Global Cell Culture Market

Market Size in USD Billion

CAGR :

%

USD

30.44 Billion

USD

70.72 Billion

2024

2032

USD

30.44 Billion

USD

70.72 Billion

2024

2032

| 2025 –2032 | |

| USD 30.44 Billion | |

| USD 70.72 Billion | |

|

|

|

Global Cell Culture Market Analysis

The global cell culture market is experiencing substantial growth, fueled by advancements in biotechnology, pharmaceuticals, and healthcare sectors. The increasing need for biopharmaceuticals, tissue engineering, and vaccine production is driving this expansion. Cell culture technologies are crucial in drug discovery, diagnostics, and therapeutic research, supporting the development of treatments for chronic diseases, cancer, and genetic disorders.

This growth is also supported by the rising demand for personalized medicine, stem cell research, and 3D cell cultures. As the healthcare industry continues to explore innovative cell-based therapies and biotechnological solutions, cell culture has become an essential tool in medical advancements. With ongoing investments in research and development, the market is expected to continue evolving, enabling breakthroughs in various fields such as regenerative medicine and targeted therapies.

Cell Culture Market Size

The global cell culture market size was valued at USD 30.44 billion in 2024 and is projected to reach USD 70.72 billion by 2032, with a CAGR of 11.11% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Cell Culture Market Trends

The cell culture market is experiencing several key trends. Advancements in 3D cell culture and organ-on-a-chip technologies are revolutionizing research, offering more accurate models for drug testing and disease studies. There's a growing focus on personalized medicine, pushing demand for tailored cell therapies and precision treatments. The rise in biopharmaceutical production and regenerative medicine is also contributing to market growth. In addition, the increasing adoption of automated and high-throughput systems is enhancing productivity in cell culture processes. Collaborations between biotech companies and research institutions are accelerating innovation. Moreover, the integration of artificial intelligence and machine learning in cell culture applications is driving efficiency and discovery, fostering continued market expansion.

Report Scope and Cell Culture Market Segmentation

|

Attributes |

Cell Culture Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada, and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Thermo Fisher Scientific (U.S.), Lonza Group (Switzerland), Merck KGaA (Germany), Becton, Dickinson and Company (U.S.), GE Healthcare (US), Sartorius AG (Germany), Corning Incorporated (U.S.), Eppendorf AG (Germany), Fujifilm Irvine Scientific (Japan), Agilent Technologies (U.S.), CELLINK (Sweden), Bio-Rad Laboratories (U.S.), Invitrogen (U.S.), Samsung Biologics (South Korea), Danaher Corporation (U.S.), Waters Corporation (U.S.), VWR International (U.S.), Promega Corporation (U.S.), JSR Corporation (Japan), Stemcell Technologies (Canada). |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Cell Culture Market Definition

Cell culture is the process of growing and maintaining cells under controlled conditions outside their natural environment, typically in a laboratory. These cells can be derived from plants, animals, or humans and are grown in a nutrient-rich medium that provides essential growth factors. Cell culture is widely used in research, biotechnology, medicine, and drug development for applications such as vaccine production, cancer studies, and regenerative medicine.

Cell Culture Market Dynamics

Drivers

- Increasing Demand for Biopharmaceuticals

The rising global need for biopharmaceuticals, including vaccines, monoclonal antibodies, and gene therapies, is significantly driving the growth of the cell culture market. Biopharmaceuticals offer targeted and effective treatment options for various diseases, including cancer, autoimmune disorders, and infectious diseases. Cell culture systems are indispensable in the production of these biologics, as they provide an optimized environment for cell growth, replication, and modification. The COVID-19 pandemic underscored the importance of large-scale cell culture applications, particularly in vaccine production, where technologies like mammalian cell culture played a crucial role in rapidly developing and manufacturing mRNA and protein-based vaccines.

- Advancements in Personalized Medicine

The increasing focus on personalized medicine is fueling advancements in cell culture technologies, enabling the development of patient-specific treatments. As therapies become more tailored to an individual’s genetic and molecular profile, cell culture plays a vital role in expanding and modifying cells for therapeutic use. In regenerative medicine and gene therapies, such as CAR-T cell therapy for cancer, patient-derived cells are cultured, engineered, and reintroduced into the body for precise treatment. These technologies require highly controlled cell culture conditions to ensure cell viability, potency, and safety, making advanced cell culture systems essential for the success of personalized medical approaches.

Opportunities

- Personalized Medicine and Cell-Based Therapies

The increasing demand for personalized medicine offers a significant opportunity in the cell culture market. As treatments become more tailored to individual genetic profiles, the need for advanced cell culture systems is expanding. Cell-based therapies, such as CAR-T cell therapy for cancer, depend on efficient cell culture techniques for growing and modifying cells for patient-specific treatments. The adoption of these therapies is accelerating due to their effectiveness in treating conditions previously resistant to conventional methods. This shift toward personalized medicine is expected to drive continuous growth in cell culture technologies, supporting the development of customized therapeutic solutions.

