Global Class Vi Compliant Polymer Compounding Services Market

Market Size in USD Million

CAGR :

%

USD

140.00 Million

USD

389.10 Million

2024

2032

USD

140.00 Million

USD

389.10 Million

2024

2032

| 2025 –2032 | |

| USD 140.00 Million | |

| USD 389.10 Million | |

|

|

|

|

Class VI Compliant Polymer Compounding Services Market Size

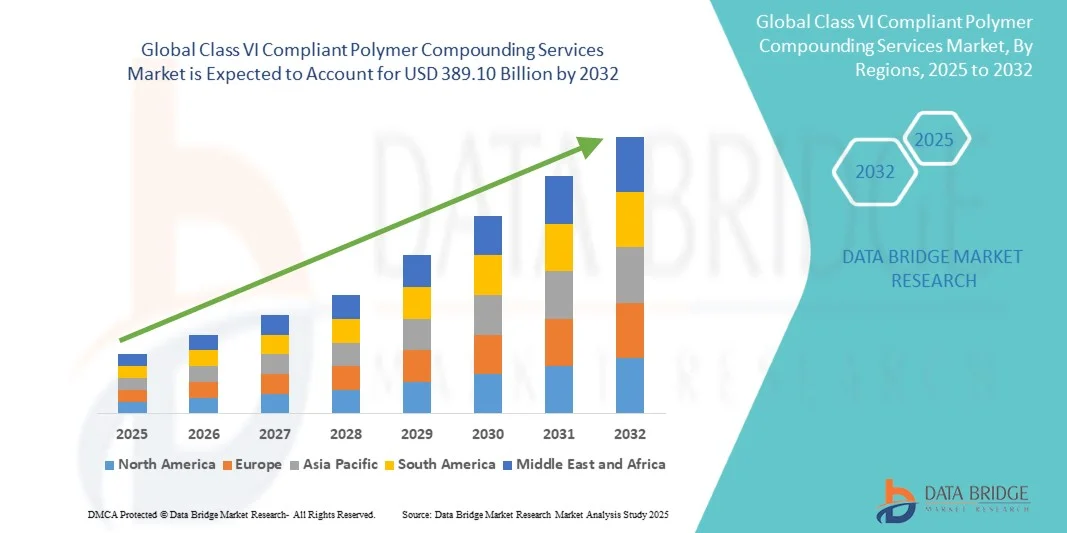

- The global Class VI compliant polymer compounding services market size was valued at USD 140.00 million in 2024 and is expected to reach USD 389.10 million by 2032, at a CAGR of 13.63% during the forecast period

- The market growth is largely fueled by the increasing use of biocompatible polymers in medical devices, implants, and pharmaceutical packaging, with stringent regulatory frameworks such as USP Class VI and ISO 10993 driving demand for specialized compounding services

- Furthermore, rising demand for customized, safe, and high-performance medical-grade materials that meet compliance requirements is positioning Class VI compliant compounding as a critical enabler in the healthcare and life sciences industries. These converging factors are accelerating the uptake of compliant polymer compounding services, thereby significantly boosting the industry's growth

Class VI Compliant Polymer Compounding Services Market Analysis

- Class VI compliant polymer compounding services, providing medical-grade, biocompatible polymer solutions for implants, medical devices, and pharmaceutical packaging, are increasingly vital in healthcare and life sciences due to their regulatory compliance, high safety standards, and ability to support customized material formulations

- The escalating demand for these services is primarily fueled by the growing production of medical devices, strict USP Class VI and ISO 10993 regulatory requirements, and the rising need for high-performance, safe, and reliable polymer materials in critical healthcare applications

- North America dominated the global Class VI compliant polymer compounding services market with the largest revenue share of 39.3% in 2024, characterized by advanced medical device manufacturing, strong regulatory frameworks, and a robust presence of key compounding service providers, with the U.S. experiencing substantial growth in the adoption of Class VI compliant polymers for both implantable and disposable devices

- Asia-Pacific is expected to be the fastest-growing region in the global Class VI compliant polymer compounding services market during the forecast period due to expanding medical device manufacturing, increasing healthcare investments, and growing awareness of material biocompatibility standards

