Global Chinese Hamster Ovary Cho Dg44 Cells Market

Market Size in USD Million

CAGR :

%

USD

40.00 Million

USD

70.64 Million

2024

2032

USD

40.00 Million

USD

70.64 Million

2024

2032

| 2025 –2032 | |

| USD 40.00 Million | |

| USD 70.64 Million | |

|

|

|

|

Chinese Hamster Ovary (CHO) DG44 Cells Market Size

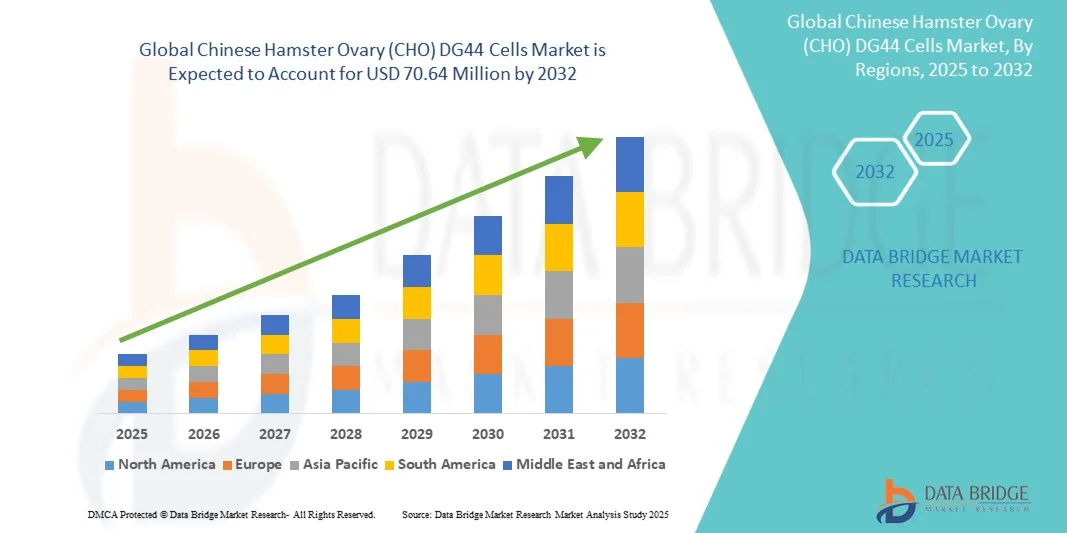

- The global Chinese Hamster Ovary (CHO) DG44 cells market size was valued at USD 40.00 million in 2024 and is expected to reach USD 70.64 million by 2032, at a CAGR of 7.37% during the forecast period

- The market growth is primarily driven by the increasing adoption of CHO DG44 cell lines in biopharmaceutical production, particularly for monoclonal antibodies, recombinant proteins, and biosimilars, owing to their high productivity and regulatory acceptance

- Additionally, the expansion of biologics manufacturing, coupled with technological advancements in cell-line engineering and process optimization, is fostering wider use of DG44 systems. These combined factors are accelerating demand for CHO DG44 cells and related services, thereby significantly boosting the industry’s growth

Chinese Hamster Ovary (CHO) DG44 Cells Market Analysis

- CHO DG44 cells, widely used for recombinant protein and monoclonal antibody production, are becoming essential components of modern biopharmaceutical manufacturing due to their high genetic stability, adaptability to serum-free suspension cultures, and proven scalability for commercial production

- The rising demand for CHO DG44 cell lines is primarily driven by the expanding biologics and biosimilars sector, increasing R&D investments in therapeutic protein development, and the growing preference for high-yield, regulatory-compliant cell systems in drug manufacturing

- North America dominated the CHO DG44 cells market with the largest revenue share of 43% in 2024, attributed to strong biopharmaceutical production capacity, well-established CDMO networks, and the presence of major biotechnology companies, particularly in the U.S., which leads in biologics research and cell-line innovation

- Asia-Pacific is expected to be the fastest-growing region in the CHO DG44 cells market during the forecast period, fueled by expanding biomanufacturing infrastructure, government support for biosimilar production, and the rapid emergence of regional CDMOs in China, India, and South Korea

- The cGMP Master and Working Cell Banks segment dominated the CHO DG44 cells market with a market share of 46.8% in 2024, driven by increasing regulatory emphasis on cell-line traceability and quality assurance, as well as the growing need for scalable and validated cell sources in commercial biopharmaceutical production

