based compounds to replace traditional flame retardants, improving environmental impact and safety without compromising effectiveness

- A report by the Global Bromine Industry Group (2023) also emphasized the importance of bromine recycling for reducing the environmental footprint, especially in industries such as electronics and automotive, where bromine is used extensively in flame-retardant materials

Restraint/Challenge

“Environmental and Health Concerns Related to Bromine Products”

- The environmental and health concerns surrounding bromine products pose a significant challenge for the global bromine market, particularly as regulations around hazardous chemicals become stricter

- Bromine-based flame retardants, although widely used in various industries, have come under scrutiny due to their potential harmful effects on human health and the environment, such as toxicity and persistence in ecosystems

- These concerns have led to increasing regulatory pressures, with governments in several regions, particularly in Europe and North America, implementing bans or restrictions on certain brominated compounds

- This regulatory environment can result in higher costs for manufacturers to comply with standards, as well as limit the range of bromine products available in the market

- As a result, companies in the bromine industry face the challenge of developing safer alternatives that meet both regulatory requirements and market demand without compromising on performance

- In addition, the need for increased sustainability practices and environmentally friendly solutions has become a key focus, requiring significant investment in research and development to reduce the environmental footprint of bromine-based products

For instance:

- In August 2023, according to a report by the European Chemical Agency, concerns over the environmental persistence of certain bromine-based flame retardants have led to stricter chemical regulations, requiring companies to invest in safer alternatives

- In September 2022, a report from the U.S. Environmental Protection Agency (EPA) highlighted the potential risks associated with the widespread use of bromine-based chemicals in consumer goods, resulting in a shift towards more sustainable bromine production practices

Global Bromine Market Scope

The market is segmented on the basis of derivative, application, and end user

|

Segmentation |

Sub-Segmentation |

|

By Derivative |

|

|

By Application |

|

|

By End User |

|

Global Bromine Market Regional Analysis

“North America is the Dominant Region in the Bromine Market”

- North America dominates the global bromine market, driven by the strong presence of key players, advanced industrial applications, and a well-established regulatory framework

- The U.S. holds a significant share due to the high demand for bromine in industries such as oil & gas, flame retardants, and water treatment

- The growing need for clear brine fluids in oil exploration, the adoption of advanced flame retardant technologies, and increasing demand for sustainable bromine solutions are key factors fueling growth in the region

- The well-established infrastructure, technological advancements, and high level of R&D investments in bromine-based solutions further contribute to the market's dominance

- In addition, North America benefits from strong regulatory support, enabling the development and adoption of safer, more efficient bromine products

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the bromine market, driven by rapid industrialization, expanding oil and gas operations, and increasing demand for bromine-based flame retardants

- Countries such as China and India are key players in the bromine market due to their large manufacturing bases, growing automotive industries, and rising adoption of bromine compounds in flame-retardant applications

- China, with its robust chemical industry and rapidly developing oil and gas sector, continues to be a major consumer of bromine for oilfield applications and flame retardant production

- India is seeing a rise in industrial activities, including the demand for bromine-based biocides, flame retardants, and clear brine fluids, driven by expanding infrastructure and industrial sectors

- Furthermore, countries in Southeast Asia are witnessing a surge in demand for bromine products in diverse applications such as water treatment, electronics, and automotive sectors

Global Bromine Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- ICL Group Ltd. (Israel)

- Albemarle Corporation (U.S.)

- LANXESS AG (Germany)

- Tosoh Corporation (Japan)

- TETRA Technologies Inc. (U.S.)

- TATA Chemicals Ltd. (India)

- Hindustan Salts Ltd. (India)

- Honeywell International Inc. (U.S.)

- Gulf Resources Inc. (China)

- Jordan Bromine Company (Jordan)

- Agrocel Industries Pvt Ltd. (India)

- Satyesh Brinechem Pvt. Ltd. (India)

- Chemtura Corporation (U.S.)

- BRB Chemicals (Netherlands)

- Dhruv Chem Industries (India)

- Krishna Solvachem Ltd (India)

- Pacific Organics Pvt. Ltd. (India)

Latest Developments in Global Bromine Market

- In January 2025, Albemarle Corporation, a leading global bromine producer, announced a significant expansion of its bromine production capabilities in the Middle East. The new plant is expected to increase the supply of high-quality bromine compounds for industries such as flame retardants, water treatment, and oil & gas applications

- In December 2024, Lanxess AG, a major player in the bromine industry, unveiled its new line of eco-friendly flame retardants. These new products, based on bromine compounds, are designed to meet stringent environmental regulations while maintaining high performance in automotive and construction materials

- In November 2024, ICL Group launched a groundbreaking bromine-based solution for water treatment. The new product, designed for industrial and municipal applications, provides enhanced efficiency and sustainability, with a lower environmental impact compared to traditional alternatives

- In October 2024, ChemChina’s Adama Agricultural Solutions introduced a new bromine-based biocide for agricultural use. This biocide is effective in controlling a wide range of pests while being safer for the environment and non-target species, responding to the increasing demand for sustainable agricultural practices

- In September 2024, the global bromine market saw increased investments in bromine recycling technologies. Companies such as Gulf Resources and Tetra Technologies have announced partnerships to develop and commercialize bromine recycling solutions, aimed at reducing the environmental footprint of bromine production and addressing the growing demand for sustainable bromine products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Bromine Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Bromine Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Bromine Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.