Global Chemical And Nutritional Testing Market

Market Size in USD Billion

CAGR :

%

USD

3.44 Billion

USD

6.29 Billion

2024

2032

USD

3.44 Billion

USD

6.29 Billion

2024

2032

| 2025 –2032 | |

| USD 3.44 Billion | |

| USD 6.29 Billion | |

|

|

|

|

What is the Global Chemical and Nutritional Testing Market Size and Growth Rate?

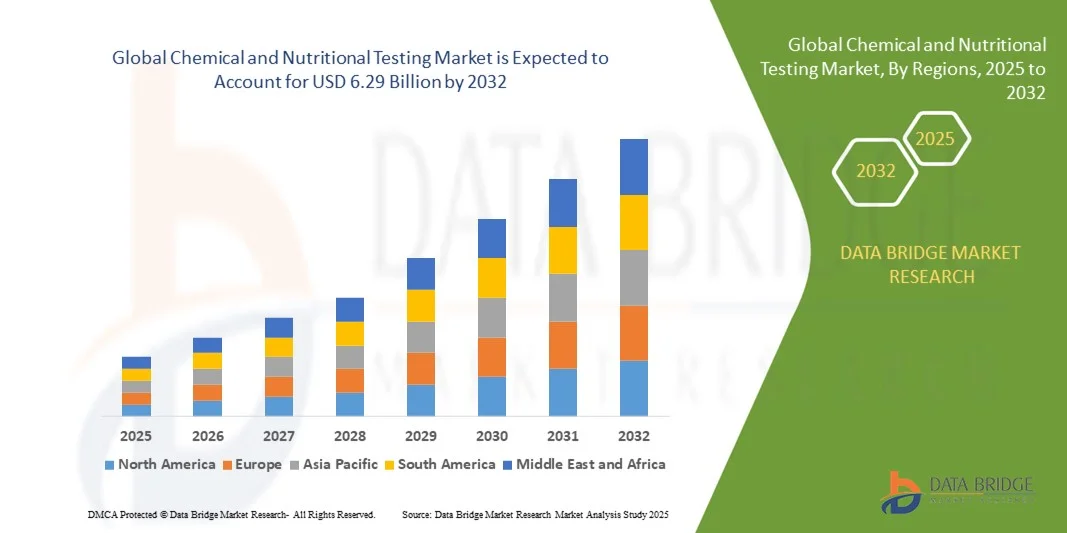

- The global chemical and nutritional testing market size was valued at USD 3.44 billion in 2024 and is expected to reach USD 6.29 billion by 2032, at a CAGR of 7.8% during the forecast period

- The rise in consumer awareness about food safety across the globe acts as one of the major factors driving the growth of chemical and nutritional testing market. The increase in the number of cases of chemical contamination in food processing industries because of improper use of techniques in the production of ready-to-eat meals, and rise in outbreaks of foodborne illnesses accelerate the market growth

What are the Major Takeaways of Chemical and Nutritional Testing Market?

- The increase in demand for convenience and packaged food products and development of advanced technologies concerning safety test procedures further influence the market

- In addition, rise in awareness among consumers, food recalls due to non-compliant food products and stringent food safety regulations positively affect the chemical and nutritional testing market. Furthermore, technological advancements in the testing industry extends profitable opportunities to the market players

- Europe dominated the chemical and nutritional testing market with the largest revenue share of 40.5% in 2024, driven by stringent regulatory standards, rising demand for quality assurance, and growing focus on food safety and pharmaceutical testing

- The Asia-Pacific market is expected to grow at the fastest CAGR of 9.54% from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, increasing health awareness, and technological advancements in countries such as China, Japan, and India

- The beverages segment dominated the market with the largest revenue share of 35.6% in 2024, driven by the increasing consumption of functional drinks, fortified beverages, and health-focused drinks worldwide

Report Scope and Chemical and Nutritional Testing Market Segmentation

|

Attributes |

Chemical and Nutritional Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Chemical and Nutritional Testing Market?

Digitalization and AI-Driven Analytical Solutions

- A significant and accelerating trend in the global chemical and nutritional testing market is the growing adoption of digital platforms, AI-powered analytics, and automation technologies. These innovations are enabling faster, more accurate testing and improving operational efficiency in laboratories worldwide

- For instance, advanced AI-driven analytical software can detect anomalies in nutritional or chemical compositions more accurately and in real time, reducing human error and turnaround time. Similarly, automated lab instrumentation allows high-throughput testing across multiple samples, enhancing productivity and consistency

- AI integration in chemical and nutritional testing enables predictive analytics, process optimization, and enhanced data interpretation. For instance, some leading laboratories are now using machine learning algorithms to predict contamination risks or optimize formulation processes based on historical datasets

- The integration of digital testing solutions with cloud platforms facilitates centralized data management, allowing laboratories, regulatory agencies, and clients to access reports remotely and in real time

- This trend toward intelligent, automated, and interconnected testing solutions is reshaping expectations for analytical accuracy, speed, and regulatory compliance. Companies such as Eurofins Scientific and SGS SA are investing heavily in AI-enabled solutions, offering automated workflows and predictive insights to meet evolving industry demands

- The demand for faster, smarter, and more integrated testing solutions is expanding rapidly across pharmaceutical, food, and nutraceutical industries, driven by the need for regulatory compliance, quality assurance, and operational efficiency

What are the Key Drivers of Chemical and Nutritional Testing Market?