Report Scope and Chinese Hamster Ovary (CHO) DG44 Cells Market Segmentation

|

Attributes |

Chinese Hamster Ovary (CHO) DG44 Cells Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Chinese Hamster Ovary (CHO) DG44 Cells Market Trends

“Advanced Bioprocessing and Cell-Line Engineering”

- A significant and accelerating trend in the global CHO DG44 cells market is the increasing adoption of advanced cell-line engineering technologies, including CRISPR-based genome editing and metabolic pathway optimization, which enhance productivity and product quality

- For instance, engineered DG44 cell lines with targeted knock-ins have demonstrated higher monoclonal antibody titers and improved glycosylation consistency, enabling more efficient biomanufacturing processes

- Integration of automated bioreactor systems with DG44 cells enables real-time monitoring of growth and productivity parameters, improving process control and reducing batch failures, while advanced analytics guide optimization of culture conditions

- The convergence of high-throughput screening, omics technologies, and automated cell-line development platforms facilitates faster clone selection, stability testing, and scale-up, transforming timelines from R&D to commercial manufacturing

- This trend towards more efficient, predictable, and scalable DG44 cell systems is reshaping expectations for upstream biologics production, prompting companies such as Lonza and Thermo Fisher Scientific to develop high-performance DG44 cell lines with integrated workflow support

- The demand for DG44 cell lines optimized for high-yield and consistent biopharmaceutical production is growing rapidly across both contract development organizations and in-house manufacturing facilities, as biologics pipelines continue to expand

Chinese Hamster Ovary (CHO) DG44 Cells Market Dynamics

Driver

“Rising Biologics Demand and Outsourcing to CDMOs”

- The expanding pipeline of monoclonal antibodies, recombinant proteins, and biosimilars, coupled with the increasing reliance on CDMOs for commercial manufacturing, is a significant driver for DG44 cell line adoption

- For instance, in March 2024, WuXi Biologics reported the expansion of its mammalian cell-line services, specifically utilizing DG44 cells to accelerate mAb production for global clients, demonstrating market growth potential

- As biopharmaceutical companies seek reliable, high-yield, and regulatory-compliant cell systems, DG44 cells offer validated performance, dhfr amplification capability, and documented scalability, making them highly attractive for both clinical and commercial manufacturing

- Furthermore, the trend towards outsourcing upstream production to CDMOs enables smaller biotech firms to access optimized DG44 cell lines without investing in in-house infrastructure, driving adoption

- The preference for reproducible, high-quality biologics and the growth of biosimilars production are creating a strong, sustained demand for DG44 cells, supporting market expansion across multiple regions

Restraint/Challenge

“High Development Costs and Regulatory Complexity”

- The relatively high cost of developing and maintaining cGMP-grade DG44 cell lines, coupled with the complexity of regulatory compliance, poses a significant challenge to broader market penetration

- For instance, the establishment of validated DG44 master and working cell banks requires extensive characterization, viral testing, and documentation to meet FDA, EMA, or NMPA standards, increasing initial investment

- Small and mid-sized biotech companies may face budgetary constraints and longer timelines for cell-line validation, limiting immediate adoption of premium DG44 systems

- Additionally, evolving regulatory expectations for comparability, traceability, and biosimilarity increase the technical burden for cell-line developers and CDMOs, requiring continuous updates and expert oversight

- Overcoming these challenges through optimized development workflows, shared CDMO services, and enhanced technical support is vital for wider adoption and sustainable growth of the DG44 cells market

Chinese Hamster Ovary (CHO) DG44 Cells Market Scope

The market is segmented on the basis of product type, application, technology type, and end user.

- By Product Type

On the basis of product type, the CHO DG44 cells market is segmented into cGMP Master and Working Cell Banks (MCB/WCB), Research-grade DG44 Cell Lines, DG44-optimized Media and Feeds, Cell-line Development and Engineering Services, Analytical Reagents and QC Kits, IP and Engineered DG44 Strains, and Technical Support and Documentation Services. The cGMP Master and Working Cell Banks segment dominated the market in 2024 with the largest revenue share of 46.8%. It is driven by the critical role of ensuring regulatory compliance, reproducibility, and traceability for clinical and commercial manufacturing. Biopharmaceutical companies and CDMOs prioritize cGMP-grade banks to meet FDA, EMA, and NMPA standards. The segment benefits from recurring demand, as new batches of monoclonal antibodies, recombinant proteins, and biosimilars require validated seed stocks. Strong industry trust and established workflows reinforce its dominance. Additionally, integration with upstream bioprocesses ensures reliable production performance and reduces batch failure risks.

