Global Cereal Bar Market

Market Size in USD Billion

CAGR :

%

USD

8.07 Billion

USD

14.32 Billion

2024

2032

USD

8.07 Billion

USD

14.32 Billion

2024

2032

| 2025 –2032 | |

| USD 8.07 Billion | |

| USD 14.32 Billion | |

|

|

|

|

Cereal Bar Market Size

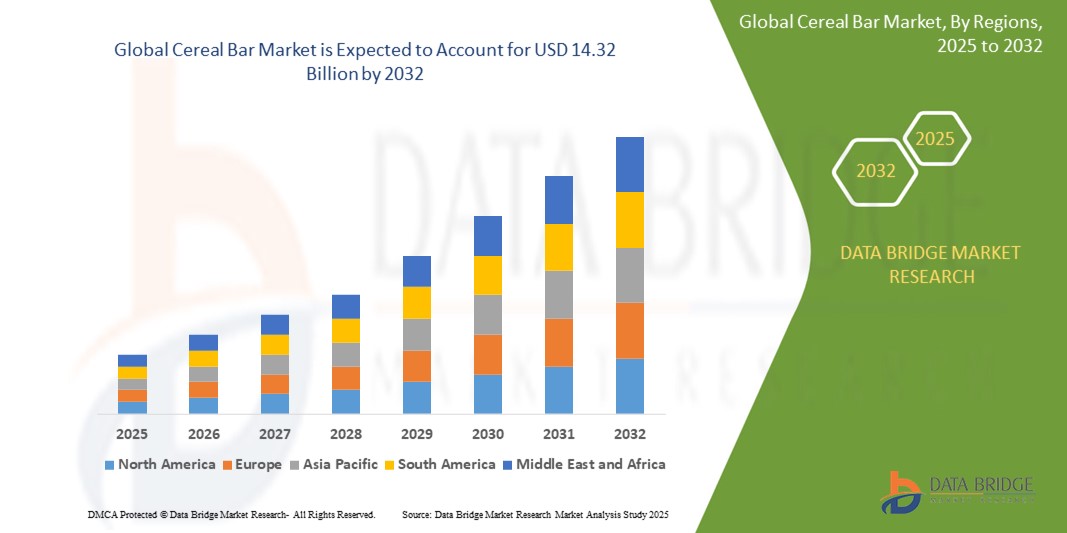

- The global cereal bar market size was valued at USD 8.07 billion in 2024 and is expected to reach USD 14.32 billion by 2032, at a CAGR of 7.44% during the forecast period

- The market growth is largely fueled by increasing consumer preference for convenient, on-the-go nutritious snacks that fit busy lifestyles and health-conscious eating habits

- Furthermore, rising awareness about wellness, fitness, and dietary management is driving demand for cereal bars enriched with proteins, fibers, and functional ingredients, making them a popular choice across age groups and demographics

Cereal Bar Market Analysis

- A cereal bar is a convenient snack typically made from a combination of cereal grains (such as oats, rice, or wheat), sweeteners (such as honey or syrup), and often mixed with fruits, nuts, or chocolate. These ingredients are compacted into a bar form and can be consumed as a quick, on-the-go snack or as a part of a balanced breakfast

- The growing demand for cereal bars is primarily driven by increasing health awareness, a rising focus on fitness and wellness, and consumer preference for quick, on-the-go food solutions that support energy, muscle building, and weight management goals

- North America dominated the cereal bar market with a share of 42.9% in 2024 due to increasing consumer demand for convenient, nutritious snack options and the strong presence of major health food brands

- Asia-Pacific is expected to be the fastest growing region in the cereal bar market with a share of during the forecast period due to growing urbanization, rising disposable income, and increasing awareness of convenient healthy snacking

- Snacks bars segment dominated the cereal bar market with a market share of 47.6% in 2024, due to rising consumer demand for convenient, on-the-go food options. Snack bars are widely consumed between meals and appeal to a broad demographic due to their variety in taste, texture, and nutritional content. Their versatility and shelf stability make them ideal for busy lifestyles, fueling widespread adoption across urban markets

Report Scope and Cereal Bar Market Segmentation

|

Attributes |

Cereal Bar Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cereal Bar Market Trends

“Rising Demand for Convenient On-The-Go Snacks”

- A significant and accelerating trend in the global cereal bar market is the increasing consumer preference for convenient, ready-to-eat snacks that fit busy lifestyles and support health goals. This shift is driving innovation in formulation and packaging to enhance portability and nutritional value

