Global Cell Lysis Dissociation Market

Market Size in USD Billion

CAGR :

%

USD

5.30 Billion

USD

10.49 Billion

2024

2032

USD

5.30 Billion

USD

10.49 Billion

2024

2032

| 2025 –2032 | |

| USD 5.30 Billion | |

| USD 10.49 Billion | |

|

|

|

|

Cell Lysis and Dissociation Market Size

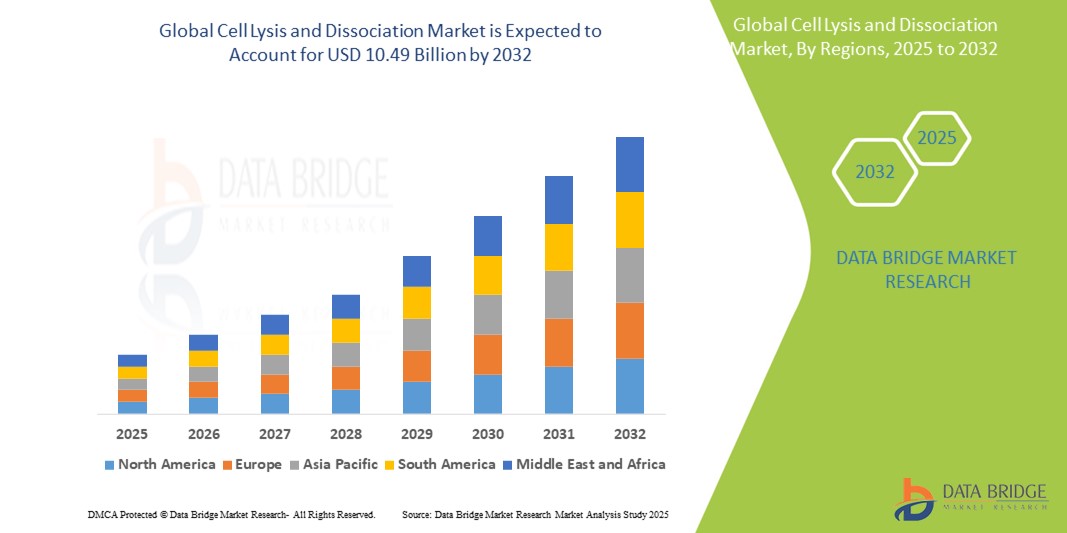

- The global cell lysis and dissociation market size was valued at USD 5.30 billion in 2024 and is expected to reach USD 10.49 billion by 2032, at a CAGR of 8.90% during the forecast period

- The market growth is largely fueled by the increasing demand for high-throughput cell-based research and advancements in biopharmaceutical development, leading to widespread adoption of cell lysis and dissociation technologies across research and clinical settings

- Furthermore, the rising focus on precision medicine, stem cell research, and single-cell analysis is driving the need for efficient, standardized, and gentle cell separation solutions. These converging trends are accelerating the deployment of cell lysis and dissociation products, thereby significantly boosting the industry's growth

Cell Lysis and Dissociation Market Analysis

- Cell lysis and dissociation technologies, which enable the effective breakdown of cell membranes and separation of tissues into single-cell suspensions, are critical tools in genomic research, cancer biology, stem cell studies, and drug development due to their ability to preserve cell integrity and functionality for downstream applications

- The escalating demand for advanced cell-based assays, personalized medicine, and single-cell analysis is primarily fuelling growth in the cell lysis and dissociation market, with increased utilization across biopharmaceutical R&D, clinical diagnostics, and academic research institutes

- North America dominated the cell lysis and dissociation market with the largest revenue share of 49.3% in 2024, driven by a strong presence of leading biopharma companies, extensive funding in cell-based research, and well-established healthcare infrastructure, particularly in the U.S., which is seeing increased demand for high-throughput cell processing technologies

- Asia-Pacific is projected to be the fastest-growing region in the cell lysis and dissociation market, registering a CAGR of 13.7% during the forecast period, owing to rapid advancements in biomedical research, increasing investment in healthcare infrastructure, and a surge in stem cell and regenerative medicine projects in countries such as China, Japan, and India

- Consumables segment dominated the cell lysis and dissociation market with a market share of 48.6% in 2024, attributed to the recurring need for reagents and kits across a wide range of applications in diagnostics, research labs, and biopharmaceutical production, thereby ensuring consistent revenue generation and growth momentum

