Global Gene Therapy Products Market

Market Size in USD Billion

CAGR :

%

USD

8.24 Billion

USD

40.86 Billion

2025

2033

USD

8.24 Billion

USD

40.86 Billion

2025

2033

| 2026 –2033 | |

| USD 8.24 Billion | |

| USD 40.86 Billion | |

|

|

|

|

Gene Therapy Products Market Size

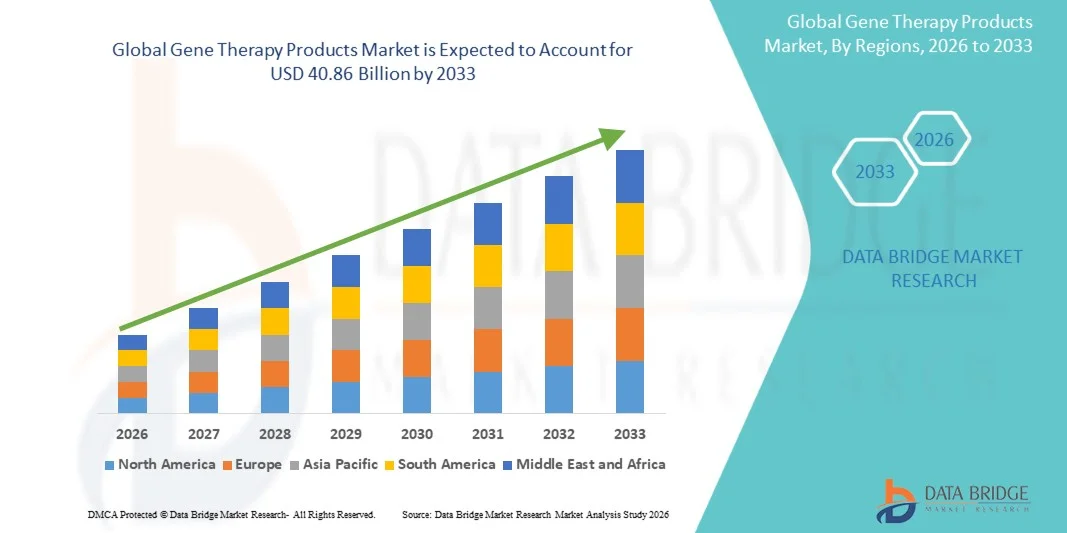

- The global gene therapy products market size was valued at USD 8.24 billion in 2025 and is expected to reach USD 40.86 billion by 2033, at a CAGR of 22.15% during the forecast period

- The market growth is largely fueled by rapid advancements in genetic engineering, viral and non-viral vector technologies, and personalized medicine approaches, enabling more effective and targeted therapies for rare and chronic diseases

- Furthermore, increasing prevalence of genetic disorders, supportive regulatory frameworks, and rising investment from biopharmaceutical companies are driving the adoption of gene therapy products. These converging factors are accelerating the development and commercialization of innovative gene therapies, thereby significantly boosting the industry's growth

Gene Therapy Products Market Analysis

- Gene therapy products, offering targeted genetic interventions to treat or prevent diseases, are increasingly vital components of modern healthcare and personalized medicine strategies due to their ability to address the root cause of genetic disorders and improve patient outcomes

- The escalating demand for gene therapy products is primarily fueled by advancements in viral and non-viral vector technologies, growing prevalence of rare and chronic genetic diseases, and increasing regulatory approvals for innovative therapies

- North America dominated the gene therapy products market with the largest revenue share of 42.5% in 2025, characterized by strong R&D infrastructure, high healthcare expenditure, and a robust presence of key biopharmaceutical players, with the U.S. experiencing substantial growth in clinical trials and commercial launches, driven by innovations from both established biotech companies and emerging startups

- Asia-Pacific is expected to be the fastest growing region in the gene therapy products market during the forecast period due to increasing healthcare investments, rising awareness of genetic disorders, and supportive government initiatives for advanced therapies

- Yescarta dominated the market with a share of 39.8% in 2025, driven by its established efficacy in treating certain hematological malignancies and its growing adoption in oncology treatment protocols

Report Scope and Gene Therapy Products Market Segmentation

|

Attributes |

Gene Therapy Products Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Gene Therapy Products Market Trends

“Increasing Focus on Personalized and Targeted Therapies”

- A significant and accelerating trend in the global gene therapy products market is the development of personalized therapies tailored to individual patient genetics, enhancing treatment efficacy and minimizing adverse effects

- For instance, Kymriah is designed for specific hematological cancers based on patient-specific T-cell modifications, offering highly targeted treatment outcomes

