Global Cleanroom Fluorescent Lighting Market

Market Size in USD Billion

CAGR :

%

USD

269.99 Billion

USD

414.35 Billion

2024

2032

USD

269.99 Billion

USD

414.35 Billion

2024

2032

| 2025 –2032 | |

| USD 269.99 Billion | |

| USD 414.35 Billion | |

|

|

|

|

What is the Global Cleanroom Fluorescent Lighting Market Size and Growth Rate?

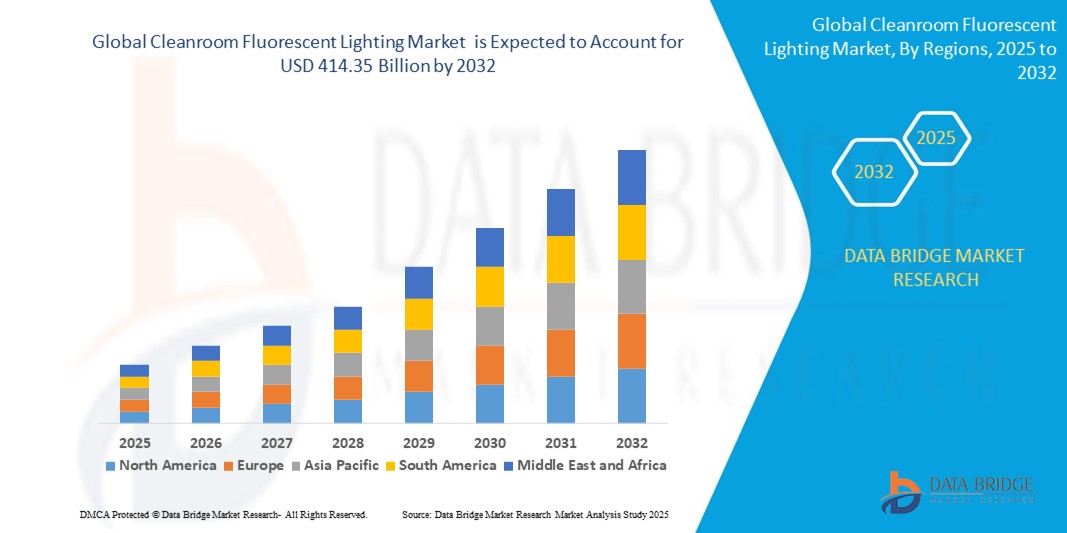

- The global cleanroom fluorescent lighting market size was valued at USD 269.99 billion in 2024 and is expected to reach USD 414.35 billion by 2032, at a CAGR of 5.50% during the forecast period

- The global cleanroom fluorescent lighting market is a segment of the global lighting industry that focuses on providing specialized lighting solutions for cleanrooms. Cleanrooms are controlled environments that have low levels of dust, airborne microbes, aerosol particles, and chemical vapors. They are used for various applications such as scientific research, biotechnology, pharmaceuticals, electronics, and aerospace

- Cleanroom fluorescent lighting is designed to meet the stringent requirements of these environments, such as high illumination, low glare, low heat emission, and resistance to corrosion and contamination

- The global cleanroom fluorescent lighting market is expected to grow at a significant rate in the coming years, driven by the increasing demand for cleanrooms across various sectors, the rising awareness about the benefits of cleanroom lighting, and the technological advancements in lighting products

What are the Major Takeaways of Cleanroom Fluorescent Lighting Market?