Report Scope and Cell Lysis and Dissociation Market Segmentation

|

Attributes |

Cell Lysis and Dissociation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cell Lysis and Dissociation Market Trends

“Growing Adoption in Precision Medicine and Single-Cell Technologies”

- A significant and accelerating trend in the global cell lysis and dissociation market is the expanding application of these solutions in precision medicine and single-cell technologies, which require highly efficient and gentle methods for cell separation and analysis

- For instance, single-cell RNA sequencing workflows rely heavily on effective dissociation techniques to obtain high-quality single-cell suspensions without compromising cell viability. Products such as Thermo Fisher Scientific’s Gibco CTS Cell Lysis Solutions and Miltenyi Biotec’s gentleMACS Dissociators are increasingly being integrated into personalized oncology research pipelines

- The precision and reproducibility of enzymatic dissociation kits and mechanical disruptors are enabling better isolation of rare cell types from complex tissues, directly supporting advancements in biomarker discovery, cell-based therapies, and targeted drug development

- Companies are also investing in automation and scalability, with platforms such as Singleron Biotechnologies’ cell dissociation systems tailored for clinical-grade sample preparation—ensuring compliance with regulatory standards while supporting high-throughput research

- This trend toward refined, application-specific lysis and dissociation tools is reshaping expectations across both academic and commercial labs, making cell preparation more consistent and compatible with downstream molecular workflows

- As the demand for more individualized and cell-specific data continues to grow, the cell lysis and dissociation market is experiencing rising traction across clinical diagnostics, cancer genomics, immunology, and regenerative medicine applications

Cell Lysis and Dissociation Market Dynamics

Driver

“Expanding Demand from Single-Cell Analysis and Personalized Medicine”

- The surging focus on personalized medicine and precision diagnostics is a major driver boosting demand in the global Cell Lysis and Dissociation market. As researchers aim to understand complex cellular functions at the single-cell level, efficient and reproducible cell dissociation and lysis protocols have become essential for downstream genomic, transcriptomic, and proteomic applications

- For instance, in February 2024, Miltenyi Biotec launched its new gentleMACS Octo Dissociator, optimized for high-throughput tissue processing with minimal cell damage, thereby accelerating research workflows in oncology and immunology. Such innovations are enabling more accurate and scalable sample preparation for personalized therapies

- Increasing adoption of single-cell RNA sequencing, flow cytometry, and CRISPR-based gene editing has driven the need for high-quality cell suspensions and intact biomolecular content, making reliable dissociation and lysis solutions vital for success

- In additioin, expanding clinical research efforts and biobanking initiatives are relying on cell lysis kits and enzymatic dissociation products to obtain viable cells and genetic material from a wide range of tissue types, further supporting the industry's momentum

- The integration of automated, standardized dissociation systems with downstream analytics tools is facilitating faster, error-free results in both academic and industrial research, thus propelling the global market forward

Restraint/Challenge

“Enzyme Sensitivity, Cost Constraints, and Workflow Complexity”

- A key restraint for the cell lysis and dissociation market is the sensitivity and variability associated with enzymatic formulations, which can impact cell viability and protein integrity during processing. Inconsistent dissociation results—especially when handling fragile or heterogeneous tissues—can compromise the quality of downstream applications, leading to reduced data reproducibility

- Moreover, the relatively high cost of premium enzymatic kits, automated tissue processors, and cell lysis reagents may limit adoption, particularly in smaller academic labs or cost-sensitive regions. These financial constraints are more pronounced when dealing with large sample volumes or longitudinal studies that demand consistent reagent supply and performance

- In addition, optimizing dissociation protocols for different tissue types remains complex and often requires technical expertise and iterative refinement, making the process time-consuming for researchers. For instance, dense or fibrotic tissues may require specific enzyme blends, incubation times, or mechanical disruption steps to achieve satisfactory single-cell yields

- Overcoming these challenges will depend on continued innovation in enzyme formulation, cost-effective kit development, and user-friendly protocols. Companies such as Worthington Biochemical Corporation and Thermo Fisher Scientific are investing in ready-to-use, standardized products to simplify workflows and improve consistency—paving the way for wider market acceptance

Cell Lysis and Dissociation Market Scope

- By Product

On the basis of product, the cell lysis and dissociation market is segmented into instruments and reagents and consumables. The consumables segment dominated the cell lysis and dissociation market with a market share of 48.6% in 2024, attributed to the recurring need for reagents and kits across a wide range of applications in diagnostics, research labs, and biopharmaceutical production, thereby ensuring consistent revenue generation and growth momentum

The instruments segment is expected to witness the fastest CAGR of 10.9% from 2025 to 2032, driven by the increasing adoption of automated and high-throughput cell processing tools in biotechnology and pharmaceutical R&D.

