Global Circulating Tumor Cells Ctc Market

Market Size in USD Billion

CAGR :

%

USD

18.24 Billion

USD

47.51 Billion

2025

2033

USD

18.24 Billion

USD

47.51 Billion

2025

2033

| 2026 –2033 | |

| USD 18.24 Billion | |

| USD 47.51 Billion | |

|

|

|

|

Circulating Tumor Cells (CTC) Market Size

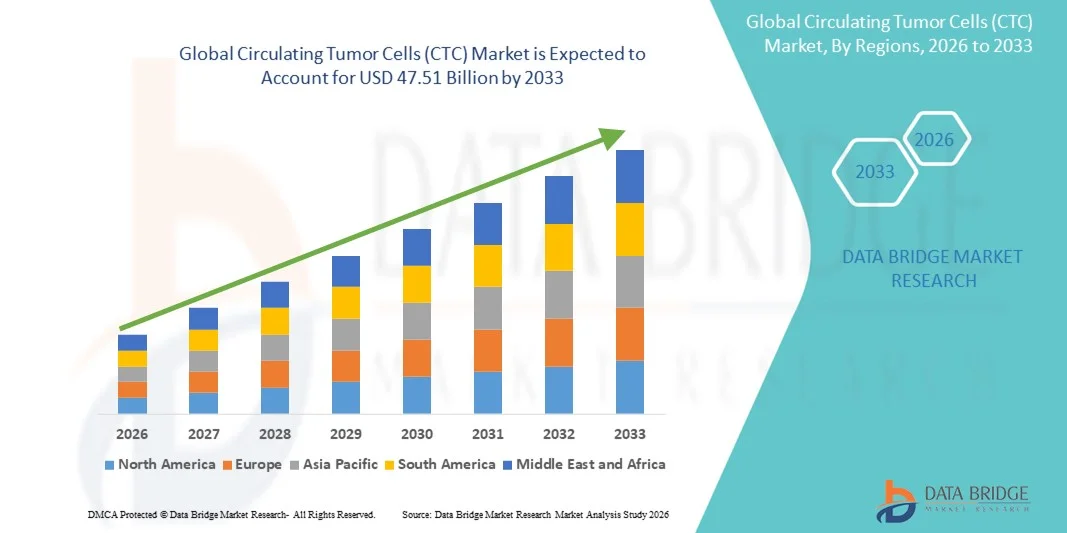

- The global Circulating Tumor Cells (CTC) market size was valued at USD 18.24 billion in 2025 and is expected to reach USD 47.51 billion by 2033, at a CAGR of 12,71% during the forecast period

- The market growth is largely fueled by the increasing global cancer burden, rising adoption of non-invasive liquid biopsy techniques, and technological advancements in CTC detection and analysis methods, leading to improved diagnostic and prognostic capabilities in oncology

- Furthermore, rising demand from hospitals, diagnostic laboratories, and research institutions for accurate, real-time, and personalized cancer monitoring solutions is establishing CTC-based technologies as a preferred tool for cancer detection and treatment management. These converging factors are accelerating the uptake of CTC solutions, thereby significantly boosting the industry's growth

Circulating Tumor Cells (CTC) Market Analysis

- Circulating Tumor Cells (CTC), offering non-invasive liquid biopsy-based detection and monitoring of cancer, are increasingly vital components of modern oncology diagnostics and precision medicine in both clinical and research settings due to their ability to enable early detection, real-time monitoring, and therapy guidance

- The escalating demand for Circulating Tumor Cells (CTC) technologies is primarily fueled by the rising global cancer incidence, growing adoption of precision oncology, and the increasing preference for non-invasive diagnostic and prognostic solutions over traditional tissue biopsies

- North America dominated the Circulating Tumor Cells (CTC) market with the largest revenue share of 43.2% in 2025, characterized by advanced healthcare infrastructure, high R&D investments, and a strong presence of key market players, with the U.S. experiencing substantial growth in CTC adoption, particularly in cancer monitoring, early diagnosis, and personalized treatment strategies, driven by innovations in microfluidics, imaging, and molecular analysis platforms

