Global Cannabis Testing Market

Market Size in USD Billion

CAGR :

%

USD

1.97 Billion

USD

4.42 Billion

2025

2033

USD

1.97 Billion

USD

4.42 Billion

2025

2033

| 2026 –2033 | |

| USD 1.97 Billion | |

| USD 4.42 Billion | |

|

|

|

|

Cannabis Testing Market Size

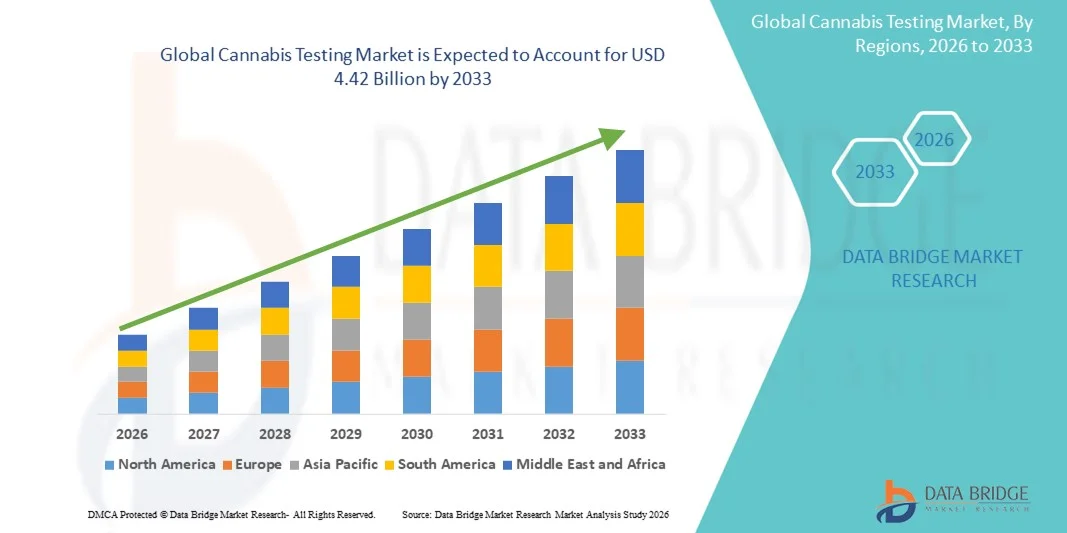

- The global cannabis testing market size was valued at USD 1.97 billion in 2025 and is expected to reach USD 4.42 billion by 2033, at a CAGR of 10.65% during the forecast period

- The market growth is largely fueled by the increasing legalization of cannabis for medical and recreational use across multiple regions, driving the need for standardized testing and quality assurance in cultivation and distribution

- Furthermore, rising consumer awareness regarding product safety, potency, and compliance with regulatory standards is positioning cannabis testing as a critical component of the industry’s supply chain. These converging factors are accelerating the adoption of advanced testing solutions, thereby significantly boosting the industry's growth

Cannabis Testing Market Analysis

- Cannabis testing, encompassing analytical testing for potency, contaminants, and quality of cannabis products, is increasingly critical for ensuring safety, regulatory compliance, and product consistency across medical and recreational markets in both developed and emerging regions

- The escalating demand for cannabis testing is primarily fueled by the legalization of cannabis in multiple countries, growing awareness among consumers about product safety, and stringent regulatory requirements for quality assurance and labelling

- North America dominated the cannabis testing market with the largest revenue share of 43% in 2025, driven by early legalization, advanced laboratory infrastructure, high consumer awareness, and a strong presence of key industry players offering comprehensive testing solutions, with the U.S. witnessing substantial growth in accredited laboratories and high-throughput testing facilities

- Asia-Pacific is expected to be the fastest growing region in the cannabis testing market during the forecast period due to increasing legalization for medical cannabis, rising healthcare standards, growing research initiatives, and expanding laboratory infrastructure in countries such as Japan, South Korea, and Australia

