Global Dairy Market

Market Size in USD Billion

CAGR :

%

USD

1,065.00 Billion

USD

1,762.57 Billion

2024

2032

USD

1,065.00 Billion

USD

1,762.57 Billion

2024

2032

| 2025 –2032 | |

| USD 1,065.00 Billion | |

| USD 1,762.57 Billion | |

|

|

|

|

What is the Global Dairy Market Size and Growth Rate?

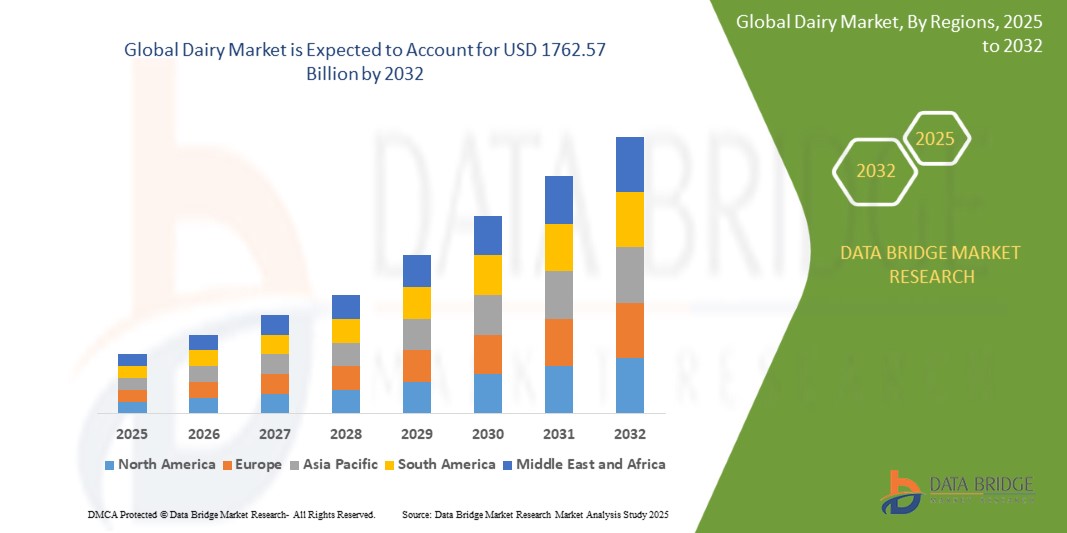

- The global dairy market size was valued at USD 1065 billion in 2024 and is expected to reach USD 1762.57 billion by 2032, at a CAGR of 6.50% during the forecast period

- Rising consumer demand for nutrient-rich diets and increasing popularity of organic and clean-label dairy products are some of the driving factors expected to propel the market growth. The technological advancements in dairy farming and processing and rising innovations and new product launches in functional and nutrient-enriched dairy products are expected to create opportunities for the market growth

What are the Major Takeaways of Dairy Market?

- The demand for dairy products is also fuelled by the increasing awareness of their role in supporting bone health, muscle function, and overall well-being. Dairy products, including milk, cheese, and yogurt, are rich sources of calcium and protein, which are critical for maintaining bone density and muscle mass. This awareness is driving consumers to incorporate more dairy into their diets to meet their nutritional needs and support a healthy lifestyle

- In addition, the dairy industry is witnessing growth due to the introduction of innovative dairy products that cater to specific health needs and dietary preferences. Products such as fortified milk, probiotic yogurt, and lactose-free options are gaining traction among consumers seeking tailored nutritional solutions. These innovations address various dietary requirements and preferences, further expanding the market for dairy products

- Asia-Pacific dominated the dairy market with the largest revenue share of 42.98% in 2024, driven by rising urbanization, population growth, and a strong preference for value-added and convenient dairy products

- Europe Dairy market is projected to grow at the fastest CAGR of 11.25% during 2025–2032, driven by strong consumer preference for organic, plant-based, and specialty dairy products

- The milk segment dominated the Dairy market with the largest market revenue share of 38.5% in 2024, supported by its role as a staple in daily nutrition across households, institutional demand, and foodservice usage

Report Scope and Dairy Market Segmentation

|

Attributes |

Dairy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Dairy Market?