- The growing complexity of food, pharmaceutical, and nutraceutical supply chains, coupled with stricter regulatory requirements, is driving demand for advanced chemical and nutritional testing

- For instance, increasing concerns around food adulteration and contamination are pushing companies to adopt high-precision testing methods, ensuring compliance with standards such as FDA, EFSA, and ISO certifications

- Rising consumer awareness about product safety, nutrition content, and clean-label products is boosting demand for accurate testing across sectors such as beverages, snacks, and dietary supplements

- The shift toward digital lab solutions and automated workflows is increasing testing efficiency, reducing turnaround times, and enabling real-time data monitoring

- Advanced testing capabilities, such as multi-residue analysis, high-throughput nutrient profiling, and allergen detection, are creating a competitive edge for companies in both food and pharmaceutical sectors

- The increasing trend of outsourcing analytical services to specialized testing laboratories is also driving market growth, as it allows companies to focus on core production while ensuring rigorous quality and compliance standards

Which Factor is Challenging the Growth of the Chemical and Nutritional Testing Market?

- High initial capital investment for automated testing platforms, AI-driven software, and digital lab infrastructure is a major barrier, especially for small- and mid-sized laboratories

- In addition, concerns about data security, cybersecurity vulnerabilities, and sensitive information protection in digital testing platforms can limit adoption, particularly in regulated industries

- Variability in global regulatory frameworks and complex compliance requirements across regions increases operational challenges for testing service providers

- The need for highly skilled professionals to operate advanced testing equipment and interpret AI-generated insights is also a constraint, adding to labor costs and training requirements

- While prices of automated analytical instruments are gradually decreasing, the perceived premium for advanced technologies can still deter adoption among cost-sensitive labs or regions with limited budgets

- Addressing these challenges through robust digital security, standardized testing protocols, workforce training, and affordable testing solutions will be critical for sustaining market growth and increasing adoption across sectors

How is the Chemical and Nutritional Testing Market Segmented?

The chemical and nutritional testing market is segmented on the basis of product type and application.

- By Product Type

On the basis of product type, the chemical and nutritional testing market is segmented into beverages, bakery & confectionery, snacks, dairy & desserts, meat & poultry, sauces, dressings & condiments, fruits & vegetables, baby food, and others. The beverages segment dominated the market with the largest revenue share of 35.6% in 2024, driven by the increasing consumption of functional drinks, fortified beverages, and health-focused drinks worldwide. Rising consumer awareness about sugar content, caloric value, and nutritional labeling has significantly fueled testing demand in this sector. Beverages require rigorous chemical and nutritional testing to ensure quality, safety, and compliance with stringent regulatory standards.

The baby food segment is expected to witness the fastest CAGR of 22.1% from 2025 to 2032, due to growing demand for safe, nutritious, and premium infant products, which necessitate frequent chemical and nutritional analyses. The adoption of automated and AI-enabled testing solutions in these segments further supports efficiency and accuracy in quality assurance.

- By Application

On the basis of application, the chemical and nutritional testing market is segmented into agrichemicals, pesticides, and pharmaceuticals. The pharmaceuticals segment held the largest market revenue share of 42% in 2024, attributed to the stringent regulatory requirements for drug safety, purity, and efficacy. Rising prevalence of chronic diseases, the demand for nutraceuticals, and stricter pharmacovigilance norms are driving testing services in this segment. Pharmaceutical manufacturers rely heavily on advanced analytical testing for raw materials, formulations, and finished products to ensure compliance with global standards.

The pesticides segment is expected to witness the fastest CAGR of 23% from 2025 to 2032, fueled by the increasing need for safe and compliant agrochemical products, particularly in regions with stringent food safety regulations. Growth is further supported by rising environmental concerns and mandatory residue testing for export compliance.

Which Region Holds the Largest Share of the Chemical and Nutritional Testing Market?