- Asia-Pacific is expected to be the fastest growing region in the Circulating Tumor Cells (CTC) market during the forecast period due to increasing cancer awareness, expanding healthcare infrastructure, and rising investments in molecular diagnostics and precision oncology

- Kits and Reagents segment dominated the Circulating Tumor Cells (CTC) market with a market share of 46.9% in 2025, driven by their widespread use in both clinical diagnostics and research applications, ease of standardization, and growing adoption in liquid biopsy workflows

Report Scope and Circulating Tumor Cells (CTC) Market Segmentation

|

Attributes |

Circulating Tumor Cells (CTC) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Circulating Tumor Cells (CTC) Market Trends

Advancements in AI-Enabled Cancer Diagnostics

- A significant and accelerating trend in the global Circulating Tumor Cells (CTC) market is the integration of artificial intelligence (AI) and machine learning with CTC detection and analysis platforms, enhancing accuracy, predictive capabilities, and treatment personalization

- For instance, some CellSearch and Epic Sciences platforms utilize AI algorithms to analyze cell morphology and molecular markers, providing automated, high-precision enumeration and classification of CTCs

- AI integration enables features such as predicting therapy response, monitoring disease progression, and identifying rare cell populations, while reducing human error and analysis time. For instance, AI-powered imaging software can track CTC dynamics in real-time across multiple patient samples

- The seamless combination of AI analytics with liquid biopsy workflows allows researchers and clinicians to integrate CTC data with genomic and clinical information, supporting precision oncology and more informed treatment decisions

- This trend towards more intelligent, automated, and data-driven CTC platforms is fundamentally reshaping expectations for cancer diagnostics. Consequently, companies such as Menarini Silicon Biosystems and RareCyte are developing AI-enhanced CTC solutions capable of high-throughput analysis and actionable insights

- The demand for CTC platforms with integrated AI and advanced analytics is growing rapidly across both clinical and research sectors, as oncology professionals increasingly prioritize speed, accuracy, and personalized treatment monitoring

- Rising collaboration between CTC technology providers and pharmaceutical companies for therapy development and clinical trials is fostering innovation in drug response monitoring and predictive modeling

- Expansion of cloud-based CTC data platforms is enabling multi-center studies and remote analysis, supporting global research collaboration and more efficient clinical decision-making

Circulating Tumor Cells (CTC) Market Dynamics

Driver

Rising Adoption Due to Increasing Cancer Burden and Precision Oncology

- The growing prevalence of cancer worldwide, coupled with the adoption of precision oncology approaches, is a significant driver for the heightened demand for Circulating Tumor Cells (CTC) technologies

- For instance, in March 2025, Menarini Silicon Biosystems announced enhanced CTC platform capabilities for breast and prostate cancer monitoring, highlighting the industry’s focus on precision diagnostics

- As clinicians and researchers aim for earlier detection and real-time therapy monitoring, CTC platforms offer advanced capabilities such as non-invasive sampling, molecular profiling, and longitudinal patient tracking

- Furthermore, the growing focus on liquid biopsy adoption in hospitals, clinics, and research institutes is making CTC platforms an integral component of personalized cancer management

- The ability to guide targeted therapies, track disease progression, and reduce reliance on invasive tissue biopsies is a key factor propelling CTC adoption in both clinical and research applications

- Increasing investment in oncology research and diagnostics by government agencies and private institutions is accelerating the development and deployment of CTC technologies

- Rising awareness among oncologists and patients about the clinical benefits of CTC monitoring, particularly for early-stage detection and therapy optimization, is driving broader market adoption

Restraint/Challenge

High Cost and Regulatory Compliance Hurdles

- The relatively high cost of advanced CTC detection and analysis platforms, compared to conventional diagnostic methods, poses a significant challenge to broader market adoption

- For instance, expensive immunoaffinity kits and high-throughput imaging systems may limit adoption in emerging markets or smaller diagnostic centers

