Global Car Rental Market

Market Size in USD Billion

CAGR :

%

USD

124.31 Billion

USD

347.23 Billion

2024

2032

USD

124.31 Billion

USD

347.23 Billion

2024

2032

| 2025 –2032 | |

| USD 124.31 Billion | |

| USD 347.23 Billion | |

|

|

|

|

Car Rental Market Size

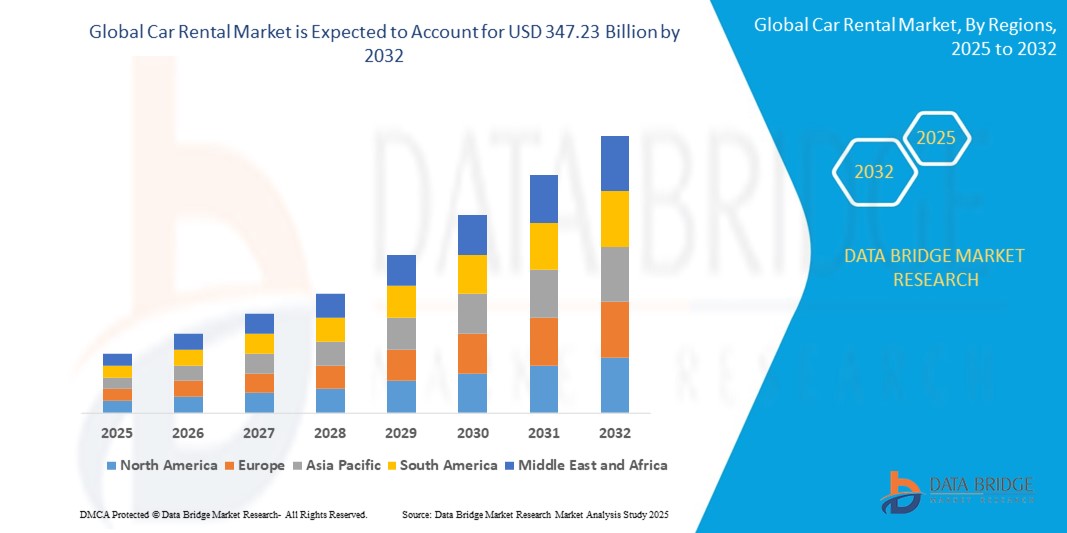

- The global car rental market was valued at USD 124.31 billion in 2024 and is expected to reach USD 347.23 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 13.70%, primarily driven by rapid growth of urbanization, increasing tourism activities, and the expanding need for on-demand transportation solutions

- This growth is driven by rising disposable incomes, the growing preference for cost-effective mobility, and the widespread adoption of app-based booking platforms are fueling market expansion

Car Rental Market Analysis

- The car rental market is experiencing significant growth, driven by the rising need for cost-effective personal mobility, increased tourism, and the widespread adoption of digital booking platforms and mobile applications

- The surge in environmental awareness is prompting rental companies to expand electric and hybrid vehicle fleets, while flexible subscription models and corporate rental solutions are catering to changing consumer preferences

- North America dominates the car rental market due to a well-established tourism industry, advanced digital infrastructure, and the strong presence of key market players offering innovative rental services

- For instance, in the U.S., companies such as Enterprise Holdings and Hertz are expanding their EV fleets and introducing AI-based vehicle tracking for enhanced customer experience

- Asia-Pacific is projected to register the highest CAGR, fueled by rapid urbanization, rising disposable incomes, and increasing government investments in smart mobility and transportation infrastructure

- Emerging trends such as contactless rentals, shared mobility services, and partnerships with ride-hailing platforms are reshaping the car rental landscape, offering both convenience and scalability to meet future transportation demands

Report Scope and Car Rental Market Segmentation

|

Attributes |

Car Rental Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to tfhe insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand |

Car Rental Market Trends

“Integration of Electric Vehicles (EVs) into Rental Fleets”

