Global Centrally Acting Anorectics Obesity Drugs Market

Market Size in USD Billion

CAGR :

%

USD

1.44 Billion

USD

4.44 Billion

2024

2032

USD

1.44 Billion

USD

4.44 Billion

2024

2032

| 2025 –2032 | |

| USD 1.44 Billion | |

| USD 4.44 Billion | |

|

|

|

|

Centrally Acting Anorectics Obesity Drugs Market Size

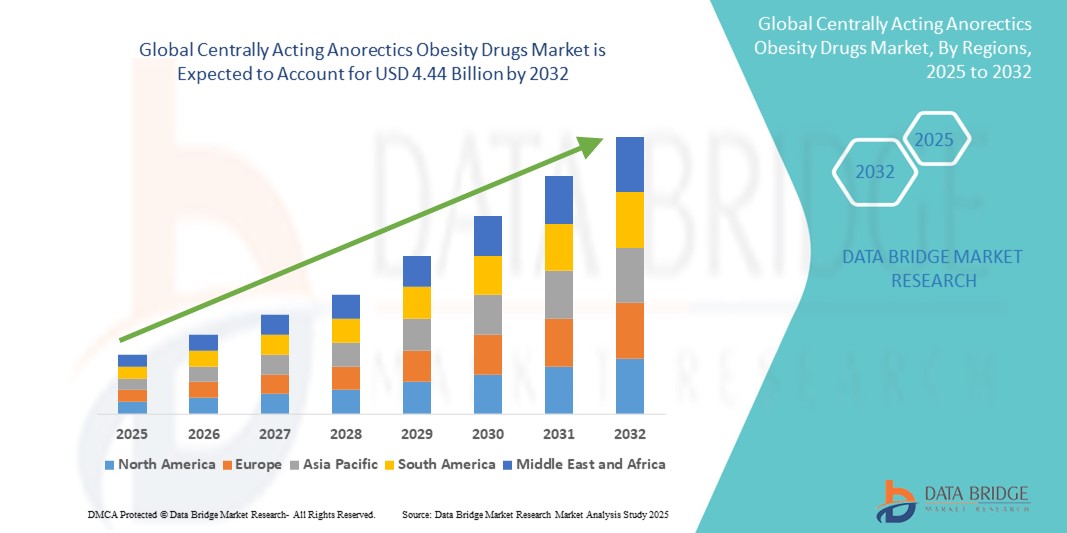

- The global centrally acting anorectics obesity drugs market size was valued at USD 1.44 billion in 2024 and is expected to reach USD 4.44 billion by 2032, at a CAGR of 15.13% during the forecast period

- The market growth is largely driven by the rising prevalence of obesity and the increasing demand for pharmacological interventions that act directly on the central nervous system to suppress appetite and promote weight loss

- Furthermore, growing awareness regarding obesity-related health risks and a surge in the approval and commercialization of CNS-acting combination therapies and GLP-1 analogs are reinforcing market expansion. These converging factors are enhancing the clinical adoption of centrally acting anorectics, thereby significantly accelerating the industry's growth

Centrally Acting Anorectics Obesity Drugs Market Analysis

- Centrally Centrally acting anorectics, which suppress appetite by targeting the brain’s satiety and reward centers, are becoming increasingly essential components of modern obesity management due to their efficacy, CNS-specific mechanisms, and ability to support long-term weight control in both clinical and outpatient settings

- The growing demand for these drugs is primarily driven by the global surge in obesity rates, heightened awareness of obesity-related comorbidities, and the expanding availability of novel centrally acting pharmacotherapies such as GLP-1 receptor agonists and combination therapies

- North America dominated the centrally acting anorectics obesity drugs market with the largest revenue share of 60.5% in 2024, attributed to early regulatory approvals, strong healthcare infrastructure, rising obesity prevalence, and the presence of major pharmaceutical manufacturers particularly in the U.S., which has seen increasing prescriptions of CNS-acting agents such as semaglutide and bupropion-naltrexone

- Asia-Pacific is expected to be the fastest growing region in this market during the forecast period due to changing dietary habits, rising healthcare spending, and expanding access to anti-obesity treatments in countries such as China, India, and South Korea

- The CNS-acting GLP-1 receptor agonist segment dominated the centrally acting anorectics market with a share of 85.5% in 2024, driven by its superior weight loss efficacy, CNS-mediated appetite suppression, and widespread physician and patient adoption across both injectable and oral formulations

Report Scope and Centrally Acting Anorectics Obesity Drugs Market Segmentation

|

Attributes |

Centrally Acting Anorectics Obesity Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Centrally Acting Anorectics Obesity Drugs Market Trends

