Global Command And Control Systems Market

Market Size in USD Billion

CAGR :

%

USD

36.80 Billion

USD

61.68 Billion

2024

2032

USD

36.80 Billion

USD

61.68 Billion

2024

2032

| 2025 –2032 | |

| USD 36.80 Billion | |

| USD 61.68 Billion | |

|

|

|

|

What is the Global Command and Control Systems Market Size and Growth Rate?

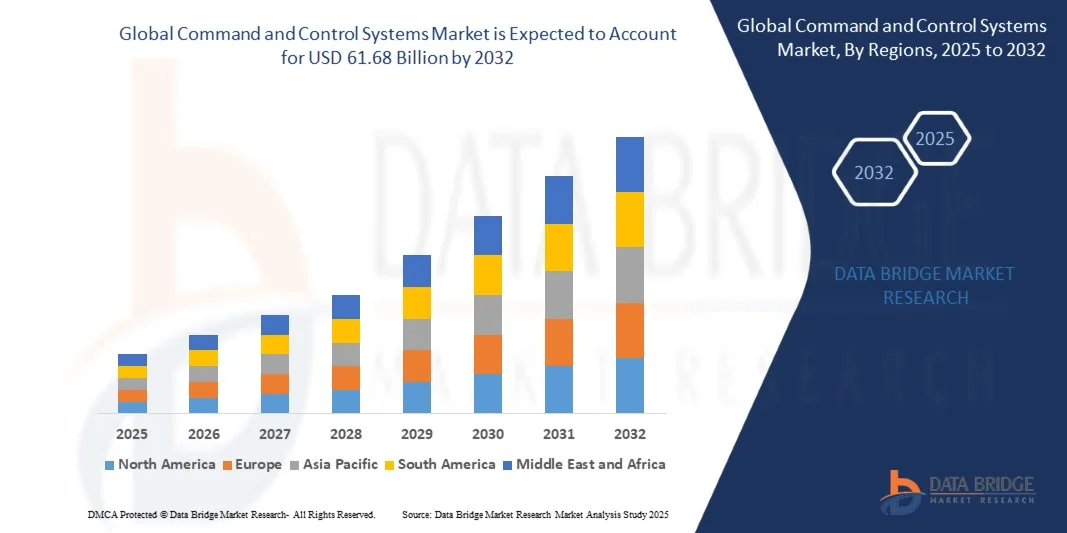

- The global command and control systems market size was valued at USD 36.80 billion in 2024 and is expected to reach USD 61.68 billion by 2032, at a CAGR of 6.67% during the forecast period

- The market growth is primarily driven by increasing adoption of advanced digital solutions, IoT integration, and technological advancements in security and surveillance systems across both residential and commercial sectors

- Moreover, rising demand for user-friendly, reliable, and integrated access management solutions is positioning Command and Control Systems as the preferred choice for modern security infrastructure. These factors are accelerating market penetration and overall industry expansion

What are the Major Takeaways of Command and Control Systems Market?

- Command and Control Systems, providing digital or electronic access control for various facilities, are becoming essential components of modern security frameworks in both residential and commercial applications due to their convenience, remote monitoring capabilities, and integration with broader automation ecosystems

- The growing need for secure, connected environments, combined with the increasing adoption of smart technologies, is fueling the demand for Command and Control Systems, driven by consumer preference for keyless and automated access solutions

- North America dominated the command and control systems market with the largest revenue share of 45.68% in 2024, driven by strong defense spending, technological advancement, and increasing adoption of smart infrastructure in both commercial and government sectors

- The Asia-Pacific Command and Control Systems market is poised to grow at the fastest CAGR of 7.69% during 2025–2032, propelled by rising urbanization, expanding defense budgets, and increasing investments in smart city technologies across China, Japan, India, and South Korea

- The solution segment dominated the market with the largest revenue share of 62.5% in 2024, driven by the increasing deployment of advanced software and hardware platforms that enable real-time monitoring, asset tracking, and operational decision-making

Report Scope and Command and Control Systems Market Segmentation

|

Attributes |

Command and Control Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Command and Control Systems Market?

“Enhanced Functionality Through AI and Integrated Platforms”

- A major trend in the global command and control systems market is the growing integration with artificial intelligence (AI) and connected platforms, enabling real-time data processing, predictive analytics, and automated decision-making. This integration is enhancing operational efficiency and situational awareness across military, industrial, and commercial applications

- For instance, modern command centers now employ AI-powered dashboards that aggregate sensor data, track assets, and optimize resource allocation, improving response times and strategic decision-making. Companies such as Lockheed Martin and Thales are pioneering solutions that combine AI with robust command platforms for smarter operations

- AI-enabled Command and Control Systems allow predictive threat analysis, anomaly detection, and automated reporting, while integrated platforms enable seamless communication across multiple devices, systems, and locations. This ensures centralized situational control and enhanced coordination

- The trend toward unified, AI-enhanced command networks is reshaping expectations for operational efficiency, driving the development of interoperable and intelligent systems capable of handling complex multi-domain environments

- Demand is rising across defense, aerospace, and industrial sectors, as organizations seek systems that combine automation, analytics, and real-time integration to enhance decision-making and safety

What are the Key Drivers of Command and Control Systems Market?

