Global Cardiac Valve Market

Market Size in USD Billion

CAGR :

%

USD

12.64 Billion

USD

30.20 Billion

2024

2032

USD

12.64 Billion

USD

30.20 Billion

2024

2032

| 2025 –2032 | |

| USD 12.64 Billion | |

| USD 30.20 Billion | |

|

|

|

|

Cardiac Valve Market Size

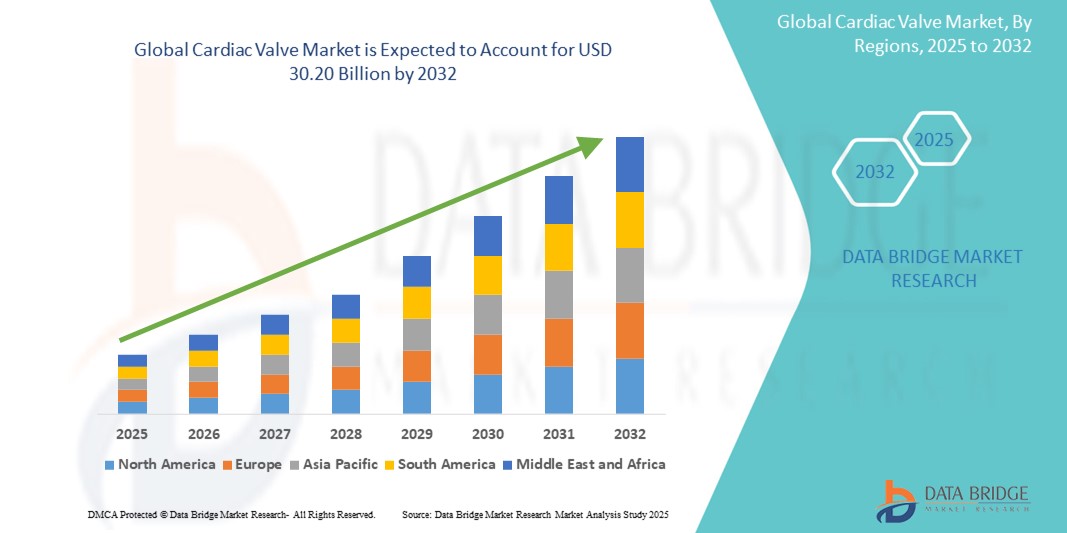

- The global cardiac valve market size was valued at USD 12.64 billion in 2024 and is expected to reach USD 30.20 billion by 2032, at a CAGR of 11.50% during the forecast period

- The market growth is largely fueled by the rising prevalence of cardiovascular diseases and the increasing number of aging individuals requiring valve replacement procedures, coupled with innovations in transcatheter valve technologies

- Furthermore, advancements in minimally invasive surgical techniques and growing patient preference for less invasive treatment options are positioning cardiac valves as a critical solution in cardiac care. These converging factors are accelerating the adoption of cardiac valve interventions, thereby significantly boosting the industry's growth

Cardiac Valve Market Analysis

- Cardiac ardiac valves, which regulate blood flow through the heart’s chambers, are becoming increasingly crucial in cardiovascular treatment due to their role in addressing valve dysfunctions such as stenosis and regurgitation, with both mechanical and tissue valves used in surgical and transcatheter procedures across global healthcare systems

- The rising demand for cardiac valve interventions is primarily driven by the increasing prevalence of heart valve diseases, aging populations, and growing awareness of minimally invasive procedures that reduce recovery time and surgical risks

- North America dominated the cardiac valve market with the largest revenue share of 39.2% in 2024, attributed to advanced healthcare infrastructure, a high burden of cardiovascular diseases, and the early adoption of next-generation valve technologies, especially in the United States, where favorable reimbursement policies and high surgical volumes further support market growth

- Asia-Pacific is expected to be the fastest growing region in the cardiac valve market during the forecast period due to expanding healthcare access, increasing healthcare expenditure, and rising demand for valve repair and replacement procedures

- Transcatheter heart valve segment dominated the cardiac valve market with a market share of 42.1% in 2024, driven by its rapid adoption as a less invasive alternative to open-heart surgery, particularly for high-risk and elderly patients

Report Scope and Cardiac Valve Market Segmentation

|

Attributes |

Cardiac Valve Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cardiac Valve Market Trends

“Rise of Transcatheter Valve Therapies and Minimally Invasive Innovations”

- A significant and accelerating trend in the global cardiac valve market is the growing shift toward transcatheter valve therapies, particularly Transcatheter Aortic Valve Replacement (TAVR), driven by innovations that allow for less invasive treatment of valvular heart diseases, especially in high-risk and elderly patient populations