Rising Demand for Plant-Based and Functional Dairy Alternatives

- A significant and accelerating trend in the global dairy market is the rapid adoption of plant-based dairy alternatives (such as oat, almond, and soy milk) along with functional dairy products enriched with probiotics, vitamins, and proteins

- For instance, Danone has expanded its plant-based portfolio under Alpro and Silk brands, while Nestlé launched dairy-free creamers and yogurt alternatives to meet consumer preferences

- The growing health-conscious consumer base, coupled with lactose intolerance and vegan lifestyle choices, is driving innovation in dairy alternatives, with functional dairy (e.g., fortified yogurts and protein-enriched milk) also gaining momentum

- The rise of sustainable consumption patterns, supported by eco-friendly packaging and carbon-neutral dairy farming practices, is reshaping consumer expectations for traditional and alternative dairy

- Companies such as Arla Foods are investing in sustainable dairy production, while Oatly and Alpro are making plant-based dairy mainstream across Europe and North America

- This trend toward plant-based, fortified, and sustainable dairy solutions is fundamentally reshaping the global dairy landscape, creating new opportunities for both traditional dairy producers and innovators in dairy alternatives

What are the Key Drivers of Dairy Market?

- Rising global demand for nutritious and protein-rich foods, supported by growing awareness of gut health and the benefits of probiotics, is a major driver of the dairy industry

- For instance, in 2024, Nestlé launched its “Goodnes” probiotic yogurt line in the U.S., focusing on digestive health and immunity benefits

- Increasing urbanization and higher disposable incomes are fueling consumption of convenience dairy products such as cheese, butter, yogurt drinks, and ready-to-drink flavored milk

- The global push towards plant-based nutrition is not cannibalizing but rather expanding the market, as hybrid dairy options (blending cow’s milk with plant-based ingredients) are gaining popularity

- Digital transformation in retail and e-commerce penetration is enabling direct-to-consumer sales for dairy brands, making fresh and functional dairy more accessible

- The demand for premiumization, health-driven dairy innovations, and convenience-focused products is propelling strong growth across developed and emerging markets asuch as

Which Factor is Challenging the Growth of the Dairy Market?

- One of the most critical challenges for the dairy market is the volatility in raw milk prices and rising feed costs for livestock, which directly affect production margins

- For instance, in 2024, European dairy cooperatives reported a surge in production costs due to rising energy and feed prices, which pressured profitability despite strong consumer demand

- Sustainability concerns related to greenhouse gas emissions, water use, and animal welfare continue to create consumer hesitancy, especially among younger, eco-conscious buyers

- Furthermore, competition from plant-based alternatives poses a challenge, as brands such as Oatly and Almond Breeze aggressively capture market share with health and sustainability-driven messaging

- Regulatory hurdles, such as labeling restrictions on plant-based milk alternatives (e.g., use of terms such as “milk” or “yogurt”), also create market fragmentation and complexity

- Overcoming these challenges requires dairy producers to innovate in sustainable farming, invest in value-added dairy products, and adopt transparent supply chain practices to maintain consumer trust and long-term growth

How is the Dairy Market Segmented?

The market is segmented on the basis of product type, distribution channel, and brand category.

• By Product Type

On the basis of product type, the dairy market is segmented into milk, cheese, butter, yogurt, dairy dessert, and others. The milk segment dominated the Dairy market with the largest market revenue share of 38.5% in 2024, supported by its role as a staple in daily nutrition across households, institutional demand, and foodservice usage. Milk’s versatility, nutritional benefits, and rising demand for fortified and flavored variants further drive consumption. In addition, the growth of lactose-free and plant-blended dairy milk options has boosted consumer adoption globally.