- Advancements in vector engineering and CRISPR-based technologies allow for more precise gene editing, enabling therapies to address rare and previously untreatable genetic disorders with higher success rates

- The integration of AI and bioinformatics in therapy design facilitates predictive modeling of treatment responses, optimizing therapeutic strategies and patient selection for better outcomes

- This trend towards personalized, data-driven gene therapies is fundamentally transforming clinical expectations, with companies such as Novartis and Gilead investing heavily in next-generation gene therapy platforms

- The demand for targeted, patient-specific gene therapies is growing rapidly across oncology and rare disease segments, as healthcare providers seek treatments with improved efficacy and safety profiles

- For instance, companies such as Spark Therapeutics are expanding Luxturna access programs to facilitate early adoption among patients with inherited retinal disorders

- Collaborations between research institutes and pharmaceutical companies are enabling faster clinical development and commercialization of novel gene therapies, creating a robust pipeline for future growth

Gene Therapy Products Market Dynamics

Driver

“Rising Prevalence of Genetic Disorders and Biopharmaceutical Innovation”

- The increasing prevalence of genetic diseases and cancers, combined with advancements in viral and non-viral delivery systems, is a significant driver for the growth of the gene therapy market

- For instance, in March 2025, Novartis announced the expansion of Kymriah production capacity to meet growing global demand for CAR-T therapies, driving market growth

- As the incidence of rare diseases becomes better documented and patient awareness grows, gene therapy offers curative potential where traditional treatments are limited or ineffective

- Furthermore, regulatory incentives and fast-track approvals for innovative therapies are accelerating product development and market entry, supporting industry expansion

- The increasing collaboration between biotech startups and established pharmaceutical companies is fostering rapid innovation, resulting in a broader pipeline of gene therapies for oncology, rare diseases, and other critical applications

- Growing awareness among healthcare providers and patients about the transformative potential of gene therapy is further propelling adoption in clinical and hospital settings worldwide

- For instance, ongoing partnerships between Gilead and multiple academic institutions are advancing novel gene therapy trials for cardiovascular and neurological disorders

- Increased government funding and grants for gene therapy research in regions such as North America and Europe are accelerating development timelines and supporting market growth

Restraint/Challenge

“High Cost and Complex Regulatory Landscape”

- The high cost of gene therapy products and the complexity of regulatory approval processes pose significant challenges to broader market adoption

- For instance, expensive therapies such as Luxturna or Zolgensma can exceed hundreds of thousands of dollars per treatment, limiting accessibility for many patients

- Strict regulatory frameworks across different regions require extensive clinical trials, long approval timelines, and post-market surveillance, which can delay product launches

- Manufacturing and quality control for gene therapies are highly complex, requiring specialized facilities and highly trained personnel, adding to operational costs

- While insurance coverage and reimbursement programs are expanding, the perceived financial burden can still hinder uptake, particularly in developing markets

- Addressing these challenges through cost reduction strategies, streamlined regulatory pathways, and patient access programs is crucial for sustained growth in the global gene therapy market

- For instance, differences in regulatory guidelines between the U.S., EU, and Asia-Pacific complicate multinational clinical trials and product approvals

- Challenges in long-term safety monitoring and potential immune responses to viral vectors necessitate rigorous post-marketing surveillance, which can slow adoption rates

Gene Therapy Products Market Scope

The market is segmented on the basis of product, application, and distribution channel.

- By Product

On the basis of product, the gene therapy products market is segmented into Yescarta, Kymriah, Luxturna, Strimvelis, and Gendicine. The Yescarta segment dominated the market with the largest revenue share of 39.8% in 2025, driven by its established efficacy in treating certain hematological malignancies and its growing adoption in oncology treatment protocols. Healthcare providers often prefer Yescarta due to its clinical success in CAR-T therapy and the robust support from Novartis for patient management programs. The segment benefits from ongoing clinical research, regulatory approvals for new indications, and increasing awareness among oncologists regarding its therapeutic potential. In addition, Yescarta’s proven safety and response rates have strengthened its position as a preferred gene therapy product in both hospital and specialty clinic settings.

The Luxturna segment is anticipated to witness the fastest growth rate of 23.4% from 2026 to 2033, fueled by rising awareness of inherited retinal disorders and expanding reimbursement support in North America and Europe. Luxturna offers a one-time treatment for patients with RPE65-mediated inherited retinal disease, making it attractive for early adopters seeking long-term outcomes. Increasing partnerships between biotech companies and ophthalmology clinics are facilitating broader access and patient enrollment. The growing focus on rare ophthalmic diseases, coupled with advancements in vector delivery technology, is expected to further accelerate Luxturna’s adoption globally.

