Global Citric Acid Market

Market Size in USD Billion

CAGR :

%

USD

7.07 Billion

USD

11.20 Billion

2024

2032

USD

7.07 Billion

USD

11.20 Billion

2024

2032

| 2025 –2032 | |

| USD 7.07 Billion | |

| USD 11.20 Billion | |

|

|

|

|

Citric Acid Market Size

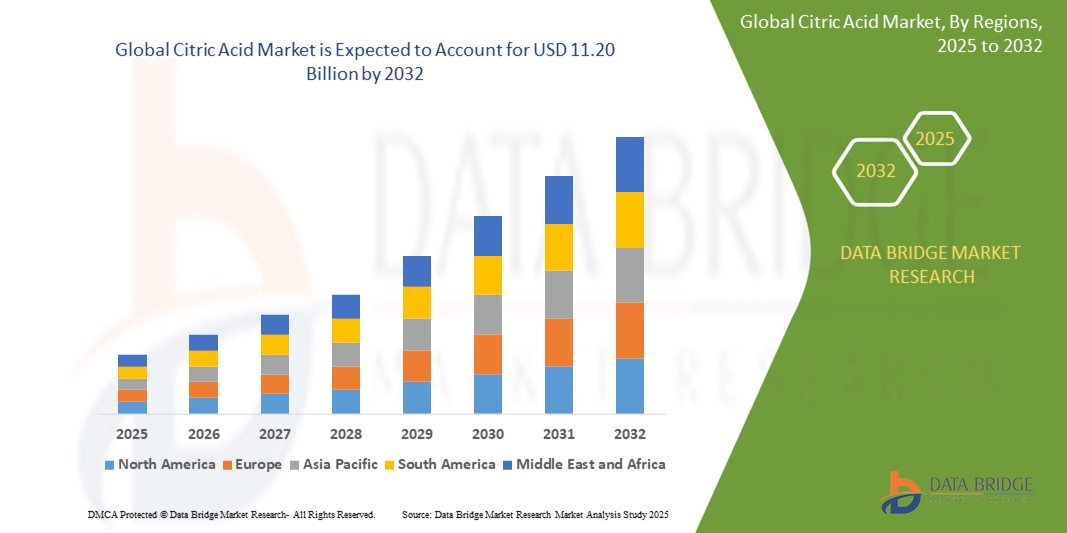

- The global citric acid market size was valued at USD 7.07 billion in 2024 and is expected to reach USD 11.20 billion by 2032, at a CAGR of 5.92% during the forecast period

- The market growth is primarily driven by the rising demand for citric acid in food & beverages, pharmaceuticals, and cleaning products due to its preservative, flavoring, and chelating properties

- In addition, increasing consumer preference for natural and organic food additives and the expansion of the processed food industry are boosting the demand for citric acid, thereby propelling market expansion global

Citric Acid Market Analysis

- Citric acid, a weak organic acid naturally found in citrus fruits, is a crucial additive across food & beverages, pharmaceuticals, and cleaning products due to its preservative, flavoring, and chelating properties, making it a vital component in various industrial and consumer applications

- The increasing demand for processed and convenience foods, coupled with consumer inclination toward natural and plant-based additives, is significantly driving the demand for citric acid globally

- North America is expected to dominate the citric acid market with a market share of 34.2% in 2024, due to increasing demand across various industries. The region’s continuous use of citric acid in food, beverages, pharmaceuticals, and cleaning products drives its sustained growth

- Asia-Pacific is expected to show significant growth in the citric acid market with a market share of 28.7% in 2024, driven by increasing use in diverse food and cosmetic formulations, expanding food processing sectors, and rising consumer demand for organic personal care products

- The food & beverage segment is expected to dominate the citric acid market with a market share of 55.8% in 2024, driven by its widespread use as an acidulant, preservative, and flavor enhancer in soft drinks, candies, and ready-to-eat meals

Report Scope and Citric Acid Market Segmentation

|

Attributes |

Citric Acid Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Citric Acid Market Trends

“Rising Demand for Eco-Friendly and Bio-Based Citric Acid Production”

- A prominent and accelerating trend in the global citric acid market is the increasing focus on eco-friendly and sustainable production methods, particularly bio-based citric acid derived from renewable resources such as sugarcane, corn, and molasses. This shift is driven by growing environmental awareness and stringent regulations on chemical manufacturing

- For instance, companies such as CJ CheilJedang and Fujian Jinqianli Bio-Technology are investing heavily in fermentation-based production technologies that utilize natural raw materials, minimizing carbon footprint and reducing reliance on petrochemical sources