- For instance, companies such as Clif Bar & Company offer a wide range of energy and nutrition bars that cater to active consumers seeking quick energy boosts during workouts or workdays. Similarly, KIND Snacks provides health and wellness bars with natural ingredients that appeal to on-the-go professionals and fitness enthusiasts

- The demand for cereal bars enriched with functional ingredients such as protein, fiber, and vitamins is rising, as consumers look for snacks that satisfy hunger and also contribute to muscle building, weight management, and sustained energy. Brands such as RXBAR utilize simple, recognizable ingredients to meet this growing consumer preference

- Packaging innovations, such as single-serve pouches and resealable wrappers, further enhance the convenience factor, allowing consumers to carry cereal bars easily and consume them anytime, anywhere without mess or preparation

- This trend towards convenient, nutritious snacking is reshaping the market landscape, prompting companies such as Nature Valley to expand their product portfolios with diverse flavors and functional benefits that cater to varied consumer needs

- The growing demand for portable, health-focused snacks is rapidly expanding across retail, e-commerce, and fitness channels, as consumers prioritize quick, wholesome options that support active and busy lifestyles

Cereal Bar Market Dynamics

Driver

“Increasing Health Awareness”

- The rising focus on health and wellness among consumers is a significant driver for the growing demand for cereal bars, as people seek convenient, nutritious options to support balanced diets and active lifestyles

- For instance, in 2024, General Mills expanded its Nature Valley product line to include more protein-rich and low-sugar bars, catering to consumers prioritizing healthier snacking choices. Such initiatives by major companies are expected to boost cereal bar market growth during the forecast period

- As awareness about nutrition and dietary needs increases, cereal bars offering functional benefits such as muscle building, weight management, and energy boosting are gaining popularity as alternatives to traditional snacks

- Furthermore, the emphasis on clean-label ingredients and natural compositions is encouraging brands to develop bars free from artificial additives and rich in wholesome ingredients, aligning with consumer preferences for transparency and health

- The convenience of portable, portion-controlled cereal bars combined with their nutritional advantages is driving adoption across various consumer segments, including fitness enthusiasts, working professionals, and students. This, along with the rise of e-commerce and health-focused retail channels, supports robust market expansion

Restraint/Challenge

“Health Concerns Over Sugar Content”

- Growing concerns about high sugar content in cereal bars pose a significant challenge to broader market acceptance, as health-conscious consumers increasingly scrutinize product ingredients

- For instance, reports highlighting excessive sugar levels in popular snack bars have made some consumers cautious about incorporating cereal bars into their regular diet

- Addressing these health concerns through the development of low-sugar and no-added-sugar options is crucial for gaining consumer trust. Companies such as Kind and RXBAR promote their use of natural sweeteners and transparent labeling to reassure buyers. In addition, the perception that healthier bars may be less tasty or more expensive can deter some consumers, especially those on a budget or new to health-focused snacks

- While more affordable and sugar-conscious options are entering the market, the challenge remains to balance taste, nutrition, and cost to appeal to a wide audience

- Overcoming these challenges through innovation in formulation, clearer nutritional communication, and competitive pricing will be vital for the cereal bar market’s sustained growth

Cereal Bar Market Scope

The market is segmented on the basis of type, application, flavor, composition, packaging, and sales channel.

- By Types

On the basis of type, the cereal bars market is segmented into breakfast bars, snack bars, health and wellness bars, energy and nutrition bars, and others. The snack bars segment dominated the largest market revenue share of 46.7% in 2024, driven by rising consumer demand for convenient, on-the-go food options. Snack bars are widely consumed between meals and appeal to a broad demographic due to their variety in taste, texture, and nutritional content. Their versatility and shelf stability make them ideal for busy lifestyles, fueling widespread adoption across urban markets.

The energy and nutrition bars segment is expected to witness the fastest CAGR of 9.4% from 2025 to 2032, driven by a surge in health-conscious consumers and fitness enthusiasts seeking nutrient-dense foods to support performance and recovery. These bars often contain added proteins, vitamins, and functional ingredients, aligning with trends in sports nutrition, clean eating, and wellness.

- By Application

On the basis of application, the cereal bars market is segmented into boost energy, muscle building, weight gainer, meal replacement, and lean muscle. The boost energy segment held the largest market revenue share in 2024, supported by the increasing need for instant energy among working professionals, students, and athletes. These bars are frequently marketed as pre-workout snacks or mid-day energy boosters, with ingredients such as oats, honey, and nuts delivering quick and sustained energy.

The meal replacement segment is anticipated to register the fastest CAGR from 2025 to 2032, driven by the growing demand for balanced, portable meal options. Busy lifestyles, diet-focused consumers, and intermittent fasting trends are fueling the preference for meal replacement bars offering proteins, fibers, and essential nutrients in a compact form.

