Global Chemical Sensors For Gas Market

Market Size in USD Billion

CAGR :

%

USD

6.60 Billion

USD

10.36 Billion

2024

2032

USD

6.60 Billion

USD

10.36 Billion

2024

2032

| 2025 –2032 | |

| USD 6.60 Billion | |

| USD 10.36 Billion | |

|

|

|

|

What is the Global Chemical Sensors for Gas Market Size and Growth Rate?

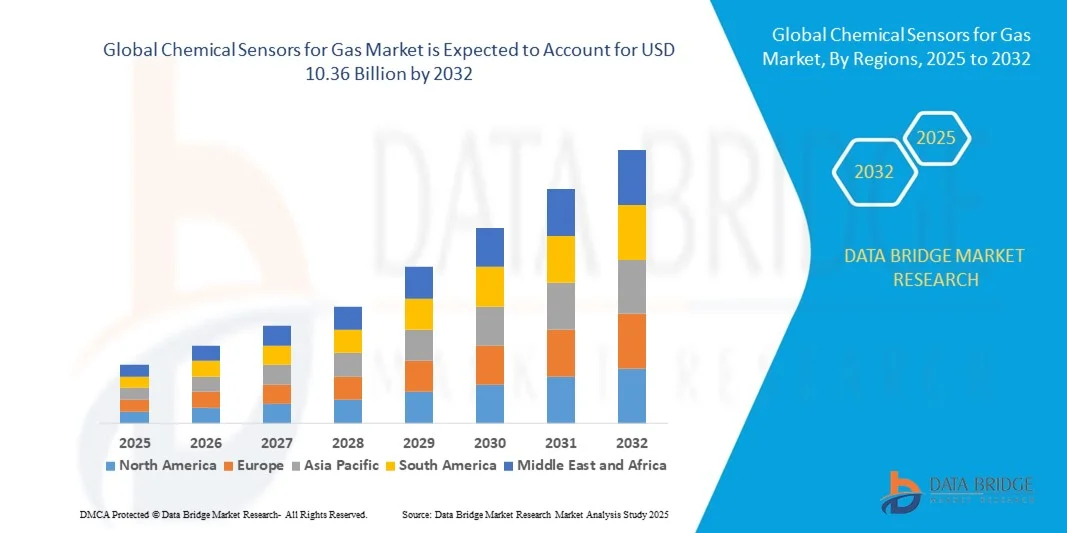

- The global chemical sensors for gas market size was valued at USD 6.60 billion in 2024 and is expected to reach USD 10.36 billion by 2032, at a CAGR of 5.80% during the forecast period

- Surging volume of patients suffering from diabetes and related disorders, growing demand for optical chemical sensors that are utilized in vehicle cabin air quality systems, rising adoption rate of centralized ventilation in residential and commercial spaces, increasing development in microelectronics and micro-fabrication technologies that call for miniaturized chemical sensor, rising number of applications from various industries are some of the vital and important factors which will such asly to accelerate the growth of the chemical sensors for gas market

What are the Major Takeaways of Chemical Sensors for Gas Market?

- Increasing number of technological advancements in clinical diagnostics along with growing adoption of direct gasoline injection and turbocharged engines in the automotive industry which will further contribute by generating immense opportunities that will led to the growth of the chemical sensors for gas market in the above-mentioned projected timeframe

- Stringent performance requirements for advanced sensor application along with poor life span which will such asly to act as market restraints factor for the growth of the chemical sensors for gas in the above-mentioned forecasted period

- North America dominated the chemical sensors for gas market with the largest revenue share of 39.36% in 2024, driven by increasing industrial automation, stringent safety regulations, and the growing awareness of environmental monitoring and smart industrial solutions

- The Asia-Pacific chemical sensors for gas market is poised to grow at the fastest CAGR of 8.5% during the forecast period of 2025 to 2032, driven by rapid industrialization, urbanization, and increasing environmental monitoring initiatives in countries such as China, Japan, and India

- The Electrochemical segment dominated the market with the largest revenue share of 41.5% in 2024, driven by its high sensitivity, selectivity, and suitability for detecting toxic gases such as CO, NO₂, and H₂S

Report Scope and Chemical Sensors for Gas Market Segmentation

|

Attributes |

Chemical Sensors for Gas Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Chemical Sensors for Gas Market?