- Potency testing segment dominated the cannabis testing market with a market share of 40.3% in 2025, driven by its critical role in product labeling, regulatory compliance, and consumer safety across both medicinal and recreational cannabis products

Report Scope and Cannabis Testing Market Segmentation

|

Attributes |

Cannabis Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Cannabis Testing Market Trends

Adoption of Advanced Analytical Technologies and Automation

- A significant and accelerating trend in the global cannabis testing market is the increasing adoption of advanced analytical technologies, such as high-performance liquid chromatography (HPLC), gas chromatography-mass spectrometry (GC-MS), and automated sample preparation systems, enhancing testing accuracy, speed, and reliability

- For instance, laboratories are integrating automated cannabinoid extraction and testing systems, allowing high-throughput analysis while reducing manual errors and operational costs

- Advanced instrumentation enables simultaneous testing for potency, pesticides, heavy metals, and microbial contaminants, providing comprehensive quality assessments for both medical and recreational cannabis products

- Automation and digital laboratory management systems facilitate streamlined workflows, data tracking, and regulatory compliance, enabling laboratories to handle larger sample volumes efficiently

- Integration of AI and machine learning in testing platforms is emerging to predict contamination risks, optimize sample processing, and enhance quality assurance

- Blockchain-based traceability solutions are being adopted to ensure product authenticity, secure data sharing, and transparent reporting across the supply chain

- This trend toward more accurate, automated, and high-throughput cannabis testing is reshaping industry expectations for product quality and regulatory adherence. Consequently, companies such as CW Analytical are deploying fully automated testing platforms capable of multi-parameter analyses

- The demand for laboratories equipped with cutting-edge analytical technologies is growing rapidly across North America, Europe, and Asia-Pacific as producers, distributors, and regulators increasingly prioritize safety, consistency, and compliance

Cannabis Testing Market Dynamics

Driver

Increasing Legalization and Regulatory Compliance Requirements

- The progressive legalization of medical and recreational cannabis in multiple regions, coupled with stringent regulatory requirements, is a significant driver for the heightened demand for cannabis testing

- For instance, in March 2025, SC Labs expanded its ISO-accredited laboratory network in the U.S., aiming to provide comprehensive testing solutions to meet evolving state regulations

- As regulatory bodies enforce mandatory testing for potency, contaminants, and labeling accuracy, cannabis producers are compelled to utilize certified testing laboratories, driving market growth

- Furthermore, rising consumer awareness about product safety and quality is increasing demand for transparent lab-tested products, making testing a critical step in the supply chain

- The emphasis on compliance with standardized testing procedures, coupled with increasing medical cannabis adoption, is propelling investments in advanced laboratory infrastructure and high-throughput testing technologies across global markets

- Growing demand for derivative products such as edibles, oils, and topicals is expanding the scope for specialized testing services, creating new revenue streams for laboratories

- Partnerships between cannabis producers and third-party testing labs are increasing, offering integrated solutions for quality assurance and market access, further driving industry growth

Restraint/Challenge

High Operational Costs and Regulatory Fragmentation

- The high operational and equipment costs associated with setting up and maintaining cannabis testing laboratories pose a significant challenge for broader market penetration, particularly in emerging regions

- For instance, smaller laboratories may struggle to invest in advanced analytical instruments such as HPLC or GC-MS systems, limiting their ability to provide comprehensive testing services

- In addition, regulatory fragmentation across states and countries creates inconsistencies in testing standards, complicating compliance efforts for producers and laboratories likely as

- Variations in permitted testing methods, reporting requirements, and certification processes can lead to operational inefficiencies and increased administrative burdens for laboratories

- Lack of skilled personnel trained in advanced testing methodologies is a critical challenge, affecting testing accuracy, turnaround time, and laboratory scalability

- Supply chain disruptions for reagents, consumables, and specialized equipment can delay testing operations, impacting product release schedules and revenue generation

- While technological advancements and regulatory harmonization are gradually improving efficiency, the high cost of operations and the complexity of navigating diverse regulations continue to constrain market growth

- Addressing these challenges through cost-effective automation, standardized testing protocols, and supportive regulatory frameworks will be vital for the sustained expansion of the cannabis testing market

Cannabis Testing Market Scope

The market is segmented on the basis of product and software, type, and end user.