- A major trend shaping the car rental market is the increasing integration of electric vehicles (EVs) into rental fleets, driven by rising environmental concerns and supportive government policies on carbon emissions

- Rental companies are investing heavily in EV infrastructure, including fast-charging stations and telematics systems, to support seamless customer experiences and operational efficiency

- For instance, in September 2023, Hertz announced a large-scale partnership with Tesla and Polestar to add over 100,000 EVs to its rental fleet globally, targeting both leisure and business travelers

- Technological innovations such as mobile apps for EV rentals, AI-powered vehicle diagnostics, and real-time battery monitoring are being adopted to streamline the EV rental process

- This trend is redefining the car rental industry by promoting sustainable mobility, meeting regulatory compliance, and attracting eco-conscious consumers, ultimately ensuring a future-ready and resilient business model.

Car Rental Market Dynamics

Driver

“Increasing Demand for On-Demand Mobility and Digital Booking Platforms”

- The car rental market is experiencing significant growth fueled by the rising consumer preference for on-demand mobility, especially among urban populations seeking cost-effective and flexible transportation alternatives

- The widespread availability of smartphones and mobile apps has simplified the car rental process, allowing users to book, unlock, and manage vehicles digitally, increasing convenience and accessibility

- For instance, in June 2024, Zoomcar expanded its app-based rental platform to over 30 cities in India, offering keyless entry and real-time vehicle tracking to enhance the user experience

- Travel aggregators and rental companies are integrating AI and data analytics to personalize rental recommendations, optimize fleet usage, and streamline customer service across platforms

- This driver is expected to further propel the car rental market by improving operational efficiency, enabling user-centric services, and strengthening the digital transformation of the transportation sector

Opportunity

“Expansion of Tourism and Business Travel in Emerging Economies”

- The car rental market is set to benefit significantly from the rapid growth of tourism and business travel in emerging economies, where rising disposable incomes and improved transportation infrastructure are driving rental service demand

- Government-led initiatives promoting tourism, coupled with increased airline connectivity and the growth of ride-hailing alternatives, are contributing to a surge in short-term and long-term vehicle rentals in developing regions

- For instance, in December 2024, MakeMyTrip expanded its car rental offerings across Tier II and Tier III cities in India to support the booming domestic travel segment and rising demand for self-drive options

- Global rental players are entering joint ventures and partnerships with local mobility providers to tap into these high-growth regions, introducing app-based platforms, multilingual customer support, and diverse vehicle fleets to cater to regional needs

- This opportunity is expected to accelerate the global expansion of the car rental market by capturing untapped customer bases, encouraging cross-border collaborations, and supporting tourism-driven economic growth

Restraint/Challenge

“Regulatory and Licensing Complexities in Car Rental Operations”

- The car rental market faces significant challenges due to the varying regulatory frameworks and licensing requirements across different regions and countries, which complicate expansion and operational consistency for rental service providers

- Differences in insurance mandates, vehicle registration norms, environmental regulations, and road safety laws make it difficult for companies to establish standardized business models and manage cross-border fleets efficiently

- For instance, in July 2024, a major U.S.-based rental company faced operational delays in Southeast Asia due to complications in meeting local licensing and emissions compliance requirements for its fleet vehicles

- In addition, inconsistent taxation policies and lack of unified digital infrastructure across regions further impact pricing transparency, customer experience, and service delivery, especially for international travelers

- Addressing these regulatory challenges will be crucial to ensuring seamless operations, enabling global scalability, and fostering a more competitive and customer-friendly car rental ecosystem

Car Rental Market Scope

The market is segmented on the basis of type, application, booking, end-use, fair price, and rental length.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Application |

|

|

By Booking |

|

|

By End-Use

|

|

|

By Fare Price |

|

|

By Rental Length |

|

Car Rental Market Regional Analysis

“North America is the Dominant Region in the Car Rental Market”

- Sophisticated technological infrastructure in North America enables rapid adoption and integration of advanced market solutions

- Widespread implementation of smart city initiatives drives innovation in urban planning, energy management, and public services across the region

