Global Cocoa Butter Alternatives Market

Market Size in USD Billion

CAGR :

%

USD

1.63 Billion

USD

2.74 Billion

2024

2032

USD

1.63 Billion

USD

2.74 Billion

2024

2032

| 2025 –2032 | |

| USD 1.63 Billion | |

| USD 2.74 Billion | |

|

|

|

|

What is the Global Cocoa Butter Alternatives Market Size and Growth Rate?

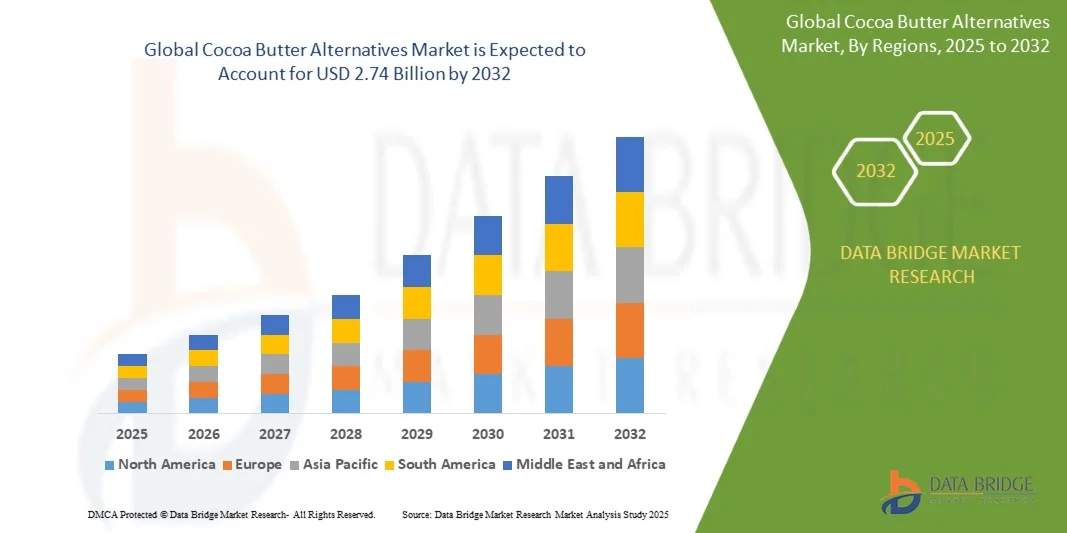

- The global cocoa butter alternatives market size was valued at USD 1.63 billion in 2024 and is expected to reach USD 2.74 billion by 2032, at a CAGR of 6.72% during the forecast period

- The market growth is primarily driven by the rising demand for cost-effective and sustainable substitutes for natural cocoa butter, especially in the confectionery, bakery, and cosmetics industries. Manufacturers are increasingly adopting cocoa butter alternatives to reduce dependency on cocoa supply chains and stabilize product pricing

- Furthermore, the expanding vegan and plant-based product segment, along with advancements in lipid technology and improved fat crystallization techniques, is fostering innovation in the market, contributing significantly to its long-term growth potential

What are the Major Takeaways of Cocoa Butter Alternatives Market?

- Cocoa butter alternatives, including cocoa butter equivalents (CBE), cocoa butter substitutes (CBS), and cocoa butter replacers (CBR), are gaining prominence as efficient, stable, and sustainable ingredients for chocolate and confectionery applications

- The market’s expansion is fueled by the rising prices and limited supply of cocoa butter, growing emphasis on cost optimization, and an increasing preference for clean-label, plant-derived ingredients among global consumers

- Moreover, continuous R&D efforts by key manufacturers to enhance texture, flavor compatibility, and heat stability are positioning cocoa butter alternatives as essential components in the modern food and cosmetic industries

- North America dominated the cocoa butter alternatives market with the largest revenue share of 38.7% in 2024, driven by the robust presence of confectionery and bakery manufacturers, coupled with rising demand for plant-based and cost-effective ingredients

- The Asia-Pacific cocoa butter alternatives market is projected to grow at the fastest CAGR of 13.4% from 2025 to 2032, driven by rapid urbanization, expanding middle-class populations, and the rising consumption of chocolates and bakery products in emerging economies such as China, India, and Indonesia

- The Cocoa Butter Equivalents (CBE) segment dominated the market with the largest revenue share of 46.8% in 2024, attributed to their ability to blend seamlessly with natural cocoa butter without affecting taste or textures

Report Scope and Cocoa Butter Alternatives Market Segmentation

|

Attributes |

Cocoa Butter Alternatives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Cocoa Butter Alternatives Market?

