Global Canned Mushroom Market

Market Size in USD Billion

CAGR :

%

USD

9.93 Billion

USD

12.06 Billion

2024

2032

USD

9.93 Billion

USD

12.06 Billion

2024

2032

| 2025 –2032 | |

| USD 9.93 Billion | |

| USD 12.06 Billion | |

|

|

|

|

Canned Mushroom Market Size

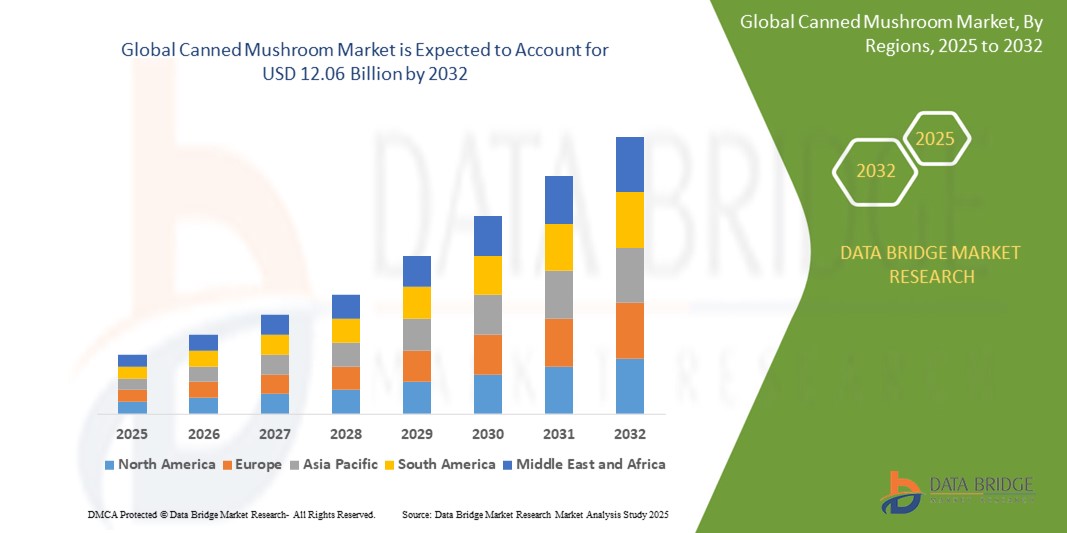

- The Global Canned Mushroom Market size was valued at USD 9.93 Billion in 2024 and is expected to reach USD 12.06 Billion by 2032, at a CAGR of 2.46 % during the forecast period

- The market growth is primarily driven by increasing consumer demand for convenient, shelf-stable, and nutritious food products, rising popularity of plant-based diets, and advancements in canning technologies that enhance flavor retention and nutritional quality

- Furthermore, the expanding applications of canned mushrooms in the foodservice industry—especially in quick-service restaurants and institutional catering—coupled with innovations in eco-friendly packaging, the introduction of organic and flavored variants, and growing online retail penetration, are accelerating market growth worldwide

Canned Mushroom Market Analysis

- Canned mushrooms consist of mushrooms (e.g., button, shiitake, oyster) processed and preserved in sealed containers, offering extended shelf life, convenience, and year-round availability. They are widely used in ready-to-eat meals, soups, sauces, and as ingredients in foodservice applications

- The market is experiencing steady growth due to busy lifestyles, increasing health consciousness, and the rising demand for plant-based proteins. Mushrooms offer nutritional benefits—such as high vitamin D, antioxidants, and low calories—which appeal to health-focused consumers seeking convenient, nutritious options

- Asia-Pacific is expected to dominate the Global Canned Mushroom Market, driven by strong cultural affinity for mushrooms, rapid urbanization, and growing disposable incomes in markets like China and India. This region accounted for over 50 % of global consumption in

- North America is projected to be the second-largest region, supported by increasing adoption of plant-based diets, expansion of retail distribution channels, and innovations in ready-to-eat product offerings. Consumers in the U.S. and Canada are gravitating toward convenient meal solutions amid busier lifestyles

- By form, the Whole Mushrooms segment holds the largest market share due to higher consumer preference for minimal processing, perceived freshness, and versatile usage in various dishes. Sliced mushrooms also constitute a significant share, particularly in ready-to-cook applications and prepared meals

Report Scope and Canned Mushroom Market Segmentation

|

Attributes |

Canned Mushroom Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Canned Mushroom Market Trends

“Emphasis on Convenience, Sustainability, and Flavor Innovation”

- A prominent and rapidly evolving trend is the development of flavored and pre-seasoned canned mushroom variants—such as garlic-infused, spicy, and organic blends—to cater to consumers seeking convenience without sacrificing taste. These products simplify meal preparation and broaden culinary applications

- Sustainability is gaining traction, with manufacturers introducing eco-friendly and biodegradable packaging, as well as sourcing organic and non-GMO mushrooms to meet growing demand for clean-label, environmentally responsible options

- Technological advancements—such as high-pressure processing and aseptic canning—are improving flavor retention, texture, and nutrient preservation, reducing the perceptual gap between fresh and canned alternatives. This has helped dispel traditional biases against canned products

- Manufacturers are also leveraging digital marketing and e-commerce platforms to reach urban consumers who prefer quick, direct purchases. Subscription models and value packs are increasing repeat sales and strengthening brand loyalty in competitive markets

Canned Mushroom Market Dynamics

Driver

“Increasing Demand for Convenient, Nutritious, and Plant-Based Food Options”

