Global Chromatography In Cannabis Testing Market

Market Size in USD Billion

CAGR :

%

USD

1.32 Billion

USD

3.91 Billion

2025

2033

USD

1.32 Billion

USD

3.91 Billion

2025

2033

| 2026 –2033 | |

| USD 1.32 Billion | |

| USD 3.91 Billion | |

|

|

|

|

Chromatography in Cannabis Testing Market Size

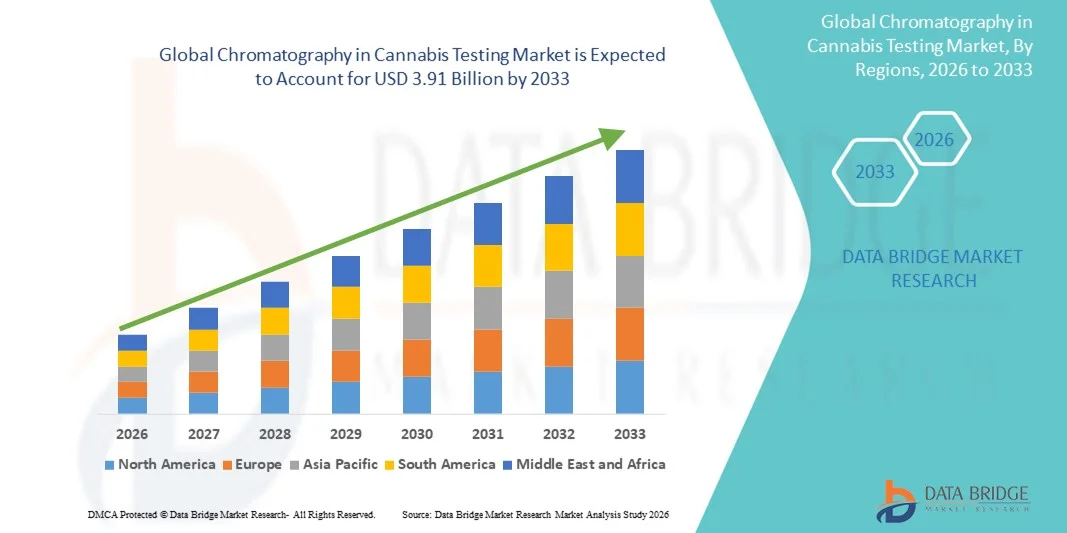

- The global chromatography in cannabis testing market size was valued at USD 1.32 billion in 2025 and is expected to reach USD 3.91 billion by 2033, at a CAGR of 14.50% during the forecast period

- The market growth is largely fueled by increasing legalization and commercialization of cannabis products worldwide, which is driving stringent regulatory requirements for potency, contaminant, and cannabinoid profiling using advanced chromatographic techniques such as HPLC and gas chromatography

- Furthermore, growing technological advancements in chromatography instruments and analytical methods, along with rising consumer demand for accurate, efficient, and reliable testing solutions in both recreational and medical cannabis sectors, are establishing chromatography‑based testing as essential for compliance and product quality assurance. These converging factors are accelerating the adoption of chromatographic technologies, thereby significantly boosting the industry’s growth

Chromatography in Cannabis Testing Market Analysis

- Chromatography, offering precise separation and quantification of cannabinoids, terpenes, and contaminants in cannabis products, is increasingly vital for ensuring product quality, regulatory compliance, and consumer safety in both medical and recreational cannabis sectors due to its accuracy, reproducibility, and adaptability to various testing workflows

- The escalating demand for chromatography in cannabis testing is primarily fueled by the growing legalization and commercialization of cannabis, rising regulatory requirements for potency and contaminant testing, and a heightened focus on product safety and standardization across markets

- North America dominated the chromatography in cannabis testing market with the largest revenue share of 42.5% in 2025, characterized by early cannabis legalization, well-established testing laboratories, high consumer awareness, and a strong presence of key industry players, with the U.S. experiencing substantial growth in testing volumes driven by innovations in both liquid chromatography and gas chromatography techniques