- By Flavor

On the basis of flavor, the cereal bars market is segmented into caramel, chocolate, peanut butter, honey, and others. The chocolate segment accounted for the largest market revenue share in 2024 due to its universal appeal and widespread usage in both indulgent and health-positioned products. Chocolate offers rich taste and pairs well with ingredients such as nuts, seeds, and grains, making it a preferred choice among brands and consumers.

The peanut butter flavor segment is projected to experience the fastest growth from 2025 to 2032, favored for its protein-rich profile and creamy texture. As consumers increasingly look for functional and protein-enriched snacks, peanut butter-flavored bars are gaining traction, especially in sports nutrition and children's segments.

- By Composition

On the basis of composition, the cereal bars market is segmented into natural, combined, and flavored. The natural segment captured the largest market revenue share in 2024, reflecting a consumer shift towards clean-label and minimally processed products. Natural bars with ingredients such as whole grains, nuts, dried fruits, and natural sweeteners resonate with health-aware buyers avoiding artificial additives.

The combined segment is expected to grow at the fastest CAGR from 2025 to 2032, driven by innovation in multi-benefit products combining taste, health, and functional attributes. These bars cater to consumers who seek both indulgence and wellness benefits, often blending flavors with ingredients such as proteins, fibers, and superfoods.

- By Packaging

On the basis of packaging, the cereal bars market is segmented into box type, pouch, and wrappers. The wrappers segment dominated the largest revenue share in 2024 due to their convenience, portability, and widespread use in individual bar packaging. Wrappers are cost-effective and suitable for retail environments, allowing easy branding and labeling.

The pouch segment is anticipated to grow at the fastest CAGR from 2025 to 2032, supported by rising eco-consciousness and the demand for resealable, recyclable, and bulk packaging options. Multi-bar pouches appeal to families and fitness enthusiasts who prefer value packs and environmentally friendly formats.

- By Sales Channel

On the basis of sales channel, the cereal bars market is segmented into B2B and B2C. The B2C segment held the largest market share in 2024, driven by robust retail penetration, the rise of online grocery platforms, and consumer-centric marketing. Supermarkets, convenience stores, and e-commerce sites contribute significantly to B2C growth as consumers look for direct access and variety.

The B2B segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by increasing bulk demand from gyms, schools, airlines, hospitals, and vending machine operators. Strategic collaborations and supply agreements in the hospitality and institutional sectors are strengthening B2B distribution networks.

Cereal Bar Market Regional Analysis

- North America dominated the cereal bar market with the largest revenue share of 42.9% in 2024, driven by increasing consumer demand for convenient, nutritious snack options and the strong presence of major health food brands

- Consumers in the region are highly inclined toward health and fitness trends, leading to a surge in demand for protein-rich, low-sugar, and functional cereal bars that cater to diverse dietary preferences including keto, vegan, and gluten-free

- High per capita income, a well-established retail network, and strong promotional strategies by manufacturers further accelerate cereal bar consumption across various age groups and lifestyle segments

U.S. Cereal Bar Market Insight

U.S. cereal bar market captured the largest revenue share in 2024 within North America, supported by an expanding health-conscious population and busy consumer lifestyles. The market benefits from the dominance of leading snack brands, growing consumer inclination toward on-the-go nutrition, and innovative product launches targeting weight management, energy boosting, and meal replacement. The availability of cereal bars across convenience stores, gyms, online platforms, and supermarkets strengthens accessibility and repeat purchase behavior.

Europe Cereal Bar Market Insight

Europe cereal bar market is projected to grow at a significant CAGR during the forecast period, driven by increasing demand for clean-label, organic, and natural products. Rising awareness of healthy eating habits and the adoption of balanced snacking fuel the market. Consumers across the region are turning to cereal bars as alternatives to traditional confectionery, supported by government-led health initiatives and food labeling regulations. Innovation in sustainable packaging and regional flavor preferences also contribute to growth.

U.K. Cereal Bar Market Insight

U.K. cereal bar market is expected to register a notable CAGR throughout the forecast period, propelled by the rising preference for nutritious snack options amid growing public awareness of obesity and diet-related diseases. British consumers are drawn to cereal bars for their perceived health benefits and portability, particularly within the breakfast and sports nutrition categories. Demand is also rising from school and workplace meal programs, supported by favorable retail placement and marketing campaigns focused on clean ingredients.

