Global Chinese Hamster Ovary Cho Dxb 11 Cells Market

Market Size in USD Million

CAGR :

%

USD

6.00 Million

USD

10.35 Million

2024

2032

USD

6.00 Million

USD

10.35 Million

2024

2032

| 2025 –2032 | |

| USD 6.00 Million | |

| USD 10.35 Million | |

|

|

|

|

Chinese Hamster Ovary (CHO) DXB 11 Cells Market Size

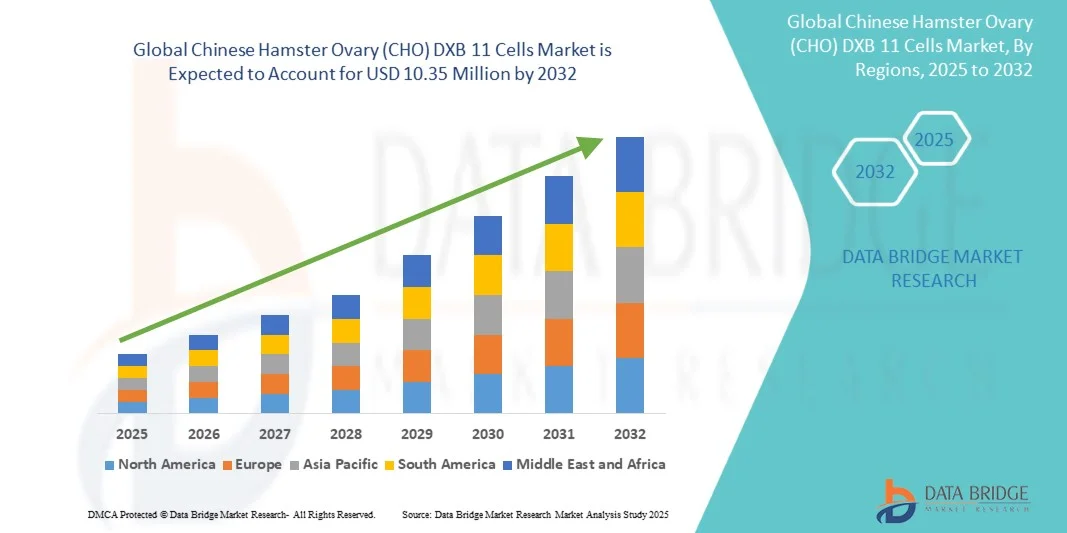

- The global Chinese Hamster Ovary (CHO) DXB 11 cells market size was valued at USD 6.00 million in 2024 and is expected to reach USD 10.35 million by 2032, at a CAGR of 7.05% during the forecast period

- The market growth is primarily driven by the expanding biopharmaceutical sector and the increasing demand for recombinant protein and monoclonal antibody production, where CHO-DXB11 cells serve as a key host system

- In addition, the rising adoption of stable, high-yield expression systems and advancements in cell line engineering, gene amplification, and bioprocess optimization are strengthening the role of CHO-DXB11 cells in biologics manufacturing. These factors collectively foster robust market expansion worldwide

Chinese Hamster Ovary (CHO) DXB 11 Cells Market Analysis

- CHO-DXB11 cells, a derivative of the Chinese Hamster Ovary cell line, are extensively used as host systems for large-scale production of recombinant proteins and monoclonal antibodies, playing a pivotal role in the manufacturing of biopharmaceuticals due to their genetic stability, scalability, and adaptability to serum-free culture conditions

- The growing demand for biologics, biosimilars, and gene therapy products, along with advancements in cell line engineering and expression optimization technologies, is significantly fueling the adoption of CHO-DXB11 cells across pharmaceutical and biotechnology industries

- North America dominated the CHO-DXB11 cells market with a revenue share of 43% in 2024, supported by the strong presence of biopharmaceutical manufacturers, advanced research infrastructure, and high investment in biologics development, particularly in the U.S., where CDMOs and biotech firms are expanding cell line development capabilities