- For instance, Edwards Lifesciences’ SAPIEN 3 Ultra and Medtronic’s Evolut PRO+ systems offer enhanced deliverability and durability, allowing cardiologists to perform precise valve replacements without open-heart surgery. These devices are becoming the standard of care in many regions for patients deemed ineligible for traditional surgical approaches

- The trend is reinforced by continuous R&D into next-generation bioprosthetic valves, improved delivery systems, and expanded clinical indications. Companies such as Abbott are investing in minimally invasive mitral and tricuspid valve repair and replacement solutions, such as the MitraClip and TriClip systems, which aim to treat structural heart conditions with lower procedural risks

- In addition, the integration of AI and imaging technologies, such as 3D echocardiography and CT-based planning, is enhancing patient selection and procedural accuracy, thereby improving clinical outcomes. AI-driven imaging platforms now assist clinicians in pre-procedural planning, enabling better assessment of anatomical suitability for transcatheter interventions

- This trend towards minimally invasive, image-guided, and patient-specific valve therapies is reshaping physician and patient expectations for cardiac care. As a result, companies such as JenaValve and Boston Scientific are developing valve systems tailored for broader patient groups, including those with mixed or complex valve disease

- The demand for transcatheter and minimally invasive cardiac valve procedures is growing rapidly across both developed and emerging markets, fueled by aging populations, higher diagnosis rates, and a clinical shift toward procedures that reduce hospitalization time and improve post-operative recovery

Cardiac Valve Market Dynamics

Driver

“Increasing Burden of Valvular Heart Disease and Aging Population”

- The rising global prevalence of valvular heart diseases—particularly aortic stenosis and mitral regurgitation—combined with an aging population base, is a primary driver for the growing demand for cardiac valve interventions

- For instance, in February 2024, Edwards Lifesciences received CE Mark approval for its latest TAVR system designed to treat aortic stenosis in intermediate-risk patients, extending the therapy to a broader population. Such developments are expected to propel the cardiac valve market in the coming years

- As populations age, the number of individuals diagnosed with degenerative valve disorders continues to rise, increasing the clinical demand for both surgical and transcatheter valve replacements and repairs

- Moreover, advancements in valve technology, greater availability of specialized cardiac centers, and improved screening tools are enhancing treatment accessibility and driving procedural volumes globally

- Patient preference for minimally invasive therapies, faster recovery times, and improved quality of life also fuels the uptake of advanced valve systems. This is particularly evident in high-income countries with mature healthcare infrastructure and favorable reimbursement pathways

- In addition, initiatives promoting early diagnosis and cardiovascular health awareness are expected to further boost demand, particularly in regions where the disease burden is high but historically underdiagnosed

Restraint/Challenge

“High Cost of Procedures and Limited Access in Developing Regions”

- Despite rapid technological advancement, the high cost of cardiac valve replacement procedures—particularly transcatheter options—remains a major barrier to widespread adoption, especially in low- and middle-income countries with constrained healthcare budgets

- For instance, the average cost of a TAVR procedure in the U.S. can exceed USD 40,000, including the valve, hospital stay, and associated diagnostics, making it unaffordable for many patients in the absence of robust insurance or government coverage

- In several emerging markets, lack of specialized infrastructure, trained interventional cardiologists, and public funding limits access to advanced valve therapies. Consequently, many patients either remain untreated or undergo more invasive procedures with longer recovery times

- Regulatory hurdles, slower device approvals, and disparities in reimbursement policies further compound the issue, delaying the introduction of newer, safer valve technologies in resource-limited settings

- Overcoming these challenges requires collaborative efforts between manufacturers, governments, and healthcare providers to reduce device costs, expand clinical training programs, and improve patient access through innovative financing models and public health initiatives aimed at early diagnosis and treatment

Cardiac Valve Market Scope

The market is segmented on the basis of treatment, type, valve position, and end-user.

- By Treatment

On the basis of treatment, the cardiac valve market is segmented into cardiac valve repair and cardiac valve replacement. The cardiac valve replacement segment dominated the market with the largest revenue share in 2024, primarily due to the rising prevalence of valvular heart diseases such as aortic stenosis and mitral regurgitation, particularly among aging populations

The cardiac valve repair segment is projected to witness the fastest growth rate from 2025 to 2032, fueled by the increasing adoption of minimally invasive surgical procedures and a growing preference for valve-preserving approaches. Improved diagnostic techniques and surgical tools have enhanced the success rates of repairs, especially for younger and lower-risk patients seeking long-term durability without the complications associated with prosthetic valves.

