Global Cell Culture Media Market

Market Size in USD Billion

CAGR :

%

USD

6.94 Billion

USD

16.59 Billion

2024

2032

USD

6.94 Billion

USD

16.59 Billion

2024

2032

| 2025 –2032 | |

| USD 6.94 Billion | |

| USD 16.59 Billion | |

|

|

|

|

Cell Culture Media Market Size

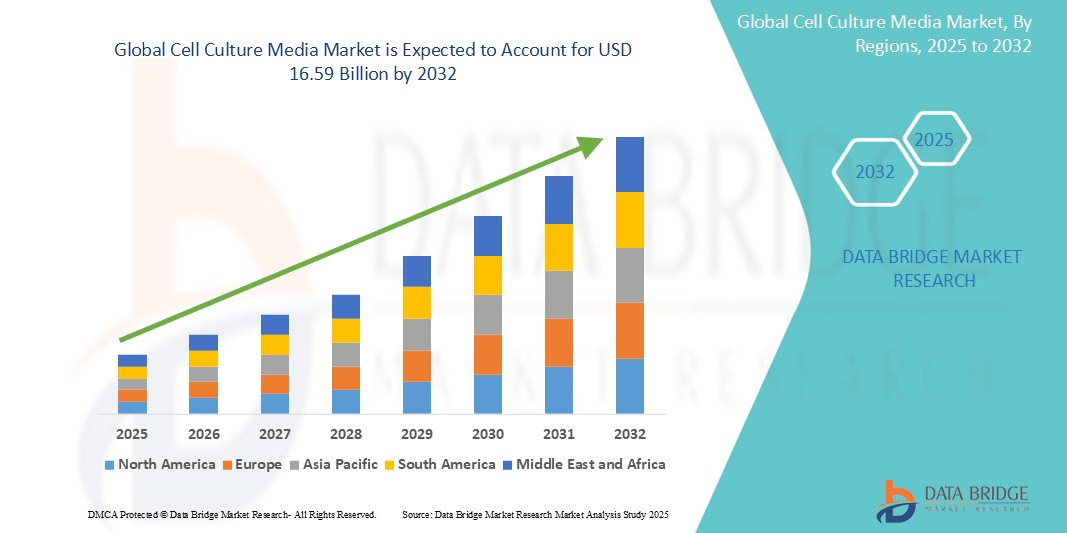

- The global cell culture media market size was valued at USD 6.94 billion in 2024 and is expected to reach USD 16.59 billion by 2032, at a CAGR of 11.50% during the forecast period

- The market growth is largely fueled by the increasing global prevalence of chronic diseases such as cancer, diabetes, and autoimmune diseases, which are driving demand for cell-based research and therapies.

- Furthermore, the growing shift towards personalized medicine and cell-based therapies, where treatments are tailored to individual patients, is boosting the demand for specialized cell culture media. These converging factors, coupled with advancements in cell culture technologies and increased R&D investments in the biopharmaceutical sector, are accelerating the uptake of cell culture media solutions

Cell Culture Media Market Analysis

- Cell culture media, a crucial component in biopharmaceutical and biotechnology industries, provides essential nutrients, growth factors, and hormones for optimal cell growth and maintenance in in vitro conditions. They are increasingly vital for the development and production of advanced therapies, contributing significantly to modern healthcare and research

- The escalating demand for cell culture media is primarily fueled by the increasing prevalence of chronic diseases such as cancer, autoimmune disorders, and rare diseases, the widespread adoption of cell-based research and therapies including personalized medicine, regenerative medicine, and gene therapy, and continuous advancements in cell culture technologies

- North America dominates the cell culture media market with the largest revenue share of 38.21% in 2024, characterized by a well-established biotechnology and pharmaceutical industry, significant investments in research and development, and a strong presence of key industry players. The U.S. continues to experience robust growth, driven by increasing demand for vaccines and biologics, and ongoing expansions in manufacturing facilities

- Asia-Pacific is expected to be the fastest growing region in the cell culture media market with a CAGR of 16.83% during the forecast period due to rapid advancements in biotechnology, increasing biopharmaceutical manufacturing capacities, growing clinical trials, and favorable government initiatives and funding for biotechnology research in countries

- Serum-Free Media segment dominates the cell culture media market with a market share of 36.56% in 2024, driven by its advantages such as reduced batch-to-batch variability, consistent performance, enhanced control over physiological responses, and lower risk of contamination from serum-borne agents

Report Scope and Cell Culture Media Market Segmentation

|

Attributes |

Cell Culture Media Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cell Culture Media Market Trends

“Advancements in Media Formulations and 3D Culture Systems”

