Global Colorectal Procedure Market

Market Size in USD Billion

CAGR :

%

USD

1.36 Billion

USD

2.47 Billion

2024

2032

USD

1.36 Billion

USD

2.47 Billion

2024

2032

| 2025 –2032 | |

| USD 1.36 Billion | |

| USD 2.47 Billion | |

|

|

|

|

Colorectal Procedure Market Size

- The global colorectal procedure market was valued at USD 1.36 billion in 2024 and is expected to reach USD 2.47 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 8.40%, primarily driven by the rising prevalence of colorectal cancer and inflammatory bowel diseases, along with increasing adoption of minimally invasive surgical techniques

- This growth is driven by factors such as the advancements in laparoscopic and robotic-assisted surgeries, increasing aging population, and greater awareness and screening for colorectal conditions

Colorectal Procedure Market Analysis

- Colorectal procedures encompass a range of surgical and non-surgical interventions used to diagnose and treat conditions affecting the colon and rectum, including colorectal cancer, diverticulitis, and inflammatory bowel disease. These procedures rely heavily on advanced imaging, surgical tools, and endoscopic technologies

- The demand for colorectal procedures is significantly driven by the rising global incidence of colorectal cancer, particularly among aging populations, along with increased public awareness and screening programs promoting early diagnosis and intervention

- North America stands out as one of the dominant regions for colorectal procedures, supported by robust healthcare infrastructure, widespread insurance coverage, and growing adoption of minimally invasive surgical techniques

- For instance, the U.S. has seen a steady rise in colorectal screening rates, coupled with an increase in laparoscopic and robotic-assisted colorectal surgeries, particularly in outpatient settings and ambulatory surgical centers

- Globally, colorectal procedures are among the top five most frequently performed surgical interventions, with technological advancements such as AI-guided colonoscopy and enhanced recovery protocols playing a crucial role in improving patient outcomes and procedural efficiency

Report Scope and Colorectal Procedure Market Segmentation

|

Attributes |

Colorectal Procedure Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Colorectal Procedure Market Trends

“Rise of Minimally Invasive Techniques and Robotic-Assisted Surgeries”

- One prominent trend in the global colorectal procedure market is the increasing adoption of minimally invasive techniques and robotic-assisted surgeries

- These advanced approaches enhance the precision and recovery time of colorectal surgeries by using smaller incisions, reducing post-operative pain, and speeding up the healing process for patients

- For instance, robotic-assisted surgeries allow for highly precise, controlled movements, enabling surgeons to perform complex procedures such as bowel resections with greater accuracy and minimal disruption to surrounding tissues

- Minimally invasive techniques also reduce the risk of infection and lead to shorter hospital stays, further contributing to improved patient outcomes and overall healthcare cost savings

- This This trend is transforming colorectal surgery, making it more efficient and less invasive, driving increased demand for robotic systems and specialized tools in the market

Colorectal Procedure Market Dynamics

Driver

“Rising Incidence of Colorectal Cancer and Age-Related Conditions”

- The increasing incidence of colorectal cancer and other age-related conditions such as diverticulitis and inflammatory bowel disease is significantly contributing to the growing demand for colorectal procedure

- As the global population ages, the risk of developing colorectal diseases rises, with older adults being more susceptible to conditions requiring surgical intervention, such as colorectal cancer and diverticulosis

- Colorectal cancer, in particular, is one of the leading causes of cancer-related deaths worldwide, necessitating early detection, surgery, and follow-up treatments that require advanced tools and technologies

- The continued advancements in colorectal surgery, including minimally invasive techniques and enhanced recovery protocols, further emphasize the need for specialized surgical equipment and technologies that provide greater precision and better post-operative outcomes

- As more individuals are diagnosed with colorectal conditions and undergo screenings, the demand for colorectal procedures increases, driving the need for improved surgical tools, diagnostic imaging systems, and treatment option

For instance,

- In 2023, the World Health Organization (WHO) reported that colorectal cancer is the third most commonly diagnosed cancer globally, with an increasing incidence in individuals aged 50 and older, contributing to the rising demand for colorectal surgeries and diagnostic procedures

- In 2022, the American Cancer Society highlighted the importance of early screening, with over 104,000 new cases of colon cancer in the U.S. alone, underscoring the need for advanced surgical tools and improved colorectal care

