Global Cold Storage Construction Market

Market Size in USD Billion

CAGR :

%

USD

15.66 Billion

USD

45.32 Billion

2024

2032

USD

15.66 Billion

USD

45.32 Billion

2024

2032

| 2025 –2032 | |

| USD 15.66 Billion | |

| USD 45.32 Billion | |

|

|

|

|

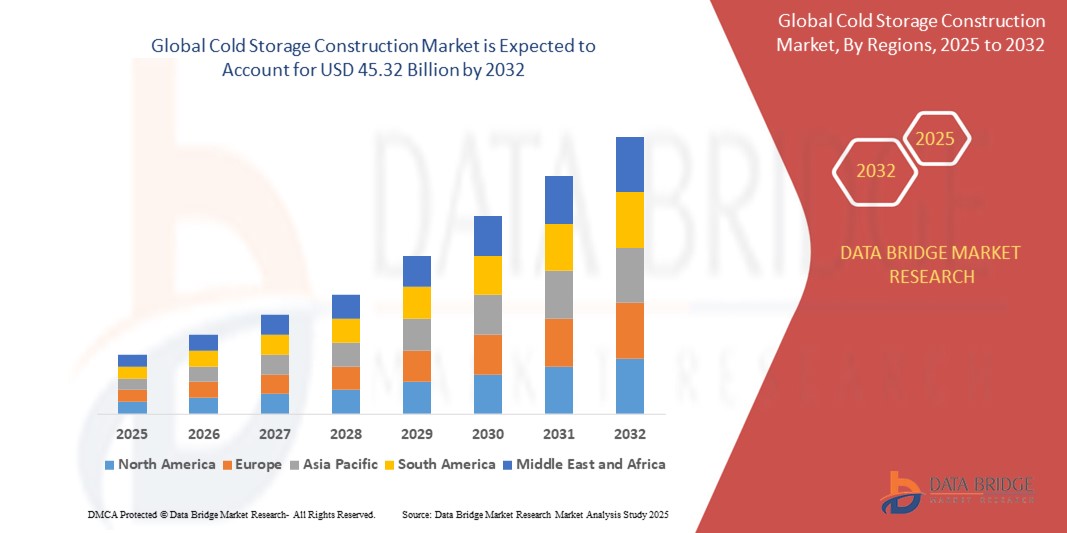

What is the Global Cold Storage Construction Market Size and Growth Rate?

- The global cold storage construction market size was valued at USD 15.66 billion in 2024 and is expected to reach USD 45.32 billion by 2032, at a CAGR of 14.20% during the forecast period

- The cold storage construction market is seeing significant growth due to the demand for perishable goods and advancements in refrigeration technology. Latest methods, such as modular construction, allow faster setup times and enhanced customization, ensuring facilities meet diverse temperature requirements

- Automation technologies are also being integrated, allowing smart temperature control systems to monitor and optimize storage conditions. Advanced insulation materials, such as vacuum-insulated panels (VIPs), are being widely adopted to minimize energy consumption.

What are the Major Takeaways of Cold Storage Construction Market?

- Growth in e-commerce, particularly in online grocery delivery services, is driving the need for more cold storage facilities globally. The increasing demand for fresh produce, pharmaceuticals, and frozen foods is further contributing to the expansion of cold storage networks

- Furthermore, technologies such as IoT and AI in cold storage systems enable predictive maintenance, reducing downtime and costs

- North America dominated the cold storage construction market with the largest revenue share of 36.25% in 2024, driven by the strong presence of established cold chain logistics, increasing demand for pharmaceutical storage, and expansion of automated warehouse infrastructure across the U.S. and Canada

- Asia-Pacific is projected to grow at the fastest CAGR of 14.7% from 2025 to 2032, fueled by rapid urbanization, expanding food retail networks, and strong government support for cold chain infrastructure development in countries such as India, China, and Southeast Asia

- The bulk stores segment dominated the cold storage construction market with the largest market revenue share of 39.7% in 2024, owing to the growing demand for large-scale storage facilities in the food processing and logistics industries

Report Scope and Cold Storage Construction Market Segmentation

|

Attributes |

Cold Storage Construction Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Cold Storage Construction Market?

“Sustainable Construction and Energy-Efficient Building Technologies”

- A prominent trend in the cold storage construction market is the growing focus on sustainable and energy-efficient infrastructure, driven by environmental regulations and the need for cost-efficient operations in logistics and food sectors

- In March 2024, Americold Realty Trust announced a strategic investment in solar-powered cold storage facilities across the U.S., showcasing the industry’s shift toward green energy and sustainable operations

- The adoption of insulated panel technologies with high R-values and low-GWP (Global Warming Potential) refrigerants is transforming how facilities maintain temperature control while reducing emissions

- Smart monitoring systems using IoT sensors are increasingly being integrated to automate temperature, humidity, and energy usage control, improving operational efficiency and minimizing waste

- Construction companies are also incorporating modular construction methods that reduce on-site waste, lower labor costs, and shorten project timelines, thereby increasing scalability and customization

- This trend reflects a broader industry commitment to ESG compliance, attracting investments from food retailers, pharmaceutical companies, and third-party logistics providers aiming to minimize their carbon footprint

What are the Key Drivers of Cold Storage Construction Market?

