Global Car Manufacturing Market

Market Size in USD Billion

CAGR :

%

USD

3,423.38 Billion

USD

6,196.99 Billion

2024

2032

USD

3,423.38 Billion

USD

6,196.99 Billion

2024

2032

| 2025 –2032 | |

| USD 3,423.38 Billion | |

| USD 6,196.99 Billion | |

|

|

|

|

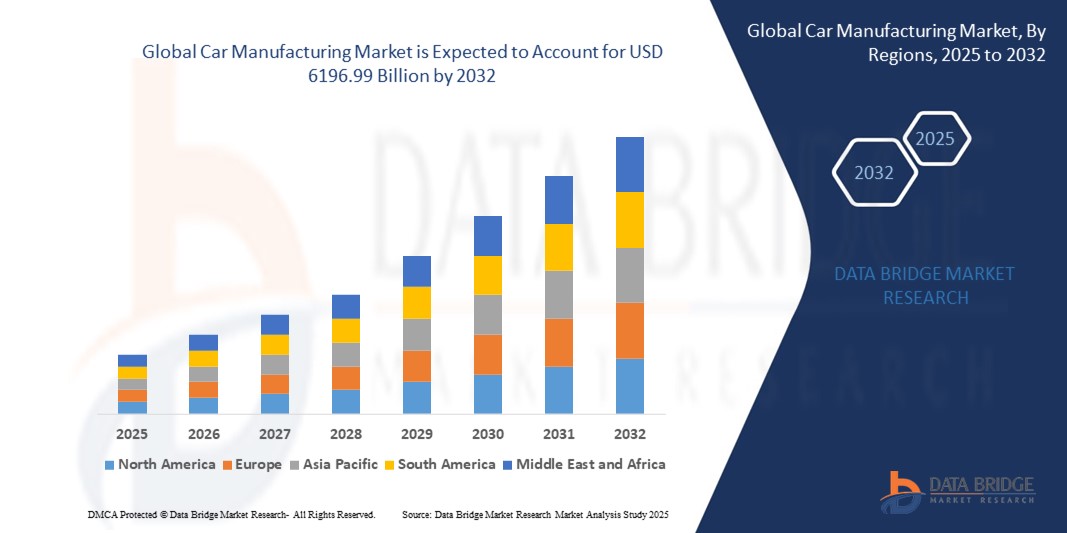

What is the Global Car Manufacturing Market Size and Growth Rate?

- The global car manufacturing market size was valued at USD 3423.38 billion in 2024 and is expected to reach USD 6196.99 billion by 2032, at a CAGR of 7.70% during the forecast period

- The car manufacturing market refers to the industry involved in the production, distribution, and utilization of metallic materials specifically tailored for automotive applications. This market encompasses various metals such as steel, aluminum, magnesium, and others, which are utilized in the manufacturing of vehicle components including body structures, engines, chassis, and interiors

- Factors driving this market include the increasing demand for lightweight materials to enhance fuel efficiency, stringent regulations on vehicle emissions and safety standards, and the growing trend towards electric vehicles, which require specialized metal components. Key players in this market include major metal producers, automotive manufacturers, and suppliers of metal components

What are the Major Takeaways of Car Manufacturing Market?

- Continuous technological advancements, including electric vehicles, autonomous driving technology, and connectivity features, stimulate market growth and innovation. Technological innovations are revolutionizing the automotive industry, from autonomous driving features to advanced infotainment systems

- Car manufacturers are investing heavily in research and development to stay competitive, leading to the integration of AI, IoT, and connectivity solutions into vehicles. These advancements enhance user experience and improve safety and efficiency

- North America dominated the car manufacturing market with the largest revenue share of 37.91% in 2024, driven by rising consumer interest in connected mobility solutions, advanced vehicle technologies, and adoption of electric and hybrid models

- Asia-Pacific (APAC) car manufacturing market is poised to record the fastest CAGR of 7.89% from 2025 to 2032, fueled by rapid urbanization, rising disposable incomes, and government support for electric and hybrid vehicles in China, Japan, and India

- The Steel segment dominated the car manufacturing market with the largest market revenue share of 52.6% in 2024, driven by its high strength, durability, cost-effectiveness, and wide adoption across conventional passenger cars and commercial vehicles

Report Scope and Car Manufacturing Market Segmentation

|

Attributes |

Car Manufacturing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Car Manufacturing Market?

