Global Cereal Ingredients Market

Market Size in USD Billion

CAGR :

%

USD

25.87 Billion

USD

33.19 Billion

2024

2032

USD

25.87 Billion

USD

33.19 Billion

2024

2032

| 2025 –2032 | |

| USD 25.87 Billion | |

| USD 33.19 Billion | |

|

|

|

|

Cereal Ingredients Market Size

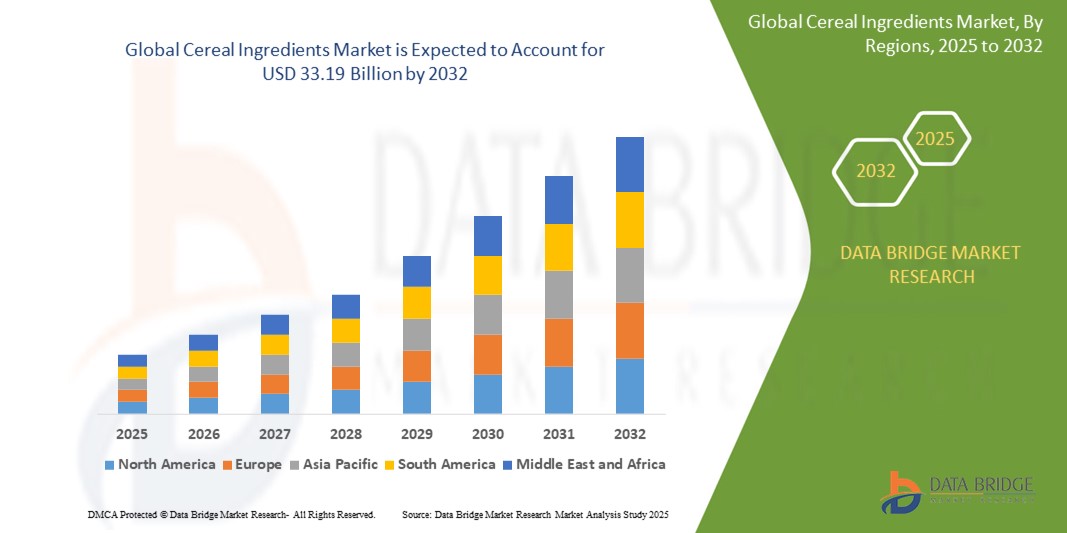

- The Global Cereal Ingredients Market size was valued at USD 25.87 Billion in 2024 and is expected to reach USD 33.19 Billion by 2032, at a CAGR of 3.38 % during the forecast period (2024–2032)

- Market growth is primarily driven by rising health consciousness, increasing demand for functional and fortified foods, and a growing breakfast cereal market—particularly in developed regions—coupled with expanding applications in bakery, snacks, and pet food industries

- Furthermore, the surge in gluten-free and plant-based dietary trends, advancements in extrusion and processing technologies, and a shift toward clean-label, sustainable sourcing practices are fueling overall market expansion worldwide

Cereal Ingredients Market Analysis

- Cereal ingredients comprise processed grains—such as wheat, oats, rice, corn, and barley—transformed into flour, flakes, puffs, bran, and other forms. These ingredients serve as foundational components in breakfast cereals, bakery products, snacks, confectionery, pet food, and biofuel sectors. They deliver nutritional benefits—rich in fiber, protein, vitamins, and minerals—while offering functional attributes like texture enhancement, emulsification, and binding in food formulations

- Asia-Pacific is projected to witness the fastest CAGR of 5.1 % from 2024 to 2032, owing to rapid urbanization, rising disposable incomes, and increasing breakfast cereal consumption—particularly in China and India—coupled with growing awareness of health and wellness

- North America holds the largest regional share (approximately 31 % in 2023), supported by strong retail infrastructure, a mature breakfast cereal market, and rising demand for functional and organic ingredients

Report Scope and Cereal Ingredients Market Segmentation

|

Attributes |

Industrial Cereal Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cereal Ingredients Market Trends

“Clean-Label, Functional Fortification, and Sustainable Sourcing”

- A key trend is the surge in clean-label and organic cereal ingredients, with manufacturers prioritizing minimally processed grains, non-GMO certifications, and transparent ingredient sourcing to meet consumer demand for “back to basics” formulations

- Functional fortification—including high-protein flours (e.g., pea- or soy-enriched mixes), fiber-rich bran blends, and micronutrient-fortified rice or corn powders—is gaining traction among health-focused consumers and sports nutrition brands

- Sustainable and ethical sourcing initiatives are rising, as companies partner with certified growers to ensure traceability, reduce carbon footprints, and implement regenerative agriculture practices—particularly in Asia-Pacific and Latin American supply chains

- E-commerce acceleration is reshaping distribution, with direct-to-consumer platforms and subscription models for specialized cereal blends boosting online retail penetration

Cereal Ingredients Market Dynamics

Driver

“Growing Demand for Convenient, Nutrient-Dense Breakfast Solutions”

- Increasing urbanization and busy lifestyles have elevated demand for ready-to-eat and ready-to-cook breakfast cereals, driving large food manufacturers and co-manufacturers to expand cereal ingredient portfolios

- Heightened health consciousness is boosting consumption of whole-grain and high-fiber cereal ingredients, as consumers seek ingredients that provide satiety, gastrointestinal health, and balanced energy release

- Technological advancements—such as extrusion cooking, micronization, and high-pressure processing—enhance texture, flavor, and shelf life, bridging the gap between fresh and processed grain applications