- A significant and accelerating trend in the global cell culture media market is the continuous advancement in media formulations, particularly the shift towards serum-free and chemically defined media, alongside the increasing adoption of three-dimensional (3D) cell culture systems

- For instance, the development of specialized serum-free media eliminates the variability and potential contaminants associated with animal serum, leading to more consistent and scalable cell culture processes. Companies are increasingly offering tailored media for specific cell types, such as CHO cells for biopharmaceutical production or various stem cell lines for regenerative medicine

- The integration of 3D cell culture systems, including spheroids, organoids, and bioprinted tissues, represents a major leap forward. These systems better mimic the in vivo environment, allowing for more accurate drug discovery, disease modeling, and toxicology testing. For instance, 3D tumor spheroids are used to screen cancer drugs, providing more reliable data than traditional 2D cultures

- Advancements in media formulations for 3D culture systems are crucial for supporting the complex cellular interactions and nutrient gradients inherent in these models. This includes the development of specialized media that promote the differentiation and long-term viability of cells in a 3D context

- The demand for cell culture media that support advanced 3D culture applications and offer enhanced control over cellular environments is growing rapidly across academic, research, and industrial sectors, as researchers and manufacturers increasingly prioritize accuracy, consistency, and the ethical considerations associated with animal-derived components

Cell Culture Media Market Dynamics

Driver

“Increasing Demand Due to Rising Prevalence of Chronic Diseases and Advancements in Biologics”

- The increasing global prevalence of chronic diseases, such as cancer, autoimmune disorders, and infectious diseases, coupled with significant advancements in the development and production of biologics is a paramount driver for the heightened demand for cell culture media

- For instance, the continuous increase in cancer research and the development of novel cancer therapies such as CAR T-cell therapy heavily rely on specialized cell culture media for cell expansion and manipulation. Similarly, the ongoing need for new vaccines, as underscored by the COVID-19 pandemic, significantly boosts the demand for high-quality media to support large-scale vaccine production

- As the biopharmaceutical industry expands to address the growing global burden of chronic illnesses, there's a corresponding surge in the need for efficient and reliable cell culture systems. Cell culture media provide the essential nutrients and optimal environment for cells to grow, proliferate, and produce therapeutic proteins or other cellular products

- Furthermore, the increasing adoption of personalized medicine, where treatments are tailored to individual patients, drives the demand for specialized cell culture media that can support the growth of specific cell types for diagnostic or therapeutic applications. This focus on patient-specific therapies necessitates highly controlled and consistent cell culture environments

- The continuous innovation in bioprocessing technologies, including the shift towards single-use systems and the integration of automation, further streamlines cell culture processes, making them more accessible and cost-effective, thus accelerating the adoption of cell culture media in both research and large-scale manufacturing across pharmaceutical and biotechnology sectors

Restraint/Challenge

“High Production Costs and Risk of Contamination”

- The high production cost associated with the development and manufacturing of specialized cell culture media, coupled with the persistent risk of contamination in cell culture processes, poses a significant challenge to broader market expansion. Producing high-quality, sterile cell culture media requires expensive raw materials, advanced processing technologies, stringent quality control measures, and specialized, often sterile, facilities, driving up operational expenses

- For instance, the transition to serum-free and chemically defined media, while offering advantages in consistency and regulatory compliance, often involves more complex formulations and higher costs for specific growth factors and recombinant proteins. This can be a significant barrier for smaller biotechnology firms and academic research institutions with budget constraints, particularly in developing regions

- Furthermore, cell culture operations are highly susceptible to various forms of contamination such as biological and chemical. Contamination can lead to experimental delays, wasted resources, and, in biopharmaceutical production, batch failures and significant financial losses. High-profile instances of contamination can erode trust and necessitate costly remediation efforts

- Addressing these challenges through robust quality management systems, aseptic techniques, stringent raw material sourcing, and continuous R&D to develop more cost-effective and contamination-resistant media formulations is crucial for building user confidence and expanding market reach. Companies are increasingly investing in automated systems and advanced analytical techniques to minimize contamination risks and optimize media performance, but these also add to the initial investment

Cell Culture Media Market Scope

The market is segmented on the basis of type, application, end-user, and distribution channel

- By Type

On the basis of type, the global cell culture media market is segmented into chemically defined media, classical media, serum-free media, specialty media, stem cell media, lysogeny broth (LB), custom media formulation, and others. The serum-free media segment dominates the market with a revenue share of 36.56 in 2024, primarily due to its increasing adoption in biopharmaceutical production. This is driven by its advantages in providing consistent and reproducible results, reducing the risk of contamination from animal-derived components, and meeting stringent regulatory requirements for therapeutic product manufacturing. The benefits of improved downstream processing and reduced variability further solidify its leading position.