Germany Cereal Bar Market Insight

Germany cereal bar market is poised for steady growth, supported by strong demand for functional foods and rising consumer focus on protein, fiber, and low-sugar content. Germany’s emphasis on quality, transparency, and sustainable food production aligns well with cereal bar trends. The market benefits from innovation in flavor combinations and growing interest in plant-based nutrition, appealing to both fitness-focused and mainstream consumers.

Asia-Pacific Cereal Bar Market Insight

Asia-Pacific cereal bar market is projected to expand at the fastest CAGR of 11.4% from 2025 to 2032, fueled by growing urbanization, rising disposable income, and increasing awareness of convenient healthy snacking. Consumer shifts toward western dietary habits, coupled with government support for nutrition-focused initiatives, are boosting demand. The rapid expansion of retail and e-commerce platforms across developing countries is further enhancing product visibility and access.

Japan Cereal Bar Market Insight

Japan cereal bar market is gaining traction as busy professionals and health-conscious consumers seek compact, nutritious alternatives to traditional meals. The demand for high-fiber, low-calorie, and functional ingredients such as green tea and soy protein is rising. The country's aging population is also influencing the market, as older consumers seek easy-to-consume, nutritionally balanced options.

China Cereal Bar Market Insight

China cereal bar market held the largest revenue share within Asia-Pacific in 2024, supported by a large consumer base, increasing health awareness, and rapid modernization of food retail infrastructure. Domestic and international players are launching targeted products that align with local taste preferences, such as red bean, taro, and matcha-infused bars. E-commerce penetration and social media marketing play a significant role in brand engagement and distribution expansion.

Cereal Bar Market Share

The cereal bar industry is primarily led by well-established companies, including:

- Kellogg Co. (U.S.)

- Jordans (U.K.)

- General Mills, Inc. (U.S.)

- Nestlé (Switzerland)

- Abbott (U.S.)

- PepsiCo (U.S.)

- Simply Good Foods USA, Inc. (U.S.)

- Ocado Retail Limited (U.K.)

- The Quaker Oats Company (U.S.)

- Mars, Incorporated (U.S.)

- Hain Celestial (U.S.)

- Associated British Foods plc (U.K.)

- Clif Bar & Company (U.S.)

- KIND LLC (U.S.)

- Concord Foods, LLC (U.S.)

- FRANK Food Products (Netherlands)

- Natural Balance Foods (U.K.)

- To You (U.K.)

- Perfect Bar (U.S.)

- Bobo's (U.S.)

What are the Recent Developments in Global Cereal Bar Market?

- In August 2024, Nature Valley introduced its Soft-Baked Muffin Bars in lemon poppy seed and chocolate chip flavors, packaged in four packs and launched through major UK retailers Sainsbury’s and Morrisons. This product expansion enhances convenient snacking options in the market, catering to consumers seeking soft-textured, flavorful cereal bars and helping Nature Valley strengthen its presence in the competitive breakfast and snack bars segment

- In August 2024, Think! collaborated with Jessie James Decker to launch Think! MINIS Protein Snack Bars, available in seven flavors designed for on-the-go consumption with a balanced macro profile. This partnership and product innovation target health-conscious consumers looking for portable, tasty protein options, positioning Think! to capture growing demand in the protein and wellness bars category

- In April 2024, KIND Snacks expanded its product portfolio with new flavors in its Seeds, Nuts, and Fruits bar line, featuring unique combinations such as Strawberry Sunflower Seed and Dark Chocolate Raspberry Pumpkin. By emphasizing taste and nutrition, KIND’s new launches reinforce its commitment to delivering nourishing snacks, driving consumer interest in wholesome, trail mix-inspired bars and strengthening its foothold in the natural and healthy cereal bar market

- In March 2024, World of Sweets entered a partnership with Mondelez International to expand the presence of the American-origin Clif brand, ensuring broader availability through retail channels

- In January 2024, McKee Foods introduced Sunbelt Bakery chewy granola bars targeted at the vending industry, featuring a sell-by date code. The new granola bars come in three flavors: classic chocolate chip, oats & honey, and fudge dipped the chocolate chip. McKee Foods emphasizes that these products are shelf-stable and individually wrapped

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL CEREAL BAR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL CEREAL BAR MARKETSIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 TOP TO BOTTOM ANALYSIS

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 EUROPE, ASIA AND THE GLOBAL MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 VALUE CHAIN ANALYSIS

