Global Cell And Gene Therapy Thawing Equipment Market

Market Size in USD Million

CAGR :

%

USD

940.57 Million

USD

2,720.95 Million

2024

2032

USD

940.57 Million

USD

2,720.95 Million

2024

2032

| 2025 –2032 | |

| USD 940.57 Million | |

| USD 2,720.95 Million | |

|

|

|

|

Cell and Gene Therapy Thawing Equipment Market Size

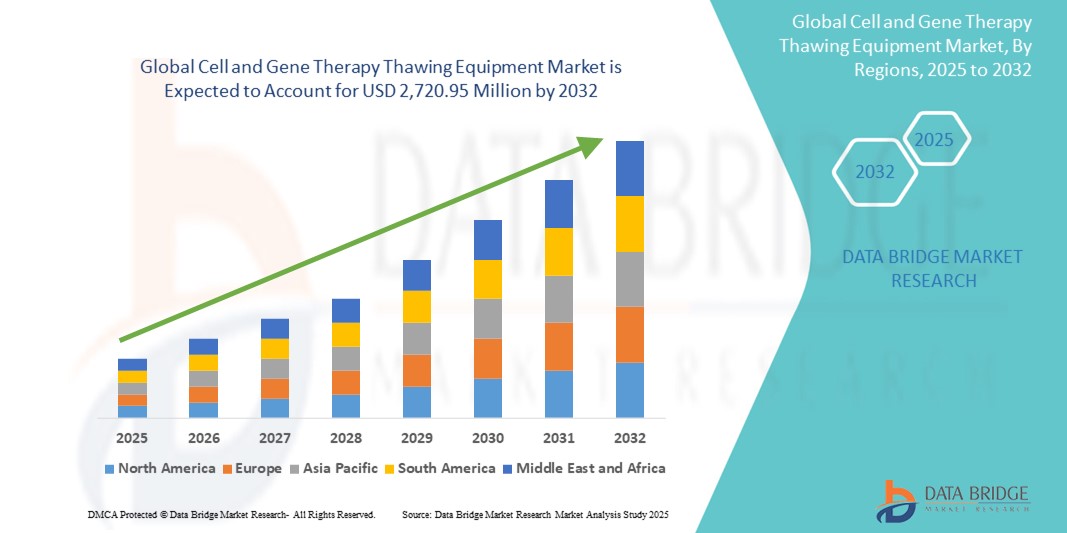

- The global cell and gene therapy thawing equipment market size was valued at USD 940.57 million in 2024 and is expected to reach USD 2,720.95 million by 2032, at a CAGR of 14.20% during the forecast period

- The market growth is largely fueled by the rapid expansion of advanced therapies, particularly in regenerative medicine and oncology, which require precise, consistent thawing processes to maintain cell viability and therapeutic efficacy

- Furthermore, increasing investments in biopharmaceutical R&D and the rising demand for automated, closed-loop thawing systems to reduce contamination risks are driving adoption across clinical and commercial manufacturing settings. These converging factors are accelerating the integration of thawing equipment into cell and gene therapy workflows, thereby significantly boosting the industry’s growth

Cell and Gene Therapy Thawing Equipment Market Analysis

- Cell and gene therapy thawing equipment, essential for preserving the viability and efficacy of cryopreserved therapeutic products, is becoming an integral part of advanced therapy manufacturing and clinical workflows due to its ability to offer precise, rapid, and contamination-free thawing solutions

- The escalating demand for thawing equipment is primarily fueled by the global surge in cell and gene therapy development, increased regulatory focus on quality and standardization, and the need for closed, automated systems to ensure consistent product handling

- North America dominated the cell and gene therapy thawing equipment market with the largest revenue share of 42.1% in 2024, supported by its strong biopharma infrastructure, leading role in regenerative medicine innovation, and the presence of major therapy developers and contract manufacturers, particularly in the U.S., which is witnessing rising adoption in both clinical trial sites and commercial production facilities

