Global Cell Therapy Market

Market Size in USD Million

CAGR :

%

USD

21.16 Million

USD

86.23 Million

2024

2032

USD

21.16 Million

USD

86.23 Million

2024

2032

| 2025 –2032 | |

| USD 21.16 Million | |

| USD 86.23 Million | |

|

|

|

|

Cell Therapy Market Size

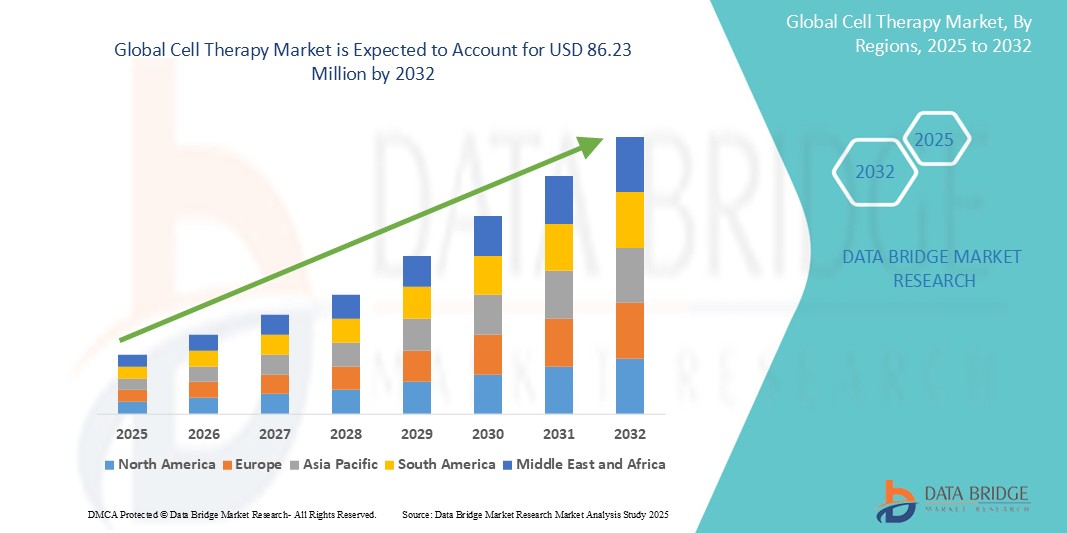

- The global cell therapy market size was valued at USD 21.16 million in 2024 and is expected to reach USD 86.23 million by 2032, at a CAGR of 19.20% during the forecast period

- The market growth is largely fueled by rising investments in regenerative medicine and advancements in gene-editing technologies

- The increasing prevalence of chronic diseases, such as cancer and autoimmune disorders, is driving demand for personalized and targeted treatments. Coupled with rising regulatory approvals and successful clinical trial outcomes, this is accelerating the adoption of cell-based therapies worldwide

Cell Therapy Market Analysis

- The global cell therapy market is currently centered around the development and adoption of personalized therapies that use a patient’s own cells to treat various diseases, enhancing treatment precision and safety

- Increasing advancements in cell processing and manufacturing technologies are improving the scalability and accessibility of these therapies, allowing more patients to benefit from tailored treatment options

- North America dominates the cell therapy market with the largest revenue share of 58.12% in 2024, driven by advanced healthcare infrastructure and strong investment in research and development, which support rapid innovation and commercialization of new therapies

- Asia-pacific is expected to be the fastest growing region in the cell therapy market during the forecast period due to increasing urbanization, rising disposable incomes, and technological advancements.

- The autologous segment held the largest market revenue share in 2024, accounting for around 91.6% of the market. This dominance is driven by the use of a patient's own cells, which minimizes the risk of immune rejection and adverse reactions, leading to higher treatment efficacy and safety for personalized therapies

Report Scope and Cell Therapy Market Segmentation

|

Attributes |

Cell Therapy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Cell Therapy Market Trends

“Advancements Driving Growth in Personalized Cell Therapy”

- The global cell therapy market is increasingly focusing on personalized therapies that use a patient’s own cells, which improve treatment accuracy and reduce immune rejection risks

- Advances in cell manufacturing techniques are enabling more efficient and scalable production, making personalized treatments more accessible to a broader patient population

- For instance, several companies have recently initiated clinical trials exploring the use of autologous cell therapies for complex conditions such as Parkinson’s disease and certain cancers, showcasing growing confidence in this approach