- The escalating need for real-time situational awareness and rapid decision-making across defense, aerospace, and industrial sectors is a primary driver for market growth

- For instance, in March 2024, Northrop Grumman introduced advanced AI-enabled command modules for battlefield and infrastructure monitoring, significantly improving operational coordination. Such innovations are expected to expand adoption globally

- The growing adoption of IoT-enabled sensors, drones, and communication networks allows Command and Control Systems to collect vast data streams, enabling predictive and preventive strategies across critical operations

- Organizations increasingly prioritize interoperable systems that can unify multiple operations, platforms, and communication protocols, driving the adoption of modular and scalable solutions

- The market is further fueled by the shift toward digitalized operations, where remote monitoring, automated alerts, and advanced analytics reduce response times and enhance operational safety

Which Factor is Challenging the Growth of the Command and Control Systems Market?

- Concerns regarding cybersecurity vulnerabilities in connected command systems pose significant obstacles to adoption. As systems rely on cloud integration and network connectivity, they are exposed to hacking, ransomware, and data breaches

- High-profile breaches in critical infrastructure and defense networks have increased caution among organizations considering new deployments

- Addressing these concerns requires robust encryption protocols, secure authentication, and continuous software updates. Companies such as Cisco and Honeywell are emphasizing cybersecurity in their offerings to build trust

- In addition, the high cost of advanced AI-enabled systems compared to traditional platforms can limit adoption in budget-conscious organizations. Premium features such as multi-domain analytics and integrated IoT capabilities often command a higher price

- Overcoming these barriers through enhanced security measures, cost-optimized solutions, and education about operational benefits is critical for sustained growth in the Command and Control Systems market

How is the Command and Control Systems Market Segmented?

The market is segmented on the basis of component, installation type, platform type, and application.

• By Component

On the basis of component, the command and control systems market is segmented into solution and service. The solution segment dominated the market with the largest revenue share of 62.5% in 2024, driven by the increasing deployment of advanced software and hardware platforms that enable real-time monitoring, asset tracking, and operational decision-making. Solutions are widely adopted across defense, industrial, and aerospace sectors due to their ability to integrate multiple data streams, provide predictive insights, and enhance situational awareness.

The service segment is expected to witness the fastest growth rate of 18.3% from 2025 to 2032, fueled by the growing demand for system maintenance, integration, training, and consulting services. Organizations are increasingly outsourcing technical support and operational management of command systems to ensure continuous, reliable performance and minimize downtime.

• By Installation Type

On the basis of installation type, the market is segmented into deployable command centers and fixed command centers. The fixed command centers segment held the largest market revenue share of 57% in 2024, owing to their permanent setup in military bases, emergency operations centers, and industrial control hubs. Fixed centers provide robust infrastructure for long-term operations and advanced analytics, supporting real-time monitoring across multiple locations.

Deployable command centers are anticipated to witness the fastest CAGR of 20.2% from 2025 to 2032, driven by the rising need for rapid-response, mobile command solutions in disaster management, field operations, and temporary military deployments. Their portability, ease of setup, and adaptability make them highly preferred for critical short-term missions.

• By Platform Type

On the basis of platform type, the command and control systems market is segmented into land and space. The land platform segment accounted for the largest market revenue share of 68% in 2024, driven by extensive adoption in terrestrial defense operations, industrial monitoring, and smart infrastructure management. Land-based systems provide high data throughput, centralized control, and secure operations, making them indispensable for conventional command and control applications.

The space platform segment is expected to witness the fastest CAGR of 22% from 2025 to 2032, propelled by increasing satellite deployments, space surveillance initiatives, and government investments in space defense and monitoring technologies. The adoption of space-based platforms enhances coverage, global connectivity, and intelligence-gathering capabilities, driving future growth.

• By Application

On the basis of application, the market is segmented into government and defense and commercial. The government and defense segment dominated the market with the largest revenue share of 72% in 2024, supported by substantial defense budgets, strategic modernization programs, and the need for secure, real-time command systems in military and public safety operations.

The commercial segment is anticipated to witness the fastest CAGR of 19.5% from 2025 to 2032, driven by growing adoption in sectors such as transportation, energy, industrial automation, and large-scale event management. Commercial organizations are increasingly investing in command and control solutions to enhance operational efficiency, security, and real-time monitoring capabilities, reflecting a rising trend toward digitalized operations in civilian sectors.

Which Region Holds the Largest Share of the Command and Control Systems Market?