- Regulatory compliance and validation requirements for clinical use also present hurdles, as CTC technologies must meet stringent standards for accuracy, reproducibility, and safety. For instance, obtaining FDA or CE approval for new devices can involve long and costly processes

- Addressing these challenges through cost optimization, streamlined regulatory approvals, and education of healthcare providers about CTC utility is crucial for accelerating market penetration

- While prices are gradually decreasing with technological advancements, the perceived premium for CTC platforms can still hinder adoption, particularly for budget-conscious institutions

- Overcoming these barriers through innovation, collaborations with clinical labs, and expanding reimbursement frameworks will be vital for sustained growth in the Circulating Tumor Cells (CTC) market

- Limited standardization across CTC detection and analysis methods can lead to variability in results, creating challenges for clinical adoption and multi-center studies

- Data privacy and management concerns related to storing sensitive patient information in cloud-based CTC analysis platforms may slow adoption, particularly in regions with strict healthcare data regulations

Circulating Tumor Cells (CTC) Market Scope

The market is segmented on the basis of technology, product, specimen, application, and end user.

- By Technology

On the basis of technology, the Circulating Tumor Cells (CTC) market is segmented into CTC Detection and Enrichment Methods, CTC Direct Detection Methods, and CTC Analysis. The CTC Detection and Enrichment Methods segment dominated the market with the largest revenue share in 2025, driven by its established capability to isolate rare CTCs from patient samples for downstream analysis. Laboratories and research institutions prioritize these methods for their reproducibility, selectivity, and accuracy in enriching viable tumor cells. Immunoaffinity-based enrichment and microfluidic platforms are widely adopted due to their efficiency and standardization. Growing demand in liquid biopsy applications for early cancer detection and monitoring therapy response further strengthens this segment. The availability of validated kits and automated enrichment systems also facilitates adoption across hospitals and diagnostic centers. In addition, ongoing integration with AI-based analytics enhances the sensitivity and precision of these enrichment techniques.

The CTC Analysis segment is expected to witness the fastest growth from 2026 to 2033, fueled by the increasing adoption of AI and high-throughput imaging platforms. Analysis tools allow detailed characterization of CTCs at genomic, transcriptomic, and morphological levels, providing actionable insights for precision oncology. Rising demand from clinical trials and pharmaceutical research to monitor therapy response accelerates segment growth. Cloud-based platforms and automated analysis systems further enhance the scalability and efficiency of CTC characterization. Increasing collaborations between technology providers and hospitals for real-time monitoring also drive adoption. Regulatory approvals for advanced CTC analysis tools are expected to support clinical integration during the forecast period.

- By Product

On the basis of product, the Circulating Tumor Cells (CTC) market is segmented into kits and reagents, blood collection tubes, and devices or systems. The Kits and Reagents segment dominated the market with the largest market revenue share of 46.9% in 2025, driven by their essential role in both CTC isolation and downstream molecular analysis. Standardized kits minimize procedural variability and provide reproducible results across research and clinical laboratories. They are widely used in liquid biopsy workflows for various cancer types. The segment benefits from pre-validated reagents compliant with regulatory standards, enhancing adoption. Hospitals, diagnostic centers, and academic institutes rely on kits for reliable and rapid processing. The segment’s dominance is further reinforced by continuous innovation in reagent formulations and compatibility with emerging enrichment and analysis platforms.

The Devices or Systems segment is expected to witness the fastest growth from 2026 to 2033, driven by increasing demand for automated, high-throughput platforms capable of integrating CTC isolation and analysis. Devices reduce manual handling, enhance reproducibility, and enable multi-parametric assessment of tumor cells. Rising adoption in hospitals and research labs for real-time disease monitoring supports growth. Technological innovations such as microfluidics, AI-enabled imaging, and cloud integration accelerate market penetration. The convenience of end-to-end systems enhances workflow efficiency in clinical and research applications. Expansion of hospital-integrated and point-of-care CTC systems is expected to sustain rapid growth.