- As a result of the rising prevalence of colorectal cancer and other age-related conditions, there is a significant increase in the demand for colorectal procedures, contributing to market growth

Opportunity

“Leveraging Robotic-Assisted Surgery for Enhanced Precision”

- Robotic-assisted colorectal surgery has the potential to significantly enhance the precision, safety, and efficiency of procedures, providing an opportunity to revolutionize colorectal care

- Robotic systems, equipped with advanced imaging and motion control technologies, allow surgeons to perform complex procedures with enhanced dexterity, minimal incisions, and better visualization of the colorectal region

- In addition, these systems can also assist in real-time decision-making, offering features such as 3D visualization and the ability to scale movements, thereby improving surgical outcomes and reducing recovery times for patient

For instance,

- In January 2024, according to an article published in the Journal of Robotic Surgery, robotic-assisted surgeries have demonstrated significantly reduced complication rates and shorter hospital stays in colorectal cancer patients, emphasizing the growing role of robotic systems in improving patient outcomes

- In October 2023, the American Society of Colon and Rectal Surgeons reported that the adoption of robotic-assisted techniques in colorectal surgery has increased by over 30% in the last five years, as these systems allow for more precise tissue handling and better post-operative recovery

- The integration of robotic systems in colorectal procedures is poised to improve surgical precision, reduce complications, and enhance patient satisfaction, providing a major opportunity for growth in the global colorectal procedure market.

Restraint/Challenge

“High Procedure and Treatment Costs Limiting Accessibility”

- The high costs associated with colorectal procedures and related treatments pose a significant challenge, particularly in low- and middle-income regions where healthcare budgets are limited

- The cost of advanced surgical systems, diagnostic imaging, and post-operative care can significantly increase the overall expense of colorectal surgeries, making them less accessible to a large portion of the global population

- These financial barriers may result in delays in diagnosis and treatment, especially for individuals who are uninsured or underinsured, limiting access to potentially life-saving colorectal interventions

For instance,

- In September 2023, according to an article published by the World Health Organization (WHO), the high costs associated with colorectal cancer treatment, including surgery, chemotherapy, and radiation, often deter patients in developing countries from seeking timely care, leading to poorer outcomes and higher mortality rates

- In August 2023, the American Cancer Society reported that the cost of robotic-assisted colorectal surgeries is a significant concern, particularly for hospitals in rural areas or those serving underserved populations, impacting the ability to provide equitable care

- Consequently, the financial burden on healthcare providers and patients can lead to disparities in the quality of care and access to advanced colorectal treatments, ultimately hindering the overall growth and development of the market

Colorectal Procedure Market Scope

The market is segmented on the basis of product, surgery type, indication, and end use.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Surgery Type |