The Cell-line Development and Engineering Services segment is expected to witness the fastest growth from 2025 to 2032, driven by CRISPR-based genome editing, high-throughput clone selection, and metabolic pathway optimization. Outsourcing these services allows biotech firms to reduce timelines and leverage specialized expertise. The segment also supports biosimilar production and next-generation therapeutic proteins. Growing demand for high-performance, custom DG44 lines fuels adoption. Rapid technological advancements and increasing CDMO partnerships enhance its growth potential. Furthermore, this segment enables improved product quality, stability, and glycosylation consistency.

- By Application

On the basis of application, the market is segmented into monoclonal antibody production, biosimilars manufacturing, recombinant protein production, gene and cell therapy upstream processes, and academic and preclinical research. The Monoclonal Antibody Production segment dominated the market in 2024. DG44 cells are widely used as hosts for stable, high-titer antibody expression. Large pharmaceutical companies and CDMOs favor DG44 cells due to dhfr amplification capability and regulatory acceptance. Continuous growth in therapeutic antibody pipelines for oncology, autoimmune, and infectious diseases sustains demand. High-volume production requirements and long-term contracts drive revenue. Integration with cGMP workflows and upstream processes further strengthens the segment’s leadership. The segment also benefits from global biopharma R&D expansion and increased biologics manufacturing capacity.

The Biosimilars Manufacturing segment is expected to witness the fastest growth from 2025 to 2032. Adoption is driven by rising regulatory approvals and the need for cost-effective biologics. CDMOs and emerging biopharma companies in Asia-Pacific and Europe increasingly rely on DG44 cells for biosimilar development. Expiring patents of reference biologics accelerate adoption. DG44 cells’ scalability and regulatory compatibility enhance their attractiveness. The segment also benefits from growing global demand for accessible therapeutics. Increased investment in local biomanufacturing infrastructure supports segment expansion.

- By Technology Type

On the basis of technology type, the market is segmented into Classical dhfr Amplification-based DG44 Systems, CRISPR-engineered DG44 Cell Lines, Perfusion-optimized DG44 Strains, Glycoengineered DG44 Systems, and Suspension-adapted DG44 Cells. The Classical dhfr Amplification-based DG44 Systems segment dominated the market in 2024. These systems are preferred for long-term reliability and regulatory familiarity. Manufacturers value their compatibility with existing media and amplification techniques. High stability and reproducibility support large-scale protein production. Regulatory acceptance and historical usage reinforce their dominance. The segment benefits from widespread adoption in commercial biologics manufacturing. Continuous process improvements and established workflows further strengthen market leadership.

The CRISPR-engineered DG44 Cell Lines segment is expected to witness the fastest growth from 2025 to 2032. Genome editing allows improved titer, glycosylation, and product consistency. CDMOs and biopharma companies adopt these lines for faster clone selection and optimized metabolic pathways. The segment supports high-performance, customized biologics production. Increasing pipeline diversity and biosimilar demand boost adoption. Rapid technology maturation and reduced development timelines enhance growth. Partnerships between CDMOs and cell-line engineering firms drive further market expansion.

- By End User

On the basis of end user, the market is segmented into biopharmaceutical and pharmaceutical companies, contract development and manufacturing organizations (CDMOs), academic and research institutes, and contract research organizations (CROs). The Biopharmaceutical and Pharmaceutical Companies segment dominated the market in 2024. In-house production of monoclonal antibodies and recombinant proteins drives high demand. Companies prioritize cGMP DG44 cells for regulatory compliance and consistent production. Large-scale contracts and high-volume requirements reinforce revenue share. Integration with existing manufacturing infrastructure strengthens adoption. The segment benefits from robust R&D pipelines and global biologics expansion. Increased investments in process optimization and quality assurance further support dominance.

The CDMOs segment is expected to witness the fastest growth from 2025 to 2032. Outsourcing upstream production allows smaller biotech firms to access validated DG44 cells without in-house infrastructure. Expansion of CDMO capacity in Asia-Pacific and Europe accelerates adoption. CDMOs provide integrated services including cell-line development and media optimization. Rapid growth of biosimilars and biopharma pipelines increases demand. The segment benefits from long-term partnerships with emerging biopharma clients. Continuous technological improvements and service differentiation further boost market growth.

