Global Calcitonin Gene Related Peptide Receptor Antagonist Market

Market Size in USD Billion

CAGR :

%

USD

3.38 Billion

USD

7.65 Billion

2024

2032

USD

3.38 Billion

USD

7.65 Billion

2024

2032

| 2025 –2032 | |

| USD 3.38 Billion | |

| USD 7.65 Billion | |

|

|

|

|

Calcitonin Gene-Related Peptide Receptor Antagonist Market Size

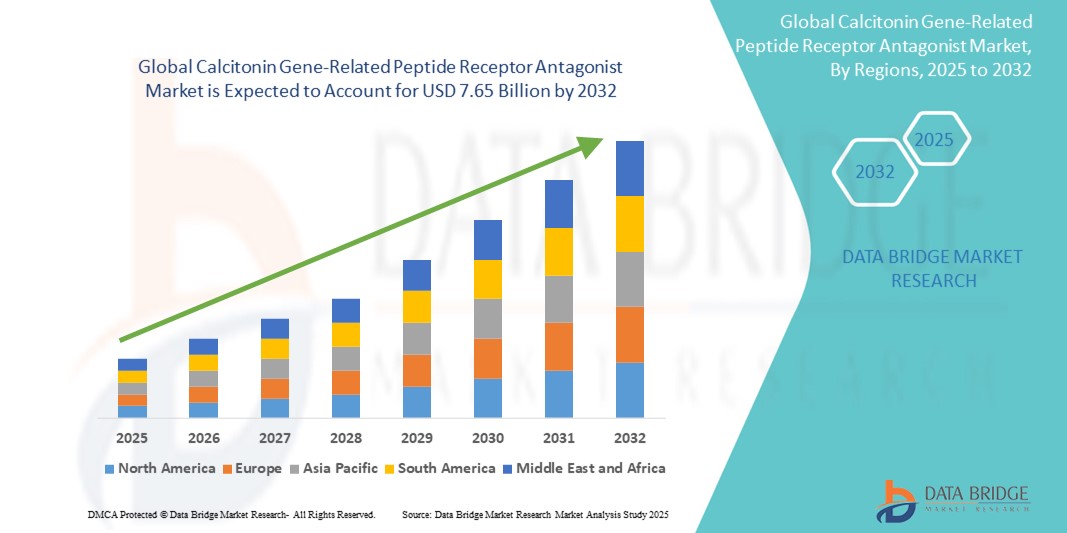

- The global calcitonin gene-related peptide receptor antagonist market size was valued at USD 3.38 billion in 2024 and is expected to reach USD 7.65 billion by 2032, at a CAGR of 10.73% during the forecast period

- The market growth is largely fueled by the increasing prevalence of migraine and other neurological disorders, along with the rising awareness and diagnosis rates, contributing to a higher demand for targeted migraine therapies such as CGRP receptor antagonists

- Furthermore, growing R&D investments, expanding regulatory approvals, and patient preference for oral, well-tolerated, and preventive treatment options are positioning CGRP receptor antagonists as a transformative solution in headache management. These converging factors are accelerating product adoption, thereby significantly boosting the industry's growth

Calcitonin Gene-Related Peptide Receptor Antagonist Market Analysis

- CGRP receptor antagonists, offering targeted therapeutic relief for migraine by blocking the activity of calcitonin gene-related peptide, are becoming essential in modern neurology due to their efficacy, favorable safety profiles, and suitability for both acute and preventive treatment strategies

- The escalating demand for CGRP receptor antagonists is primarily fueled by the global rise in migraine prevalence, increasing patient awareness, and the limitations of traditional therapies that often lead to poor compliance or adverse effects

- North America dominated the calcitonin gene-related peptide receptor antagonist market with the largest revenue share of 42.2% in 2024, supported by robust healthcare infrastructure, high diagnosis and treatment rates, and early adoption of novel therapeutics, particularly in the U.S. where major pharmaceutical players continue to innovate and expand CGRP-based treatment offerings