- By Specimen

On the basis of specimen, the Circulating Tumor Cells (CTC) market is segmented into blood, bone marrow, and other body fluids. The Blood segment dominated the market with the largest revenue share in 2025 due to its non-invasive collection and established role in liquid biopsy workflows. Blood samples allow repeated sampling for longitudinal studies, facilitating therapy monitoring. The segment benefits from standardized blood collection tubes and validated enrichment protocols. Hospitals, diagnostic centers, and research institutes rely on blood specimens for metastatic and solid tumor studies. The widespread use in clinical trials and research applications ensures consistent demand. Blood specimens also support multi-center studies due to ease of handling and global acceptance in clinical settings.

The Bone Marrow segment is expected to witness the fastest growth from 2026 to 2033, driven by its importance in hematologic malignancies such as leukemia and lymphoma. Bone marrow specimens enable detection of rare tumor cells not present in peripheral blood. Rising research interest in tumor microenvironment studies and metastatic progression supports segment growth. Technological advancements reduce procedural invasiveness while improving cell recovery. Increasing collaboration between hospitals and research institutes drives adoption. Regulatory approvals for bone marrow-based liquid biopsy methods further enhance clinical use.

- By Application

On the basis of application, the Circulating Tumor Cells (CTC) market is segmented into clinical/liquid biopsy and research. The Clinical/Liquid Biopsy segment dominated the market with the largest revenue share in 2025, driven by growing adoption for early cancer detection, therapy monitoring, and personalized treatment planning. Hospitals and diagnostic centers increasingly use CTC-based liquid biopsy to complement traditional tissue biopsies. The non-invasive nature reduces patient discomfort and enables repeated sampling. Rising demand in oncology for real-time therapy response monitoring strengthens the segment. The availability of validated clinical kits and integrated workflows facilitates adoption. Regulatory approvals for liquid biopsy applications further boost confidence among clinicians.

The Research segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing focus on cancer biology, metastasis studies, and drug development. Academic institutions and pharmaceutical companies are adopting CTC platforms for preclinical research and clinical trial support. Integration of AI and high-throughput platforms accelerates discovery and characterization of rare tumor cells. The growing importance of personalized medicine enhances research demand. Expansion of multi-center and collaborative studies globally supports adoption. Technological advancements enabling efficient and reproducible research workflows further drive segment growth.

- By End User

On the basis of end user, the Circulating Tumor Cells (CTC) market is segmented into hospitals, clinics, research and academic institutes, diagnostic centers, and others. The Hospitals segment dominated the market with the largest revenue share in 2025, driven by the increasing integration of CTC-based diagnostics in oncology departments. Hospitals utilize CTC technologies for patient monitoring, early detection, and therapy response evaluation. Availability of validated systems and kits facilitates routine adoption in clinical workflows. Rising collaborations with diagnostic laboratories and pharmaceutical companies support segment growth. Hospitals benefit from non-invasive, rapid, and reliable testing solutions. Increasing demand for precision oncology services enhances market penetration.

The Research and Academic Institutes segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising interest in studying metastasis, tumor heterogeneity, and biomarker discovery. Academic and pharmaceutical research institutes are increasingly adopting CTC platforms for experimental studies and clinical trial support. Advanced analysis tools and AI integration enhance research capabilities and reproducibility. Growing funding for cancer research and collaborations with hospitals accelerate adoption. The ability to perform multi-parametric and longitudinal studies makes CTC platforms critical in research. Expansion of global research networks and multi-center studies supports segment growth.