- The global cleanroom fluorescent lighting market is projected to witness a significant expansion in the coming years, owing to the rising demand from the semiconductor industry. The semiconductor industry requires high-quality lighting solutions that can ensure a clean and sterile environment for the fabrication of electronic components

- Cleanroom fluorescent lighting products are designed to meet the stringent standards of cleanliness, brightness, and energy efficiency that are essential for the semiconductor industry. Therefore, the increasing demand from the semiconductor industry is expected to act as a driver for the growth of the global cleanroom fluorescent lighting market

- Asia-Pacific dominated the cleanroom fluorescent lighting market with the largest revenue share of 41.2% in 2024, driven by strong demand from industries such as pharmaceuticals, semiconductors, and food & beverages, where contamination control is critical

- North America cleanroom fluorescent lighting market is poised to grow at the fastest CAGR of 8.7% from 2025 to 2032, driven by increasing adoption in healthcare, biotechnology, and semiconductor manufacturing

- The customized segment dominated the cleanroom fluorescent lighting market with the largest market revenue share of 57.6% in 2024, driven by the increasing demand for lighting solutions tailored to specific cleanroom classifications, layout designs, and compliance requirements

Report Scope and Cleanroom Fluorescent Lighting Market Segmentation

|

Attributes |

Cleanroom Fluorescent Lighting Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Cleanroom Fluorescent Lighting Market?

Integration of Smart Controls and Energy-Efficient Technologies

- A key and accelerating trend in the global cleanroom fluorescent lighting market is the incorporation of smart lighting controls, sensors, and automation systems, enabling precise illumination management, reduced energy consumption, and enhanced compliance with cleanroom standards

- For instance, leading manufacturers are introducing fixtures with integrated occupancy and daylight sensors, allowing real-time adjustment of light levels while maintaining ISO class requirements. Similarly, smart ballast systems offer programmable settings for dimming, scheduling, and maintenance alerts

- Advanced control capabilities allow facilities to monitor lighting performance, track energy usage, and optimize replacement cycles through centralized building management systems (BMS). These systems can be seamlessly integrated with HVAC and filtration controls to support overall cleanroom efficiency

- The convergence of cleanroom fluorescent lighting with IoT-based platforms enables remote monitoring and predictive maintenance, helping operators minimize downtime and extend fixture lifespan

- This shift toward intelligent, energy-efficient, and easily controllable lighting solutions is transforming cleanroom environments in industries such as pharmaceuticals, electronics, and biotechnology. Manufacturers like Signify and Wipro Lighting are developing tunable-white and sensor-based luminaires that enhance worker comfort while reducing operational costs

- The rising demand for cleanroom fluorescent lighting that combines precision control, regulatory compliance, and sustainability is driving innovation and adoption in both new installations and retrofit projects

What are the Key Drivers of Cleanroom Fluorescent Lighting Market?

- The growing need for contamination control and compliance with stringent regulatory standards in sectors such as pharmaceuticals, semiconductor manufacturing, and healthcare is a primary driver of market growth

- For instance, in February 2025, Signify launched its latest cleanroom-rated LED luminaires with advanced IP65 protection, low-glare optics, and industry-specific certifications to meet the demands of critical environments

- As awareness of energy efficiency and lifecycle cost savings expands, facility managers are increasingly replacing conventional lighting with high-performance, low-maintenance fluorescent fixtures designed for cleanrooms. These solutions offer consistent lumen output, easy cleaning surfaces, and resistance to dust and moisture ingress

- In addition, the expansion of biotechnology and advanced electronics manufacturing is fueling demand for lighting that ensures optimal visibility without compromising cleanroom integrity

- The shift toward integrated lighting and building automation systems is further accelerating adoption, providing operators with centralized control and operational insights

- The market is also benefiting from government incentives and corporate sustainability goals, encouraging investment in eco-friendly lighting solutions that lower operational expenses and support environmental compliance

Which Factor is challenging the Growth of the Cleanroom Fluorescent Lighting Market?