- Asia-Pacific is expected to be the fastest growing region in the cell and gene therapy thawing equipment market during the forecast period due to expanding biotech investments, growing clinical research activity, and supportive government policies in countries such as China, Japan, and South Korea

- Automated thawing systems segment dominated the market with a market share of 47.2% in 2024, driven by their reliability, scalability, and compliance with good manufacturing practices (GMP), making them the preferred choice for commercial-scale applications

Report Scope and Cell and Gene Therapy Thawing Equipment Market Segmentation

|

Attributes |

Cell and Gene Therapy Thawing Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cell and Gene Therapy Thawing Equipment Market Trends

“Automation and Closed-System Thawing for GMP Compliance”

- A significant and accelerating trend in the global cell and gene therapy thawing equipment market is the adoption of fully automated and closed-system thawing devices to meet Good Manufacturing Practice (GMP) standards and reduce contamination risks. These systems are crucial for ensuring the safety, consistency, and viability of advanced therapeutic products during clinical and commercial handling

- For instance, Cytiva’s VIA Thaw series offers controlled, water-free thawing within a closed environment, providing a repeatable and traceable thawing process, ideal for GMP-compliant workflows. Similarly, BioLife Solutions’ evo Thaw system is designed to maintain optimal temperature control and minimize human intervention, reducing the chances of user error or contamination

- Automated thawing devices can provide real-time temperature monitoring, integrated quality assurance tracking, and controlled thaw cycles tailored to various therapy types. These features enable manufacturers to preserve the potency and integrity of cell and gene therapies, which are often highly sensitive to time and temperature fluctuations

- Integration of digital monitoring systems allows researchers and manufacturers to track and document each thawing event, supporting regulatory documentation and quality control. This digitization is streamlining workflows, improving operational efficiency, and facilitating scalability in commercial manufacturing

- This trend toward automation and closed systems is fundamentally reshaping industry expectations for handling cryopreserved therapies. As more therapies advance from clinical trials to commercialization, the demand for reliable, standardized thawing equipment is expected to rise significantly. Companies such as Sartorius and Thermo Fisher Scientific are investing in smart thawing platforms that align with evolving regulatory and production requirements

- The growing emphasis on precision, reproducibility, and safety across the biomanufacturing spectrum is rapidly driving demand for advanced thawing solutions in both developed and emerging markets, positioning automated thawing systems as a critical component in the cell and gene therapy value chain

Cell and Gene Therapy Thawing Equipment Market Dynamics

Driver

“Surging Demand Driven by Cell and Gene Therapy Commercialization”

- The increasing approval and commercialization of cell and gene therapies worldwide are major drivers of the growing demand for specialized thawing equipment, which is essential to maintain the integrity of cryopreserved biological products at the point of care or during production

- For instance, in January 2024, the U.S. FDA approved multiple autologous CAR-T therapies, prompting biopharmaceutical companies to invest in scalable thawing technologies that ensure reproducible outcomes in clinical and commercial settings

- As cell and gene therapies are often extremely temperature-sensitive, advanced thawing systems that offer consistent, GMP-compliant thaw cycles help reduce variability and prevent loss of therapeutic efficacy. These factors are making thawing equipment a crucial investment across pharmaceutical manufacturing facilities, hospitals, and specialty clinics

- Furthermore, the increasing global pipeline of investigational gene-modified and stem cell therapies is expanding the need for standardized thawing protocols that can handle diverse cell types, product formats, and volume requirements

- The demand is also bolstered by the growing use of centralized and decentralized manufacturing models, requiring portable and validated thawing units suitable for point-of-care administration and logistical integration

Restraint/Challenge

“High Capital Cost and Operational Standardization Issues”

- Despite the strong growth trajectory, the high initial cost of automated thawing systems and the challenge of establishing universally accepted thawing protocols across different therapy types pose notable barriers to market expansion

- For instance, while systems such as the VIA Thaw or evo Thaw provide significant benefits, their cost may be prohibitive for smaller biotech firms or early-phase research institutions with limited budgets, especially in developing regions