- Asia-Pacific is expected to be the fastest growing region in the calcitonin gene-related peptide receptor antagonist market during the forecast period due to improving healthcare access, growing public health awareness, and rising investments in neurology-focused research and clinical trials

- The oral segment dominated the calcitonin gene-related peptide receptor antagonist market with a market share of 45.8% in 2024, driven by patient preference for ease of administration and the availability of multiple FDA-approved oral CGRP treatments for acute migraine therapy

Report Scope and Calcitonin Gene-Related Peptide Receptor Antagonist Market Segmentation

|

Attributes |

Calcitonin Gene-Related Peptide Receptor Antagonist Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Calcitonin Gene-Related Peptide Receptor Antagonist Market Trends

“Targeted Migraine Relief Through Next-Gen Therapeutics”

- A significant and accelerating trend in the global calcitonin gene-related peptide receptor antagonist market is the evolution of highly targeted, patient-friendly therapies that address both acute and preventive treatment needs for migraine sufferers. This therapeutic advancement is significantly improving patient outcomes and adherence

- For instance, products such as Ubrelvy (Allergan, an AbbVie company) and Nurtec ODT (Biohaven/Royalty Pharma) offer oral formulations that provide effective acute migraine relief with minimal side effects. Similarly, Emgality and Ajovy deliver sustained preventive benefits via monthly injections, offering diverse treatment modalities tailored to patient preferences

- These novel drugs are engineered to block the CGRP pathway central to migraine pathophysiology without causing vasoconstriction, making them suitable for a broader patient population, including those with cardiovascular risks. This represents a key shift from older treatment options such as triptans, which are often contraindicated in such cases

- The emergence of once-monthly injectables and orally disintegrating tablets (ODTs) underscores the market trend toward convenience, rapid onset of action, and long-term efficacy. Patient-centric formulations also enhance adherence and reduce migraine frequency and severity

- Pharmaceutical innovators are increasingly investing in real-world evidence (RWE) and patient-reported outcomes (PROs) to further validate these therapies, while expanding into adjacent indications such as cluster headaches. Companies such as Pfizer and Amgen are exploring lifecycle strategies, including combination therapies and expanded labeling

- The rising awareness about migraine as a neurological disorder and the availability of CGRP blockers as first-line therapy in several markets are accelerating global demand for these treatments across both developed and emerging economies

Calcitonin Gene-Related Peptide Receptor Antagonist Market Dynamics

Driver

“Rising Migraine Burden and Shift Toward Precision Medicine”

- The increasing global prevalence of migraines, affecting over 1 billion individuals worldwide, is a major driver of demand for targeted CGRP receptor antagonists. Migraine ranks among the top causes of disability, particularly in women under 50, making effective treatment a pressing healthcare need

- For instance, in February 2024, Pfizer expanded access to Zavegepant (intranasal CGRP antagonist) across new global markets, aiming to reach underserved patient populations. Such strategic launches are driving momentum in CGRP therapy adoption

- Growing recognition of the limitations of existing migraine therapies such as triptans and NSAIDs has led to a shift toward precision medicine, where CGRP blockers offer both acute relief and preventive care without the cardiovascular risks associated with older drugs

- Patients and healthcare providers as such as are prioritizing therapies with strong efficacy, reduced side effects, and ease of use. Oral formulations and self-administered injectables align with this need, boosting patient satisfaction and long-term adherence

- The rising prevalence of migraine-related disability, along with employer-driven demand for improved worker productivity and reduced healthcare costs, is reinforcing payer support and favorable reimbursement structures in several regions

Restraint/Challenge

“High Cost of Therapy and Access Barriers in Low-Income Regions”

- The relatively high cost of CGRP receptor antagonists especially branded injectable therapies presents a major challenge to widespread market adoption, particularly in low- and middle-income countries where reimbursement frameworks are limited or absent