- Biopharmaceutical Production

The growing emphasis on biologics, vaccines, and biosimilars presents a major opportunity for the cell culture market. Cell culture systems are vital in the production of biologics, including vaccines, which have seen significant demand due to global health needs. With the continued rise in biologic therapies for diseases such as cancer and autoimmune disorders, the demand for cell culture technologies will remain high. This trend is amplified by the increasing production of vaccines and therapies for conditions that require precise and scalable cell culture systems, positioning cell culture as an essential technology in biopharmaceutical manufacturing.

Restraints/Challenges

- High Cost of Cell Culture Technologies

The expense associated with advanced cell culture systems can limit accessibility, particularly for smaller biotech companies or research institutions. Such as, the cost of purchasing bioreactors and high-quality culture media for large-scale production of biologics can reach millions of dollars. The significant investment required for maintaining these systems, along with the specialized skills needed to operate them, can be a financial strain. This challenge is evident in emerging biotech firms that struggle to compete with larger, well-funded companies.

- Contamination and Quality Control Issues:

Contamination in cell cultures can lead to inconsistent results, affecting the reliability of research outcomes and the quality of pharmaceutical products. An instance of this challenge can be seen with the contamination of cell lines in vaccine production. Such as, during the development of a therapeutic protein, contamination by bacteria or fungi could compromise the entire batch, leading to delays and increased production costs. Rigorous quality control measures and contamination prevention protocols are essential, yet they add complexity and operational costs, hindering efficient scaling in commercial production.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Cell Culture Market Scope

The market is segmented on the basis of product, application, end user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Equipment

- Centrifuges

- Culture Systems/Bioreactors

- Biosafety Equipment

- Cryostorage Equipment

- Pipetting Instruments

- Incubators

- Cell Culture Vessels

- Others

- Consumables

- Reagents

- Growth Factors & Cytokines

- Albumin

- Protease inhibitor

- Thrombin

- Attachment Factors

- Amino Acids

- Sera

- Fetal Bovine Serum (FBS)

- Others

- Media

- Chemically Defined

- Classical Media

- Lysogeny Broth

- Serum Free

- Protein Free

- Specialty Media

Application

- Drug Discovery

- Biopharmaceuticals

- Monoclonal antibodies

- Vaccines production

- Other therapeutic proteins

- Tissue Culture and Engineering

- Cell and gene therapy

- Other tissue engineering & regenerative medicine applications

- Vaccine Production

- Gene Therapy

- Others

End User

- Pharmaceutical & Biotechnology Companies

- Hospitals & Diagnostic Laboratories

- Research & Academic Institutes

- Other

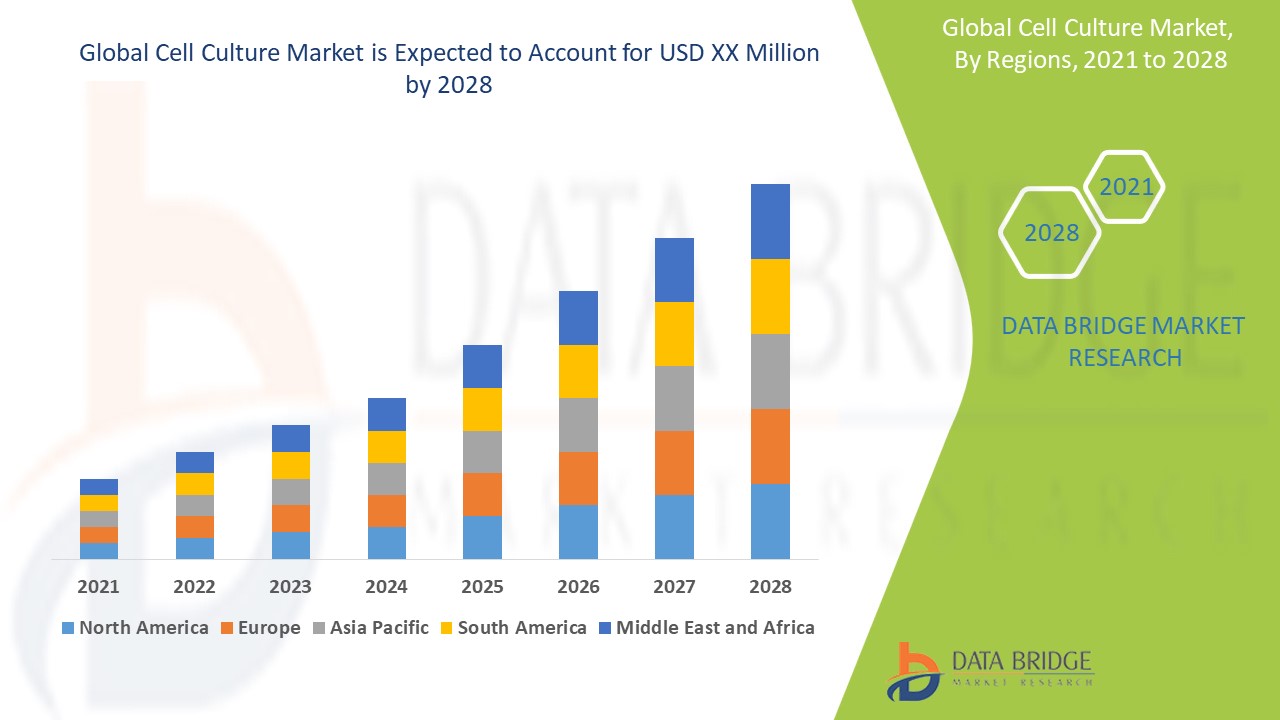

Cell Culture Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, product, application, end user as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