“AI-Driven Personalization and Digital Health Integration”

- A major and accelerating trend in the global centrally acting anorectics market is the integration of artificial intelligence (AI) and digital health platforms to enhance patient adherence and treatment personalization. This convergence is enabling tailored therapy approaches based on individual metabolic responses, behavioral data, and lifestyle monitoring

- For instance, platforms such as Noom and Oura, though not drug developers, are being integrated with anti-obesity medications to provide behavioral support, optimize dosing schedules, and alert healthcare providers to early signs of non-compliance or adverse reactions

- AI-powered tools are increasingly used in remote patient monitoring, capturing data such as diet, physical activity, sleep, and medication use to fine-tune treatment protocols. Pharmaceutical players are exploring AI-based dosing algorithms to improve efficacy and minimize side effects

- Integration with digital therapeutics and telehealth ecosystems further supports centralized data collection and real-time health coaching, boosting treatment outcomes and long-term weight management

- This shift toward smarter, tech-enabled obesity treatment is reshaping market expectations and driving pharmaceutical companies to develop comprehensive therapy packages that pair centrally acting drugs with app-based interventions and real-world patient data feedback loops

- As health systems and insurers prioritize outcomes-based reimbursement, demand for digitally enhanced, evidence-backed drug interventions is growing across both developed and emerging markets

Centrally Acting Anorectics Obesity Drugs Market Dynamics

Driver

“Escalating Global Obesity Burden and Unmet Need for Effective CNS Therapies”

- The rising global prevalence of obesity and obesity-related comorbidities such as diabetes, cardiovascular diseases, and hypertension is a major growth driver for centrally acting anorectics. According to WHO estimates, over 1 billion people worldwide are currently classified as obese

- Centrally acting drugs that target hunger signaling pathways, such as GLP‑1 receptor agonists and naltrexone-bupropion, provide an effective pharmacological approach to long-term weight management, particularly where lifestyle modification alone has failed

- For instance, the FDA approval of Wegovy (semaglutide) and the growing off-label use of other GLP-1 drugs such as Ozempic for weight loss have significantly raised awareness of centrally acting obesity drugs as a mainstream medical solution

- The unmet clinical need for effective, sustainable weight reduction therapies is prompting strong interest from providers, payers, and patients asuch as, further reinforced by growing investments in R&D and pharmaceutical innovation within the neuroendocrine and appetite regulation space

- In addition, increasing insurance coverage and policy recognition of obesity as a chronic disease in markets such as the U.S. are helping to expand the eligible patient population and drive drug adoption

Restraint/Challenge

“High Treatment Cost and Long-Term Adherence Issues”

- Despite clinical efficacy, the high cost of centrally acting obesity drugs—particularly GLP 1 receptor agonists remains a major barrier to broader adoption, especially in low- and middle-income countries and among uninsured populations

- For instance, the monthly out-of-pocket cost for semaglutide-based treatments can exceed hundreds of dollars in markets without robust insurance support, discouraging long-term adherence

- In addition, side effects such as nausea, vomiting, and gastrointestinal distress—common with many centrally acting drugs—can lead to early treatment discontinuation, particularly among patients unprepared for such reactions

- Adherence to centrally acting obesity drugs also wanes when patients do not see rapid weight loss or are not concurrently supported with behavioral interventions, highlighting the importance of integrated care models

- Furthermore, regulatory and reimbursement variability across global markets introduces delays and challenges in market entry and commercialization, with several governments still treating obesity more as a lifestyle issue than a treatable chronic disease

- Addressing these barriers through pricing reforms, patient education, and digital engagement tools will be critical to sustaining long-term market growth and realizing the full potential of centrally acting anorectics

Centrally Acting Anorectics Obesity Drugs Market Scope

The market is segmented on the basis of product type, drug type, route of administration, and distribution channel.

- By Product Type

On the basis of product type, the global centrally acting anorectics obesity drugs market is segmented into mono-component anorectics, combination drugs, and CNS-acting GLP-1 receptor agonists. The CNS-acting GLP-1 receptor agonist segment dominated the market with a share of 85.5% in 2024, driven by its superior weight loss efficacy, CNS-mediated appetite suppression, and widespread physician and patient adoption across both injectable and oral formulations.

The CNS-acting GLP-1 receptor agonists segment is also projected to witness the fastest growth rate from 2025 to 2032 due to their dual benefit of appetite regulation and glycemic control. These drugs, such as liraglutide and semaglutide, modulate central satiety signaling, offering substantial weight loss outcomes backed by robust clinical trials. Their expanding application in obesity management beyond diabetes is expected to reshape treatment paradigms in the coming years.