- Asia-Pacific is expected to be the fastest-growing regions in the chromatography in cannabis testing market during the forecast period due to increasing regulatory enforcement, expanding medical cannabis adoption, and growing investments in advanced testing laboratories

- Potency testing dominated the chromatography in cannabis testing market with a market share of 38.8% in 2025, driven by the essential need to determine cannabinoid concentrations for product labeling, dosage accuracy, and consumer safety

Report Scope and Chromatography in Cannabis Testing Market Segmentation

|

Attributes |

Chromatography in Cannabis Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Chromatography in Cannabis Testing Market Trends

Advancements in Multi-Residue and High-Throughput Testing

- A significant and accelerating trend in the global chromatography in cannabis testing market is the increasing adoption of multi-residue testing platforms and high-throughput chromatographic techniques, enabling faster, more accurate analysis of cannabinoids, pesticides, and contaminants

- For instance, modern HPLC and GC systems are capable of simultaneously analyzing multiple cannabinoids and terpenes, allowing laboratories to meet growing regulatory demands efficiently

- Integration of chromatography with mass spectrometry (LC-MS/MS, GC-MS) enables highly sensitive detection of trace contaminants and residual solvents, improving the reliability and comprehensiveness of cannabis product testing

- These advanced testing solutions facilitate streamlined laboratory workflows, higher sample throughput, and reduced operational costs, thereby enhancing overall productivity in both commercial and research laboratories

- This trend toward more efficient, sensitive, and versatile chromatographic methods is reshaping laboratory standards, with companies developing instruments that combine speed, accuracy, and compliance features to meet the evolving needs of the cannabis industry

- The demand for high-throughput and multi-residue chromatography solutions is growing rapidly across regulatory, medical, and recreational cannabis testing sectors, as producers and laboratories prioritize quality, safety, and efficiency

- Adoption of miniaturized and portable chromatography instruments is also emerging, enabling on-site testing and faster decision-making for producers and regulators

- Increasing integration of digital reporting and cloud-based data management with chromatography instruments is improving traceability, record-keeping, and regulatory reporting efficiency

Chromatography in Cannabis Testing Market Dynamics

Driver

Increasing Regulatory Compliance and Legalization of Cannabis

- The growing legalization of cannabis and stringent regulatory requirements for potency, contaminants, and product labeling are significant drivers for the rising adoption of chromatography in cannabis testing

- For instance, in 2025, several U.S. states mandated advanced chromatographic testing for pesticide residues and cannabinoid quantification, compelling laboratories to adopt high-precision HPLC and GC systems

- As cannabis producers seek to comply with evolving safety standards and provide accurate product information, chromatographic testing ensures reliable and consistent results for both medical and recreational products

- Furthermore, the expanding recreational and medical cannabis markets are increasing the overall testing volume, driving demand for specialized laboratories and analytical instruments capable of handling high sample throughput

- The need for accurate, reproducible, and rapid testing methods, along with growing awareness among consumers and regulators about product safety, is propelling investments in advanced chromatography solutions across global markets

- Rising consumer focus on product transparency and verified potency is encouraging laboratories to adopt robust chromatographic methods to differentiate their testing services

- Collaborations between instrument manufacturers and cannabis testing laboratories are accelerating innovation and expanding access to cutting-edge chromatography solutions

Restraint/Challenge

High Operational Costs and Skilled Workforce Requirements

- The relatively high capital investment and operational costs of advanced chromatographic equipment pose a significant challenge to widespread adoption, particularly for small-scale laboratories and emerging markets

- For instance, maintenance, consumables, and calibration of HPLC and GC systems can be expensive, limiting access for budget-conscious cannabis producers and testing service providers

- Chromatographic testing also requires skilled technicians and trained analysts to ensure accurate operation and data interpretation, which can be a barrier in regions with limited technical expertise

- While automated systems and training programs are gradually improving accessibility, the combination of high equipment costs and labor skill requirements continues to restrain market growth

- Overcoming these challenges through cost-effective instrument development, user-friendly automation, and workforce training initiatives will be critical for sustaining the market’s expansion in both emerging and established regions

- Limited standardization across regional testing regulations can lead to inconsistent testing practices and additional compliance costs, restricting market scalability

- Dependency on high-quality reagents, solvents, and calibration standards for accurate chromatographic results adds operational complexity and increases vulnerability to supply chain disruptions

Chromatography in Cannabis Testing Market Scope

The market is segmented on the basis of test type, service provider, product, and application.