- Operational complexity can also limit adoption, as thawing procedures must be customized based on cell type, cryoprotectant, and container format, creating challenges in standardizing practices across organizations. Variability in operator training, manual handling errors, or suboptimal thawing environments may compromise therapy outcomes

- In addition, regulatory agencies are increasingly scrutinizing thawing steps within cell and gene therapy workflows. Ensuring equipment compliance with global regulatory requirements such as FDA, EMA, and PMDA guidelines requires robust validation and documentation, which may be resource-intensive for smaller players

- Overcoming these restraints through the development of cost-effective thawing solutions, modular systems tailored for smaller-scale needs, and cross-industry collaboration on standardized thawing protocols will be essential for achieving broader market penetration and sustainable growth

Cell and Gene Therapy Thawing Equipment Market Scope

The market is segmented on the basis of modality, sample, type, application, end user, and distribution channel.

- By Modality

On the basis of modality, the cell and gene therapy thawing equipment market is segmented into benchtop and portable thawing systems. The benchtop segment dominated the market with the largest market revenue share in 2024, owing to its widespread use in centralized laboratories and commercial manufacturing settings where consistent and validated thawing processes are essential. Benchtop systems provide greater temperature stability, precise thawing control, and compatibility with GMP workflows, making them the preferred choice for high-throughput applications.

The portable segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the growing demand for decentralized treatment models and point-of-care administration. These systems offer flexibility, mobility, and ease of use for bedside applications, enabling thawing at hospitals, outpatient clinics, and mobile infusion centers without compromising product viability.

- By Sample

On the basis of sample, the cell and gene therapy thawing equipment market is segmented into cell therapies and gene therapies. The cell therapies segment dominated the market with the largest market revenue share in 2024, driven by the rapid commercialization of CAR-T cell and stem cell therapies. Maintaining cell viability during the thawing process is critical for therapeutic efficacy, making precise and repeatable thawing essential for clinical success.

The gene therapies segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the expanding pipeline of gene-modified therapies requiring cryopreserved vectors or cells. Gene therapies often require stringent thawing protocols, and the growing focus on regulatory compliance is further accelerating the adoption of specialized thawing equipment.

- By Type

On the basis of type, the cell and gene therapy thawing equipment market is segmented into manual thawing systems and automatic thawing systems. The automatic thawing system segment dominated the market with the largest market revenue share of 47.2% in 2024, driven by increased demand for standardized, GMP-compliant processes in commercial manufacturing. These systems offer superior control, reduce contamination risks, and support automated data logging for regulatory documentation.

The manual thawing system segment is anticipated to witness slower growth, as these systems are more prone to variability and user error. However, they remain widely used in early-stage research and academic settings due to their lower cost and adaptability.

- By Application

On the basis of application, the cell and gene therapy thawing equipment market is segmented into upstream processing and downstream processing. The downstream processing segment dominated the market with the largest market revenue share in 2024, driven by the critical nature of the thawing step prior to therapy administration. Reliable thawing ensures product integrity and viability, which is vital for patient safety and therapeutic outcomes.

The upstream processing segment is expected to witness fastest growth from 2025 to 2032, supported by increasing integration of thawing systems in early production stages, where precise temperature management enhances batch consistency and reduces waste.

- By End User

On the basis of end user, the cell and gene therapy thawing equipment market is segmented into blood banks and transfusion centers, hospitals and diagnostic laboratories, research laboratories and academic institutes, biotechnology and pharmaceutical industry, cord blood and stem cell banks, gene banks, and others. The biotechnology and pharmaceutical industry segment dominated the market with the largest market revenue share in 2024, as large-scale developers and manufacturers rely on advanced thawing systems for consistent, GMP-grade processing of cell and gene therapies.

The cord blood and stem cell banks segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by rising interest in regenerative therapies and increasing storage and use of stem cell samples that require reliable, sterile thawing methods to maintain efficacy.