The yogurt segment is expected to witness the fastest CAGR from 2025 to 2032, owing to increasing health consciousness, demand for probiotic-rich foods, and rising preference for flavored and Greek-style yogurts. Convenience packaging and the product’s alignment with healthy snacking trends also strengthen its growth. Yogurt’s expanding presence in functional and fortified categories makes it a key growth driver for the dairy sector.

• By Brand Category

On the basis of brand category, the dairy market is segmented into branded and private label. The branded segment held the largest market revenue share of 64.2% in 2024, driven by consumer trust, consistent quality, and strong marketing by leading global players. Branded dairy products benefit from wide availability, premium positioning, and innovation in packaging and product variety. They also leverage consumer loyalty, particularly in urban and developed markets where premium dairy choices dominate.

The private label segment is projected to witness the fastest CAGR from 2025 to 2032, supported by competitive pricing, expanding supermarket chains, and the growing preference for affordable yet quality products. Retailers increasingly promote private label dairy products with improved packaging and product innovation, bridging the gap with branded options. Rising demand in emerging markets, where cost-conscious consumers prioritize value-for-money offerings, further accelerates private label growth.

• By Distribution Channel

On the basis of distribution channel, the dairy market is segmented into store-based retailing and non-store retailing. The store-based retailing segment dominated the Dairy market with the largest market revenue share of 72.1% in 2024, attributed to the widespread presence of supermarkets, hypermarkets, convenience stores, and specialty outlets. Consumers prefer physical retail for dairy products due to trust in product freshness, immediate availability, and the ability to compare multiple options. Retail expansion in emerging regions has also supported this segment’s strong performance.

The non-store retailing segment is forecasted to grow at the fastest CAGR from 2025 to 2032, driven by the rapid adoption of e-commerce platforms and online grocery delivery services. Rising smartphone penetration, improved cold chain logistics, and subscription-based dairy delivery services further boost this channel. The convenience of doorstep delivery and customization in product choice make non-store retailing a preferred option among busy urban consumers worldwide.

Which Region Holds the Largest Share of the Dairy Market?

- Asia-Pacific dominated the dairy market with the largest revenue share of 42.98% in 2024, driven by rising urbanization, population growth, and a strong preference for value-added and convenient dairy products

- Consumers in the region are increasingly demanding functional dairy items, organic milk, and fortified products to meet nutritional needs

- This robust growth is further fueled by expanding retail channels, rising disposable incomes, and strong government support for domestic dairy production, making Asia-Pacific the key hub for global dairy demand

China Dairy Market Insight

The China Dairy market captured the largest revenue share of 43% in Asia-Pacific in 2024, driven by the growing middle-class population, rising health awareness, and government-backed initiatives for self-sufficiency in milk production. The country is witnessing rapid adoption of value-added products such as yogurt, cheese, and infant milk formula. In addition, e-commerce platforms are expanding the accessibility of dairy, while the government’s focus on modernizing supply chains and cold storage infrastructure further boosts market expansion.

India Dairy Market Insight

The India Dairy market is expected to grow at a significant CAGR during the forecast period, supported by its position as the world’s largest milk producer. Rising per capita consumption, increasing demand for branded packaged products, and the expansion of organized retail are driving growth. Moreover, investments in cold chain infrastructure and rural supply networks are improving distribution, ensuring dairy reaches urban and semi-urban consumers efficiently.

Japan Dairy Market Insight

The Japan Dairy market is gaining traction, fueled by its aging population, rising health-consciousness, and preference for premium and functional dairy products. Japanese consumers are showing increasing demand for lactose-free and probiotic-based dairy options. Furthermore, the popularity of convenience stores and ready-to-drink dairy beverages supports consumption growth, while technological innovations in dairy processing ensure sustainability and high product quality.