- The busy lifestyles of working professionals and urban households are driving demand for ready-to-eat and ready-to-cook products. Canned mushrooms offer a combination of convenience and nutrition, satisfying consumers’ need for quick meal solutions without compromising health benefits

- Mushrooms are rich in essential nutrients—such as vitamin D, antioxidants, and dietary fiber—making them an attractive plant-based protein source for vegetarian, vegan, and flexitarian consumers. This aligns with the growing trend toward health and wellness, propelling market growth

- Advancements in food processing technologies—such as high-pressure processing and retort sterilization—have significantly improved the taste, texture, and safety of canned mushrooms, reducing perceptual barriers and enhancing consumer acceptance

Restraint/Challenge

“Availability of Fresh and Frozen Alternatives and Price Volatility of Raw Materials”

- The availability of fresh and frozen mushrooms—often perceived as higher-quality or more “natural”—restricts the growth of the canned segment, as some consumers still prefer fresh produce for taste and texture

- Fluctuations in raw material costs—driven by seasonal yields, weather conditions, and input price volatility—pose challenges for manufacturers, potentially leading to higher retail prices or compressed margins

- Canning processes require significant capital investment in specialized equipment, quality control, and sterilization facilities. Smaller or regional producers may struggle to compete on price or scale, limiting market consolidation

Canned Mushroom Market Scope

The market is segmented on the basis of nature, product type, form, end-use, and distribution channel

- By Nature

On the basis of Nature it is segmented into Conventional, Organic

The Conventional segment dominates the market with over 80 % revenue share in 2024, owing to wider availability, lower price points, and established supply chains. However, the Organic segment is expected to witness the highest growth rate during the forecast period as consumers prioritize clean-label and chemical-free options

- By Fabric

On the basis of product type the Canned Mushroom Market is segmented into Button Mushroom, Shiitake Mushroom, Oyster Mushroom, Others (Enoki, Portobello, etc.)

The Button Mushroom segment holds the largest revenue share in 2024 due to its widespread cultivation, mild flavor, and versatility in global cuisines. Shiitake and Oyster segments are gaining traction in premium and organic categories

- By Form

On the basis of Form the Canned Mushroom Market is segmented into Whole, Sliced, Pieces & Stems Whole.

The Whole Mushrooms segment dominates in 2024, driven by consumer preference for minimally processed products. The Sliced segment is also significant, particularly in ready-to-cook offerings and meal kits

- By End-Use

On the basis of End-Use it is segmented into Retail (Hypermarkets/Supermarkets, Traditional Grocery Stores, Convenience Stores, Online Retail)

Retail accounts for the largest share in 2024, as consumers increasingly purchase canned mushrooms for at-home use. The Food Processing segment is projected to grow steadily due to rising demand for consistent-quality ingredients in packaged foods

Canned Mushroom Market Regional Analysis

- Asia-Pacific dominates the market with a revenue share of approximately 45 % in 2024, driven by high consumption in China, India, and Southeast Asia. Rapid urbanization, growing middle-class populations, and dietary shifts toward convenience products have boosted canned mushroom demand

China holds the largest share within Asia-Pacific, supported by vast mushroom production, increasing disposable incomes, and the proliferation of modern retail outlets. Government initiatives to promote food processing industries have further propelled market expansion

India is expected to witness the fastest CAGR of 6.2 % from 2025 to 2032, fueled by rising health awareness, the growth of organized retail, and the increasing popularity of Western-style cuisines featuring mushrooms. Expansion of cold chain logistics and processing facilities is also supporting market growth

North America holds the second-largest share at 25 % in 2024, led by the U.S. Market growth is driven by busy lifestyles, strong retail and e-commerce infrastructure, and the trend toward plant-based eating. Canada is also witnessing steady growth due to similar consumer preferences and supportive government programs promoting healthy eating

The U.S. Canned Mushroom Market captured approximately 80 % of North America’s revenue in 2024. Demand is propelled by meal-kit services, increasing vegan/vegetarian population, and innovation in packaging. Manufacturers are introducing resealable cans and portion-controlled packaging to appeal to on-the-go consumers

Canned Mushroom Market Share

The speciality starches is primarily led by well-established companies, including:

- Bonduelle (France)

- Hain Celestial Group (U.S.)

- Seneca Foods Corporation (U.S.)

- Eden Foods (U.S.)

- Roland Foods (U.S.)

- Olam International (Singapore)

- Campbell Soup Company (U.S.)

- Del Monte Foods, Inc. (U.S.)

- Conagra Brands, Inc. (U.S.)

- Monterey Mushrooms (U.S.)

Latest Developments in Global Canned Mushroom Market

- In April 2025, Seneca Foods Corporation launched a new line of organic canned button mushrooms packaged in fully recyclable cans, targeting health-conscious consumers and improving shelf stability.

- In March 2025, Olam International expanded its canned mushroom processing facility in Malaysia to increase production capacity of shiitake and oyster varieties, addressing growing demand across Asia-Pacific

- In February 2025, Campbell Soup Company introduced a spicy garlic flavored canned mushroom variant under its “Healthy Creations” line, catering to consumers seeking bold flavors in plant-based proteins

- In January 2025, Eden Foods unveiled eco-friendly, BPA-free cans for its entire lineup of canned mushrooms, emphasizing clean-label and sustainable packaging initiatives

- In January 2025, Roland Foods partnered with a European organic mushroom supplier to develop a premium range of wild, flavored canned mushrooms—such as porcini and chanterelle—targeting gourmet retail channels

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Canned Mushroom Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Canned Mushroom Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Canned Mushroom Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.