- By Type

On the basis of type, the cardiac valve market is segmented into mechanical valves, tissue/bioprosthetic valves, transcatheter heart valves (THV)/percutaneous heart valves, and others. The transcatheter heart valves segment held the largest market share of 42.1% in 2024 due to its minimally invasive nature and growing acceptance among high-risk and elderly patient groups who are ineligible for open-heart surgery. Transcatheter procedures, such as TAVR (Transcatheter Aortic Valve Replacement), offer shorter recovery times and reduced surgical risks, accelerating adoption across developed markets.

The tissue/bioprosthetic valves segment is expected to witness the fastest CAGR from 2025 to 2032, owing to increasing preference among patients for valves that do not require lifelong anticoagulation. Advances in material science and valve design are improving the durability of bioprosthetic valves, making them a more attractive option for middle-aged patients as well.

- By Valve Position

On the basis of valve position, the cardiac valve market is segmented into mitral valve, aortic valve, and other positions. The aortic valve segment accounted for the largest revenue share in 2024, driven by the high incidence of aortic valve stenosis and the rapid adoption of TAVR procedures in both developed and emerging healthcare systems. Aortic valve interventions are among the most commonly performed due to the critical function of this valve and the availability of advanced replacement solutions.

The mitral valve segment is projected to grow at the fastest rate from 2025 to 2032, as innovative transcatheter mitral valve repair and replacement (TMVR) technologies gain traction. Growing awareness and detection of mitral valve regurgitation, coupled with improved imaging techniques, are expanding the eligible patient pool for mitral interventions.

- By End User

On the basis of end-user, the cardiac valve market is segmented into hospitals and clinics, specialty centers, cardiac research institutes, and others. The hospitals and clinics segment led the market with the largest share in 2024, as the majority of cardiac surgeries and valve replacement procedures are performed in these settings. The availability of advanced diagnostic and surgical infrastructure, along with reimbursement support for in-patient procedures, makes hospitals the primary hub for valve treatment.

The cardiac research institute segment is anticipated to register the highest CAGR during the forecast period, driven by increased investment in clinical trials and research for next-generation cardiac valve therapies. These institutes play a critical role in early-stage adoption of cutting-edge valve technologies and often serve as centers of excellence for training and innovation.

Cardiac Valve Market Regional Analysis

- North America dominated the cardiac valve market with the largest revenue share of 39.2% in 2024, attributed to advanced healthcare infrastructure, a high burden of cardiovascular diseases, and the early adoption of next-generation valve technologies, especially in the United States, where favorable reimbursement policies and high surgical volumes further support market growth

- The region benefits from well-established healthcare infrastructure, increased awareness about valvular disorders, and favorable reimbursement policies that support both traditional and minimally invasive cardiac interventions

- In addition, the presence of major medical device companies, high healthcare spending, and continued innovation in transcatheter valve technologies further contribute to North America's market leadership, positioning it as a hub for both clinical adoption and technological advancement

U.S. Cardiac Valve Market Insight

The U.S. cardiac valve market captured the largest revenue share of 79.4% in North America in 2024, driven by the high incidence of valvular heart diseases, rapid adoption of transcatheter valve procedures, and robust healthcare infrastructure. The widespread availability of advanced diagnostic and surgical technologies, along with favorable reimbursement policies, has accelerated patient access to valve repair and replacement procedures. Furthermore, strong clinical research support, FDA approvals for innovative valve devices, and growing awareness among patients and practitioners continue to propel market growth.

Europe Cardiac Valve Market Insight

The Europe cardiac valve market is projected to grow at a healthy CAGR during the forecast period, bolstered by an aging population and rising prevalence of cardiovascular disorders. Increased investments in minimally invasive cardiac surgeries, particularly transcatheter aortic valve replacement (TAVR), are fueling regional market expansion. The market is also supported by enhanced regulatory pathways, advanced healthcare systems, and increased adoption of tissue valves over mechanical alternatives, reflecting evolving patient and physician preferences across countries such as Germany, France, and the U.K.

U.K. Cardiac Valve Market Insight

The U.K. cardiac valve market is expected to grow significantly over the forecast period, driven by a rise in valvular disease incidence and increased preference for transcatheter and minimally invasive procedures. Government-funded healthcare initiatives and growing collaborations between public hospitals and medical device companies are boosting the availability of advanced cardiac interventions. In addition, improved screening programs and a strong focus on post-surgical care outcomes are enhancing the overall treatment landscape in the country.