- North America dominated the command and control systems market with the largest revenue share of 45.68% in 2024, driven by strong defense spending, technological advancement, and increasing adoption of smart infrastructure in both commercial and government sectors

- Organizations in the region highly value the integration capabilities, real-time monitoring, and secure data handling offered by Command and Control Systems across applications such as defense, aerospace, and critical infrastructure

- High disposable incomes, robust R&D investment, and a technologically adept workforce are further supporting adoption, establishing Command and Control Systems as the preferred solution for both public and private organizations

U.S. Command and Control Systems Market Insight

The U.S. command and control systems market captured the largest revenue share of 75% in 2024 within North America, fueled by substantial government and defense contracts, as well as growing investments in smart city infrastructure. The adoption of advanced analytics, AI, and IoT-enabled monitoring systems is accelerating market growth. Furthermore, the U.S. focus on modernizing military operations and critical infrastructure contributes significantly to market expansion.

Europe Command and Control Systems Market Insight

The Europe command and control systems market is projected to grow at a considerable CAGR during the forecast period, driven by stringent security regulations, increased urbanization, and demand for connected industrial and defense operations. European organizations are increasingly integrating these systems with energy-efficient and sustainable platforms, enhancing operational efficiency. Residential, commercial, and defense applications across the region are witnessing rising adoption.

U.K. Command and Control Systems Market Insight

The U.K. command and control systems market is expected to expand at a notable CAGR, owing to the growing adoption of defense modernization programs, commercial security upgrades, and smart city initiatives. Rising concerns regarding cybersecurity and operational efficiency are motivating both government and private sectors to deploy advanced command solutions.

Germany Command and Control Systems Market Insight

The Germany market is anticipated to witness steady growth, supported by innovation-driven infrastructure and demand for high-security, eco-friendly command and control solutions. Integration with industrial automation, urban smart systems, and defense monitoring platforms is driving adoption, while data privacy and security compliance remain key considerations.

Which Region is the Fastest Growing Region in the Command and Control Systems Market?

The Asia-Pacific command and control systems market is poised to grow at the fastest CAGR of 7.69% during 2025–2032, propelled by rising urbanization, expanding defense budgets, and increasing investments in smart city technologies across China, Japan, India, and South Korea. Government initiatives promoting digitalization and IoT adoption are accelerating market expansion.

Japan Command and Control Systems Market Insight

The Japan market is gaining momentum due to high-tech infrastructure, a strong emphasis on public safety, and rising adoption of smart building solutions. The integration of AI-driven systems and IoT platforms with command and control operations supports enhanced security and operational efficiency in both commercial and defense sectors.

China Command and Control Systems Market Insight

The China market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid urbanization, government smart city programs, and the country’s focus on national defense modernization. Affordable domestic solutions, expanding commercial infrastructure, and increasing adoption in industrial and public safety sectors are key growth factors.

Which are the Top Companies in Command and Control Systems Market?

The command and control systems industry is primarily led by well-established companies, including:

- L3Harris Technologies, Inc. (U.S.)

- Thales Group (France)

- RTX Corporation (U.S.)

- General Dynamics Corporation (U.S.)

- Lockheed Martin Corporation (U.S.)

- Rockwell Collins (U.S.)

- BAE Systems (U.K.)

- The Boeing Company (U.S.)

- Raytheon Company (U.S.)

- Honeywell International (U.S.)

- Leonardo SpA (Italy)

- Elbit Systems (Israel)

- International Business Machines Corporation (U.S.)

- Cisco Systems Inc. (U.S.)

- Schneider Electric SE (France)

- Northrop Grumman Corporation (U.S.)

- NEC Corporation (Japan)

- ASELSAN Elektronik Sanayi ve Ticaret A.S. (Turkey)

- CACI International Inc (U.S.)

What are the Recent Developments in Command and Control Systems Market?

- In May 2024, VuWall Technology Inc. secured an indefinite-delivery/indefinite-quantity contract with a maximum ceiling of USD 4.09 billion from the Missile Defense Agency, aimed at accelerating the development of command and control, battle management, and communications systems. This contract is expected to significantly enhance the company’s capabilities in advanced defense solutions

- In April 2024, Lockheed Martin Corporation introduced the new Power over Ethernet (POE) touchscreen panel, Controlvu Touch Panel, for command and control applications, allowing operators to manage and monitor multiple video sources in real-time directly from the panel. This launch strengthens Lockheed Martin’s position in next-generation command and control technology

- In March 2024, Northrop Grumman signed a Memorandum of Understanding (MOU) with Diehl Defense GmbH & Co. KG to support Germany’s innovative layered air and missile defense capabilities, combining Northrop’s expertise in IAMD and integrated battle command systems with Diehl’s ground-based defense platforms. This collaboration is set to enhance air and missile defense effectiveness in Europe

- In February 2024, BAE Systems Plc. announced plans to deliver advanced electromagnetic warfare mission systems for the U.S. Air Force’s EA-37B fleet as part of the Compass Call mission, countering enemy command and control, computing, communications, combat systems, and C5ISRT capabilities. This initiative underscores BAE Systems’ commitment to advancing modern electronic warfare solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.