5.2 IMPORT-EXPORT ANALYSIS

5.3 PESTEL ANALYSIS

5.4 VENDOR SELECTION CRITERIA

5.5 PORTER’S FIVE FORCES ANALYSIS

5.5.1 BARGAINING POWER OF SUPPLIERS

5.5.2 BARGAINING POWER OF BUYERS/CONSUMERS

5.5.3 THREAT OF NEW ENTRANTS

5.5.4 THREAT OF SUBSTITUTE PRODUCTS

5.5.5 INTENSITY OF COMPETITIVE RIVALRY

5.6 RAW MATERIAL SOURCING ANALYSIS

5.7 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

5.8 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

5.9 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.1 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

5.11 CONSUMER BUYING BEHAVIOUR

5.12 PRODUCT ADOPTION SCENARIO

6 SUPPLY CHAIN ANALYSIS

6.1 OVERVIEW

6.2 LOGISTIC COST SCENARIO

6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

7.1 IMPACT ON PRICE

7.2 IMPACT ON SUPPLY CHAIN

7.3 IMPACT ON SHIPMENT

7.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

8 REGULATORY FRAMEWORK AND GUIDELINES

9 PRICING INDEX (PRICE AT B2B END & PRICES AT FOB)

10 PRODUCTION CAPACITY OF KEY MANUFACTURERES

11 BRAND OUTLOOK

11.1 COMPARATIVE BRAND ANALYSIS

11.2 PRODUCT VS BRAND OVERVIEW

12 GLOBAL CEREAL BAR MARKET, BY PRODUCT, 2022-2031, (USD MILLION) (KILO TONS)

12.1 OVERVIEW

12.2 GRANOLA BARS

12.2.1 GRANOLA BARS, BY INCLUSION

12.2.1.1. NO INCLUSION

12.2.1.2. WITH INCLUSION

12.2.2 GRANOLA BARS, BY PRODUCT CATEGORY

12.2.2.1. REGULAR

12.2.2.2. MEAL REPLACEMENT BAR

12.2.2.3. PRE WORK OUT BARS

12.2.2.4. POST WORK OUT BARS

12.2.2.5. YOGA BARS

12.2.2.6. ENERGY BARS

12.2.2.7. OTHERS

12.2.3 GRANOLA BARS, BY PRODUCT NATURE

12.2.3.1. CONVENTIONAL

12.2.3.2. ORGANIC

12.3 OAT BARS

12.3.1 OAT BARS, BY INCLUSION

12.3.1.1. NO INCLUSION

12.3.1.2. WITH INCLUSION

12.3.2 OAT BARS, BY PRODUCT CATEGORY

12.3.2.1. REGULAR

12.3.2.2. MEAL REPLACEMENT BAR

12.3.2.3. PRE WORK OUT BARS

12.3.2.4. POST WORK OUT BARS

12.3.2.5. YOGA BARS

12.3.2.6. ENERGY BARS

12.3.2.7. OTHERS

12.3.3 GRANO OAT LA BARS, BY PRODUCT NATURE

12.3.3.1. CONVENTIONAL

12.3.3.2. ORGANIC

12.4 RICE BARS

12.4.1 RICE BARS, BY INCLUSION

12.4.1.1. NO INCLUSION

12.4.1.2. WITH INCLUSION

12.4.2 RICE BARS, BY PRODUCT CATEGORY

12.4.2.1. REGULAR

12.4.2.2. MEAL REPLACEMENT BAR

12.4.2.3. PRE WORK OUT BARS

12.4.2.4. POST WORK OUT BARS

12.4.2.5. YOGA BARS

12.4.2.6. ENERGY BARS

12.4.2.7. OTHERS

12.4.3 RICE BARS, BY PRODUCT NATURE

12.4.3.1. CONVENTIONAL

12.4.3.2. ORGANIC

12.5 MIXED CEREAL BARS

12.5.1 MIXED CEREAL BARS, BY INCLUSION

12.5.1.1. NO INCLUSION

12.5.1.2. WITH INCLUSION

12.5.2 MIXED CEREAL BARS, BY PRODUCT CATEGORY

12.5.2.1. REGULAR

12.5.2.2. MEAL REPLACEMENT BAR

12.5.2.3. PRE WORK OUT BARS

12.5.2.4. POST WORK OUT BARS