Restraint/Challenge

“Raw Material Price Volatility and Competition from Alternative Ingredients”

- Weather-driven yield fluctuations and global trade policy shifts (e.g., tariffs between major grain‐exporting regions) lead to volatile raw material prices, squeezing manufacturer margins and causing hesitancy in capacity expansions

- The proliferation of alternative ingredients—such as pulses (lentil, chickpea protein), nut flours (almond, coconut), and novel proteins (pea, insect)—poses substitution threats, particularly among “flexitarian” consumers looking to reduce grain intake

- Strict regulatory frameworks around food labeling, non-GMO verification, and allergen declarations increase compliance costs for manufacturers largely reliant on imported grains

Cereal Ingredients Market Scope

The market is segmented on the basis of nature, type, form, end-use, and distribution channel

- By Nature

Conventional: Holds majority share (80 % revenue share in 2024), due to established supply chains and lower price points.

Organic: Expected to post the fastest growth, driven by consumer preference for clean-label and chemical-free ingredients

- By Type

Wheat: Dominates with ~ 35 % share in 2024, owing to its versatility in bakery, snack, and breakfast cereal applications.

Oats: Holding ~ 20 % share, propelled by rising demand for oat-based bars, muesli, and high-protein oats blends.

Rice: Accounts for ~ 15 %, driven by gluten-free trends and use in both human food and pet food segments

- By Form

Flakes: Largest share (~ 40 % in 2023), as they are core to breakfast cereals and snack clusters.

Puffs: ~ 20 %, popular in cereal bars and ready-to-eat puffed snacks.

- By End-Use

Food & Beverages (≈ 60 % share in 2024): Breakfast cereals (35 %), bakery products (20 %), snacks & confectionery (15 %), bars & RTE foods (10 %), others (20 %)

Animal Feed (≈ 20 %): Primarily rice and corn byproducts, catering to poultry, swine, and aquaculture.

Biofuel (≈ 10 %): Mainly corn and barley derivatives used for ethanol and bio-ethanol.

Others (≈ 10 %): Pet food, industrial starches, brewery co-products

- By Distribution Channel

Modern Trade (Hypermarkets/Supermarkets): ~ 45 % share in 2024, as consumers prefer one-stop shopping for both conventional and healthy ingredients.

Traditional Trade (Grocery/Convenience Stores): ~ 30 %, especially in emerging markets where modern retail penetration is limited

Cereal Ingredients Market Regional Analysis

Asia-Pacific (≈ 45 % revenue share in 2024): Strong consumption in China, India, and Southeast Asia. Rapid urbanization, rising middle-class incomes, and government support for food processing have bolstered demand for convenience cereals and organic grains. China leads within the region, backed by large-scale grain production and expanding modern retail channels. India is set to register the highest CAGR (≈ 6.2 %) from 2025 to 2032, driven by growing health awareness, organized retail expansion, and increasing westernized dietary patterns

North America (≈ 31 % share in 2023): Led by the U.S. market, with demand fueled by busy lifestyles, a mature breakfast cereal industry, and innovation in functional and organic ingredients. Canada follows closely, supported by similar health trends. The U.S. accounted for ~ 80 % of North American revenue in 2024, propelled by meal-kit services, high vegan/vegetarian populations, and packaging innovations (e.g., biodegradable liners, portion-control pouches).

Europe (≈ 15 % share): Germany, the U.K., and France lead adoption of whole-grain, high-fiber, and organic cereal ingredients. Regulatory emphasis on clean labels and non-GMO formulations supports moderate growth (≈ 4 % CAGR). Eastern European markets (e.g., Poland, Russia) also show potential due to rising health consciousness

Cereal Ingredients Market Share

The speciality starches is primarily led by well-established companies, including:

- Cargill, Inc. (U.S.)

- Archer Daniels Midland Company (U.S.)

- Bunge Limited (U.S.)

- Ingredion Incorporated (U.S.)

- Tate & Lyle PLC (U.K.)

- Kellogg Company (U.S.)

- General Mills, Inc. (U.S.)

- Kerry Group PLC (Ireland)

- Olam International (Singapore)

- Kraft Heinz Company (U.S.)

- Roquette Frères (France)

- Wilmar International (Singapore)

- Cofco Corporation (China)

- Barry Callebaut (Switzerland)

Latest Developments in Global Cereal Ingredients Market

- February 2025: Cargill, Inc. unveiled a high-protein oat flour line, FortiOat™, targeting sports nutrition and functional bakery segments—featuring 40 % more plant protein than standard oat flours. This launch is part of Cargill’s “Health & Performance” initiative aimed at expanding its oat-based ingredient portfolio

- March 2025: Ingredion Incorporated completed the acquisition of CleanGrains Ltd. (U.K.), a specialty oat and barley ingredient producer, to bolster its clean-label, gluten-free cereal ingredient offerings in European and North American markets

- January 2025: Archer Daniels Midland Company (ADM) inaugurated a new extrusion facility in Decatur, Illinois, dedicated to producing high-fiber and fortified cereal breakfast blends—aimed at meeting rising demand for heart-healthy and gut-health formulations

- January 2025: Bunge Limited launched SustainGrain™, a traceable, sustainably sourced wheat ingredient program for foodservice and industrial bakery, certified by a third-party sustainability auditor and featuring reduced water usage in cultivation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cereal Ingredients Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cereal Ingredients Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cereal Ingredients Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.