Global Calcium Chloride Market

Market Size in USD Billion

CAGR :

%

USD

1.33 Billion

USD

2.05 Billion

2024

2032

USD

1.33 Billion

USD

2.05 Billion

2024

2032

| 2025 –2032 | |

| USD 1.33 Billion | |

| USD 2.05 Billion | |

|

|

|

|

What is the Global Calcium Chloride Market Size and Growth Rate?

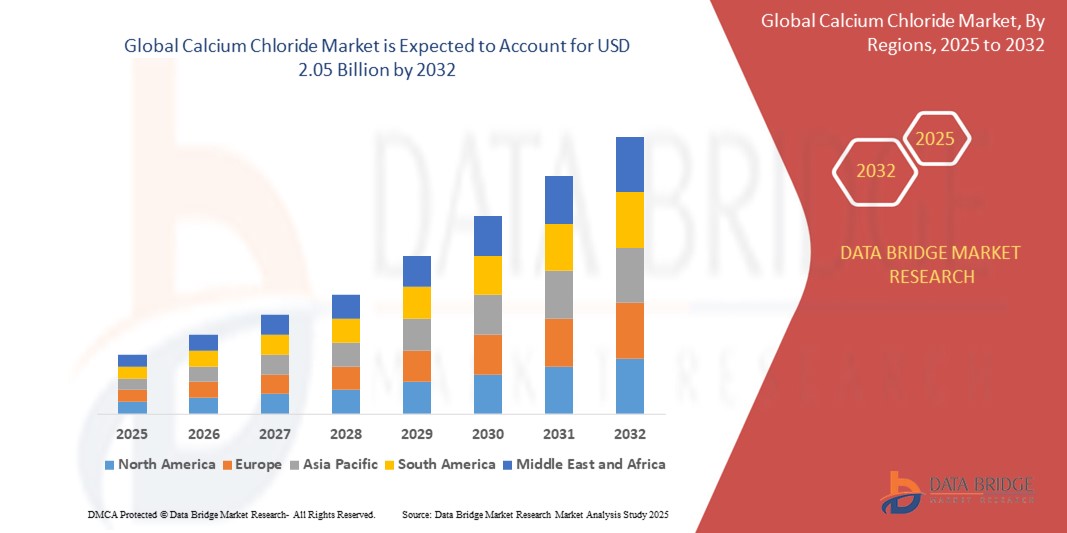

- The global calcium chloride market size was valued at USD 1.33 billion in 2024 and is expected to reach USD 2.05 billion by 2032, at a CAGR of 5.50% during the forecast period

- The global calcium chloride market is experiencing steady growth, driven by its diverse applications across several industries. Key factors contributing to market expansion include its role as a versatile chemical compound used extensively as a de-icing agent on roads and highways during winter months to enhance road safety

- In addition, calcium chloride finds widespread use in dust control applications for unpaved roads, construction sites, and mining operations due to its hygroscopic properties and ability to suppress dust effectively

What are the Major Takeaways of Calcium Chloride Market?

- In the industrial sector, calcium chloride serves as a crucial component in the production of chemicals, pharmaceuticals, and food additives, owing to its properties as a drying agent and desiccant. Furthermore, advancements in drilling technologies in the oil and gas industry have bolstered demand for calcium chloride-based drilling fluids, further propelling market growth

- North America dominated the calcium chloride market with the largest revenue share of 34.62% in 2024, primarily driven by widespread usage in de-icing, oil & gas operations, and dust control applications

- Asia-Pacific region is projected to register the fastest CAGR of 13.8% from 2025 to 2032, driven by growing construction activities, increased demand in food processing, and rapid industrial expansion

- The Liquid Grade segment dominated the market with the largest revenue share of 31.2% in 2024, owing to its high solubility, ease of application, and widespread use in dust control, de-icing, and oilfield brine solutions

Report Scope and Calcium Chloride Market Segmentation

|

Attributes |

Calcium Chloride Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Calcium Chloride Market?

“Growing Usage in Dust Control and Road Stabilization Applications”

- A prominent trend in the calcium chloride market is its increasing use for dust suppression and road stabilization, particularly in construction zones, unpaved roads, and mining operations. Calcium chloride’s hygroscopic nature allows it to absorb moisture from the air, keeping surfaces damp and reducing airborne dust

- Municipalities and transportation departments are adopting liquid and flake calcium chloride as a cost-effective, eco-safe alternative to traditional methods for controlling PM10 and PM2.5 emissions in high-traffic zones

- For instance, in February 2024, OxyChem announced expanded supply partnerships across Midwest U.S. for its road treatment grade calcium chloride products due to increased demand from state highway agencies

- In addition to dust control, calcium chloride is being used for soil stabilization, where it helps increase compaction and strength, extending road durability in rural and remote areas

- The trend is further supported by growing environmental regulations pushing for non-toxic, biodegradable dust control methods, making calcium chloride a preferred choice over petroleum-based alternatives

- As global infrastructure investments rise and environmental sustainability becomes a priority, the adoption of calcium chloride for road maintenance applications is set to grow steadily in the coming years

What are the Key Drivers of Calcium Chloride Market?