- For instance, treatments such as Aimovig and Vyepti can cost several thousand dollars annually per patient, making them inaccessible to large patient populations without strong insurance coverage

- Limited availability of headache specialists, lack of widespread diagnostic tools, and low awareness about CGRP-targeted treatments further constrain adoption in emerging markets

- While major players are working to expand global access and educate both patients and clinicians, logistical hurdles such as cold-chain requirements for injectable products and regulatory delays can impede timely market entry

- Overcoming these challenges through the development of cost-effective generics or biosimilars, enhanced insurance coverage, patient support programs, and greater healthcare professional training will be critical for achieving equitable access and sustaining long-term growth in the CGRP receptor antagonist market

Calcitonin Gene-Related Peptide Receptor Antagonist Market Scope

The market is segmented on the basis of drug type, application, dosage, route of administration, end-user, and distribution channel.

- By Drug Type

On the basis of drug type, the calcitonin gene-related peptide receptor antagonist market is segmented into zavegepant, ubrogepant, olcegepant, telcegepant, rimegepant, and others. The rimegepant segment dominated the market with the largest market revenue share in 2024, owing to its dual-approval for both acute and preventive migraine treatment and convenient oral disintegrating tablet (ODT) formulation. The broad usage and strong clinical efficacy of Rimegepant contribute to its widespread acceptance among both healthcare professionals and patients.

The Zavegepant segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by its novel intranasal formulation that offers rapid onset of action, appealing to patients requiring fast-acting relief during acute migraine episodes. Its non-oral route makes it suitable for patients experiencing nausea or vomiting, common during severe migraines.

- By Application

On the basis of application, the calcitonin gene-related peptide receptor antagonist market is segmented into migraine, osteoarthritis, and others. The Migraine segment held the largest share in 2024, fueled by the high global prevalence of migraine and increasing awareness of CGRP's role in migraine pathophysiology. The strong pipeline of CGRP-based therapies and widespread clinical endorsement for both preventive and acute migraine care further drive this segment’s dominance.

The osteoarthritis segment is expected to expand at the fastest CAGR during the forecast period, driven by emerging research into CGRP’s involvement in pain signaling and inflammation beyond migraine, especially in joint-related conditions. However, this application remains in the exploratory stage and is dependent on further clinical validation.

- By Dosage

On the basis of dosage, the calcitonin gene-related peptide receptor antagonist market is segmented into tablet and others. The Tablet segment dominated the market in 2024 due to patient preference for oral formulations and the availability of leading CGRP antagonists such as Ubrogepant and Rimegepant in tablet or ODT forms. Tablets are easy to administer, non-invasive, and widely accepted across all patient demographics.

The others segment—which includes intranasal sprays and injectable formulations— is expected to expand at the fastest CAGR during the forecast period, as newer non-oral delivery formats, such as Zavegepant, gain market traction for rapid relief needs.

- By Route of Administration

On the basis of route of administration, the calcitonin gene-related peptide receptor antagonist market is segmented into oral, sublingual, and other. The oral segment held the largest revenue share of 45.8% in 2024, owing to high patient compliance, ease of distribution, and the approval of multiple oral CGRP antagonists. Oral routes also enable self-administration and are well-suited for both acute and preventive treatment models.

The sublingual is expected to expand at the fastest CAGR during the forecast period, due to its faster onset of action and usability in cases where oral intake is compromised.

- By End-User

On the basis of end-user, the calcitonin gene-related peptide receptor antagonist market is segmented into clinic, hospital, and others. The Hospital segment dominated the market in 2024 due to higher diagnosis rates, access to advanced migraine therapies, and growing use of CGRP antagonists in emergency or outpatient neurology settings. Hospitals are often the first point of care for severe migraines requiring prescription therapy initiation.

The clinic segment is projected to grow at the fastest CAGR from 2025 to 2032, supported by the decentralization of care and increased prescribing of CGRP antagonists in primary care and specialized neurology clinics for long-term migraine management.