- Strong presence of leading industry players and a thriving research ecosystem fosters continuous development and commercialization of emerging technologies

- These combined factors position North America as a dominant market leader, offering abundant opportunities for innovation, investment, and sustained growth

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Rapid urbanization and extensive infrastructure development across countries such as China, Japan, and India are driving the need for advanced security solutions such as infrared biometrics

- Thriving automotive and consumer electronics industries in the region are significantly contributing to the rising demand for integrated biometric technologies

- Supportive government policies and smart city initiatives are accelerating investments in infrared biometric systems for enhanced public safety and efficiency

- These combined factors position Asia-Pacific as a high-growth region in the infrared biometrics market, paving the way for widespread adoption and technological advancement

Car Rental Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Avis Budget Group (U.S.)

- Sixt (Germany)

- Enterprise Holdings, Inc (U.S.)

- Europcar (France)

- Localiza (Brazil)

- The Hertz Corporation (U.S.)

- Carzonrent India Pvt Ltd (India)

- ECO Mobility (India)

- Advantage (U.S.)

- Bettercar Rental LLC (U.A.E.) (Dubai)

- Zoomcar Ltd (India)

Latest Developments in Global Car Rental Market

- In November 2023, MakeMyTrip made a strategic entry into the car rental space by acquiring Savaari, an Indian intercity car rental company, through a small ticket investment to broaden its travel services portfolio. This move strengthens MakeMyTrip’s presence in the domestic mobility segment and positions it for integrated travel offerings

- In August 2023, Avis Budget Group partnered with Albatha Automotive Group to bring the Budget Rent a Car and Payless Car Rental brands under Albatha’s mobility division, offering both self-drive and chauffeur-driven rental and leasing services for passenger and commercial vehicles. This collaboration boosts brand visibility and service diversification across the Gulf region

- In March 2023, IndusGo, supported by its parent company Indus Motors, raised INR 200 crore to expand its self-drive car rental services from South India to Bengaluru and Hyderabad, reinforcing its presence in key urban markets. The funding allows IndusGo to accelerate growth and strengthen regional competitiveness

- In April 2022, SIXT expanded its operations in the U.S. by opening new branches in Charlotte and Baltimore, aiming to enhance rental accessibility and convenience on the East Coast as part of its global expansion strategy. This initiative reinforces SIXT’s footprint in a competitive and high-demand rental market

- In May 2021, Uber introduced Uber Rent in Washington DC, marking its foray into the car rental space, along with the expansion of Uber Reserve to major U.S. airports, with initial services focused on the capital city. These launches reflect Uber’s intent to diversify mobility services and offer end-to-end travel solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL CAR RENTAL MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL CAR RENTAL MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMAPANY MARKET SHARE ANALYSIS

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 STANDARDS OF MEASUREMENT

2.2.8 VENDOR SHARE ANALYSIS

2.2.9 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.10 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL CAR RENTAL MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHT

