Global Cell Separation Technology Market

Market Size in USD Billion

CAGR :

%

USD

16.30 Billion

USD

57.29 Billion

2025

2033

USD

16.30 Billion

USD

57.29 Billion

2025

2033

| 2026 –2033 | |

| USD 16.30 Billion | |

| USD 57.29 Billion | |

|

|

|

|

Cell Separation Technology Market Size

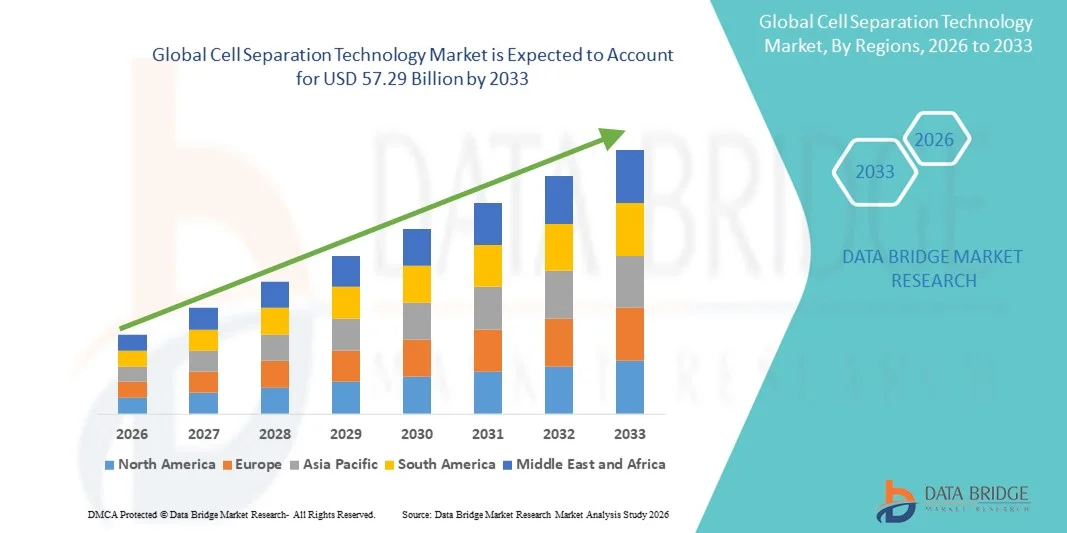

- The global cell separation technology market size was valued at USD 16.30 billion in 2025 and is expected to reach USD 57.29 billion by 2033, at a CAGR of 17.01% during the forecast period

- The market growth is largely fueled by rising demand for personalized medicine, regenerative therapies, and cell‑based research, along with technological advancements in cell isolation methods such as immunomagnetic sorting, density‑gradient centrifugation, and filtration, driving adoption across pharmaceutical, biotechnology, and research sectors

- Furthermore, increasing prevalence of chronic and degenerative diseases, growing investments in life sciences R&D, and the need for precise and efficient cell separation solutions are establishing these technologies as essential tools in modern biomedical workflows. These converging factors are accelerating the uptake of cell separation solutions, thereby significantly boosting the industry's growth

Cell Separation Technology Market Analysis

- Cell separation technologies, encompassing methods such as immunomagnetic sorting, density-gradient centrifugation, filtration, and fluorescence-activated cell sorting (FACS), are increasingly vital components of modern biomedical research, regenerative medicine, and cell-based therapy workflows due to their precision, efficiency, and ability to isolate specific cell populations for downstream applications

- The escalating demand for cell separation technologies is primarily fueled by the growing adoption of personalized medicine, stem cell research, immunotherapy development, and increasing investments in biotechnology and pharmaceutical R&D

- North America dominated the cell separation technology market with the largest revenue share of 39.8% in 2025, characterized by advanced healthcare infrastructure, high research funding, and a strong presence of key industry players, with the U.S. witnessing substantial growth in adoption across hospitals, research institutes, and biopharmaceutical companies, driven by innovations in automated and high-throughput cell isolation platforms

- Asia-Pacific is expected to be the fastest-growing region in the cell separation technology market during the forecast period due to increasing biomedical research initiatives, expanding healthcare infrastructure, and rising investments in regenerative medicine and personalized therapies

- Immunomagnetic Cell Separation segment dominated the cell separation technology market with a market share of 43% in 2025, driven by its high specificity, scalability, and widespread application in research, clinical diagnostics, and therapeutic cell processing

Report Scope and Cell Separation Technology Market Segmentation

|

Attributes |

Cell Separation Technology Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Cell Separation Technology Market Trends

Automation and AI-Driven Cell Isolation

- A significant and accelerating trend in the global cell separation technology market is the growing integration of automation and artificial intelligence (AI) in cell isolation workflows, enhancing precision, throughput, and reproducibility across research and clinical applications