Enhanced Accuracy and Connectivity Through Smart Sensing Technologies

- A major and accelerating trend in the global chemical sensors for gas market is the integration of smart sensing technologies with IoT, AI, and cloud-based platforms. This fusion enhances real-time monitoring, predictive maintenance, and automated control across industrial, residential, and commercial environments

- For instance, smart gas sensors integrated with AI can detect early signs of hazardous leaks, automatically trigger alerts, and provide actionable recommendations to prevent accidents. These devices are increasingly compatible with building management systems, cloud dashboards, and mobile applications for centralized monitoring

- AI-enabled sensors can analyze historical data to predict anomalies, optimize safety protocols, and reduce false alarms. Voice-enabled systems are also emerging, allowing users to receive notifications or check sensor status via digital assistants such as Amazon Alexa or Google Assistant

- The seamless integration of chemical gas sensors with smart platforms enables real-time data visualization, cross-device alerts, and automated safety responses, creating safer and more efficient industrial and residential environments

- This trend is reshaping user expectations for gas detection systems, driving demand for connected, intelligent, and predictive chemical sensors. Companies such as Alphasense and Figaro Engineering are developing AI-enabled sensors with enhanced connectivity, predictive analytics, and cloud integration

- The growing need for rapid detection, automated response, and remote monitoring is driving adoption across industrial, commercial, and residential sectors, reflecting a shift toward more intelligent and reliable gas safety solutions

What are the Key Drivers of Chemical Sensors for Gas Market?

- The rising emphasis on safety, environmental compliance, and industrial automation is a key driver for the chemical sensors for gas market. Increased regulations on air quality, industrial emissions, and workplace safety are pushing companies to adopt advanced gas detection solutions

- For instance, in 2024, Honeywell introduced next-generation gas sensors with IoT connectivity for industrial facilities, allowing predictive maintenance and real-time hazard monitoring. Such initiatives are expected to accelerate market growth

- Growing awareness of workplace hazards and residential gas safety is creating demand for advanced detection systems that provide real-time alerts, automated shutdowns, and remote monitoring capabilities

- Integration with IoT and cloud-based platforms enables seamless connectivity between devices, allowing centralized monitoring, data logging, and enhanced operational efficiency

- The convenience of real-time monitoring, early leak detection, and automated alerts drives adoption across industrial, commercial, and residential sectors. In addition, the rising demand for portable and low-power chemical gas sensors in smart homes, laboratories, and process industries contributes significantly to market expansion

- Overall, the market growth is supported by increasing industrial automation, regulatory enforcement, and the rising importance of workplace and residential safety

Which Factor is Challenging the Growth of the Chemical Sensors for Gas Market?

- Cybersecurity vulnerabilities in IoT-connected chemical sensors, along with concerns about data integrity, pose a notable challenge to widespread adoption. Connected sensors may be targeted for hacking or manipulation, raising safety and privacy concerns

- High-profile incidents of compromised industrial IoT devices have made some organizations hesitant to adopt fully connected gas monitoring solutions

- Mitigating these challenges requires robust encryption, secure authentication protocols, and regular firmware updates. Companies such as Alphasense and NGK Spark Plugs emphasize advanced security features and data protection measures to reassure users

- The relatively high cost of smart gas sensors, especially those with AI-enabled predictive features and wireless connectivity, can deter adoption among cost-sensitive end users, particularly in developing regions. While basic gas sensors are more affordable, advanced models with cloud integration and real-time analytics remain premium solutions

- Despite gradual cost reductions, the perceived expense for advanced sensors may still limit adoption, especially in smaller enterprises or residential segments

- Overcoming these challenges through enhanced cybersecurity, education on device reliability, and cost-effective product offerings will be essential for sustained market growth and broader penetration across industrial and residential sectors

How is the Chemical Sensors for Gas Market Segmented?

The chemical sensors for gas market is segmented on the basis of product type and application.

- By Product Type

On the basis of product type, the chemical sensors for gas market is segmented into Electrochemical, Optical, Pellistor/Catalytic Bead, Semiconductor, and Others. The Electrochemical segment dominated the market with the largest revenue share of 41.5% in 2024, driven by its high sensitivity, selectivity, and suitability for detecting toxic gases such as CO, NO₂, and H₂S. These sensors are widely used across industrial facilities and environmental monitoring systems due to their reliability and accuracy in low-concentration detection.

The Optical sensors segment is expected to witness the fastest CAGR of 22.3% from 2025 to 2032, fueled by rising adoption in industrial process control, safety-critical environments, and smart city applications. Optical sensors offer benefits such as rapid response, minimal interference, and long-term stability, making them increasingly preferred for continuous monitoring applications. Overall, demand for advanced, high-precision sensing technologies is reshaping the product landscape.

- By Application

On the basis of application, the chemical sensors for gas market is segmented into Industrial, Environmental Monitoring, Medical, Defence and Homeland Security, and Others. The Industrial segment accounted for the largest market revenue share of 45.8% in 2024, driven by stringent workplace safety regulations, the need for real-time hazardous gas detection, and process control requirements across chemical, oil & gas, and manufacturing industries.

The Environmental Monitoring segment is expected to witness the fastest CAGR of 23.1% from 2025 to 2032, owing to growing concerns over air quality, climate change, and urban pollution. Increasing government mandates for emission monitoring and industrial compliance, combined with smart city initiatives and IoT integration, are driving adoption. These trends emphasize the rising importance of chemical sensors for ensuring public safety, environmental compliance, and operational efficiency across applications

Which Region Holds the Largest Share of the Chemical Sensors for Gas Market?