- Thermoplastics segment dominated the Class VI compliant polymer compounding services market with a market share of 45.5% in 2024, driven by their established biocompatibility, versatility in medical applications, and widespread acceptance for both R&D and commercial-scale production

Report Scope and Class VI Compliant Polymer Compounding Services Market Segmentation

|

Attributes |

Class VI Compliant Polymer Compounding Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Class VI Compliant Polymer Compounding Services Market Trends

“Rising Adoption of Customized Biocompatible Polymers”

- A significant and accelerating trend in the global Class VI compliant polymer compounding services market is the growing demand for customized, application-specific medical-grade polymers for implants, disposables, and diagnostic devices, enhancing safety and performance

- For instance, companies are offering tailored formulations of silicones and thermoplastics with specific mechanical and chemical properties to meet regulatory and clinical requirements

- Advanced compounding techniques enable polymers to achieve properties such as antimicrobial, lubricious, or radiopaque functionality, improving device efficacy and patient safety

- Integration of biocompatible polymers with emerging medical technologies, such as wearable devices and drug delivery systems, is enabling more versatile and efficient healthcare solutions

- This trend towards more specialized, performance-driven polymer solutions is reshaping expectations in the medical device and pharmaceutical industries

- The demand for high-quality, USP Class VI and ISO 10993 compliant polymer compounding services is growing rapidly across medical and pharmaceutical sectors, as manufacturers prioritize safety, performance, and regulatory compliance

Class VI Compliant Polymer Compounding Services Market Dynamics

Driver

“Increasing Need Due to Regulatory Compliance and Medical Device Growth”

- The growing production of medical devices and stricter regulatory requirements, including USP Class VI and ISO 10993 compliance, is a significant driver for the heightened demand for Class VI compliant polymer compounding services

- For instance, rising approvals of implantable and disposable medical devices have intensified the need for polymers that meet strict biocompatibility standards

- Manufacturers increasingly require polymers that are fully tested and certified for Class VI compliance to ensure safety and efficacy in critical healthcare applications

- Expanding applications in drug delivery, surgical instruments, and diagnostic equipment are making Class VI compliant polymers essential components in modern medical products

- The convenience of using pre-compounded, tested polymers reduces development timelines and regulatory risks, further propelling adoption across the healthcare and pharmaceutical sectors

- Increasing awareness among OEMs and contract manufacturers about regulatory compliance and patient safety is driving sustained growth in Class VI compliant polymer compounding services

Restraint/Challenge

“High Production Costs and Stringent Regulatory Hurdles”

- The high cost of producing USP Class VI compliant polymers and maintaining rigorous testing protocols poses a significant challenge to broader market penetration

- For instance, extensive biocompatibility testing and process validation requirements increase operational costs for compounding service providers, limiting scalability for smaller players

- Adhering to evolving regulatory standards across multiple regions can be complex and resource-intensive, creating barriers for new entrants

- Maintaining consistency in polymer quality, sterilization compatibility, and documentation is critical but challenging, especially for custom formulations

- While advanced manufacturing techniques exist, the perceived premium of Class VI compliant polymers can hinder adoption for cost-sensitive medical device manufacturers

- Overcoming these challenges through process optimization, regulatory support, and cost-effective manufacturing solutions will be vital for sustained market growth

Class VI Compliant Polymer Compounding Services Market Scope

The market is segmented on the basis of service type, material class, functionality, and end use.

- By Service Type

On the basis of service type, the Class VI compliant polymer compounding services market is segmented into bespoke compounding, contract compounding, additive blending, and testing & validation support. Bespoke Compounding segment dominated the market in 2024 with the largest revenue share, driven by the increasing need for custom polymer formulations that meet strict USP Class VI and ISO 10993 compliance. Manufacturers of medical devices and implants prioritize bespoke solutions to ensure compatibility with specific applications such as drug delivery devices and implantables. This segment benefits from the ability to tailor mechanical, chemical, and sterilization properties according to client specifications. The demand is further supported by regulatory requirements, which necessitate rigorous testing and documentation for new medical device designs. In addition, bespoke compounding services help reduce product development timelines and minimize regulatory risks, making them the preferred choice for OEMs. As a result, bespoke compounding is widely adopted across both large and small medical device manufacturers, reinforcing its dominance.