- Asia-Pacific is projected to be the fastest-growing region, driven by the rapid expansion of biologics production facilities, government support for biomanufacturing, and the increasing focus on biosimilar development in countries such as China, India, and South Korea

- The biopharmaceutical production segment dominated the CHO-DXB11 cells market with a share of 55.8% in 2024, owing to its critical application in the expression of therapeutic proteins and antibodies, supported by rising demand for efficient, regulatory-compliant, and high-yield cell systems in global biologics manufacturing

Report Scope and Chinese Hamster Ovary (CHO) DXB 11 Cells Market Segmentation

|

Attributes |

Chinese Hamster Ovary (CHO) DXB 11 Cells Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Chinese Hamster Ovary (CHO) DXB 11 Cells Market Trends

“Advancements in Cell Line Engineering and High-Yield Expression”

- A significant and accelerating trend in the CHO-DXB11 cells market is the adoption of genetic engineering techniques and optimized expression systems, enhancing protein yield, stability, and productivity in biopharmaceutical manufacturing

- For instance, companies are developing CHO-DXB11 variants with targeted gene knockouts or insertions to improve monoclonal antibody expression and glycosylation profiles for therapeutic applications

- Advanced cell line engineering enables faster development timelines, more predictable performance, and improved scalability, meeting the increasing demand for biologics and biosimilars

- Furthermore, integration of high-throughput screening and automated clone selection tools is facilitating the identification of top-performing CHO-DXB11 clones with superior productivity and growth characteristics

- This trend towards more efficient, tailored, and high-yield CHO-DXB11 cell lines is reshaping expectations in biologics development, prompting companies such as Lonza and Cytiva to invest heavily in proprietary engineered strains

- The demand for CHO-DXB11 cells with enhanced expression capabilities is growing rapidly across pharmaceutical and biotechnology sectors, as manufacturers prioritize efficiency, regulatory compliance, and cost-effective production

Chinese Hamster Ovary (CHO) DXB 11 Cells Market Dynamics

Driver

“Rising Biologics and Biosimilars Demand”

- The growing global demand for monoclonal antibodies, recombinant proteins, and biosimilars is a major driver for the widespread adoption of CHO-DXB11 cells in large-scale production

- For instance, leading biopharmaceutical firms are expanding their CDMO partnerships to utilize CHO-DXB11 cells for high-yield antibody and protein manufacturing

- Increasing investment in therapeutic biologics research and commercialization is propelling the need for stable, high-performance CHO-DXB11 cell lines capable of supporting GMP production

- Moreover, regulatory emphasis on consistency, traceability, and quality in biologics production is making CHO-DXB11 cells the preferred host system for clinical and commercial applications

- The scalability and adaptability of CHO-DXB11 cells allow manufacturers to rapidly respond to market demand fluctuations, further encouraging adoption in both established and emerging biopharmaceutical markets

- The trend of outsourcing cell line development and bioprocessing to CDMOs using CHO-DXB11 cells is accelerating market growth, driven by efficiency, expertise, and cost-effectiveness

Restraint/Challenge

“High Cost and Regulatory Complexity”

- The relatively high cost of CHO-DXB11 cell line development, coupled with the expenses of maintaining GMP-compliant production, poses a challenge to widespread adoption, particularly for small-scale biotechs

- For instance, establishing and validating CHO-DXB11-based production lines requires substantial investment in equipment, media, and quality control infrastructure

- Navigating complex regulatory requirements for clinical-grade biologics adds additional time and financial burden for manufacturers using CHO-DXB11 cells

- Furthermore, technical challenges such as clone instability, batch-to-batch variability, and process optimization can hinder efficiency and productivity in some cases

- Smaller biotech companies and startups may face barriers to entry due to limited access to proprietary CHO-DXB11 technologies and high licensing costs

- Overcoming these challenges through optimized bioprocessing, cost reduction strategies, and collaborative partnerships with CDMOs is essential for sustained market growth

Chinese Hamster Ovary (CHO) DXB 11 Cells Market Scope

The market is segmented on the basis of expression system, offering, application, end user, and distribution channel.