- For instance, automated FACS platforms now incorporate AI algorithms to optimize sorting parameters in real time, reducing manual intervention and increasing yield of target cell populations

- AI-driven systems can predict optimal separation conditions, detect anomalies during processing, and provide intelligent alerts for sample quality, ensuring higher reliability and efficiency in downstream applications

- The integration of automated and AI-enabled cell separation platforms enables laboratories to streamline operations, minimize human error, and maintain consistent performance across multiple experiments or therapeutic batches

- This trend toward intelligent, high-throughput, and reproducible cell separation workflows is reshaping expectations in biomedical research and therapeutic manufacturing

- The demand for AI-enabled automated cell separation systems is growing rapidly across both research institutions and biopharmaceutical companies, as stakeholders increasingly prioritize efficiency, accuracy, and scalable operations

- For instance, microfluidics-based cell separation devices are gaining traction for rare cell isolation, offering higher sensitivity and reduced sample handling time

- Integration of cloud-based monitoring and data analytics in cell separation platforms is enabling remote oversight, workflow optimization, and real-time decision-making, driving adoption in large-scale laboratories and contract manufacturing organizations

Cell Separation Technology Market Dynamics

Driver

Increasing Demand for Cell-Based Therapies and Research Applications

- The growing focus on personalized medicine, regenerative therapies, and immunotherapies is a key driver for the rising adoption of cell separation technologies

- For instance, CAR-T cell manufacturing requires high-purity T-cell isolation, driving demand for precise immunomagnetic and flow cytometry-based separation platforms

- As biomedical research and clinical applications expand, the need for consistent, high-quality cell isolation is increasing, encouraging the deployment of advanced cell separation technologies

- Furthermore, rising investments in biotechnology, pharmaceutical R&D, and academic research are creating a robust ecosystem for market growth, with a focus on cell therapy, stem cell research, and disease modeling

- The scalability, reproducibility, and precision offered by modern cell separation systems are critical for meeting regulatory and clinical standards, further propelling adoption across laboratories and therapeutic production facilities

- The demand for streamlined, efficient, and reproducible cell separation workflows is accelerating market growth in both research and clinical domains

- For instance, growing stem cell banking initiatives are driving demand for standardized, high-throughput separation solutions

- Increasing collaborations between biotech companies and research institutes for novel cell-based therapies are creating further opportunities for advanced cell separation technology adoption

Restraint/Challenge

High Cost and Regulatory Compliance Requirements

- The relatively high cost of advanced cell separation platforms, including automated and AI-enabled systems, poses a challenge to adoption, particularly for small laboratories or emerging markets

- For instance, high-throughput FACS or immunomagnetic separation systems can cost tens of thousands of dollars, limiting accessibility for budget-constrained research facilities

- Compliance with stringent regulatory requirements for clinical and therapeutic applications also complicates adoption, as systems must meet GMP standards and maintain traceable quality records

- Training requirements and technical expertise needed to operate complex separation platforms can hinder deployment in some institutions, slowing market penetration

- While costs are gradually decreasing with technological advancements, the premium for high-precision, automated, or AI-integrated systems remains a barrier to widespread adoption

- Overcoming these challenges through cost-effective solutions, standardized protocols, and regulatory support is vital for sustaining long-term market growth

- For instance, lengthy validation and certification processes for therapeutic-grade cell separation devices can delay product launch and adoption

- Limited awareness and adoption of advanced separation technologies in emerging regions further restrict market expansion, highlighting the need for targeted training and demonstration programs

Cell Separation Technology Market Scope

The market is segmented on the basis of technology type, application, and end user.

- By Technology Type

On the basis of technology type, the cell separation technology market is segmented into immunomagnetic cell separation, fluorescence-activated cell sorting (FACS), density gradient centrifugation, microfluidic cell separation, and others. The immunomagnetic cell separation segment dominated the market with the largest market revenue share of 43% in 2025, driven by its high specificity, scalability, and reproducibility for isolating target cells. Researchers and biopharmaceutical companies often prioritize immunomagnetic separation for CAR-T therapy, stem cell isolation, and clinical-grade cell processing. Its ease of use, compatibility with automated systems, and ability to process large volumes make it the preferred choice in both research and therapeutic applications. Furthermore, immunomagnetic platforms integrate well with existing laboratory workflows, enabling seamless downstream applications in diagnostics and drug development. The segment’s dominance is also supported by continuous innovation, including magnetic bead technology enhancements and multi-target separation capabilities.