- By Distribution Channel

On the basis of distribution channel, the calcitonin gene-related peptide receptor antagonist market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. The retail pharmacy segment held the largest revenue share in 2024, driven by widespread accessibility, convenience, and growing insurance coverage of CGRP-based drugs. Retail channels also benefit from physician referrals and repeat prescriptions for chronic patients.

The online pharmacy segment is expected to witness the fastest growth during the forecast period, supported by the rising adoption of telemedicine, digital prescriptions, and home delivery services. Increased consumer preference for discreet, time-saving purchase methods further supports this trend, especially in urban settings.

Calcitonin Gene-Related Peptide Receptor Antagonist Market Regional Analysis

- North America dominated the calcitonin gene-related peptide receptor antagonist market with the largest revenue share of 42.2% in 2024, supported by robust healthcare infrastructure, high diagnosis and treatment rates, and early adoption of novel therapeutics, particularly in the U.S. where major pharmaceutical players continue to innovate and expand CGRP-based treatment offerings

- Consumers in the region place high value on targeted therapies that offer fast relief with minimal side effects, and CGRP antagonists have emerged as a preferred solution due to their clinical efficacy and convenience of use in both acute and preventive treatment

- This widespread adoption is further supported by high levels of diagnosis, favorable reimbursement policies, strong presence of leading pharmaceutical companies, and increasing awareness about migraine as a neurological disorder, firmly establishing CGRP receptor antagonists as a key therapeutic advancement in North American healthcare systems

U.S. Calcitonin Gene-Related Peptide Receptor Antagonist Market Insight

The U.S. calcitonin gene-related peptide receptor antagonist market captured the largest revenue share of 83% in 2024 within North America, fueled by high migraine diagnosis rates, advanced healthcare infrastructure, and early regulatory approvals. The strong presence of pharmaceutical leaders and widespread insurance coverage support the growing adoption of CGRP-based therapies. The preference for patient-friendly options, such as oral tablets and nasal sprays, combined with increasing awareness of targeted treatments for migraine, continues to drive significant market expansion.

Europe CGRP Receptor Antagonist Market Insight

The Europe calcitonin gene-related peptide receptor antagonist market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing migraine prevalence, heightened awareness, and growing access to novel therapies. The region’s stringent healthcare standards and favorable reimbursement structures support the uptake of CGRP-based medications. Furthermore, clinical adoption is rising across countries with advanced neurology networks, and real-world evidence is reinforcing physician and patient confidence in these treatments.

U.K. CGRP Receptor Antagonist Market Insight

The U.K. calcitonin gene-related peptide receptor antagonist market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by strong National Health Service (NHS) backing for innovative migraine therapies and increasing demand for personalized care. Growing public health campaigns and patient advocacy for migraine awareness are encouraging the use of CGRP-targeted medications. The U.K.’s commitment to precision medicine and digital health integration is also contributing to the market’s expansion.

Germany CGRP Receptor Antagonist Market Insight

The Germany calcitonin gene-related peptide receptor antagonist market is expected to expand at a considerable CAGR during the forecast period, driven by the country’s strong emphasis on pharmaceutical innovation and its high standards of migraine care. Germany’s universal healthcare system facilitates access to advanced therapies, and rising migraine diagnoses among the working population are supporting market growth. Adoption is further enhanced by clinical research efforts and strong collaborations between academia and industry.

Asia-Pacific CGRP Receptor Antagonist Market Insight

The Asia-Pacific calcitonin gene-related peptide receptor antagonist market is poised to grow at the fastest CAGR of 25% during the forecast period of 2025 to 2032, driven by increased awareness of neurological disorders, rising healthcare investments, and improving diagnostic infrastructure. Countries such as China, Japan, and India are experiencing growing demand for migraine therapies amid expanding middle-class populations and broader access to novel medications. Government initiatives to expand pharmaceutical access and digital health ecosystems are also fostering regional market growth.