- By Test Type

On the basis of test type, the chromatography in cannabis testing market is segmented into potency testing, pesticide screening, residual solvent screening, heavy metal testing, terpene testing, and mycotoxin testing. The potency testing segment dominated the market with the largest revenue share of 38.8% in 2025, driven by mandatory regulatory requirements for accurate cannabinoid labeling in both medical and recreational cannabis products. Potency testing is essential for determining THC, CBD, and other cannabinoid concentrations, which directly impact product dosage, efficacy, and consumer safety. Regulatory bodies across legalized markets require precise potency measurements, making this test type a routine and high-volume application for testing laboratories. Additionally, increasing consumer awareness regarding product strength and consistency further reinforces the dominance of potency testing. The widespread use of liquid chromatography techniques enhances accuracy and repeatability, supporting large-scale adoption. As cannabis product diversity increases, potency testing remains a foundational requirement across all product

The pesticide screening segment is expected to witness the fastest growth rate during the forecast period, fueled by growing regulatory scrutiny over agricultural practices and chemical residues in cannabis cultivation. Governments and regulatory agencies are enforcing stricter limits on pesticide residues, compelling producers to conduct comprehensive screening before product commercialization. Pesticide screening involves complex multi-residue analysis, driving demand for advanced chromatography systems coupled with mass spectrometry. Rising public health concerns regarding long-term exposure to toxic chemicals further accelerate adoption. As cultivation scales globally, especially in emerging legal markets, pesticide screening requirements are becoming more standardized. This trend positions pesticide screening as a high-growth segment within chromatography-based cannabis testing.

- By Service Provider

On the basis of service provider, the market is segmented into laboratories, manufacturers, and research institutes. The laboratories segment dominated the market in 2025, driven by the outsourcing preference of cannabis cultivators and product manufacturers for compliance-based testing. Independent and certified laboratories offer specialized expertise, regulatory accreditation, and high-throughput testing capabilities, making them the preferred choice across regions. These laboratories handle large sample volumes for routine testing, including potency, contaminants, and safety analysis. Continuous investments in advanced chromatography instruments further strengthen their market position. The expansion of legal cannabis markets has led to a rapid increase in the number of licensed testing laboratories. Their role as third-party validators ensures credibility and regulatory acceptance of test results.

The research institutes segment is anticipated to be the fastest growing during the forecast period, supported by rising scientific research on cannabis-based therapeutics and pharmaceutical applications. Research institutions are increasingly involved in studying cannabinoid interactions, formulation development, and clinical efficacy, requiring advanced chromatographic analysis. Government funding and academic collaborations are accelerating cannabis research activities globally. These institutes utilize chromatography for method development, compound isolation, and long-term safety studies. As medical cannabis gains traction, research-driven testing demand continues to rise. This growing emphasis on scientific validation supports rapid growth of the research institutes segment.

- By Product

On the basis of product, the chromatography in cannabis testing market is segmented into liquid chromatography and gas chromatography. The liquid chromatography segment dominated the market in 2025, driven by its versatility and suitability for analyzing heat-sensitive cannabinoids and complex cannabis matrices. Liquid chromatography enables simultaneous detection of multiple cannabinoids, pesticides, and mycotoxins with high accuracy. Its compatibility with mass spectrometry enhances sensitivity and regulatory compliance. Testing laboratories widely adopt liquid chromatography due to its reproducibility and minimal sample preparation requirements. The technique is especially preferred for potency and contaminant testing across diverse product forms. This broad applicability solidifies liquid chromatography’s leading position.

The gas chromatography segment is expected to witness the fastest growth rate during the forecast period, fueled by increasing demand for terpene profiling and residual solvent analysis. Gas chromatography is highly effective for volatile compound detection, making it essential for flavor, aroma, and solvent safety assessment. Growing consumer interest in terpene composition is driving its adoption in premium cannabis products. Advances in detector sensitivity and automation further enhance gas chromatography efficiency. Regulatory emphasis on residual solvent limits strengthens demand for this technique. As product formulations diversify, gas chromatography adoption is expected to accelerate rapidly.

