Global Cardio Equipment Market

Market Size in USD Billion

CAGR :

%

USD

17.85 Billion

USD

28.90 Billion

2024

2032

USD

17.85 Billion

USD

28.90 Billion

2024

2032

| 2025 –2032 | |

| USD 17.85 Billion | |

| USD 28.90 Billion | |

|

|

|

|

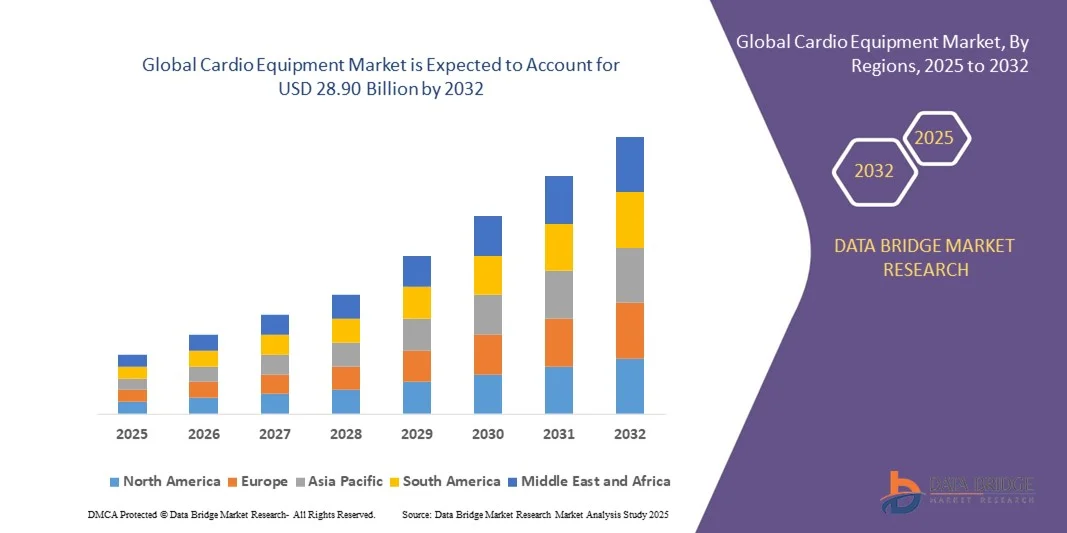

What is the Global Cardio Equipment Market Size and Growth Rate?

- The global cardio equipment market size was valued at USD 17.85 billion in 2024 and is expected to reach USD 28.90 billion by 2032, at a CAGR of 5.50% during the forecast period

- Growing corporate wellness programs and rising levels of stress will also create lucrative and remunerative cardio equipment market growth opportunities in the long run

- On the flip side, high product cost and maintenance cost will pose a major challenge to the growth of cardio equipment market in the long run. Availability of alternative options will further derail the market growth rate. Lack of awareness in the underdeveloped economies will slow down the market growth rate

What are the Major Takeaways of Cardio Equipment Market?

- Rising westernization, modernization, ever-rising obese population, and increasing personal disposable income are the major factors fostering the growth of cardio equipment market. Growing awareness about the availability of smart cardio equipment in the market and increasing popularity of e-commerce platforms are some other cardio equipment market growth determinants

- Rising initiatives by the government to promote healthy lifestyle has further propelled the manufacturers to foster large scale availability of different varieties of cardio equipment in the market

- North America dominated the cardio equipment market with the largest revenue share of 32.65% in 2024, driven by high consumer awareness of fitness and wellness, widespread adoption of commercial gyms, and growing interest in home exercise solutions

- The Asia-Pacific Cardio Equipment market is poised to grow at the fastest CAGR of 7.96% from 2025 to 2032, driven by rising health awareness, increasing disposable incomes, and rapid urbanization in countries such as China, Japan, and India

- The treadmill segment dominated the market with the largest revenue share of 38.5% in 2024, driven by its widespread adoption in both residential and commercial fitness settings

Report Scope and Cardio Equipment Market Segmentation

|

Attributes |

Cardio Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Cardio Equipment Market?