Japan CGRP Receptor Antagonist Market Insight

The Japan calcitonin gene-related peptide receptor antagonist market is gaining momentum due to a high-tech healthcare system, an aging population, and a cultural focus on precise, well-tolerated medical treatments. Japanese patients and physicians are showing growing interest in non-triptan migraine solutions, particularly CGRP-based options that offer fewer cardiovascular risks. The emphasis on integrated care and IoT-based patient monitoring supports market penetration of CGRP therapies.

India CGRP Receptor Antagonist Market Insight

The India calcitonin gene-related peptide receptor antagonist market accounted for the largest market revenue share in Asia Pacific in 2024, supported by the country’s growing burden of migraine, expanding pharmaceutical sector, and increasing awareness of neurologic care. The affordability and availability of oral CGRP antagonists, along with government healthcare programs promoting chronic disease management, are boosting adoption. Domestic clinical trials and partnerships with multinational pharma companies are also strengthening the market outlook.

Calcitonin Gene-Related Peptide Receptor Antagonist Market Share

The calcitonin gene-related peptide receptor antagonist industry is primarily led by well-established companies, including:

- Pfizer Inc. (U.S.)

- AbbVie Inc. (U.S.)

- Lilly (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Amgen Inc. (U.S.)

- Biohaven Ltd. (U.S.)

- Lundbeck A/S (Denmark)

- Novartis AG (Switzerland)

- Takeda Pharmaceutical Company Limited (Japan)

- Viatris Inc. (U.S.)

- Sun Pharmaceutical Industries Ltd. (India)

- Dr. Reddy’s Laboratories Ltd. (India)

- Zydus Lifesciences Ltd. (India)

- Ipsen S.A. (France)

- Sanofi (France)

- Intas Pharmaceuticals Ltd. (India)

- Glenmark Pharmaceuticals Ltd. (India)

- Sandoz Group AG (Switzerland)

What are the Recent Developments in Global Calcitonin Gene-Related Peptide Receptor Antagonist Market?

- In April 2023, Pfizer Inc. announced the global expansion of Zavegepant, its intranasal CGRP receptor antagonist, into several new international markets following regulatory approvals. The drug’s rapid-onset intranasal formulation addresses acute migraine attacks more efficiently, especially for patients unable to take oral medications. This move reinforces Pfizer’s commitment to diversifying migraine treatment options and expanding access to fast-acting therapies worldwide

- In March 2023, Biohaven Ltd., in collaboration with Royalty Pharma, launched an expanded access program for Rimegepant in emerging markets. This initiative aims to address the high unmet need for migraine treatment by providing oral CGRP antagonist therapy in regions with limited access. The effort demonstrates Biohaven’s strategic emphasis on global health equity and its dedication to making innovative treatments more accessible to underserved populations

- In March 2023, Eli Lilly and Company received extended European Medicines Agency (EMA) approval for Emgality (galcanezumab) for the treatment of cluster headaches in addition to migraine prevention. The expansion of approved indications marks a significant milestone in the CGRP space, highlighting the drug's therapeutic versatility and Lilly’s continued leadership in neurology-focused biologics

- In February 2023, Teva Pharmaceuticals launched a real-world evidence (RWE) initiative to assess the long-term outcomes of Ajovy (fremanezumab) in migraine patients across North America and Europe. This program aims to provide robust post-market data on the safety, effectiveness, and patient-reported satisfaction of CGRP monoclonal antibodies, supporting the clinical value proposition of CGRP-targeted therapies in diverse healthcare systems

- In January 2023, AbbVie Inc. presented positive Phase 3 trial results for Atogepant, a once-daily oral CGRP receptor antagonist, demonstrating its efficacy in the preventive treatment of chronic migraine. These results reinforce AbbVie’s growing presence in the CGRP market and its commitment to addressing both episodic and chronic forms of migraine with differentiated, patient-centric therapies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.