Enhanced Connectivity and Autonomous Features

- A significant and accelerating trend in the global car manufacturing market is the integration of advanced connected vehicle technologies, artificial intelligence (AI), and semi- or fully autonomous driving features. These innovations are reshaping user experiences by improving convenience, safety, and driving efficiency

- For instance, Tesla’s latest models incorporate AI-driven autopilot systems and voice-assisted controls, enabling drivers to manage navigation, climate, and infotainment hands-free. Similarly, BMW and Mercedes-Benz integrate smart connectivity features that allow remote vehicle monitoring and advanced driver assistance functionalities

- AI-powered features such as predictive maintenance, adaptive cruise control, lane-keeping assist, and real-time traffic optimization are increasingly embedded in modern cars, making vehicles smarter, safer, and more responsive

- The seamless integration of vehicles with mobile apps, cloud platforms, and smart ecosystems allows users to control and monitor car functions remotely, including locking/unlocking, battery management, and route planning

- This trend toward intelligent, connected, and semi- or fully autonomous vehicles is fundamentally transforming consumer expectations. Consequently, leading companies such as Tesla, Ford, and Toyota are accelerating development of AI-driven and autonomous vehicle systems to meet growing demand

- The rising consumer preference for connected, safer, and autonomous cars is pushing manufacturers to invest heavily in AI, connectivity, and smart features, driving competitive innovation across the automotive industry

What are the Key Drivers of Car Manufacturing Market?

- The increasing adoption of electric vehicles (EVs), connected technologies, and autonomous features is a major driver of growth in the car manufacturing market, fueled by environmental concerns and government regulations promoting sustainability

- For instance, in March 2024, Tesla expanded deliveries of its fully electric and AI-enabled Cybertruck, highlighting the shift toward electric and autonomous pickup adoption. Such initiatives reflect the growing focus on eco-friendly, high-performance vehicles

- Rising consumer interest in vehicles offering enhanced safety, driver assistance, and intelligent connectivity is accelerating the transition from conventional ICE vehicles to advanced EVs and smart cars, particularly in North America, Europe, and China

- Convenience features such as fast charging, long-range batteries, integrated apps, and AI-enabled predictive maintenance make connected and electric vehicles highly attractive for both individual buyers and commercial fleets

- In addition, increasing investments in EV charging infrastructure, supportive government incentives, and falling battery costs are expected to further boost adoption and market penetration in the forecast period

Which Factor is Challenging the Growth of the Car Manufacturing Market?

- A major challenge restraining market growth is the high upfront cost of advanced vehicles equipped with autonomous, AI, and electric drivetrain technologies. Premium features significantly increase purchase prices, limiting accessibility for price-sensitive consumers

- For instance, fully autonomous models such as Tesla’s Full Self-Driving variant carry substantial price premiums, which may deter mass-market adoption despite technological advantages

- Concerns regarding cybersecurity, software vulnerabilities, and data privacy in connected and autonomous vehicles also hinder consumer confidence, as vehicles rely heavily on networked systems and cloud connectivity. Companies such as Tesla and BMW are focusing on encryption, secure software updates, and privacy safeguards to address these concerns

- Battery performance, charging infrastructure gaps, and long-term maintenance of EVs pose additional challenges, particularly in rural or developing regions. Consumers remain cautious about range limitations and infrastructure availability

- Overcoming these barriers through cost reduction, enhanced cybersecurity, infrastructure expansion, and ongoing innovation in battery and autonomous technologies will be crucial to sustaining growth in the car manufacturing market

How is the Car Manufacturing Market Segmented?