- North America dominated the chemical sensors for gas market with the largest revenue share of 39.36% in 2024, driven by increasing industrial automation, stringent safety regulations, and the growing awareness of environmental monitoring and smart industrial solutions

- Consumers and industrial operators in the region highly value the precision, reliability, and seamless integration of chemical sensors for gas with broader IoT and industrial monitoring systems.

- This widespread adoption is further supported by advanced manufacturing infrastructure, high R&D investment, and the growing demand for real-time hazardous gas detection, establishing chemical sensors for gas as a preferred solution across industrial, environmental, and commercial applications

U.S. Chemical Sensors for Gas Market Insight

The U.S. chemical sensors for gas market captured the largest revenue share of 82% in 2024 within North America, driven by extensive industrial automation, stringent occupational safety regulations, and adoption of smart environmental monitoring solutions. Growing investments in energy, oil & gas, and chemical processing industries, coupled with the increasing integration of IoT-enabled sensors, further propel market growth. In addition, U.S. manufacturers and research institutions are continuously innovating sensor technology, contributing to higher adoption of advanced and reliable gas detection systems.

Europe Chemical Sensors for Gas Market Insight

The Europe chemical sensors for gas market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by strict industrial safety standards, environmental protection regulations, and the adoption of smart manufacturing solutions. Rising investments in Industry 4.0, industrial IoT, and emission monitoring programs are fostering the integration of chemical sensors across manufacturing and urban infrastructure.

Which Region is the Fastest Growing Region in the Chemical Sensors for Gas Market?

The Asia-Pacific chemical sensors for gas market is poised to grow at the fastest CAGR of 8.5% during the forecast period of 2025 to 2032, driven by rapid industrialization, urbanization, and increasing environmental monitoring initiatives in countries such as China, Japan, and India. The region’s growing adoption of smart manufacturing, IoT-based gas detection systems, and safety compliance solutions is boosting demand for chemical sensors across industrial and environmental applications.

Japan Chemical Sensors for Gas Market Insight

Japan’s market is growing steadily due to advanced industrial infrastructure, a focus on workplace safety, and the adoption of intelligent sensor solutions in industrial, medical, and environmental applications. Integration of IoT and smart monitoring platforms is driving growth in both commercial and industrial sectors.

China Chemical Sensors for Gas Market Insight

The China market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to industrial expansion, technological advancements, and increased investments in environmental and workplace safety. Rapid urbanization, development of smart factories, and government initiatives for air quality monitoring are key factors propelling the adoption of chemical sensors.

Which are the Top Companies in Chemical Sensors for Gas Market?

The chemical sensors for gas industry is primarily led by well-established companies, including:

- ABB (Switzerland)

- BorgWarner Inc. (U.S.)

- Bosch Rexroth AG (Germany)

- Siemens (Germany)

- DENSO CORPORATION (Japan)

- Honeywell International Inc. (U.S.)

- Emerson Electric Co. (U.S.)

- Yokogawa India Ltd. (India)

- Halma plc (U.K.)

- Thermo Fisher Scientific Inc. (U.S.)

- NGK Spark Plugs USA, Inc. (U.S.)

- Alphasense (U.K.)

- AMETEK Inc. (U.S.)

- Alpha MOS (France)

- Figaro Engineering Inc. (Japan)

- NXP Semiconductors (Netherlands)

- Heraeus Holding (Germany)

- General Electric Company (U.S.)

- Industrial Scientific (U.S.)

- Xylem (U.S.)

- Nova Biomedical (U.S.)

What are the Recent Developments in Global Chemical Sensors for Gas Market?

- In November 2023, researchers at Incheon National University proposed a novel approach to develop organic-inorganic hybrid gas sensors, offering exceptional endurance, selectivity, and sensitivity, which is expected to advance gas sensing technology in critical applications

- In October 2023, Emerson completed its acquisition of NI, strengthening its position in global automation and sensor technologies, which is anticipated to enhance its product offerings and market reach

- In October 2024, AlphaSense introduced PIDX, a new PID (Photoionization Detector) sensor technology designed to improve gas detection capabilities. The sensor delivers higher sensitivity and accuracy for volatile organic compounds (VOCs) at low concentrations, enhanced durability, and faster response times, which is crucial for real-time monitoring in safety-critical environments

- In March 2023, Sensorix GmbH unveiled its latest range of sensors for toxic gases at Sensor + Test 2023. The lineup includes highly versatile gas sensors and customized solutions for exotic toxic gases, meeting the growing global demand for high-quality detection solutions across multiple industries

- In October 2022, Alphasense Inc. expanded its product portfolio by launching a series of photo-ionization detection (PID) sensors, providing customers with exceptional performance and a broader selection of detection ranges, further strengthening its position in the gas sensor market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Chemical Sensors For Gas Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Chemical Sensors For Gas Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Chemical Sensors For Gas Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.