- Bio-based citric acid not only appeals to environmentally conscious consumers but also offers improved biodegradability and safety in applications across food and beverages, pharmaceuticals, and cosmetics. This trend is particularly visible in the clean-label movement, where consumers seek naturally derived ingredients

- Furthermore, innovations in fermentation process optimization, such as genetically engineered strains of Aspergillus niger, are enhancing production efficiency and lowering costs, making bio-based citric acid increasingly competitive with its synthetic counterpart

- The growing use of citric acid as a natural preservative and pH adjuster in organic and natural products is also fueling market demand. Companies like Tate & Lyle have launched product lines specifically targeting clean-label formulations

- This trend toward sustainable and bio-based citric acid production is reshaping manufacturer strategies, with many expanding their green product portfolios to meet rising consumer demand and regulatory expectations globally

- Consequently, the global citric acid market is witnessing rapid growth in segments emphasizing sustainability, driven by heightened consumer preference for natural ingredients and regulatory pushes for greener manufacturing processes

Citric Acid Market Dynamics

Driver

“Increasing Demand from Food & Beverage and Pharmaceutical Industries”

- The rising demand for citric acid as a natural preservative, flavor enhancer, and acidulant in the food and beverage industry is a key driver fueling the global citric acid market growth. Its multifunctional use in beverages, canned foods, and confectionery products supports enhanced shelf life and taste

- For instance, in March 2024, Tate & Lyle announced the expansion of its citric acid production capacity to meet growing demand from the beverage sector, especially in clean-label and natural product formulations. Such strategic investments by major producers are expected to stimulate market growth during the forecast period

- In addition, the pharmaceutical sector's increased use of citric acid as an excipient in effervescent tablets, syrups, and anticoagulants contributes significantly to market expansion. The compound’s role in improving product stability and bioavailability is increasingly recognized

- The surge in health-conscious consumers opting for natural and organic food and medicines is further propelling the adoption of citric acid. It aligns well with trends towards clean-label products in both food and pharmaceutical manufacturing

- Moreover, the growing preference for citric acid in cosmetic formulations as a pH adjuster and antioxidant adds to its market demand, especially in personal care products emphasizing natural ingredients

- This broad-based demand across multiple end-use industries combined with ongoing product innovations and capacity expansions is driving the sustained growth of the global citric acid market

Restraint/Challenge

“Fluctuating Raw Material Prices and Environmental Concerns in Production”

- The global citric acid market faces challenges due to the volatility in prices and availability of key raw materials such as corn, sugarcane, and molasses, which are crucial for bio-based citric acid production. Fluctuations in agricultural commodity prices can directly impact production costs and profit margins for manufacturers

- For instance, in late 2023, several producers reported increased production costs due to rising corn prices in major growing regions like the U.S. and Brazil, causing some supply constraints and pricing pressure in the market

- In addition, environmental concerns related to the fermentation process, including high water usage and waste generation, pose regulatory and operational challenges. Some regions are imposing stricter effluent discharge regulations, which increase compliance costs for manufacturers

- Moreover, dependence on agricultural feedstocks makes the market vulnerable to adverse weather conditions, crop failures, and geopolitical trade tensions, which can disrupt supply chains

- While efforts are underway to improve fermentation efficiency and develop waste treatment technologies, these challenges limit rapid scaling and may restrain market growth in cost-sensitive regions

- To overcome these challenges, companies are investing in research for alternative feedstocks, waste valorization, and process optimization to reduce environmental impact and stabilize supply costs

Citric Acid Market Scope

The global citric acid market is segmented on the basis of form, application, function, and grade.

By Form

On the basis of form, the citric acid market is segmented into anhydrous and liquid forms. The anhydrous segment dominates the market revenue share in 2025, driven by its superior stability, longer shelf life, and ease of transport. It is widely preferred across food and pharmaceutical industries due to its concentrated nature and convenience in powder form.

The liquid segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand in beverage manufacturing and cosmetic applications. The liquid form facilitates easy blending and uniform dispersion, making it attractive for manufacturers focusing on formulation efficiency.

By Application

On the basis of application, the citric acid market is segmented into food, pharmaceutical and cosmetics, reagent, and others. The food segment accounted for the largest market revenue share in 2024, driven by its extensive use as an acidulant, preservative, and flavor enhancer in processed foods and beverages worldwide.

The pharmaceutical and cosmetics segment is expected to witness the fastest CAGR from 2025 to 2032, owing to rising demand for natural ingredients in skincare products and increased usage in drug formulations as an acidulant and antioxidant.