- By Distribution Channel

On the basis of distribution channel, the cell and gene therapy thawing equipment market is segmented into direct tender, third-party distributor, and others. The direct tender segment dominated the market with the largest market revenue share in 2024, as hospitals, pharma companies, and large laboratories typically procure thawing systems through direct agreements for guaranteed service support and custom solutions.

The third-party distributor segment is expected to grow at the fastest CAGR from 2025 to 2032, fueled by rising demand in emerging economies and smaller institutions where local distributors play a key role in providing access to specialized thawing equipment and post-sales service.

Cell and Gene Therapy Thawing Equipment Market Regional Analysis

- North America dominated the cell and gene therapy thawing equipment market with the largest revenue share of 42.1% in 2024, supported by its strong biopharma infrastructure, leading role in regenerative medicine innovation, and the presence of major therapy developers and contract manufacturers

- Institutions and manufacturers in the region place high importance on reliable thawing technologies that ensure product safety, consistency, and compliance with regulatory standards such as those set by the FDA and Health Canada

- This widespread adoption is further supported by the presence of leading therapy developers, well-established GMP manufacturing facilities, and a growing demand for point-of-care thawing solutions in hospitals and specialty clinics, establishing advanced thawing equipment as an essential component in the region’s cell and gene therapy ecosystem

U.S. Cell and Gene Therapy Thawing Equipment Market Insight

The U.S. cell and gene therapy thawing equipment market captured the largest revenue share of 75.2% in 2024 within North America, fueled by its leadership in advanced therapy development and commercialization. The nation’s strong regulatory framework, expansive clinical trial activity, and presence of major biopharmaceutical players drive consistent demand for GMP-compliant thawing systems. The rising number of autologous and allogeneic therapy applications, coupled with increased adoption of automated thawing solutions in hospitals and specialized clinics, further accelerates market growth.

Europe Cell and Gene Therapy Thawing Equipment Market Insight

The Europe cell and gene therapy thawing equipment market is projected to expand at a substantial CAGR throughout the forecast period, driven by growing investments in regenerative medicine, supportive regulatory initiatives, and increasing therapy approvals. Rising demand for quality-controlled thawing in both clinical and commercial settings is pushing the adoption of automated, closed-loop thawing systems. The region is seeing widespread implementation across pharmaceutical manufacturing, stem cell banks, and academic research facilities, particularly in countries with strong biotech sectors.

U.K. Cell and Gene Therapy Thawing Equipment Market Insight

The U.K. cell and gene therapy thawing equipment market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by the nation’s thriving life sciences sector and active involvement in advanced therapy research. As cell and gene therapy infrastructure expands, there is increasing demand for validated, precision thawing systems in GMP facilities and clinical trial centers. Government initiatives promoting innovation in biotech and healthcare further contribute to market expansion across both public and private sectors.

Germany Cell and Gene Therapy Thawing Equipment Market Insight

The Germany cell and gene therapy thawing equipment market is expected to expand at a considerable CAGR during the forecast period, driven by the country’s strong emphasis on medical innovation, precision technologies, and compliance with EU regulatory standards. Germany’s highly developed pharmaceutical industry and investment in biomanufacturing infrastructure are driving adoption of advanced thawing equipment in research labs, hospitals, and production units. Integration with digital monitoring systems and quality control measures is becoming standard, aligning with Germany’s focus on safe, efficient therapeutic delivery.

Asia-Pacific Cell and Gene Therapy Thawing Equipment Market Insight

The Asia-Pacific cell and gene therapy thawing equipment market is poised to grow at the fastest CAGR of 25% during the forecast period of 2025 to 2032, driven by increasing biotech investments, growing clinical trials, and expanding cell and gene therapy facilities in countries such as China, Japan, South Korea, and India. Government support for biotech innovation and manufacturing capacity is accelerating the need for reliable thawing solutions across both public and private healthcare settings. The rise in point-of-care models and decentralization of treatment is also fueling demand for portable, automated thawing systems.

