Global Coal To Liquid Market

Market Size in USD Billion

CAGR :

%

USD

5.13 Billion

USD

7.03 Billion

2024

2032

USD

5.13 Billion

USD

7.03 Billion

2024

2032

| 2025 –2032 | |

| USD 5.13 Billion | |

| USD 7.03 Billion | |

|

|

|

|

Coal to Liquid Market Size

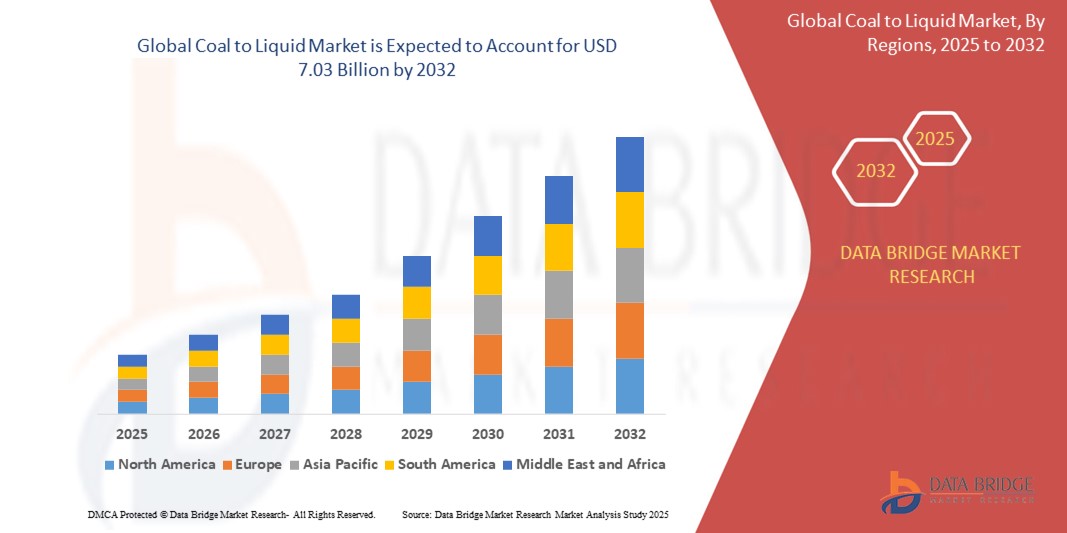

- The global coal to liquid market was valued at USD 5.137 billion in 2024 and is expected to reach USD 7.031 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 4.00%, primarily driven by factors such as the abundant coal reserves and the increasing demand for liquid fuels like diesel and jet fuel

- This growth is also attributed to technological advancements in CTL processes, which have improved production efficiency and expanded the range of liquid fuels that can be produced

Coal to Liquid Market Analysis

- Coal-to-Liquid (CTL) technology involves converting coal into liquid fuels such as diesel and gasoline through processes like direct coal liquefaction (DCL) and indirect coal liquefaction (ICL). This technology provides an alternative source of liquid fuels, especially in regions with abundant coal reserves

- The demand for CTL technology is significantly driven by the increasing global need for liquid fuels, particularly in the transportation sector. Despite the growing popularity of renewable energy sources, liquid fuels remain essential for various industries, ensuring a consistent and reliable energy supply

- The Asia Pacific region stands out as a dominant player in the CTL market, driven by its substantial coal reserves and the escalating demand for alternative liquid fuels. Countries like China are investing heavily in CTL projects to enhance energy security and reduce dependence on imported crude oil

- For instance, China has been heavily investing in Coal-to-Liquid (CTL) projects to enhance energy security and reduce reliance on imported crude oil. The country operates some of the world’s largest CTL plants, such as the Shenhua CTL plant, which produces millions of barrels of synthetic fuel annually

- Globally, advancements in CTL processes have improved production efficiency and reduced environmental impacts. Innovations such as carbon capture, utilization, and storage (CCUS) systems are being integrated to mitigate carbon emissions, making CTL a more sustainable option in the energy mix

Report Scope and Coal to Liquid Market Segmentation

|

Attributes |

Coal to Liquid Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Coal to Liquid Market Trends