The market is segmented on the basis of material and application.

- By Material

On the basis of material, the car manufacturing market is segmented into Steel, Aluminum, and Composites. The Steel segment dominated the car manufacturing market with the largest market revenue share of 52.6% in 2024, driven by its high strength, durability, cost-effectiveness, and wide adoption across conventional passenger cars and commercial vehicles. Steel remains a preferred choice for automakers due to its structural integrity, ease of manufacturing, and compatibility with existing production lines.

The Aluminum segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing demand for lightweight vehicles that improve fuel efficiency and EV range. Aluminum is being widely adopted in electric and premium vehicles due to its strength-to-weight ratio and recyclability, enabling manufacturers to meet sustainability and performance goals.

- By Application

On the basis of application, the car manufacturing market is segmented into Passenger Cars, Commercial Vehicles, and Electric Vehicles. The Passenger Cars segment held the largest market revenue share of 61.4% in 2024, driven by high production volumes, consumer demand for personal mobility, and strong sales in emerging and developed markets. Passenger vehicles continue to dominate due to affordability, comfort, and the expanding middle-class population across major regions.

The Electric Vehicles segment is projected to witness the fastest CAGR from 2025 to 2032, driven by rising environmental awareness, government incentives, and growing consumer preference for zero-emission mobility solutions. Automakers are increasingly introducing electric models across passenger and commercial segments to capture this high-growth market opportunity.

Which Region Holds the Largest Share of the Car Manufacturing Market?

- North America dominated the car manufacturing market with the largest revenue share of 37.91% in 2024, driven by rising consumer interest in connected mobility solutions, advanced vehicle technologies, and adoption of electric and hybrid models

- Consumers in the region highly value fuel efficiency, safety features, autonomous driving capabilities, and integration with smart vehicle ecosystems

- This widespread adoption is further supported by high disposable incomes, strong automotive infrastructure, and the presence of leading global automakers, establishing Car Manufacturing as a major market segment in North America

U.S. Car Manufacturing Market Insight

U.S. car manufacturing market captured the largest revenue share of 81% in 2024 within North America, fueled by rapid adoption of electric vehicles (EVs), hybrid models, and connected car technologies. Consumers are increasingly prioritizing vehicles with advanced driver-assistance systems (ADAS), infotainment integration, and energy-efficient designs. The strong presence of automakers such as Tesla, Ford, and General Motors, along with government incentives for EV adoption, further drives the market’s expansion.

Europe Car Manufacturing Market Insight

Europe car manufacturing market is projected to grow at a substantial CAGR during the forecast period, driven by stringent emission regulations, government subsidies for EVs, and rising demand for premium and connected vehicles. Urbanization, technological adoption, and environmental awareness are boosting market penetration across passenger cars, commercial vehicles, and electric models. The region is witnessing strong growth in Germany, France, and the U.K., with automakers focusing on sustainable and technologically advanced vehicles.

U.K. Car Manufacturing Market Insight

U.K. car manufacturing market is expected to grow at a noteworthy CAGR, propelled by government initiatives to achieve net-zero emissions, increasing EV adoption, and growing consumer preference for connected and autonomous vehicles. The expansion of EV charging infrastructure and supportive policies for fleet electrification are encouraging both personal and commercial users to transition toward advanced vehicle technologies.

Germany Car Manufacturing Market Insight

Germany car manufacturing market is anticipated to expand at a considerable CAGR, driven by the country’s engineering expertise, strong presence of global OEMs, and emphasis on green mobility solutions. Germany’s advanced automotive R&D, coupled with adoption of electric and hybrid vehicles, supports long-term growth across passenger and commercial segments. The integration of connected technologies and automated driving systems is further strengthening market demand.

Which Region is the Fastest Growing Region in the Car Manufacturing Market?