- Europe dominated the chemical and nutritional testing market with the largest revenue share of 40.5% in 2024, driven by stringent regulatory standards, rising demand for quality assurance, and growing focus on food safety and pharmaceutical testing

- Consumers and manufacturers in the region highly value the reliability, accuracy, and regulatory compliance offered by Chemical and Nutritional Testing services, ensuring product safety and global market acceptance

- This widespread adoption is further supported by advanced laboratory infrastructure, strong R&D capabilities, and growing awareness of nutritional labeling, establishing Chemical and Nutritional Testing as a preferred solution across food, beverage, and pharmaceutical industries

Germany Chemical and Nutritional Testing Market Insight

Germany leads the European Chemical and Nutritional Testing market, accounting for 28% of regional revenue in 2024. The market is driven by strict EU regulations on food safety, pharmaceuticals, and chemicals, along with a strong network of accredited laboratories. Companies and manufacturers prioritize testing for contaminants, nutritional content, and chemical compliance to meet both domestic and international standards. Growth is further supported by advanced R&D facilities, rising consumer awareness of product safety, and the adoption of cutting-edge analytical technologies. The demand spans food, beverage, and pharmaceutical sectors, establishing Germany as a dominant hub for high-quality testing services.

U.K. Chemical and Nutritional Testing Market Insight

The U.K. chemical and nutritional testing market is growing steadily due to increasing consumer focus on health, safety, and quality compliance. Rising regulatory requirements for food, beverages, and pharmaceuticals are boosting demand for reliable testing services. The expansion of private and third-party laboratories provides greater accessibility to testing for small and large manufacturers asuch as. In addition, the trend toward nutritional labeling, organic foods, and functional beverages is driving market growth. The integration of advanced testing technologies such as chromatography and spectrometry ensures accurate results, reinforcing trust among manufacturers, consumers, and regulatory authorities.

France Chemical and Nutritional Testing Market Insight

France’s chemical and nutritional testing market is witnessing consistent growth, fueled by rising consumer demand for safe, organic, and nutritionally verified products. Government regulations on food and pharmaceutical safety require stringent compliance, driving manufacturers to invest in testing services. The market benefits from established laboratory infrastructure and advanced analytical technologies, supporting high-accuracy testing for contaminants, additives, and nutritional composition. Key growth sectors include processed foods, dairy, beverages, and pharmaceuticals. Increasing awareness of food quality and traceability among consumers is encouraging adoption of chemical and nutritional testing services, ensuring that products meet both domestic and international quality standards.

Which Region is the Fastest Growing Region in the Chemical and Nutritional Testing Market?

The Asia-Pacific market is expected to grow at the fastest CAGR of 9.54% from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, increasing health awareness, and technological advancements in countries such as China, Japan, and India. Growing demand for safe, high-quality food, beverages, and pharmaceuticals is encouraging widespread adoption of Chemical and Nutritional Testing services.

China Chemical and Nutritional Testing Market Insight

China dominates the Asia-Pacific region, holding the largest market share in 2024 due to rapid urbanization, rising middle-class income, and increased focus on food and pharmaceutical safety. Government initiatives promoting food safety, smart manufacturing, and quality control standards are driving demand for reliable chemical and nutritional testing. Domestic and international manufacturers are investing in accredited laboratories and advanced analytical technologies to meet regulatory and consumer expectations. The growing awareness of health, nutrition, and product safety among Chinese consumers further fuels market expansion. Testing services are increasingly adopted across food, beverage, and pharmaceutical industries to ensure compliance and build consumer trust.

Japan Chemical and Nutritional Testing Market Insight

Japan’s chemical and nutritional testing market is expanding steadily due to high consumer awareness of health, nutrition, and product safety. Stringent government regulations in the food, beverage, and pharmaceutical sectors drive demand for accurate and reliable testing. The country’s technologically advanced laboratories leverage high-precision analytical methods to ensure compliance with domestic and international standards. Aging demographics and a focus on functional foods, supplements, and pharmaceuticals contribute to market growth. In addition, Japanese consumers increasingly demand transparency and product traceability, encouraging manufacturers to adopt chemical and nutritional testing solutions. The market is expected to continue growing as quality and safety remain top priorities.

Which are the Top Companies in Chemical and Nutritional Testing Market?

The chemical and nutritional testing industry is primarily led by well-established companies, including:

- Eurofins Scientific (Luxembourg)

- SGS SA (Switzerland)

- BUREAU VERITAS (France)

- Intertek Group plc (U.K.)

- ALS Limited (Australia)

- Thermo Fisher Scientific Inc. (U.S.)

- SCS Global Services (U.S.)

- SAI Global Pty Limited (Australia)

- TÜV Rheinland (Germany)

- TÜV NORD GROUP (Germany)

- ASPIRATA (Germany)

- Mérieux NutriSciences (France)

- UL LLC (U.S.)

- ALS Laboratories (Australia)

- Alex Stewart Food Test Lab (U.K.)

- ALS Laboratories (UK) Limited (U.K.)

- Certified Laboratories, Inc (U.S.)

- Alfa Chemistry (U.S.)

- RBP Chemical Technology, Inc. (U.S.)

- AGQ Labs USA (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Chemical And Nutritional Testing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Chemical And Nutritional Testing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Chemical And Nutritional Testing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.