Contract Compounding is anticipated to witness the fastest growth rate from 2025 to 2032 due to rising outsourcing of polymer compounding by medical device OEMs seeking cost-effective and compliant manufacturing. Contract services allow smaller manufacturers to access high-quality Class VI compliant materials without investing in in-house facilities. The segment also benefits from increasing demand for scalable production and rapid turnaround times. Innovations in contract compounding, such as integration with advanced extrusion and additive blending techniques, further drive adoption. Growing awareness among OEMs of regulatory complexities and process validation requirements boosts reliance on specialized contract providers. This trend is particularly strong in emerging markets, where local OEMs increasingly partner with contract compounders to meet regulatory standards efficiently.

- By Material Class

On the basis of material class, the Class VI compliant polymer compounding services market is segmented into medical elastomers & silicones, thermoplastics, cyclic olefin copolymers (COC) & specialty resins, and resorbable polymers. Thermoplastics segment dominated the market in 2024 with a market share of 45.5%, owing to their versatility, high mechanical strength, and broad acceptance in both implantable and disposable medical devices. Thermoplastics such as PEEK, PC, and PEI are preferred for components requiring sterilization compatibility and long-term biocompatibility. Their ability to be easily processed into custom shapes and compounded with functional additives increases their demand. Regulatory compliance with USP Class VI standards is well-established for these polymers, providing confidence to medical device manufacturers. In addition, thermoplastics are compatible with various sterilization methods, making them ideal for devices that undergo gamma, EO, or autoclave sterilization. Their dominance is reinforced by widespread adoption in cardiovascular, orthopedic, and diagnostic device applications.

Medical Elastomers & Silicones are expected to witness the fastest growth from 2025 to 2032 due to their superior flexibility, biocompatibility, and application in catheters, tubing, and implantable devices. The segment benefits from growing demand for soft-touch and patient-friendly materials in disposable and long-term implantable devices. Increasing adoption of silicone-based polymers in wearable medical devices and drug delivery systems further drives growth. Innovations in elastomer compounding, including antimicrobial and lubricious formulations, enhance their market potential. The segment is also expanding due to strong acceptance in regulatory submissions, ensuring reliable USP Class VI certification. Emerging healthcare markets are increasingly adopting elastomer-based components, contributing to the rapid growth of this material class.

- By Functionality

On the basis of functionality, the Class VI compliant polymer compounding services market is segmented into anti-thrombogenic additives, radiopaque fillers, lubricious modifiers, flame-retardant systems, and medical-grade colorants. Radiopaque Fillers segment dominated the market in 2024 as they are critical for ensuring visibility of medical devices under imaging techniques such as X-ray and fluoroscopy. These fillers are widely used in catheters, stents, and implantable devices to enhance patient safety and procedural accuracy. Manufacturers prioritize radiopaque formulations to meet regulatory and clinical requirements. The compatibility of these fillers with USP Class VI compliant polymers ensures that devices remain biocompatible and safe for implantation. Radiopaque compounds also reduce the need for additional imaging markers, simplifying device design. The segment’s dominance is driven by the integration of radiopaque fillers across a wide range of cardiovascular and diagnostic applications.

Anti-thrombogenic Additives are anticipated to witness the fastest growth rate from 2025 to 2032 due to increasing demand for blood-contacting medical devices such as catheters, stents, and extracorporeal devices. These additives reduce the risk of thrombosis, improving patient outcomes and device safety. The segment is bolstered by the rising prevalence of cardiovascular diseases and the regulatory emphasis on patient safety for implantable devices. Advanced polymer compounding techniques allow precise integration of anti-thrombogenic agents while maintaining USP Class VI compliance. Manufacturers are also innovating to combine multiple functionalities, such as lubricity and antimicrobial properties, in a single formulation, further driving growth. The growing use of minimally invasive devices in both developed and emerging markets contributes to the rapid adoption of this functionality.