- By Product and Software

On the basis of product and software, the global cannabis testing market is segmented into cannabis testing products and cannabis testing software. The cannabis testing products segment dominated the market with the largest revenue share in 2025, driven by the growing demand for analytical instruments, reagents, and consumables used for potency, contaminant, and microbial testing. Laboratories and research facilities prioritize these products to ensure accurate, reliable, and compliant testing results, making them essential for regulatory adherence. Furthermore, the increasing number of accredited laboratories in North America and Europe is contributing to higher consumption of testing products. The availability of advanced testing kits that streamline multi-parameter analysis further strengthens the segment's dominance. In addition, cannabis producers rely on these products to validate quality and maintain consistency across batches, increasing recurring demand. The strong focus on product safety and consumer trust also incentivizes laboratories to adopt high-quality testing products.

The cannabis testing software segment is expected to witness the fastest growth during 2026–2033 due to the rising adoption of digital laboratory management systems and cloud-based platforms. These software solutions enable laboratories to track samples, manage workflows, store analytical data, and ensure regulatory compliance efficiently. With the expansion of multi-state operations and international markets, software solutions that provide centralized data management and reporting are increasingly critical. The integration of AI and predictive analytics into software platforms allows laboratories to detect anomalies, optimize testing protocols, and improve turnaround times. Software solutions also support traceability and blockchain-enabled reporting, which are becoming key requirements in regulated markets. Growing demand for automated, error-free, and scalable operations across laboratories is further fueling the adoption of cannabis testing software.

- By Type

On the basis of type, the market is segmented into potency testing, terpene profiling, residual solvent screening, microbial analysis, pesticide screening, heavy metal testing, and genetic testing. The potency testing segment dominated the market with the largest share of 40.3% in 2025, driven by regulatory mandates requiring accurate labeling of THC, CBD, and other cannabinoids. Accurate potency testing ensures consumer safety and supports product standardization, which is crucial for both medical and recreational cannabis markets. Laboratories focus heavily on potency testing as it directly affects product pricing, market acceptance, and compliance with state or national regulations. The segment benefits from the availability of advanced HPLC, GC-MS, and automated extraction systems, which provide precise and high-throughput results. In addition, potency testing is a critical determinant for dosage in medical cannabis applications, driving continuous demand for reliable testing solutions. Growing consumer awareness and regulatory scrutiny ensure that potency testing remains the most widely performed test across the industry.

The microbial analysis segment is anticipated to witness the fastest growth during 2026–2033 due to increasing concerns about contamination in cannabis products. Rising consumer focus on safety and stricter regulations on microbial contaminants are compelling producers to adopt comprehensive testing protocols. Microbial testing helps detect bacteria, fungi, and mold that could compromise product safety, particularly in edibles, oils, and other derivatives. With legalization spreading in Asia-Pacific and Europe, the demand for high-throughput microbial analysis is rising rapidly. Innovations in automated microbial detection, such as PCR-based assays and rapid pathogen testing, enhance laboratory efficiency and reduce turnaround times. The growing emphasis on safety certifications and compliance with international standards is further driving the expansion of microbial testing.

- By End User

On the basis of end user, the cannabis testing market is segmented into product and software providers and services. The services segment dominated the market in 2025, driven by the increasing outsourcing of testing activities to third-party accredited laboratories. Cannabis producers and distributors rely on specialized testing services to ensure regulatory compliance, validate product quality, and maintain consumer trust without incurring high operational costs of in-house laboratories. The presence of ISO-accredited and state-certified laboratories in North America and Europe supports the dominance of this segment. In addition, service providers offer multi-parameter testing, consulting, and reporting solutions, further adding value to clients and strengthening their market position. Continuous expansion of medical cannabis programs and recreational legalization contributes to the sustained demand for testing services.