Integration of AI, Smart Connectivity, and Personalized Training

- A major and accelerating trend in the global cardio equipment market is the increasing incorporation of artificial intelligence (AI) and smart connectivity, including integration with mobile apps, cloud platforms, and wearable devices. These advancements provide highly personalized workout experiences, real-time performance tracking, and adaptive training programs tailored to individual fitness goals

- For instance, NordicTrack’s iFit-enabled treadmills and bikes leverage AI and smart connectivity to automatically adjust speed, incline, and resistance, providing users with guided workouts based on fitness data. Similarly, Peloton’s connected bikes and treadmills offer interactive classes and live coaching via app integration, enhancing engagement and motivation

- AI-driven features, such as adaptive resistance, virtual coaching, and predictive performance tracking, allow users to optimize workout efficiency and monitor progress over time. Connected Cardio Equipment can also sync with wearables, heart rate monitors, and nutrition apps, providing a holistic fitness ecosystem

- The seamless integration of Cardio Equipment with smartphones, tablets, and cloud platforms enables users to track and analyze performance metrics, compete with others virtually, and participate in gamified challenges, creating a highly immersive fitness experience

- This trend toward intelligent, connected, and interactive Cardio Equipment is redefining consumer expectations for home and commercial gyms. Companies such as Peloton, NordicTrack, and Technogym are continually innovating with AI-powered training programs and integrated connectivity to deliver more engaging, customized, and results-driven workout experiences

- The rising demand for connected, smart, and interactive Cardio Equipment is growing across residential fitness enthusiasts and commercial gyms, driven by convenience, enhanced user engagement, and the pursuit of optimized training outcomes

What are the Key Drivers of Cardio Equipment Market?

- The growing health awareness, rising fitness consciousness, and increasing prevalence of lifestyle-related diseases are key factors driving the demand for Cardio Equipment worldwide. Consumers are seeking efficient ways to maintain physical health, manage weight, and improve cardiovascular wellness

- For instance, in 2024, Peloton reported an increase in home fitness subscriptions as consumers prioritized at-home workouts, highlighting the adoption of connected Cardio Equipment for guided exercise routines. Such consumer trends are expected to drive significant market growth

- Increasing gym memberships, the proliferation of boutique fitness studios, and the rise of digital fitness platforms are boosting demand for advanced Cardio Equipment offering interactive experiences, real-time tracking, and adaptive training

- Technological innovations, including AI-based performance tracking, virtual reality-enabled workouts, and mobile app integration, are enhancing the appeal of Cardio Equipment for both home and commercial users

- The convenience of personalized workouts, the ability to track metrics such as heart rate and calories, and the integration with wearables and smart apps are key factors propelling market growth. Rising disposable incomes and urbanization further encourage adoption in both developed and emerging economies

Which Factor is Challenging the Growth of the Cardio Equipment Market?

- High initial costs of premium Cardio Equipment and ongoing subscription fees for connected services may limit adoption, particularly among price-sensitive consumers in developing regions

- Concerns regarding equipment maintenance, limited technical support, and the complexity of AI-enabled or connected machines can discourage first-time users from investing in advanced Cardio Equipment

- In addition, connectivity and cybersecurity challenges pose potential barriers, as data from smart devices could be vulnerable to breaches if not adequately protected. Companies such as NordicTrack and Peloton emphasize encryption and secure user authentication to mitigate such risks

- The preference for traditional gym memberships or outdoor exercise over at-home connected Cardio Equipment may also slow market adoption among certain consumer segments

- Overcoming these challenges through cost-effective models, simplified user interfaces, enhanced technical support, and secure digital platforms is essential to sustaining growth in the global Cardio Equipment market

How is the Cardio Equipment Market Segmented?

The market is segmented on the basis of type, application, and distribution channel.

- By Type

On the basis of type, the cardio equipment market is segmented into treadmill, fitness car, dynamic cycling, climbing machines, and others. The treadmill segment dominated the market with the largest revenue share of 38.5% in 2024, driven by its widespread adoption in both residential and commercial fitness settings. Treadmills are favored for their versatility, ability to provide controlled cardio workouts, and ease of monitoring performance metrics such as speed, incline, and heart rate. Homeowners, gyms, and hotels prefer treadmills for their compact footprint and adaptability for users of all fitness levels.

The growing incorporation of digital screens, virtual training sessions, and AI-based adaptive programs is further enhancing their appeal. The dynamic cycling segment is anticipated to witness the fastest CAGR of 22% from 2025 to 2032, driven by the rising popularity of interactive indoor cycling classes, connected bike platforms, and gamified workout experiences that provide high engagement and cardiovascular benefits.