- In addition, improvements in cell storage and transportation technologies are helping maintain cell viability and potency, which is critical for the success of personalized therapies

- The ongoing trend toward personalized cell therapy combined with technological progress in production and logistics is shaping the market’s future, offering new hope for patients with difficult-to-treat diseases

Cell Therapy Market Dynamics

Driver

“Increasing Adoption of Regenerative Medicine Techniques”

- Regenerative medicine’s rise is fueling cell therapy growth by repairing damaged tissues, with FDA approvals such as CAR-T therapies for cancer highlighting progress in this field

- Cell therapies target autoimmune diseases, orthopedic injuries, and heart disorders, as seen in mesenchymal stem cell trials for osteoarthritis and heart failure treatment

- Major pharma companies such as Novartis and Gilead Sciences are boosting investments in cell therapy, accelerating the transition from research to approved clinical applications

- Regulatory bodies support innovation by streamlining processes, exemplified by the FDA’s regenerative medicine advanced therapy designation, speeding up market access for new therapies

- Growing patient awareness, driven by positive outcomes in autologous therapies for Parkinson’s disease, encourages wider adoption and recommendation by healthcare providers

- Together, these factors create a strong foundation for regenerative medicine to significantly advance the cell therapy market

Restraint/Challenge

“Complex Manufacturing and Scalability Issues”

- Manufacturing cell therapies involves complex steps such as cell sourcing, modification, and quality control, requiring specialized equipment and strict protocols to maintain cell viability and safety

- The autologous nature of many therapies means each batch uses patient-specific cells, creating variability that complicates standardization and raises production costs

- Personalized handling and rapid processing needs limit large-scale manufacturing and require advanced logistics such as temperature-controlled transport to ensure timely delivery

- Strict regulatory requirements for potency, purity, and sterility add lengthy validation processes and increase production expenses, which can make therapies less accessible

- Current manufacturing facilities often cannot meet growing demand, causing delays in treatment availability and slowing commercial expansion of cell therapies

- Overall, overcoming these manufacturing and scalability challenges is essential for the cell therapy market to achieve widespread adoption and sustained growth

Cell Therapy Market Scope

The global cell therapy market is segmented on the basis of technology, type, cell type, cell source, application, and end-user.

- By Technology

On the basis of technology, the cell therapy market is segmented into somatic cell technology, cell immortalization technology, viral vector technology, genome editing technology, cell plasticity technology, and three-dimensional technology. The somatic cell technology segment is estimated to hold the largest market share in 2024. This dominance is driven by its established and widely adopted methods for modifying and utilizing somatic cells for therapeutic purposes, particularly in areas such as car-t cell therapies which have seen significant clinical success and regulatory approvals.

The genome editing technology segment is anticipated to witness the fastest growth rate from 2025 to 2032. This rapid growth is fueled by advancements in tools such as crispr-cas9, which offer unprecedented precision in modifying genes for therapeutic applications. The potential to correct genetic defects and enhance cell function for various diseases is driving significant research and investment in this area.

- By Type

On the basis of type, the cell therapy market is segmented into autologous and allogeneic. The autologous segment held the largest market revenue share in 2024, accounting for around 91.6% of the market. This dominance is driven by the use of a patient's own cells, which minimizes the risk of immune rejection and adverse reactions, leading to higher treatment efficacy and safety for personalized therapies.

The allogeneic segment is expected to witness the fastest CAGR from 2025 to 2032. This growth is propelled by its potential for scalability, immediate availability ("off-the-shelf" therapies), and cost-effectiveness compared to autologous treatments. Ongoing research and clinical trials are focused on overcoming immune rejection challenges to broaden the application of allogeneic therapies.

- By Cell Type

On the basis of cell type, the cell therapy market is segmented into stem cell and non-stem cell. The stem cell segment is estimated to hold the largest market share in 2024. This is due to the inherent regenerative and differentiation capabilities of stem cells, making them highly versatile for treating a wide range of degenerative diseases, tissue repair, and various chronic conditions.

The non-stem cell segment is expected to witness significant growth from 2025 to 2032. This growth is driven by the increasing exploration and development of non-stem cell therapies, such as t-cell therapies (e.g., car-t cells) for oncology, which have demonstrated remarkable success in treating specific diseases and are rapidly expanding their therapeutic indications.