Which Region is the Fastest Growing Region in the Dairy Market?

Europe Dairy market is projected to grow at the fastest CAGR of 11.25% during 2025–2032, driven by strong consumer preference for organic, plant-based, and specialty dairy products. Strict regulatory standards for quality and sustainability are also influencing product innovation. In addition, rising demand for cheese, butter, and premium dairy in foodservice and retail sectors, coupled with increasing exports, supports Europe’s growth momentum.

Germany Dairy Market Insight

The Germany Dairy market is expanding considerably, driven by strong consumer demand for organic and eco-friendly dairy solutions. With its robust infrastructure, sustainability-focused policies, and innovations in dairy technology, Germany is emerging as a leading hub for premium dairy production. The country’s emphasis on animal welfare and traceability enhances consumer trust and strengthens market demand.

U.K. Dairy Market Insight

The U.K. Dairy market is anticipated to grow steadily, driven by changing dietary habits, a preference for healthier dairy alternatives, and increased popularity of cheese and yogurt. The rise of e-commerce and subscription-based delivery services has boosted the accessibility of fresh and organic dairy. In addition, innovation in plant-based and hybrid dairy products is contributing to market expansion across retail and foodservice sectors.

Which are the Top Companies in Dairy Market?

The dairy industry is primarily led by well-established companies, including:

- DMK GROUP (Germany)

- Dairy Farmers of America, Inc. (U.S.)

- Nestlé (Switzerland)

- SAVENCIA SA (France)

- Glanbia plc (Ireland)

- The Coca-Cola Company (U.S.)

- Yeo Valley Organic Limited (U.K.)

- Arla Foods amba (Denmark)

- Parmalat S.p.A. (Italy, subsidiary of Lactalis – France)

- Dana Dairy (Switzerland)

- Sodiaal (France)

- Milcobel CV (Belgium)

- Unilever (U.K./Netherlands)

- Danone (France)

- Unternehmensgruppe Theo Müller (Germany)

- Valio Oy (Finland)

- Hochland SE (Germany)

- MEGGLE Group GmbH (Germany)

- Almarai (Saudi Arabia)

- China Mengniu Dairy Company Limited (China)

- Tiviski Pvt Ltd (Mauritania)

- Viju Industries (Nigeria)

- Ausnutria Dairy Corporation Ltd. (Netherlands)

- Emmi Group (Switzerland)

- CapriLac (Australia)

- Castle Dairy s.a. (Belgium)

What are the Recent Developments in Global Dairy Market?

- In January 2022, The Michigan State University (MSU) Department of Animal Science awarded DFA family farm-owners Dennis and Doris Tubergen, founders of Tubergen Dairy Farm in Ionia, Mich., the 2022 Dairy Farmer of the Year title. MSU awards the Dairy Farmer of the Year to farmers who display excellence in management and leadership on their farms and in their communities

- In April 2024, Danone North America aimed to capitalize on the rise in consumer snacking with Remix, a new line of yogurt and dairy snacks. The Remix portfolio is spread across three Danone brands, featuring a yogurt or dairy base with mix-in toppings. Offerings included Oikos Remix in coco almond chocolate, s’mores, and salted caramel flavors; Too Good & Co. Remix with strawberry dark chocolate almond, banana dark chocolate almond, and blueberry almond oat crisp flavors; and Light + Fit Remix in strawberry cheesecake, Key lime, and brownie sundae varieties. New and innovative products such as Remix can attract new customers and encourage repeat purchases, boosting overall sales

- In August 2021, Savencia Cheese USA has announced the launch of CheeseLoverShop.com, a one-of-a-kind online destination for imported and domestic cheeses. Customers can now shop the wide array of award-winning cheeses under the Savencia Fromage & Dairy portfolio - as well as partnering brands to get their fix of specialty cheese. This helps company to become the ultimate resource for specialty cheese products and education

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Dairy Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Dairy Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Dairy Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.