- Rapid industrialization and infrastructure expansion in emerging markets are major demand drivers, as calcium chloride is used in concrete acceleration, de-icing, oil & gas drilling, and industrial brine solutions

- In March 2024, TETRA Technologies, Inc. reported a surge in orders for calcium chloride brines used in completion fluids for shale gas extraction across Texas and Oklahoma, signaling increased drilling activity

- The winter maintenance segment is a significant contributor, particularly in North America and Europe, where calcium chloride is widely applied for de-icing roads, sidewalks, and parking areas due to its low freezing point and quick action

- Calcium chloride’s application in food processing (as a firming agent), pharmaceuticals, and water treatment is also gaining momentum, driven by its safety profile and regulatory approvals for limited food-grade usage

- Increasing emphasis on water conservation and dust control in agriculture and mining is promoting the use of calcium chloride as a soil moisture retainer and stabilizer, especially in arid regions such as the Middle East and parts of Asia-Pacific

Which Factor is challenging the Growth of the Calcium Chloride Market?

- A primary challenge facing the market is the fluctuation in raw material costs, particularly for limestone and hydrochloric acid, which are key feedstocks in calcium chloride production. These fluctuations directly impact pricing and profit margins

- For instance, in late 2023, producers in Europe faced production slowdowns due to increased energy prices and acid supply chain disruptions, impacting output and raising prices of industrial calcium chloride

- Environmental concerns also pose a constraint, as over-application of calcium chloride for de-icing or dust control can lead to soil salinization, water contamination, and corrosion of infrastructure if not properly managed

- In addition, the seasonal nature of demand, particularly for de-icing, creates supply-demand imbalances and limits production scalability in certain regions

- To overcome these challenges, companies must invest in cost-efficient manufacturing technologies, diversify raw material sourcing, and develop eco-safe formulations that address both performance and environmental impact

How is the Calcium Chloride Market Segmented?

The market is segmented on the basis of product type, form, raw material, grade, and application.

- By Product Type

On the basis of product type, the calcium chloride market is segmented into Flakes 77%, Flakes 94%, Prills 94%, Pellets 94%, Liquid Grade, and Others. The Liquid Grade segment dominated the market with the largest revenue share of 31.2% in 2024, owing to its high solubility, ease of application, and widespread use in dust control, de-icing, and oilfield brine solutions. Liquid calcium chloride is preferred for its efficient performance in both industrial and municipal applications.

The Prills 94% segment is projected to grow at the fastest CAGR from 2025 to 2032, due to its rising adoption in construction, agriculture, and de-icing applications where high purity and controlled release are critical.

- By Form

On the basis of form, the market is segmented into Liquid, Hydrated Solid, and Others. The Liquid segment accounted for the largest market revenue share of 42.8% in 2024, driven by its extensive use in road treatment, oil & gas operations, and food processing. The ready-to-use format and easy handling make liquid calcium chloride the most preferred form.

The Hydrated Solid segment is expected to witness the highest CAGR during the forecast period, as demand grows for moisture-absorbing agents and packaging desiccants in industrial and agricultural sectors.

- By Raw Material

On the basis of raw material, the market is segmented into Natural Brine, Solvay Process, Limestone, and Hydrochloric Acid (HCL). The Natural Brine segment dominated the market with the largest revenue share of 36.5% in 2024, due to its cost-effective extraction process and environmental sustainability. The availability of large brine reserves in the U.S., China, and Middle East supports consistent production.

The Hydrochloric Acid (HCL) segment is anticipated to grow at the fastest rate owing to its role in producing high-purity calcium chloride used in food, pharma, and specialty applications.

- By Grade

On the basis of grade, the market is segmented into Food Grade, Industrial Grade, Agriculture Grade, and Pharmaceutical Grade. The Industrial Grade segment held the largest revenue share of 45.7% in 2024, driven by heavy usage across oilfield, construction, and de-icing sectors. Its versatility and bulk availability make it the go-to option for commercial-scale operations.

The Pharmaceutical Grade segment is projected to grow rapidly due to increasing demand for high-purity calcium chloride in intravenous solutions, supplements, and medical-grade moisture absorbers.

- By Application

On the basis of application, the calcium chloride market is segmented into Dust Control and De-icing, Gas and Oil, Construction, Food, and Others. The Dust Control and De-icing segment led the market with the largest revenue share of 39.6% in 2024, attributed to growing infrastructure development and extreme weather patterns driving demand for safer roads and surfaces.

The Gas and Oil segment is expected to witness the highest CAGR, as calcium chloride is extensively used as a completion fluid, drilling aid, and stabilizing agent in the oilfield industry.