|

|

By Indication |

|

|

By End Use |

|

Colorectal Procedure Market Regional Analysis

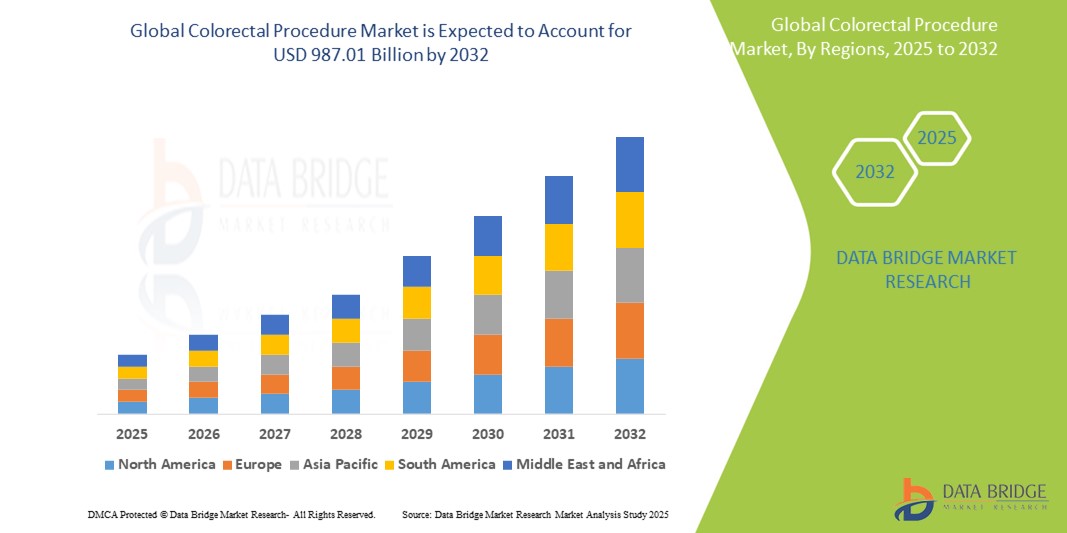

“North America is the Dominant Region in the Colorectal Procedure Market”

- North America leads the colorectal procedure market, driven by its advanced healthcare infrastructure, high adoption of innovative medical technologies, and the presence of prominent healthcare institutions and surgical centers

- U.S. holds a substantial share of the market due to the high demand for colorectal cancer screenings, early diagnosis, and treatment procedures, coupled with a rising aging population that is more susceptible to colorectal diseases

- The availability of comprehensive insurance coverage, favorable reimbursement policies, and continuous advancements in minimally invasive surgical techniques, such as robotic-assisted surgery, further bolster market growth in the region

- In addition, the rising number of outpatient and ambulatory surgical procedures is fueling the expansion of colorectal treatments, driving the demand for advanced surgical equipment and diagnostic tools across the U.S. and Canada

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is anticipated to experience the highest growth rate in the colorectal procedure market, driven by rapid improvements in healthcare infrastructure, growing awareness of colorectal health, and increasing healthcare investments

- Countries such as China, India, and Japan are emerging as key markets due to their large populations, rising incidence of colorectal cancer, and an aging demographic that is more prone to colorectal diseases

- Japan, with its advanced medical technology and high adoption of innovative surgical equipment, remains a vital market for colorectal procedures, particularly in robotic-assisted surgeries and minimally invasive treatments

- China and India are seeing increased investments in healthcare facilities, with a growing focus on colorectal cancer screening programs, improved diagnostic methods, and a rising number of specialized colorectal surgical centers. The expanding presence of global medical device manufacturers and government initiatives to improve healthcare accessibility contribute significantly to the market's growth in the region

Colorectal Procedure Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Medtronic (Ireland)

- Johnson & Johnson Services, Inc. (U.S.)

- Stryker (U.S.)

- Boston Scientific Corporation (U.S.)

- Abbott (U.S.)

- Olympus Corporation (Japan)

- Smith+Nephew (U. K.)

- CONMED Corporation (U.S.)

- Cook (U.S.)

- KARL STORZ (Germany)

- Hoya Corporation (Japan)

- B. Braun SE (Germany)

- Intuitive Surgical (U.S.)

- Zimmer Biomet (U.S.)

- Medline Industries, Inc. (U.S.)

- Terumo Corporation (Japan)

- FUJIFILM Corporation (Japan)

- AngioDynamics (U.S.)

- Lumenis Be Ltd. (Israel)

Latest Developments in Global Colorectal Procedure Market

- In January 2025, the U.S. FDA approved Amgen’s combination therapy of Lumakras and Vectibix for treating metastatic colorectal cancer with specific gene mutations. This approval was based on a late-stage study showing increased progression-free survival

- In October 2024, the adoption of robotic-assisted surgeries, such as those using the da Vinci Surgical System, has increased, offering benefits such as shorter recovery periods and enhanced precision in colorectal procedures. Studies have highlighted superior outcomes with robotic surgery compared to traditional methods

- In September 2024, Olympus Corporation received FDA 510(k) clearance for its CADDIE system, an AI-powered tool designed to assist gastroenterologists in detecting colorectal polyps during colonoscopy procedures, enhancing diagnostic accuracy

- In May 2024, The U.S. Preventive Services Task Force recommended lowering the starting age for colorectal cancer screening to 45. This policy change is expected to increase demand for diagnostic and surgical procedures, driving market growth

- In April 2024, Researchers from the UK developed a tiny, magnetically guided robot aimed at detecting and treating bowel cancer. This 3D-printed device, the size of a UK penny, has shown promise in early trials and could streamline cancer screening and treatment processes

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.