The microfluidic cell separation segment is anticipated to witness the fastest growth rate of 20.3% from 2026 to 2033, fueled by the increasing demand for rare cell isolation and lab-on-a-chip applications. Microfluidic devices offer high sensitivity, reduced sample handling, and precise separation at a microscale, making them ideal for cancer research, circulating tumor cell detection, and stem cell analysis. The compact design, low reagent consumption, and compatibility with automated platforms make microfluidic separation attractive for both clinical and research laboratories. Its growth is further accelerated by ongoing integration with AI and imaging systems, enabling high-throughput and real-time monitoring of cell separation processes. Increasing funding in precision medicine and liquid biopsy research is also driving adoption in both developed and emerging markets.

- By Application

On the basis of application, the cell separation technology market is segmented into stem cell research, immunology, neuroscience, cancer research, and others. The stem cell research segment dominated the market with the largest revenue share in 2025, driven by the growing focus on regenerative medicine, personalized therapies, and stem cell banking initiatives. Researchers and therapeutic developers prioritize high-purity stem cell isolation to ensure reproducibility and safety for clinical applications. Stem cell research is expanding across academic, hospital, and biopharmaceutical sectors, requiring robust and scalable separation technologies. Technological advancements, such as immunomagnetic and microfluidic separation, are enabling efficient isolation of rare stem cell populations. Furthermore, regulatory support and increasing funding for regenerative medicine projects are accelerating market growth in this segment.

The cancer research segment is expected to witness the fastest CAGR from 2026 to 2033 due to rising adoption of liquid biopsy, circulating tumor cell (CTC) isolation, and precision oncology research. High-purity separation techniques are critical for detecting rare cancer cells, enabling early diagnosis and monitoring therapeutic responses. Advanced technologies such as microfluidic and FACS-based separation are increasingly applied in oncology studies to isolate target cells efficiently. The growing prevalence of cancer worldwide, along with increased R&D investments and collaborations between biotech companies and research institutes, is further driving the adoption of cell separation in cancer research. In addition, technological innovations allowing automated and high-throughput processing enhance the appeal of these systems for large-scale oncology studies.

- By End User

On the basis of end user, the cell separation technology market is segmented into biotechnology and pharmaceutical companies, hospitals and diagnostic laboratories, academic and research institutes, and others. The biotechnology and pharmaceutical companies segment dominated the market with the largest revenue share in 2025, driven by the need for high-throughput, precise, and reproducible cell isolation for therapeutic development and clinical trials. Companies developing cell-based therapies, immunotherapies, and regenerative medicine products rely heavily on advanced separation platforms to ensure quality and regulatory compliance. Integration with automated and AI-enabled systems enhances workflow efficiency, reduces human error, and supports large-scale production requirements. Continuous innovation in separation technologies further strengthens adoption in this segment.

The academic and research institutes segment is anticipated to witness the fastest growth rate of 19.8% from 2026 to 2033, fueled by increasing funding for biomedical research, stem cell studies, and disease modeling. Research institutions are adopting advanced immunomagnetic, FACS, and microfluidic platforms to conduct precise and reproducible experiments. The rising collaboration between academia and biotech companies for translational research also drives demand. Affordable and compact separation systems designed for lab-scale experiments are becoming increasingly popular in universities and research labs. Technological integration, including automation and real-time data monitoring, further accelerates adoption in the academic segment.

Cell Separation Technology Market Regional Analysis

- North America dominated the cell separation technology market with the largest revenue share of 39.8% in 2025, characterized by advanced healthcare infrastructure, high research funding, and a strong presence of key industry players

- Institutions and companies in the region highly value precision, reproducibility, and scalability offered by advanced cell separation technologies, which are critical for research, clinical applications, and therapeutic manufacturing

- This widespread adoption is further supported by strong government and private investments in biotechnology and life sciences R&D, a skilled workforce, and the presence of leading global players, establishing cell separation technologies as essential tools in both academic and commercial biomedical applications

U.S. Cell Separation Technology Market Insight

The U.S. cell separation technology market captured the largest revenue share of 82% in 2025 within North America, fueled by the presence of leading biotechnology and pharmaceutical companies and extensive investments in cell-based research and therapies. Institutions prioritize high-throughput, precise, and reproducible separation systems for applications such as CAR-T therapy, stem cell research, and immunology studies. The growing trend of automated and AI-enabled cell separation platforms further drives adoption. Moreover, integration with clinical and research workflows, along with regulatory compliance support, significantly contributes to the market's expansion.

Europe Cell Separation Technology Market Insight

The Europe cell separation technology market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising investments in biotechnology, stringent regulatory standards for clinical and therapeutic applications, and the increasing demand for cell-based therapies. Advanced research institutions and hospitals are adopting high-precision separation systems for immunology, cancer research, and stem cell studies. Furthermore, the emphasis on innovation, collaboration among research organizations, and adoption of automated platforms are fostering market growth across multiple European countries.