5.1 PORTERS FIVE FORCES

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL TRENDS

5.4 PATENT ANALYSIS

5.5 CASE STUDY

5.6 VALUE CHAIN ANALYSIS

5.7 COMPANY COMPARITIVE ANALYSIS

5.8 PRICING CATEGORY

6 GLOBAL CAR RENTAL MARKET, BY VEHICLE TYPE

6.1 OVERVIEW

6.2 LUXURY CAR

6.2.1 BY TYPE

6.2.1.1. SPORTS UTILITY VEHICLE (SUV)

6.2.1.1.1. MID SIZE

6.2.1.1.2. FULL SIZE

6.2.1.1.3. STANDARD SUV

6.2.1.2. MULTI UTILITY VEHICLE (MUV)

6.2.1.3. MINIVAN

6.2.1.4. COVERTIBLE

6.3 EXECUTIVE CAR

6.3.1 BY TYPE

6.3.1.1. SPORTS UTILITY VEHICLE (SUV)

6.3.1.1.1. MID SIZE

6.3.1.1.2. FULL SIZE

6.3.1.1.3. STANDARD SUV

6.3.1.2. MULTI UTILITY VEHICLE (MUV)

6.3.1.3. MINIVAN

6.3.1.4. CONVERTIBLE

6.4 ECONOMICAL CAR

6.4.1 BY TYPE

6.4.1.1. SPORTS UTILITY VEHICLE (SUV)

6.4.1.1.1. MID SIZE

6.4.1.1.2. FULL SIZE

6.4.1.1.3. STANDARD SUV

6.4.1.2. MULTI UTILITY VEHICLE (MUV)

6.4.1.3. MINIVAN

6.4.1.4. CONVERTIBLE

6.5 JEEPS

6.6 VANS

6.7 OTHERS

7 GLOBAL CAR RENTAL MARKET, BY BOOKING TYPE

7.1 OVERVIEW

7.2 OFFLINE ACCESS

7.3 ONLINE ACCESS

8 GLOBAL CAR RENTAL MARKET, BY UTILITY TYPE

8.1 OVERVIEW

8.2 SELF-DRIVE

8.2.1 BY VEHICLE TYPE

8.2.1.1. LUXURY CAR

8.2.1.2. EXECUTIVE CAR

8.2.1.3. ECONOMICAL CAR

8.2.1.4. JEEPS

8.2.1.5. VANS

8.2.1.6. OTHERS

8.3 CHAUFFEUR DRIVE

8.3.1 BY VEHICLE TYPE

8.3.1.1. LUXURY CAR

8.3.1.2. EXECUTIVE CAR

8.3.1.3. ECONOMICAL CAR

8.3.1.4. JEEPS

8.3.1.5. VANS

8.3.1.6. OTHERS

9 GLOBAL CAR RENTAL MARKET, BY RENTAL TYPE

9.1 OVERVIEW

9.2 DAILY BASIS FEE

9.3 HOURLY BASIS

9.4 OTHERS

10 GLOBAL CAR RENTAL MARKET, BY RENTAL PERIOD

10.1 OVERVIEW

10.2 SHORT TERM

10.3 LONG TERM

11 GLOBAL CAR RENTAL MARKET, BY PURPOSE

11.1 OVERVIEW

11.2 LEISURE

11.3 COMMERCIAL

12 GLOBAL CAR RENTAL MARKET, BY NUMBER OF SEATS