Circulating Tumor Cells (CTC) Market Regional Analysis

- North America dominated the Circulating Tumor Cells (CTC) market with the largest revenue share of 43.2% in 2025, characterized by advanced healthcare infrastructure, high R&D investments, and a strong presence of key market players

- Hospitals, diagnostic centers, and research institutes in the region increasingly rely on CTC technologies for early cancer detection, real-time therapy monitoring, and personalized treatment planning

- This widespread adoption is further supported by regulatory approvals, availability of validated CTC platforms, and collaborations between technology providers, pharmaceutical companies, and clinical institutions, establishing CTC solutions as a preferred tool for cancer diagnostics and monitoring

U.S. Circulating Tumor Cells (CTC) Market Insight

The U.S. Circulating Tumor Cells (CTC) market captured the largest revenue share of 79% in 2025 within North America, fueled by the early adoption of precision oncology and liquid biopsy technologies. Hospitals, diagnostic centers, and research institutes are increasingly prioritizing non-invasive cancer detection and real-time therapy monitoring. Rising collaborations between technology providers and pharmaceutical companies for clinical trials and therapy optimization further propel the market. Moreover, the presence of advanced healthcare infrastructure and strong R&D investments enhances the deployment of CTC platforms. The integration of AI and high-throughput analysis systems is also contributing significantly to the market’s expansion. In addition, awareness among oncologists and patients regarding the clinical benefits of CTC-based diagnostics supports sustained growth.

Europe Circulating Tumor Cells (CTC) Market Insight

The Europe Circulating Tumor Cells (CTC) market is projected to expand at a substantial CAGR throughout the forecast period, driven by increasing investments in oncology research and rising adoption of liquid biopsy for early cancer detection. Regulatory support and standardized protocols for clinical applications encourage hospitals and diagnostic centers to adopt CTC technologies. Urbanization and improved healthcare access are facilitating market growth, alongside demand for non-invasive, personalized diagnostic tools. European research institutions are increasingly integrating CTC platforms into multi-center studies and clinical trials. Hospitals and diagnostic centers in the region also focus on improving therapy monitoring and disease progression tracking, contributing to adoption. Technological innovation, including AI-based analysis, further strengthens the market potential across Europe.

U.K. Circulating Tumor Cells (CTC) Market Insight

The U.K. Circulating Tumor Cells (CTC) market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising precision oncology adoption and increasing investments in cancer research. Healthcare providers are leveraging CTC platforms for early detection and monitoring of treatment response. Concerns regarding cancer incidence and therapy optimization are encouraging both public and private hospitals to integrate non-invasive diagnostics. The country’s advanced healthcare infrastructure and robust clinical trial network support market expansion. Rising awareness of liquid biopsy advantages among oncologists and patients is also fueling adoption. Moreover, collaborations between technology providers and research institutes strengthen the market growth trajectory.

Germany Circulating Tumor Cells (CTC) Market Insight

The Germany Circulating Tumor Cells (CTC) market is expected to expand at a considerable CAGR during the forecast period, fueled by advanced healthcare systems, technological innovation, and increasing investments in oncology diagnostics. Hospitals and diagnostic centers emphasize non-invasive cancer detection and real-time monitoring of therapy effectiveness. Research institutes actively integrate CTC platforms into clinical trials for biomarker discovery and personalized treatment strategies. Rising regulatory support and availability of validated CTC systems promote clinical adoption. The integration of AI and automated analysis tools enhances workflow efficiency and accuracy. Moreover, increasing awareness of precision oncology and early cancer detection drives widespread utilization of CTC technologies.

Asia-Pacific Circulating Tumor Cells (CTC) Market Insight

The Asia-Pacific Circulating Tumor Cells (CTC) market is poised to grow at the fastest CAGR of 23% during the forecast period of 2026 to 2033, driven by increasing cancer incidence, rising healthcare investments, and growing adoption of precision medicine in countries such as China, Japan, and India. Urbanization and increasing disposable incomes are expanding access to advanced diagnostics. Government initiatives promoting digital health and oncology research are supporting adoption. The affordability and accessibility of CTC platforms are improving due to local manufacturing and technological advancements. Hospitals, clinics, and research institutes are increasingly deploying CTC solutions for therapy monitoring and early detection. Moreover, collaborations between global technology providers and local institutions are accelerating market penetration.