“Rising Demand for Alternative Fuel Sources and Technological Advancements”

- One prominent trend in the global coal to liquid (CTL) market is the increasing demand for alternative fuel sources, driven by the need to reduce reliance on traditional crude oil

- Technological advancements have significantly enhanced the efficiency and environmental sustainability of coal liquefaction processes, making CTL a more viable option

- For instance, Direct Coal Liquefaction (DCL) involves the direct conversion of coal into liquid hydrocarbons by adding hydrogen at high pressures and temperatures in the presence of a catalyst. This process is known for its high efficiency and the ability to produce liquid fuels directly from coal

- The integration of carbon capture and storage (CCS) technologies with CTL plants is also gaining traction, helping to mitigate greenhouse gas emissions and align with global sustainability goals

- This trend is revolutionizing the way ophthalmic surgeries are performed, improving patient outcomes and increasing the demand for technologically advanced microscopes in the This trend is driving investments in CTL projects, particularly in coal-rich regions such as China, which is making significant investments in CTL technology to strengthen its energy security and lessen its reliance on foreign oil

Coal to Liquid Market Dynamics

Driver

“Energy Security and Diversification of Fuel Sources”

- Growing concerns over energy security and the volatility of global crude oil prices are pushing countries to diversify their fuel sources, which is significantly driving the demand for coal to liquid (CTL) technologies

- CTL provides an alternative pathway to produce synthetic liquid fuels from abundant coal reserves, helping reduce dependency on imported oil and improving national energy independence

- Several countries with large domestic coal reserves, such as China, India, South Africa, and the U.S., are increasingly turning to CTL technologies as part of their long-term energy strategies

- CTL fuels offer logistical and strategic advantages, especially for countries with strained access to oil or under import restrictions, by ensuring a stable and local source of liquid fuels

- Governments are introducing policy frameworks and incentives that support domestic CTL projects to enhance energy resilience and reduce exposure to international market fluctuations

For instance,

- In March 2024, Indonesia’s Ministry of Energy and Mineral Resources approved a national initiative to develop CTL plants in coal-rich provinces, aiming to cut diesel imports by up to 30% over the next decade

- In July 2023, Poland’s Jastrzębska Spółka Węglowa (JSW) began construction of a pilot CTL plant to reduce reliance on petroleum imports from outside the EU and to support the country’s long-term fuel security goals

- As a result, CTL technologies are gaining traction as a strategic tool for countries seeking greater control over their energy mix, reducing geopolitical risk, and ensuring fuel availability in times of crisis

Opportunity

“Enhancing CTL Efficiency with AI and Digitalization”

- The integration of artificial intelligence (AI) and digital technologies into coal to liquid (CTL) processes presents a significant opportunity to enhance efficiency, reduce operational costs, and optimize fuel production

- AI-powered predictive analytics can improve coal selection, gasification efficiency, and catalyst performance, enabling CTL plants to maximize fuel output while minimizing waste

- Machine learning algorithms can analyze real-time data from CTL facilities to detect inefficiencies, predict maintenance needs, and reduce downtime, leading to higher productivity and cost savings

- In addition, AI-driven carbon capture systems can optimize the process of capturing and storing carbon dioxide emissions, making CTL more environmentally sustainable

For instance,

- In February 2025, according to an article published by the International Energy Agency (IEA), AI-based optimization tools have improved coal-to-liquid conversion rates by 15%, making the process more economically viable

- In December 2023, according to an article published in the Journal of Cleaner Production, China and the U.S. are investing in AI-powered predictive maintenance for CTL plants, reducing operational failures and improving fuel quality

- The integration of AI and digitalization in CTL processes offers a transformative opportunity to enhance efficiency, lower emissions, and improve economic feasibility, driving further adoption of CTL technologies worldwide

Restraint/Challenge

“High Capital Investment Hindering Market Expansion”

- The high capital investment required for establishing coal to liquid (CTL) plants poses a significant challenge for market growth, particularly in emerging economies and regions with limited financial resources

- CTL facilities involve complex infrastructure, including coal gasification units, Fischer-Tropsch synthesis reactors, and carbon capture systems, leading to initial setup costs reaching billions of dollars