12.1 OVERVIEW

12.2 4 SEATS

12.3 4 TO 7 SEATS

12.4 MORE THAN7 SEATS

13 GLOBAL CAR RENTAL MARKET, BY BAGS/SUITCASES

13.1 OVERVIEW

13.2 ONE TO THREE SUITCASE

13.3 MORE THAN THREE SUITCASE

14 GLOBAL CAR RENTAL MARKET, BY BOOKING SYSTEM TYPE

14.1 OVERVIEW

14.2 SELF OWNED

14.3 PARTHNERSHIP

14.4 HYBRID

15 GLOBAL CAR RENTAL MARKET, BY APPLICATION

15.1 OVERVIEW

15.2 LOCAL USAGE

15.2.1 BY VEHICLE TYPE

15.2.1.1. LUXURY CAR

15.2.1.2. EXECUTIVE CAR

15.2.1.3. ECONOMICAL CAR

15.2.1.4. JEEPS

15.2.1.5. VANS

15.2.1.6. OTHERS

15.2.2 BY BOOKING TYPE

15.2.2.1. OFFLINE ACCESS

15.2.2.2. ONLINE ACCESS

15.3 AIRPORT

15.3.1 BY VEHICLE TYPE

15.3.1.1. LUXURY CAR

15.3.1.2. EXECUTIVE CAR

15.3.1.3. ECONOMICAL CAR

15.3.1.4. JEEPS

15.3.1.5. VANS

15.3.1.6. OTHERS

15.3.2 BY BOOKING TYPE

15.3.2.1. OFFLINE ACCESS

15.3.2.2. ONLINE ACCESS

15.4 TRANSPORT

15.4.1 BY VEHICLE TYPE

15.4.1.1. LUXURY CAR

15.4.1.2. EXECUTIVE CAR

15.4.1.3. ECONOMICAL CAR

15.4.1.4. JEEPS

15.4.1.5. VANS

15.4.1.6. OTHERS

15.4.2 BY BOOKING TYPE

15.4.2.1. OFFLINE ACCESS

15.4.2.2. ONLINE ACCESS

15.5 OUTSTATION

15.5.1 BY VEHICLE TYPE

15.5.1.1. LUXURY CAR

15.5.1.2. EXECUTIVE CAR

15.5.1.3. ECONOMICAL CAR

15.5.1.4. JEEPS

15.5.1.5. VANS

15.5.1.6. OTHERS

15.5.2 BY TYPE

15.5.2.1. WEEKEND GATEWAYS

15.5.2.2. BUSINESS TRIPS

15.5.2.3. ROAD TRIPS

15.5.2.4. PILGRIMAGE

15.5.3 BY BOOKING TYPE

15.5.3.1. OFFLINE ACCESS

15.5.3.2. ONLINE ACCESS

16 GLOBAL CAR RENTAL MARKET, BY PROPULSION TYPE

16.1 OVERVIEW

16.2 INTERNAL COMBUSTION ENGINE (ICE)

16.2.1 PETROL

16.2.2 DIESEL

16.2.3 LPG

16.2.4 CNG

16.3 ELECTRIC ENGINE

16.3.1 BATTERY ELECTRIC VEHICLES (BEVS)

16.3.2 HYBRID ELECTRIC VEHICLES (HEVS)

16.3.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEV)