“Rising Demand for Sustainable and Plant-Based Ingredients”

- A significant and accelerating trend in the global cocoa butter alternatives market is the growing preference for sustainability and plant-based formulations. Manufacturers are increasingly shifting toward alternatives derived from natural oils and fats, such as shea butter, mango kernel fat, and palm mid fractions, to reduce dependency on traditional cocoa butter

- For instance, AAK AB launched sustainable cocoa butter equivalents (CBEs) made from responsibly sourced shea and palm oils, addressing both environmental concerns and cost volatility associated with cocoa production

- This trend is further fueled by the rising consumer awareness of ethical sourcing and the increasing demand for vegan and clean-label confectionery products. Cocoa butter alternatives align with these preferences, enabling producers to maintain product quality while promoting environmental responsibility

- Companies such as Cargill, Incorporated and Fuji Oil Company, Ltd. are investing in traceable and deforestation-free supply chains, strengthening their position in the sustainable fats and oils market

- The growing shift toward eco-friendly formulations, along with advancements in fat processing technologies, is expected to reshape the global confectionery and bakery sectors, driving long-term adoption of cocoa butter alternatives

What are the Key Drivers of Cocoa Butter Alternatives Market?

- The primary driver of the cocoa butter alternatives market is the increasing volatility in cocoa butter prices, prompting manufacturers to explore cost-effective substitutes without compromising texture or flavor

- For instance, in June 2024, Bunge Ltd. expanded its portfolio of cocoa butter equivalents to help confectionery manufacturers maintain consistent product performance amid cocoa supply fluctuations

- Another key driver is the rising demand for vegan and plant-based products, particularly in chocolate and bakery applications, where consumers seek products free from animal-derived ingredients

- Moreover, technological advancements in fat crystallization and fractionation are enabling producers to mimic the melting characteristics and sensory attributes of cocoa butter with greater accuracy

- In addition, the growing use of palm and shea-based alternatives supports the industry’s push toward sustainable sourcing and environmental compliance. These drivers collectively position cocoa butter alternatives as a strategic solution for cost efficiency, product innovation, and sustainability across the food manufacturing sector

Which Factor is Challenging the Growth of the Cocoa Butter Alternatives Market?

- A major challenge hindering market growth is the fluctuating prices and supply chain constraints of raw materials such as shea, palm, and illipe butter, which can directly impact production costs

- For instance, supply disruptions in West Africa, a major shea-producing region, have led to price volatility and inconsistent quality, posing risks for large-scale chocolate and bakery manufacturers

- Another critical challenge is the regulatory restriction on the permissible percentage of cocoa butter alternatives in chocolate formulations, especially in regions such as the U.K. and the European Union, where strict labeling standards apply

- In addition, consumer perception remains a barrier—many consumers associate cocoa butter with superior quality and may view alternatives as inferior substitutes. Educating consumers on the sustainability and performance benefits of CBEs and CBRs (Cocoa Butter Replacers) is essential to overcome this stigma

- To ensure long-term success, manufacturers must focus on supply chain transparency, improved formulation quality, and regulatory compliance, enabling the cocoa butter alternatives market to achieve sustainable growth

How is the Cocoa Butter Alternatives Market Segmented?

The market is segmented on the basis of type, source, and application.

• By Type

On the basis of type, the cocoa butter alternatives market is segmented into Cocoa Butter Equivalents (CBE), Cocoa Butter Replacers (CBR), and Cocoa Butter Substitutes (CBS). The Cocoa Butter Equivalents (CBE) segment dominated the market with the largest revenue share of 46.8% in 2024, attributed to their ability to blend seamlessly with natural cocoa butter without affecting taste or texture. CBEs are highly preferred by premium chocolate and confectionery manufacturers seeking cost efficiency while maintaining quality standards. The Cocoa Butter Substitutes (CBS) segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by their increasing use in compound coatings and bakery products where full cocoa butter compatibility is not essential. The growing trend toward affordable confectionery and large-scale industrial production continues to expand the adoption of CBS across emerging economies.

• By Source

On the basis of source, the cocoa butter alternatives market is categorized into Shea, Sal, Kokum and Mango Kernel, and Illipe and Palm Kernel Stearin. The Shea segment accounted for the largest market revenue share of 39.5% in 2024, owing to its high stearic and oleic acid content, which closely resembles cocoa butter in texture and melting characteristics. Shea-based alternatives are increasingly favored by chocolate producers aiming to maintain product creaminess while managing ingredient costs. The Kokum and Mango Kernel segment is projected to register the fastest CAGR from 2025 to 2032, driven by their growing recognition as sustainable and regionally abundant fat sources, particularly in Asia-Pacific markets. As consumer demand shifts toward natural and ethically sourced ingredients, manufacturers are investing in R&D to optimize extraction efficiency and functionality of these exotic kernel fats, boosting their market share in premium and health-oriented applications.