By Function

On the basis of function, the citric acid market is segmented into acidulant, antioxidant, preservative, and sequestrant. The acidulant segment held the largest market revenue share in 2025, as citric acid is primarily used to control acidity and improve flavor profiles in food and beverages.

The preservative and sequestrant functions are anticipated to grow steadily, driven by the need to enhance product shelf life and maintain stability by chelating metal ions in diverse applications such as food preservation and cosmetics.

By Grade

On the basis of grade, the citric acid market is segmented into food grade, beverages grade, pharmaceuticals & nutraceuticals grade, personal care grade, and others. The food grade segment dominated the market revenue share in 2024, supported by the growth in processed foods and beverages consumption globally.

The pharmaceuticals & nutraceuticals grade segment is expected to register significant growth over the forecast period, driven by rising health awareness and demand for dietary supplements and pharmaceutical products with natural ingredients.

By End User

On the basis of end user, the citric acid market is segmented into food & beverages manufacturers, pharmaceutical companies, personal care & cosmetics manufacturers, chemical industry, and others. The food & beverages manufacturers segment holds the largest market revenue share in 2025, fueled by the increasing demand for convenience foods and flavored beverages.

The personal care & cosmetics segment is projected to grow rapidly, driven by increased consumer preference for natural and eco-friendly cosmetic products incorporating citric acid as a pH adjuster and preservative.

By Distribution Channel

On the basis of distribution channel, the citric acid market is segmented into direct sales and indirect sales. The direct sales channel dominates due to strong supplier relationships with large-scale manufacturers ensuring bulk supply and consistent quality.

The indirect sales channel is expected to witness significant growth, supported by the rise of e-commerce platforms and increasing accessibility for small and medium-sized enterprises to source citric acid conveniently.

Citric Acid Market Regional Analysis

- North America is expected to dominate the citric acid market with a market share of 34.2% in 2024, fueled by strong demand from the food and beverage, pharmaceutical, and personal care industries

- The growing consumer preference for natural ingredients and clean-label products in the region is significantly boosting citric acid consumption

- The presence of major manufacturers and advanced production facilities in North America further supports the region’s market growth

U.S. Citric Acid Market Insight

The U.S. citric acid market accounted for the largest revenue share of approximately 38% within North America in 2024, driven by strong demand from the food & beverage, pharmaceutical, and personal care sectors. Consumers increasingly favor natural preservatives and clean-label ingredients, fueling citric acid usage in processed foods, beverages, and cosmetics. The rising trend of health-consciousness and demand for organic products further supports market growth. In addition, continuous innovations by key manufacturers and expansions in production capacity contribute significantly to the market’s expansion.

Europe Citric Acid Market Insight

The European citric acid market is expected to grow steadily at a notable CAGR during the forecast period, driven by increasing demand from the food, pharmaceutical, and personal care industries. Strict regulations on food safety and clean-label products are encouraging the use of natural preservatives like citric acid. Urbanization and rising consumer awareness about natural and sustainable ingredients are further boosting market adoption. The market growth is also supported by expanding applications in cosmetics and pharmaceuticals, as well as new product developments by key regional manufacturers.

U.K. Citric Acid Market Insight

The U.K. citric acid market is projected to grow at a significant CAGR during the forecast period, driven by increasing demand from the food and beverage, pharmaceutical, and personal care sectors. Rising consumer preference for natural and clean-label ingredients is encouraging manufacturers to incorporate citric acid into a wide range of products. In addition stringent food safety regulations and growing awareness about health and wellness further support market expansion. The country’s well-developed manufacturing base and strong supply chain infrastructure also contribute to steady market growth.

Germany Citric Acid Market Insight

The German citric acid market is projected to witness robust growth at a considerable CAGR over the forecast period, driven by increasing demand from the food, pharmaceutical, and personal care industries. Growing consumer awareness about natural ingredients and sustainable products is pushing manufacturers to prioritize citric acid in their formulations. Germany’s strong focus on innovation, quality standards, and environmental sustainability supports the development of advanced citric acid applications. In addition, stringent regulatory frameworks around food safety and cosmetics further drive the adoption of citric acid in various sectors.

Asia-Pacific Citric Acid Market Insight

The Asia-Pacific citric acid market is expected to grow at the fastest CAGR during the forecast period, driven by rapid urbanization, rising disposable incomes, and expanding industrialization in key countries such as China, India, and Japan. Increasing demand from the food and beverage, pharmaceutical, and personal care industries, combined with a growing preference for natural and clean-label products, is boosting citric acid consumption across the region. Government initiatives promoting food safety and quality standards further support market growth. In addition, the region’s emergence as a manufacturing hub for citric acid production enhances product availability and affordability, contributing to market expansion.