- By Application

On the basis of application, the cardio equipment market is segmented into gym, school, community, sports centre, and others. The gym segment accounted for the largest market revenue share of 41.2% in 2024, propelled by the increasing demand for commercial fitness facilities and growing health consciousness among urban populations. Gyms integrate a range of cardio equipment such as treadmills, bikes, and climbing machines to provide comprehensive cardiovascular training for members. The rise of boutique fitness studios and chain gyms further supports adoption in this segment.

The school segment is expected to witness the fastest CAGR of 20.5% from 2025 to 2032, driven by the incorporation of fitness programs into educational curricula, emphasis on physical health, and government initiatives promoting youth fitness. Schools are increasingly adopting cardio equipment for physical education classes, sports training, and wellness programs, ensuring early fitness engagement among students.

- By Distribution Channel

On the basis of distribution channel, the cardio equipment market is segmented into commercial, residential, industrial, government institution, and others. The commercial segment dominated the market with the largest revenue share of 45% in 2024, fueled by the rising number of fitness centers, corporate wellness programs, and hotels integrating state-of-the-art cardio equipment to attract clients. Commercial facilities prioritize durability, connectivity features, and versatile usage to accommodate multiple users simultaneously.

The residential segment is projected to witness the fastest CAGR of 23% from 2025 to 2032, driven by increasing home fitness trends, especially in urban areas. Growing awareness of health and wellness, the convenience of exercising at home, and the availability of compact, smart cardio machines with interactive training options are encouraging consumers to invest in personal cardio equipment for home gyms.

Which Region Holds the Largest Share of the Cardio Equipment Market?

- North America dominated the cardio equipment market with the largest revenue share of 32.65% in 2024, driven by high consumer awareness of fitness and wellness, widespread adoption of commercial gyms, and growing interest in home exercise solutions

- Consumers in the region highly value the convenience, durability, and advanced features offered by Cardio Equipments, such as connected workout consoles, performance tracking, and interactive training programs

- This strong adoption is further supported by high disposable incomes, a technologically inclined population, and the expansion of fitness infrastructure, establishing North America as a key hub for both residential and commercial cardio equipment demand

U.S. Cardio Equipment Market Insight

The U.S. cardio equipment market captured the largest revenue share of 81% in 2024 within North America, fueled by rising home gym setups, fitness-focused lifestyles, and advanced commercial gym networks. Consumers increasingly prefer interactive treadmills, bikes, and smart fitness machines that integrate performance tracking and app connectivity. The growing demand for connected devices, virtual training platforms, and AI-powered fitness features further accelerates market growth. The increasing integration of digital fitness ecosystems, including wearable compatibility and guided workouts, is significantly contributing to the U.S. market expansion. The country remains a key driver for innovation and adoption in the global cardio equipment market.

Europe Cardio Equipment Market Insight

The Europe cardio equipment market is expected to expand at a substantial CAGR during the forecast period, driven by rising health awareness, urbanization, and government initiatives promoting active lifestyles. Demand for commercial gyms and boutique fitness studios is rising, and residential adoption is increasing due to convenience and interactive training trends. Countries such as Germany, France, and the U.K. are witnessing steady growth, supported by advanced infrastructure and robust consumer spending. European consumers value sustainable, high-quality cardio equipment with connected features, resulting in continuous adoption across gyms, community centers, and residential setups.

U.K. Cardio Equipment Market Insight

The U.K. cardio equipment market is anticipated to grow at a noteworthy CAGR, driven by increasing interest in fitness, home exercise solutions, and the adoption of connected equipment. Concerns about health and wellness are motivating both households and gyms to invest in cardio machines that offer interactive programs and performance monitoring. The U.K.’s strong retail and e-commerce infrastructure supports widespread access to advanced fitness devices, while commercial fitness chains and corporate wellness programs continue to encourage adoption. Smart, space-efficient cardio equipment with app integration is gaining popularity among consumers seeking convenience and engagement.

Germany Cardio Equipment Market Insight

The Germany cardio equipment market is projected to expand at a considerable CAGR, driven by high health consciousness, urban population density, and increasing adoption of smart fitness technologies. German consumers emphasize durable, connected, and energy-efficient cardio machines for home and commercial use. The integration of interactive workout programs, AI-driven training, and performance tracking is fostering adoption in both residential and professional fitness facilities. Germany’s focus on innovation, sustainability, and quality standards ensures that cardio equipment with advanced features is widely accepted across commercial gyms, sports centers, and home setups.

Which Region is the Fastest Growing Region in the Cardio Equipment Market?