- By Cell Type

On the basis of cell type, the market is segmented into mammalian cell, bacterial cell, yeast/algae/fungi, and plant cell. The mammalian cell segment held the largest market share of 49.7% in 2024, due to its widespread use in cancer research, stem cell therapy, and monoclonal antibody production. These cells are commonly used in both basic research and advanced therapeutic development.

The bacterial cell segment is projected to witness the fastest growth at a CAGR of 11.4% from 2025 to 2032, supported by increased genomic research and recombinant protein production in E. coli and other bacterial models.

- By Application

On the basis of application, the market is segmented into protein isolation, downstream processing, cell organelle isolation, and nucleic acid isolation. the nucleic acid isolation segment dominated with a market share of 38.6% in 2024, owing to the rising demand for RNA/DNA extraction in genetic studies, PCR-based diagnostics, and next-generation sequencing workflows.

The downstream processing segment is expected to record the fastest CAGR of 12.1% during 2025 to 2032, driven by the expanding biopharmaceutical manufacturing sector and the critical need for efficient cell disruption in purification and formulation stages.

- By End User

On the basis of end user, the market is segmented into academic and research institutes, hospitals and diagnostic labs, cell banks, and pharmaceutical and biotechnology companies. The pharmaceutical and biotechnology companies segment accounted for the highest revenue share of 45.3% in 2024, propelled by the growing investment in drug discovery, cell-based assays, and biologics manufacturing. These companies consistently require robust cell lysis and dissociation tools for upstream and downstream processes.

The hospitals and diagnostic labs segment is forecasted to grow at the fastest CAGR of 11.6% from 2025 to 2032, as clinical diagnostics increasingly rely on molecular testing and cell-based biomarker analysis, which necessitate efficient sample preparation techniques.

Cell Lysis and Dissociation Market Regional Analysis

- North America dominated the cell lysis and dissociation market with the largest revenue share of 49.3% in 2024, driven by the strong presence of biotechnology and pharmaceutical companies, advanced research infrastructure, and increasing investments in life sciences research

- Researchers and clinicians in the region prioritize high-quality and efficient cell lysis and dissociation solutions to support various applications such as protein isolation, downstream processing, and nucleic acid isolation

- This leading market position is further supported by growing funding for academic and research institutes, the rising adoption of advanced laboratory instruments, and the focus on personalized medicine, establishing North America as the key hub for innovation and demand in the Cell Lysis and Dissociation industry

U.S. Cell Lysis and Dissociation Market Insight

The U.S. cell lysis and dissociation market captured the largest revenue share of 78.2% within North America in 2024, driven by strong investments in biotechnology and pharmaceutical research. The country’s robust academic and clinical research infrastructure fuels demand for high-quality cell lysis and dissociation instruments and reagents. Growing focus on personalized medicine and advanced biologics development further accelerates market growth. Increasing adoption of automated and high-throughput cell processing technologies also contributes to the expansion.

Europe Cell Lysis and Dissociation Market Insight

The Europe cell lysis and dissociation market is expected to grow at a steady CAGR during the forecast period. The growth is primarily supported by increasing funding for biomedical research, stringent regulatory frameworks, and the rising number of clinical trials across the region. Countries such as Germany, France, and the U.K. lead in demand for advanced cell processing solutions, with an emphasis on sustainability and eco-friendly reagents. Integration with downstream molecular biology workflows is gaining traction in academic and industrial labs.

U.K. Cell Lysis and Dissociation Market Insight

The U.K. cell lysis and dissociation market is projected to expand at a noteworthy CAGR during the forecast period, propelled by government initiatives supporting life sciences innovation and a growing biopharmaceutical sector. The adoption of automated cell dissociation systems is rising due to increasing demand for reproducibility and efficiency in research. In addition, collaborations between academic institutions and biotech companies are fostering product development and adoption.