The stem cell media segment is expected to witness the fastest growth rate, fueled by the accelerating pace of research and therapeutic applications in regenerative medicine and cell therapy. The burgeoning clinical trials involving stem cells for various diseases are creating a significant demand for specialized media formulations that can maintain the pluripotency and promote the differentiation of various stem cell types.

- By Application

On the basis of application, the global cell culture media market is segmented into biopharmaceutical production, drug screening & development, diagnostics, regenerative medicine & tissue engineering, and others. The biopharmaceutical production segment is expected to account for the largest market revenue share. This dominance is driven by the robust growth of the biologics market, including monoclonal antibodies, vaccines, and recombinant proteins, all of which rely heavily on cell culture for large-scale manufacturing. The increasing number of biologics in development and commercial production by pharmaceutical companies globally significantly fuels this segment.

The drug screening & development segment is anticipated to witness the fastest CAGR. This growth is propelled by the increasing complexity of drug discovery processes, the adoption of high-throughput screening technologies, and the rising demand for in vitro models that accurately predict drug efficacy and toxicity. Cell culture media are fundamental for maintaining healthy and functional cell lines used in these critical research and development stages.

- By End User

On the basis of end-user, the global cell culture media market is segmented into biopharmaceutical companies, biotechnology organizations, academic and research laboratories, hospitals, diagnostic centers, cell banks, forensic laboratories, and others. The biopharmaceutical companies segment is expected to hold the largest market revenue share. This is attributed to their substantial investments in R&D, continuous expansion of manufacturing capacities for biologics and biosimilars, and the increasing number of cell-based therapies entering clinical trials and commercialization. Their large-scale operational needs make them the primary consumers of cell culture media

The biotechnology organizations segment is expected to witness the fastest CAGR. This growth is driven by the dynamic and innovative nature of the biotechnology sector, which is at the forefront of developing novel cell and gene therapies, advanced diagnostics, and research tools. These organizations heavily rely on specialized cell culture media for their diverse research and product development activities.

- By Distribution Channel

On the basis of distribution channel, the global cell culture media market is segmented into direct tenders, third-party distribution, and retail sales. The third-party distribution segment is anticipated to hold the largest market revenue share. This is because third-party distributors offer broad market reach, efficient logistics, and a comprehensive portfolio of products from various manufacturers, catering to a diverse customer base ranging from small research labs to large institutions. Their ability to provide consolidated purchasing and supply chain management is a significant advantage

The direct tenders segment is expected to witness substantial growth, particularly for large-volume orders from major biopharmaceutical companies and governmental research institutions. Direct tenders allow for customized contracts, bulk pricing, and direct technical support from manufacturers, making it a preferred channel for large-scale, long-term supply agreement.

Cell Culture Media Market Regional Analysis

- North America dominates the cell culture media market with the largest revenue share of 38.21% in 2024, driven by a well-established biotechnology and pharmaceutical industry, significant investments in research and development, and a strong presence of key industry players

- Consumers and research institutions in the region highly value high-quality, specialized media for applications in drug discovery, vaccine production, and cell and gene therapies, further fueling market growth

- This widespread adoption is further supported by significant R&D investments, a high concentration of leading market players, and a robust regulatory framework, establishing cell culture media as a favored solution for advanced research and therapeutic production

U.S. Cell Culture Media Market Insight

The U.S. cell culture media market captured a significant revenue share within North America fueled by the rapid growth of the biopharmaceutical and biotechnology sectors. Consumers and research institutions are increasingly prioritizing high-quality and specialized cell culture media for advanced research, drug discovery, and large-scale bioproduction. The growing demand for biologics, vaccines, and cell & gene therapies, combined with significant investments in R&D, further propels the cell culture media industry. Moreover, the increasing focus on personalized medicine and the development of new therapies for chronic diseases are significantly contributing to the market's expansion.

Europe Cell Culture Media Market Insight

The Europe cell culture media market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing R&D activities in biopharmaceuticals and regenerative medicine, coupled with rising demand for biologics. The increase in government funding for life sciences research, coupled with the need for advanced cell culture techniques, is fostering the adoption of cell culture media. European researchers and manufacturers are also drawn to the consistency and reduced contamination risks offered by serum-free and chemically defined media. The region is experiencing significant growth across biopharmaceutical production, academic research, and diagnostic applications.

U.K. Cell Culture Media Market Insight

The U.K. cell culture media market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the escalating focus on drug development and vaccine production, and a desire for heightened research capabilities. In addition, the increasing incidence of chronic diseases and the push for advanced therapies are encouraging both academic institutions and biotech companies to invest in high-quality cell culture media. The UK’s robust biopharmaceutical sector, alongside its strong research infrastructure and government support for life sciences, is expected to continue to stimulate market growth.