12.5.2.5. YOGA BARS

12.5.2.6. ENERGY BARS

12.5.2.7. OTHERS

12.5.3 MIXED CEREAL BARS, BY PRODUCT NATURE

12.5.3.1. CONVENTIONAL

12.5.3.2. ORGANIC

12.6 OTHERS

13 GLOBAL CEREAL BAR MARKET, BY INCLUSION, 2022-2031, (USD MILLION)

13.1 OVERVIEW

13.2 NO INCLUSION

13.3 WITH INCLUSION

13.3.1 WITH INCLUSION, BY INCLUSION TYPE

13.3.1.1. FRUIT

13.3.1.1.1. BERRIES

13.3.1.1.2. CHERRY

13.3.1.1.3. APPLE

13.3.1.1.4. ORANGES

13.3.1.1.5. AVOCADO

13.3.1.1.6. BANANA

13.3.1.1.7. OTHERS

13.3.1.2. NUT

13.3.1.2.1. ALMOND

13.3.1.2.2. CASHEW

13.3.1.2.3. PEANUT

13.3.1.2.4. DATES

13.3.1.2.5. HAZELNUTS

13.3.1.2.6. OTHERS

13.3.1.3. BOTH FRUITS AND NUTS

13.3.1.4. CHOCOLATE CHUNKS

13.3.1.5. OTHERS

14 GLOBAL CEREAL BAR MARKET, BY PRODUCT CATEGORY, 2022-2031, (USD MILLION)

14.1 OVERVIEW

14.2 REGULAR

14.3 MEAL REPLACEMENT BAR

14.4 PRE WORK OUT BARS

14.5 POST WORK OUT BARS

14.6 YOGA BARS

14.7 ENERGY BARS

14.8 OTHERS

15 GLOBAL CEREAL BAR MARKET, BY NATURE, 2022-2031, (USD MILLION)

15.1 OVERVIEW

15.2 CONVENTIONAL

15.3 ORGANIC

16 GLOBAL CEREAL BAR MARKET, BY CLAIM, 2022-2031, (USD MILLION)

16.1 OVERVIEW

16.2 GLUTEN FREE

16.3 LACTOSE FREE

16.4 PRESERVATIVE FREE

16.5 NON-GMO

16.6 ALL OF THE ABOVE

16.7 VEGAN

16.8 NO CLAIMS

17 GLOBAL CEREAL BAR MARKET, BY FLAVOR, 2022-2031, (USD MILLION)

17.1 OVERVIEW

17.2 REGULAR

17.3 FLAVOR

17.3.1 CARAMEL

17.3.2 BUTTERSCOTCH

17.3.3 PEPPERMINT

17.3.4 VANILLA

17.3.5 MOCHA

17.3.6 STRAWBERRY

17.3.7 BLUBERRY

17.3.8 BANANA

17.3.9 CHERRY

17.3.10 CHOCOLATES

17.3.11 PEACH

17.3.12 AMARETTO

17.3.13 COCONUT

17.3.14 BLUEBERRY

17.3.15 STRAWBERRY

17.3.16 BLACK CURRENT

17.3.17 BLACKBERRY

17.3.18 HONEY

17.3.19 NUTS

17.3.20 GREEN TEA

17.3.21 OTHERS

18 GLOBAL CEREAL BAR MARKET, BY PACKAGING, 2022-2031, (USD MILLION)

18.1 OVERVIEW

18.2 WRAP IN

18.3 POUCHES

18.4 CARD BOX

18.5 OTHERS

19 GLOBAL CEREAL BAR MARKET, BY DISTRIBUTION CHANNEL, 2022-2031, (USD MILLION)

19.1 OVERVIEW

19.2 STORE BASED RETAILERS

19.2.1 SUPERMARKETS/HYPERMARKETS

19.2.2 CONVENIENCE STORES

19.2.3 SPECIALTY STORES

19.2.4 DRUG STIRES AND PHARMACIES

19.2.5 OTHERS

19.3 NON-STORE RETAILERS

19.3.1 ONLINE

19.3.2 VENDING MACHINE

20 GLOBAL CEREAL BAR MARKET, COMPANY LANDSCAPE

20.1 COMPANY SHARE ANALYSIS: GLOBAL

20.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

20.3 COMPANY SHARE ANALYSIS: EUROPE

20.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

20.5 MERGERS & ACQUISITIONS

20.6 NEW PRODUCT DEVELOPMENT & APPROVALS

20.7 EXPANSIONS & PARTNERSHIP

20.8 REGULATORY CHANGES

21 GLOBAL CEREAL BAR MARKET, BY GEOGRAPHY, 2022-2031, (USD MILLION) (KILO TONS)

OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