Japan Cell and Gene Therapy Thawing Equipment Market Insight

The Japan cell and gene therapy thawing equipment market is gaining momentum due to the country’s rapid aging population, strong biotech research environment, and early adoption of regenerative medicine. Japan’s focus on healthcare innovation and personalized therapies is driving the adoption of thawing systems that support safe, accurate, and scalable cell handling. Integration of thawing units with digital health platforms and automation technologies is a key trend, supporting their use in both clinical treatment centers and research institutions.

India Cell and Gene Therapy Thawing Equipment Market Insight

The India cell and gene therapy thawing equipment market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s expanding healthcare infrastructure, rapidly growing biotech sector, and rising interest in advanced therapies. Increased government initiatives supporting domestic biomanufacturing and the development of cost-effective solutions are driving demand for precision thawing systems. The market is seeing rising adoption across stem cell banks, academic research centers, and private hospitals, especially in major urban regions.

Cell and Gene Therapy Thawing Equipment Market Share

The cell and gene therapy thawing equipment industry is primarily led by well-established companies, including:

- Cytiva (U.S.)

- BioLife Solutions, Inc. (U.S.)

- Sartorius AG (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

- GE HealthCare (U.S.)

- Helmer Scientific Inc. (U.S.)

- Barkey GmbH & Co. KG (Germany)

- Biocision, LLC (U.S.)

- Avantor, Inc. (U.S.)

- Panasonic Healthcare Co., Ltd. (Japan)

- PHC Holdings Corporation (Japan)

- Fujifilm Irvine Scientific, Inc. (U.S.)

- Azenta Life Sciences, Inc. (U.S.)

- Trinity Biotech plc (Ireland)

- Stemcell Technologies Inc. (Canada)

- Cryoport, Inc. (U.S.)

- Zellbio GmbH (Germany)

- A.G. Thermo Tech Co., Ltd. (South Korea)

- Terumo BCT, Inc. (U.S.)

What are the Recent Developments in Global Cell and Gene Therapy Thawing Equipment Market?

- In April 2023, Cytiva, a global provider of life sciences technologies, expanded its VIA Thaw platform by launching a new GMP-compliant model designed for commercial cell therapy production. This new version features enhanced automation, real-time temperature monitoring, and integrated data logging capabilities to meet the rigorous requirements of large-scale manufacturing. The development reinforces Cytiva’s commitment to supporting the scalability and standardization of advanced therapy workflows through innovative thawing solutions

- In March 2023, BioLife Solutions, Inc. introduced an upgraded version of its evo® Smart Thawing System, equipped with wireless connectivity and improved user interface features. The system now allows for remote monitoring and traceability, ensuring better quality control and compliance in the thawing of cryopreserved cell therapies. This advancement highlights BioLife’s continued leadership in cryopreservation and thawing technologies that support the safe, efficient delivery of cell-based therapies to patients

- In February 2023, Sartorius AG announced a collaboration with a leading European biopharmaceutical company to co-develop a fully closed, automated thawing solution tailored for stem cell-derived therapies. The partnership aims to accelerate clinical translation and streamline manufacturing workflows by minimizing contamination risk and improving thaw consistency. This initiative demonstrates Sartorius’ strategic focus on innovation and customized solutions for cell and gene therapy manufacturing

- In January 2023, Thermo Fisher Scientific Inc. launched its CryoMed Controlled-Rate Thawing System for clinical research and biopharma applications. The system is designed to ensure consistent thawing of critical biological samples with high reproducibility, supporting regulatory compliance and improving workflow efficiency. The launch marks Thermo Fisher’s expanded commitment to providing advanced tools for end-to-end cell therapy processing

- In January 2023, Vineti, a digital supply chain platform for cell and gene therapies, integrated thawing data capture functionality into its personalized therapy management system. This update enables real-time documentation of thawing events, enhancing traceability and improving chain-of-identity and chain-of-condition compliance. The integration reflects the growing importance of digitalization in ensuring product quality and regulatory readiness throughout the cell and gene therapy lifecycle

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.