-

High initial installation costs and retrofitting challenges represent notable hurdles for market expansion, especially for small and medium-scale facilities with limited budgets. Specialized cleanroom-rated fixtures often require higher upfront investment compared to standard lighting solutions

-

For instance, the cost of installing IP65-rated, low-glare fluorescent fixtures with integrated smart controls can be significantly higher than conventional alternatives, making decision-makers cautious about immediate adoption

-

Maintenance complexity in highly controlled environments also adds to operational costs, as servicing fixtures often requires downtime and strict contamination prevention procedures

-

Furthermore, the growing preference for LED-based solutions is gradually reducing demand for traditional fluorescent lighting, pressuring manufacturers to innovate or diversify product lines

-

Regulatory compliance requirements, including photometric validation and regular audits, can also slow procurement cycles, particularly in pharmaceutical and semiconductor facilities

-

To overcome these challenges, manufacturers must focus on offering cost-effective, modular designs with easier installation processes, extended lifespans, and hybrid product lines that bridge the gap between fluorescent and LED technologies

How is the Cleanroom Fluorescent Lighting Market Segmented?

The market is segmented on the basis of offering, end-user, and sales channel.

- By Offering

On the basis of offering, the cleanroom fluorescent lighting market is segmented into customized and non-customizable. The customized segment dominated the cleanroom fluorescent lighting market with the largest market revenue share of 57.6% in 2024, driven by the increasing demand for lighting solutions tailored to specific cleanroom classifications, layout designs, and compliance requirements. Industries such as pharmaceuticals and semiconductors are increasingly adopting bespoke fixtures to optimize illumination, enhance energy efficiency, and meet strict contamination control standards.

The non-customizable segment is anticipated to witness steady growth from 2025 to 2032, supported by cost-effective standard models suitable for smaller cleanrooms and general-purpose controlled environments. The ease of procurement and shorter lead times for off-the-shelf products are contributing to their adoption among cost-conscious buyers.

- By End-user

On the basis of end-user, the Cleanroom Fluorescent Lighting market is segmented into industrial manufacturing, pharmaceutical, semiconductors and electronics, healthcare, food and beverages, and others. The pharmaceutical segment dominated the cleanroom fluorescent lighting market with a market revenue share of 34.9% in 2024, driven by stringent GMP (Good Manufacturing Practice) requirements and the critical need for sterile, particle-free environments in drug manufacturing. Growing investment in biologics, vaccines, and advanced therapies is further boosting demand for compliant lighting systems in pharmaceutical cleanrooms.

The semiconductors and electronics segment is projected to grow at the fastest CAGR from 2025 to 2032, fueled by rising demand for precision lighting in wafer fabrication, microchip assembly, and electronics testing processes where dust-free conditions are crucial.

- By Sales Channel

On the basis of sales channel, the cleanroom fluorescent lighting market is segmented into direct and indirect sales. The direct sales segment held the largest market revenue share at 63.1% in 2024, supported by manufacturers’ preference to work closely with clients on design, installation, and after-sales support for specialized cleanroom projects. This channel enables better customization, quality assurance, and compliance validation.

The indirect sales segment is expected to grow steadily, driven by the expansion of distributor networks, online procurement platforms, and partnerships with regional contractors catering to small and medium-scale cleanroom projects.

Which Region Holds the Largest Share of the Cleanroom Fluorescent Lighting Market?

- Asia-Pacific dominated the cleanroom fluorescent lighting market with the largest revenue share of 41.2% in 2024, driven by strong demand from industries such as pharmaceuticals, semiconductors, and food & beverages, where contamination control is critical

- The region benefits from a large manufacturing base, rapid industrialization, and significant investments in cleanroom infrastructure across China, Japan, South Korea, and Southeast Asia

- Growing government support for high-tech manufacturing, coupled with rising adoption of energy-efficient and compliant lighting solutions, reinforces Asia-Pacific’s leadership. Strong supply chain capabilities and competitive production costs further position the region as a global hub for cleanroom lighting manufacturing and export

China Cleanroom Fluorescent Lighting Market Insight

The China cleanroom fluorescent lighting market captured the largest revenue share in Asia-Pacific in 2024, driven by its dominance in semiconductor fabrication, pharmaceutical production, and electronics assembly. Government initiatives promoting GMP compliance and technological upgrades in manufacturing facilities are further fueling demand. The country’s strong domestic manufacturing ecosystem enables cost-effective production while meeting international quality standards.