U.K. Cell Separation Technology Market Insight

The U.K. cell separation technology market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by expanding biomedical research, stem cell initiatives, and a strong focus on immunotherapy development. Hospitals, academic institutions, and biotech companies are increasingly adopting high-quality, reproducible cell separation systems to meet clinical and research standards. The country's robust funding programs, skilled workforce, and collaborative projects with global biotech firms are expected to further stimulate market growth.

Germany Cell Separation Technology Market Insight

The Germany cell separation technology market is expected to expand at a considerable CAGR during the forecast period, fueled by a well-established healthcare infrastructure, growing R&D investments, and the rising adoption of regenerative medicine and immunotherapies. German research institutions and hospitals prioritize precision, efficiency, and reproducibility in cell isolation, encouraging the uptake of advanced immunomagnetic, FACS, and microfluidic technologies. Integration with automated platforms and compliance with stringent European regulations further strengthens market penetration.

Asia-Pacific Cell Separation Technology Market Insight

The Asia-Pacific cell separation technology market is poised to grow at the fastest CAGR of 22% during the forecast period of 2026 to 2033, driven by increasing investments in biotechnology, expanding healthcare infrastructure, and growing research in stem cell therapies and immunology in countries such as China, Japan, and India. Government initiatives promoting biomedical research and digitalization in healthcare are accelerating adoption. Furthermore, the availability of cost-effective cell separation solutions and increasing collaborations between academic and biotech institutions are expanding the market to a broader user base.

Japan Cell Separation Technology Market Insight

The Japan cell separation technology market is gaining momentum due to the country's advanced biomedical research ecosystem, high focus on precision medicine, and increasing applications in regenerative therapies. Research institutes and hospitals are adopting automated and AI-enabled cell separation systems for efficiency and reproducibility. Integration with other laboratory automation platforms and demand for high-purity cell isolation in clinical studies is fueling growth. Moreover, Japan’s aging population is such asly to drive demand for regenerative medicine and stem cell-based therapies, boosting market adoption.

India Cell Separation Technology Market Insight

The India cell separation technology market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid expansion in biotechnology research, rising academic and clinical studies, and increasing government support for healthcare innovation. Adoption of immunomagnetic, FACS, and microfluidic separation systems is growing across hospitals, research institutes, and pharmaceutical companies. The push for affordable and scalable cell separation solutions, alongside a rising number of biotech startups and domestic manufacturers, are key factors propelling market growth in India.

Cell Separation Technology Market Share

The Cell Separation Technology industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Miltenyi Biotec (Germany)

- BD (U.S.)

- Beckman Coulter, Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- STEMCELL Technologies Inc. (Canada)

- Terumo Corporation (Japan)

- Merck KGaA (Germany)

- GE Healthcare (U.K.)

- Akadeum Life Sciences, Inc. (U.S.)

- Corning Incorporated (U.S.)

- Agilent Technologies, Inc (U.S.)

- Sony Biotechnology Inc (U.S.)

- Cytek Biosciences (U.S.)

- Cell Microsystems, Inc (U.S.)

- NanoCellect Biomedical, Inc. (U.S.)

- Cytonome/ST, LLC (U.S.)

- Sartorius AG, (Germany)

- CorEvitas, LLC (U.S.)

What are the Recent Developments in Global Cell Separation Technology Market?

- In September 2025, Charles River Laboratories International, Inc. announced integration of Akadeum’s GMP‑grade T cell isolation kit into its Cell Therapy Flex Platform marking a major CDMO adoption of buoyancy‑based separation for clinical‑grade cell therapy production

- In June 2025, Akadeum secured over USD 20 million in a financing round, aimed at scaling commercial operations and supporting customers entering clinical trials a strong signal of growing investor confidence and expansion of cell separation adoption in therapeutic contexts

- In May 2025, Akadeum Life Sciences announced that its microbubble‑based cell separation platform (its Human T Cell Leukopak Isolation Kit) can now be broadly integrated on existing cell‑therapy manufacturing platforms enabling scalable, decentralized cell therapy production with reduced footprint and cost

- In April 2024, BD Biosciences launched globally its new cell sorter lines BD FACSDiscover S8 Cell Sorter featuring breakthrough real‑time imaging and spectral flow cytometry technology (BD CellView + SpectralFX), enabling high‑parameter, image‑enabled sorting that enhances insights beyond traditional flow cytometry

- In October 2022, Thermo Fisher Scientific unveiled its new Gibco CTS DynaCellect Magnetic Separation System a closed and automated magnetic separation and bead‑removal solution intended to streamline cell therapy manufacturing, increasing throughput, efficiency, and standardization

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.