Germany Cell Culture Media Market Insight

The Germany cell culture media market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing investments in biopharmaceutical production and a strong emphasis on innovation in biotechnology. Germany’s well-developed research infrastructure, combined with its leading position in biopharmaceutical manufacturing in Europe, promotes the adoption of advanced cell culture media. The increasing production of active pharmaceutical ingredients (APIs) for monoclonal antibodies and biologics is also becoming increasingly prevalent, with a strong preference for high-quality, traceable media aligning with local regulatory expectations and consumer demand for effective treatments.

Asia-Pacific Cell Culture Media Market Insight

The Asia-Pacific cell culture media market is poised to grow at the fastest CAGR of 16.83% during the forecast period, driven by increasing investments in biotechnology, rising healthcare expenditure, and technological advancements in countries such as China, Japan, and India. The region's growing focus on biopharmaceutical manufacturing, supported by government initiatives promoting life sciences research and development, is driving the adoption of cell culture media. Furthermore, as APAC emerges as a hub for contract research and manufacturing organizations the demand for high-quality and affordable cell culture media is expanding to a wider base of research institutions and production facilities.

Japan Cell Culture Media Market Insight

The Japan cell culture media market is gaining momentum due to the country’s high-tech culture, significant investments in biotechnology, and increasing demand for advanced therapies. The Japanese market places a significant emphasis on cancer research and personalized medicine, and the adoption of cell culture media is driven by the increasing number of biopharmaceutical companies and research institutions. The integration of cell culture media with advanced technologies, such as 3D cell culture and bioreactors, is fueling growth. Moreover, Japan's aging population is likely to spur demand for novel therapeutic solutions, relying heavily on cell-based research and production.

India Cell Culture Media Market Insight

The India cell culture media market accounted for a significant market revenue share in Asia Pacific in 2024, attributed to the country's expanding biopharmaceutical industry, rapid advancements in research and development, and high rates of technological adoption. India stands as a rapidly growing market for biopharmaceuticals and vaccines, and cell culture media are becoming increasingly popular in drug discovery, manufacturing, and academic research. The push towards indigenous manufacturing capabilities and the availability of affordable cell culture media options, alongside strong domestic research initiatives, are key factors propelling the market in India.

Cell Culture Media Market Share

The cell culture media industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific, Inc. (U.S.)

- Merck & Co., Inc. (Germany)

- Danaher Corporation (U.S.)

- Lonza (Switzerland)

- Sartorius AG (Germany)

- Bio-Rad Laboratories, Inc. (U.S.)

- Corning Incorporated (U.S.)

- GE Healthcare (U.S.)

- BD (U.S.)

- HiMedia Laboratories (India)

- PromoCell (Germany)

- VWR International, LLC (U.S.)

- Elex Biological Products (Shanghai) Co., Ltd. (China)

- Vitro Biopharma (U.S.)

- STEMCELL Technologies (India)

- Plant Cell Technology Inc. (U.S.)

- Kohjin Bio Co., Ltd. (Japan)

- InvivoGen (U.S.)

- Fujifilm Corporation (U.S.)

- Takara Bio Inc. (Japan)

Latest Developments in Global Cell Culture Media Market

- In December 2024, Merck KGaA announced the closing of its acquisition of HUB Organoids Holding B.V. (HUB). This strategic acquisition aims to expand Merck's next-generation biology portfolio and reinforces its commitment to providing novel solutions that enable faster and more effective drug development, integrating organoid technology with its cell culture portfolio

- In September 2023, Sigma-Aldrich announced an investment to boost its research facilities in Mumbai, India. This move is expected to enhance local production capabilities for various life science products, including cell culture media, to cater to the growing Indian market

- In August 2023, Corning launched Videodrop, an optical technology that applies the principles of interferometric microscopy to quantify the size and concentration of nanoparticles. While not exclusively cell culture media, this technology is a valuable addition to bioprocessing, improving real-time analysis of cell culture components and formulations

- In July 2023, Sartorius opened a 21,500 square-foot cell culture media manufacturing plant at its existing Yauco, Puerto Rico site. This expansion signifies Sartorius' commitment to increasing production capacity for cell culture media to meet growing global demand

- In April 2023, AnaBios, a preclinical contract research organization, acquired Cell Systems, a human primary cell and cell culture media provider. This acquisition aimed to expand AnaBios portfolio of human tissue and cells, thereby strengthening its product pipeline for drug discovery and understanding cell biology

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.