• By Application

On the basis of application, the cocoa butter alternatives market is segmented into Bakery and Confectionery, Dairy and Frozen Desserts, Sweet and Savory Snacks, and Dips, Sauces, and Dressings. The Bakery and Confectionery segment dominated the market with the largest revenue share of 52.4% in 2024, driven by widespread use in chocolate bars, fillings, and coatings, where consistent texture and flavor replication are critical. The segment benefits from rising global chocolate consumption and the need for cost-effective fat replacements. The Dairy and Frozen Desserts segment is expected to exhibit the fastest CAGR from 2025 to 2032, fueled by increasing product innovation in non-dairy ice creams and dessert toppings utilizing cocoa butter alternatives to achieve smoothness and stability. Growing consumer preference for plant-based and lower-cost dairy formulations is accelerating adoption, positioning the segment as a key growth area for manufacturers targeting clean-label and sustainable product lines.

Which Region Holds the Largest Share of the Cocoa Butter Alternatives Market?

- North America dominated the cocoa butter alternatives market with the largest revenue share of 38.7% in 2024, driven by the robust presence of confectionery and bakery manufacturers, coupled with rising demand for plant-based and cost-effective ingredients. The region’s strong focus on sustainable sourcing and clean-label products is encouraging food producers to adopt cocoa butter alternatives derived from shea, palm kernel, and other vegetable fats

- Consumers in the region highly value consistent texture, flavor stability, and the premium quality these alternatives offer in chocolates, coatings, and desserts. The food industry’s innovation in formulating trans-fat-free and temperature-stable products further strengthens market adoption

- The widespread use of cocoa butter alternatives in confectionery manufacturing, alongside strong retail demand and R&D investments by leading brands, solidifies North America’s position as the global leader in this segment

U.S. Cocoa Butter Alternatives Market Insight

The U.S. cocoa butter alternatives market captured the largest revenue share of 83% in 2024 within North America, supported by the nation’s dominant chocolate and bakery industries. Major food processors and confectionery brands are increasingly substituting cocoa butter with cost-effective and sustainable alternatives to manage raw material fluctuations. The demand for cocoa butter equivalents (CBEs) and replacers (CBRs) is growing rapidly, driven by the push for clean-label, non-hydrogenated fats. In addition, the rising trend of vegan and plant-based desserts further fuels the adoption of these alternatives. Continuous technological advancements in fat processing and blending, along with the presence of major manufacturers and R&D centers, ensure the U.S. maintains a leading position in product innovation and commercialization.

Europe Cocoa Butter Alternatives Market Insight

The Europe cocoa butter alternatives market is projected to expand at a significant CAGR throughout the forecast period, primarily driven by the region’s established chocolate and confectionery industry and stringent sustainability regulations. The demand for responsibly sourced and deforestation-free ingredients is pushing European manufacturers to replace traditional cocoa butter with ethical alternatives such as shea and sal fats. Increasing awareness of fair-trade sourcing and the region’s strong emphasis on clean-label formulations are further fostering adoption. Countries such as Germany, France, and the U.K. are leading in product innovation, incorporating cocoa butter alternatives in both premium and mass-market applications, from bakery fillings to chocolate coatings.

U.K. Cocoa Butter Alternatives Market Insight

The U.K. cocoa butter alternatives market is anticipated to grow at a steady CAGR during the forecast period, driven by the country’s rapidly evolving bakery and confectionery sectors. Rising consumer preference for healthier, sustainable, and affordable ingredients is prompting manufacturers to adopt cocoa butter equivalents and replacers in chocolate spreads, biscuits, and snack coatings. Moreover, the growth of artisanal and premium chocolate brands emphasizing natural ingredients has accelerated the use of shea- and palm-based alternatives. Strong retail infrastructure and innovation in plant-based desserts continue to fuel market expansion in the U.K.

Germany Cocoa Butter Alternatives Market Insight

The Germany cocoa butter alternatives market is expected to witness substantial growth during the forecast period, fueled by the strong presence of confectionery manufacturers and increasing demand for sustainable fat ingredients. German producers are focusing on R&D to develop temperature-stable, trans-fat-free alternatives suitable for high-quality chocolates and bakery products. In addition, the rising consumer inclination toward environmentally friendly and ethically sourced ingredients aligns with Germany’s emphasis on sustainability. The incorporation of advanced processing technologies and partnerships with West African suppliers are also driving innovation in the market.

Which Region is the Fastest Growing Region in the Cocoa Butter Alternatives Market?