- By Expression System

On the basis of expression system, the CHO-DXB11 cells market is segmented into DHFR/MTX selection system, Antibiotic selection system, Gene amplification system, and Site-specific integration system. The DHFR/MTX selection system segment dominated the market with the largest revenue share in 2024, owing to its long-standing use in monoclonal antibody production and reliable selection of high-expressing clones. This system allows stepwise amplification of target genes using methotrexate, enabling consistent and high-yield protein expression. Biopharmaceutical manufacturers often prefer DHFR/MTX for clinical and commercial production due to its regulatory familiarity and historical track record. The segment also benefits from widespread availability of established protocols, cell banks, and technical support, making it a trusted choice across pharma and CDMO workflows. Its scalability for large-scale manufacturing further consolidates its dominance in the CHO-DXB11 market. Adoption in North America and Europe reinforces the segment’s market leadership globally.

The Site-specific integration system segment is expected to witness the fastest growth from 2025 to 2032, driven by increasing adoption of precise genome engineering techniques such as CRISPR and recombinase-mediated cassette exchange. This system ensures predictable expression levels, reduced clonal variability, and accelerated cell line development timelines. Site-specific integration is especially advantageous for next-generation biologics, including complex antibodies and fusion proteins, where stable and reproducible expression is critical. Growth is supported by biotech startups and CDMOs seeking rapid, cost-effective, and high-performance CHO-DXB11 lines. Companies are increasingly investing in proprietary site-specific integration technologies to differentiate in the market. The segment also benefits from rising interest in high-throughput automated screening platforms.

- By Offering

On the basis of offering, the market is segmented into cell banks, cell line development services, genetic engineering and licensing services, media, reagents, and supplements, analytical and technical support services. The Cell banks segment dominated the market with the largest revenue share in 2024, as pharmaceutical and biotechnology companies prioritize ready-to-use research-grade and GMP-compliant CHO-DXB11 banks for consistent protein production. Cell banks provide validated starting material for manufacturing, reducing development time and ensuring regulatory compliance. The availability of frozen master and working cell banks from established suppliers simplifies process standardization across CDMOs and in-house production. Their dominance is reinforced by trust in quality, reproducibility, and traceability for therapeutic applications, including monoclonal antibodies, recombinant proteins, and vaccines. The segment is supported by strong demand in North America and Europe, where large-scale biologics manufacturing is concentrated.

The Cell line development services segment is projected to register the fastest growth from 2025 to 2032, fueled by increasing outsourcing to CDMOs and biotech companies seeking high-yield, engineered CHO-DXB11 clones. Services include stable clone selection, gene optimization, and expression screening, which shorten timelines for biologics development. Growth is supported by technological advancements in automation, high-throughput screening, and CRISPR-based engineering. The segment is particularly attractive for startups and emerging biopharmaceutical firms aiming to reduce CAPEX on in-house development. Rapid adoption in Asia-Pacific is expected due to expansion of contract development facilities. Increased R&D investment and innovation in cell line engineering are accelerating demand for these services.

- By Application

On the basis of application, the market is segmented into biopharmaceutical production, research and development, vaccine production, gene and cell therapy manufacturing, biosimilar development. The Biopharmaceutical production segment dominated the market with the largest revenue share of 55.8% in 2024, driven by the extensive use of CHO-DXB11 cells in monoclonal antibody and recombinant protein manufacturing. These cells offer scalability, regulatory compliance, and predictable glycosylation profiles, which are critical for therapeutic efficacy. Pharmaceutical companies rely heavily on CHO-DXB11 systems for both clinical and commercial-scale production. The segment benefits from increasing biologics pipelines and rising global demand for therapeutic proteins. Adoption is strongest in North America and Europe due to established production infrastructure. Manufacturers prefer CHO-DXB11 cells for their robust performance and reproducibility.