The Asia-Pacific cardio equipment market is poised to grow at the fastest CAGR of 7.96% from 2025 to 2032, driven by rising health awareness, increasing disposable incomes, and rapid urbanization in countries such as China, Japan, and India. The region’s growing adoption of fitness programs, home gyms, and connected cardio equipment is supported by government initiatives promoting wellness and smart fitness infrastructure. Moreover, APAC is emerging as a manufacturing hub for cardio machines, enhancing affordability and accessibility. Growing demand in commercial gyms, hotels, and residential setups is further propelling the market, making Asia-Pacific the fastest-growing region globally.

Japan Cardio Equipment Market Insight

The Japan cardio equipment market is witnessing robust growth due to urbanization, technological adoption, and a focus on convenience in fitness. Consumers increasingly invest in compact, smart cardio machines suitable for home gyms and apartments. The integration of AI, virtual training, and connected platforms in cardio equipment is fueling adoption. Moreover, Japan’s aging population is driving demand for safe, low-impact cardio solutions that provide guided workouts and health monitoring features, supporting growth in both residential and commercial sectors.

China Cardio Equipment Market Insight

The China cardio equipment market accounted for the largest share in Asia-Pacific in 2024, owing to a rising middle class, increasing health awareness, and high adoption of home and commercial gyms. The push towards smart cities, growth of boutique fitness studios, and expanding domestic manufacturing of cardio equipment are key drivers. Consumers prefer interactive treadmills, cycling machines, and climbing equipment with app connectivity and AI features. Affordable pricing, coupled with urban lifestyle changes and the rise of e-commerce platforms, is accelerating adoption in residential, commercial, and rental fitness spaces.

Which are the Top Companies in Cardio Equipment Market?

The cardio equipment industry is primarily led by well-established companies, including:

- Nautilus, Inc. (U.S.)

- ICON Health & Fitness (U.S.)

- Johnson Health Tech. (Taiwan)

- Precor Incorporated (U.S.)

- Technogym S.p.A (Italy)

- Cybex International, Inc. (U.S.)

- TRUE. (U.S.)

- Adidas (Germany)

- Amer Sports (Finland)

- ASICS Asia Pte. Ltd. (Singapore)

- Brunswick Corporation (U.S.)

- Pure Gym Limited (U.K.)

- HOIST Fitness Systems (U.S.)

- Vectra Fitness Parts LLC. (U.S.)

- Fitness World (Denmark)

- Hammer Sport AG (Germany)

- Rogue Fitness (U.S.)

- Core Health & Fitness, LLC (U.S.)

- Seca GmbH (Germany)

- JERAI FITNESS PVT LTD (India)

What are the Recent Developments in Global Cardio Equipment Market?

- In August 2023, Technogym SpA, an Italy-based sports equipment manufacturer, launched the Technogym Run, a home treadmill featuring innovative seat-belt technology, at its Dubai boutique and experience center. This launch highlights Technogym’s continued focus on smart, user-friendly home fitness solutions that cater to modern consumers seeking safety and convenience

- In June 2023, Speediance, owned by Shenzhen Speediance Life Technology Co., Ltd., introduced the Speediance Gym Pal, an advanced strength training machine in the U.S. home fitness market. Equipped with smart tracking features and workout analytics, the device allows users to monitor progress and optimize their strength routines. This launch reflects growing demand for connected and data-driven home fitness equipment

- In September 2021, Hy-Vee, Inc., a U.S.-based supermarket chain, partnered with Johnson Wellness & Fitness, a U.S.-based fitness retailer, to open a new fitness equipment showroom in the United States. The showroom features a variety of residential and commercial equipment, including treadmills, ellipticals, and exercise bikes, strengthening access to premium cardio solutions for local consumers

- In April 2021, Peloton Interactive Inc., a U.S.-based fitness equipment manufacturer, completed the acquisition of Precor Incorporated, a U.S.-based gym equipment brand, to expand its product portfolio and solidify its position in both home and commercial fitness sectors. This strategic move supports Peloton’s goal of offering comprehensive connected cardio solutions across multiple markets

- In May 2020, Peloton Interactive Inc., a U.S.-based fitness equipment manufacturer, reported a 66% increase in its third-quarter online sales of home fitness equipment, reflecting a surge in consumer demand for at-home cardio and strength solutions. This growth emphasizes the rising popularity of connected fitness and digital training platforms

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.