- By Cell Source

On the basis of cell source, the cell therapy market is segmented into induced pluripotent stem cells, bone marrow, umbilical cord blood-derived cells, adipose tissues, and neural stem cells. The bone marrow segment is estimated to hold the largest market share in 2024. This is due to bone marrow being a traditional and well-established source of hematopoietic stem cells, widely used in transplantation for hematological malignancies and other blood disorders, with extensive clinical experience and infrastructure.

The induced pluripotent stem cells (IPSCS) segment is anticipated to witness the fastest CAGR from 2025 to 2032. This rapid growth is fueled by their unique ability to differentiate into various cell types, offering a highly versatile and patient-specific source for regenerative medicine without ethical concerns associated with embryonic stem cells, leading to substantial research and development.

- By application

On the basis of application, the cell therapy market is segmented into musculoskeletal, cardiovascular, gastrointestinal, neurological, oncology, dermatology, wounds and injuries, ocular, and others. The oncology segment held the largest market revenue share in 2024, accounting for approximately 70.2% of the market. This dominance is driven by the significant breakthroughs and commercial success of car-t cell therapies in treating various blood cancers, coupled with a high unmet need and extensive research in cancer immunotherapies.

The dermatology segment is expected to witness the fastest CAGR from 2025 to 2032. This growth is fueled by the increasing application of cell therapies for treating various skin conditions, including chronic wounds, burns, and aesthetic procedures, driven by advancements in tissue engineering and regenerative approaches for skin repair and regeneration.

- By End-User

On the basis of end-user, the cell therapy market is segmented into hospitals and clinics, regenerative medicine centres, diagnostic and research centres, and others. The hospitals and clinics segment accounted for the largest market revenue share in 2024, holding approximately 41.7% of the market. This is driven by their role as primary points of patient care, where cell therapies are administered, and the increasing integration of these advanced treatments into standard clinical practice.

The regenerative medicine centres segment is expected to witness the fastest CAGR from 2025 to 2032. This growth is propelled by increasing specialization in cell-based therapies, significant investments in dedicated facilities, and a growing focus on research and clinical trials for new regenerative treatments, making them crucial hubs for the advancement and delivery of cell therapies.

Cell Therapy Market Regional Analysis

- North America dominates the cell therapy market with the largest revenue share of 58.12% in 2024, driven by advanced healthcare infrastructure and strong investment in research and development, which support rapid innovation and commercialization of new therapies

- The region benefits from favorable regulatory frameworks that expedite approval processes, encouraging pharmaceutical companies and biotech firms to launch cutting-edge cell therapies, thus enhancing market growth

- In addition, increasing awareness among patients and healthcare providers about personalized medicine and regenerative treatments is boosting adoption rates, while collaborations between academia and industry further accelerate clinical advancements and product availability

U.S. Cell Therapy Market Insight

The U.S. holds the largest market share globally, driven by high healthcare expenditure, advanced research capabilities, and widespread adoption of cutting-edge cell therapy treatments. the U.S. leads with significant investments in biotech innovation, strong regulatory support, and increasing approvals of novel cell therapy products. growing demand for personalized medicine and rising incidence of cancer and rare diseases further stimulate market growth. the region’s robust healthcare infrastructure and presence of major market players create a favorable environment for continued expansion.

Europe Cell Therapy Market Insight

Europe’s cell therapy market is set for substantial growth, supported by well-established healthcare systems and increasing government initiatives to foster innovation. Stringent regulatory standards and a focus on safety are pushing the development of highly efficient and standardized therapies. Countries such as Germany, the U.K., and France lead the market with strong clinical trial activity and rising adoption in both public and private healthcare sectors. Urbanization and an aging population are also key factors boosting demand.

U.K. Cell Therapy Market Insight

The U.K. cell therapy market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by expanding investment in biotechnology research and development. increasing government funding, collaborations between academic institutions and industry, and growing patient awareness of novel therapies support market growth. the U.K.’s favorable regulatory environment and strong healthcare infrastructure encourage adoption of advanced cell therapy treatments across various medical fields.

Germany Cell Therapy Market Insight

The German cell therapy market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing clinical trial activities and rising awareness of cell-based treatments for chronic diseases. Germany’s well-developed healthcare infrastructure, emphasis on innovation, and supportive reimbursement policies promote the growth of the cell therapy sector. The integration of cell therapy in personalized medicine and regenerative treatments is gaining traction, particularly for oncology and rare genetic disorders.