21.1 NORTH AMERICA

21.1.1 U.S.

21.1.2 CANADA

21.1.3 MEXICO

21.2 EUROPE

21.2.1 GERMANY

21.2.2 U.K.

21.2.3 ITALY

21.2.4 FRANCE

21.2.5 SPAIN

21.2.6 SWITZERLAND

21.2.7 NETHERLANDS

21.2.8 BELGIUM

21.2.9 RUSSIA

21.2.10 DENMARK

21.2.11 SWEDEN

21.2.12 POLAND

21.2.13 TURKEY

21.2.14 REST OF EUROPE

21.3 ASIA-PACIFIC

21.3.1 JAPAN

21.3.2 CHINA

21.3.3 SOUTH KOREA

21.3.4 INDIA

21.3.5 AUSTRALIA

21.3.6 SINGAPORE

21.3.7 THAILAND

21.3.8 INDONESIA

21.3.9 MALAYSIA

21.3.10 PHILIPPINES

21.3.11 NEW ZEALAND

21.3.12 VIETNAM

21.3.13 REST OF ASIA-PACIFIC

21.4 SOUTH AMERICA

21.4.1 BRAZIL

21.4.2 ARGENTINA

21.4.3 REST OF SOUTH AMERICA

21.5 MIDDLE EAST AND AFRICA

21.5.1 UAE

21.5.2 SAUDI ARABIA

21.5.3 EGYPT

21.5.4 SOUTH AFRICA

21.5.5 OMAN

21.5.6 QATAR

21.5.7 KUWAIT

21.5.8 REST OF MIDDLE EAST AND AFRICA

22 GLOBAL CEREAL BAR MARKET, SWOT & DBMR ANALYSIS

23 GLOBAL CEREAL BAR MARKET, COMPANY PROFILES

23.1 ATKINS NUTRITIONALS

23.1.1 COMPANY OVERVIEW

23.1.2 REVENUE ANALYSIS

23.1.3 GEOGRAPHICAL PRESENCE

23.1.4 PRODUCT PORTFOLIO

23.1.5 RECENT DEVELOPMENTS

23.2 CLIF BAR & COMPANY

23.2.1 COMPANY OVERVIEW

23.2.2 REVENUE ANALYSIS

23.2.3 GEOGRAPHICAL PRESENCE

23.2.4 PRODUCT PORTFOLIO

23.2.5 RECENT DEVELOPMENTS

23.3 GENERAL MILLS

23.3.1 COMPANY OVERVIEW

23.3.2 REVENUE ANALYSIS

23.3.3 GEOGRAPHICAL PRESENCE

23.3.4 PRODUCT PORTFOLIO

23.3.5 RECENT DEVELOPMENTS

23.4 KELLANOVA

23.4.1 COMPANY OVERVIEW

23.4.2 REVENUE ANALYSIS

23.4.3 GEOGRAPHICAL PRESENCE

23.4.4 PRODUCT PORTFOLIO

23.4.5 RECENT DEVELOPMENTS

23.5 KASHI COMPANY

23.5.1 COMPANY OVERVIEW

23.5.2 REVENUE ANALYSIS

23.5.3 GEOGRAPHICAL PRESENCE

23.5.4 PRODUCT PORTFOLIO

23.5.5 RECENT DEVELOPMENTS

23.6 QUAKER OATS COMPANY

23.6.1 COMPANY OVERVIEW

23.6.2 REVENUE ANALYSIS

23.6.3 GEOGRAPHICAL PRESENCE

23.6.4 PRODUCT PORTFOLIO

23.6.5 RECENT DEVELOPMENTS

23.7 MARS INCORPORATED

23.7.1 COMPANY OVERVIEW

23.7.2 REVENUE ANALYSIS

23.7.3 GEOGRAPHICAL PRESENCE

23.7.4 PRODUCT PORTFOLIO

23.7.5 RECENT DEVELOPMENTS

23.8 LUNA BAR

23.8.1 COMPANY OVERVIEW

23.8.2 REVENUE ANALYSIS

23.8.3 GEOGRAPHICAL PRESENCE

23.8.4 PRODUCT PORTFOLIO

23.8.5 RECENT DEVELOPMENTS

23.9 FRANK FOOD COMPANY

23.9.1 COMPANY OVERVIEW

23.9.2 REVENUE ANALYSIS

23.9.3 GEOGRAPHICAL PRESENCE

23.9.4 PRODUCT PORTFOLIO

23.9.5 RECENT DEVELOPMENTS

23.1 ABBOTT

23.10.1 COMPANY OVERVIEW

23.10.2 REVENUE ANALYSIS

23.10.3 GEOGRAPHICAL PRESENCE

23.10.4 PRODUCT PORTFOLIO

23.10.5 RECENT DEVELOPMENTS

23.11 KIND CEREALS

23.11.1 COMPANY OVERVIEW

23.11.2 REVENUE ANALYSIS

23.11.3 GEOGRAPHICAL PRESENCE

23.11.4 PRODUCT PORTFOLIO

23.11.5 RECENT DEVELOPMENTS