- The substantial financial burden can deter governments and private investors from pursuing large-scale CTL projects, limiting the widespread adoption of the technology

- In addition, ongoing operational costs, such as coal procurement, water usage, and energy consumption, add further economic challenges, making it difficult for smaller energy companies to compete in the market

For instance,

- In October 2024, according to an article published by the World Coal Association, the high capital costs of CTL plants remain a major barrier to expansion, with only a few countries able to afford large-scale production facilities

- Consequently, the high capital investment associated with CTL projects presents a major restraint to market expansion, limiting global adoption and restricting accessibility in cost-sensitive regions

Coal to Liquid Market Scope

The market is segmented on the basis product, and technology.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Technology |

|

|

By Application |

|

Coal to Liquid Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Coal-to-Liquid (CTL) Market”

- Asia-Pacific leads the global Coal-to-Liquid (CTL) market, driven by abundant coal reserves, escalating energy demands, and significant investments in alternative fuel technologies

- China holds a substantial share due to its extensive coal resources and governmental initiatives aimed at reducing reliance on imported oil. The country's focus on energy security has led to the development of large-scale CTL projects, positioning it as a key player in the market

- The presence of well-established infrastructure and supportive policies further bolster the CTL market in the region

- In addition, the increasing demand for liquid fuels in transportation and industrial sectors, coupled with advancements in CTL technology, is fueling market expansion across the Asia-Pacific region

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is anticipated to experience the highest growth rate in the global Coal-to-Liquid (CTL) market, driven by increasing energy demands, abundant coal reserves, and supportive governmental policies

- China, with its vast coal resources and initiatives to reduce dependence on imported oil, is leading the region's CTL market. The Chinese government's focus on energy security has resulted in significant investments in CTL technology, positioning the country as a key player in the industry

- India is also emerging as a notable market due to its substantial coal reserves and growing energy requirements. The country's emphasis on alternative fuel technologies to meet its escalating energy needs is contributing to the expansion of the CTL market

- In addition, countries like Indonesia are witnessing increased investments in CTL projects, leveraging their abundant coal resources to produce liquid fuels and enhance energy security

- The Asia-Pacific region's focus on utilizing domestic coal reserves for liquid fuel production, coupled with advancements in CTL technology, is expected to drive significant market growth in the coming years

Coal to Liquid Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Air Products and Chemicals Inc. (U.S.)

- Altona Rare Earths Plc (U.K.)

- Chevron Corp. (U.S.)

- China Shenhua Energy Co. Ltd. (China)

- DKRW Energy Partners LLC (U.S.)

- Envidity Energy Inc. (Canada)

- Inner Mongolia Yitai Investment Co. Ltd. (China)

- Linc Energy Systems (U.S.)

- Pall Corp. (U.S.)

- PT. Bakrie Global Ventura (Indonesia)

- Qatargas Operating Co. Ltd. (Qatar)

- Regius Synfuels Ltd. (Mozambique)

- Sasol Ltd. (South Africa)

- Shell plc (U.K.)

- TransGas Development Systems (U.S.)

- Yankuang Group (China)

Latest Developments in Global Coal to Liquid Market

- In September 2023, Sasol Limited completed a study on implementing a new destoning unit to enhance coal quality. The company aimed to improve coal standards through various initiatives, including miner training programs to increase quality awareness and contamination monitoring. In addition, Sasol planned to integrate advanced components, such as an inclinometer and new technology testing, to optimize coal processing

- In 2024, China Shenhua Energy Co. Ltd expanded its Coal-to-Liquid (CTL) operations, emphasizing the production of cleaner liquid fuels to address rising energy demands

- In 2024, Linc Energy Systems announced advancements in Coal-to-Liquid (CTL) technology, aiming to enhance efficiency and minimize environmental impact. The company is focused on utilizing coal reserves to develop more sustainable energy solutions

- In 2023, Siemens Energy advanced Coal-to-Liquid (CTL) technologies, prioritizing carbon emission reduction and improving the scalability of coal liquefaction processes. These developments reflect the company’s commitment to innovation and sustainability in the energy sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Coal To Liquid Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Coal To Liquid Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Coal To Liquid Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.