The Biosimilar development segment is expected to witness the fastest growth from 2025 to 2032, owing to rising adoption of cost-effective biologics in emerging markets. CHO-DXB11 cells provide stable, high-yield expression necessary for biosimilar manufacturing, enabling companies to meet stringent regulatory requirements while maintaining product comparability. Growth is supported by government initiatives to promote biosimilar adoption and increasing investment from CDMOs in emerging economies. The segment benefits from rapid expansion in Asia-Pacific, especially China and India. Increasing patent expirations of biologics are also driving biosimilar pipeline growth. Advanced cell line engineering techniques further enhance biosimilar production efficiency.

- By End User

On the basis of end user, the market is segmented into pharmaceutical and biotechnology companies, contract development and manufacturing organizations (CDMOs), academic and research institutes, and biotech startups. The Pharmaceutical and biotechnology companies segment dominated the market with the largest revenue share in 2024, as large-scale biologics manufacturers rely on CHO-DXB11 cells for clinical and commercial protein production. Their dominance is reinforced by established manufacturing facilities, technical expertise, and long-term supplier relationships. Companies prioritize proven performance, scalability, and regulatory compliance, which CHO-DXB11 cells reliably deliver. North America and Europe are key regions driving demand in this segment. High-volume production of monoclonal antibodies and recombinant proteins strengthens the segment’s leadership. Regulatory familiarity with CHO-DXB11 cells also supports continued adoption.

The CDMO segment is expected to witness the fastest growth from 2025 to 2032, driven by increasing outsourcing of cell line development, process optimization, and manufacturing. CDMOs leverage CHO-DXB11 systems to offer turnkey solutions for biologics production, enabling smaller biotech firms and startups to enter the market without investing in in-house infrastructure. Growth is further fueled by rising global demand for cost-effective, high-quality therapeutic proteins. Asia-Pacific and Latin America are emerging as fast-growing regions for CDMO services. Strategic partnerships with biotech startups and mid-size pharma companies enhance market penetration. Expansion of contract manufacturing capacity supports rapid adoption of CHO-DXB11 cells.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct sales, distributors, and online catalog. The Direct sales segment dominated the market with the largest revenue share in 2024, as manufacturers prefer sourcing CHO-DXB11 cells directly from suppliers to ensure quality, authenticity, and regulatory documentation. Direct sales provide technical support, custom solutions, and bulk supply agreements that cater to large-scale biopharmaceutical companies and CDMOs. North America and Europe are key regions supporting this segment’s dominance. Long-term supplier relationships and bulk procurement contracts reinforce leadership. Trusted suppliers offer validated cell banks, media, and technical guidance.

The Online catalog segment is projected to witness the fastest growth from 2025 to 2032, driven by the increasing availability of research-grade CHO-DXB11 cells, reagents, and supplements through e-commerce platforms. Online distribution simplifies procurement for academic institutes, startups, and smaller biotech firms, offering rapid delivery, competitive pricing, and access to global suppliers. Asia-Pacific and Latin America are emerging as fast-growing regions for online procurement. The trend is supported by rising demand for convenient access to small-volume or customized orders. User-friendly ordering platforms and expanded product listings accelerate adoption.

Chinese Hamster Ovary (CHO) DXB 11 Cells Market Regional Analysis

- North America dominated the CHO-DXB11 cells market with a revenue share of 43% in 2024, supported by the strong presence of biopharmaceutical manufacturers, advanced research infrastructure, and high investment in biologics development, particularly in the U.S., where CDMOs and biotech firms are expanding cell line development capabilities

- Companies in the region prioritize CHO-DXB11 cells for large-scale production of monoclonal antibodies, recombinant proteins, and other therapeutic biologics due to their reliability, scalability, and regulatory compliance