- By Application

On the basis of application, the market is segmented into pain management, seizures, sclerosis, and others. The pain management segment dominated the market in 2025, driven by widespread use of cannabis-based products for chronic pain treatment. Medical cannabis formulations used in pain management require precise potency and safety testing to ensure consistent therapeutic outcomes. The high patient population suffering from chronic pain conditions increases testing volumes. Regulatory oversight for medical cannabis products further necessitates rigorous chromatographic testing. Continuous product innovation in oils, edibles, and topical formulations reinforces demand. These factors collectively support the dominance of the pain management segment.

The seizures segment is projected to be the fastest growing during the forecast period, supported by increasing adoption of cannabinoid-based therapies for epilepsy and neurological disorders. Clinical evidence supporting cannabinoid efficacy in seizure control has expanded medical acceptance. Products used for seizure treatment require stringent testing due to narrow therapeutic windows. Chromatography plays a crucial role in ensuring formulation consistency and contaminant-free products. Rising approvals of cannabis-derived pharmaceuticals further stimulate demand. As neurological applications expand, testing requirements for this segment are expected to grow at a rapid pace.

Chromatography in Cannabis Testing Market Regional Analysis

- North America dominated the chromatography in cannabis testing market with the largest revenue share of 42.5% in 2025, characterized by early cannabis legalization, well-established testing laboratories, high consumer awareness, and a strong presence of key industry players, with the U.S. experiencing substantial growth in testing volumes driven by innovations in both liquid chromatography and gas chromatography techniques

- Testing laboratories and cannabis producers in the region place strong emphasis on accurate potency, contaminant, and compliance testing, supported by widespread adoption of advanced liquid and gas chromatography technologies

- This strong market position is further reinforced by a well-established laboratory infrastructure, high testing volumes, and continuous technological innovation, positioning chromatography-based testing as an essential component across both medical and recreational cannabis markets

U.S. Chromatography in Cannabis Testing Market Insight

The U.S. chromatography in cannabis testing market captured the largest revenue share within North America in 2025, driven by widespread cannabis legalization and stringent regulatory mandates for product safety and quality assurance. Testing laboratories across the country are increasingly prioritizing high-precision chromatographic techniques to comply with state-level requirements for potency, pesticide, and contaminant analysis. The rapid expansion of medical and recreational cannabis markets continues to elevate testing volumes nationwide. Moreover, strong investments in advanced laboratory infrastructure and analytical technologies further support market growth. The presence of a mature cannabis ecosystem and a high concentration of certified testing facilities significantly contributes to the market’s expansion.

Europe Chromatography in Cannabis Testing Market Insight

The Europe chromatography in cannabis testing market is projected to expand at a substantial CAGR during the forecast period, primarily driven by growing medical cannabis adoption and tightening regulatory oversight. European regulatory authorities emphasize standardized testing protocols to ensure product consistency and patient safety. Increasing urbanization and rising acceptance of cannabis-based therapeutics are fueling demand for advanced testing solutions. Laboratories across the region are adopting sophisticated chromatography systems to meet compliance requirements. Growth is observed across pharmaceutical research, clinical testing, and commercial cannabis applications, particularly in regulated medical markets.

U.K. Chromatography in Cannabis Testing Market Insight

The U.K. chromatography in cannabis testing market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by expanding medical cannabis prescriptions and regulatory focus on product quality. Rising awareness regarding cannabinoid-based treatments is encouraging investments in analytical testing capabilities. The country’s strong pharmaceutical and life sciences infrastructure supports the adoption of chromatography technologies. Additionally, increasing research activities related to cannabis-derived medicines are boosting testing demand. The emphasis on compliance and patient safety continues to stimulate market growth.