- By End Use

On the basis of end use, the Class VI compliant polymer compounding services market is segmented into implantables, surgical instruments, disposable medical devices, diagnostics & labware, and pharmaceutical packaging. Implantables segment dominated the market in 2024, driven by stringent regulatory requirements for long-term biocompatibility and safety. Devices such as orthopedic implants, cardiovascular stents, and dental implants require Class VI compliant polymers to minimize adverse reactions. OEMs prefer high-performance polymer compounds that can withstand sterilization processes and maintain mechanical integrity over prolonged implantation periods. The segment’s dominance is also supported by increasing global demand for advanced implantable medical devices and innovations in personalized medicine. Regulatory approvals and documented USP Class VI compliance are critical factors contributing to the widespread adoption of these materials in implantable applications.

Disposable Medical Devices are expected to witness the fastest growth rate from 2025 to 2032 due to rising global demand for cost-effective, single-use devices such as catheters, syringes, IV components, and tubing. These devices require biocompatible, safe, and sterilization-ready polymers, creating a strong market opportunity for Class VI compliant compounding services. Growth is further driven by increasing healthcare access, infection control requirements, and rising awareness of patient safety. Innovations in rapid compounding and scalable production methods support fast adoption in this segment. Emerging markets are particularly contributing to growth as healthcare infrastructure expands and demand for disposable medical devices rises.

Class VI Compliant Polymer Compounding Services Market Regional Analysis

- North America dominated the Class VI compliant polymer compounding services market with the largest revenue share of 39.3% in 2024, characterized by advanced medical device manufacturing, strong regulatory frameworks, and a robust presence of key compounding service providers

- Manufacturers in the region highly prioritize USP Class VI and ISO 10993 compliant polymers to ensure safety, biocompatibility, and regulatory approval for implantable and disposable medical devices

- This widespread adoption is further supported by advanced healthcare infrastructure, high R&D investment, and a strong focus on innovation, establishing Class VI compliant polymer compounding services as a preferred solution for both large and small medical device OEMs

U.S. Class VI Compliant Polymer Compounding Services Market Insight

The U.S. Class VI compliant polymer compounding services market captured the largest revenue share of 80% in North America in 2024, fueled by the high concentration of medical device manufacturers and stringent regulatory compliance requirements. Manufacturers are increasingly prioritizing USP Class VI and ISO 10993 certified polymers to ensure biocompatibility and safety for implantable and disposable medical devices. The growing trend of outsourcing polymer compounding to specialized service providers further propels market growth. In addition, the integration of advanced compounding technologies and rapid prototyping capabilities supports faster development cycles and regulatory approvals. Strong R&D investment and a focus on innovation continue to drive the adoption of high-quality Class VI compliant materials.

Europe Class VI Compliant Polymer Compounding Services Market Insight

The Europe Class VI compliant polymer compounding services market is projected to expand at a substantial CAGR during the forecast period, driven by stringent medical device regulations and increasing demand for safe, compliant polymers across implantable, diagnostic, and disposable applications. The region’s well-established healthcare infrastructure and focus on patient safety foster adoption of USP Class VI compliant materials. Increasing urbanization and rising healthcare investments are also promoting market growth. Manufacturers in Europe are integrating biocompatible polymers into new medical device designs and upgrades, further expanding demand. The region experiences strong growth across both R&D and commercial production segments.

U.K. Class VI Compliant Polymer Compounding Services Market Insight

The U.K. Class VI compliant polymer compounding services market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising demand for advanced, safe, and regulatory-compliant polymers in medical devices. Healthcare providers and manufacturers prioritize polymers that meet USP Class VI standards for implants, surgical instruments, and disposable devices. In addition, the country’s robust regulatory framework, emphasis on innovation, and growing medical device industry support market expansion. Increasing adoption of biocompatible polymers in new device development and clinical applications continues to stimulate demand.

Germany Class VI Compliant Polymer Compounding Services Market Insight

The Germany Class VI compliant polymer compounding services market is expected to expand at a considerable CAGR during the forecast period, fueled by strong regulatory compliance requirements and growing awareness of biocompatible materials in healthcare. German medical device manufacturers focus on polymers that maintain mechanical integrity and safety after sterilization processes, supporting adoption of Class VI compliant solutions. The country’s advanced healthcare infrastructure, emphasis on precision engineering, and innovation in medical devices promote market growth. Integration of USP Class VI compliant polymers into implantables, surgical instruments, and diagnostic devices is becoming increasingly prevalent.