16.3.4 FUEL CELL ELECTRIC VEHICLES

17 GLOBAL CAR RENTAL MARKET, BY TRANSMISSION TYPE

17.1 OVERVIEW

17.2 AUTOMATIC

17.3 MANUAL

18 GLOBAL CAR RENTAL MARKET, BY GEOGRAPHY

GLOBAL CAR RENTAL MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

18.1 NORTH AMERICA

18.1.1 U.S.

18.1.2 CANADA

18.1.3 MEXICO

18.2 EUROPE

18.2.1 GERMANY

18.2.2 FRANCE

18.2.3 U.K.

18.2.4 ITALY

18.2.5 SPAIN

18.2.6 RUSSIA

18.2.7 TURKEY

18.2.8 BELGIUM

18.2.9 NETHERLANDS

18.2.10 NORWAY

18.2.11 FINLAND

18.2.12 SWITZERLAND

18.2.13 DENMARK

18.2.14 SWEDEN

18.2.15 POLAND

18.2.16 REST OF EUROPE

18.3 ASIA PACIFIC

18.3.1 JAPAN

18.3.2 CHINA

18.3.3 SOUTH KOREA

18.3.4 INDIA

18.3.5 AUSTRALIA

18.3.6 NEW ZEALAND

18.3.7 SINGAPORE

18.3.8 THAILAND

18.3.9 MALAYSIA

18.3.10 INDONESIA

18.3.11 PHILIPPINES

18.3.12 TAIWAN

18.3.13 VIETNAM

18.3.14 REST OF ASIA PACIFIC

18.4 SOUTH AMERICA

18.4.1 BRAZIL

18.4.2 ARGENTINA

18.4.3 REST OF SOUTH AMERICA

18.5 MIDDLE EAST AND AFRICA

18.5.1 SOUTH AFRICA

18.5.2 EGYPT

18.5.3 SAUDI ARABIA

18.5.4 U.A.E

18.5.5 OMAN

18.5.6 BAHRAIN

18.5.7 ISRAEL

18.5.8 KUWAIT

18.5.9 QATAR

18.5.10 REST OF MIDDLE EAST AND AFRICA

18.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

19 GLOBAL CAR RENTAL MARKET,COMPANY LANDSCAPE

19.1 COMPANY SHARE ANALYSIS: GLOBAL

19.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

19.3 COMPANY SHARE ANALYSIS: EUROPE

19.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

19.5 MERGERS & ACQUISITIONS

19.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

19.7 EXPANSIONS

19.8 REGULATORY CHANGES

19.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

20 GLOBAL CAR RENTAL MARKET, SWOT & DBMR ANALYSIS

21 GLOBAL CAR RENTAL MARKET, COMPANY PROFILE

21.1 KAYAK (A PART OF BOOKING HOLDINGS INC.)

21.1.1 COMPANY SNAPSHOT

21.1.2 REVENUE ANALYSIS

21.1.3 GEOGRAPHIC PRESENCE

21.1.4 PRODUCT PORTFOLIO

21.1.5 RECENT DEVELOPMENT

21.2 EXPEDIA GROUP, INC

21.2.1 COMPANY SNAPSHOT

21.2.2 REVENUE ANALYSIS

21.2.3 GEOGRAPHIC PRESENCE

21.2.4 PRODUCT PORTFOLIO

21.2.5 RECENT DEVELOPMENT

21.3 AVIS CAR RENTAL, LLC

21.3.1 COMPANY SNAPSHOT

21.3.2 REVENUE ANALYSIS

21.3.3 GEOGRAPHIC PRESENCE

21.3.4 PRODUCT PORTFOLIO

21.3.5 RECENT DEVELOPMENT

21.4 HERTZ

21.4.1 COMPANY SNAPSHOT

21.4.2 REVENUE ANALYSIS

21.4.3 GEOGRAPHIC PRESENCE

21.4.4 PRODUCT PORTFOLIO

21.4.5 RECENT DEVELOPMENT

21.5 SIXT

21.5.1 COMPANY SNAPSHOT

21.5.2 REVENUE ANALYSIS

21.5.3 GEOGRAPHIC PRESENCE

21.5.4 PRODUCT PORTFOLIO

21.5.5 RECENT DEVELOPMENT

21.6 ENTERPRISE HOLDINGS, INC (ALAMO)

21.6.1 COMPANY SNAPSHOT

21.6.2 REVENUE ANALYSIS

21.6.3 GEOGRAPHIC PRESENCE

21.6.4 PRODUCT PORTFOLIO

21.6.5 RECENT DEVELOPMENT

21.7 TURO

21.7.1 COMPANY SNAPSHOT

21.7.2 REVENUE ANALYSIS

21.7.3 GEOGRAPHIC PRESENCE

21.7.4 PRODUCT PORTFOLIO

21.7.5 RECENT DEVELOPMENT

21.8 UBER TECHNOLOGIES INC.

21.8.1 COMPANY SNAPSHOT

21.8.2 REVENUE ANALYSIS

21.8.3 GEOGRAPHIC PRESENCE

21.8.4 PRODUCT PORTFOLIO