Germany Cardiac Valve Market Insight

The Germany cardiac valve market is expected to expand at a considerable CAGR during the forecast period, due to the country’s highly developed healthcare infrastructure, strong focus on innovation, and widespread adoption of advanced valve repair and replacement techniques. The demand for bioprosthetic valves is growing, supported by favorable patient outcomes and a preference for reduced anticoagulation therapy requirements. Furthermore, Germany's role as a major center for clinical trials and regulatory approval of cardiac devices positions it as a key contributor to Europe’s overall market dynamics.

Asia-Pacific Cardiac Valve Market Insight

The Asia-Pacific cardiac valve market is poised to grow at the fastest CAGR from 2025 to 2032, driven by rising healthcare expenditure, increasing awareness of heart valve disorders, and rapid urbanization. Countries such as China, India, and Japan are witnessing greater adoption of transcatheter and surgical valve procedures due to improved healthcare access and a growing middle class. Government investments in healthcare infrastructure and partnerships with global device manufacturers are further accelerating market growth across the region.

Japan Cardiac Valve Market Insight

The Japan cardiac valve market is gaining traction with the country’s aging population and increasing burden of cardiovascular diseases. Japan has been at the forefront of adopting minimally invasive cardiac procedures, supported by sophisticated healthcare systems and a strong culture of technological innovation. In addition, the growing acceptance of TAVR and ongoing clinical trials focused on novel valve technologies are contributing to the expansion of the Japanese market.

India Cardiac Valve Market Insight

The India cardiac valve market accounted for the largest revenue share in Asia-Pacific in 2024, fueled by increasing healthcare investments, expanding insurance coverage, and rising demand for affordable cardiac procedures. The adoption of transcatheter heart valves is growing, supported by rising awareness and government efforts to modernize cardiac care infrastructure. With a large patient pool suffering from rheumatic heart disease and increasing local manufacturing capabilities, India is emerging as a key growth market for cardiac valve solutions

Cardiac Valve Market Share

The cardiac valve industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- LivaNova PLC (U.K)

- Abbott (U.S)

- TTK (India)

- Edwards Lifesciences Corporation (U.S)

- Colibri Heart Valve (U.S)

- On-X Life Technologies Inc. (U.S)

- JenaValve Technology Inc. (U.S)

- CryoLife Inc (U.S)

- Boston Scientific Corporation (U.S)

- Symetis (Switzerland)

- Lepu Medical Technology(Beijing)Co.,Ltd. (China)

- Braile Biomédica (Brazil)

- Micro Interventional Devices, Incorporated (U.S)

- Auto Tissue Berlin GmbH (Germany)

What are the Recent Developments in Global Cardiac Valve Market?

- In May 2025, Abbott received U.S. FDA approval for its Tendyne Transcatheter Mitral Valve Implantation (TMVI) system, marking a pivotal advancement in structural heart therapies. As the first mitral valve replacement system approved for patients not eligible for open-heart surgery, Tendyne represents a transformative solution for those with severe mitral regurgitation. This development solidifies Abbott’s leading role in the transcatheter valve space while expanding minimally invasive treatment options globally

- In May 2025, Edwards Lifesciences gained FDA approval for its SAPIEN 3 transcatheter aortic valve platform to treat asymptomatic severe aortic stenosis patients. This decision, grounded in the successful EARLY TAVR trial, extends access to life-saving treatment earlier in disease progression. It reflects the growing clinical acceptance of TAVR procedures as a proactive intervention, advancing Edwards’ position as a key innovator in the cardiac valve domain

- In April 2025, UPMC Heart & Vascular Institute became the first center in Pennsylvania to perform a valve-in-valve TAVR procedure using the FDA-approved ShortCut device. This tool enhances procedural safety by modifying calcified leaflets to allow for better access. The milestone showcases progress in reintervention strategies, especially for patients with prior valve replacements, reinforcing the evolution of structural heart techniques

- In March 2025, Medtronic released five-year clinical data from its Evolut TAVR platform, demonstrating sustained durability and positive outcomes in low-risk aortic stenosis patients. The findings confirm the long-term viability of transcatheter valves, supporting broader adoption across patient profiles. This bolsters Medtronic’s global leadership in next-generation heart valve innovation and long-term valve performance.

- In March 2025, early clinical results from the Trilogy transcatheter valve platform showed promise for patients with aortic regurgitation. The device, designed for transcatheter mitral and aortic valve replacement, is gaining attention for its versatility and safety profile. This underlines the momentum behind next-gen devices that can address broader clinical indications in the cardiac valve market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.