Asia-Pacific Class VI Compliant Polymer Compounding Services Market Insight

The Asia-Pacific Class VI compliant polymer compounding services market is poised to grow at the fastest CAGR during the forecast period, driven by increasing medical device manufacturing, rising healthcare investments, and technological advancements in countries such as China, Japan, and India. The region’s growing focus on patient safety and regulatory compliance is driving adoption of USP Class VI certified polymers. Furthermore, emerging markets are increasingly outsourcing polymer compounding services to meet global quality standards. Expansion of domestic medical device production, government initiatives promoting healthcare innovation, and improving access to biocompatible polymers are further propelling market growth.

Japan Class VI Compliant Polymer Compounding Services Market Insight

The Japan Class VI compliant polymer compounding services market is gaining momentum due to the country’s focus on healthcare innovation, advanced medical infrastructure, and high demand for safe, biocompatible polymers. The adoption of USP Class VI compliant polymers is driven by increasing implantable and disposable medical device production. Integration with cutting-edge medical technologies, including diagnostics and wearable devices, supports growth. In addition, Japan’s aging population is spurring demand for safe and reliable polymer solutions in healthcare applications. The country emphasizes precision, quality, and regulatory adherence, reinforcing market expansion.

India Class VI Compliant Polymer Compounding Services Market Insight

The India Class VI compliant polymer compounding services market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid growth in medical device manufacturing, urbanization, and rising adoption of high-quality polymers. USP Class VI and ISO 10993 compliant polymers are increasingly used in implants, diagnostics, and disposable devices. Government initiatives supporting healthcare infrastructure and domestic medical device production further propel market growth. Availability of affordable polymer compounding services, combined with growing healthcare investments, is enabling wider adoption among OEMs and contract manufacturers. The country continues to emerge as a key hub for polymer compounding services in the region.

Class VI Compliant Polymer Compounding Services Market Share

The Class VI Compliant Polymer Compounding Services industry is primarily led by well-established companies, including:

- Foster, LLC (U.S.)

- California Plastics (U.S.)

- Americhem, Inc. (U.S.)

- Evonik (Germany)

- Midland Compounding, (U.S.)

- OTECH CORPORATION (U.S.)

- RTP Company (U.S.)

- Chroma Color Corporation (U.S.)

- Entec Polymers (U.S.)

- PolyComp, Inc. (U.S.)

- Canada Colors and Chemicals Limited (Canada)

- Northwire, Inc. (U.S.)

- Master Bond, Inc. (U.S.)

- Atlantic Rubber Company, Inc. (U.S.)

- NewAge (U.S.)

- Cole-Parmer Instrument Company, LLC (U.S.)

- ROW, Inc. (U.S.)

- Radwell International, Inc. (U.S.)

- Total Plastics (U.S.)

- Trelleborg Group (U.S.)

What are the Recent Developments in Global Class VI Compliant Polymer Compounding Services Market?

- In September 2025, California's new EPR regulations, require producers of single-use packaging to register and report their packaging data. These regulations aim to reduce plastic waste and encourage recycling, impacting manufacturers of medical device packaging materials

- In July 2025, Formerra, a leading distributor of medical-grade polymers, announced its expanded distribution agreement with Foster Corporation to supply Foster's USP Class VI and ISO 10993-compliant compounds throughout North and South America. This strategic partnership aims to enhance the availability of high-quality materials for critical medical applications, including drug delivery systems and diagnostic devices

- In January 2025, Geon Performance Solutions, a materials supplier, announced the acquisition of Foster Corporation, a compounder of medical-grade polymers. This strategic move enhances Geon's participation in the high-value medical market, allowing them to offer a broader range of rigid and flexible PVC, thermoplastic elastomers (TPEs), and contract manufacturing services to healthcare customers

- In November 2024, Foster Corporation was awarded EcoVadis Silver status for 2024, recognizing its exceptional sustainability efforts. This achievement places Foster among the top 15% of companies in the rubber and plastics industry for environmental and sustainability initiatives

- In January 2024, PEAK Performance Compounding launched its Synnergy Low Friction Compounds, custom-formulated using a proprietary blend of lubricious additives to significantly reduce the coefficient of friction in natural resins. These compounds are USP Class VI certified, making them suitable for medical device applications that require smooth movement and reduced wear, such as catheters and surgical instruments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.