- By Drug Type

On the basis of drug type, the global centrally acting anorectics obesity drugs market is segmented into prescription drugs and over-the-counter (OTC) drugs. The prescription drugs segment dominated the market in 2024, owing to regulatory restrictions on centrally acting anorectics and the need for clinical supervision due to potential side effects and misuse risks. Physicians tend to prefer prescription-based treatments to ensure appropriate patient monitoring and compliance.

The OTC drugs segment is expected to grow steadily over the forecast period, supported by increasing consumer interest in self-directed weight management and the availability of milder formulations. However, this segment remains limited in centrally acting anorectics due to regulatory and safety concerns.

- By Route Of Administration

On the basis of route of administration, the global centrally acting anorectics obesity drugs market is segmented into oral and injectable. The oral segment accounted for the largest market share in 2024, driven by patient preference for non-invasive administration, ease of dosing, and wider availability of oral anorectic medications. Tablets and capsules continue to dominate due to convenience, especially for long-term therapy.

The injectable segment is anticipated to register a significant growth rate from 2025 to 2032, mainly due to the increasing use of injectable GLP-1 receptor agonists, such as semaglutide. These injectables offer extended-release formulations and superior efficacy, attracting growing adoption among both healthcare providers and patients.

- By Distribution Channel

On the basis of distribution channel, the global centrally acting anorectics obesity drugs market is categorized into hospital pharmacies, retail pharmacies, and online pharmacies. The hospital pharmacies segment held the dominant share in 2024, due to high prescription volumes for centrally acting drugs and regulatory oversight in dispensing controlled substances. Hospitals remain the primary access points for initiating treatment under medical supervision.

The online pharmacies segment is projected to grow at the fastest pace through 2032, propelled by the global shift toward digital healthcare, increasing consumer convenience, and the expansion of telehealth platforms. As more regions adopt e-prescription and online drug delivery models, this channel is expected to gain substantial traction, especially in urban settings.

Centrally Acting Anorectics Obesity Drugs Market Regional Analysis

- North America dominated the centrally acting anorectics obesity drugs market with the largest revenue share of 60.5% in 2024, attributed to early regulatory approvals, strong healthcare infrastructure, rising obesity prevalence, and the presence of major pharmaceutical manufacturers

- The region exhibits a high demand for medically supervised weight management options, with centrally acting anorectics gaining traction due to their proven efficacy and regulatory approvals

- Factors such as favorable reimbursement frameworks, growing investment in obesity research, and increasing public awareness about weight-related comorbidities support robust market penetration across both the U.S. and Canada, making the region a leading hub for therapeutic advancements in obesity care

U.S. Centrally Acting Anorectics Obesity Drugs Market Insight

The U.S. centrally acting anorectics obesity drugs market captured the largest revenue share of 78.4% in 2024 within North America, fueled by high obesity rates, favorable reimbursement policies, and increased adoption of prescription weight-loss medications. A robust regulatory framework and accelerated FDA approvals for centrally acting therapies further strengthen the market. Rising patient awareness, physician-driven interventions, and integrated digital health support for weight management contribute to continued demand for centrally acting anorectics across clinical and retail settings.

Europe Centrally Acting Anorectics Obesity Drugs Market Insight

The Europe centrally acting anorectics obesity drugs market is projected to expand at a notable CAGR throughout the forecast period, primarily driven by rising obesity prevalence and enhanced public health strategies targeting metabolic disorders. Governments across the region are promoting pharmaceutical interventions as part of national obesity reduction programs. The growing preference for personalized medicine and the availability of combination anorectics are fostering market growth, particularly in Western European countries such as Germany, France, and the Netherlands.

U.K. Centrally Acting Anorectics Obesity Drugs Market Insight

The U.K. centrally acting anorectics obesity drugs market is anticipated to grow at a healthy CAGR during the forecast period, supported by NHS initiatives, increased public-private R&D collaborations, and rising demand for non-invasive obesity treatment alternatives. Consumer openness to novel pharmacotherapies and clinician confidence in centrally acting agents, particularly GLP-1 receptor agonists with central nervous system activity, is reinforcing market expansion. Public health campaigns further boost awareness and access to obesity treatments.

Germany Centrally Acting Anorectics Obesity Drugs Market Insight

The Germany centrally acting anorectics obesity drugs market is expected to expand considerably during the forecast period, driven by a structured healthcare system, proactive obesity management programs, and the country’s strong presence of global pharmaceutical companies. Demand is increasing for prescription anorectics with proven long-term efficacy, particularly in treating patients with obesity-linked diabetes or cardiovascular risks. Regulatory support and reimbursement for new-generation drugs are key accelerators for market growth.