- Rising demand for temperature-controlled storage due to the expansion of e-commerce grocery, pharmaceuticals, and perishable goods sectors is a primary driver of cold storage infrastructure

- In February 2024, Lineage Logistics began constructing a 500,000 sq. ft. automated cold storage facility in Texas to meet growing demand for just-in-time food distribution

- Government support through incentives and infrastructure investments in rural cold chains, particularly in India, China, and Africa, is boosting market opportunities for construction firms

- The growth of international trade in frozen food and biologics is increasing the need for temperature-sensitive logistics hubs near ports, airports, and major transit corridors

- Emerging technologies such as automated racking systems, AI-powered inventory management, and robotic pallet handling are driving innovation in construction design and operations

- Increased awareness about food safety standards and regulatory compliance is prompting companies to upgrade or build new facilities that meet global hygiene and thermal performance norms

Which Factor is challenging the Growth of the Cold Storage Construction Market?

- A key challenge in the cold storage construction market is the high upfront capital investment required for facility setup, including refrigeration, insulation, automation, and energy systems

- In addition, shortage of skilled labor and rising construction material costs—especially steel and insulation panels—are creating delays and increasing project costs globally

- For instance, in January 2024, a major cold storage project in the U.K. was delayed by six months due to construction inflation and supply chain disruption

- Energy consumption and sustainability compliance also pose operational challenges, as facilities consume large amounts of electricity, prompting the need for costly renewable integrations.

- Zoning regulations and permitting issues in urban and semi-urban areas can complicate site selection, limiting expansion in high-demand regions

- To overcome these obstacles, market players must invest in energy-efficient technologies, form public-private partnerships, and pursue innovative financing models to balance cost with long-term ROI

How is the Cold Storage Construction Market Segmented?

The market is segmented on the basis of type, application, and warehouse type.

• By Type

On the basis of type, the cold storage construction market is segmented into production stores, bulk stores, ports, and others. The bulk stores segment dominated the Cold Storage Construction market with the largest market revenue share of 39.7% in 2024, owing to the growing demand for large-scale storage facilities in the food processing and logistics industries. These facilities are optimized for mass storage of temperature-sensitive products and are commonly used by third-party logistics providers and food manufacturers.

The ports segment is expected to witness the fastest CAGR from 2025 to 2032, supported by the increasing international trade of perishable goods and the expansion of cold chain logistics hubs in port cities. The strategic location of port-based cold storage facilities enables efficient import/export handling and distribution, reducing spoilage and transportation costs.

• By Application

On the basis of application, the cold storage construction market is segmented into perishable food, biopharmaceutical products, processed food, chemicals, and flowers and plants. The perishable food segment held the largest market revenue share of 44.2% in 2024, driven by the rising global demand for fresh fruits, vegetables, dairy, and meat products. Supermarkets and food retailers are investing heavily in temperature-controlled warehouses to ensure freshness and extend shelf life.

The biopharmaceutical products segment is expected to witness the fastest CAGR from 2025 to 2032, as the pharmaceutical industry increasingly requires precise temperature management for vaccines, biologics, and clinical trial samples. Regulatory guidelines on drug storage and the growth of personalized medicine are also fueling segment growth.

• By Warehouse Type

On the basis of warehouse type, the cold storage construction market is segmented into cold rooms, refrigerated containers, blast freezers and chillers, and pharmaceutical cold storage warehouses. The cold rooms segment dominated the market with the largest revenue share of 35.6% in 2024, as they are a cost-effective and scalable solution for small to mid-sized businesses dealing with perishable goods. These rooms are widely adopted in retail, hospitality, and small-scale food processing operations.

The pharmaceutical cold storage warehouse segment is projected to witness the fastest CAGR from 2025 to 2032, propelled by the need for specialized storage environments for temperature-sensitive medical products. The segment’s growth is supported by increasing healthcare spending and regulatory requirements for pharmaceutical distribution infrastructure.

Which Region Holds the Largest Share of the Cold Storage Construction Market?

- North America dominated the cold storage construction market with the largest revenue share of 36.25% in 2024, driven by the strong presence of established cold chain logistics, increasing demand for pharmaceutical storage, and expansion of automated warehouse infrastructure across the U.S. and Canada

- The region benefits from advanced construction technologies, integration of energy-efficient systems, and high investments in food safety compliance, making it a leader in cold storage infrastructure

- In addition, growing adoption of smart warehousing, IoT integration, and sustainability certifications such as LEED in storage facilities are boosting the market’s growth across North America.