Japan Cleanroom Fluorescent Lighting Market Insight

The Japan cleanroom fluorescent lighting market is expanding steadily, supported by its advanced electronics sector, pharmaceutical innovation, and precision manufacturing industries. Demand is driven by strict contamination control standards and a focus on energy efficiency, with LED-based fluorescent alternatives gaining traction. The country’s reputation for high-quality engineering and compliance with global certification standards continues to attract investments in modern cleanroom facilities.

Which Region is the Fastest Growing Region in the Cleanroom Fluorescent Lighting Market?

North America cleanroom fluorescent lighting market is poised to grow at the fastest CAGR of 8.7% from 2025 to 2032, driven by increasing adoption in healthcare, biotechnology, and semiconductor manufacturing. The region’s growth is fueled by the expansion of pharmaceutical research labs, stringent FDA compliance requirements, and rising investment in clean manufacturing environments. Strong technological innovation, coupled with the presence of leading cleanroom lighting manufacturers, supports rapid market expansion.

U.S. Cleanroom Fluorescent Lighting Market Insight

The U.S. cleanroom fluorescent lighting market accounted for the largest share in North America in 2024, supported by large-scale investments in advanced manufacturing, healthcare facilities, and research laboratories. Growing adoption of energy-efficient, low-maintenance lighting systems and retrofitting of existing cleanrooms are key trends driving market growth.

Canada Cleanroom Fluorescent Lighting Market Insight

The Canada cleanroom fluorescent lighting market is set to witness healthy growth during the forecast period, driven by rising pharmaceutical production, aerospace manufacturing, and electronics assembly operations. Supportive regulatory frameworks and government incentives for energy-efficient infrastructure are further propelling demand for advanced cleanroom lighting solutions.

Which are the Top Companies in Cleanroom Fluorescent Lighting Market?

The cleanroom fluorescent lighting industry is primarily led by well-established companies, including:

- Signify Holding (Netherlands)

- Wipro Lighting (India)

- Crompton Greaves Consumer Electricals Limited (India)

- Acuity Brands, Inc. (U.S.)

- Kenall Manufacturing (U.S.)

- Terra Universal Inc. (U.S.)

- Bukas Lighting Group (U.S.)

- Solite Europe (U.K.)

- LUG S.A. (Poland)

- Imperial (Poland)

What are the Recent Developments in Global Cleanroom Fluorescent Lighting Market?

- In February 2025, Jansen Cleanrooms & Labs introduced a new range of cleanroom construction products, including an interlock system, specialized lighting, a hinged door system, a wall system, and a pass box. These solutions are engineered to ensure contamination-free environments for critical operations, marking a significant step in the company’s commitment to high-performance cleanroom infrastructure

- In January 2025, Acuity Brands reported Q1 sales of USD 951.6 million, reflecting a 1.8% increase, with the recent QSC acquisition projected to contribute an additional USD 500 million in annual revenue. This milestone underscores Acuity Brands’ strategic growth and expanding market influence

- In August 2024, Total Clean Air launched Modulab, a modular cleanroom solution constructed from robust aircraft-grade structural aluminum, offering exceptional strength, efficiency, and a reduced carbon footprint. This innovation highlights the company’s focus on sustainability and adaptability across sectors such as pharmaceuticals, electronics, and aerospace

- In April 2024, Fujifilm announced an investment of USD 1.2 billion to double its biomanufacturing capacity in North Carolina, creating 680 new jobs in the process. This expansion reinforces Fujifilm’s long-term commitment to advancing biopharmaceutical manufacturing capabilities in the region

- In November 2023, Kenall Manufacturing unveiled the CSSGI series, a low-profile plenum troffer designed for cleanrooms and controlled environments, including food processing plants, pharmacies, and pharmaceutical manufacturing facilities. This launch strengthens Kenall’s SimpleSeal line and affirms its leadership in IP-rated cleanroom lighting solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cleanroom Fluorescent Lighting Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cleanroom Fluorescent Lighting Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cleanroom Fluorescent Lighting Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.