Germany Chromatography in Cannabis Testing Market Insight

The Germany chromatography in cannabis testing market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s rapidly growing medical cannabis program. Germany’s strict regulatory environment requires comprehensive testing for potency, contaminants, and consistency, driving chromatography adoption. The nation’s strong focus on pharmaceutical-grade standards supports advanced analytical practices. Well-established laboratory networks and increasing imports of medical cannabis further elevate testing needs. The integration of high-precision chromatography systems aligns with Germany’s emphasis on quality and reliability.

Asia-Pacific Chromatography in Cannabis Testing Market Insight

The Asia-Pacific chromatography in cannabis testing market is poised to grow at the fastest CAGR during the forecast period, driven by gradual regulatory liberalization and increasing acceptance of medical cannabis in select countries. Rising investments in healthcare infrastructure and laboratory capabilities are supporting market expansion. Countries exploring medical cannabis frameworks are establishing testing standards that rely on chromatography-based methods. The region’s growing pharmaceutical manufacturing base further contributes to demand. As regulatory clarity improves, testing volumes are expected to increase significantly.

Japan Chromatography in Cannabis Testing Market Insight

The Japan chromatography in cannabis testing market is gaining momentum due to rising research interest in cannabinoid-based pharmaceuticals and controlled medical applications. Japan’s strong emphasis on precision, safety, and quality supports the use of advanced chromatographic analysis. Research institutions and pharmaceutical companies are increasingly utilizing chromatography for compound analysis and formulation development. Strict regulatory oversight necessitates accurate and reproducible testing methods. These factors collectively support steady market growth.

India Chromatography in Cannabis Testing Market Insight

The India chromatography in cannabis testing market accounted for a notable share within Asia-Pacific in 2025, driven by increasing research activities related to medicinal cannabis and traditional therapeutic applications. Growing interest in cannabinoid research is encouraging investments in analytical testing infrastructure. India’s expanding pharmaceutical and biotechnology sectors support the adoption of chromatography technologies. Academic and research institutions play a key role in driving testing demand. As regulatory pathways evolve, the need for standardized and compliant testing solutions is expected to rise further.

Chromatography in Cannabis Testing Market Share

The Chromatography in Cannabis Testing industry is primarily led by well-established companies, including:

- Agilent Technologies, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Waters Corporation (U.S.)

- PerkinElmer (U.S.)

- Shimadzu Corporation (Japan)

- Restek Corporation (U.S.)

- MilliporeSigma (U.S.)

- AB SCIEX LLC (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Bruker Corporation (U.S.)

- Hitachi High-Tech Corporation (Japan)

- JASCO International Co., Ltd. (Japan)

- GE Healthcare (U.S.)

- Gilson, Inc. (U.S.)

- KNAUER Wissenschaftliche Geräte GmbH (Germany)

- Trajan Scientific and Medical (Australia)

- Hamilton Company (U.S.)

- VWR International, LLC (U.S.)

- SC Laboratories Inc. (U.S.)

- CannaSafe Analytics (U.S.)

What are the Recent Developments in Global Chromatography in Cannabis Testing Market?

- In September 2024, licensed cannabis testing labs in the U.S. faced scrutiny over “lab shopping,” where some labs allegedly inflated THC results to attract business, prompting regulatory attention on testing integrity and reinforcing the need for reliable chromatographic analysis

- In April 2024, industry discussion highlights the impact of emerging legal markets on cannabis testing, noting increased regulatory and technical challenges that are shaping the adoption of advanced analytical methods, including chromatography, as legalization expands globally

- In November 2023, Forbes highlighted the FDA’s adoption of the LightLab 3 High Sensitivity Cannabis Analyzer, underscoring real-world regulatory recognition of portable chromatography-based cannabis testing tools to improve testing accuracy and compliance

- In October 2023, Orange Photonics unveiled the LightLab 3 Psy Analyzer, a derivative of its chromatography-based cannabis testing technology, enabling portable HPLC analysis for psychedelic product testing indicating cross-sector expansion of chromatographic analysis methods

- In August 2023, the U.S. Food and Drug Administration (FDA) selected the LightLab 3 High Sensitivity Cannabis Analyzer a portable HPLC-based system to support regulatory cannabis analysis and improve consumer safety by enabling on-site cannabinoid testing and faster compliance checks

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.