Asia-Pacific Cell Therapy Market Insight

The Asia-pacific cell therapy market is poised to grow at the fastest CAGR in 2025, driven by increasing healthcare investments, rapid urbanization, and technological advancements in countries such as China, Japan, and India. The region’s growing focus on regenerative medicine and rising prevalence of chronic diseases stimulate demand. Government initiatives supporting biotechnology innovation and expanding clinical trial infrastructure further boost the market. Additionally, the affordability and accessibility of cell therapy treatments are improving, widening the consumer base.

Japan Cell Therapy Market Insight

The Japan cell therapy market is gaining momentum due to the country’s strong focus on advanced medical technology and regenerative medicine. An aging population and rising incidence of chronic diseases, such as cancer and neurological disorders, are key drivers. The government’s promotion of regenerative medicine and streamlined regulatory pathways support market expansion. Japan’s emphasis on safety and efficacy ensures development of high-quality therapies, with increasing adoption in hospitals and research centers.

China Cell Therapy Market Insight

The China cell therapy market accounted for the largest market revenue share in Asia-pacific in 2025, attributed to rapid urbanization, expanding healthcare infrastructure, and increasing government support for biotech innovation. China’s large patient pool and growing prevalence of chronic and rare diseases create significant demand for cell therapy solutions. The country is also becoming a hub for clinical trials and manufacturing of cell therapy products. Affordable pricing and rising public awareness further propel market growth.

Cell Therapy Market Share

The cell therapy industry is primarily led by well-established companies, including:

- Kolon TissueGene, Inc. (U.S.)

- JCR Pharmaceuticals Co. Ltd. (Japan)

- MEDIPOST (South Korea)

- Stemedica Cell Technologies Inc. (U.S.)

- NuVasive Inc. (U.S.)

- Castle Creek Biosciences, Inc. (U.S.)

- Cellectis (France)

- BioNTech IMFS (Germany)

- Pluri Biotech Ltd. (Israel)

- PRAXIS HEALTHCARE & PHARMACEUTICALS PVT. LTD. (U.S.)

- PHARMICELL Co. Ltd (South Korea)

- ANTEROGEN CO. LTD. (South Korea)

- Novartis AG (Switzerland)

- GSK plc (U.K.)

- Bristol-Myers Squibb Company (U.S.)

- Celyad Oncology SA (Belgium)

- Regen BioPharma, Inc. (U.S.)

- Advancells (India)

Latest Developments in Global Cell Therapy Market

- In March 2025, AGC Biologics launched a dedicated Cell and Gene Technologies Division to enhance support for developers of cell and gene therapies. The new division provides expanded capacity, scientific expertise, and specialized CDMO services across facilities in Milan, Longmont, Colorado, and Yokohama, Japan. This initiative aims to accelerate the development and manufacturing of advanced therapies globally

- In October 2023, Aurion Biotech initiated a phase 1/2 clinical trial in the U.S. to evaluate its cell therapy aimed at treating corneal edema. This study marks a significant advancement in exploring innovative treatment options for this eye condition. The trial's progression will be closely monitored as it seeks to demonstrate the therapy's safety and efficacy in patients

- In October 2023, Nkarta, Inc. received FDA approval for its Investigational New Drug (IND) application to study NKX019, an allogeneic CAR NK cell therapy targeting CD19. This therapy aims to provide a novel treatment option for lupus nephritis, a challenging autoimmune condition. The approval marks a crucial step in advancing NKX019 towards clinical trials, where its effectiveness and safety will be assessed

- In June 2023, Vertex Pharmaceuticals Incorporated partnered with Lonza to establish a joint venture aimed at enhancing the production of Vertex's investigational stem cell therapies. This collaboration specifically targets treatments for Type 1 Diabetes (T1D), concentrating on the clinical trial programs VX-880 and VX-264. The initiative is expected to streamline manufacturing processes and support the advancement of these promising therapies

- In May 2023, Johnson & Johnson entered into a global collaboration and licensing agreement with Cellular Biomedicine Group to co-develop advanced CAR-T therapies. This partnership aims to innovate and enhance the effectiveness of CAR-T treatments, reflecting both companies' commitment to advancing cancer therapies. The collaboration is expected to accelerate the development of these next-generation therapies in the oncology space

- In March 2023, Adaptimmune Therapeutics plc and TCR2 Therapeutics announced a strategic partnership aimed at establishing a leading cell therapy organization focused on treating solid tumors. This alliance is designed to leverage each company's expertise and resources to advance innovative therapies in this challenging area of oncology. The collaboration reflects a shared commitment to improving

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.