Asia-Pacific Centrally Acting Anorectics Obesity Drugs Market Insight

The Asia-Pacific centrally acting anorectics obesity drugs market is poised to grow at the fastest CAGR from 2025 to 2032, driven by a rising incidence of lifestyle-related obesity and expanding access to advanced therapeutics in emerging economies. Countries such as China, India, and South Korea are witnessing increased investment in obesity care infrastructure, with pharmaceutical companies launching centrally acting formulations tailored to local needs. The market benefits from improving healthcare access, government-backed health awareness campaigns, and increasing disposable income.

Japan Centrally Acting Anorectics Obesity Drugs Market Insight

The Japan’s centrally acting anorectics obesity drugs market is gaining momentum due to an aging population, growing prevalence of metabolic syndrome, and strong public interest in healthy aging and weight control. Physicians are increasingly prescribing centrally acting anorectics to manage weight in patients with associated comorbidities. The integration of pharmacologic therapy into national health plans and a preference for scientifically validated interventions support market uptake, especially among urban populations.

India Centrally Acting Anorectics Obesity Drugs Market Insight

The India centrally acting anorectics obesity drugs market accounted for the largest revenue share in the Asia-Pacific market in 2024, supported by rising obesity rates in urban centers, increasing awareness of weight-related health risks, and improved access to medical weight-loss options. Growing demand for prescription anorectics in private clinics and hospitals, along with a surge in local drug development, is fueling market expansion. Health-tech platforms and telemedicine are also enhancing drug accessibility and adherence across various socio-economic groups.

Centrally Acting Anorectics Obesity Drugs Market Share

The centrally acting anorectics obesity drugs industry is primarily led by well-established companies, including:

- Novo Nordisk A/S (Denmark)

- Lilly (U.S.)

- Amgen Inc. (U.S.)

- Pfizer Inc. (U.S.)

- Currax Pharmaceuticals LLC (U.S.)

- Boehringer Ingelheim International GmbH (Germany)

- Sanofi (France)

- Zealand Pharma A/S (Denmark)

- Otsuka Pharmaceutical Co., Ltd. (Japan)

- Altimmune, Inc. (U.S.)

- Hanmi Pharmaceutical Co., Ltd. (South Korea)

- Gelesis, Inc. (U.S.)

- Structure Therapeutics Inc. (U.S.)

- Rhythm Pharmaceuticals, Inc. (U.S.)

- Vivus LLC (U.S.)

- AstraZeneca plc (U.K.)

- Regeneron Pharmaceuticals, Inc. (U.S.)

- Zydus Lifesciences Limited (India)

- Innovent Biologics, Inc. (China)

- Viking Therapeutics, Inc. (U.S.)

What are the Recent Developments in Global Centrally Acting Anorectics Obesity Drugs Market?

- In May 2024, Novo Nordisk A/S launched a real-world evidence study for its centrally acting GLP-1 receptor agonist Wegovy across multiple regions, aiming to evaluate long-term safety, adherence, and cardiovascular outcomes in obese patients. The study underscores the company's commitment to advancing clinical validation and expanding access to its innovative centrally acting therapies as demand surges for pharmacological solutions to obesity

- In April 2024, Eli Lilly and Company announced the FDA approval of Zepbound (tirzepatide), a dual GIP/GLP-1 receptor agonist with central nervous system activity, for chronic weight management. This marks a significant milestone in the obesity therapeutics landscape, with Zepbound offering substantial efficacy in appetite suppression and metabolic regulation. The launch positions Lilly at the forefront of centrally acting obesity drug development

- In March 2024, Currax Pharmaceuticals LLC expanded the distribution of its centrally acting obesity drug, Contrave (naltrexone HCl/bupropion HCl), into several new European markets following regulatory clearance. The move reflects the company’s strategic intent to globalize access to prescription weight-loss medications and cater to the growing demand for combination anorectic therapies with central activity.

- In February 2024, Gelesis Inc. initiated clinical trials for a next-generation hydrogel-based anorectic formulation with central effects targeting neurohormonal pathways involved in appetite regulation. While the company is best known for its mechanical appetite suppressants, this innovation signals a diversification into centrally acting modalities, aligning with emerging trends in obesity pharmacotherapy.

- In January 2024, Amgen Inc. announced promising Phase 1 trial results for AMG 133, a novel GLP-1 receptor and GIPR agonist with central mechanisms of action. The candidate demonstrated significant appetite reduction and weight loss in obese individuals, prompting advancement to late-stage clinical trials. The development reflects Amgen's entry into the rapidly evolving market of CNS-targeted obesity treatments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.