21.8.5 RECENT DEVELOPMENT

21.9 EUROPCAR

21.9.1 COMPANY SNAPSHOT

21.9.2 REVENUE ANALYSIS

21.9.3 GEOGRAPHIC PRESENCE

21.9.4 PRODUCT PORTFOLIO

21.9.5 RECENT DEVELOPMENT

21.1 GETAROUND, INC.

21.10.1 COMPANY SNAPSHOT

21.10.2 REVENUE ANALYSIS

21.10.3 GEOGRAPHIC PRESENCE

21.10.4 PRODUCT PORTFOLIO

21.10.5 RECENT DEVELOPMENT

21.11 LOCAUTO GROUP

21.11.1 COMPANY SNAPSHOT

21.11.2 REVENUE ANALYSIS

21.11.3 GEOGRAPHIC PRESENCE

21.11.4 PRODUCT PORTFOLIO

21.11.5 RECENT DEVELOPMENT

21.12 AUTO EUROPE

21.12.1 COMPANY SNAPSHOT

21.12.2 REVENUE ANALYSIS

21.12.3 GEOGRAPHIC PRESENCE

21.12.4 PRODUCT PORTFOLIO

21.12.5 RECENT DEVELOPMENT

21.13 DRIVENOW

21.13.1 COMPANY SNAPSHOT

21.13.2 REVENUE ANALYSIS

21.13.3 GEOGRAPHIC PRESENCE

21.13.4 PRODUCT PORTFOLIO

21.13.5 RECENT DEVELOPMENT

21.14 DRIVAR

21.14.1 COMPANY SNAPSHOT

21.14.2 REVENUE ANALYSIS

21.14.3 GEOGRAPHIC PRESENCE

21.14.4 PRODUCT PORTFOLIO

21.14.5 RECENT DEVELOPMENT

21.15 ZOOMCAR LTD.

21.15.1 COMPANY SNAPSHOT

21.15.2 REVENUE ANALYSIS

21.15.3 GEOGRAPHIC PRESENCE

21.15.4 PRODUCT PORTFOLIO

21.15.5 RECENT DEVELOPMENT

21.16 REVV

21.16.1 COMPANY SNAPSHOT

21.16.2 REVENUE ANALYSIS

21.16.3 GEOGRAPHIC PRESENCE

21.16.4 PRODUCT PORTFOLIO

21.16.5 RECENT DEVELOPMENT

21.17 VIRTUO

21.17.1 COMPANY SNAPSHOT

21.17.2 REVENUE ANALYSIS

21.17.3 GEOGRAPHIC PRESENCE

21.17.4 PRODUCT PORTFOLIO

21.17.5 RECENT DEVELOPMENT

21.18 RENTIS S.A.

21.18.1 COMPANY SNAPSHOT

21.18.2 REVENUE ANALYSIS

21.18.3 GEOGRAPHIC PRESENCE

21.18.4 PRODUCT PORTFOLIO

21.18.5 RECENT DEVELOPMENT

21.19 FOX RENT A CAR

21.19.1 COMPANY SNAPSHOT

21.19.2 REVENUE ANALYSIS

21.19.3 GEOGRAPHIC PRESENCE

21.19.4 PRODUCT PORTFOLIO

21.19.5 RECENT DEVELOPMENT

21.2 TOYOTA

21.20.1 COMPANY SNAPSHOT

21.20.2 REVENUE ANALYSIS

21.20.3 GEOGRAPHIC PRESENCE

21.20.4 PRODUCT PORTFOLIO

21.20.5 RECENT DEVELOPMENT

21.21 ALPHA COMPANIES

21.21.1 COMPANY SNAPSHOT

21.21.2 REVENUE ANALYSIS

21.21.3 GEOGRAPHIC PRESENCE

21.21.4 PRODUCT PORTFOLIO

21.21.5 RECENT DEVELOPMENT

21.22 RENTACHEAPIE

21.22.1 COMPANY SNAPSHOT

21.22.2 REVENUE ANALYSIS

21.22.3 GEOGRAPHIC PRESENCE

21.22.4 PRODUCT PORTFOLIO

21.22.5 RECENT DEVELOPMENT

21.23 FIREFLY

21.23.1 COMPANY SNAPSHOT

21.23.2 REVENUE ANALYSIS

21.23.3 GEOGRAPHIC PRESENCE

21.23.4 PRODUCT PORTFOLIO

21.23.5 RECENT DEVELOPMENT

21.24 TEMPEST

21.24.1 COMPANY SNAPSHOT

21.24.2 REVENUE ANALYSIS

21.24.3 GEOGRAPHIC PRESENCE

21.24.4 PRODUCT PORTFOLIO

21.24.5 RECENT DEVELOPMENT

21.25 FIRST CAR RENTAL

21.25.1 COMPANY SNAPSHOT

21.25.2 REVENUE ANALYSIS

21.25.3 GEOGRAPHIC PRESENCE

21.25.4 PRODUCT PORTFOLIO

21.25.5 RECENT DEVELOPMENT

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

22 CONCLUSION

23 QUESTIONNAIRE

24 RELATED REPORTS

25 ABOUT DATA BRIDGE MARKET RESEARCH

Global Car Rental Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Car Rental Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Car Rental Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.