Asia-Pacific (APAC) car manufacturing market is poised to record the fastest CAGR of 7.89% from 2025 to 2032, fueled by rapid urbanization, rising disposable incomes, and government support for electric and hybrid vehicles in China, Japan, and India. The region’s growing automotive manufacturing base and focus on smart and sustainable mobility solutions are driving widespread adoption of advanced passenger and commercial vehicles.

Japan Car Manufacturing Market Insight

Japan car manufacturing market is gaining momentum due to technological innovation, high consumer interest in EVs and hybrid models, and strong government support for sustainable transportation. Japanese automakers are emphasizing smart vehicle integration, autonomous driving features, and energy-efficient designs, driving demand across passenger and commercial segments.

China Car Manufacturing Market Insight

China car manufacturing market accounted for the largest revenue share within APAC in 2024, driven by the country’s expanding middle-class population, rapid urbanization, and aggressive EV policies. China is emerging as a global leader in EV production, with strong domestic manufacturers offering cost-effective and technologically advanced vehicles. The push for smart cities and widespread adoption of electric and hybrid vehicles continues to fuel market growth across multiple applications.

Which are the Top Companies in Car Manufacturing Market?

The car manufacturing industry is primarily led by well-established companies, including:

- Toyota Motor Corporation (Japan)

- Volkswagen AG (Germany)

- General Motors Company (U.S.)

- Ford Motor Company (U.S.)

- Honda Motor Co., Ltd. (Japan)

- Nissan Motor Corporation (Japan)

- Hyundai Motor Company (South Korea)

- BMW Group (Germany)

- Mercedes-Benz (Germany)

- Tesla, Inc. (U.S.)

- BYD Company Limited (China)

- Geely Automobile Holdings Ltd. (China)

- Tata Motors Limited (India)

- Renault Group (France)

- Suzuki Motor Corporation (Japan)

- Mazda Motor Corporation (Japan)

- Subaru Corporation (Japan)

- Kia Corporation (South Korea)

- Peugeot S.A. (France)

- Mitsubishi Motors Corporation (Japan)

- Chery Automobile Co., Ltd. (China)

- FCA Italy S.p.A. (Italy)

- SAIC Motor Corporation Limited (China)

- Dongfeng Motor Corporation (China)

What are the Recent Developments in Global Car Manufacturing Market?

- In April 2025, ABB (Switzerland) announced plans to spin off its Robotics division into a separately listed company by the second quarter of 2026, aiming to sharpen strategic focus, improve capital allocation, and unlock long-term value, positioning the Robotics unit to better leverage rising automation demand and accelerate market growth

- In February 2025, Dassault Systèmes (Germany) partnered with KUKA AG (Germany) to integrate its 3DEXPERIENCE platform into KUKA's mosaixx digital ecosystem, enhancing robotics and automation efficiency through virtual twin simulations and real-time data-driven design, which is expected to accelerate innovation across industries including automotive

- In November 2024, FANUC America Corporation, a subsidiary of FANUC CORPORATION (Japan), introduced the M-950iA/500, a high-performance industrial robot capable of lifting components up to 500 kg with a 2,830 mm reach and wide motion range, making it suitable for tight spaces and demanding tasks such as welding, drilling, and palletizing, further strengthening automation capabilities in automotive, EV, and construction sectors

- In October 2024, ABB (Switzerland) partnered with NAMTECH (India) to launch a School of Robotics in India, focusing on industry-specific curricula and hands-on training programs to cultivate a skilled workforce, which is expected to drive future growth in robotics and automation in the region

- In May 2024, ABB (Switzerland) launched the IRB 7710 SFX, a press tending robot for automotive stamping lines capable of handling up to 15 strokes per minute with tilt and shift capabilities, powered by the OmniCore controller to deliver faster cycle times and up to 30% energy savings, enhancing efficiency and sustainability in manufacturing operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.