The product and software end-user segment is expected to witness the fastest growth during 2026–2033 due to increasing investments in laboratory infrastructure, digital solutions, and analytical instruments by cannabis producers and research organizations. Adoption of automated testing platforms, cloud-based software, and AI-enabled analytical tools allows companies to perform in-house testing more efficiently. This segment benefits from the need for integrated testing solutions that can support multi-parameter analysis, improve operational throughput, and ensure compliance with evolving regulations. Growing awareness about the advantages of in-house testing for faster product release and quality control is further driving market growth. Expansion of cannabis research initiatives and new product development in emerging markets is also accelerating adoption in this segment.

Cannabis Testing Market Regional Analysis

- North America dominated the cannabis testing market with the largest revenue share of 43% in 2025, driven by early legalization, advanced laboratory infrastructure, high consumer awareness, and a strong presence of key industry players offering comprehensive testing solutions, with the U.S. witnessing substantial growth in accredited laboratories and high-throughput testing facilities

- Consumers and producers in the region prioritize product safety, potency verification, and compliance with state-specific regulations, increasing demand for accredited testing laboratories and advanced analytical solutions

- This widespread adoption is further supported by high consumer awareness, significant investments in laboratory automation and high-throughput testing, and the presence of key industry players, establishing cannabis testing as an essential service across both medical and recreational markets

U.S. Cannabis Testing Market Insight

The U.S. cannabis testing market captured the largest revenue share of 79% in 2025 within North America, fueled by the early legalization of both medical and recreational cannabis across multiple states. Producers and dispensaries are increasingly prioritizing product safety, potency verification, and regulatory compliance through accredited third-party laboratories. The growing demand for high-throughput testing, advanced analytical instruments, and digital laboratory management solutions further propels the market. Moreover, the integration of AI and automation in testing workflows is significantly enhancing accuracy, turnaround time, and operational efficiency, driving industry expansion.

Europe Cannabis Testing Market Insight

The Europe cannabis testing market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing legalization of medical cannabis and the enforcement of stringent testing regulations. Rising urbanization and the growing adoption of advanced laboratory technologies are fostering the demand for comprehensive testing services. European producers and distributors are also emphasizing product safety, potency, and compliance with European Pharmacopoeia standards. The region is witnessing significant growth across laboratories, medical cannabis facilities, and research institutions, with testing becoming a mandatory part of both new product launches and ongoing quality control programs.

U.K. Cannabis Testing Market Insight

The U.K. cannabis testing market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising legalization of medical cannabis and increasing awareness of product safety standards. Concerns regarding contamination, accurate potency labeling, and regulatory compliance are encouraging cannabis producers and distributors to rely on accredited testing laboratories. In addition, the U.K.’s investment in laboratory infrastructure, advanced analytical technologies, and digital solutions is expected to continue stimulating market growth. The adoption of cannabis testing software and automated workflows is further enhancing testing efficiency and data traceability.

Germany Cannabis Testing Market Insight

The Germany cannabis testing market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s stringent regulatory framework for medical cannabis and focus on product quality. Growing awareness of laboratory accreditation, advanced analytical methods, and accurate potency testing promotes adoption across medical cannabis producers and research institutions. Germany’s well-developed infrastructure and emphasis on scientific rigor support the integration of automated and high-throughput testing platforms. The increasing focus on sustainability and traceability in cannabis production aligns with the growing demand for precise and reliable testing solutions.