Chinese Hamster Ovary (CHO) DG44 Cells Market Regional Analysis

- North America dominated the CHO DG44 cells market with the largest revenue share of 43% in 2024, attributed to strong biopharmaceutical production capacity, well-established CDMO networks, and the presence of major biotechnology companies, particularly in the U.S., which leads in biologics research and cell-line innovation

- Biopharmaceutical companies and CDMOs in the region prioritize DG44 cells for their high productivity, regulatory acceptance, and compatibility with large-scale monoclonal antibody and recombinant protein production

- This widespread adoption is further supported by strong R&D investments, access to advanced cell-line engineering technologies, and a growing number of clinical and commercial biologics pipelines

U.S. Chinese Hamster Ovary (CHO) DG44 Cells Market Insight

The U.S. CHO DG44 cells market captured the largest revenue share of 45% in 2024 within North America, fueled by a well-established biopharmaceutical ecosystem and the presence of leading monoclonal antibody and recombinant protein manufacturers. Biopharma companies increasingly prioritize cGMP-grade DG44 cells for their high productivity, regulatory acceptance, and scalability. The growing adoption of outsourcing to CDMOs and contract manufacturing for biologics further propels market demand. Moreover, strong R&D investments and advanced cell-line engineering technologies, including CRISPR and high-throughput clone selection, are significantly contributing to market expansion. The increasing focus on biosimilars and next-generation therapeutics also drives adoption. Additionally, U.S. biopharma companies leverage DG44 cells for both clinical and commercial biologics production, reinforcing market leadership.

Europe Chinese Hamster Ovary (CHO) DG44 Cells Market Insight

The Europe CHO DG44 cells market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent regulatory standards and the growing biologics manufacturing base across Germany, the U.K., and Switzerland. Adoption is fueled by increasing demand for monoclonal antibodies, biosimilars, and recombinant proteins. European biopharma firms and CDMOs increasingly use DG44 cells for scalable, high-yield, and regulatory-compliant production processes. The region benefits from established biomanufacturing infrastructure, advanced R&D capabilities, and a supportive regulatory environment. Growing focus on biosimilar pipelines and clinical biologics further enhances market demand. DG44 cell adoption in both in-house and outsourced manufacturing strengthens Europe’s market position.

U.K. Chinese Hamster Ovary (CHO) DG44 Cells Market Insight

The U.K. CHO DG44 cells market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the country’s increasing biopharma R&D initiatives and expansion of contract manufacturing services. The rising monoclonal antibody and biosimilar pipelines encourage biopharma companies to adopt high-performance DG44 cell lines. Increasing outsourcing to CDMOs allows smaller biotech firms to access validated, cGMP-grade cell lines. The U.K.’s strong life sciences infrastructure and investment in advanced upstream technologies support market expansion. Demand for scalable, reproducible, and regulatory-compliant production processes continues to rise. Integration with automated bioreactor systems and optimized media also drives adoption.

Germany Chinese Hamster Ovary (CHO) DG44 Cells Market Insight

The Germany CHO DG44 cells market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s emphasis on advanced biologics manufacturing and stringent quality standards. German biopharma companies and CDMOs increasingly utilize DG44 cells for monoclonal antibody and recombinant protein production. Strong R&D capabilities, robust regulatory frameworks, and government support for biotech innovation promote adoption. Integration with upstream bioprocessing systems and advanced cell-line engineering enhances efficiency and scalability. Demand for high-titer, stable, and compliant DG44 cell lines in both clinical and commercial applications continues to grow. Sustainability and process optimization initiatives further reinforce market growth.

Asia-Pacific Chinese Hamster Ovary (CHO) DG44 Cells Market Insight

The Asia-Pacific CHO DG44 cells market is poised to grow at the fastest CAGR of 26% during 2025–2032, driven by expanding biomanufacturing infrastructure, increasing R&D investments, and government support for biosimilars and monoclonal antibody production in countries such as China, India, and Japan. The region’s growing biotech sector and rising adoption of outsourced manufacturing via CDMOs are key growth drivers. Affordable cGMP-grade DG44 cells and optimized media enhance accessibility for emerging biopharma firms. The demand for high-performance cell lines for clinical and commercial biologics continues to rise. Rapid technological adoption, process automation, and a focus on biosimilar pipelines further fuel market expansion.