Germany Cell Lysis and Dissociation Market Insight

The Germany cell lysis and dissociation market is expected to expand at a considerable CAGR during the forecast period. The country’s advanced manufacturing capabilities and emphasis on precision instruments drive demand for high-quality cell disruption technologies. German researchers’ focus on stem cell research and regenerative medicine further fuels market growth. Eco-friendly and energy-efficient reagents are preferred, aligning with sustainability goals.

Asia-Pacific Cell Lysis and Dissociation Market Insight

The Asia-Pacific cell lysis and dissociation market is poised to register the fastest growth with a CAGR of 13.7% from 2025 to 2032, driven by rapid urbanization, increasing healthcare expenditures, and expansion of biotechnology research facilities in China, Japan, India, and South Korea. Government initiatives promoting innovation and digitalization in research laboratories are supporting widespread adoption. In addition, increasing manufacturing capacity and competitive pricing of cell lysis instruments are expanding market accessibility.

China Cell Lysis and Dissociation Market Insight

The China cell lysis and dissociation market leads the Asia-Pacific region with the largest revenue share of 35% in 2024, supported by government-backed biotech initiatives and rapid urbanization. The growing middle class and increasing investment in life sciences infrastructure stimulate demand for cost-effective and scalable cell lysis solutions. Smart city projects and development of biotech clusters further contribute to the market’s expansion.

India Cell Lysis and Dissociation Market Insight

The India cell lysis and dissociation market is emerging rapidly, with a CAGR of 9.6%, driven by expanding pharmaceutical and biotechnology sectors. Increased government funding for research, rising number of academic and private research institutes, and growing focus on biopharmaceutical manufacturing underpin market growth. The rising availability of affordable reagents and instruments, combined with increasing collaborations with global biotech firms, is accelerating adoption. In addition, the surge in contract research organizations (CROs) and clinical research activity further fuels demand in India.

Cell Lysis and Dissociation Market Share

The cell lysis and dissociation industry is primarily led by well-established companies, including:

- Merck KGaA (Germany)

- Bio-Rad Laboratories, Inc. (U.S.)

- BD (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Cell Signaling Technology, Inc. (U.S.)

- Qsonica (U.S.)

- Covaris, LLC. (U.S.)

- Abcam Limited (U.K.)

- IDEX (U.S.)

- Claremont BioSolutions, LLC. (U.S.)

- Miltenyi Biotec (Germany)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Parr Instrument Company (U.S.)

What are the Recent Developments in Global Cell Lysis and Dissociation Market?

- In April 2023, Merck KGaA (Germany) announced the expansion of its reagent portfolio for cell lysis and dissociation applications, targeting both academic research and biopharmaceutical manufacturing. This strategic move is aimed at supporting high-throughput workflows and enhancing efficiency in nucleic acid and protein isolation, particularly in precision medicine and drug development sectors

- In March 2023, Thermo Fisher Scientific Inc. (U.S.) launched a next-generation mechanical dissociation system integrated with temperature control, designed for consistent processing of plant and mammalian tissues. The product aims to reduce sample variability and improve cell viability, reinforcing Thermo Fisher’s leadership in laboratory automation and molecular biology solutions

- In March 2023, Miltenyi Biotec (Germany) introduced a new enzymatic dissociation kit specifically optimized for delicate neural tissues. The kit is intended for use in neuroscience research and single-cell sequencing workflows, underlining the company’s focus on enabling high-yield, high-purity cell isolation from complex tissues

- In February 2023, Qsonica (U.S.) unveiled its upgraded ultrasonic cell disruptor equipped with enhanced amplitude control and real-time data logging. This new generation of instruments is designed to serve bioprocessing and microbiology labs requiring precision in bacterial and yeast cell lysis, thus improving reproducibility and throughput

- In January 2023, Bio-Rad Laboratories, Inc. (U.S.) partnered with multiple university research centers to validate its next-gen nucleic acid extraction kits that integrate both chemical and mechanical lysis technologies. The kits are engineered for downstream applications such as PCR, qPCR, and next-gen sequencing, supporting rapid diagnostic advancements and biomarker discovery initiatives

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.