North America is expected to dominate the cell culture market due to several key factors. The region is home to major biotechnology, pharmaceutical, and healthcare companies, which are driving the demand for cell culture technologies in drug discovery, vaccine production, and biologics manufacturing. The U.S., in particular, leads in biopharmaceutical production, with extensive use of cell culture systems in the development of biologics, including monoclonal antibodies, insulin, and therapeutic proteins.

The increasing focus on personalized medicine and cell-based therapies, such as CAR-T cell treatments, further contributes to the region’s market dominance. In addition, North America benefits from strong research and development investments, cutting-edge healthcare infrastructure, and supportive regulatory frameworks that foster innovation in cell culture technologies. The region also experiences a high rate of adoption of advanced cell culture models, including 3D cultures and organ-on-a-chip technologies, which enhance drug testing and disease research. These factors position North America to maintain a leading role in the global cell culture market

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Cell Culture Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Cell Culture Market Leaders Operating in the Market Are:

- Thermo Fisher Scientific (U.S.)

- Lonza Group (Switzerland)

- Merck KGaA (Germany),

- Becton, Dickinson and Company (U.S.)

- GE Healthcare (U.S.)

- Sartorius AG (Germany)

- Corning Incorporated (U.S.)

- Eppendorf AG (Germany)

- Fujifilm Irvine Scientific (Japan)

- Agilent Technologies (U.S.)

- CELLINK (Sweden)

- Bio-Rad Laboratories (U.S.)

- Invitrogen (U.S.)

- Samsung Biologics (South Korea)

- Danaher Corporation (U.S.)

- Waters Corporation (U.S.)

- VWR International (U.S.)

- Promega Corporation (U.S.)

- JSR Corporation (Japan)

- Stemcell Technologies (Canada)

Latest Developments in Cell Culture Market

- In January 2025, Terumo announces that Carter Blood care has become the first U.S. blood center to complete the transition to automated whole blood processing using Terumo's Reveos Automated Blood Processing System with Lumia Software. This innovative system automates the separation of whole blood into platelets, plasma, and red blood cells, improving the efficiency and accuracy of the process. By reducing the traditional 20+ steps to a single centrifugation cycle, the system enhances blood donation and processing, helping address critical platelet shortages. This milestone demonstrates Terumo’s commitment to advancing automation in the blood collection industry, with plans to expand the use of this technology in additional U.S. blood centers in the future

- In November 2024, Agilent Technologies has introduced a new organizational structure designed to enhance its market-focused strategy, with particular emphasis on the Life Sciences and Diagnostics Markets Group. This group will focus on advancing cell-based solutions in diagnostics, therapeutic development, and research, enabling Agilent to better serve the growing demand for cell biology and cellular analysis technologies. By re-aligning its business units, Agilent aims to accelerate innovation in areas such as single-cell analysis, genomics, and cell-based assays, supporting breakthroughs in cell therapies and drug discovery. This restructuring positions Agilent to lead in cell-focused technologies and further drive growth in life sciences

- In March 2024, Merck KGaA, Darmstadt, Germany, has announced an investment of more than €300 million to create a cutting-edge Life Science Research Center, with a strong focus on cell-based research. This new center will explore advanced technologies in cell biology, which play a key role in drug discovery, development, and production. The facility will serve as a hub for breakthrough research in cell therapies, regenerative medicine, and cellular diagnostics

- In October 2023, Thermo Fisher Scientific introduced the Gibco CTS Detachable Dynabeads with an active release mechanism. This innovative product allows for the controlled, active release of magnetic beads from target cells at any point during the process. It utilizes a competitive binding mechanism to detach the beads, providing greater flexibility in T-cell isolation, activation, and purification. This technology enables enhanced control over cell activation and ensures higher purity and yield of T-cells, which are crucial in cell therapies such as T-cell and gene therapies. It also shortens the manufacturing process and preserves early memory T-cell phenotypes, which are associated with higher efficacy in therapeutic treatments

- In July 2023, Lonza launched the TheraPRO CHO Media System, a new cell culture platform aimed at improving productivity and protein quality in therapeutic protein manufacturing. This system is designed to optimize the production of monoclonal antibodies and supports GS-CHO cell lines. It is scalable from cell line development to bioprocess manufacturing, offering significant performance improvements. The TheraPRO system delivers high viable cell concentrations and more than double the protein titer compared to existing solutions, helping reduce time-to-market. In addition, it simplifies media preparation and is supported by Lonza’s technical expertise for troubleshooting and regulatory guidance

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.