The Asia-Pacific cocoa butter alternatives market is projected to grow at the fastest CAGR of 13.4% from 2025 to 2032, driven by rapid urbanization, expanding middle-class populations, and the rising consumption of chocolates and bakery products in emerging economies such as China, India, and Indonesia. The increasing availability of affordable cocoa butter alternatives and the region’s strengthening manufacturing capabilities are further supporting this growth.

Japan Cocoa Butter Alternatives Market Insight

The Japan cocoa butter alternatives market is gaining momentum, driven by rising consumer interest in premium confectionery and dairy-based desserts. Japanese manufacturers prioritize quality and innovation, integrating cocoa butter equivalents and substitutes to achieve smooth texture and flavor stability while controlling costs. The growing preference for plant-based and allergen-free ingredients, coupled with strong demand from the country’s bakery and frozen dessert sectors, is expected to sustain market expansion.

China Cocoa Butter Alternatives Market Insight

The China cocoa butter alternatives market accounted for the largest revenue share within Asia-Pacific in 2024, propelled by the booming confectionery and bakery sectors and the rising consumption of Western-style desserts. Domestic manufacturers are scaling up production of cocoa butter replacers and substitutes to meet the demand from chocolate producers and snack manufacturers. The push toward cost efficiency, coupled with government initiatives promoting sustainable sourcing and food innovation, continues to strengthen China’s leadership position in the regional market.

Which are the Top Companies in Cocoa Butter Alternatives Market?

The cocoa butter alternatives industry is primarily led by well-established companies, including:

- Cargill, Incorporated (U.S.)

- Barry Callebaut AG (Switzerland)

- Fuji Oil Company, Ltd. (Japan)

- Olam International Limited (Singapore)

- Bunge Ltd. (U.S.)

- AAK AB (Sweden)

- Wilmar International Ltd. (Singapore)

- Musim Mas Group (Singapore)

- Ariyan International Inc. (Canada)

- Manorama Industries Limited (India)

- AAK AB (Sweden)

- Bunge (U.S.)

- Fuji Vegetable Oil, Inc. (U.S.)

- Intercontinental Specialty Fats Sdn. Bhd. (‘ISF’) (Malaysia)

- Makendi Worldwide (Singapore)

- Manorma Industries Limited (India)

- Musim Mas (Singapore)

- Olam International Limited (Singapore)

- WILMAR CAHAYA INDONESIA TBK (Indonesia)

- USHA Edible Oils (India)

- Wild Oils (Canada)

- Wilmar International Ltd. (Singapore)

What are the Recent Developments in Global Cocoa Butter Alternatives Market?

- In March 2025, Fuji Oil Holdings, a leading Japanese producer of industrial chocolate and plant-based food solutions, launched a cacao-free alternative chocolate in response to rising cocoa costs. The innovative product utilizes Fuji Oil's deep expertise in vegetable oils and fats to deliver a sustainable, affordable, and high-quality chocolate substitute. This launch highlights Fuji Oil’s commitment to addressing supply challenges while promoting sustainable chocolate innovation

- In October 2024, Döhler announced a strategic partnership with Nukoko, the company behind the world’s first cocoa-free ‘bean-to-bar’ chocolate. The collaboration aims to scale Nukoko’s patent-pending fermentation technology, which replicates traditional cocoa fermentation to craft authentic chocolate flavors from fava beans, to an industrial level by the end of 2025. This partnership marks a major step toward transforming sustainable chocolate production through innovative fermentation methods

- In July 2024, Bunge introduced Coberine 206, a shea-based Cocoa Butter Equivalent (CBE) developed to overcome challenges in the soft chocolate and ganache market. The product delivers a rich, indulgent flavor with a smooth, soufflé-such as texture, offering premium sensory quality in chocolate applications. This innovation reinforces Bunge’s leadership in creating advanced fat solutions for the confectionery industry

- In June 2024, Blommer Chocolate, a subsidiary of Fuji Oil Holdings, launched Elevate Chocolate Coatings, formulated using Cocoa Butter Equivalent (CBE) technology as an alternative to traditional cocoa butter. These coatings are designed to integrate seamlessly with cocoa butter, enhancing both functionality and taste. This development demonstrates Blommer’s continuous efforts to blend innovation with practicality in chocolate manufacturing

- In May 2023, AAK introduced CEBES Choco 15, a plant-based Cocoa Butter Substitute (CBS) engineered to improve cocoa content and sensory performance in chocolate formulations. The solution effectively addresses issues such as fat bloom and texture inconsistencies commonly found in high-cocoa CBS products. This introduction underscores AAK’s dedication to improving product stability and chocolate quality through sustainable fat technology

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cocoa Butter Alternatives Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cocoa Butter Alternatives Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cocoa Butter Alternatives Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.