Japan Circulating Tumor Cells (CTC) Market Insight

The Japan Circulating Tumor Cells (CTC) market is gaining momentum due to the country’s high-tech healthcare environment, increasing cancer prevalence, and emphasis on precision medicine. Hospitals and diagnostic centers adopt CTC technologies for early detection and therapy monitoring in both clinical and research settings. Integration with AI-driven platforms and automated analysis systems is enhancing diagnostic accuracy. Japan’s aging population further drives the demand for non-invasive, easy-to-use cancer monitoring solutions. Government support for advanced diagnostics and strong clinical research infrastructure facilitate adoption. In addition, collaborations with pharmaceutical companies for therapy development strengthen market growth in Japan.

India Circulating Tumor Cells (CTC) Market Insight

The India Circulating Tumor Cells (CTC) market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rising cancer awareness, increasing healthcare infrastructure, and rapid adoption of innovative diagnostics. Hospitals, diagnostic centers, and research institutes are increasingly implementing CTC platforms for early detection and therapy monitoring. Government initiatives promoting oncology research and digital health are driving adoption. The availability of affordable CTC solutions and collaborations with global technology providers further propel the market. Rising urbanization and a growing middle class expand access to advanced diagnostics. Moreover, increasing participation in clinical trials and research studies enhances market penetration across India.

Circulating Tumor Cells (CTC) Market Share

The Circulating Tumor Cells (CTC) industry is primarily led by well-established companies, including:

- Menarini Silicon Biosystems S.p.A. (Italy)

- Bio-Rad Laboratories, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Epic Sciences, Inc. (U.S.)

- Rarecells Diagnostics SAS (France)

- Greiner Bio‑One International GmbH (Germany)

- Miltenyi Biotec GmbH (Germany)

- Bio‑Techne Corporation (U.S.)

- BIOCEPT, Inc. (U.S.)

- Fluxion Biosciences, Inc. (U.S.)

- ApoCell, Inc. (U.S.)

- Ikonisys, Inc. (U.S.)

- Canopus Bioscience Ltd. (U.K.)

- BioFluidica, Inc. (U.S.)

- ScreenCell SAS (France)

- Sysmex Corporation (Japan)

- STEMCELL Technologies, Inc. (Canada)

- Precision for Medicine, LLC (U.S.)

- Advanced Cell Diagnostics, Inc. (U.S.)

- Clearbridge BioMedics Pte Ltd. (Singapore)

What are the Recent Developments in Global Circulating Tumor Cells (CTC) Market?

- In September 2025, Rarecells announced new clinical data from its BioMolCTC Trial showing that combining its next‑generation ISET® CTC‑DNA assay with traditional ctDNA analysis significantly increases sensitivity and better captures tumor heterogeneity in early‑stage lung cancer patients

- In April 2025, a major investigation of the CTC market pointed out that “investments in precision medicine & CTC research skyrocket”, underlining a period of heightened interest in CTC‑based diagnostics as oncology moves toward more personalized, non‑invasive monitoring

- In October 2024, a pilot study published in BMC Cancer demonstrated the use of a novel Rare Cell Sorter (RCS) device to isolate CTCs from blood of lung cancer patients; in that study, CTCs captured by RCS showed high concordance (≈ 96%) of EGFR mutation status compared with tissue biopsies highlighting the feasibility of non‑EpCAM‑dependent, size‑based CTC isolation for clinical mutation profiling

- In June 2024, Bio-Rad Laboratories launched Celselect Slides 2.0 an upgraded rare‑cell enrichment platform for CTC capture, compatible with its Genesis Cell Isolation System. The new slides allow processing up to 2.5× more sample volume and greatly increase microchamber count significantly improving CTC recovery efficiency from liquid biopsy samples

- In March 2024, Bio‑Rad also launched a set of validated antibodies for rare cell and CTC enumeration, enabling more specific and sensitive immunostaining of captured CTCs — thereby improving downstream analysis reliability and facilitating better identification of heterogeneous tumor-cell populations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.