23.12 QUEST NUTRITIONAL

23.12.1 COMPANY OVERVIEW

23.12.2 REVENUE ANALYSIS

23.12.3 GEOGRAPHICAL PRESENCE

23.12.4 PRODUCT PORTFOLIO

23.12.5 RECENT DEVELOPMENTS

23.13 PREMIER NUTRITIONAL

23.13.1 COMPANY OVERVIEW

23.13.2 REVENUE ANALYSIS

23.13.3 GEOGRAPHICAL PRESENCE

23.13.4 PRODUCT PORTFOLIO

23.13.5 RECENT DEVELOPMENTS

23.14 NUGO NUTRITIONAL

23.14.1 COMPANY OVERVIEW

23.14.2 REVENUE ANALYSIS

23.14.3 GEOGRAPHICAL PRESENCE

23.14.4 PRODUCT PORTFOLIO

23.14.5 RECENT DEVELOPMENTS

23.15 NATURELL INDIA PVT. LTD.

23.15.1 COMPANY OVERVIEW

23.15.2 REVENUE ANALYSIS

23.15.3 GEOGRAPHICAL PRESENCE

23.15.4 PRODUCT PORTFOLIO

23.15.5 RECENT DEVELOPMENTS

23.16 IDAHO CANDY COMPANY

23.16.1 COMPANY OVERVIEW

23.16.2 REVENUE ANALYSIS

23.16.3 INVESTMENT & ROI

23.16.4 PRODUCT PORTFOLIO

23.16.5 GEOGRAPHICAL PRESENCE

23.16.6 RECENT DEVELOPMENTS

23.17 BOYER

23.17.1 COMPANY OVERVIEW

23.17.2 REVENUE ANALYSIS

23.17.3 INVESTMENT & ROI

23.17.4 PRODUCT PORTFOLIO

23.17.5 GEOGRAPHICAL PRESENCE

23.17.6 RECENT DEVELOPMENTS

23.18 ÜLKER

23.18.1 COMPANY OVERVIEW

23.18.2 REVENUE ANALYSIS

23.18.3 INVESTMENT & ROI

23.18.4 GEOGRAPHICAL PRESENCE

23.18.5 PRODUCT PORTFOLIO

23.18.6 RECENT DEVELOPMENTS

23.19 FERRERO GROUP

23.19.1 COMPANY OVERVIEW

23.19.2 REVENUE ANALYSIS

23.19.3 INVESTMENT & ROI

23.19.4 PRODUCT PORTFOLIO

23.19.5 GEOGRAPHICAL PRESENCE

23.19.6 RECENT DEVELOPMENTS

23.2 WRIGLEY CONFECTIONERY (GLOBAL) CO LTD.

23.20.1 COMPANY OVERVIEW

23.20.2 REVENUE ANALYSIS

23.20.3 INVESTMENT & ROI

23.20.4 PRODUCT PORTFOLIO

23.20.5 GEOGRAPHICAL PRESENCE

23.20.6 RECENT DEVELOPMENTS

23.21 GRUPO BIMBO

23.21.1 COMPANY OVERVIEW

23.21.2 REVENUE ANALYSIS

23.21.3 INVESTMENT & ROI

23.21.4 PRODUCT PORTFOLIO

23.21.5 GEOGRAPHICAL PRESENCE

23.21.6 RECENT DEVELOPMENTS

23.22 HERSHEY

23.22.1 COMPANY OVERVIEW

23.22.2 REVENUE ANALYSIS

23.22.3 INVESTMENT & ROI

23.22.4 GEOGRAPHICAL PRESENCE

23.22.5 PRODUCT PORTFOLIO

23.22.6 RECENT DEVELOPMENTS

23.23 BARRY CALLEBAUT

23.23.1 COMPANY OVERVIEW

23.23.2 REVENUE ANALYSIS

23.23.3 INVESTMENT & ROI

23.23.4 GEOGRAPHICAL PRESENCE

23.23.5 PRODUCT PORTFOLIO

23.23.6 RECENT DEVELOPMENTS

23.24 NESTLÉ

23.24.1 COMPANY OVERVIEW

23.24.2 REVENUE ANALYSIS

23.24.3 INVESTMENT & ROI

23.24.4 GEOGRAPHICAL PRESENCE

23.24.5 PRODUCT PORTFOLIO

23.24.6 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

24 RELATED REPORTS

25 CONCLUSION

26 QUESTIONNAIRE

27 ABOUT DATA BRIDGE MARKET RESEARCH

Global Cereal Bar Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cereal Bar Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cereal Bar Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.