- This dominance is further supported by well-established CDMOs, robust R&D capabilities, and a high adoption rate of contract development and manufacturing services, making North America the leading market for both clinical and commercial biologics production

U.S. Chinese Hamster Ovary (CHO) DXB 11 Cells Market Insight

The U.S. CHO-DXB11 cells market captured the largest revenue share of 78% in 2024 within North America, fueled by the strong presence of leading biopharmaceutical companies and CDMOs. Manufacturers are increasingly prioritizing CHO-DXB11 cells for the production of monoclonal antibodies, recombinant proteins, and other therapeutic biologics due to their scalability, regulatory compliance, and high-yield performance. The growing demand for biosimilars and innovative biologics further propels the market. In addition, well-established research infrastructure and robust R&D investment in cell line development are contributing to market expansion. The trend of outsourcing cell line development and bioprocessing to CDMOs is also accelerating adoption. Integration with advanced bioprocessing technologies and automation enhances efficiency and production consistency.

Europe Chinese Hamster Ovary (CHO) DXB11 Cells Market Insight

The Europe CHO-DXB11 cells market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing biologics manufacturing, strict regulatory compliance requirements, and growing demand for monoclonal antibodies and recombinant proteins. The adoption of advanced cell line engineering technologies and outsourcing to CDMOs is fostering market growth. European biopharmaceutical companies are investing in high-yield CHO-DXB11 cell lines to improve productivity and reduce development timelines. The market is experiencing significant growth in Germany, France, and Switzerland, with applications across clinical and commercial biologics production. Rising government support for biotech innovation is further boosting adoption. Companies in Europe are focusing on GMP-grade CHO-DXB11 cells to meet international quality standards.

U.K. Chinese Hamster Ovary (CHO) DXB11 Cells Market Insight

The U.K. CHO-DXB11 cells market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing biologics pipeline and demand for efficient cell line solutions. Concerns regarding drug supply consistency and regulatory compliance are encouraging manufacturers to adopt stable, high-performing CHO-DXB11 cells. The U.K.’s strong biotechnology ecosystem, advanced research facilities, and increasing outsourcing to CDMOs continue to stimulate market growth. Adoption is also being driven by clinical and commercial production requirements for monoclonal antibodies, vaccines, and recombinant proteins. Companies are leveraging local technical expertise and innovation to accelerate cell line development. Government initiatives supporting biomanufacturing further enhance market opportunities.

Germany Chinese Hamster Ovary (CHO) DXB11 Cells Market Insight

The Germany CHO-DXB11 cells market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing biopharmaceutical R&D activities and demand for advanced cell line technologies. Germany’s well-established biologics manufacturing infrastructure and strong focus on innovation support the adoption of high-yield, GMP-compliant CHO-DXB11 cells. Companies are integrating CHO-DXB11 systems into automated bioprocessing workflows to enhance efficiency. The market growth is also driven by rising monoclonal antibody and biosimilar production, alongside clinical research applications. Germany’s regulatory framework encourages the use of validated cell lines, supporting widespread adoption. The preference for quality-assured, high-performance CHO-DXB11 cells aligns with local pharmaceutical standards.

Asia-Pacific Chinese Hamster Ovary (CHO) DXB11 Cells Market Insight

The Asia-Pacific CHO-DXB11 cells market is poised to grow at the fastest CAGR of 23% during the forecast period of 2025 to 2032, driven by increasing biologics production facilities and government initiatives promoting biotechnology innovation. Countries such as China, India, and Japan are witnessing rapid adoption of CHO-DXB11 cells for both clinical and commercial protein manufacturing. The region’s growing biosimilar pipeline and expanding CDMO presence are supporting market growth. Rising R&D investment, availability of cost-effective cell line solutions, and technological advancements in high-yield expression systems are further propelling adoption. Asia-Pacific is emerging as a global hub for biologics development and manufacturing. Market growth is also aided by collaborations between international biopharmaceutical firms and local CDMOs.