Japan Smart Citric Acid Insight

The Japan citric acid market is experiencing steady growth, driven by the country’s advanced food processing industry and strong pharmaceutical sector. Increasing consumer preference for natural preservatives and clean-label ingredients is boosting demand for citric acid in food, beverage, and personal care products. Japan’s aging population is also fueling demand in the pharmaceutical and nutraceutical segments, where citric acid is widely used as an excipient and pH regulator. In addition, the integration of sustainable and eco-friendly practices in manufacturing supports the adoption of citric acid across various applications.

China Citric Acid Market Insight

China holds the largest market revenue share in the Asia-Pacific citric acid market, driven by rapid urbanization, an expanding middle class, and increasing demand from the food and beverage, pharmaceutical, and personal care industries. The country’s large-scale production capabilities and investments in advanced manufacturing technologies help meet the growing domestic and export demand for citric acid. Government initiatives supporting clean-label food production and quality standards further boost consumption. In addition, China’s role as a global manufacturing hub ensures the availability of cost-effective citric acid products, fueling market growth.

Citric Acid Market Share

The citric acid industry is primarily led by well-established companies, including:

- ADM (U.S.)

- Cargill, Incorporated (U.S.)

- Tate & Lyle (U.K.)

- Jungbunzlauer Suisse AG (Switzerland)

- Kenko Corporation (Japan)

- Pfizer, Inc. (U.S.)

- Huangshi Xinghua Biochemical Co. Ltd (China)

- Foodchem International Corporation (China)

- RZBC Group (China)

- Weifang Ensign Industry Co., Ltd. (China)

- Danisco A/S (Denmark)

- Gadot Biochemical Industries Ltd. (Israel)

- S.A. Citrique Belge N.V. (Belgium)

- BASF SE (Germany)

- Associated British Foods plc (U.K.)

- DSM (Netherlands)

- Chemelco International (Netherlands)

Latest Developments in Global Citric Acid Market

- In March 2024, Jungbunzlauer acquired Alliance Gums & Industries (AGI), a French-based expert in texturizing solutions, previously owned by Roquette Ventures. AGI will continue operating as an independent subsidiary within the Jungbunzlauer Group, preserving its brand identity and specialized expertise. The acquisition reinforces Jungbunzlauer’s commitment to expanding its texturants business, complementing its recent investment in a new Biogums plant in Canada. Customers can expect uninterrupted service and continued innovation in hydrocolloid-based solutions

- In March 2023, Noble Biomaterials introduced Ionic+ Botanical, a bio-based citric acid formula designed to inhibit microbial growth and reduce fabric odors. This innovative technology received EPA registration, allowing manufacturers to claim antimicrobial benefits for treated textiles. The formula integrates plant-based solutions into performance fabrics, enhancing sustainability while maintaining durability. Noble Biomaterials developed Ionic+ Botanical in response to growing demand for eco-friendly antimicrobial treatments, with products expected to launch in 2024

- In November 2022, Gadot Biochemical Industries introduced Cal2Mg, an innovative calcium-magnesium citrate blend designed to meet growing consumer demand for nutritious food ingredients. This formulation enhances texture and usability through a binder-based granulation method, improving handling and cooking processes. Cal2Mg supports bone health and mineral absorption, offering a highly bioavailable alternative to traditional calcium sources. The launch aligns with industry trends favoring functional food components that promote wellness and sustainability

- In June 2022, Jungbunzlauer launched monomagnesium citrate, a monobasic magnesium salt with a 1:1 molar ratio, designed for functional foods, beverages, and dietary supplements. This innovative ingredient features high solubility and a pleasant sour taste, making it ideal for mineral-fortified beverage powders. As a partly neutralized salt, it serves as both a mild acidifier and a magnesium source, supporting cleaner labeling and shorter ingredient lists. The introduction of monomagnesium citrate aligns with the growing demand for health-oriented food components and nutritional fortification

- In January 2022, Gadot Biochemical Industries introduced Cal2Mag, a calcium-magnesium citrate blend designed to support long-term bone health. This formulation combines scientifically validated ratios of calcium citrate and magnesium citrate, ensuring optimal absorption and effectiveness. Cal2Mag addresses the growing demand for nutritional supplements that promote bone strength while preventing arterial calcification. Gadot’s commitment to high-quality, bioavailable ingredients is reflected in this innovative product, which enhances mineral intake without compromising taste or usability

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Citric Acid Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Citric Acid Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Citric Acid Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.