- By Application

On the basis of application, the gene therapy products market is segmented into oncological disorders, rare diseases, cardiovascular diseases, neurological disorders, infectious diseases, and other diseases. The oncological disorders segment accounted for the largest market share of 44.1% in 2025, owing to the increasing incidence of hematological and solid tumors and the demonstrated clinical success of CAR-T and other targeted gene therapies. Hospitals and specialty clinics actively adopt these therapies due to their ability to provide personalized treatment and improved survival rates. The segment is further supported by rising R&D investments, ongoing clinical trials for new indications, and collaborations between biotech firms and academic institutions.

The neurological disorders segment is expected to witness the fastest CAGR of 25.1% from 2026 to 2033, driven by the growing prevalence of neurodegenerative diseases such as spinal muscular atrophy (SMA) and Parkinson’s disease. Advances in gene therapy delivery to the central nervous system are expanding treatment possibilities for patients with previously untreatable conditions. Increasing patient awareness, coupled with regulatory incentives for orphan disease therapies, is encouraging early adoption. Collaborations between biotech companies and neurology clinics are also facilitating rapid clinical trial recruitment and therapy commercialization.

- By Distribution Channel

On the basis of distribution channel, the gene therapy products market is segmented into hospital pharmacy, online pharmacy, retail pharmacy, and others. The hospital pharmacy segment held the largest market share of 49.3% in 2025, reflecting its critical role in administering complex gene therapies that require clinical oversight and specialized storage conditions. Hospitals provide end-to-end support for patient evaluation, treatment administration, and follow-up care, making them the preferred channel for gene therapy products. The presence of trained medical personnel and necessary infrastructure ensures safe and effective delivery of therapies.

The online pharmacy segment is anticipated to witness the fastest growth rate of 27.6% from 2026 to 2033, driven by increasing e-commerce adoption, telemedicine integration, and home delivery options for specialty medications. Online platforms offer patients convenience, wider product access, and enhanced privacy when ordering rare or specialized gene therapies. Strategic partnerships between biotech companies and digital health providers are facilitating secure supply chain management and patient education programs. The segment is expected to expand further with the adoption of digital health platforms and remote patient monitoring tools.

Gene Therapy Products Market Regional Analysis

- North America dominated the gene therapy products market with the largest revenue share of 42.5% in 2025, characterized by strong R&D infrastructure, high healthcare expenditure, and a robust presence of key biopharmaceutical players, with the U.S. experiencing substantial growth in clinical trials and commercial launches, driven by innovations from both established biotech companies and emerging startups

- Healthcare providers and patients in the region highly value the efficacy, personalized nature, and innovative delivery methods of gene therapies, particularly in oncology and rare diseases

- This widespread adoption is further supported by high healthcare expenditure, increasing awareness of genetic disorders, and rapid clinical trial activities, establishing gene therapy products as a preferred treatment option in both hospital and specialty clinic settings

U.S. Gene Therapy Products Market Insight

The U.S. gene therapy products market captured the largest revenue share of 79% in 2025 within North America, fueled by a robust biopharmaceutical ecosystem and advanced clinical research infrastructure. Patients and healthcare providers increasingly prioritize innovative, targeted therapies for oncology and rare genetic disorders. The growing number of clinical trials, coupled with regulatory incentives such as fast-track approvals and orphan drug designations, further propels market growth. Moreover, increasing collaborations between biotech startups and established pharmaceutical companies are accelerating product development and commercialization, significantly contributing to market expansion.

Europe Gene Therapy Products Market Insight

The Europe gene therapy products market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by favorable healthcare policies, rising R&D investments, and growing awareness of genetic diseases. The presence of advanced medical facilities and supportive reimbursement frameworks fosters the adoption of gene therapies. European patients and clinicians are increasingly adopting gene therapy for oncology and rare disease applications. In addition, the integration of innovative therapies into national healthcare programs is boosting market growth across major countries such as Germany, France, and Italy.

U.K. Gene Therapy Products Market Insight

The U.K. gene therapy products market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising investment in personalized medicine and advanced biologics. Increased patient awareness and the adoption of targeted therapies for rare diseases and cancers are encouraging uptake. The country’s strong healthcare infrastructure, alongside collaborative initiatives between biotech companies and research institutions, is expected to continue to stimulate market growth. Moreover, government support for advanced therapy medicinal products (ATMPs) is further promoting clinical adoption.

Germany Gene Therapy Products Market Insight

The Germany gene therapy products market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing government funding for biotech research and strong R&D capabilities. German healthcare providers are adopting gene therapies for oncology and rare diseases due to proven clinical outcomes and advanced hospital infrastructure. The emphasis on innovation and quality in medical treatments promotes the adoption of next-generation therapies. Furthermore, collaborations between academic institutions and pharmaceutical companies are supporting the rapid commercialization of novel gene therapy products.