Japan Global Chinese Hamster Ovary (CHO) DXB11 Cells Market Insight

The Japan CHO-DXB11 cells market is gaining momentum due to the country’s advanced biotechnology ecosystem, high R&D investment, and increasing demand for innovative biologics. Japanese manufacturers are adopting CHO-DXB11 cells for monoclonal antibody, vaccine, and recombinant protein production to meet domestic and global demand. Integration with automated bioprocessing systems enhances productivity and consistency. The aging population and rising healthcare needs are further driving biologics development, supporting CHO-DXB11 adoption. Partnerships with CDMOs and international firms accelerate cell line utilization. Regulatory support for clinical-grade production ensures market stability and growth.

India Chinese Hamster Ovary (CHO) DXB11 Cells Market Insight

The India CHO-DXB11 cells market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s expanding biopharmaceutical manufacturing sector and rapid biotechnology adoption. India is becoming a key hub for monoclonal antibody and recombinant protein production using CHO-DXB11 cells. Government initiatives promoting biotech innovation and the growth of contract development organizations support market expansion. Affordable and scalable cell line solutions, coupled with increasing demand for biosimilars, drive adoption across clinical and commercial production. India’s strong domestic CDMO presence enhances accessibility to CHO-DXB11 cells. The growing focus on biosimilar pipelines and R&D investments further propels market growth.

Chinese Hamster Ovary (CHO) DXB 11 Cells Market Share

The Chinese Hamster Ovary (CHO) DXB 11 Cells industry is primarily led by well-established companies, including:

- Lonza (Switzerland)

- Thermo Fisher Scientific Inc. (U.S.)

- Sartorius AG (Germany)

- Revvity Discovery Limited, (U.K.)

- ATCC (U.S.)

- Sygnature Discovery Ltd (U.S.)

- Canton Bio (China)

- Biointron Biological Inc (South Korea)

- Merck & Co., Inc., (Germany)

- Promega Corporation (U.S.)

- ABM Industries Incorporated (Canada)

- RayBiotech, Inc. (U.S.)

- CLS Cell Lines Service GmbH (Germany)

- BPS Bioscience, Inc. (U.S.)

- GenTarget Inc. (U.S.)

- Abeomics (U.S.)

- Cytiva (U.S.)

- Curia (U.S.)

- Evitria AG (Switzerland)

What are the Recent Developments in Chinese Hamster Ovary (CHO) DXB 11 Cells Market?

- In August 2025, CHO Plus announced a strategic partnership with Avid Bioservices to scale up monoclonal antibody (mAb) production using engineered CHO-DXB11 cell lines. This collaboration aims to meet industrial-scale requirements for mAb manufacturing, addressing the growing demand for biologics

- In August 2025, researchers developed a CHO-DXB11-derived cell line, CHO2353, engineered to minimize the expression of retrovirus-such as particles (RVLPs). This advancement aims to enhance the safety profile of biologics produced using CHO-DXB11 cells by reducing the risk of contamination with retroviral elements. The study involved sequencing the predominant RVLP RNA expressed by these cells and implementing strategies to mitigate their presence

- In June 2025, the CLANet framework was introduced as a comprehensive solution for cross-batch cell line identification using brightfield images. This deep learning-based approach addresses challenges associated with batch effects in cell line authentication, ensuring consistent and reliable identification of CHO-DXB11 cells across different production batches

- In March 2025, Danaher published an article discussing the evolution of CHO cells, including CHO-DXB11, in cell line development. The article highlights the advancements in CHO cell lines for the production of recombinant therapeutic proteins, reflecting ongoing improvements in cell line engineering

- In January 2025, UC San Diego's CHO Systems Biology Center reported a genetic optimization in CHO cells that blocks the buildup of toxic byproducts, enhancing the efficiency of drug-making cells. This advancement contributes to the improved performance of CHO-DXB11 cell lines in biomanufacturing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.