Which Region Holds the Largest Share of the Calcium Chloride Market?

- North America dominated the calcium chloride market with the largest revenue share of 34.62% in 2024, primarily driven by widespread usage in de-icing, oil & gas operations, and dust control applications

- The region's cold climate and extensive road infrastructure demand consistent calcium chloride application for winter maintenance and road stabilization

- The U.S. and Canada also have a strong industrial base, which boosts demand for calcium chloride in concrete acceleration, brine refrigeration, and wastewater treatment. In addition, robust distribution channels and the presence of leading manufacturers contribute to sustained market growth

U.S. Calcium Chloride Market Insight

The U.S. accounted for the largest market share in North America in 2024, owing to its massive consumption in oilfield brines, highway de-icing, and industrial processing. Government contracts for road maintenance and shale gas extraction activities continue to drive significant volume demand. Companies such as Occidental Chemical Corporation and TETRA Technologies, Inc. are key contributors to supply and innovation in the domestic market.

Canada Calcium Chloride Market Insight

Canada’s market is growing steadily, supported by its expansive rural road network and harsh winters, which require consistent de-icing solutions. The agriculture sector is also adopting calcium chloride for soil stabilization and livestock feed supplements, while mining and construction projects utilize it for dust suppression in remote locations.

Which Region is the Fastest Growing Region in the Calcium Chloride Market?

Asia-Pacific region is projected to register the fastest CAGR of 13.8% from 2025 to 2032, driven by growing construction activities, increased demand in food processing, and rapid industrial expansion. Rising awareness about the benefits of calcium chloride in moisture control, cement acceleration, and refrigeration systems is fueling its adoption across China, India, and Southeast Asia. Favorable government infrastructure initiatives, increasing agricultural productivity goals, and expanding demand for packaged food preservation are contributing to overall regional growth.

China Calcium Chloride Market Insight

China captured the largest share in Asia-Pacific in 2024, owing to large-scale production capabilities and strong domestic demand across chemical manufacturing, construction, and oil & gas. Government-backed initiatives for industrial modernization and increased infrastructure investment are boosting market volume.

India Calcium Chloride Market Insight

India is expected to grow at the highest CAGR in the region, driven by increasing adoption in irrigation systems, food preservation, and cement manufacturing. The rising focus on rural road development and agricultural yield enhancement is further accelerating demand.

Japan Calcium Chloride Market Insight

Japan’s market is supported by its high standards in food safety, industrial precision, and demand for moisture-absorbing agents in electronics and packaging. The country is also investing in eco-friendly de-icing solutions due to environmental regulations, pushing innovation in bio-based formulations.

Which are the Top Companies in Calcium Chloride Market?

The calcium chloride industry is primarily led by well-established companies, including:

- Occidental Chemical Corporation (U.S.)

- Solvay (Belgium)

- TETRA Technologies, Inc. (U.S.)

- Ward Chemical Ltd (Canada)

- Weifang Haibin Chemical Co., Ltd. (China)

- Zirax Limited (U.K.)

- Nedmag B.V. (Netherlands)

- SAMEER CHEMICALS (India)

- Sulaksh Chemicals (India)

- Sitara Chemical Industries Ltd. (India)

- BASF SE (Germany)

- Aditya Birla Chemicals (India)

- Gujarat Alkalies and Chemical Limited (India)

- Dow (U.S.)

What are the Recent Developments in Global Calcium Chloride Market?

- In June 2024, Kemin Industries, a global ingredient solutions provider, entered the U.S. dairy sector with the launch of CholiGEM™, a rumen-protected choline supplement aimed at tackling fatty liver and ketosis in lactating cows. This move underscores Kemin’s commitment to enhancing livestock health and advancing sustainable animal nutrition solutions

- In May 2024, Fast&Up, India’s leading active nutrition brand, launched Fast&Up Reload Ready-to-Drink, a hydration solution designed for athletes and fitness enthusiasts seeking quick and effective energy replenishment. This innovation strengthens Fast&Up’s positioning in India’s fast-growing performance nutrition market

- In July 2023, Occidental Chemical Corporation committed a USD 1.2 billion investment to expand its Geismar, Louisiana facility, aiming to increase its calcium chloride production capacity by 20%. This expansion is expected to reinforce Occidental’s supply capabilities and meet growing industrial demand

- In June 2023, Solvay S.A. introduced a new line of high-purity calcium chloride products tailored for the food and beverage industry, including applications in food processing, brewing, and water treatment. This product line highlights Solvay’s focus on high-quality, multi-sector calcium chloride solutions

- In May 2023, TETRA Technologies, Inc. acquired ProFrac Services, gaining access to its pressure pumping fleet and experienced personnel. This acquisition enhances TETRA’s strength in well completion services and expands its calcium chloride-based drilling fluid offerings, reinforcing its leadership in the energy sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Calcium Chloride Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Calcium Chloride Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Calcium Chloride Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.