U.S. Cold Storage Construction Market Insight

The U.S. cold storage construction market accounted for over 76% of North America's revenue in 2024, driven by growing e-commerce grocery fulfillment, pharmaceutical storage demands, and modernization of aging cold storage infrastructure. Major retailers and logistics firms are heavily investing in high-tech, automated, and energy-optimized storage spaces to enhance delivery speed and reduce operational costs. The rise in vaccine storage demand post-COVID and growing consumption of frozen foods continue to sustain market expansion.

Canada Cold Storage Construction Market Insight

The Canada cold storage construction market is witnessing steady growth, supported by rising investments in food processing, mining exports, and renewable energy logistics. Cold storage facilities in remote and northern regions are being designed with extreme climate resilience and thermal efficiency. The country’s regulatory push for energy-efficient buildings and growing investments in green infrastructure are fueling demand for sustainable cold storage solutions.

Which Region Is the Fastest Growing in the Cold Storage Construction Market?

Asia-Pacific is projected to grow at the fastest CAGR of 14.7% from 2025 to 2032, fueled by rapid urbanization, expanding food retail networks, and strong government support for cold chain infrastructure development in countries such as India, China, and Southeast Asia. Increasing consumption of perishable goods, rising pharmaceutical production, and globalization of food trade are driving investments in advanced cold storage construction projects across the region. The integration of solar-powered systems, modular cold rooms, and cost-effective insulation technologies is further accelerating growth in developing economies.

China Cold Storage Construction Market Insight

The China cold storage construction market held over 53% of Asia-Pacific's revenue share in 2024, led by rapid growth in e-commerce logistics, food exports, and temperature-controlled pharmaceutical storage. Government initiatives to reduce food wastage and improve rural cold chain connectivity are also pushing demand. Local players are adopting AI-based inventory systems and green building techniques to scale facilities sustainably.

India Cold Storage Construction Market Insight

The India cold storage construction market is anticipated to grow at the highest CAGR in Asia-Pacific from 2025 to 2032, driven by smart city initiatives, agriculture infrastructure development, and increased focus on logistics modernization. Programs such as PM Gati Shakti and Mega Food Parks are incentivizing private investment in cold chain networks. Local construction companies are adopting modular and energy-efficient building materials to meet rising demand from both agri-based and pharmaceutical sectors.

Which are the Top Companies in Cold Storage Construction Market?

The cold storage construction industry is primarily led by well-established companies, including:

- Preferred Freezer Services, Inc. (U.S.)

- LINEAGE LOGISTICS HOLDING, LLC (U.S.)

- Burris Logistics (U.S.)

- NICHIREI CORPORATION. (Japan)

- AmeriCold Logistics, LLC (U.S.)

- Emergent Cold (U.S.)

- Primus Builders (U.S.)

- Hansen Cold Storage Construction (U.S.)

- Tippmann Group (U.S.)

- HENNINGSEN COLD STORAGE CO. (U.S.)

- Stellar (U.S.)

- United States Cold Storage (U.S.)

What are the Recent Developments in Global Cold Storage Construction Market?

- In September 2024, BGO and Yukon Real Estate Partners collaborated to construct a sustainable cold storage warehouse spanning 291,000 square feet in New Century, Kansas. The facility, leased by CJ Logistics America, will cater primarily to Flora Food Group and incorporate advanced refrigeration systems, rail connectivity, and eco-friendly design features. This project aims to set a new benchmark in sustainable cold storage development and support the region’s growing logistics demands

- In May 2024, CJ Logistics America announced its plans to inaugurate a 291,000-square-foot cold storage facility in New Century, Kansas, by Q3 2025. Developed in partnership with Yukon Real Estate Partners and BGO, the site will feature a conveyor bridge linked to Upfield's production plant for direct product transfers. This move is set to streamline distribution processes and meet the surging demand for cold storage solutions in the region

- In October 2023, RealCold revealed plans to establish two high-tech cold storage centers in Lakeland, Florida, and Lockhart, Texas. These facilities will support more than 78,000 pallet positions and are scheduled to be operational by early 2025. This expansion aligns with RealCold’s objective to grow its footprint into four additional strategic markets within three years, strengthening its role in the U.S. cold chain ecosystem

- In September 2022, Celcius Logistics launched an intelligent last-mile delivery platform to tackle India’s cold chain logistics challenges. Integrated with a robust Inventory Management System (IMS), the platform enhances distribution efficiency and has been adopted by major clients including Zepto, Maersk, and Jubilant FoodWorks. The initiative reflects Celcius' ongoing mission to digitize and expand cold logistics services across metro and tier-2 cities in India

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cold Storage Construction Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cold Storage Construction Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cold Storage Construction Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.