Asia-Pacific Gene Therapy Products Market Insight

The Asia-Pacific gene therapy products market is poised to grow at the fastest CAGR of 26% during the forecast period of 2026 to 2033, driven by increasing healthcare investments, rising prevalence of genetic disorders, and technological advancements in countries such as China, Japan, and India. Growing awareness about advanced therapies and government initiatives supporting rare disease treatment are driving adoption. Furthermore, as APAC emerges as a manufacturing and clinical trial hub for gene therapies, affordability and accessibility are improving, expanding the market to a wider patient population.

Japan Gene Therapy Products Market Insight

The Japan gene therapy products market is gaining momentum due to the country’s advanced healthcare infrastructure, high R&D investment, and growing demand for innovative treatments. Adoption is driven by increasing cases of rare genetic disorders and cancers, with hospitals and specialty clinics actively offering advanced therapies. The integration of gene therapy with precision medicine and digital healthcare platforms is fueling growth. Moreover, Japan’s aging population is such asly to spur demand for effective, targeted therapies to manage age-related genetic conditions in both clinical and hospital settings.

India Gene Therapy Products Market Insight

The India gene therapy products market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rising healthcare expenditure, rapid urbanization, and growing awareness of genetic diseases. India is emerging as a key hub for clinical trials and biotechnology research, with increasing adoption of innovative therapies in hospitals and specialty clinics. Government initiatives supporting advanced healthcare solutions and the availability of cost-effective gene therapy options are key factors propelling market growth. In addition, collaborations between domestic biotech firms and global pharmaceutical companies are accelerating therapy availability across the country.

Gene Therapy Products Market Share

The Gene Therapy Products industry is primarily led by well-established companies, including:

- Bristol-Myers Squibb Company (U.S.)

- GSK plc (U.K.)

- Merck KGaA (Germany)

- Novartis AG (Switzerland)

- Danaher (U.S.)

- Illumina, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- QIAGEN (Germany)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Adaptimmune (U.K.)

- bluebird bio, Inc. (U.S.)

- Achieve Life Sciences, Inc. (U.S.)

- AbbVie Inc. (U.S.)

- Spark Therapeutics, Inc. (U.S.)

- Abeona Therapeutics Inc. (U.S.)

- Adverum Biotechnologies, Inc. (U.S.)

- Arbutus Biopharma (Canada)

- Amgen Inc. (U.S.)

- Audentes Therapeutics (U.S.)

- Gilead Sciences, Inc. (U.S.)

What are the Recent Developments in Global Gene Therapy Products Market?

- In November 2025, Itvisma (onasemnogene abeparvovec‑brve) was approved by the U.S. Food and Drug Administration (FDA) for treatment of Spinal Muscular Atrophy (SMA) in children aged two years and older, teens and adults making it the first gene‑replacement therapy available for this broader SMA patient population. This approval expands access of gene therapy beyond infants offering a one‑time treatment to older SMA patients and potentially reducing the need for lifelong treatment

- In November 2024, Eladocagene exuparvovec was approved by the FDA for treatment of Aromatic L‑amino Acid Decarboxylase (AADC) deficiency a rare neurodevelopmental disorder expanding the reach of gene therapy into neurological and metabolic genetic diseases. This development signals growing diversity in gene‑therapy applications beyond blood disorders and reinforces momentum toward treating a broader range of rare genetic diseases

- In January 2024, FDA extended approval of Casgevy to also treat transfusion‑dependent Beta Thalassemia (TDT), offering a potentially curative one-time therapy for patients reliant on frequent blood transfusions. This further broadened the impact of CRISPR-based therapies beyond sickle cell, underlining regulatory confidence and the therapeutic potential of genome editing for inherited blood disorders

- In December 2023, Casgevy (exagamglogene autotemcel), the first-ever CRISPR/Cas9-based gene‑editing therapy, was approved by FDA for treatment of Sickle Cell Disease (SCD) in patients 12 years and older. This represented a major milestone in gene therapy the first regulatory green‑light for a CRISPR‑based therapy opening the door for a new class of genome‑editing treatments with “one-and-done” potential.

- In June 2023, Roctavian (valoctocogene roxaparvovec) was approved by the U.S. Food and Drug Administration (FDA) for the treatment of adults with severe Hemophilia A the first gene therapy approved for adults with this condition. U.S. Food and Drug Administration. This marks an important expansion of gene therapy beyond pediatric and rare‑disease use, offering adults a one-time treatment that enables their bodies to produce clotting Factor VIII and potentially avoid lifelong prophylactic infusions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.