Asia-Pacific Cannabis Testing Market Insight

The Asia-Pacific cannabis testing market is poised to grow at the fastest CAGR of 25% during the forecast period of 2026 to 2033, driven by gradual legalization in countries such as Japan, South Korea, and Australia, along with rising healthcare awareness and research initiatives. The region's growing focus on quality, safety, and regulatory compliance is driving the adoption of advanced analytical instruments and laboratory automation. Government initiatives supporting medical cannabis research and the establishment of accredited laboratories are expanding testing capabilities. Furthermore, as APAC develops its domestic cannabis testing infrastructure, affordability and accessibility of high-quality testing services are increasing, accelerating market growth.

Japan Cannabis Testing Market Insight

The Japan cannabis testing market is gaining momentum due to increasing medical cannabis legalization, high safety standards, and demand for reliable quality control. Japanese laboratories emphasize precision testing for potency, contaminants, and microbial presence, driven by stringent government regulations. The adoption of automated testing platforms, AI-assisted analytics, and integrated laboratory software is fueling growth. In addition, the expansion of research initiatives on cannabinoids and their therapeutic applications is supporting market development. The need for efficient, accurate, and regulatory-compliant testing solutions in both clinical and research settings is further accelerating the market.

India Cannabis Testing Market Insight

The India cannabis testing market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to emerging medical cannabis programs, increasing research on cannabis-based therapeutics, and rising awareness of product safety. India is witnessing growth in laboratory infrastructure and adoption of advanced analytical instruments to meet regulatory requirements. The push towards establishing accredited testing facilities, alongside government initiatives supporting controlled medical cannabis use, is propelling the market. In addition, increasing investment in digital laboratory management systems and automation is improving testing accuracy, efficiency, and traceability, boosting overall market expansion.

Cannabis Testing Market Share

The Cannabis Testing industry is primarily led by well-established companies, including:

- ACS Laboratory (U.S.)

- Encore Labs (U.S.)

- Kaycha Labs (U.S.)

- CannaLabs (Canada)

- Steep Hill (U.S.)

- SC Labs (U.S.)

- ProVerde Laboratories (U.S.)

- CannaSafe Analytics (U.S.)

- EVIO Labs (U.S.)

- GreenLeaf Lab (U.S.)

- Anresco Laboratories (U.S.)

- Digipath Labs (U.S.)

- Smithers CTS (U.S.)

- New Jersey Cannalytics (U.S.)

- Green Analytics East (U.S.)

- Sriven Labs (U.S.)

- Trichome Analytical (U.S.)

- Highgrade Labs of New Jersey (U.S.)

- Pathogenia Inc. (Canada)

- Peace Naturals Project Inc. (Canada)

What are the Recent Developments in Global Cannabis Testing Market?

- In August 2025, Eurofins Scientific completed the acquisition of a cannabis testing laboratory in the U.S., expanding its footprint and capabilities in one of the world’s most regulated cannabis testing environments. This move enhances Eurofins’ operational scale to meet rising demand for comprehensive analytical testing services under complex regulatory frameworks

- In July 2025, Massachusetts regulators suspended the business license of a commercial cannabis testing lab (Assured Testing Laboratories) for failing to reliably report yeast and mold results, marking one of the first enforcement actions in the state’s regulated testing sector

- In March 2025, Kaycha Labs was selected by the Massachusetts Cannabis Control Commission as the official statewide cannabis testing laboratory, solidifying its role in public health and regulatory compliance by analyzing cannabinoid profiles and contaminants (pesticides, solvents, heavy metals, microbials) under strict guidelines

- In March 2025, Thermo Fisher Scientific launched a compact LC‑MS system tailored for cannabinoid profiling, increasing sample throughput and reducing analysis time for cannabis testing laboratories. The instrument supports potency and contaminant analysis with strong software integration and lower maintenance, addressing growing demand for high‑precision testing in regulated markets

- In February 2025, A legal dispute emerged in the U.S. when MCR Labs sued multiple cannabis testing laboratories, claiming some inflated THC potency readings and underreported contaminants, highlighting industry challenges around test accuracy and consumer trust

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.