Japan Chinese Hamster Ovary (CHO) DG44 Cells Market Insight

The Japan CHO DG44 cells market is gaining momentum due to the country’s strong biotechnology ecosystem, increasing monoclonal antibody production, and demand for high-quality recombinant proteins. Japanese biopharma companies prioritize DG44 cells for cGMP-compliant, scalable, and stable production. Integration with automated bioreactor systems and process optimization tools enhances efficiency. The growing number of clinical biologics and biosimilars pipelines drives adoption. Advanced cell-line engineering technologies, including CRISPR-based modifications, further boost performance. Japan’s focus on high-quality, regulated biologics manufacturing reinforces market growth in both commercial and research applications.

India Chinese Hamster Ovary (CHO) DG44 Cells Market Insight

The India CHO DG44 cells market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid expansion of the biotechnology sector, government initiatives for biosimilars, and increasing contract manufacturing activities. India’s growing number of CDMOs and biotech startups are adopting DG44 cells for cost-effective and scalable biologics production. The availability of affordable, cGMP-grade DG44 cells and optimized media supports adoption in both clinical and commercial pipelines. Strong domestic manufacturing capabilities and investments in biopharma R&D further propel market growth. Rising demand for monoclonal antibodies and recombinant proteins strengthens market prospects. India’s position as an emerging hub for biosimilar and biologics manufacturing enhances regional adoption rates.

Chinese Hamster Ovary (CHO) DG44 Cells Market Share

The Chinese Hamster Ovary (CHO) DG44 Cells industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Lonza. (Switzerland)

- FUJIFILM Irvine Scientific, Inc. (U.S.)

- Sartorius AG (Germany)

- ProBioGen AG (Germany)

- Premas Life Sciences. (India)

- AGC Biologics (U.S.)

- WuXi Biologics (China)

- Cellca GmbH (Germany)

- Selexis SA (Switzerland)

- BASF SE (Germany)

- Cytiva (U.S.)

- BioVectra Inc. (Canada)

- Bio-Techne Corporation (U.S.)

- Celltrion, Inc. (South Korea)

- Samsung Biologics. (South Korea)

What are the Recent Developments in Chinese Hamster Ovary (CHO) DG44 Cells Market?

- In August 2025, CHO Plus, a company specializing in engineered cell lines, signed two monoclonal antibody (mAb) production agreements. These agreements involve using their engineered CHO DG44 cell lines to produce monoclonal antibodies against highly contagious and lethal filoviruses. Additionally, CHO Plus was selected for the 2025 BioTools Innovator Accelerator, highlighting its role in advancing biomanufacturing capabilities

- In August 2025, Asimov announced a partnership with Ottimo Pharma to develop a high-titer CHO cell line for the production of OTP-01, a PD1/VEGFR2 dual pathway antibody. Utilizing its CHO Edge platform, Asimov delivered a stable CHO DG44-based cell line ahead of schedule, supporting Ottimo's IND submission planned for late 2025. This collaboration underscores the growing demand for optimized CHO cell lines in the production of complex biologics

- In April 2024, Eminence Bio introduced the EmCD CHO® 121 medium series, a next-generation cell culture medium designed to enhance the performance of CHO cell lines, including CHO-DG44. This medium addresses challenges such as rapid cell apoptosis and low expression titer during scale-up processes, ensuring high cell viability and yield. It supports higher cell densities and maintains stable expression titers during bioreactor scale-up, making it suitable for both CHO-S and CHO-DG44 cells

- In August 2023, Aragen announced the launch of its royalty-free CHO GS cell line development platform under the RapTr CLD services. This platform includes the proven CHO-DG44 and CHO-GS cell lines and proprietary vector combinations with an innovative clone selection process. The RapTr CLD services accelerate the process of cell line engineering from DNA transfection in the host cell lines to Research Cell Bank (RCB) all within 18 weeks, offering a cost-effective solution for biopharmaceutical companies

- In April 2023, FUJIFILM Irvine Scientific introduced the BalanCD CHO DG44 medium, a chemically defined, animal component-free medium designed to support high cell density conditions and deliver high titres. This medium is specifically developed for optimal growth and productivity of CHO DG44 cell lines, one of the leading cell lines utilized for therapeutic biomolecule development and manufacture

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.